Global Vineyard Equipment Market Size, Share Analysis Report By Type of Equipment (Tractors, Sprayers, Harvesting, Pruning, Soil Management, Mulching, Others), By Application (Large Vineyard, Small Vineyard, Medium Vineyard) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159686

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

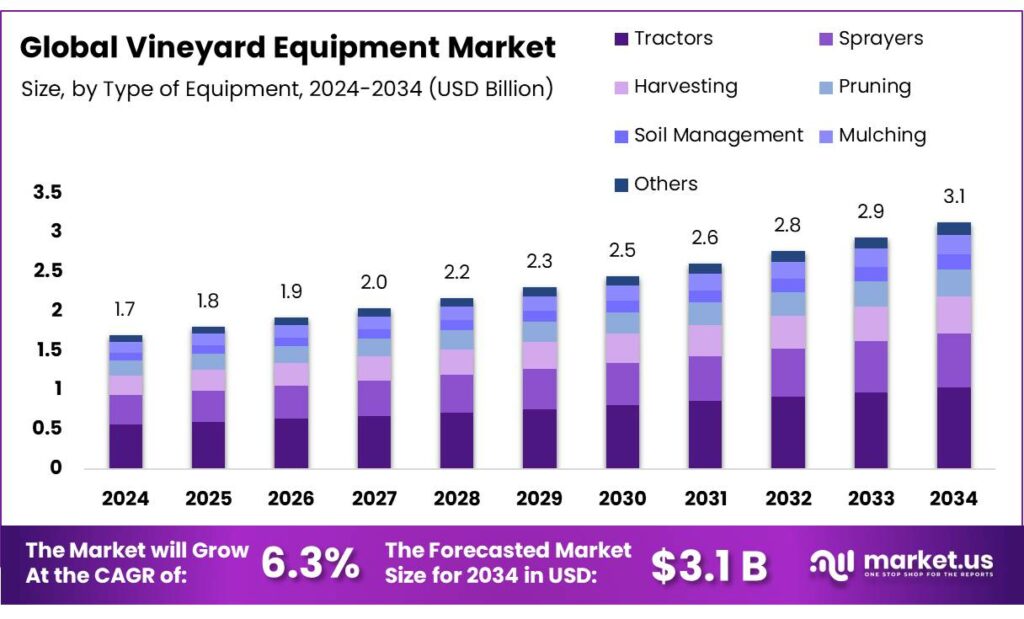

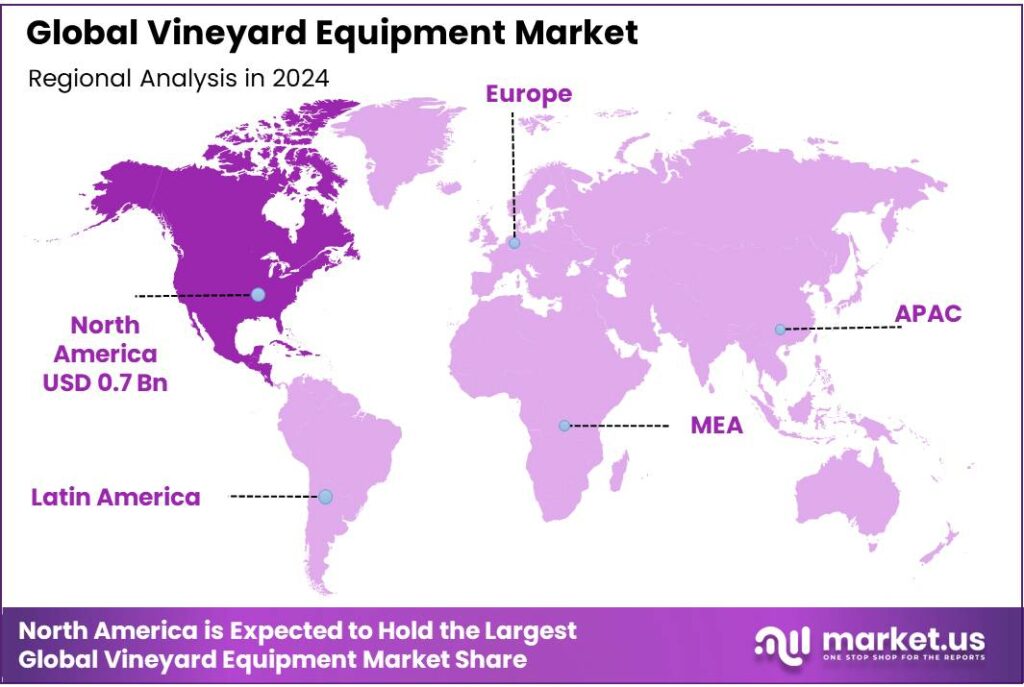

The Global Vineyard Equipment Market size is expected to be worth around USD 3.1 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.8% share, holding USD 0.7 Billion in revenue.

