Global Wet Wipes Canister Market By Type (Baby wipes, Anti-bacterial wipes, Disinfecting wipes, Flushable wipes, Personal care and cosmetic wipes), By Material Type (Non-woven fabrics, Woven fabrics and Cross-fold), By Distribution Channel (Supermarkets, Online stores, Convenience stores, and Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169529

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

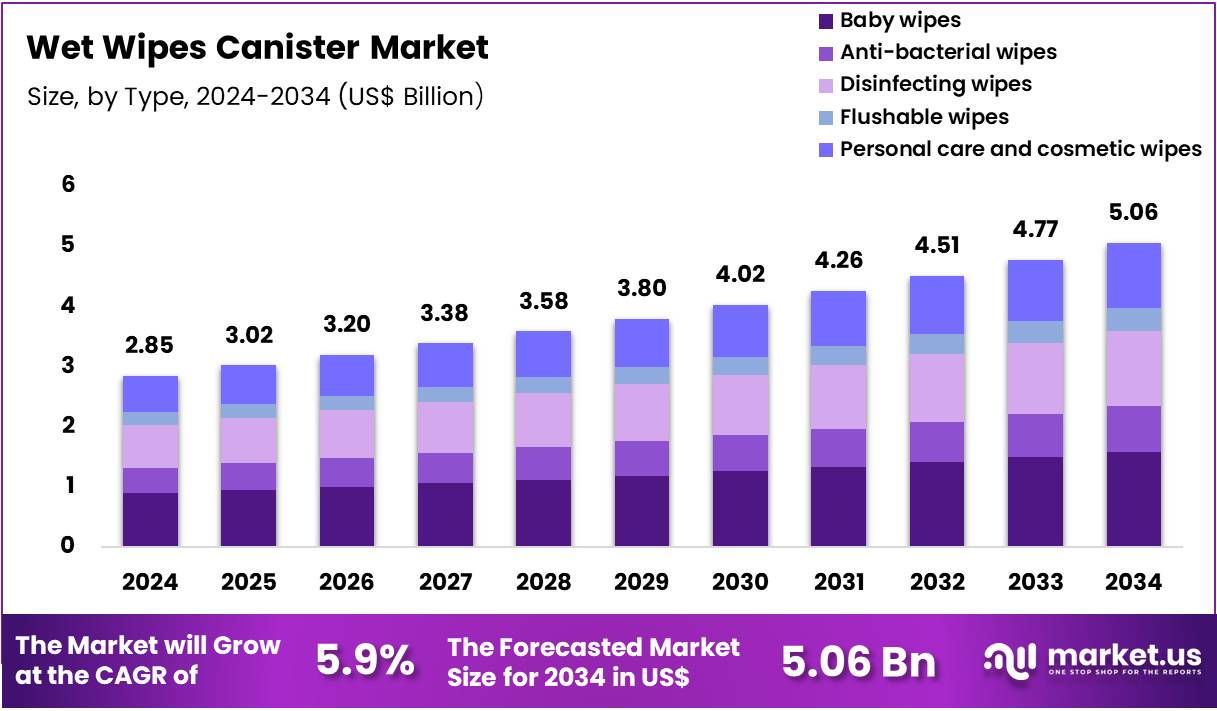

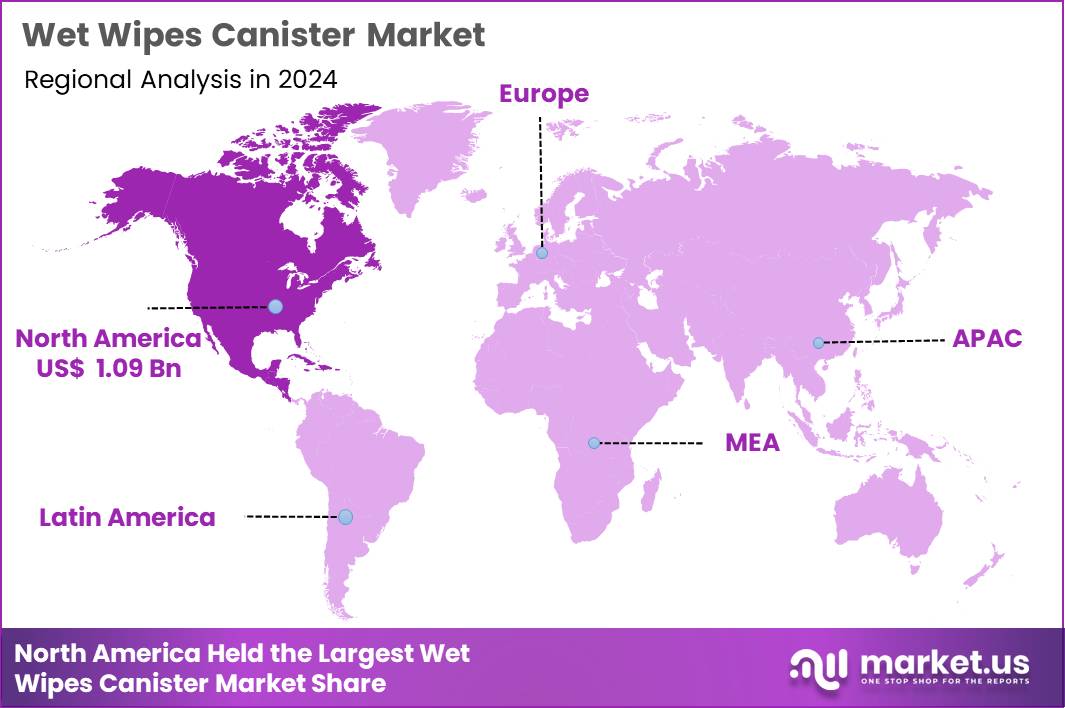

The Global Wet Wipes Canister Market size is expected to be worth around US$ 5.06 Billion by 2034 from US$ 2.85 Billion in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 1.09 Billion.

The Wet Wipes Canister Market has emerged as a key segment within the global hygiene and surface-disinfection ecosystem, driven by rising demand for portable cleaning solutions, household sanitization, and institutional hygiene compliance. Wet wipes packed in canisters provide convenient dispensing, prolonged moisture retention, and increased shelf stability, making them highly preferred across households, healthcare facilities, commercial spaces, and industrial environments. The market has expanded substantially over the past five years, supported by heightened infection-control awareness, evolving cleaning standards, and an increasing shift toward disposable, ready-to-use hygiene products.

The market is expected to progress steadily through 2025–2034 due to sustained usage in childcare, personal care, healthcare sanitation, and household surface cleaning. The baby wipes segment continues to anchor market growth, as newborn and toddler hygiene remains a high-priority category globally.

