Global Usage Based Insurance Automotive Market Size, Share, Growth Analysis By Type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive), By Technology (OBD II, Black Box, Smartphones, Others), By Vehicle (Passenger Auto, Commercial Auto), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146484

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

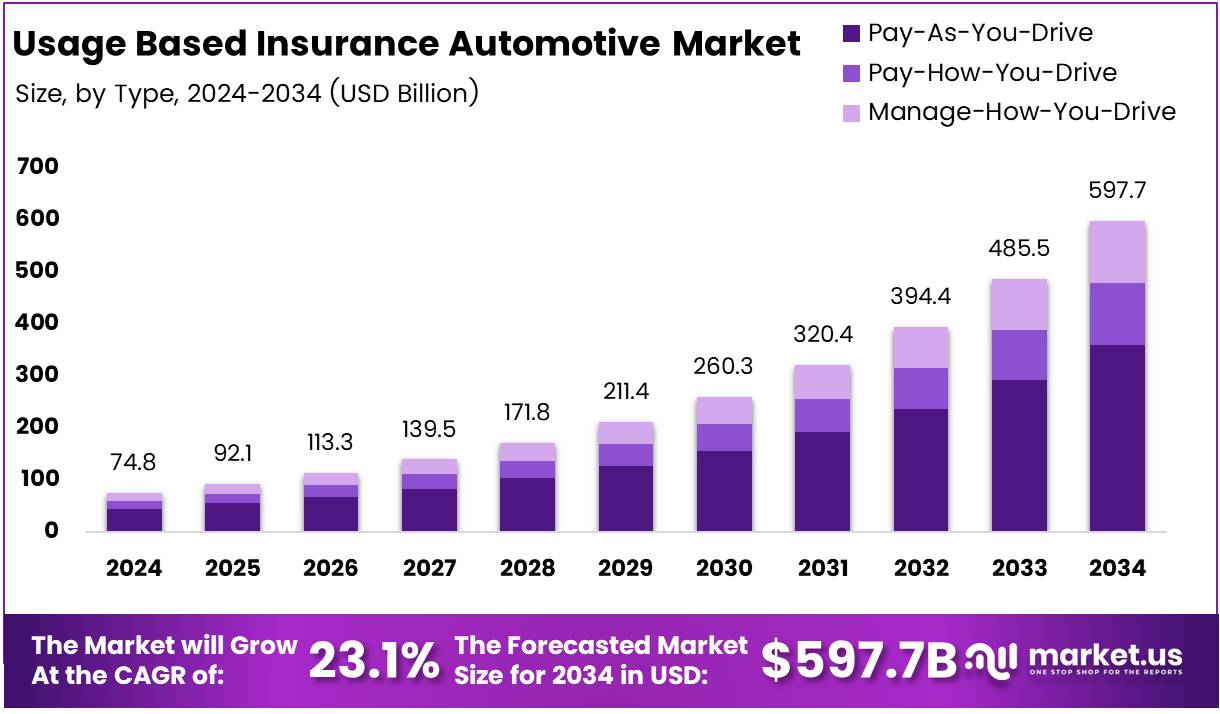

The Global Usage Based Insurance Automotive Market size is expected to be worth around USD 597.7 Billion by 2034, from USD 74.8 Billion in 2024, growing at a CAGR of 23.1% during the forecast period from 2025 to 2034.

Usage-Based Insurance (UBI) in the automotive sector is an innovative model that tailors car insurance premiums based on actual driving behavior rather than traditional risk factors such as age, gender, or credit score. By using telematics technology, insurers can track metrics like speed, distance traveled, driving time, and even the types of roads driven on. This personalized approach allows for more accurate pricing and offers drivers the opportunity to reduce their premiums by adopting safer driving habits.

UBI models are gaining traction as they align with consumer demands for greater transparency and fairness in insurance pricing. Furthermore, the market is becoming increasingly competitive as traditional insurers, as well as newer tech-driven companies, enter the space.

