Global Vacuum Blood Collection Device Market By Product Type (Serum separation tubes, Anti-coagulant tubes, Coagulation analysis tubes, Glucose analysis tubes, Blood Collection Needle and Accessories), By Material (Plastic / PET / Polymer tubes and Glass tubes), By Application (Serology & Immunology testing, General diagnostics, Coagulation tests, Genetic testing, Glucose testing and Other specialised tests), By End-User (Hospitals & Clinics, Diagnostic and Pathology Laboratories, Blood Banks, Research & Academic Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169449

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

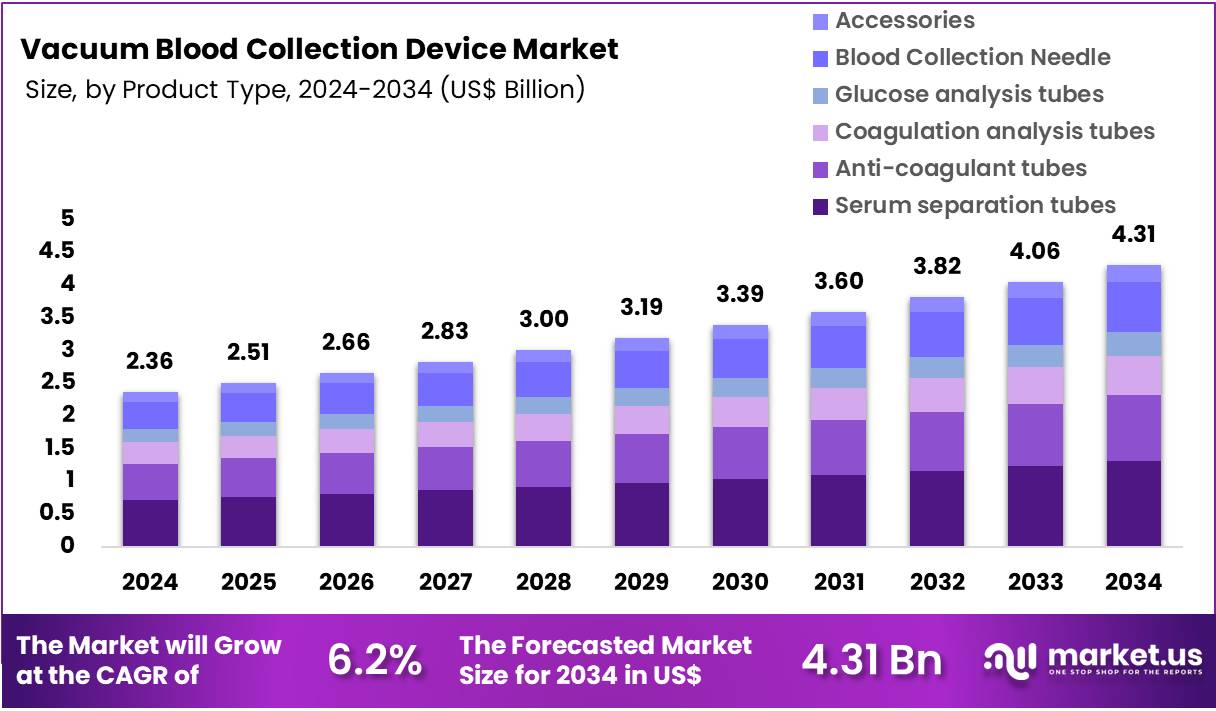

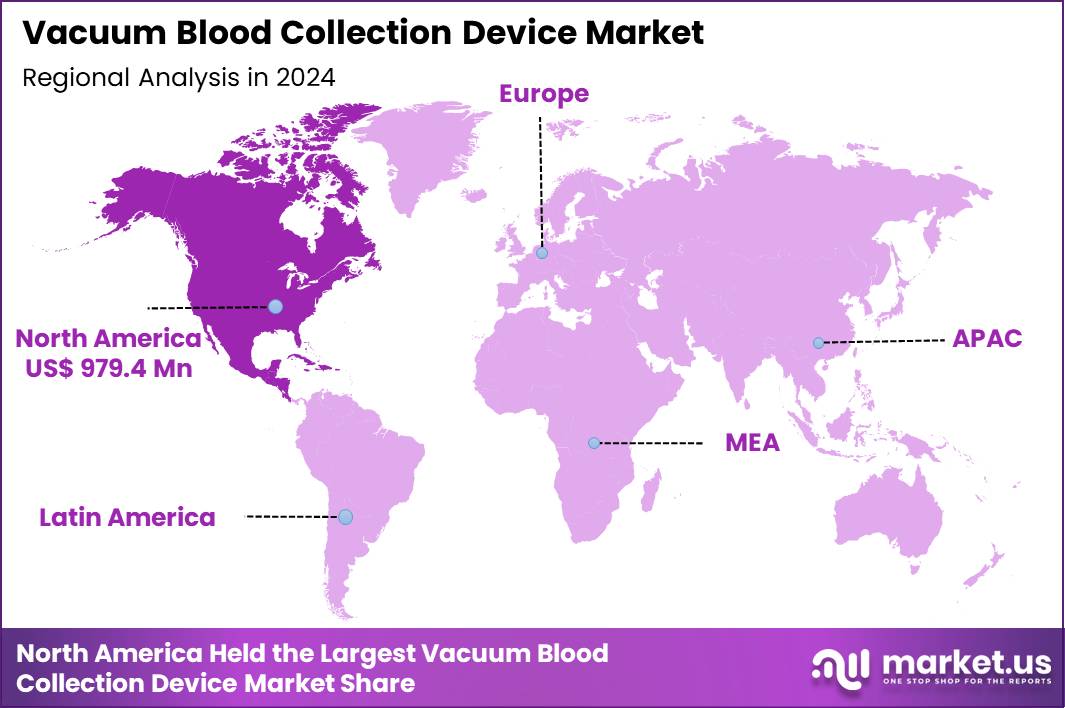

Global Vacuum Blood Collection Device Market size is expected to be worth around US$ 4.31 Billion by 2034 from US$ 2.36 Billion in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.5% share with a revenue of US$ 979.4 Million.

The Vacuum Blood Collection Device Market size is expanding steadily as hospitals, laboratories, and blood banks adopt safer, closed-system blood collection methods that reduce contamination risk and improve sample quality. Vacuum-based devices such as serum separation tubes, plasma anticoagulant tubes, EDTA tubes, heparin tubes, glucose tubes, needles, and accessories ensure precise sample volumes and consistent diagnostic outcomes.

Rising global testing volumes in hematology, serology, oncology, endocrinology, and infectious disease screening strongly support market growth. The shift toward preventive healthcare, growing burden of chronic diseases, and rapid expansion of diagnostic laboratories contribute to sustained device adoption across regions.

Governments worldwide continuously strengthen guidelines for standardized sample collection, especially under WHO, CDC, and national blood safety programs. Manufacturers enhance device safety with polymer tubes, advanced additives, barrier gels, and high-precision needles that improve workflow efficiency and reduce pre-analytical errors. Increasing demand for multi-test panels in routine check-ups and growth of molecular diagnostics indirectly contribute to higher sample collection frequency, reinforcing market expansion.

In June 2020, Drawbridge Health announced that its OneDraw™ Blood Collection Device the core technology behind the FDA-cleared OneDraw™ A1C Test System received the prestigious Red Dot Award: Product Design 2020 in the Medical Devices category. This accolade highlights the company’s commitment to advancing patient-centric blood collection solutions and driving innovation in modern diagnostic sampling.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.36 billion, with a CAGR of 6.2%, and is expected to reach US$ 4.31 Billion by the year 2034.

