Veterinary Medicine Market By Product Type-Drugs (Anti-Infective, Anti-Inflammatory, Parasiticide, Other Drug Type) Vaccines-(Inactivated Vaccines, Attenuated Vaccines, Recombinant Vaccines) Medicated Feed Additives (Animal, Companion Animals, Livestock Animals) By Route of Administration (Oral Route, Parenteral Route, Topical Route) By End-User (Reference Laboratories, Point-of-care testing/in-house testing, Veterinary Hospitals & Clinics, Other End-User) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 118053

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

The Global Veterinary Medicine Market size is expected to be worth around USD 97.0 Billion by 2033 from USD 47.5 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

Veterinary medicine encompasses a range of products designed to address different medical conditions in animals. This can include medications like anti-infective drugs and parasiticides that must be given orally; vaccines play an integral part in providing immunity against infectious diseases like Equine Influenza Virus (EIV) and Parainfluenza 3-respiratory Syncytial.

Medicated feed additives are also an integral part of veterinary medicine, often added into animal feed to induce pharmaceutical effects. This field serves an array of animals from companion animals like dogs and cats to livestock like cattle, pigs, and poultry. Administration methods vary, with drugs typically given orally while vaccines must be given via parenteral routes or topically applied parasiticidal preparations.

Numerous factors drive the expansion of the veterinary medicine market. These include rising incidence of chronic diseases in animals, increased adoption rates and evolving preferences of pet and poultry farm owners regarding drug usage. Furthermore, this market benefits from continuous human population expansion leading to an increase in meat and animal-derived product demand; with livestock populations showing significant gains; figures released by United States Department of Agriculture showing increased cattle and sheep numbers as evidence for such growth; this trend should persist into the years ahead.

Key Takeaways

- Market Size: Veterinary Medicine Market size is expected to be worth around USD 97.0 Billion by 2033 from USD 47.5 Billion in 2023.

- Market Growth: The market growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

- Product Analysis: Drugs dominate with 58.2% market share in 2023.

- Animal Analysis: Livestock animals accounts 56.8% market share in veterinary medicine market.

- Route of Administration: Parenteral administration currently dominates with 58% market share in 2023.

- End-Use Analysis: hospitals and clinics dominating with a 46.8% market share.

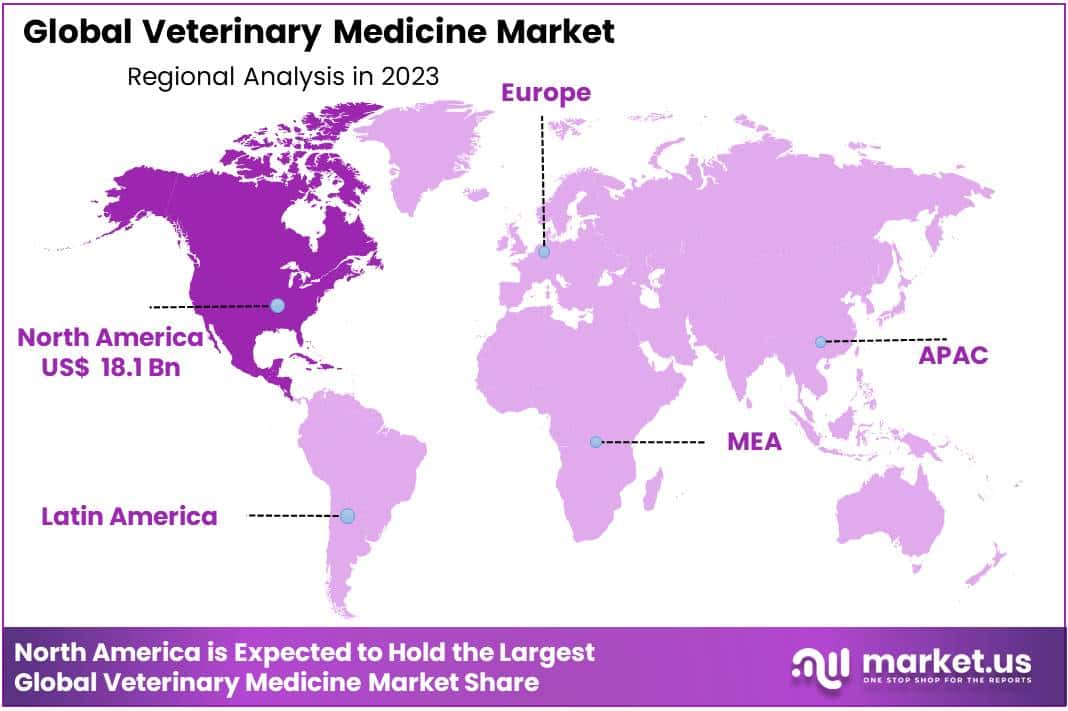

- Regional Analysis: North America held a market share of 38.2% of the veterinary medicine market in 2023.

