Global Veterinary Dermatology Drugs Market By Animal Type (Companion Animals (Dogs, Cats, Horses, and Others) and Livestock Animals (Cattle and Others)), By Route of Administration (Oral, Topical, and Injectable), By Application (Parasitic Infections, Allergic Infections, and Others), By Distribution Channel (Hospital Pharmacies, Retail, and E-commerce), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151391

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Animal Type Analysis

- Route of Administration Analysis

- Application Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

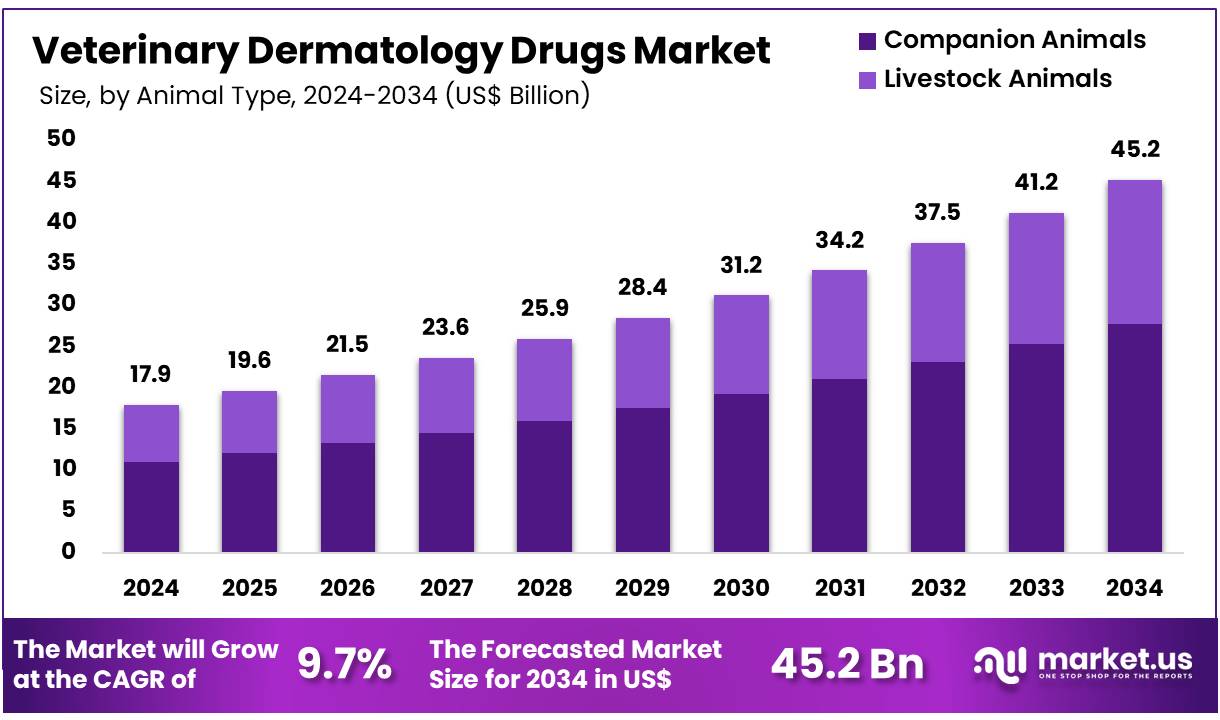

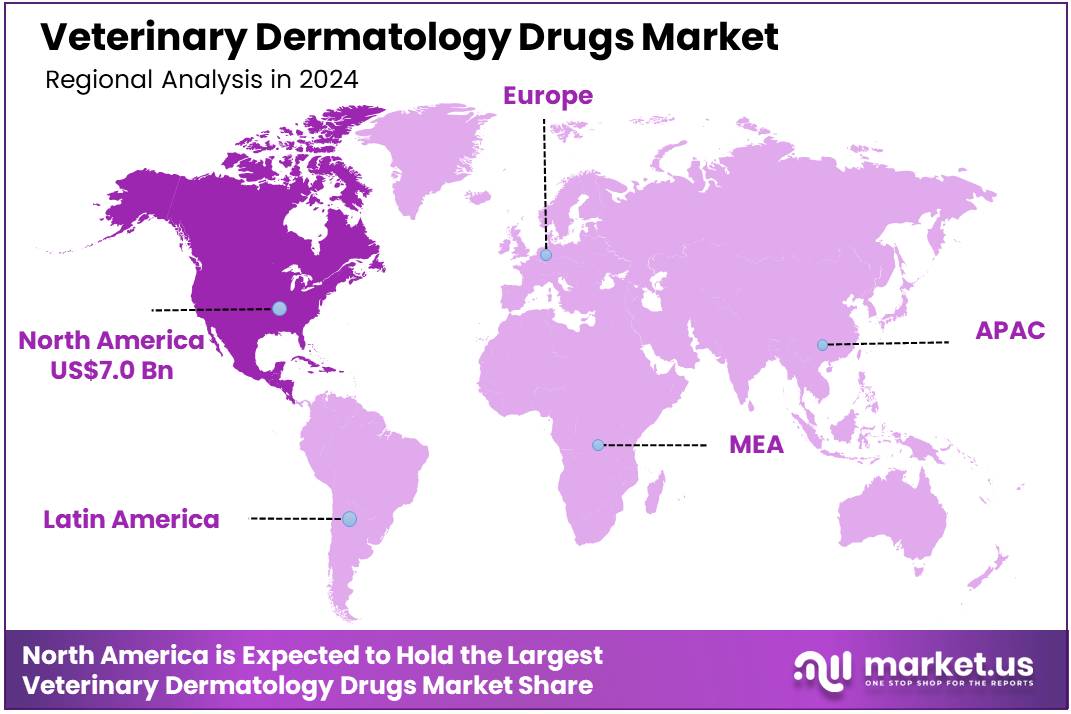

Global Veterinary Dermatology Drugs Market size is expected to be worth around US$ 45.2 Billion by 2034 from US$ 17.9 Billion in 2024, growing at a CAGR of 9.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.2% share with a revenue of US$ 7.0 Billion.

Increasing awareness of pet health and the growing prevalence of dermatological conditions in animals are driving significant demand for veterinary dermatology drugs. These medications address a wide array of skin-related issues in pets, such as allergic reactions, infections, and parasitic infestations. Rising pet ownership, coupled with heightened concerns over pet welfare, has also contributed to the market’s expansion.