- The Product Type segment is divided into Serum separation tubes, Anti-coagulant tubes, Coagulation analysis tubes, Glucose a, with Serum separation tubes taking the lead in 2024 with a market share of 30.5%

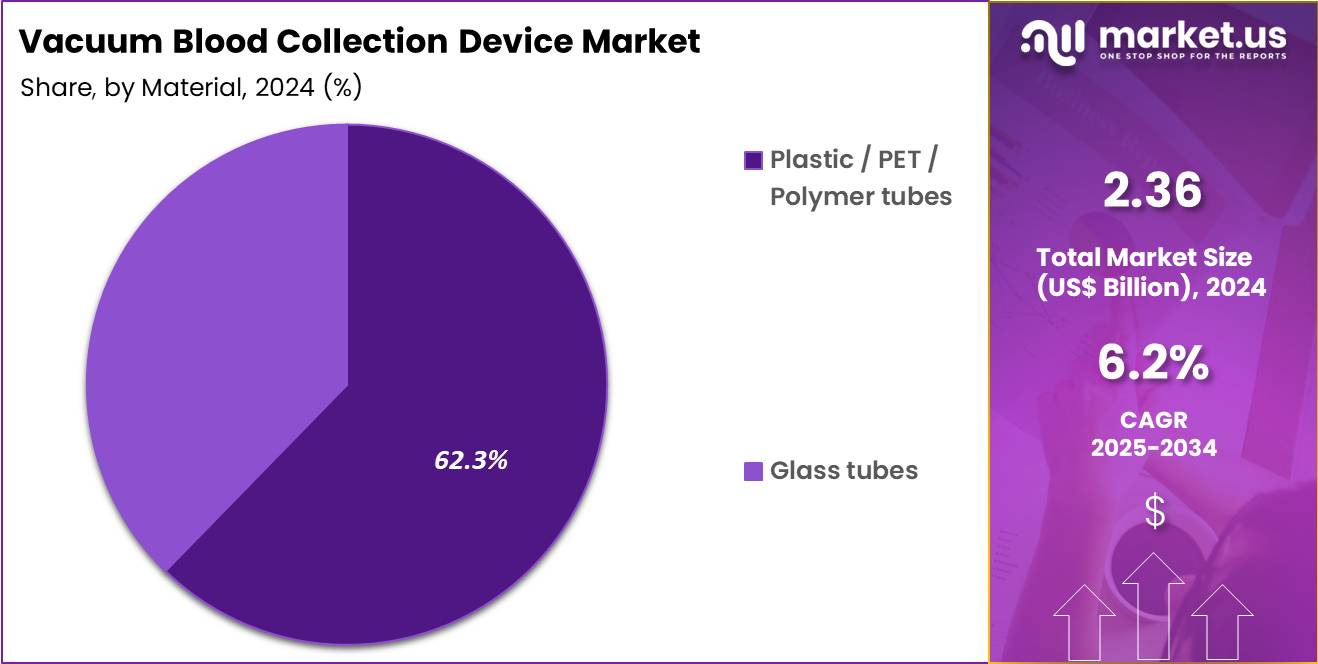

- The Material segment is divided into Plastic / PET / Polymer tubes, and Glass tubes, with Plastic / PET / Polymer tubes taking the lead in 2024 with a market share of 62.3%

- The Application segment is divided Serology & Immunology testing, General diagnostics, Coagulation tests, Genetic testing, Glucose test, with General diagnostics taking the lead in 2024 with a market share of 44.1%

- The End-User segment is divided into Hospitals & Clinics, Diagnostic and Pathology Laboratories, Blood Banks, Research & Academic Institutes, and Others, with Diagnostic and Pathology Laboratories taking the lead in 2024 with a market share of 43.2%

- North America led the market by securing a market share of 41.5% in 2024.

Product Type Analysis

Serum separation tubes hold a leading share of 30.5% due to extensive use in routine chemistry, liver function tests, renal markers, and infectious disease panels. Hospitals depend on these tubes to process millions of annual blood chemistry tests. For example, large hospital networks across the US and Europe perform over 2 billion routine chemistry tests annually, where serum tubes form the primary collection format.

