Global Usability Testing Tools Market Size, Share Analysis Report By Type (Qualitative, Quantitative), By Deployment (Cloud, On-Premise), By Application (Mobile Applications, Web Applications, Others), By Enterprise Size (SMEs, Large Enterprise), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153088

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

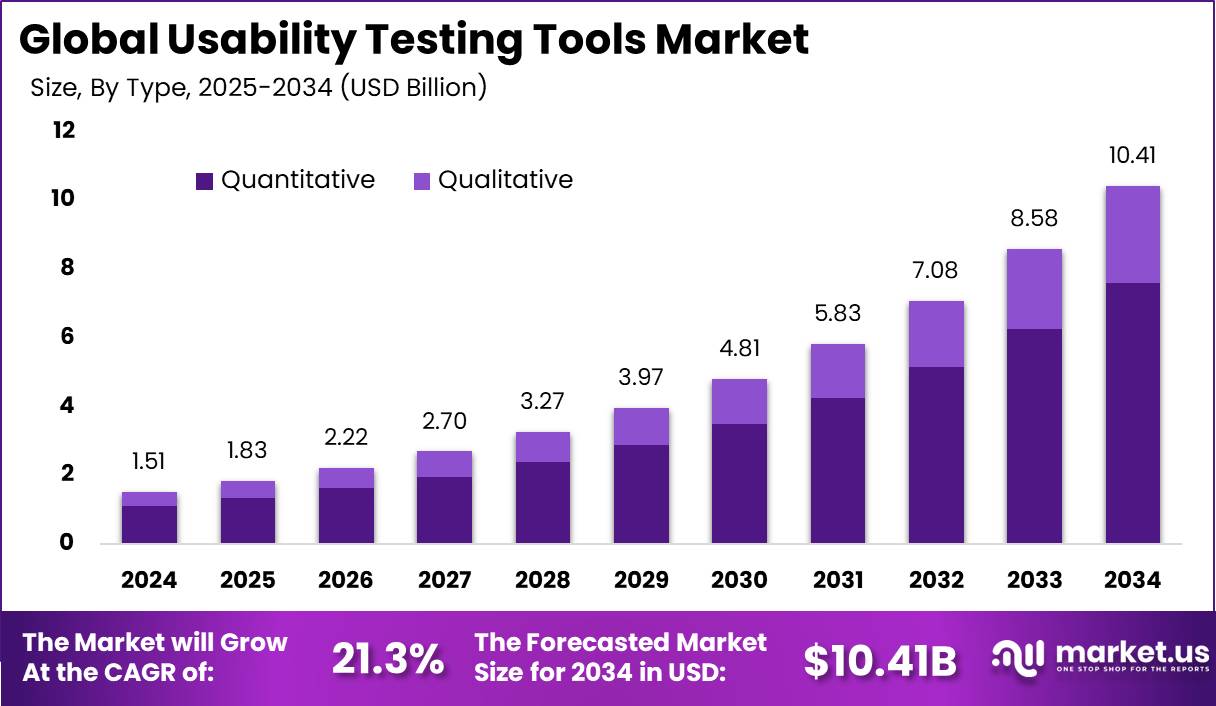

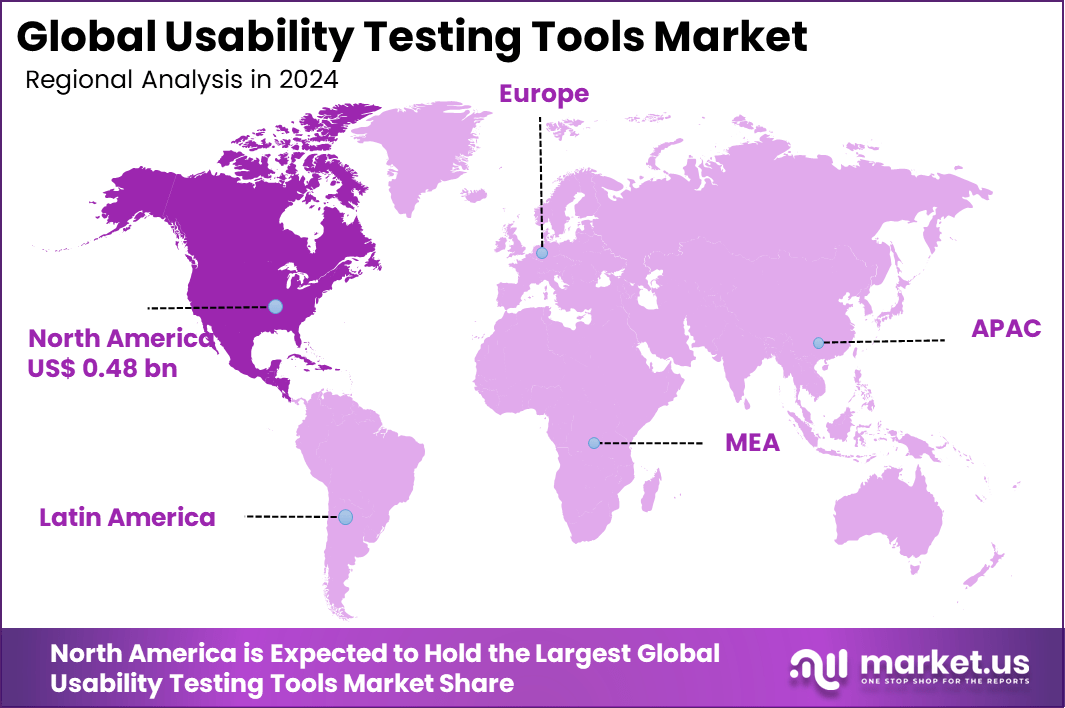

The Global Usability Testing Tools Market size is expected to be worth around USD 10.41 billion by 2034, from USD 1.51 billion in 2024, growing at a CAGR of 21.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.14% share, holding USD 0.48 billion in revenue.

The Usability Testing Tools Market encompasses software and platforms that enable businesses to evaluate how real users interact with digital products – such as websites, apps, and IoT devices. These tools facilitate session recording, heatmap analysis, sentiment detection, and user feedback collection, supporting iterative design improvements. The market has grown as companies prioritize seamless user experiences to maintain competitiveness in a digital-first environment.

The top driving factors include the rapid proliferation of mobile devices and IoT platforms, which require consistent usability across multiple touchpoints, and the growing recognition that user-centric design directly influences conversion rates and loyalty. Tools that can provide early insights into usability issues save time and resources by preventing expensive post-launch redesigns.