Veterinary dermatology drugs are vital in treating skin conditions like pyoderma, dermatitis, and mange, improving the quality of life for animals while enhancing the capabilities of veterinary care. Additionally, advancements in drug formulations, including the development of topical treatments and oral therapeutics, present new opportunities for growth in the market. The focus on reducing side effects and enhancing drug efficacy has led to innovations that cater to different animal species, ranging from household pets to livestock.

As a result, new treatments are emerging for complex conditions, further fueling market growth. In August 2024, Boehringer Ingelheim India’s collaboration with Vvaan Lifesciences Pvt Ltd marked a notable development in expanding the distribution of parasiticidal products for pets. By utilizing Vvaan’s extensive network, the initiative aims to strengthen pet healthcare infrastructure in underserved areas, demonstrating how strategic partnerships can enhance the reach and impact of veterinary dermatology drugs in growing markets.

Key Takeaways

- In 2024, the market for veterinary dermatology drugs generated a revenue of US$ 17.9 Billion, with a CAGR of 9.7%, and is expected to reach US$ 45.2 Billion by the year 2034.

- The animal type segment is divided into companion animals and livestock animals, with companion animals taking the lead in 2023 with a market share of 61.5%.

- Considering route of administration, the market is divided into oral, topical, and injectable. Among these, topical held a significant share of 49.2%.