Barrier gels and advanced clot activators in modern tubes help reduce sample hemolysis, improving diagnostic accuracy. In April 2024, KBMED introduced its FDA 510(k)-cleared vacuum serum-separating tubes to the U.S. market. This expansion of its blood collection tube portfolio marks an important milestone for the company and strengthens its competitive position within the North American diagnostics sector.

Anti-coagulant tubes, including EDTA, citrate, and heparin tubes, are critical for hematology and plasma-based assays. EDTA tubes represent one of the highest-volume subcategories globally due to their essential role in complete blood count (CBC), one of the most commonly prescribed diagnostic tests. CBC is used in cancer monitoring, infectious disease diagnosis, and general health screening, driving EDTA tube consumption.

Material Analysis

Plastic/PET/Polymer tubes dominated the market with 62.3% market share due to their lightweight design, better shock resistance, and safer handling compared to glass. Polymer materials also ensure consistent vacuum retention and compatibility with automated analyzers. Their use in large diagnostic chains and point-of-care settings reinforces their dominance.

Plastic/PET/polymer vacuum blood collection tubes are evacuated, sterile containers made from shatter-resistant polyethylene terephthalate (PET) or other polymers, replacing fragile glass for safer phlebotomy and transport. These tubes feature color-coded caps indicating additives for specific tests, maintaining vacuum to draw precise blood volumes while preserving sample integrity.

Some examples include Lavender (EDTA): PET tubes with K2/K3-EDTA for hematology, CBC, and blood cell counts; prevents clotting by chelating calcium and Gold/Red (SST/PST): Polymer gel and clot activator (silica) for serum chemistry, immunology; gel separates serum/plasma post-centrifugation. BD Vacutainer and similar brands dominated the market, along with many local players.

Glass tubes maintain a smaller, niche share, mainly in specialized testing and geographies where legacy systems remain in use. Although glass provides strong chemical stability, its breakage risk and higher weight limit its long-term applicability.

Application Analysis

Serology & Immunology testing accounts for an important share, as hospitals rely heavily on serum or plasma samples for antibody and antigen detection in infectious disease management, autoimmune disease profiling, and vaccine response monitoring.

General diagnostics represent the largest application area covering 44.1% of the global market, covering routine tests such as CBC, liver function tests, lipid profiles, thyroid panels, renal markers, and metabolic panels. The increasing frequency of preventive health checkups and insurance-based annual wellness programs continue to elevate sample collection volumes.

Coagulation tests continue to rise in demand due to increasing incidence of cardiovascular disease and widespread use of anticoagulant therapies. Emergency departments and ICUs depend on rapid coagulation analysis, making citrate tubes essential.

Genetic testing, although smaller in share, shows rapid growth as precision medicine advances. Many genetic testing workflows begin with high-quality EDTA plasma or whole blood samples, expanding demand for specialized anticoagulant tubes.

End-User Analysis

Diagnostic and Pathology Laboratories represent the largest end-user segment accounting for over 43.2% market share in 2024 due to high-volume sample processing. National reference labs, corporate diagnostic chains, and private pathology centers conduct millions of routine and specialized tests daily, driving sustained consumption of vacuum tubes, needles, and accessories.

Diagnostic and pathology laboratories serve as indirect end users in the organ transport devices market by relying on viable organs delivered via these devices for transplant compatibility testing, histocompatibility analysis (HLA typing), and rejection monitoring. These labs process organs post-transport to perform pre-transplant diagnostics like PCR/NGS for genetic markers and donor-specific antibodies, ensuring match success amid rising transplant volumes.

Hospitals & Clinics remain major users of vacuum blood collection devices due to continuous inpatient and outpatient testing requirements. Emergency rooms rely heavily on rapid sampling for critical diagnostics such as CBC, blood sugar, cardiac markers, and coagulation tests.

