Global Vegan Cosmetics Market Report By Product Type (Skin Care, Hair Care, Makeup, Others), By Packaging Type (Pumps & Dispensers, Bottles, Jars, Pencils and Sticks, Tubes, Others), By Formulation (Liquid, Solid, Powder, Cream), By Distribution Channel (E-commerce, Hypermarkets/Supermarkets, Specialty Stores, Departmental Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132168

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

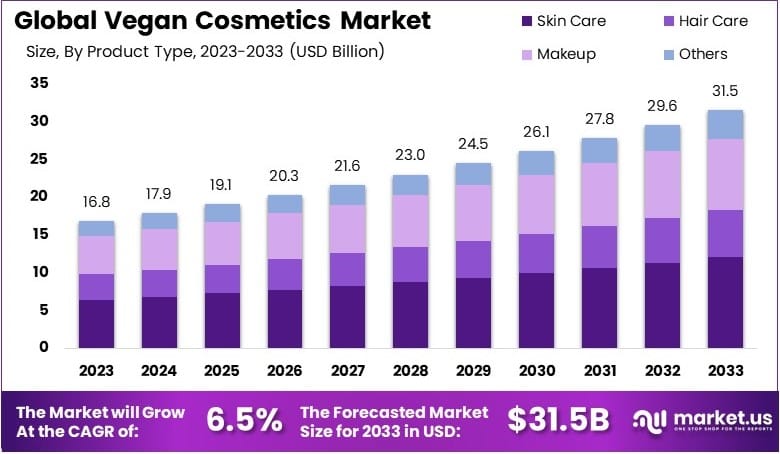

The Global Vegan Cosmetics Market size is expected to be worth around USD 31.5 Billion by 2033, from USD 16.8 Billion in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

Vegan cosmetics are beauty products that do not contain any animal-derived ingredients or byproducts. They are developed with a commitment to cruelty-free standards and typically exclude substances like lanolin, collagen, and keratin, which are common in traditional cosmetics.

The vegan cosmetics market includes the production and sale of beauty products that adhere to vegan principles. This market is distinguished by a growing consumer preference for ethical, sustainable, and animal-friendly beauty solutions, spanning a range of products from makeup to skincare.

The vegan cosmetics market encompasses the production and sale of products adhering to these vegan principles. Consumers increasingly favor ethical and eco-friendly beauty solutions, including makeup and organic skincare products, which has led to notable growth in this sector.

Rising demand is further propelled by consumer awareness of both animal welfare and environmental impacts, which are now seen as critical factors in purchasing decisions.

Demand for vegan cosmetics is influenced by concerns over harmful chemicals traditionally used in beauty products. A recent study found that 48% of consumers cite chemicals in personal care items as their top safety concern.

Consequently, 61% of consumers now view environmental health as directly tied to their personal well-being. This awareness is shifting demand toward vegan and toxin-free products, spurring brands to innovate and meet evolving consumer expectations.

Meanwhile, government action has ramped up to address these concerns. In 2024, 36 U.S. states introduced over 450 bills aimed at reducing toxic chemicals in consumer products.

This legislative focus mirrors the growing consumer vigilance in ingredient transparency and safety, as reflected in a EWG poll showing that 75% of Americans consider toxic chemicals in personal care products a significant threat. Additionally, 71% of household purchasers prefer to shop in-store for personal care items, emphasizing the need for accessible, trusted products.

According to a survey by the International Journal of Creative Research Thoughts (IJCRT), 67% of respondents actively avoid products containing harmful cosmetic chemicals, particularly in personal care and household goods.

Moreover, 82% of consumers indicated they would reject purchases suspected of containing toxic substances. This shows the importance of ingredient transparency and safe formulation in driving brand loyalty and market growth.

Key Takeaways

- The Vegan Cosmetics Market was valued at USD 16.8 billion in 2023 and is projected to reach USD 31.5 billion by 2033, growing at a CAGR of 6.5%.

- In 2023, Skin Care dominates the product type segment with 38.1%, driven by increasing demand for cruelty-free skin care products.

- In 2023, Cream-Based products lead the formulation segment due to their popularity among consumers seeking natural textures.