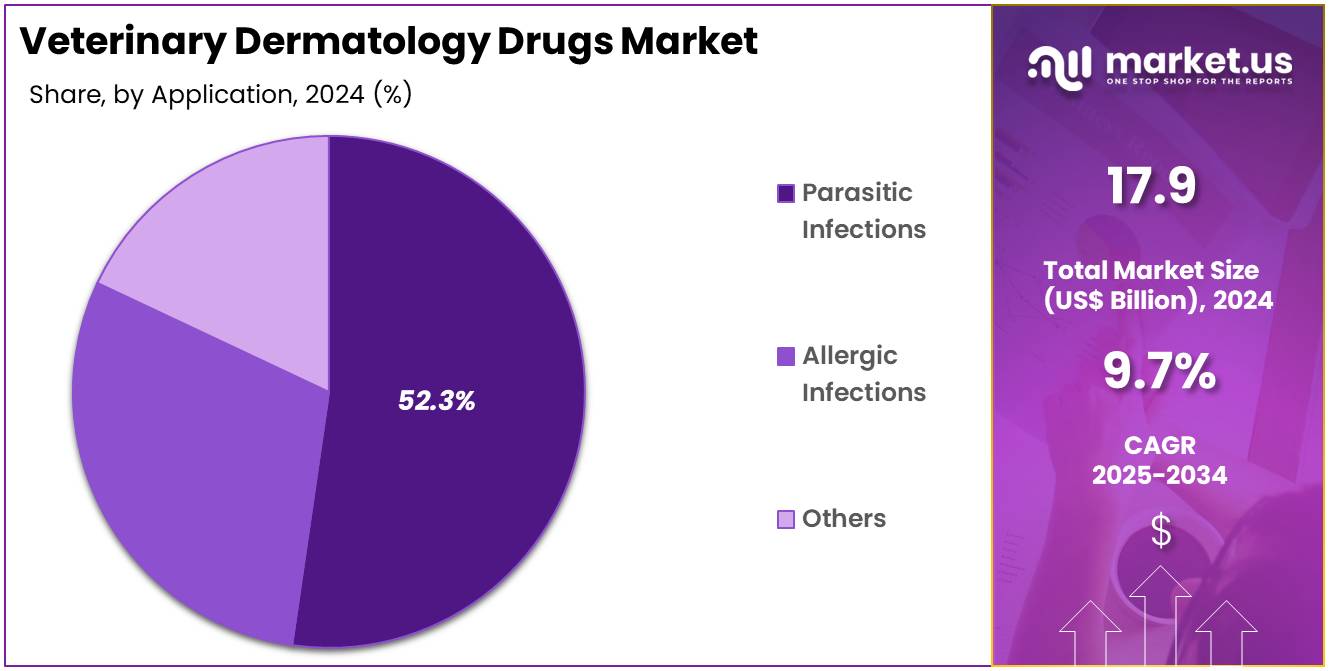

- Furthermore, concerning the application segment, the market is segregated into parasitic infections, allergic infections, and others. The parasitic infections sector stands out as the dominant player, holding the largest revenue share of 52.3% in the veterinary dermatology drugs market.

- The distribution channel segment is segregated into hospital pharmacies, retail, and e-commerce, with the hospital pharmacies segment leading the market, holding a revenue share of 53.8%.

- North America led the market by securing a market share of 39.2% in 2023.

Animal Type Analysis

The companion animals segment claimed a market share of 61.5% owing to the growing focus on pet healthcare and the increasing pet ownership globally. The rising prevalence of dermatological conditions in companion animals, such as allergies, skin infections, and parasitic infestations, is anticipated to drive market growth in this segment. The increasing willingness of pet owners to spend on healthcare for their animals, along with the rising trend of humanization of pets, is projected to further boost demand for dermatology drugs for companion animals.

Additionally, advancements in veterinary dermatology treatments, including safer and more effective topical medications, will contribute to the growth of this segment. Companion animal dermatology is expected to continue gaining momentum as pet owners prioritize the health and well-being of their animals, resulting in a strong and expanding market.

Route of Administration Analysis

The topical held a significant share of 49.2% due to their direct application to affected areas, which makes them effective for managing skin conditions in animals. The convenience of topical drugs, particularly in the treatment of dermatological conditions like infections, allergies, and parasitic infestations, is likely to drive their continued adoption. The segment is expected to grow as more topical formulations, such as creams, sprays, and ointments, become available, offering a variety of treatment options for veterinarians and pet owners.