At the same time, the adoption of antibacterial and disinfecting wipe canisters has strengthened across corporate offices, gyms, transportation hubs, and restaurants, where quick single-use sanitation is essential. Manufacturers such as Kimberly-Clark, Procter & Gamble, The Clorox Company, Rockline Industries, and Nice-Pak continue to expand production capabilities, introduce biodegradable non-woven formulations, and focus on recyclability in canister packaging to align with sustainability expectations.

In February 2022, Essity, a global hygiene and health company, acquired the US-based professional wiping and cleaning manufacturer Legacy Converting, Inc. The company provides sanitizing and disinfecting wet wipes, chemical-ready wipes, and dry wipes. The acquisition was valued at USD 40 million (approximately SEK 370 million), with a potential additional earnout of USD 10 million (around SEK 90 million) on a cash- and debt-free basis. Essity, through its leading Tork brand, is recognized as the world’s largest supplier in the professional hygiene market.

In addition, government hygiene initiatives, including public facility sanitation mandates, hospital infection-prevention protocols, and childcare cleanliness guidelines, continue to strengthen product adoption. The popularity of online channels has also amplified market penetration, enabling retail consumers and small businesses to source wet-wipes canister products more easily and at scale. Increasing demand for biodegradable materials and dermatologically safe formulations is also shaping innovation pipelines. The combination of consumer hygiene awareness, regulatory support, and manufacturer investment contributes to a strong long-term outlook for the Wet Wipes Canister Market.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.85 billion, with a CAGR of 5.9%, and is expected to reach US$ 5.06 billion by the year 2034.

