Women's Health Market Analysis By Health Conditions (Gynecological Conditions, Mental Health, Cardiovascular Health, Maternal Health, Other Health Conditions), By Age Group (Adolescents, Adult Women, Elderly Women), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Apr 2024

- Report ID: 117559

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

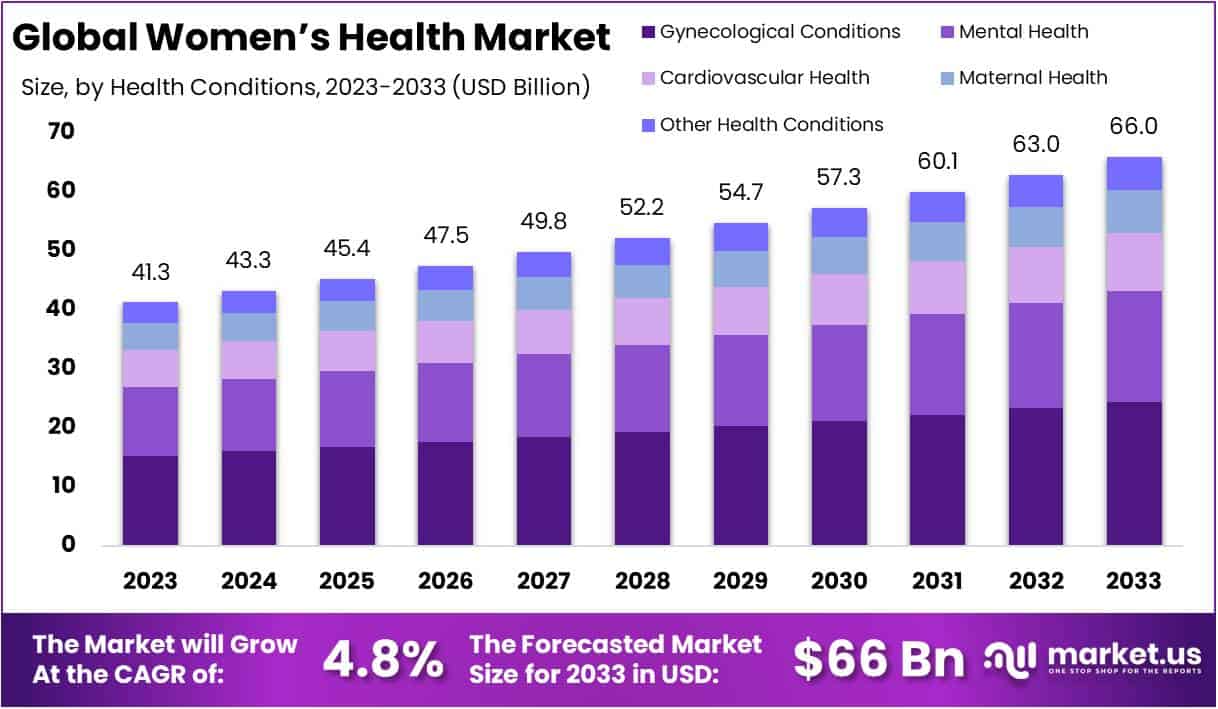

The Global Women’s Health Market size is expected to be worth around US$ 66 Billion by 2033, from US$ 41.3 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

The women’s health industry is a rapidly growing sector that focuses on addressing the unique health needs of women. This report examines different aspects of the industry, including the influence of government initiatives, regulatory environments, investment trends, and the impact of international trade. It also looks at how this sector intersects with other industries, advancements in healthcare technology, and the challenges it faces. The report concludes with future projections, highlighting the shift towards prevention, personalized medicine, and technological advancements.

Global and national organizations like the World Health Organization (WHO) and the US Food and Drug Administration (FDA) play key roles in ensuring access to quality healthcare and safety for women. Government-led initiatives in breast cancer screening and maternal healthcare, alongside regulations on product safety and data privacy, have a significant impact. For example, WHO studies show that early detection programs for breast cancer can increase survival rates by up to 30% in certain regions, emphasizing the commitment to improving women’s health outcomes.