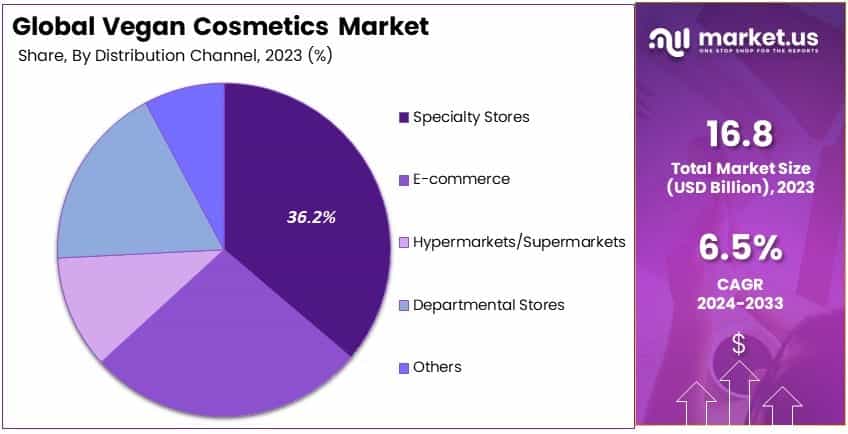

- In 2023, Specialty Stores command the distribution channel with 36.2%, catering to consumers seeking niche, vegan products.

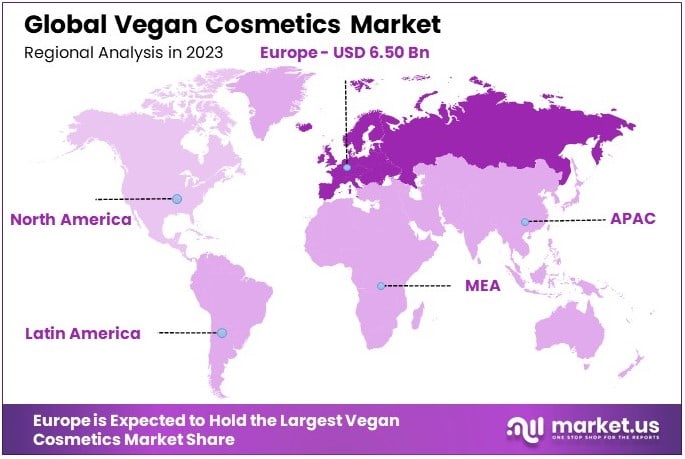

- In 2023, Europe holds the largest market share at 38.7%, supported by a strong demand for vegan and sustainable beauty products.

Product Type Analysis

Skin Care Dominates with 38.1% Due to Increasing Consumer Awareness About Skincare Health

In the Vegan Cosmetics Market, the “Product Type” segment is significantly led by Skin Care, which holds a dominant 38.1% market share. This substantial portion is primarily due to the growing consumer awareness regarding the health benefits of vegan skincare products.

These products are preferred for their use of natural cosmetic ingredients that are less likely to cause skin irritation compared to their non-vegan counterparts. Additionally, the trend toward ethical consumerism has spurred interest in skincare products that are not only effective but also cruelty-free and environmentally friendly.

Hair Care products, while not as dominant, are gaining traction due to similar reasons. These products are increasingly favored for their gentle effect on hair and scalp, free from harsh chemicals often found in traditional hair care products.

Makeup is another crucial segment, evolving rapidly as consumers demand products free from animal-derived ingredients, which aligns with the broader trend of ethical beauty. The “Others” category includes products like nail polish and perfumes, which are also seeing increased interest as manufacturers innovate with vegan formulations in these areas too.

Packaging Type Analysis

Bottles Lead Packaging Types in Vegan Cosmetics due to Convenience and Sustainability

The “Packaging Type” segment of the Vegan Cosmetics Market finds Bottles as the leading sub-segment. This preference is driven by their convenience for liquid products and the ease of incorporating eco-friendly materials, which are important to vegan cosmetics consumers. Bottles, especially those made from recycled materials, align well with the sustainability ethos that often accompanies the vegan label.

Pumps & Dispensers are also widely used due to their ability to control the amount of product used, reducing waste. Jars are preferred for thicker creams and gels, which are common in vegan skincare lines.

Pencils and Sticks are commonly used for makeup items like eyeliners, eye shadow sticks and lip colors, appreciated for their portability and ease of use. Tubes hold a smaller market share but are essential for products like hand creams and some types of makeup.

Formulation Analysis

Cream-Based Formulations Dominate Due to Their Versatility and Hydration Properties

Within the “Formulation” segment, Cream-based formulations lead the Vegan Cosmetics Market. Their dominance is attributed to their versatility in skin care and makeup products, along with their superior hydration properties, which are highly sought after in vegan cosmetics.