Key Market Segments

By Product Type

- Serum separation tubes

- Anti-coagulant tubes

- Coagulation analysis tubes

- Glucose analysis tubes

- Blood Collection Needle

- Accessories

By Material

- Plastic / PET / Polymer tubes

- Glass tubes

By Application

- Serology & Immunology testing

- General diagnostics

- Coagulation tests

- Genetic testing

- Glucose testing

- Other specialised tests

By End-User

- Hospitals & Clinics

- Diagnostic and Pathology Laboratories

- Blood Banks

- Research & Academic Institutes

- Others

Drivers

Rising global diagnostic volumes, expanding chronic disease burden, and increased adoption of standardized phlebotomy protocols

Demand for Vacuum Blood Collection Devices grows due to rising global diagnostic volumes, expanding chronic disease burden, and increased adoption of standardized phlebotomy protocols. Routine diagnostics such as CBC, lipid profiles, thyroid tests, and metabolic panels account for hundreds of millions of tests globally every year, directly increasing vacuum tube usage. Rising prevalence of diabetes drives demand for glucose tubes, as precise glycolysis-controlled samples are critical for accurate assessment.

Similarly, increasing cardiovascular disease cases fuel PT/INR and D-dimer testing, boosting coagulation tube adoption. Growing infectious disease surveillance programs by government bodies also require high-quality vacuum-based samples for viral load, serology, and general screening tests. Technological advancements, including polymer tubes, safety needles, barcoded labels, and gel barriers enhance workflow efficiency and reduce pre-analytical errors, making these devices indispensable in modern diagnostics. The movement toward preventive healthcare in both urban and rural settings increases annual diagnostic test cycles per person, further strengthening market demand.

Restraints

High volumes of single-use plastic waste and limited adoption of advanced tubes

Key restraints affecting market expansion include high volumes of single-use plastic waste, limited adoption of advanced tubes in low-resource settings, and occasional supply chain interruptions in additives and polymer materials. Although plastic tubes dominate due to safety, their environmental footprint raises concerns across several regions implementing stricter medical waste regulations.

Cost barriers also impact smaller laboratories and clinics, especially in developing countries where price-sensitive buyers still prefer glass tubes or syringe-based collection. Some regions face challenges such as inconsistent vacuum retention, counterfeit products, or low-quality additives that lead to unreliable sample integrity. Shortages of citrate, EDTA, or specialized clot activators during geopolitical disruptions can also affect production cycles.

Training gaps in phlebotomy practices including improper mixing, incorrect draw volumes, or hemolysis may cause sample rejection and inefficiencies, discouraging adoption among inexperienced staff. Additionally, despite increasing automation, many healthcare systems still face infrastructural limitations preventing seamless integration of pre-barcoded tubes or automated handlers.

Opportunities

Shift toward automated laboratory systems

Opportunities arise from the shift toward automated laboratory systems, expansion of decentralized diagnostic centers, and adoption of safer, eco-friendly tube materials. Polymer innovation enables development of recyclable tubes or reduced-resin designs, addressing environmental concerns and appealing to regions with strong sustainability commitments. Rapid expansion of diagnostic chains in Asia Pacific, Middle East, and Africa creates high-volume demand for standardized blood collection devices.

Growth in genetic testing, oncology biomarker analysis, and advanced serology expands need for high-integrity EDTA, heparin, and serum tubes. Increasing government investments in public health programs, newborn screening initiatives, and community testing also accelerate device consumption. Large-scale preventive screening programs, corporate health packages, and insurance-driven annual health checkups widen the routine diagnostics base, offering consistent revenue opportunities. Mobile phlebotomy services and home-collection models further expand application areas.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the Vacuum Blood Collection Device Market by shaping production stability, material availability, regulatory environments, and healthcare spending patterns. Inflationary pressure increases manufacturing costs for polymers, additives, rubber stoppers, and metal components used in needles, resulting in higher procurement prices for hospitals and laboratories.

Currency fluctuations in import-dependent regions affect the affordability of polymer-based tubes, especially in markets relying on materials sourced from multinational suppliers. Geopolitical tensions can disrupt supply chains for plastics, citrates, EDTA, and specialty gel additives, leading to temporary shortages or delayed shipments for diagnostic networks. During such disruptions, laboratories often shift to alternative suppliers or adjust testing volumes based on tube availability.