Product Type

Within the veterinary medicine market, drugs dominate with 58.2% share, with vaccines playing an essential role in protecting against various infectious diseases that threaten animals’ health and welfare. Veterinary vaccines are widely utilized by veterinary practitioners to protect companion animals, livestock and poultry from common pathogens. As awareness increases among pet owners and livestock producers regarding vaccination, demand for veterinary vaccines increases rapidly.

Key players in the market, including pharmaceutical giants such as Zoetis, Elanco and Boehringer Ingelheim, invest heavily in research and development activities to advance vaccine formulations and discover novel solutions. Collaborations between academic institutions and government agencies further facilitate the production and distribution of effective vaccines, with partnerships leading to their creation being especially helpful in expanding veterinary medicine markets and animal health management strategies. It is expected that vaccines will continue to play an integral part in increasing market size and supporting animal wellbeing management strategies.

Animal Analysis

Within the expansive realm of veterinary medicine, livestock animals occupy an outsized share of 56.8%. This segment covers various species such as cattle, poultry, swine and others that play key roles in agriculture and food production. Services tailored specifically to livestock animals’ needs such as preventive care, diagnostic testing, illness treatments and reproductive management aim to safeguard their wellbeing and productivity.

Companion animals make up an essential yet smaller component of the veterinary medicine market, comprising beloved pets such as dogs, cats, and small mammals. This segment is marked by increasing demand for top-tier healthcare services – such as regular checkups, vaccinations, surgical procedures, and treating ailments – providing high quality services such as regular check-ups, vaccinations and surgeries as well as treatments tailored specifically for specific ailments.

As global population and awareness of animal welfare continue to increase, both segments of veterinary medicine markets should experience steady expansion – offering promising opportunities to stakeholders within this industry.

Route of Administration Analysis

As part of the rapidly evolving veterinary medicine market, route of administration plays an essential part in providing effective treatments to animals. Parenteral administration currently dominates with 58% market share – this method involves directly administering medications into an animal’s body using injections, intravenous drips or implants in order to ensure rapid absorption and precise dosing – it’s particularly favored because it ensures quick absorption rates and quick dosing accuracy during emergency situations.

Oral route medications offer a quick and accessible option, enabling medications to be ingested by animals themselves through tablets, capsules or liquids administered orally. This approach is often employed for long-term treatments, preventive medication regimens or supplements.

Topical treatment includes applying medications directly onto animal skin or mucous membranes for targeted local treatment of conditions like skin infections, wounds or eye ailments. With advances in pharmaceutical formulations and delivery systems, all routes of administration will continue to progress, meeting the diverse needs of veterinary medicine and improving animal health worldwide.

End-User Analysis

End users play an essential part in shaping the market of veterinary medicine, with hospitals and clinics dominating with a 46.8% market share. They serve as access points for pet owners seeking medical treatment for their beloved companions; offering regular check-ups, surgical procedures, diagnostic testing, as well as comprehensive treatments to animals of all sizes and breeds.

Reference laboratories play a pivotal role in providing diagnostic services for veterinarians. Utilizing advanced technology and expert personnel, these laboratories specialize in sample analysis to produce accurate results that assist veterinarians with diagnosing and treating various animal illnesses and conditions.

Point-of-care testing, or in-house testing, has quickly gained prominence as an efficient and rapid diagnostic solution for veterinary clinics. This form of analysis allows for on-site analysis of samples to facilitate timely decision-making and efficient management of animal health. As veterinary medicine evolves further, point-of-care testers will become key contributors towards innovation while protecting animal welfare globally.

Market Segments

Product Type

Drugs

- Anti-Infective

- Anti-Inflammatory

- Parasiticide

- Other Drug Type

Vaccines

- Inactivated Vaccines

- Attenuated Vaccines

- Recombinant Vaccines

Medicated Feed Additives

Animal

- Companion Animals

- Livestock Animals

Route of Administration

- Oral Route

- Parenteral Route

- Topical Route

End-User

- Reference Laboratories

- Point-of-care testing/in-house testing

- Veterinary Hospitals & Clinics

- Other End-User

Driver

Rising Trend of Pet Ownership

A major driver behind the growth of the veterinary medicine market is rising trends of pet ownership worldwide, particularly among individuals and families that embrace pets as companions. As more households adopt pets as companions, demand for veterinary services and medicines increases exponentially – this phenomenon being especially visible in developed regions like North America and Europe, where pet ownership rates have seen dramatic spikes. An emotional bond between pets and their owners fuels significant investments into pet healthcare such as preventive care, diagnostics and treatments thus driving market expansion forward and creating opportunities.