For instance, In February 2025, Alida launched a new usability testing tool within its advanced UX platform. This addition enables businesses to integrate qualitative feedback with quantitative data, allowing for more informed and data-driven decisions. The tool is designed to simplify usability testing while delivering deeper, actionable insights to enhance product design and boost user satisfaction.

Scope and Forecast

Report Features Description Market Value (2024) USD 1.51 Bn Forecast Revenue (2034) USD 10.41 Bn CAGR (2025-2034) 21.3% Largest market in 2024 North America [32.14% market share] The increasing adoption of technologies such as AI/ML analytics, eye‑tracking, voice and sentiment analysis, AR/VR environments, and biometric integration are enhancing usability insights. These tools offer predictive analytics and automated session review, reducing manual workloads and increasing scalability.

Key reasons for adoption include improved customer satisfaction through intuitive interfaces, reduced abandonment rates, enhanced compliance with accessibility standards, and the ability to make design decisions backed by user data rather than assumptions. Such tools enable faster time‑to‑market and more efficient iteration.

Key Takeaway

- The Global Usability Testing Tools market is projected to grow from USD 1.51 billion in 2024 to approximately USD 10.41 billion by 2034, achieving a strong 21.3% CAGR, driven by increasing demand for user-centric digital experiences and agile development practices.

- In 2024, North America led the market with over 32.14% share, generating around USD 0.48 billion, supported by advanced IT ecosystems and high adoption among digital service providers.