- The Type segment is divided into Baby wipes, Anti-bacterial wipes, Disinfecting wipes, Flushable wipes, and Personal care and cosmetic wipes, with Baby wipes taking the lead in 2024 with a market share of 31.2%

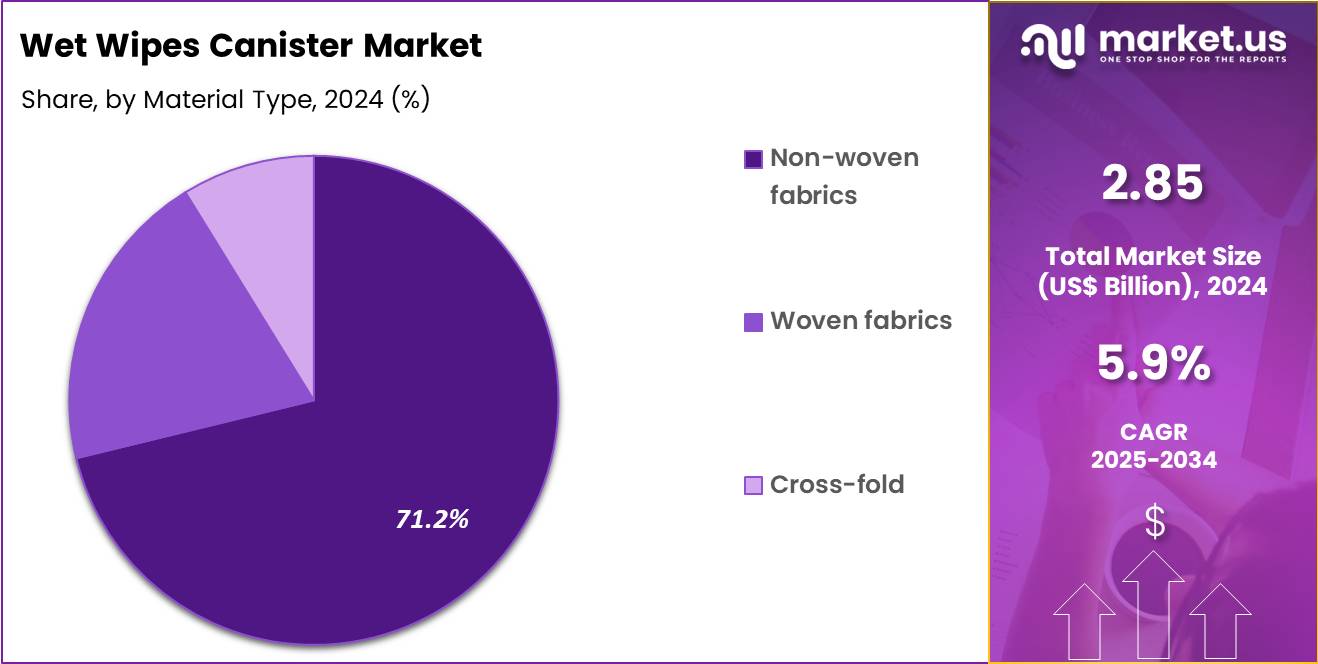

- The Material Type segment is divided into Non-woven fabrics, Woven fabrics, and Cross-fold, with Non-woven fabrics taking the lead in 2024 with a market share of 71.2%

- The Distribution Channel segment is divided into Supermarkets, Online stores, Convenience stores, and Pharmacies, with Supermarkets taking the lead in 2024 with a market share of 44.2%

- North America led the market by securing a market share of 38.4% in 2024.

Type Analysis

Baby Wipes dominated the Type segment with approximately 30.0% market share in 2024 due to consistent demand for infant hygiene. Parents rely heavily on baby wipes for diaper changes, feeding-related cleanup, and general daily hygiene routines. Baby care regulations in regions such as Europe and the US emphasize skin-safe, alcohol-free, hypoallergenic formulations, prompting manufacturers to expand dermatologically tested baby-wipe canister lines. For example, major brands have launched fragrance-free, paraben-free variants specifically for sensitive skin.