Technological Advancements

One key driver driving growth of the veterinary medicine market is continuous advances in diagnostics and treatment modalities for animals. Advances such as advanced imaging techniques, genetic testing, minimally invasive surgeries and targeted therapies have transformed veterinary healthcare and enabled more accurate diagnoses with tailored plans of treatment plans for each pet patient. Veterinarians are rapidly adopting cutting-edge technologies like these in order to optimize patient outcomes – driving demand for sophisticated pharmaceuticals and therapeutic solutions in this market.

Trend

Shift towards Preventive Care

One trend driving the veterinary medicine market is an increasing emphasis on preventive healthcare measures for pets. Pet owners are becoming more proactive about safeguarding their animals’ wellbeing with regular check-ups, vaccinations, parasite control products and nutritional supplements; this preventive care increases quality of life while simultaneously decreasing incidence of costly diseases and treatments – driving demand for preventive veterinary medicines and wellness products.

Focus on Holistic and Integrative Medicine

Another noteworthy trend in the veterinary medicine market is an increasing focus on holistic and integrative approaches to pet healthcare. Both veterinarians and pet owners alike are exploring complementary therapies such as acupuncture, chiropractic care, herbal remedies, and nutritional therapy in order to address various health issues while improving overall wellness for pets. This holistic approach complements traditional veterinary medicine while offering additional treatment options as well as increasing market demand for alternative products like alternative veterinary medicines or wellness products.

Restraint

Restraints and Compliance Burden

One of the main challenges preventing growth in veterinary medicine market is its stringent regulatory landscape, which governs development, approval, and marketing of pharmaceuticals and biologics for animal use. Compliance requirements vary across regions and countries causing manufacturers difficulty with complex approval processes ensuring compliance with strict safety and efficacy standards imposed on them by regulatory bodies. Time-consuming and costly approval processes for new veterinary medications hinder product innovation as well as market entry; ultimately slowing market expansion.

Rising Concerns About Antimicrobial Resistance

One key limiting factor facing the veterinary medicine market is rising antimicrobial resistance (AMR). Overuse and misuse of antibiotics contributes to resistant bacterial strains posing serious threats to animal and public health, prompting regulatory agencies and healthcare stakeholders to scrutinize use of these agents in veterinary practice and advocate for careful use. As a result, veterinarians face pressure from regulatory bodies to limit usage resulting in decreased demand for certain pharmaceuticals and antimicrobial agents.

Opportunity

Expanded Pet Insurance Penetration

One promising trend in the veterinary medicine market is the increasing adoption of pet insurance policies across geographies. As more pet owners recognize its utility in mitigating unexpected vet expenses, adoption has skyrocketed. Plus, pet insurance provides access to comprehensive services and treatments, such as medications and surgeries that expands its market for therapeutics and medicines.

Expansion of Companion Animal Healthcare in Emerging Markets

Another promising opportunity for the veterinary medicine market is the expansion of companion animal healthcare services in emerging markets. Rapid urbanization, rising disposable incomes, and evolving pet ownership trends in countries across Asia-Pacific, Latin America, and the Middle East present untapped opportunities for market players to establish a presence and capitalize on the growing demand for veterinary medicines and healthcare products. Strategic partnerships, distribution agreements, and market expansion initiatives can enable companies to tap into emerging markets and unlock new growth opportunities in the veterinary medicine sector.

Regional Analysis

North America held a market share of 38.2% of the veterinary medicine market in 2023 and this trend is projected to continue, driven by rising companion animal ownership numbers and widespread availability of veterinary medicines. Factors like rising animal health expenditure also contribute to market expansion in North America.

Meanwhile, Asia-Pacific region may experience faster market expansion thanks to increasing awareness regarding use of veterinary medicines and increasing companion animal ownership rates – factors which further augment market expansion there.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Player Analysis

Veterinary medicine markets are highly competitive environments. To gain market dominance and maintain their edge over competitors, key players employ strategic initiatives and new product offerings in an attempt to remain on top. Major pharmaceutical firms such as Zoetis, Elanco and Boehringer Ingelheim dominate the veterinary drug market by capitalizing on their research and development capacities to bring out innovative veterinary drugs.

