Global Vegan Wines Market Size, Share and Report Analysis By Type (Rose Wine, White Wine, Sparkling Wine, Others), By Nature (Organic, Biodynamic), By Packaging Type (Bottles, Cans), By Distribution Channel (Super Markets/Hyper Market, Specialty Stores, Online Retailers, Pubs/Bras/Restaurants, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175286

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

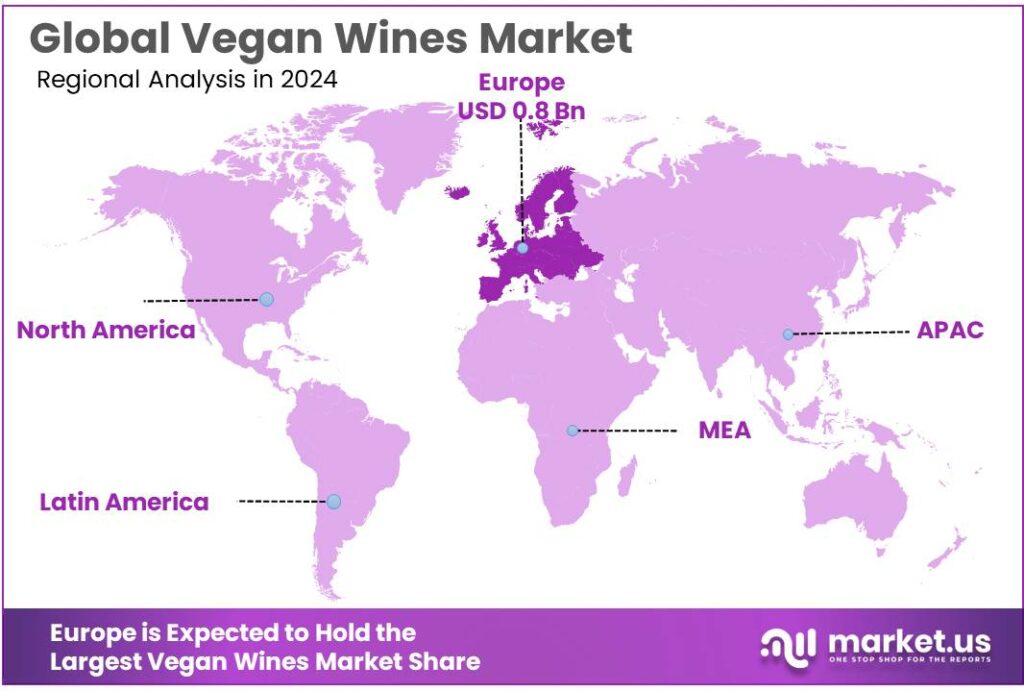

Global Vegan Wines Market size is expected to be worth around USD 4.7 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 39.9% share, holding USD 0.8 Billion in revenue.

Vegan wine sits inside the broader global wine industry, but it is defined by one practical requirement: the producer avoids animal-derived processing aids and additives. In conventional winemaking, products derived from egg and milk can be used during clarification and stabilization, which is why “vegan-friendly” positioning matters for ingredient-conscious buyers. At the same time, vegan wine demand is developing during a period of structural change in wine supply and consumption. In 2024, global wine production fell to 225.8 million hectolitres, while consumption was estimated at 214.2 million hectolitres, highlighting a tight, climate-affected supply backdrop alongside softening demand in several mature markets.

Industry conditions are also shifting due to regulation and transparency expectations, especially in Europe. In parallel, sustainability policy is reinforcing the move toward lower-impact viticulture that often overlaps with vegan positioning. The EU’s Farm to Fork direction includes an objective of 25% of agricultural land under organic farming by 2030, which encourages investment and innovation in certified practices that many vegan wine buyers already associate with ethical purchasing.

Demand-side drivers are closely linked to the broader plant-based economy and to certification visibility. In 2024, global retail sales of plant-based categories tracked by GFI reached $28.6 billion, and the U.S. retail plant-based food market was valued at $8.1 billion—figures that reflect sustained shopper interest even amid year-to-year fluctuations. On the signaling side, The Vegan Society reports its Vegan Trademark has surpassed 70,000 product registrations across 68 countries, including about 18,000 food and drink items—an indicator that brands increasingly see value in verified vegan labeling rather than relying on informal claims.

Another important accelerator is certification and recognizable marks that reduce shopper friction. The Vegan Society reports its Vegan Trademark reached a milestone of 70,000 product registrationsk, reinforcing how quickly certification ecosystems are scaling across categories that include food and drink. At the same time, plant-based purchasing has normalized in mainstream retail: the Good Food Institute summarizes SPINS-commissioned tracking showing the U.S. retail plant-based food market at $8.1 billion in 2024.