The vineyard equipment industry is integral to modern agricultural practices, playing a crucial role in ensuring the efficiency and productivity of grape cultivation. Vineyard equipment encompasses a range of machinery and tools utilized for planting, irrigation, pruning, pest control, harvesting, and maintenance of vineyards. As vineyards are often located in regions with specific climate and soil requirements, the demand for specialized equipment is a driving force in this sector. The global market for vineyard equipment is influenced by advancements in technology, increasing adoption of precision farming methods, and rising demand for wine production.

Industrial activity is concentrated in the EU, the US, South America, and parts of Oceania. In the United States, California alone reported ~590,000 acres of grapes in 2024 (bearing and non-bearing), indicating a sizable fleet of specialty equipment and ongoing renewal cycles as acreage shifts among wine, table and raisin uses. In parallel, FAO-based datasets show grapes remain one of the world’s largest fruit crops by volume, providing a long-term base for equipment suppliers even as regional plantings ebb and flow.

Driving factors for growth in the vineyard equipment market include climate change adaptation, the increasing shift toward organic farming, and a growing focus on sustainable agricultural practices. With climate variability impacting traditional grape-growing regions, vineyard operators are adopting more resilient practices, which often require advanced equipment.

- According to a 2023 report by the International Organisation of Vine and Wine (OIV), organic vineyard area increased by 20% globally from 2018 to 2022, further driving demand for specialized equipment suited to organic practices.

Government initiatives also play a significant role in supporting the industry. In Europe, the Common Agricultural Policy (CAP) has earmarked substantial funds for promoting sustainability in agriculture, with a specific focus on the wine sector. The European Union has allocated €1.6 billion for 2021-2027 for measures including rural development programs that encourage the use of environmentally-friendly vineyard equipment.

Key Takeaways

- Vineyard Equipment Market size is expected to be worth around USD 3.1 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 6.3%.

- Tractors held a dominant position in the vineyard equipment market, capturing more than 44.9% of the total market share.

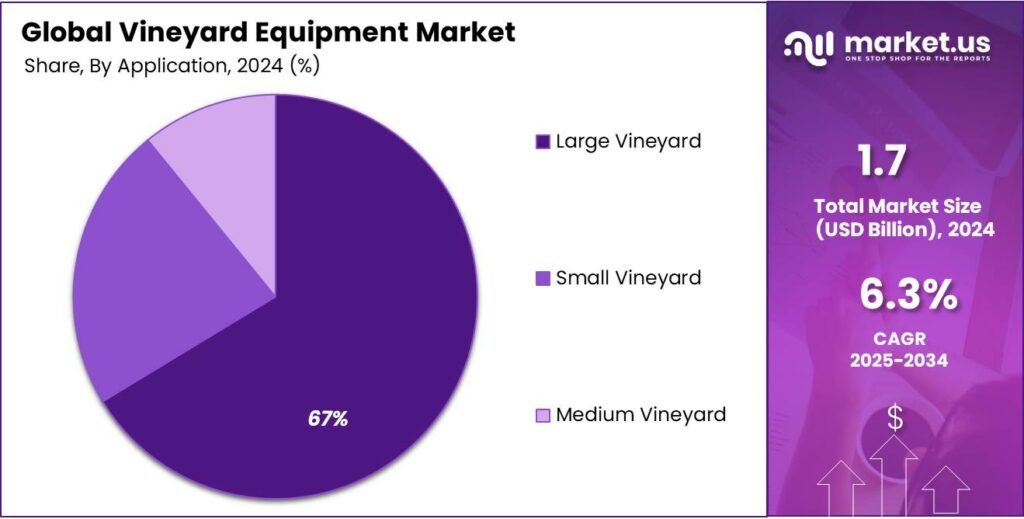

- Large Vineyards held a dominant position in the vineyard equipment market, capturing more than 67.2% of the total market share.

- North America held a dominant position in the vineyard equipment market, capturing a substantial 43.8% share, valued at approximately USD 0.7 billion.

By Type of Equipment Analysis

Tractors dominate Vineyard Equipment Market with 44.9% Share in 2024

In 2024, Tractors held a dominant position in the vineyard equipment market, capturing more than 44.9% of the total market share. This dominance is attributed to the essential role tractors play in various vineyard operations, including planting, plowing, and harvesting. Tractors are the backbone of vineyard mechanization, and their versatility in handling different tasks has made them indispensable to vineyard owners globally.

The widespread adoption of tractors can be linked to their ability to increase operational efficiency and reduce labor costs. Over the past few years, the tractor market for vineyards has seen steady growth, with a notable surge in 2024, driven by technological advancements like GPS guidance systems and automated features. These innovations have made tractors more efficient, allowing them to work with greater precision, even in challenging vineyard terrains.