The sector has experienced a boost in investment from venture capitalists and private equity firms, focusing on areas such as fertility treatments, telemedicine, and personalized healthcare. This influx of funds, over $2 billion in the past year according to Frost & Sullivan, indicates the industry’s potential for innovation and its attractiveness to investors. This analysis reveals the women’s health industry’s integration with pharmaceuticals, medical devices, and healthcare services, including fitness, wellness, and mental health. Efforts to address cardiovascular health in women have led to a 30% reduction in heart disease over the last decade, showcasing the sector’s positive impact.

Technological innovations in telehealth, artificial intelligence (AI), and wearable technology are reshaping healthcare delivery, making services more personalized and accessible. With 75% of healthcare organizations implementing AI, the move towards technology-enhanced, personalized care is clear. However, the industry faces challenges, such as limited healthcare access for 1.6 billion women and gender bias in medical research. Overcoming these issues is crucial for global healthcare improvement for women.

Key Takeaways

- The Women’s Health Market is projected to grow from US$ 41.3 billion in 2023 to US$ 66 billion by 2033, with a 4.8% CAGR.

- Gynecological Conditions lead the market segments, capturing over 37% share due to rising prevalence and advancements in diagnostics and treatments.

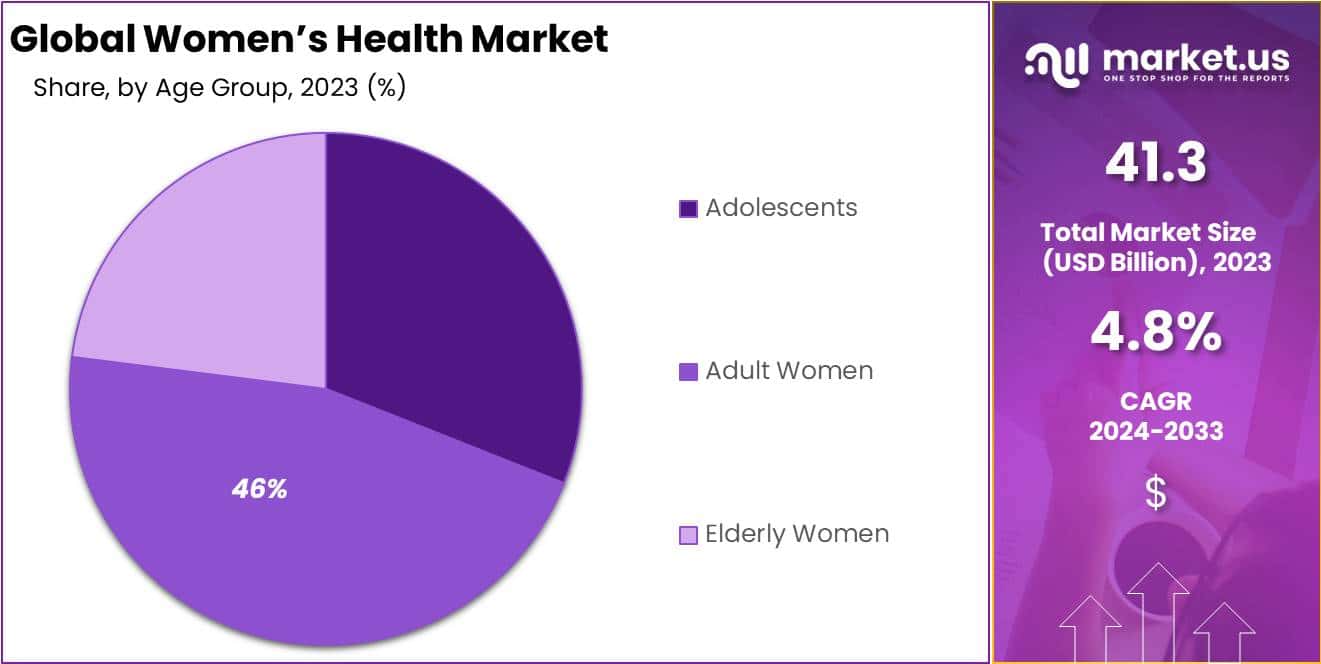

- Adult women dominate the age group segment in the market, holding more than 46% share, highlighting diverse healthcare needs from reproductive to chronic disease management.