The Usage-Based Insurance (UBI) automotive market is experiencing rapid growth, driven by the rise of telematics and connected vehicle technologies. With UBI, consumers can now pay premiums that are directly linked to their driving behavior, making it a more affordable and tailored solution compared to traditional insurance models. According to the Economic Times, auto insurance rates saw a 2.6% increase in March, with a notable 22% rise compared to the previous year.

Moreover, the increasing adoption of connected vehicles and the Internet of Things (IoT) are expected to further fuel the growth of the UBI market, presenting ample opportunities for both new entrants and established insurers to capitalize on emerging technologies.

The UBI automotive market is witnessing significant growth, driven by a combination of consumer demand for more affordable and personalized insurance products, along with technological advancements in telematics and IoT.

As vehicle maintenance and repair costs have risen by nearly 38% over the past five years (Bureau of Labor Statistics Consumer Price Index), drivers are increasingly seeking cost-effective solutions, which UBI provides. Additionally, according to Financial Express, zero-dep cover is a top choice for 95% of new car customers, highlighting the growing preference for comprehensive coverage options.

Government investment and regulations play a pivotal role in shaping the UBI landscape. As governments around the world push for more sustainable transportation solutions, they are also considering regulations that could incentivize insurers to adopt more innovative pricing models.

Furthermore, telematics-based insurance models align with the increasing emphasis on data privacy and transparency, prompting regulatory bodies to introduce frameworks that balance consumer protection with the benefits of personalized insurance pricing. With these factors at play, the UBI automotive market is well-positioned for further expansion, offering substantial opportunities for growth.

Key Takeaways

- Global UBI Automotive Market size is expected to reach USD 597.7 Billion by 2034, growing at a CAGR of 23.1% from USD 74.8 Billion in 2024.

- Pay-As-You-Drive (PAYD) dominates the By Type Analysis segment, holding 60.1% share in 2024.

- OBD II technology leads the By Technology Analysis segment, providing detailed data on vehicle performance and driver behavior.