Key Takeaways

- Vegan Wines Market size is expected to be worth around USD 4.7 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.5%.

- Single Circuit held a dominant market position, capturing more than a 38.5% share of the Vegan Wines Market.

- Organic held a dominant market position, capturing more than a 69.8% share in the Vegan Wines Market.

- Bottles held a dominant market position, capturing more than a 88.2% share in the Vegan Wines Market.

- Super Markets/Hyper Market held a dominant market position, capturing more than a 36.1% share in the Vegan Wines Market.

- Europe is the dominating region in the Vegan Wines market, holding 39.9% share and reaching USD 0.8 Bn.

By Type Analysis

White Wine leads the Vegan Wines market with a strong 38.5% share, supported by clean-label demand and wide consumer acceptance.

In 2024, Single Circuit held a dominant market position, capturing more than a 38.5% share of the Vegan Wines Market within the White Wine segment. This leadership is driven by the natural clarity and lighter profile of vegan white wines, which align well with the clean-label trend. Many consumers shifting toward plant-based lifestyles prefer white wine because it avoids the common animal-based fining agents traditionally used in winemaking. During 2024, wineries also saw rising retail demand for transparent ingredient disclosures, further supporting white wine’s appeal. As vegan certification became more visible across shelves and online platforms, white wine retained a stable preference among urban buyers seeking low-additive, fresh-tasting options.

By Nature Analysis

Organic vegan wines lead the market with a strong 69.8% share, reflecting rising trust in clean and chemical-free winemaking.

In 2024, Organic held a dominant market position, capturing more than a 69.8% share in the Vegan Wines Market, driven by the growing consumer preference for chemical-free, additive-free, and ethically produced wines. Buyers increasingly associate organic farming with healthier soils, better grape quality, and a more transparent production process, which fits naturally with vegan expectations. During 2024, many wineries strengthened their shift toward organic-certified vineyards, supported by cleaner agricultural methods and reduced pesticide use. This helped organic vegan wines become a preferred choice in supermarkets, online stores, and premium restaurant lists, especially among younger consumers who prioritize sustainability.

By Packaging Type Analysis

Bottled vegan wines dominate the market with a strong 88.2% share, supported by premium appeal and trusted storage quality.

In 2024, Bottles held a dominant market position, capturing more than a 88.2% share in the Vegan Wines Market, largely because bottled formats continue to represent quality, authenticity, and long-term preservation. Consumers still prefer glass bottles for wine due to their ability to maintain flavor integrity, protect against oxidation, and offer a premium presentation. During 2024, wineries focused heavily on sustainable packaging, using lighter-weight glass and recyclable materials to match the growing expectations of environmentally conscious vegan buyers. Retailers also noted that bottled vegan wines perform well in both offline and online channels, as customers perceive them as reliable and suitable for gifting or special occasions.

By Distribution Channel Analysis

Super Markets and Hyper Markets lead the vegan wine distribution landscape with a solid 36.1% share, reflecting strong consumer reach and wider product visibility.

In 2024, Super Markets/Hyper Market held a dominant market position, capturing more than a 36.1% share in the Vegan Wines Market. This leadership is driven by the convenience, variety, and reliability these large-format stores offer to everyday shoppers. During 2024, supermarkets expanded their plant-based alcohol sections, giving vegan wines more shelf space and clearer labeling to help customers easily identify animal-free options. Wide product assortments—ranging from affordable table wines to premium organic vegan selections—helped these stores attract both new and experienced buyers. Their ability to run in-store promotions, offer tasting sessions, and bundle vegan wines with plant-based food items further strengthened their influence.

Key Market Segments

By Type

- Rose Wine

- White Wine

- Sparkling Wine

- Others

By Nature

- Organic

- Biodynamic

By Packaging Type

- Bottles

- Cans

By Distribution Channel

- Super Markets/Hyper Market

- Specialty Stores

- Online Retailers

- Pubs/Bras/Restaurants

- Others

Emerging Trends

Sustainability and digital transparency are shaping the latest trend in vegan wines

One of the latest and most impactful trends in the vegan wine world is the growing focus on sustainability combined with digital transparency, letting consumers see more of what they are buying and why it matters. People today care not just about what they drink, but how it was made, where it comes from, and how that choice links to environmental and ethical values. For vegan wines, this trend is becoming more than a buzzword — it is shaping packaging, labeling, and the entire brand story.