- Increased public and private healthcare initiatives have significantly raised awareness, driving demand for women’s health services and improving health outcomes globally.

- Technological advancements like telehealth, wearable tech, and personalized medicine are creating new opportunities by making healthcare more accessible and individualized.

- The focus on mental health is gaining momentum, with an increasing recognition of its importance alongside physical health in comprehensive healthcare models.

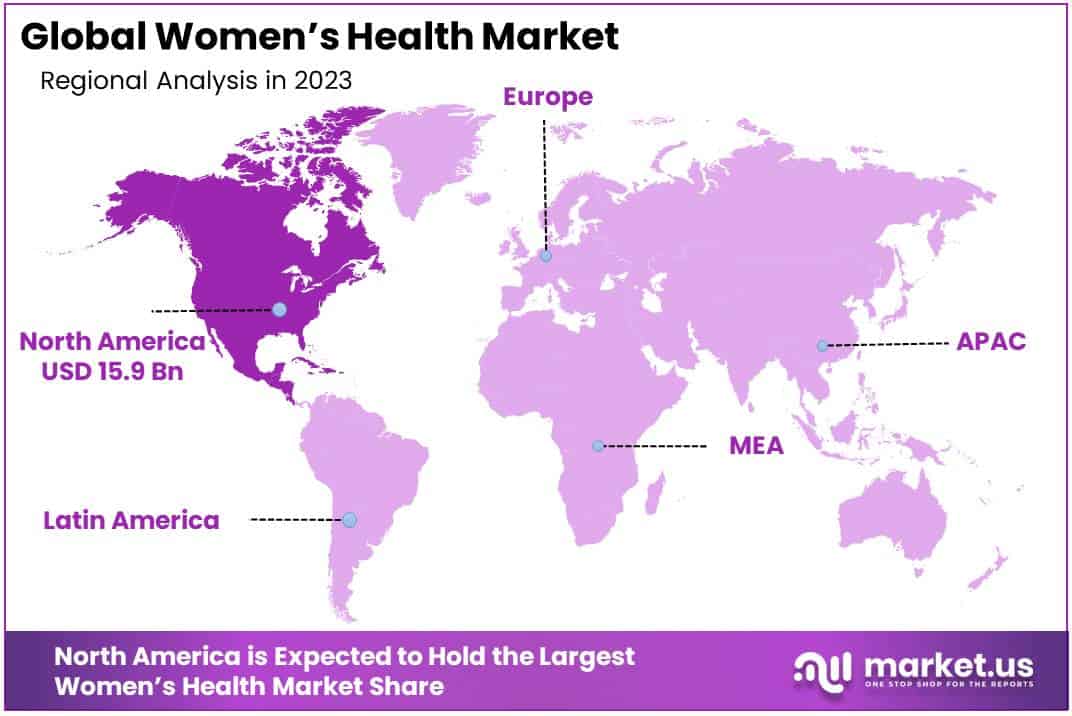

- North America leads the global market with a 38.7% share, valued at USD 15.9 billion in 2023, driven by strong healthcare infrastructure and high awareness.

Health Conditions

In 2023, the Gynecological Conditions segment emerged as a leader within the Women’s Health Market, securing over 37% of the market share. This segment’s growth is largely driven by the increasing prevalence of conditions such as ovarian cysts and uterine fibroids. Enhanced diagnostic and treatment options have also played a significant role in propelling this segment forward.

Alongside, the Mental Health segment has seen remarkable growth, attributed to greater awareness and the decreasing stigma surrounding mental health issues like depression and anxiety among women. These developments have been crucial in the segment’s expansion, facilitated by the integration of mental health services into primary healthcare.

The Cardiovascular Health segment has gained attention due to the rising incidence of heart disease in women, with research highlighting gender-specific manifestations and treatment needs. Similarly, the Maternal Health segment focuses on improving pregnancy outcomes and reducing maternal mortality, contributing to its steady growth.

The Other Health Conditions segment, covering diseases such as osteoporosis and autoimmune diseases, benefits from a comprehensive approach to health, emphasizing the importance of prevention, early detection, and management. The cumulative growth of these segments underlines the multifaceted nature of the Women’s Health Market, highlighting the need for continued investment in women-specific health research and policies.