The effectiveness and ease of use of topical treatments, combined with minimal systemic side effects, make them the preferred choice for treating skin disorders in both companion and livestock animals. The rising awareness of dermatological conditions in animals and the growing demand for non-invasive treatment options will likely propel the growth of the topical segment.

Application Analysis

The parasitic infections segment had a tremendous growth rate, with a revenue share of 52.3% owing to the high incidence of parasitic diseases in both companion and livestock animals. The increasing prevalence of flea, tick, and mite infestations in pets, along with parasitic infections affecting livestock, is anticipated to drive demand for veterinary dermatology drugs targeted at managing these conditions.

As awareness of the impact of parasitic infections on animal health grows, veterinarians are likely to recommend more specialized treatments, further boosting the market for parasitic infection drugs. The segment’s growth is also expected to be supported by the ongoing development of more effective and longer-lasting treatments for parasites, such as spot-on treatments, shampoos, and systemic medications. The growing concern over zoonotic diseases transmitted by parasites will likely continue to drive the adoption of parasitic infection treatments.

Distribution Channel Analysis

The hospital pharmacies segment grew at a substantial rate, generating a revenue portion of 53.8% due to their critical role in providing specialized healthcare for animals, especially in emergency and treatment settings. The increasing number of veterinary hospitals and clinics, along with the rising demand for advanced dermatology treatments, is expected to drive the growth of this segment.

Hospital pharmacies are likely to benefit from the increasing adoption of dermatology drugs in clinical environments, where veterinary professionals require access to a wide range of pharmaceutical options for treating complex skin conditions. The segment is anticipated to continue growing as veterinary hospitals focus on providing comprehensive care for animals, including dermatological treatments. The strong relationship between hospitals and pharmaceutical suppliers will ensure that hospital pharmacies remain a key player in the distribution of veterinary dermatology drugs.

Key Market Segments

By Animal Type

- Companion Animals

- Dogs

- Cats

- Horses

- Others

- Livestock Animals

- Cattle

- Others

By Route of Administration

- Oral

- Topical

- Injectable

By Application

- Parasitic Infections

- Allergic Infections

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail

- E-commerce

Drivers

Increasing Incidence of Pet Skin Allergies and Diseases is Driving the Market

The rising global incidence of various dermatological conditions in companion animals, particularly skin allergies, infections, and parasitic infestations, is a primary driver for the veterinary dermatology drugs market. Pet owners are becoming increasingly aware of their pets’ health and well-being, leading to a higher demand for diagnostic and therapeutic solutions for skin issues that cause discomfort and reduce quality of life for animals.

According to data published in the Journal of Veterinary Medicine in February 2024, atopic dermatitis, a chronic allergic skin condition, impacts 20-30% of the canine population. Furthermore, skin diseases in dogs are relatively common, accounting for 30-45% of all reported conditions in this species. This high prevalence necessitates effective pharmaceutical interventions, ranging from anti-inflammatories and antiparasitics to antibiotics and antifungals, to manage these widespread conditions.

Restraints

High Cost of Veterinary Care and Limited Pet Insurance Penetration are Restraining the Market

The veterinary dermatology drugs market faces significant restraint due to the relatively high cost of comprehensive veterinary care and the limited penetration of pet insurance, particularly in many parts of the world. Diagnosing and treating complex dermatological conditions often requires multiple veterinary visits, specialized tests, and long-term medication, which can accumulate into substantial expenses for pet owners.

The American Pet Products Association (APPA) reported that pet industry expenditures in the US totaled US$147 billion in 2023, with veterinary care and product sales accounting for US$38.3 billion. In 2024, veterinary care and product sales reached US$39.8 billion. While pet ownership is high, a survey from The Zebra in 2024 indicated that only 20% of American pet owners could afford to pay a US$5,000 vet bill. This financial burden can lead to pet owners delaying or foregoing necessary dermatological treatments for their animals, thereby limiting the growth of the market for specialized drugs.

Opportunities

Rising Pet Humanization and Increased Spending on Pet Health Creates Growth Opportunities

The growing trend of pet humanization, where pets are increasingly viewed as integral family members, coupled with a corresponding increase in discretionary spending on pet health, presents significant growth opportunities in the veterinary dermatology drugs market. This shift in perception encourages pet owners to seek higher quality and more advanced medical care for their animals, including specialized dermatological treatments.