Disinfecting Wipes held the second-largest share at 25.0%, driven by strong adoption across households, hotels, restaurants, gyms, and healthcare settings. These wipes are widely used to sanitize high-touch surfaces such as doorknobs, desks, shopping carts, and electronic accessories. The global priority on infection prevention supports continued expansion, especially in airports and commercial complexes where fast-turnover cleaning is needed.

Material Type Analysis

Non-woven fabrics dominated the Material Type segment with 71.2% share in 2024 due to their absorbency, softness, durability, and compatibility with skin- and surface-care formulations. Spunlace and air-laid non-woven fabrics remain widely used because they efficiently retain moisture and release cleaning agents. These materials also support biodegradable product lines, which are increasingly preferred by environmentally conscious consumers.

Woven fabrics contributed approximately 20.0%, primarily serving industrial or heavy-duty wiping applications. Their higher tensile strength makes them suitable for mechanical cleaning tasks, equipment maintenance, and grease removal.

Cross-fold formats accounted for 8.8%, representing wipes arranged in interlocked sheets for continuous dispensing. Cross-fold fabrics are preferred for gym-wipe stations, office cafeterias, and retail-store sanitizing stands where controlled, one-by-one dispensing reduces waste and improves hygiene compliance.

Distribution Channel Analysis

Supermarkets & Hypermarkets dominated distribution with 44.2% market share in 2024 due to strong product visibility, multi-brand availability, and consumer preference for bulk purchases. Retailers often stock value packs and family-size canisters, driving high-volume sales.

Online Stores captured 30.0%, supported by subscription models, fast home delivery, and availability of bulk or professional-grade canisters used by small businesses, preschools, and clinics. E-commerce channels witnessed rapid growth as consumers increasingly purchase cleaning essentials online. Convenience Stores focusing on quick-purchase, portable canister formats suitable for personal use, car storage, and travel.

Key Market Segments

By Type

- Baby wipes

- Anti-bacterial wipes

- Disinfecting wipes

- Flushable wipes

- Personal care and cosmetic wipes

By Material Type

- Non-woven fabrics

- Woven fabrics

- Cross-fold

By Distribution Channel

- Supermarkets

- Online stores

- Convenience stores

- Pharmacies

Drivers

Rising Global Hygiene Awareness and Regulatory Emphasis

Growing global emphasis on hygiene, infection control, and surface disinfection remains the strongest driver for the Wet Wipes Canister Market. According to the World Bank, over 3.5 billion people live in urban areas where public hygiene compliance standards have increased substantially since 2020. The CDC and European Centre for Disease Prevention and Control (ECDC) recommend routine surface disinfection in schools, hospitals, and workplaces, supporting continuous demand for disinfecting and antibacterial wipe canisters. For example, US commercial buildings alone are estimated to spend USD 10–12 billion annually on janitorial supplies, a category in which disinfecting wipe canisters increasingly replace liquid cleaners due to convenience and portability.

Childcare regulations also stimulate significant usage of baby wipes in canister packaging. UNICEF estimates that 140 million babies are born each year, directly influencing demand for gentle, dermatologically tested baby wipes. In parallel, increasing gym memberships crossing 230 million globally drive consumption of large-format disinfecting wipe canisters used for equipment sanitation. Restaurants and hospitality businesses have implemented hygiene protocols requiring single-use wipes for customer tables, menus, and food-prep areas.

Restraints

Environmental Concerns Regarding Wipe Disposal and Waste Management

Despite strong demand, environmental concerns present a major restraint. Municipal wastewater agencies globally report that wet wipes especially non-flushable types are a leading cause of sewer blockages. For instance, Water UK found that 93% of the materials causing sewer fatbergs contained wipes, prompting many European cities to consider stricter disposal regulations. In the US, the National Association of Clean Water Agencies estimates that wipes contribute to USD 500 million per year in sewer maintenance costs. These statistics create significant pressure on manufacturers to redesign materials and labeling.