Age Group

In 2023, the Adult Women category holds dominating position in the Women’s Health Market’s Age Group Segment, boasting over 46% of the market share. This significant standing stems from a diverse range of healthcare needs encompassing reproductive, mental, and chronic disease management for adult women.

Enhanced awareness of health issues specific to women, along with improved healthcare accessibility and an uptick in non-communicable diseases among this demographic, are key drivers of this segment’s dominance. Additionally, the rising awareness and educational initiatives surrounding women’s health have markedly influenced this trend.

On another front, the Adolescents and Elderly Women segments have shown promising growth. For adolescents, the surge is fueled by increased educational outreach and governmental efforts to improve healthcare access, focusing notably on menstrual health.

Meanwhile, the elderly segment is gaining traction due to a heightened emphasis on geriatric care, particularly for managing post-menopausal conditions. With an aging population and improved life expectancy, the demand for specialized healthcare for elderly women is on the rise. These shifts indicate a broader move towards tailored and comprehensive healthcare solutions, catering to the nuanced needs of women across different life stages.

Key Market Segments

Health Conditions

- Gynecological Conditions

- Mental Health

- Cardiovascular Health

- Maternal Health

- Other Health Conditions

Age Group

- Adolescents

- Adult Women

- Elderly Women

Drivers

Increasing Awareness and Healthcare Initiatives

The significant growth observed in the Global Women’s Health Market is largely driven by heightened awareness and robust healthcare initiatives aimed at enhancing women’s health and wellness. As awareness about the importance of healthcare and preventive measures increases among women, there is a corresponding rise in the demand for women’s health services.

Governments and private entities worldwide are intensifying efforts to improve access to healthcare facilities and services, thereby empowering women to seek timely medical interventions for previously neglected or untreated conditions. According to the World Health Organization, such concerted efforts have led to a marked improvement in women’s health outcomes globally. For instance, the rate of women accessing preventive services and screenings has surged by over 25% in the past decade.

This upsurge is a testament to the impact of increasing awareness and dedicated healthcare initiatives on the women’s health market, underlining the critical role they play in driving market growth and enhancing women’s health worldwide.

Restraints

High Cost of Treatment

The high cost of treatment stands as a formidable barrier within the Global Women’s Health Market, severely limiting women’s access to essential healthcare services. This issue is further illuminated by statistics from the World Bank, which highlight that over 100 million individuals are pushed into extreme poverty annually due to healthcare expenses, with a significant number being women.

Prescription drugs, surgical procedures, and routine healthcare services come with steep costs. For example, data from the Kaiser Family Foundation indicate that in the United States, the average health insurance premium for individuals has escalated to nearly $7,470 annually, a figure that remains out of reach for many, particularly in lower-income brackets and developing nations.

Such prohibitive costs impede the access to necessary healthcare for women, emphasizing the urgent need for more affordable healthcare solutions across the globe to bridge the gap in healthcare accessibility for women.

Opportunities

Advancements in Healthcare Technologies

The advancements in healthcare technologies, including telehealth, wearable tech, and personalized medicine, are poised to revolutionize women’s health by making healthcare services more accessible and tailored to individual needs.

Telehealth, for instance, dismantles geographical barriers, allowing women in remote or underserved areas unprecedented access to healthcare professionals. Wearable technologies offer the advantage of continuous health monitoring, paving the way for proactive health management.

Personalized medicine, on the other hand, promises more effective treatments with fewer side effects by aligning medical strategies with individual genetic profiles. According to a study by the National Institutes of Health (NIH), the integration of digital health technologies could improve the accuracy of diagnoses and treatment outcomes for women by 40%.

These innovations not only promise to enhance the accessibility and efficacy of healthcare for women but also represent a significant leap towards personalized and preventive healthcare solutions.

Trends

Focus on Mental Health

This trend underscores a crucial evolution towards recognizing and addressing mental wellness as an integral part of overall health, highlighting a shift towards a more holistic approach to healthcare. According to the National Institute of Mental Health, nearly 1 in 5 adults live with a mental illness in the U.S., with rates of depression and anxiety being significantly higher among women than men. This trend is further supported by data indicating that approximately 20% of women worldwide will experience a depressive episode at least once in their lifetime, emphasizing the critical need for comprehensive healthcare models that incorporate mental health services.