By Application Analysis

Large Vineyards Dominate Vineyard Equipment Market with 67.2% Share in 2024

In 2024, Large Vineyards held a dominant position in the vineyard equipment market, capturing more than 67.2% of the total market share. This segment’s leadership can be attributed to the extensive land area and the scale of operations typical in large vineyards, which require high-capacity equipment for planting, harvesting, and maintaining large crop volumes efficiently.

As large-scale vineyards tend to be more capital-intensive, they often invest in advanced machinery to optimize productivity and ensure consistent quality. In recent years, there has been a shift towards automated equipment such as self-propelled sprayers, advanced pruning machines, and automated harvesters. This trend has been particularly noticeable in regions like California, France, and Australia, where large vineyard operators seek technologies that help minimize labor costs and maximize output.

Key Market Segments

By Type of Equipment

- Tractors

- Sprayers

- Harvesting

- Pruning

- Soil Management

- Mulching

- Others

By Application

- Large Vineyard

- Small Vineyard

- Medium Vineyard

Emerging Trends

Government Support for Vineyard Mechanization

Vineyard mechanization is gaining momentum as a solution to labor shortages and rising costs in grape production. However, the high initial investment remains a significant barrier for many vineyard operators. Government initiatives play a crucial role in alleviating these financial challenges, providing grants and subsidies to support the adoption of advanced equipment.

In the United States, the USDA offers several programs to assist agricultural businesses, including vineyards, in acquiring essential machinery. For instance, the Equipment Grant Program (EGP) provides grants ranging from $25,001 to $500,000 to eligible institutions for the acquisition of major research equipment. These grants are intended to strengthen the quality and expand the scope of fundamental and applied research in food and agricultural sciences.

In New York State, the Farm and Food Growth Fund provides Equipment-Only Grants ranging from $30,000 to $100,000 to eligible applicants. These grants are focused on funding equipment for post-harvest activities, such as aggregation, processing, manufacturing, storing, transporting, wholesaling, or distribution of agricultural food products. Notably, no match is required for these grants, making them accessible to a broader range of vineyard operators.

These government initiatives are instrumental in reducing the financial burden associated with vineyard mechanization. By providing grants and subsidies, they enable vineyard operators to invest in advanced equipment that can enhance productivity, reduce labor costs, and improve overall operational efficiency. Such support is vital for the long-term sustainability and competitiveness of the vineyard industry.

Drivers

A Driving Force Behind Vineyard Mechanization

The vineyard industry is increasingly turning to mechanization as a solution to escalating labor shortages and rising operational costs. In regions like California’s San Joaquin Valley, labor-intensive tasks such as pruning and harvesting have become increasingly difficult to staff. This shortage has prompted growers to adopt mechanized equipment to maintain productivity and profitability.

- For instance, in the San Joaquin Valley, over 30,000 acres of vineyards have transitioned to mechanization, incorporating technologies like mechanical pruning and shoot thinning. This shift has resulted in significant cost savings, with production expenses per acre decreasing from $3,000 to $2,500, marking a 20% reduction in costs. Collectively, these changes have the potential to save the industry approximately $15 million annually

Similarly, in the U.S., mechanical harvesting has become prevalent, with about 90% of wine grapes being harvested mechanically. This method has been shown to reduce labor costs by approximately 50% compared to traditional hand harvesting, without compromising grape quality

The adoption of mechanization is further supported by government initiatives aimed at modernizing agriculture. For example, the U.S. Department of Agriculture’s Specialty Crop Research Initiative allocates up to $80 million annually to support research and extension projects that address critical challenges in specialty crop industries, including viticulture

Restraints

High Initial Investment and Financial Barriers

One of the most significant obstacles to adopting mechanized equipment in vineyards is the substantial upfront investment required. While mechanization offers long-term savings, the initial costs of purchasing and implementing advanced machinery can be prohibitive for many vineyard operators.

- Similarly, in France, the Cadard family invested nearly €200,000 in a Vitibot robot to address labor shortages in their vineyard. While the robot has proven effective, the high initial cost remains a significant barrier for many vineyard operators

To mitigate these financial challenges, government initiatives and subsidies play a crucial role. In the United States, programs like the USDA’s Rural Development grants and the Farm Service Agency (FSA) loans provide financial assistance to agricultural businesses, including vineyards, to support the purchase of equipment and other essential resources

In France, state subsidies have been instrumental in making robotic technology more accessible to vineyard operators. Without these subsidies, the cost of robotic equipment would be prohibitive for many, highlighting the importance of government support in facilitating the adoption of mechanization in viticulture

Opportunity

Government Support for Vineyard Mechanization

Vineyard mechanization is gaining momentum as a solution to labor shortages and rising costs in grape production. However, the high initial investment remains a significant barrier for many vineyard operators. Government initiatives play a crucial role in alleviating these financial challenges, providing grants and subsidies to support the adoption of advanced equipment.