Landfill waste is another challenge. Non-woven polyester and polypropylene wipes may take up to 100 years to decompose, raising environmental objections. Consumer awareness of plastic pollution—especially in markets like Germany, Japan, and Canada has resulted in shifting preferences toward biodegradable alternatives. Regulatory bodies are also intensifying scrutiny; for example, the EU’s Single-Use Plastics Directive mandates reductions in plastic-containing disposables, forcing brands to reconsider packaging formats such as rigid plastic canisters.

Cost factors also contribute to this restraint. Biodegradable materials typically cost 20–40% more than conventional fibers, limiting adoption in cost-sensitive developing markets. As sustainability expectations rise, companies unable to transition to eco-friendly materials risk losing competitive advantage.

Opportunities

Growth of Biodegradable Materials, Compostable Fibers & Sustainable Packaging

Sustainability demands create one of the largest long-term opportunities. As consumers become more environmentally conscious, biodegradable wet wipes made from plant fibers such as bamboo, cotton, cellulose, and wood pulp are gaining rapid traction. The biodegradable wipes industry itself is projected to exceed USD 8–10 billion by 2030, providing strong downstream opportunities for canister-based variants. Companies like Kimberly-Clark, Unilever, and Nice-Pak are investing heavily in compostable substrates and water-based formulations free of alcohol, parabens, and microplastics.

Packaging innovation is equally promising. Canisters made with PCR (post-consumer recycled) plastics or refillable dispenser systems can reduce plastic usage by up to 70%, fulfilling retailer and regulatory sustainability benchmarks. For example, Rockline Industries introduced refillable wipe stations for gyms and airports, an initiative that reduced single-use plastic consumption by an estimated 30–35% per customer site.

Emerging markets add further opportunity. Rapid urbanization in India, Indonesia, Nigeria, and Vietnam is expected to increase hygiene product penetration rates by 20–25% over the next decade, driving first-time adoption of disinfecting and baby-wipe canisters. Government sanitation programs—such as India’s Swachh Bharat Mission—enhance institutional demand across public sectors, creating billions in long-term procurement potential.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical developments influence raw-material sourcing (non-woven fibers, disinfectant chemicals, plastic canisters) and global supply-chain stability. Fluctuations in resin and pulp prices directly impact production costs. Trade restrictions and port congestion can delay shipment of disinfecting formulations and packaging materials. Inflationary pressures may increase retail prices, affecting low-income consumer segments. However, hygiene remains a resilient category, and recessionary periods often sustain or increase wet wipe consumption due to prioritization of essential cleaning products.

Geopolitical tensions also affect chemical export regulations, cross-border logistics, and availability of disinfectant concentrates. Regulatory changes in environmental legislation influence packaging innovation, prompting manufacturers to shift toward recyclable or PCR-plastic canisters. Urban migration, changes in commercial building occupancy, and public-health policies continue shaping long-term consumption patterns for canister-packaged wet wipes.

Latest Trends

Shift Toward Decentralized, On-the-Go & Refillable Wipe Solutions

One of the strongest trends reshaping the Wet Wipes Canister Market is the transition toward decentralized cleaning models. Instead of relying solely on central janitorial operations, businesses now position wipe canisters and refill stations at high-touch points like office desks, elevators, gyms, cafeterias, and retail checkouts. With over 300,000 fitness centers worldwide, demand for high-capacity disinfecting wipe canisters has surged. Gyms in the US alone consume over 1.5 billion wipes annually, supporting the proliferation of jumbo canister formats.

Another trend is increased demand for travel-friendly and workplace-ready wipe containers. The International Air Transport Association (IATA) reports over 4.7 billion global air passengers expected by 2034, boosting sales of personal disinfecting travel-size canisters. Corporate offices with hybrid work arrangements are adopting personal hygiene kits that include antibacterial wipes in compact canisters.

Refillable systems are gaining popularity, particularly in Europe and North America, where sustainability pressures are strongest. Refillable wipe stations can reduce plastic canister waste by 40–60%, appealing to retail chains, hospitals, and hospitality groups.