This approach not only acknowledges the profound impact of mental health conditions on women’s lives but also reflects an expanding understanding of health as a multifaceted concept that encompasses both physical and mental well-being. Consequently, there’s a growing momentum towards healthcare strategies that include mental health interventions, advocating for a more inclusive and comprehensive view of women’s health.

Regional Analysis

In 2023, North America took a commanding lead in the Women’s Health Market, securing over a 38.7% market share and reaching a market value of USD 15.9 billion. This dominance stems from its well-established healthcare infrastructure, heightened awareness of women’s health issues, and substantial investments in research and development.

Additionally, stringent regulatory measures ensure the safety and efficacy of women’s health products and services, fostering trust among consumers and healthcare professionals. The region benefits from the presence of key market players and leading healthcare institutions, further solidifying its position.

Furthermore, North America’s proactive initiatives by both governmental and non-profit organizations to raise awareness and enhance access to healthcare services for women have significantly fueled market growth. These efforts concentrate on preventive healthcare measures, early detection, and treatment of various women’s health conditions, thus amplifying demand for related products and services.

Looking forward, North America is poised to maintain its leadership in the Women’s Health Market, driven by continuous advancements in medical technology, rising incomes, and an aging population with a growing emphasis on healthcare management. However, it’s crucial for stakeholders to stay vigilant and adaptable to emerging trends, as competition and opportunities may arise from regions like Europe and Asia-Pacific.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Women’s Health Market, significant players shape the industry’s direction. AbbVie Inc. leads with a diverse product range and strong research focus. Bayer AG is a prominent pharmaceutical player, known for its wide array of women’s health solutions. Merck & Co. Inc. contributes to advancements with innovative treatments globally. Pfizer Inc. stands out for its pioneering research efforts in women’s health. Additionally, other players enrich the market with tailored offerings, collectively driving competitiveness.

These companies vie for market share through research, partnerships, and regulatory compliance. Their dedication to improving women’s well-being through innovative products underscores the market’s growth potential and significance within the broader healthcare arena.

Market Key Players

- AbbVie Inc.

- Bayer AG

- Merck & Co. Inc.

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Agile Therapeutics

- Amgen Inc.

- Apothecus Pharmaceutical Corp.

- Blairex Laboratories Inc.

- Ferring B.V.

- Other Key Players

Recent Developments

- In December 2023: Marked a notable achievement for Agile Therapeutics as they received FDA approval for Twirla, their new low-dose birth control pill. This product stands out for its advanced dispensing technology, offering a more user-friendly option for contraception.

- In October 2023: Merck & Co. Inc. formed a collaboration with Getaway Diagnostics to develop a companion diagnostic test designed to complement their postpartum depression medication. This initiative aims to enhance the treatment’s effectiveness by tailoring it to the individual needs of patients.

- In October 2023: Pfizer Inc. made headlines by securing FDA approval for a pioneering maternal vaccine designed to protect infants against Respiratory Syncytial Virus (RSV). This breakthrough represents a significant advancement in maternal and infant health care.

- In April 2023: Ferring B.V. expanded its commitment to women’s health through a strategic partnership with the BioInnovation Institute. This alliance is focused on accelerating the development of innovative solutions in the field of women’s health, promising to bring new advancements and improvements to care.

Report Scope

Report Features Description Market Value (2023) US$ 41.3 Billion Forecast Revenue (2033) US$ 66 Billion CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Health Conditions (Gynecological Conditions, Mental Health, Cardiovascular Health, Maternal Health, Other Health Conditions), By Age Group (Adolescents, Adult Women, Elderly Women) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AbbVie Inc., Bayer AG, Merck & Co. Inc., Pfizer Inc., Teva Pharmaceutical Industries Ltd., Agile Therapeutics, Amgen Inc., Apothecus Pharmaceutical Corp., Blairex Laboratories Inc., Ferring B.V., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AbbVie Inc.

- Bayer AG

- Merck & Co. Inc.

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Agile Therapeutics

- Amgen Inc.

- Apothecus Pharmaceutical Corp.

- Blairex Laboratories Inc.

- Ferring B.V.

- Other Key Players