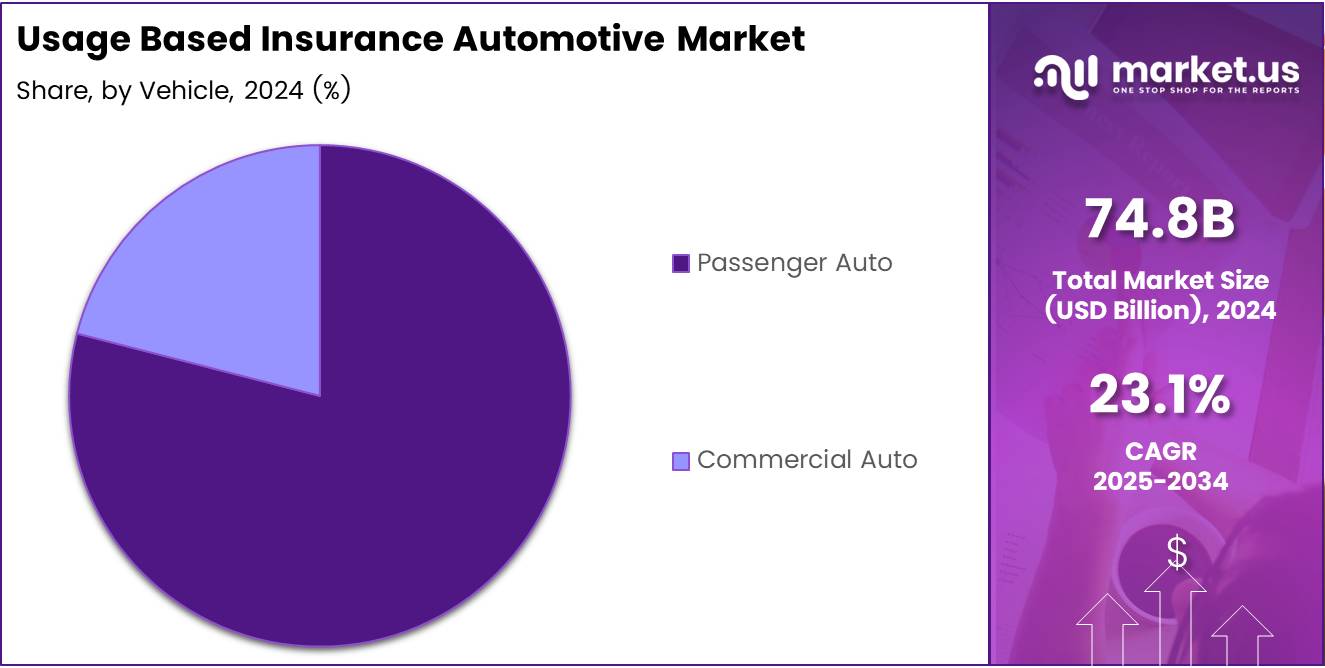

- Passenger Autos dominate the By Vehicle Analysis segment, driven by the high volume of passenger vehicles and increased adoption of UBI.

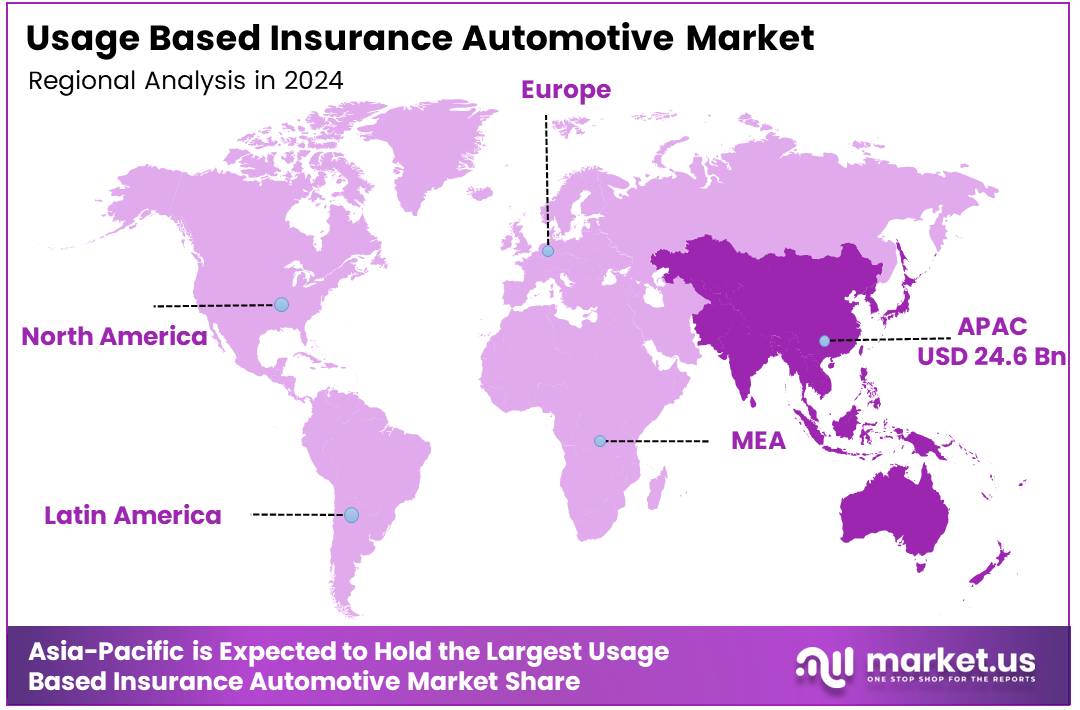

- Asia Pacific holds the largest share in the UBI automotive market at 33.1%, valued at USD 24.6 billion.