In the United States, the USDA offers several programs to assist agricultural businesses, including vineyards, in acquiring essential machinery. For instance, the Equipment Grant Program (EGP) provides grants ranging from $25,001 to $500,000 to eligible institutions for the acquisition of major research equipment. These grants are intended to strengthen the quality and expand the scope of fundamental and applied research in food and agricultural sciences

Additionally, the Rural Business Development Grants program offers funding to assist with economic development planning and the financing or expansion of rural businesses. This program aims to support the growth and sustainability of rural economies, including those involved in viticulture

In New York State, the Farm and Food Growth Fund provides Equipment-Only Grants ranging from $30,000 to $100,000 to eligible applicants. These grants are focused on funding equipment for post-harvest activities, such as aggregation, processing, manufacturing, storing, transporting, wholesaling, or distribution of agricultural food products. Notably, no match is required for these grants, making them accessible to a broader range of vineyard operators

Regional Insights

North America Leads Vineyard Equipment Market with 43.8% Share in 2024

In 2024, North America held a dominant position in the vineyard equipment market, capturing a substantial 43.8% share, valued at approximately USD 0.7 billion. The region’s leadership in the vineyard equipment sector can be attributed to its well-established wine production industry, particularly in countries like the United States, which is the fourth-largest wine producer globally. California, accounting for nearly 90% of U.S. wine production, continues to be a major driving force behind vineyard equipment demand.

The growth in vineyard mechanization is largely driven by the need to reduce labor costs, improve operational efficiency, and meet the growing demand for high-quality wine. Over the past few years, the adoption of automated technologies, such as GPS-guided tractors and automated harvesters, has surged in North American vineyards. These innovations not only enhance productivity but also improve the precision of vineyard management, including irrigation and crop protection.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Yanmar Holdings Co., Ltd. is a key player in the vineyard equipment market, renowned for its advanced agricultural machinery, including tractors and specialized vineyard equipment. The company’s focus on innovation and sustainability has positioned it as a preferred choice for vineyard operators worldwide. Yanmar’s strong emphasis on efficient, compact tractors tailored to the unique needs of vineyards enhances productivity, while its commitment to environmentally friendly solutions aligns with growing industry trends towards sustainability.

CNH Industrial N.V. is a global leader in the production of agricultural equipment, including machinery for vineyards under its brands such as New Holland and Case IH. The company’s extensive portfolio includes tractors, sprayers, and harvesting machines designed for large-scale operations. CNH Industrial is known for integrating cutting-edge technologies like precision farming solutions, offering improved operational efficiency and resource optimization. Their focus on sustainable farming practices and advanced machinery has solidified their position in the vineyard equipment market.

John Deere, a recognized leader in the agricultural equipment industry, offers a wide range of vineyard machinery, including tractors, sprayers, and harvesters. Known for their durability and advanced technological features, John Deere’s machines help vineyard operators maximize productivity while minimizing labor costs. The company’s precision farming solutions, including GPS guidance systems and automated equipment, enhance vineyard operations by improving efficiency and reducing environmental impact. John Deere’s strong brand reputation ensures its continued leadership in the vineyard equipment sector.

Top Key Players Outlook

- Yanmar Holdings Co., Ltd

- Pellenc

- CNH Industrial N.V.

- John Deere

- SAGCO

- Maschio Gaspardo S.p.A.

- GRIMME Landmaschinenfabrik GmbH & Co.

- Blueline Manufacturing Co

Recent Industry Developments

In 2024 SAGCO, is expected to see a 3.5% increase in market share due to its high-quality sprayers, tractors, and harvesters designed for efficiency and precision.

In 2024, Pellenc is expected to generate around USD 650 million in revenue from its vineyard equipment line, with strong sales in regions like Europe and North America.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 3.1 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Equipment (Tractors, Sprayers, Harvesting, Pruning, Soil Management, Mulching, Others), By Application (Large Vineyard, Small Vineyard, Medium Vineyard) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Yanmar Holdings Co., Ltd, Pellenc, CNH Industrial N.V., John Deere, SAGCO, Maschio Gaspardo S.p.A., GRIMME Landmaschinenfabrik GmbH & Co., Blueline Manufacturing Co Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Yanmar Holdings Co., Ltd

- Pellenc

- CNH Industrial N.V.

- John Deere

- SAGCO

- Maschio Gaspardo S.p.A.

- GRIMME Landmaschinenfabrik GmbH & Co.

- Blueline Manufacturing Co