Creams are particularly popular because they can deliver intense moisture while using plant-based cosmetic ingredients, which aligns with the vegan ethos of natural, cruelty-free products.

Liquid formulations are significant for their application in foundations and other skin products, offering a lightweight and often hydrating option for vegan cosmetics users. Powder products, particularly in makeup like blushes and eye shadows, are valued for their longevity and matte finish.

Solid formulations include items like bar soaps and shampoo bars, which are gaining popularity due to their minimal packaging and reduced water content, appealing to environmentally conscious consumers.

Distribution Channel Analysis

Specialty Stores Lead with 36.2% Owing to Their Focused Consumer Reach

The “Distribution Channel” segment is predominantly led by Specialty Stores, which account for 36.2% of the Vegan Cosmetics Market. This dominance is due to their ability to offer a curated selection of vegan products, coupled with knowledgeable staff who can educate consumers on the benefits of vegan cosmetics.

Specialty stores provide a shopping experience that aligns with the values of vegan consumers, who are often looking for expert advice and high-quality products in a more personalized shopping environment.

E-commerce is another crucial distribution channel, growing rapidly as consumers appreciate the convenience of online shopping. This channel allows access to a wide array of vegan cosmetics products from around the world.

Hypermarkets/Supermarkets are incorporating more vegan options into their beauty sections as consumer demand increases. Departmental Stores, although slower to adapt, are beginning to offer more vegan cosmetic products, particularly in urban and upscale markets where consumer awareness is higher.

Key Market Segments

By Product Type

- Skin Care

- Hair Care

- Makeup

- Others

By Packaging Type

- Pumps & Dispensers

- Bottles

- Jars

- Pencils and Sticks

- Tubes

- Others

By Formulation

- Liquid

- Solid

- Powder

- Cream

By Distribution Channel

- E-commerce

- Hypermarkets/Supermarkets

- Specialty Stores

- Departmental Stores

- Others

Drivers

Rising Demand for Cruelty-Free Products Drives Market Growth

The Vegan Cosmetics Market is significantly driven by a rising demand for cruelty-free products. Consumers are increasingly favoring products that align with ethical practices, as cruelty-free labeling becomes a key buying factor.

Additionally, heightened awareness of environmental sustainability propels the market, as plant-based cosmetics often result in fewer environmental impacts. Consequently, eco-conscious consumers are seeking products made with sustainable sourcing and biodegradable packaging, aligning with their lifestyle choices.

Furthermore, the health benefits of plant-based ingredients, such as reduced skin irritation and allergenic potential, enhance the appeal of vegan cosmetics. In particular, consumers are drawn to vegan cosmetics due to their non-toxic and hypoallergenic properties, which cater to sensitive skin types.

Moreover, the growing global vegan population creates a consistent and expanding demand for these products. Together, these factors cultivate an environment of ethical, sustainable, and health-conscious demand, propelling steady growth in the Vegan Cosmetics Market.

Restraints

Higher Production Costs Restraints Market Growth

The high production costs associated with vegan cosmetics restrain market growth, as these products often require premium ingredients sourced from ethical suppliers. Plant-based formulations tend to be costlier to produce, resulting in higher prices that may limit consumer access, particularly in price-sensitive markets.

Additionally, the limited shelf life of natural ingredients poses challenges in product longevity and storage, necessitating added preservatives that may compromise vegan product integrity. Price sensitivity among consumers further restricts market expansion, as vegan cosmetics are often positioned at a premium price point compared to conventional alternatives.

Moreover, in emerging markets, limited consumer awareness of vegan cosmetics hampers adoption, as traditional cosmetic preferences persist. Thus, these cost-related and awareness limitations collectively hinder the market’s full growth potential.

Opportunity

Expansion of E-Commerce Platforms Provides Opportunities

The expansion of e-commerce platforms presents significant growth opportunities for the Vegan Cosmetics Market. Online retail offers a broad reach, allowing vegan brands to access a diverse global customer base efficiently.

Additionally, the rise of e-commerce has enabled brands to directly connect with consumers, providing tailored marketing and seamless product accessibility. The development of innovative vegan ingredients also presents opportunities, as brands can introduce novel products that enhance functionality and appeal.

Moreover, collaborations with influencers and celebrities have become a key strategy to promote vegan cosmetics, as endorsements amplify brand visibility. Furthermore, emerging markets show untapped potential, where rising disposable incomes and increased exposure to vegan lifestyles may boost demand.