Mergers, acquisitions and collaborations are common strategies employed by these businesses in order to expand their global footprint and diversify product portfolios. As more companies opt for biologics, specialty pharmaceuticals, and personalized medicine for companion and production animals, innovation in treatment options has proliferated rapidly. Compliance with quality standards is of critical importance as companies vie for market share while meeting evolving animal needs.

Market Key Players

- Zoetis Inc.

- Boehringer Ingelheim International Gmbh

- Merck & Co., Inc.

- Elanco

- Evonik Industries AG

- Dechra Pharmaceuticals PLC

- Ceva Santé Animale

- Virbac SA

- Phibro Animal Health Corporation

- Bimeda Corporate

Recent Developments

- Zoetis: Specializing in innovative solutions for companion animals and livestock, including product launches, research advancements or acquisitions. For specific details it may require further investigation.

- Boehringer Ingelheim: Similar to Zoetis, Boehringer Ingelheim is another major player. They may have recent developments; however, specific details would require additional investigation.

- Merck & Co: Merck has long recognized animal health as a core area of focus for their business, and may provide recent news related to this division; however, for specifics on it more focused research would likely be required.

- Elanco: Elanco acquired Bayer’s animal health business in 2020 and since then have likely made developments to their market position; more research will likely reveal them.

Report Scope

Report Features Description Market Value (2023) USD 47.5 Billion Forecast Revenue (2033) USD 97.0 Billion CAGR (2024-2033) 7.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type-Drugs(Anti-Infective, Anti-Inflammatory, Parasiticide, Other Drug Type) Vaccines-(Inactivated Vaccines, Attenuated Vaccines, Recombinant Vaccines) Medicated Feed Additives (Animal, Companion Animals, Livestock Animals) By Route of Administration (Oral Route, Parenteral Route, Topical Route) By End-User (Reference Laboratories, Point-of-care testing/in-house testing, Veterinary Hospitals & Clinics, Other End-User) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Zoetis Inc., Boehringer Ingelheim International Gmbh, Merck & Co., Inc., Elanco, Evonik Industries AG, Dechra Pharmaceuticals PLC, Ceva Santé Animale, Virbac SA, Phibro Animal Health Corporation, Bimeda Corporate Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current state of the veterinary medicine market?The veterinary medicine market is robust and continually evolving to meet the growing needs of animals worldwide. It encompasses various segments, including pharmaceuticals, vaccines, diagnostics, and veterinary services.

How big is the Veterinary Medicine Market?The global Veterinary Medicine Market size was estimated at USD 47.5 Billion in 2023 and is expected to reach USD 97.0 Billion in 2033.

What is the Veterinary Medicine Market growth?The global Veterinary Medicine Market is expected to grow at a compound annual growth rate of 7.4%. From 2024 To 2033

Who are the key companies/players in the Veterinary Medicine Market?Some of the key players in the Veterinary Medicine Markets are Zoetis Inc., Boehringer Ingelheim International Gmbh, Merck & Co., Inc., Elanco, Evonik Industries AG, Dechra Pharmaceuticals PLC, Ceva Santé Animale, Virbac SA, Phibro Animal Health Corporation, Bimeda Corporate.

What are the primary routes of administration in veterinary medicine?The primary routes of administration include parenteral (injections, implants), oral (tablets, liquids), and topical (ointments, sprays). Each route offers unique advantages and is selected based on the specific needs of the animal and the condition being treated.

What types of animals are covered in the veterinary medicine market?The veterinary medicine market serves a wide range of animals, including livestock such as cattle, poultry, and swine, as well as companion animals like dogs, cats, and small mammals. The market also caters to exotic animals, equines, and others.

What factors are driving growth in the veterinary medicine market?Factors driving growth include increasing pet ownership, rising awareness of animal health and welfare, advancements in veterinary technology, and the growing demand for preventive healthcare services for animals. Additionally, trends such as humanization of pets and the focus on natural products are influencing market dynamics.

Veterinary Medicine MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Veterinary Medicine MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Zoetis Inc.

- Boehringer Ingelheim International Gmbh

- Merck & Co., Inc.

- Elanco

- Evonik Industries AG

- Dechra Pharmaceuticals PLC

- Ceva Santé Animale

- Virbac SA

- Phibro Animal Health Corporation

- Bimeda Corporate