A big part of this trend is digital wine labels that go beyond the traditional front-of-bottle graphics. In the European Union, new wine labeling rules came into force on 8 December 2023, which require producers to include ingredient lists and nutrition information on all wines sold in EU markets. These regulations allow brands to use QR codes or online information platforms to provide details, which gives vegan wine makers a perfect place to explain vegan production methods in plain, human language.

This matters because many people who might choose vegan wine are motivated by sustainability. They care about reducing their environmental footprint, supporting humane farming, and avoiding animal products. Digital labels help brands share sustainability credentials — such as organic farming, low-intervention winemaking, recyclable packaging, and low carbon footprints — in an accessible way. For example, organic vegan wines often tap into broader environmental values: data from the International Organisation of Vine and Wine (OIV) shows that global wine production dropped to 225.8 million hectolitres in 2024, the lowest level in more than 60 years, due in part to climate pressures such as drought and heat stress.

Another measurable aspect of this trend is third-party certification, which plays well with digital communication. The Vegan Society reported that its Vegan Trademark reached more than 70,000 product registrations worldwide as of September 2024 — across food and drink categories — showing how familiar consumers are becoming with trusted vegan marks. The wider plant-based movement also feeds into this trend. In the U.S., the plant-based food category reached $8.1 billion in retail sales in 2024, showing a strong interest in products that tell a values-centered story.

Drivers

Clear labeling and trusted certification are pushing more shoppers toward vegan wines

One major driving factor for vegan wines is the growing demand for clear, checkable product information—especially around processing aids that most people never see on the front label. In wine, “vegan” often comes down to how the wine is clarified (fining). When shoppers learn that some traditional fining methods can use egg, milk, or fish-derived agents, many prefer bottles that avoid those inputs.

Government-backed labeling changes are making that transparency easier to deliver at scale. In the European Union, wine labeling requirements were updated so that ingredient lists and nutrition information became mandatory for EU-market wines produced after the rule’s application date of 8 December 2023. Even when the vegan claim itself is voluntary, this shift has nudged producers to modernize labels, add digital disclosures, and speak more openly about inputs. That matters for vegan wines because the decision is often driven by what is not used during processing.

Industry conditions also amplify why this driver is working now. The global wine sector is dealing with tighter supply conditions and weaker overall demand in some markets, so producers are looking for ways to stand out without changing the core product experience. The International Organisation of Vine and Wine (OIV) estimated global wine consumption at 214.2 million hectolitres in 2024 and global wine production at 225.8 million hectolitres in 2024, described as the lowest in over 60 years.

Certification growth shows how quickly “verified vegan” is becoming mainstream across food and drink, not just niche shelves. The Vegan Society reported that its Vegan Trademark surpassed 70,000 product registrations across 68 countries, which signals expanding manufacturer participation and rising shopper recognition of third-party vegan labels.

Restraints

Limited consumer awareness and inconsistent labeling slow down adoption of vegan wines

One of the clearest restraining factors for the growth of vegan wines is that many buyers still don’t understand what “vegan wine” really means, and labeling isn’t consistently helping them. Most consumers walk into a store thinking about taste, region, or price—not production methods. While terms such as “organic” or “low-sugar” are familiar, the idea that wine can be filtered with animal products isn’t widely known. This lack of basic awareness makes it harder for vegan wines to win trial purchases, especially among casual or occasional wine drinkers who may not connect “vegan” with benefits they care about.

This matters because the broader wine market itself is not growing rapidly, which limits the number of people open to experimenting with niche claims. According to the International Organisation of Vine and Wine, global wine consumption was 214.2 million hectolitres in 2024, down about 3.3% from 2023, while global production dropped to 225.8 million hectolitres—the lowest in more than six decades. In a shrinking or stagnant market, only the most effective differentiators attract attention, and a claim that many people do not fully understand can struggle to compete against tradition or price.

Another factor is the scale of certification penetration. Organizations like The Vegan Society report milestones in vegan trademarks—for example, more than 70,000 product registrations worldwide as of September 2024—but most products registered are foods, not alcoholic beverages. Because fewer wineries pursue these certifications, the visual cues that help consumers make quick choices remain limited. A shopper may see a vegan snack next to regular options but fail to spot a vegan label on a bottle of wine, simply because it’s absent or too small.

Opportunity

Digital labels and certification can turn “vegan wine” into an easy shelf decision

A major growth opportunity for vegan wines is the ability to scale trust through clearer labeling and third-party certification, especially as governments push the wine industry toward more transparent product information. For many shoppers, the biggest barrier is not taste—it is uncertainty. They may like the idea of vegan wine, but they do not want to spend time decoding production methods like fining. When the label gives a simple, verifiable signal, vegan wines become a low-effort choice rather than a niche, “only for experts” product.