Challenges

Regulatory Compliance for Vegan Labeling Challenges Market Growth

Regulatory compliance challenges significantly impact the Vegan Cosmetics Market, as ensuring accurate vegan labeling is complex. Many countries lack standardization in vegan certification, resulting in varied criteria across markets and complicating global distribution.

Additionally, the lack of consistent standards among certification bodies can lead to consumer confusion, affecting brand credibility. High competition from traditional cosmetic brands also presents a challenge, as mainstream brands increase their investment in vegan alternatives.

Moreover, maintaining quality and stability in vegan cosmetics without synthetic preservatives is challenging, as natural ingredients are sensitive to environmental factors. These challenges collectively add to the market’s complexity, requiring brands to navigate regulatory, competitive, and quality-related barriers to growth.

Growth Factors

Expanding Distribution Channels Globally Are Growth Factors

The global expansion of distribution channels serves as a vital growth factor for the Vegan Cosmetics Market. Increased accessibility through retail partnerships and online platforms allows vegan brands to reach wider audiences across regions.

Additionally, rising investments in research and development foster the development of advanced vegan formulas, supporting innovation in product offerings. This aligns with a broader consumer shift toward sustainable lifestyles, where vegan cosmetics fit the demand for eco-friendly products.

Furthermore, the growth of clean beauty movements amplifies interest in vegan products, as consumers prioritize purity and ethical standards. These growth factors collectively create an environment where vegan cosmetics can expand their market presence and capitalize on global sustainability trends.

Emerging Trends

Demand for Multi-Functional Products Is Latest Trending Factor

The demand for multi-functional vegan cosmetics is a trending factor driving the market. Consumers are increasingly interested in products that offer multiple benefits, such as moisturizers that include SPF or makeup with skincare properties.

This trend reflects consumer preference for convenience and value, as well as the demand for innovative formulations. Additionally, the growth of organic and natural segments aligns with vegan cosmetics, as clean beauty becomes more mainstream and supports the vegan ethos.

The rise in vegan beauty subscriptions also marks a trend, as consumers are keen on discovering new products through curated packages. Furthermore, social media advocacy for veganism reinforces the popularity of vegan cosmetics, with influencers and activists promoting vegan beauty routines.

Regional Analysis

Europe Dominates with 38.7% Market Share

Europe leads the Vegan Cosmetics Market, holding a 38.7% share valued at USD 6.50 billion. This significant market presence is driven by high consumer awareness of cruelty-free and eco-friendly products, alongside stringent regulations that promote sustainable practices. Major markets such as Germany, France, and the UK are key drivers, with a strong commitment to ethical and plant-based cosmetics.

European market dynamics benefit from well-established regulatory standards and a cultural shift towards environmental sustainability. The European Union’s ban on animal testing in cosmetics has further accelerated the demand for vegan beauty products. Additionally, the emphasis on transparent labeling and clean ingredients resonates with consumers prioritizing health and eco-conscious choices.

Looking forward, Europe’s influence in the Vegan Cosmetics Market is expected to grow as sustainability concerns continue to shape consumer behavior. As brands innovate to meet the rising demand for vegan and organic options, the region’s market share is likely to expand. Europe’s role as a trendsetter in sustainable beauty will drive further market developments and strengthen its global leadership.

Regional Mentions:

- North America: North America holds a robust position in the Vegan Cosmetics Market, with increasing demand for cruelty-free and organic products. A high awareness of clean beauty among consumers and a strong presence of vegan brands support steady market growth, particularly in the U.S. and Canada.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the Vegan Cosmetics Market, driven by urbanization and rising disposable incomes. Markets like South Korea and Japan lead the demand, with consumers showing a preference for ethical and plant-based beauty products.

- Middle East & Africa: The Middle East and Africa regions are emerging in the Vegan Cosmetics Market, as awareness of cruelty-free products grows. The rise in conscious consumerism and demand for halal-certified, vegan options contribute to gradual market expansion.

- Latin America: Latin America sees rising interest in vegan cosmetics, especially in Brazil and Argentina. A younger, eco-conscious demographic drives demand, pushing local brands to explore sustainable, plant-based beauty solutions as part of a broader trend toward ethical consumerism.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Vegan Cosmetics Market is led by prominent brands recognized for their commitment to cruelty-free, plant-based formulations. These companies, including Lush Cosmetics, e.l.f. Cosmetics, Pacifica Beauty, and The Body Shop, have built strong brand identities by aligning with ethical beauty standards and sustainable practices.