The American Pet Products Association (APPA)’s 2023-2024 National Pet Owners Survey reported that an estimated 66% of US households, or about 86.9 million families, own a pet, indicating a large and committed owner base. This strong emotional bond and willingness to spend on premium pet care drive demand for innovative and effective solutions for skin conditions, including new formulations, more targeted therapies, and improved palatability for ease of administration.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the veterinary dermatology drugs market, primarily through their impact on consumer spending on pets, the overall healthcare expenditure in the animal health sector, and the availability of capital for research and development. In periods of economic prosperity, pet owners are generally more willing to spend on premium veterinary services and specialized medications for their animals, including advanced dermatological treatments.

Conversely, during economic downturns or high inflationary periods, households may reduce discretionary spending, potentially leading to delayed or forgone non-emergency veterinary visits and a preference for more affordable, over-the-counter solutions. The International Monetary Fund (IMF) projected global economic growth to be 3.2% in both 2024 and 2025, which can support continued investment in pet care. Geopolitical factors, such as trade stability and the global sourcing of active pharmaceutical ingredients (APIs), are also crucial.

Disruptions in international supply chains, exacerbated by geopolitical tensions, can lead to shortages or increased costs of raw materials for veterinary drug manufacturers, impacting production and drug availability. However, the strong human-animal bond and the increasing recognition of pets as family members often provide a resilient foundation for the market, ensuring continued demand even through economic fluctuations.

Current US tariff policies can directly impact the veterinary dermatology drugs market by influencing the cost of imported raw materials, active pharmaceutical ingredients (APIs), and finished animal health products. Tariffs imposed on these imports, particularly from key manufacturing regions, can increase production costs for pharmaceutical companies operating in the US. For example, while specific tariffs on veterinary dermatology drugs might vary, broader tariffs on chemicals or pharmaceutical intermediates could indirectly affect their pricing.

The US Food and Drug Administration (FDA) has noted ongoing challenges in the animal drug supply chain, with reports of manufacturing delays and discontinuation of some animal drug products in 2024, partly influenced by global sourcing complexities. This can lead to higher prices for animal health products or force manufacturers to absorb increased costs, potentially impacting the affordability of essential medications for pet owners.

Conversely, these tariff policies can encourage greater domestic manufacturing of veterinary drugs and their components within the US. This strategic shift could lead to a more secure and localized supply chain, reducing reliance on foreign sources and enhancing national self-sufficiency in animal health product provision, ultimately fostering a more stable market despite initial cost pressures.

Latest Trends

Integration of Telemedicine and Digital Health Platforms is a Recent Trend

A prominent recent trend in the veterinary dermatology drugs market is the increasing integration of telemedicine and digital health platforms for remote consultations and monitoring of pet skin conditions. Telehealth allows veterinarians to provide initial assessments, follow-up on treatments, and manage chronic dermatological cases more conveniently for pet owners, especially those in remote areas or with mobility challenges.

A 2024 research study from the National Library of Medicine (NLM) on telemedicine in veterinary practices highlighted the rising adoption rates, with many veterinary clinics continuing to offer virtual consultations post-pandemic due to their efficiency. Several companies, such as Vetster and FirstVet, have seen significant investment and expansion in their veterinary telehealth services in 2024, including those for dermatological issues, demonstrating the market’s embrace of digital solutions to enhance accessibility and continuity of care for pets with skin ailments.

Regional Analysis

North America is leading the Veterinary Dermatology Drugs Market

North America dominated the market with the highest revenue share of 39.2% owing to increasing pet ownership, the humanization of pets, and a heightened awareness among owners regarding pet health. According to the American Pet Products Association (APPA), US households owning at least one pet increased to 94 million in 2024, up from 82 million in 2023, indicating a substantial expansion of the potential patient base.

This rise in pet ownership, particularly among younger generations like Gen Z and Millennials, often translates to increased spending on specialized veterinary care, including dermatology. Zoetis, a leading animal health company, reported robust performance in its companion animal segment in the US, with sales increasing by 7% in the fourth quarter of 2024, driven partly by its key dermatology portfolio, including products like Apoquel and Cytopoint.