This opportunity is expanding because wine labels in key markets are becoming more informative by rule, not by preference. In the European Union, new requirements on wine and aromatised wine products entered into application on 8 December 2023, adding ingredient listing and nutrition information obligations. For vegan wine producers, this change creates a practical opening: the same QR-based or digital disclosure workflows being adopted for nutrition and ingredients can also be used to explain vegan processing in plain language, show certification, and answer common questions. That reduces confusion for consumers and reduces risk for retailers, because documentation becomes easier to verify and standardize across many SKUs.

The timing matters because the wider wine sector is under pressure, so brands are actively looking for meaningful differentiation. The International Organisation of Vine and Wine (OIV) estimated global wine consumption at 214.2 million hectolitres in 2024 and global wine production at 225.8 million hectolitres in 2024, described as the lowest in over 60 years. Certification is the second part of the opportunity, because it turns a complex topic into a recognizable cue. The Vegan Society reported that its Vegan Trademark surpassed 70,000 product registrations across 68 countries.

Regional Insights

Europe leads Vegan Wines with 39.9% share, valued at USD 0.8 Bn, supported by premium wine culture and strong clean-label demand

Europe is the dominating region in the Vegan Wines market, holding 39.9% share and reaching USD 0.8 Bn in value. This leadership is closely linked to Europe’s deep wine heritage and its high consumer comfort with quality cues like organic, sustainability, and certified sourcing. The region also benefits from a mature retail structure—supermarkets, specialty wine shops, and premium on-trade channels—where vegan-labelled bottles are easier to list, explain, and promote through shelf signage and menu descriptions.

Structurally, Europe has the strongest wine ecosystem to scale vegan offerings quickly. The European Commission notes the EU is the world-leading wine producer; in 2023, it accounted for 44% of global wine-growing areas, over 60% of production, and 48% of consumption—an advantage that supports both innovation and distribution depth. Export strength also helps Europe push vegan wine beyond local shelves: Eurostat reported the EU exported €29.8 billion worth of alcoholic beverages in 2024, showing the region’s ability to commercialize premium beverage categories internationally.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Pure Wines Ltd. is a UK-registered business incorporated on 7 June 2018 and listed with Companies House under company number 11402198. The registered office is in London (WC1N 3AX). For year-wise context, its most recent accounts shown by Companies House are made up to 30 June 2024, with the next due cycle dated 30 June 2025.

Bonterra’s organic positioning is long-standing: it was introduced in 1993 as one of the early organically farmed wine lines in the U.S. It later added credibility on climate action, announcing Climate Neutral certification for its business in 2021. On farming scale, Bonterra has stated 850 Mendocino County estate acres are farmed using regenerative organic practices—supporting volume plus sustainability messaging.

O’Briens is a long-running drinks retailer with 34 physical stores across Ireland and a strong online channel. Its range includes over 1,000 wines, and it sources from more than 180 wineries worldwide—useful scale for listing vegan options alongside mainstream labels. It is also widely cited as having been founded in 1944, giving it deep retail reach.

Top Key Players Outlook

- O’Briens Wine

- Pure Wines Ltd.

- Frey Vineyards

- The Vegan Vine

- Bonterra Organic Vineyards

- Bodegas Garciarevalo

- Atlantik Imports

- Natura Wines

- Red Truck Wines

Recent Industry Developments

O’Briens Wine is an Irish, family-run drinks retailer that has built a clear route for vegan wines to reach mainstream shoppers through both stores and e-commerce. From a market analyst view, its scale matters: the business says it imports almost all of its range of over 1,000 wines directly from over 180 wineries worldwide, which gives it strong buying control and room to expand specialist ranges like vegan-labelled bottles without relying heavily on wholesalers.

In 2024–2025, Frey continued to highlight its commitment to avoiding animal-derived fining agents by producing wines that remain vegan, gluten-free and made with USDA Organic certification from vineyard to bottle.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 4.7 Bn CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rose Wine, White Wine, Sparkling Wine, Others), By Nature (Organic, Biodynamic), By Packaging Type (Bottles, Cans), By Distribution Channel (Super Markets/Hyper Market, Specialty Stores, Online Retailers, Pubs/Bras/Restaurants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape O’Briens Wine, Pure Wines Ltd., Frey Vineyards, The Vegan Vine, Bonterra Organic Vineyards, Bodegas Garciarevalo, Atlantik Imports, Natura Wines, Red Truck Wines Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- O'Briens Wine

- Pure Wines Ltd.

- Frey Vineyards

- The Vegan Vine

- Bonterra Organic Vineyards

- Bodegas Garciarevalo

- Atlantik Imports

- Natura Wines

- Red Truck Wines