Type Analysis

PAYD Dominates with 60.1% in UBI Automotive Market by Type in 2024

In 2024, Pay-As-You-Drive (PAYD) was the dominant player in the By Type Analysis segment of the Usage-Based Insurance (UBI) Automotive Market, capturing an impressive 60.1% share. This model charges drivers based on the actual distance they drive, appealing to those who drive infrequently or have low-mileage usage. The PAYD model’s simplicity and flexibility continue to drive its popularity among insurance companies and consumers alike.

The Pay-How-You-Drive (PHYD) model follows, offering a solution that is based on both driving behavior and distance traveled. Although PHYD is growing, it does not yet match the widespread appeal and market penetration of PAYD. Insurance companies can adjust rates based on factors like speed, braking, and acceleration, creating a more personalized pricing structure.

Lastly, the Manage-How-You-Drive (MHYD) model, which emphasizes driver behavior and encourages safer driving through incentives, remains a niche offering. Although it is being gradually adopted by insurers aiming for better risk management, it does not yet capture the same level of market share as PAYD.

Technology Analysis

OBD II Leads in UBI Automotive Market by Technology in 2024

The On-Board Diagnostics II (OBD II) technology held a dominant position in the By Technology Analysis segment of the Usage-Based Insurance (UBI) Automotive Market. As a crucial component of modern vehicles, the OBD II system allows insurance companies to collect detailed data on vehicle performance and driver behavior, providing an essential advantage in risk assessment.

Black Box technology is another popular choice among insurers, with its ability to record a wide range of data regarding driving patterns and vehicle condition. While it has become more common, it still trails behind OBD II in terms of widespread adoption due to its higher cost and more complex installation process.

Smartphones, often paired with telematics apps, are also contributing to the market but are still not as reliable or detailed as OBD II or Black Box systems. Nevertheless, they offer convenience and cost-effectiveness for consumers, allowing insurers to access data without additional hardware installation.

Other technologies, though available, contribute less significantly to the market. These include devices that may rely on alternative forms of data collection, but they have not yet gained significant traction compared to OBD II.

Vehicle Analysis

Passenger Auto Holds Major Share in UBI Automotive Market by Vehicle in 2024

In the By Vehicle Analysis segment of the Usage-Based Insurance (UBI) Automotive Market, Passenger Auto vehicles dominated, capturing the largest share. This segment’s dominance is primarily driven by the higher volume of passenger vehicles on the road, as well as the increasing adoption of UBI by private car owners who are keen to pay for insurance based on actual usage and driving behavior.

Commercial Auto vehicles, while significant, represent a smaller portion of the market. The demand for UBI in the commercial sector is growing but faces challenges such as higher vehicle fleets and varied usage patterns. Businesses are more hesitant to adopt UBI compared to individual consumers, mainly due to the complexities involved in fleet management and the varying nature of commercial driving.

Despite this, the commercial auto market is expected to grow as businesses seek ways to lower insurance costs and monitor driver behavior in fleet operations. However, the passenger auto segment will continue to lead due to its greater flexibility, larger customer base, and faster adoption of telematics-based insurance solutions.

Key Market Segments

By Type

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

- Manage-How-You-Drive (MHYD)

By Technology

- OBD II

- Black Box

- Smartphones

- Others

By Vehicle

- Passenger Auto

- Commercial Auto

Drivers

Cost Savings for Consumers Driving Adoption of Usage-Based Insurance

Usage-Based Insurance (UBI) is gaining traction primarily due to its potential for cost savings, especially for drivers with safe driving habits. Consumers who consistently exhibit good driving behavior are rewarded with lower premiums, which makes UBI an attractive option for cost-conscious individuals.

The pricing model is directly tied to the individual’s driving patterns, making it more appealing compared to traditional insurance models. This cost-efficient approach is particularly appealing to younger drivers and those with lower annual mileage.

By aligning premiums with driving behavior, UBI ensures that individuals who drive less or drive safely are not penalized by higher insurance costs, offering a more affordable and personalized option. As a result, UBI is increasingly seen as a fairer, more tailored alternative to traditional insurance pricing.