Similarly, Merck Animal Health’s companion animal product sales grew by 12% in the fourth quarter of 2023, primarily due to higher demand for its BRAVECTO line of products, which includes solutions for flea and tick control, often linked to dermatological issues. These trends underscore a market propelled by a growing and dedicated pet parent demographic increasingly prioritizing specialized care for their companion animals’ skin health.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the escalating trend of pet humanization, rising disposable incomes, and the expanding availability of veterinary services across the region. Pet ownership is rapidly increasing, with China leading the region with over 116 million pets in 2023, including over 58 million dogs and 60 million cats, as per recent reports. India also saw a surge to approximately 32 million pets in 2023, with projections for continued expansion.

As pets are increasingly viewed as family members, owners are more willing to invest in premium healthcare, including specialized treatments for skin conditions. Companies like Zoetis are strategically positioned for this growth; their international segment, which includes Asia Pacific, saw revenues increase by 9% operationally in 2023, with key dermatology products contributing to this performance.

Elanco Animal Health also reported its overall organic constant currency revenue growing by 3% in 2024, reflecting broad market stability including regions like Asia Pacific. This heightened commitment to pet well-being and improved access to veterinary care are expected to collectively drive the demand for these specialized medications.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the veterinary dermatology market adopt several strategies to boost their growth, including expanding their product portfolios, investing in R&D to develop innovative treatments, and forging strategic partnerships with animal health distributors. Additionally, companies are focusing on strengthening their market presence by enhancing their sales channels and improving access to advanced treatments in emerging markets.

A significant emphasis is placed on education and awareness campaigns for pet owners, which further drives product adoption. Moreover, mergers and acquisitions play a key role in gaining access to new technologies and expanding market share. These players also capitalize on regulatory advancements to introduce products with improved efficacy and safety profiles.

Zoetis, a leading global animal health company, specializes in developing and marketing medications and vaccines for livestock and companion animals. Founded in 1952 and headquartered in Parsippany, New Jersey, Zoetis has established itself as a key player in the veterinary health space, with a strong portfolio of products addressing various animal health needs, including dermatological conditions.

The company is committed to continuous innovation, leveraging cutting-edge science to provide effective treatments for pet owners and veterinary professionals alike. Zoetis is also known for its robust global presence, operating in more than 100 countries, and has invested heavily in advancing animal healthcare through research and development.

Top Key Players

Recent Developments

- In October 2024, FelicaMed Biotechnology received clearance from China’s Ministry of Agriculture and Rural Affairs for its Class I veterinary therapy, Lirucitinib. Specifically formulated to address canine pruritus, this JAK inhibitor interrupts the itch-scratch-inflammation sequence, offering prompt symptom relief. Licensing responsibilities were transferred to Elanco’s local arm in China, underscoring both companies’ shared emphasis on innovation and pet health advancement in the region.

- In September 2024, Elanco launched Zenrelia, marketed as ilunocitinib tablets, targeting allergic and atopic dermatitis in dogs aged one year and older. This once-daily oral treatment eases itching efficiently and is introduced as a safer, cost-effective option compared to current solutions, empowering pet owners with an alternative for better skin care management in dogs.

Report Scope

Report Features Description Market Value (2024) US$ 17.9 Billion Forecast Revenue (2034) US$ 45.2 Billion CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Animal Type (Companion Animals (Dogs, Cats, Horses, and Others) and Livestock Animals (Cattle and Others)), By Route of Administration (Oral, Topical, and Injectable), By Application (Parasitic Infections, Allergic Infections, and Others), By Distribution Channel (Hospital Pharmacies, Retail, and E-commerce) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zoetis, Vivaldis, Virbac, Vetoquinol, FelicaMed Biotechnology, Elanco, Ceva, Bimeda, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Dermatology Drugs MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Dermatology Drugs MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zoetis

- Vivaldis

- Virbac

- Vetoquinol

- FelicaMed Biotechnology

- Elanco

- Ceva

- Bimeda, Inc