Economic slowdowns also influence government budgets for public health diagnostics, especially in developing regions where funding constraints may reduce adoption of premium safety-engineered devices. Conversely, geopolitical events that increase infectious disease surveillance or humanitarian healthcare needs significantly raise demand for vacuum blood collection tubes and needles.

Strengthening national health security programs, border-screening protocols, and emergency preparedness drives higher procurement of standardized collection devices. The growing focus on local manufacturing in Asia, the Middle East, and parts of Europe arises from geopolitical risks and encourages capacity expansion to reduce dependence on global supply chain routes, providing long-term resilience for this market.

Latest Trends

Adoption of pre-barcoded tubes

Key trends include adoption of pre-barcoded tubes, digital phlebotomy workflow systems, safety-engineered needle devices, and increased preference for polymer tubes in automated analyzers. Laboratories increasingly integrate automation-compatible tubes with consistent dimensions, clear labels, and rapid clotting formulations to support high-throughput analyzers. Safety needles with push-button retraction or shield mechanisms are rapidly replacing conventional needles, driven by global worker safety regulations.

Another trend is the expansion of point-of-care and decentralized sample collection units that require high-quality vacuum tubes with stable shelf life and efficient additive formulations. Manufacturers are introducing color-coded closures, advanced gel formulations, and improved anticoagulant blends to support multi-disciplinary testing. Additionally, many large diagnostic groups are investing in digital sample-tracking systems that integrate with electronic health records, improving pre-analytical accuracy and reducing labeling errors.

Regional Analysis

North America is leading the Vacuum Blood Collection Device Market

North America represents the largest regional share of 41.5% in 2024 in the Vacuum Blood Collection Device Market due to its high testing volumes, advanced laboratory infrastructure, and strict compliance with safety-engineered phlebotomy standards. The US conducts more than 7 billion diagnostic tests annually, with CBC, metabolic panels, thyroid tests, and lipid profiles accounting for a significant portion, directly increasing consumption of serum, EDTA, and coagulation tubes.

The Centers for Disease Control and Prevention (CDC) reports that over 37 million Americans have diabetes, driving strong demand for glucose analysis tubes in hospitals and outpatient clinics. Widespread use of anticoagulant therapy also fuels the need for citrate tubes, especially as cardiovascular disease remains the leading cause of death in the region.

Strict OSHA regulations accelerate adoption of safety needles and polymer tubes across major hospital networks. Large integrated diagnostic chains and reference labs such as LabCorp and Quest Diagnostics further strengthen market dominance through high-throughput testing operations and standardized vacuum tube usage.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region owing to rapid healthcare expansion, rising chronic disease cases, and increasing national screening programs. The International Diabetes Federation estimates over 206 million adults with diabetes in the region, significantly driving demand for glycolysis-controlled glucose tubes in community clinics and large hospital settings.

Countries such as India and China are scaling up diagnostics infrastructure, with India alone performing more than 1.2 billion pathology tests annually, boosting consumption of serum, EDTA, and heparin tubes. Japan and South Korea show high adoption of safety-engineered needles, aligned with strong occupational safety standards.

Government-led infectious disease surveillance covering dengue, influenza, hepatitis, and emerging viral threats further accelerates tube consumption in public health laboratories. The rapid growth of private diagnostic chains, including major networks in India, Thailand, and Indonesia, expands routine test volumes and strengthens demand for polymer tubes compatible with automated analyzers, making Asia Pacific the most dynamic growth market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Becton, Dickinson and Company (BD), Terumo Corporation, Greiner Bio-One International GmbH, Sarstedt AG & Co. KG, Sekisui Medical Co., Ltd., FL Medical s.r.l., Cardinal Health, CML Biotech Pvt. Ltd., AdvaCare Pharma, Gong Dong Medical Technology Co., Ltd., Improve Medical, Nipro Medical Corporation, and Other key players

Becton, Dickinson and Company (BD) maintains a leading position in the Vacuum Blood Collection Device Market with its widely adopted BD Vacutainer range, known for precise vacuum control, advanced additive formulations, and strong compatibility with automated analyzers. BD supports hospitals and laboratories globally with safety-engineered needles and collection systems that reduce pre-analytical errors and enhance healthcare worker protection. The company’s continuous design improvements and global distribution strength reinforce its dominant role in high-volume diagnostic environments.