Restraints

Privacy Concerns and Technological Barriers Hindering UBI Adoption

Despite its benefits, the widespread adoption of UBI faces certain challenges, primarily related to privacy concerns and technological barriers. Consumers often express hesitancy about sharing their driving data, including location and behavior patterns, due to fears about how this data will be used or misused. This concern is particularly prominent in regions with strict data protection laws. Additionally, implementing the required telematics devices and data infrastructure can be expensive.

For insurers and consumers, the cost of installing and maintaining the necessary technology can be prohibitive, particularly in developing markets where affordability is a major consideration. These factors pose significant barriers to the broader adoption of UBI, limiting its market penetration.

Growth Factors

Expansion into Emerging Markets Opens New Growth Opportunities for UBI

The Usage-Based Insurance market holds significant growth opportunities, particularly in emerging markets where the demand for affordable and personalized insurance options is rising. These markets, especially in regions like Asia and Latin America, are seeing an increased need for more flexible insurance models that cater to individual driving behaviors. The growing middle class in these regions is also looking for ways to lower the cost of vehicle insurance.

In addition, the development of autonomous vehicles presents another exciting opportunity for UBI. As self-driving cars become more prevalent, insurers could integrate UBI models to assess risks and set premiums based on the behavior of autonomous systems. Partnerships with technology providers specializing in IoT and AI can also enhance the accuracy and efficiency of UBI models, helping insurers refine their offerings and expand their market reach.

Emerging Trends

Pay-As-You-Drive and Connected Cars Fuel UBI Market Growth

Several emerging trends are driving the growth of the Usage-Based Insurance market. One notable trend is the rise of Pay-As-You-Drive (PAYD) models, where insurance premiums are based on the distance driven rather than a fixed rate. This model offers consumers greater flexibility and can be more appealing to those who drive infrequently.

Additionally, insurers are increasingly integrating UBI programs with mobile apps, allowing drivers to monitor their driving behavior and receive real-time feedback.

These apps also offer incentives, making UBI more user-friendly and attractive. Furthermore, the rise of connected cars, equipped with GPS tracking and real-time diagnostics, is making it easier for insurers to collect accurate data, thus facilitating the adoption of UBI models. These trends point to a more connected, personalized, and flexible future for the automotive insurance industry.

Regional Analysis

Asia Pacific Dominates the Usage-Based Insurance Automotive Market, Accounting for 33.1% Share and USD 24.6 Billion

The Usage-Based Insurance (UBI) automotive market in Asia Pacific holds the largest share at 33.1%, valued at USD 24.6 billion. This dominance is largely driven by the rapid adoption of telematics technology, significant growth in the automotive sector, and supportive government initiatives in countries like China, Japan, and India. The rising number of connected vehicles and smart cities contributes to the region’s market leadership.

Regional Mentions:

North America remains a strong contender, with the U.S. at the forefront of the UBI market. The demand for personalized and flexible insurance solutions, along with technological advancements in telematics, has fueled market growth. Insurance providers in this region are increasingly incorporating UBI models to meet consumer preferences for usage-based policies, offering real-time driving data to adjust premiums accordingly.

In Europe, the adoption of Usage-Based Insurance is expanding steadily, supported by regulatory policies aimed at reducing carbon emissions and promoting safer driving behaviors. Countries like Germany, France, and the U.K. are witnessing an increased integration of telematics within their automotive industries. UBI schemes are gaining popularity as consumers seek cost-effective, tailored insurance based on actual driving data.

Latin America is experiencing gradual growth in the UBI automotive market, primarily driven by increasing smartphone penetration and the introduction of telematics technologies. While adoption is slower compared to other regions, there is a growing demand for flexible, data-driven insurance solutions that are expected to drive future market growth in countries like Brazil and Mexico.