Lush Cosmetics stands out for its all-natural, handmade products and staunch commitment to ethical sourcing. Known for advocating against animal testing, Lush has garnered a loyal consumer base that values transparency and high-quality vegan ingredients. Lush’s environmental initiatives, such as packaging-free products, further reinforce its position as a pioneer in vegan cosmetics.

e.l.f. Cosmetics has made a significant impact in the market by offering affordable, cruelty-free, and vegan products. With widespread availability in retail stores and online platforms, e.l.f. appeals to a broad demographic seeking ethical beauty at accessible prices. Its proactive stance on removing harmful chemicals from products and gaining PETA certification underscores its commitment to safe, vegan beauty.

Pacifica Beauty emphasizes natural, eco-conscious ingredients and sustainable practices. Known for its clean, vegan, and cruelty-free formulations, Pacifica targets environmentally conscious consumers looking for high-quality, ethical skincare and makeup. With a focus on recyclable packaging and transparent ingredient sourcing, Pacifica has become a favored choice in the vegan beauty sector.

The Body Shop, a long-standing advocate for cruelty-free beauty, has established itself as a trusted name in vegan cosmetics. With a commitment to ethical sourcing and environmental sustainability, The Body Shop’s product range supports its dedication to responsible beauty. Its strong retail presence and dedication to social causes, such as community trade, enhance its reputation in the market.

These leading players drive the Vegan Cosmetics Market by aligning with consumer values of ethical beauty, sustainability, and transparency, shaping the market’s growth and setting standards for innovation and responsible practices in the beauty industry.

Top Key Players in the Market

- Lush Cosmetics

- e.l.f. Cosmetics

- Pacifica Beauty

- The Body Shop

- Cover FX

- Milk Makeup

- KVD Vegan Beauty

- Bite Beauty

- Hourglass Cosmetics

- Lime Crime

- Urban Decay

- Axiology

- INIKA Organic

- Gabriel Cosmetics

- Meow Meow Tweet

Recent Developments

- Smashbox: In August 2024, Smashbox, a prominent cruelty-free beauty brand, launched its storefront in the U.S. Amazon Premium Beauty store. This expansion aims to make Smashbox’s high-performance products, including the Original Photo Finish Smooth and Blur Primer, more accessible.

- Unilever Ventures: In July 2024, Unilever Ventures led a US$4 million Series B funding round in Esqa, Indonesia’s pioneering vegan cosmetics brand. This investment follows a US$6 million Series A round in 2022, bringing Esqa’s total funding to US$10 million. Established in 2016, Esqa provides Halal-certified makeup and has expanded its reach across 47 local cities and other Southeast Asian countries, with a strong presence on platforms like TikTok.

- Dibs Beauty: In August 2024, Dibs Beauty, known for its clean, vegan, and cruelty-free products, announced its partnership with Ulta Beauty. Select Dibs Beauty products became available at over 590 Ulta stores in the U.S. starting August 26 through Ulta’s emerging brand platform, Sparked.

- Evonik: In February 2024, Evonik launched Vecollage Fortify L, a biotech-based, vegan collagen ingredient identical to human skin collagen, created through fermentation technology. This product addresses the demand for non-animal, sustainable collagen options in beauty and personal care, particularly for anti-aging and hydration.

Report Scope

Report Features Description Market Value (2023) USD 16.8 Billion Forecast Revenue (2033) USD 31.5 Billion CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Skin Care, Hair Care, Makeup, Others), By Packaging Type (Pumps & Dispensers, Bottles, Jars, Pencils and Sticks, Tubes, Others), By Formulation (Liquid, Solid, Powder, Cream), By Distribution Channel (E-commerce, Hypermarkets/Supermarkets, Specialty Stores, Departmental Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lush Cosmetics, e.l.f. Cosmetics, Pacifica Beauty, The Body Shop, Cover FX, Milk Makeup, KVD Vegan Beauty, Bite Beauty, Hourglass Cosmetics, Lime Crime, Urban Decay, Axiology, INIKA Organic, Gabriel Cosmetics, Meow Meow Tweet Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lush Cosmetics

- e.l.f. Cosmetics

- Pacifica Beauty

- The Body Shop

- Cover FX

- Milk Makeup

- KVD Vegan Beauty

- Bite Beauty

- Hourglass Cosmetics

- Lime Crime

- Urban Decay

- Axiology

- INIKA Organic

- Gabriel Cosmetics

- Meow Meow Tweet