Regional Analysis

North America is leading the Wet Wipes Canister Market

North America accounted for an estimated 38.4%of global Wet Wipes Canister Market share in 2024. The region benefits from strong household adoption, commercial hygiene standards, and institutional procurement from schools, gyms, hospitals, and government facilities. The presence of leading manufacturers such as Kimberly-Clark, Clorox, Nice-Pak, and P&G supports innovation in disinfecting wipes, biodegradable materials, and refillable canister formats. High awareness of infection control—supported by CDC cleaning guidelines—continues to reinforce category strength. In July 2024, Kimberly-Clark expanded its biodegradable baby wipes line in North America, utilizing plant-based fibers and recyclable canisters to reduce environmental impact.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to register the highest growth due to rising disposable incomes, expanding infant population, and increased urban hygiene initiatives. China, Japan, India, South Korea, and Southeast Asia drive heavy consumption of baby wipes, cosmetic wipes, and household disinfecting wipes. Regional manufacturers are aggressively scaling production, offering cost-efficient products to meet diverse consumer needs. Public transport sanitation, hospitality expansion, and corporate facility management fuel sustained growth.

In May 2024, Cugo, a baby care solutions company, announced the launch of its eco-friendly baby wipes. The press release noted that Cugo aims to offer a diverse range of high-quality baby essentials designed to prioritize both comfort and environmental responsibility.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Kimberly-Clark Corporation, Procter & Gamble, Johnson & Johnson, The Clorox Company, Diamond Wipes International, Inc., Nice-Pak Products, Inc., S. C. Johnson & Son, Inc., Unicharm Corporation, Reckitt Benckiser Group plc, Beiersdorf AG, Unilever, Rockline Industries, Inc. and Other key players.

Kimberly-Clark Corporation remains a major contributor to the wet wipes canister segment through its Huggies and Cottonelle product lines, focusing on baby hygiene and household cleaning needs. Its innovations in plant-based non-woven fabrics and recyclable canister packaging strengthen its competitive position.

Procter & Gamble plays a significant role with its Pampers and personal-care wipes, supported by global distribution and strong R&D in dermatologically safe formulations. P&G’s emphasis on sensitive-skin products and bulk-pack canister formats enhances adoption among families and institutions.

Johnson & Johnson participates through its baby-care hygiene portfolio and clinically approved formulations, catering to parents seeking gentle, pediatric-tested wipe options packaged in convenient canister formats for home and travel use.

Top Key Players

- Kimberly-Clark Corporation

- Procter & Gamble

- Johnson & Johnson

- The Clorox Company

- Diamond Wipes International, Inc.

- Nice-Pak Products, Inc.

- C. Johnson & Son, Inc.

- Unicharm Corporation

- Reckitt Benckiser Group plc

- Beiersdorf AG

- Unilever

- Rockline Industries, Inc.

- Other key players

Recent Developments

- In April 2025, The Clorox Company introduced a new range of disinfecting wipes formulated for electronics-safe cleaning, aimed at offices and hybrid-work households.

- In March 2025, Rockline Industries launched refillable sanitizing-wipe canister systems targeted at fitness centers and retail chains to reduce single-use plastic consumption.

- In December 2024, Nice-Pak announced its upgraded manufacturing plant in the UK to support increased demand for antibacterial wipe canisters across Europe.

Report Scope

Report Features Description Market Value (2024) US$ 2.85 Billion Forecast Revenue (2034) US$ 5.06 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Baby wipes, Anti-bacterial wipes, Disinfecting wipes, Flushable wipes, Personal care and cosmetic wipes), By Material Type (Non-woven fabrics, Woven fabrics and Cross-fold), By Distribution Channel (Supermarkets, Online stores, Convenience stores, and Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kimberly-Clark Corporation, Procter & Gamble, Johnson & Johnson, The Clorox Company, Diamond Wipes International, Inc., Nice-Pak Products, Inc., S. C. Johnson & Son, Inc., Unicharm Corporation, Reckitt Benckiser Group plc, Beiersdorf AG, Unilever, Rockline Industries, Inc. and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kimberly-Clark Corporation

- Procter & Gamble

- Johnson & Johnson

- The Clorox Company

- Diamond Wipes International, Inc.

- Nice-Pak Products, Inc.

- C. Johnson & Son, Inc.

- Unicharm Corporation

- Reckitt Benckiser Group plc

- Beiersdorf AG

- Unilever

- Rockline Industries, Inc.

- Other key players