The Middle East & Africa region shows slower adoption of UBI, but the market is gradually growing due to the increasing awareness of telematics and the benefits of usage-based insurance. As the region’s automotive market continues to expand, particularly in countries like the UAE and South Africa, UBI adoption is expected to rise, driven by the desire for more personalized insurance offerings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Usage-Based Insurance (UBI) automotive market in 2024 is set to be significantly influenced by a range of prominent players, each contributing unique capabilities and innovation. MAPFRE, a leading global insurer, has been expanding its UBI offerings, capitalizing on its strong presence in Europe and Latin America. With a focus on personalized insurance policies that cater to individual driving behaviors, MAPFRE is expected to continue its growth by integrating more advanced telematics and IoT technologies.

Liberty Mutual Insurance has also positioned itself as a strong contender in the UBI market, leveraging its existing infrastructure and customer base in the U.S. and abroad. The company is focusing on data-driven pricing models to offer drivers more flexibility and fairness, appealing to the rising demand for personalized auto insurance. Liberty Mutual’s commitment to innovation through partnerships with technology companies ensures its competitiveness in the evolving market.

Allianz is another key player, with a strong emphasis on digital transformation and customer-centric solutions. As UBI continues to evolve, Allianz’s advanced analytics and telematics services are helping to shape the future of risk management in the automotive industry, focusing on predictive data to drive premiums.

Progressive Casualty Insurance Company is a frontrunner in the UBI space, offering its Snapshot program, which has seen considerable success. The company’s focus on behavioral-based pricing has been a major driver of its market share growth.

Companies like Assicurazioni Generali S.p.A., State Farm, AXA, and others are also embracing UBI models, making data-driven decisions to refine their offerings. Collectively, these firms are pushing the boundaries of UBI, reshaping the insurance landscape to better meet customer needs in a connected world.

Top Key Players in the Market

- MAPFRE

- Liberty Mutual Insurance

- Allianz

- Progressive Casualty Insurance Company

- Assicurazioni Generali S.p.A.

- State Farm Mutual Automobile Insurance Company

- AXA

- American International Group, Inc.

- Allstate Insurance Company

- insurethebox

Recent Developments

- In February 2025, High Definition Vehicle Insurance raised $40M in funding to enhance its technology platform and expand its offerings in the vehicle insurance market. The funding aims to accelerate its growth and improve its service capabilities.

- In April 2025, insurance technology startup Ominimo raised €10M in funding to support the development of its innovative digital solutions for the insurance industry. The company plans to use the funds to enhance its product offerings and scale its operations.

- In July 2024, Roadzen CEO and Chairman agreed to exchange $3.5 million of short-term debt for equity in the company as part of a strategic move to strengthen its balance sheet. This decision reflects the company’s long-term vision to increase its value and operational flexibility.

- In September 2024, Milan-based hlpy raised €18 million in a Series B round to fuel its expansion within the vehicle assistance sector across Europe. The funds will help the company scale its operations and enhance its technological infrastructure.

- In May 2024, UK challenger bank Monzo secured another $190M in funding as it prepares for expansion into the US market. The additional capital will support Monzo’s growth strategy, focusing on user acquisition and scaling its operations in new markets.

Report Scope

Report Features Description Market Value (2024) USD 74.8 Billion Forecast Revenue (2034) USD 597.7 Billion CAGR (2025-2034) 23.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive), By Technology (OBD II, Black Box, Smartphones, Others), By Vehicle (Passenger Auto, Commercial Auto) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape MAPFRE, Liberty Mutual Insurance, Allianz, Progressive Casualty Insurance Company, Assicurazioni Generali S.p.A., State Farm Mutual Automobile Insurance Company, AXA, American International Group, Inc., Allstate Insurance Company, insurethebox Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Usage Based Insurance Automotive MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Usage Based Insurance Automotive MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- MAPFRE

- Liberty Mutual Insurance

- Allianz

- Progressive Casualty Insurance Company

- Assicurazioni Generali S.p.A.

- State Farm Mutual Automobile Insurance Company

- AXA

- American International Group, Inc.

- Allstate Insurance Company

- insurethebox