Terumo Corporation plays a key role through its high-quality vacuum blood collection tubes and needles engineered for stable sample integrity. Terumo’s focus on polymer innovation, smooth-flow needle technology, and user-friendly safety mechanisms supports strong adoption across Asia, Europe, and emerging markets. Its devices are widely used in clinical chemistry, hematology, and coagulation testing due to consistent performance and reliability.

Greiner Bio-One International GmbH is recognized for its VACUETTE line featuring premium polymer tubes, advanced gel separators, and color-coded closures optimized for automated laboratory workflows. The company emphasizes precision manufacturing and additive consistency, making its tubes preferred in high-throughput diagnostic chains and research institutions. Greiner’s strong footprint in Europe and growing global presence reinforce its importance in standardized blood collection systems.

Top Key Players

- Becton, Dickinson and Company (BD)

- Terumo Corporation

- Greiner Bio-One International GmbH

- Sarstedt AG & Co. KG

- Sekisui Medical Co., Ltd.

- FL Medical s.r.l.

- Cardinal Health

- CML Biotech Pvt. Ltd.

- AdvaCare Pharma

- Gong Dong Medical Technology Co., Ltd.

- Improve Medical

- Nipro Medical Corporation

- Other key players

Recent Developments

- In April 2025 Greiner Bio-One International GmbH (GBO) obtained regulatory approval for its new Vacuette Z-Grip PLUS vacuum blood collection tubes, designed for improved ergonomics and ease of handling in diagnostic labs.

- In April 2024, Becton, Dickinson and Company (BD) India launched BD Vacutainer UltraTouch Push Button Blood Collection Set, designed with “RightGauge” thin-needle technology and “PentaPoint” design to reduce insertion pain and support single-prick success; BD claims the set reduces risk of needle injury by 88%.

- In March 2024, Terumo Corporation entered into a strategic partnership with F. Hoffmann‑La Roche Ltd. to co-develop next-generation venous blood collection devices, combining Terumo’s medical-device expertise with Roche’s diagnostics capabilities.

Report Scope

Report Features Description Market Value (2024) US$ 2.36 Billion Forecast Revenue (2034) US$ 4.31 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Serum separation tubes, Anti-coagulant tubes, Coagulation analysis tubes, Glucose analysis tubes, Blood Collection Needle and Accessories), By Material (Plastic / PET / Polymer tubes and Glass tubes), By Application (Serology & Immunology testing, General diagnostics, Coagulation tests, Genetic testing, Glucose testing and Other specialised tests), By End-User (Hospitals & Clinics, Diagnostic and Pathology Laboratories, Blood Banks, Research & Academic Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Becton, Dickinson and Company (BD), Terumo Corporation, Greiner Bio-One International GmbH, Sarstedt AG & Co. KG, Sekisui Medical Co., Ltd., FL Medical s.r.l., Cardinal Health, CML Biotech Pvt. Ltd., AdvaCare Pharma, Gong Dong Medical Technology Co., Ltd., Improve Medical, Nipro Medical Corporation, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vacuum Blood Collection Device MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Vacuum Blood Collection Device MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton, Dickinson and Company (BD)

- Terumo Corporation

- Greiner Bio-One International GmbH

- Sarstedt AG & Co. KG

- Sekisui Medical Co., Ltd.

- FL Medical s.r.l.

- Cardinal Health

- CML Biotech Pvt. Ltd.

- AdvaCare Pharma

- Gong Dong Medical Technology Co., Ltd.

- Improve Medical

- Nipro Medical Corporation

- Other key players