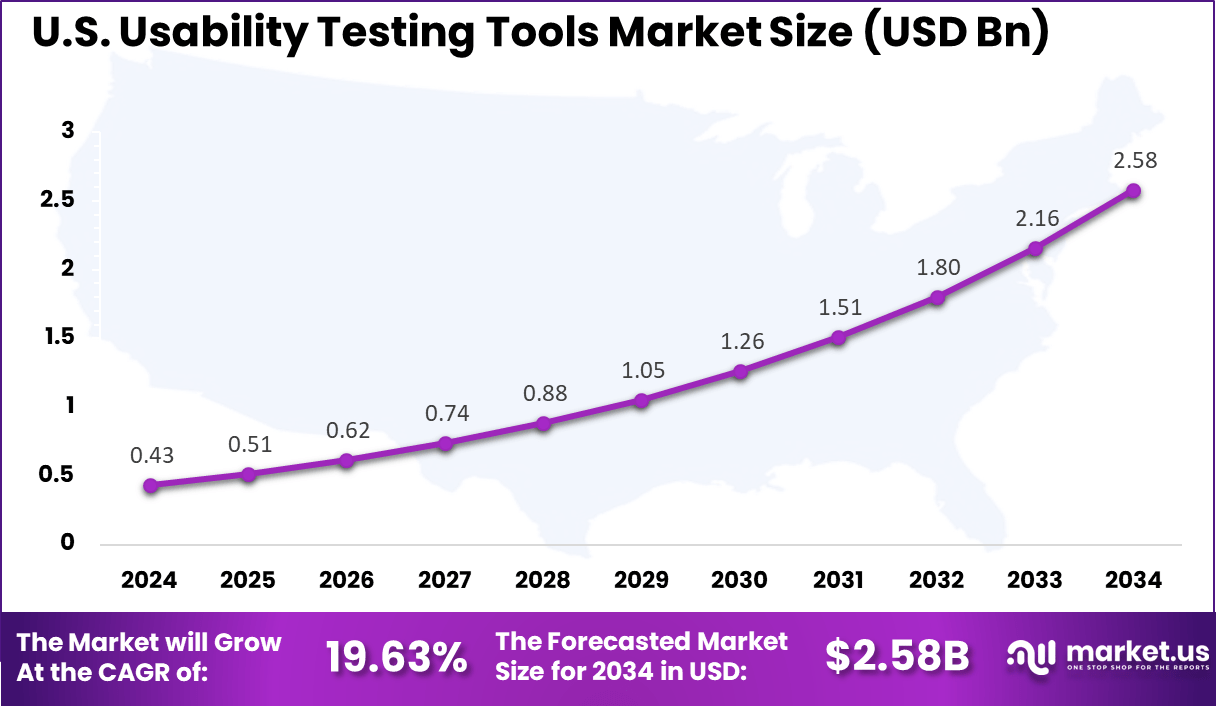

- The United States alone accounted for nearly USD 0.43 billion, with a projected 19.63% CAGR, reflecting strong enterprise investments in improving user engagement and retention.

- By type, Quantitative testing dominated with a substantial 72.84% share, as data-driven insights became critical for optimizing digital products.

- By deployment, Cloud-based solutions led the market with 61.35% share, favored for their scalability, accessibility, and integration flexibility.

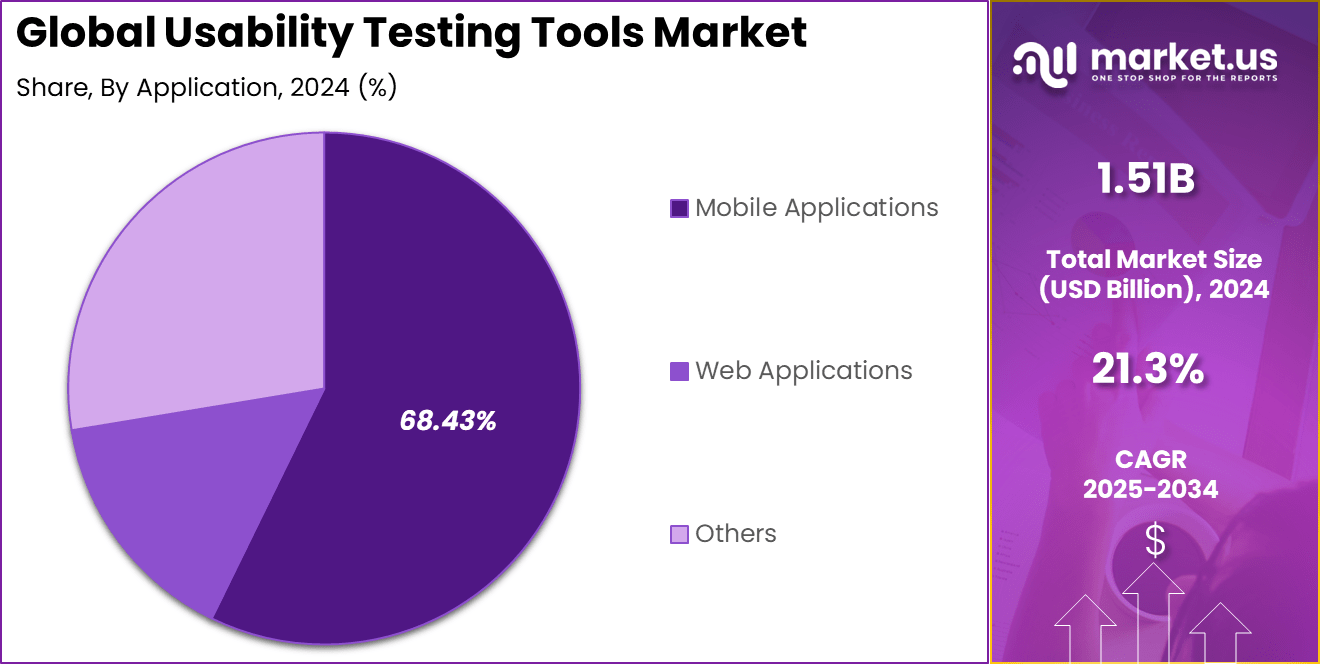

- By application, Mobile Applications accounted for the largest share at 68.43%, highlighting the priority of optimizing mobile user experiences.

- By enterprise size, Large Enterprises held a commanding 69.15% share, driven by their focus on delivering seamless, high-quality digital interactions.

U.S. Market Size

The market for Usability Testing Tools within the U.S. is growing tremendously and is currently valued at USD 0.43 billion, the market has a projected CAGR of 19.63%. The increasing emphasis on designing with the customer has resulted in a significant increase in the demand for usability testing tools to improve websites, applications, and digital offerings.

With the rise of e-commerce and technology, as well as increasing attention to mobile-first technologies and voice-responsive capabilities, companies are increasingly allocating resources to these solutions. Digital transformation, artificial intelligence-driven insights, and cheaper remote testing are driving this movement, which is ultimately leading to increased customer engagement and satisfaction.

For instance, In April 2025, BetPokies announced a potential collaboration with Hotjar, a U.S. based usability testing platform, to strengthen its focus on user experience. The partnership aims to utilize Hotjar’s tools such as heatmaps, session recordings, and surveys to gain actionable insights. By integrating these capabilities, BetPokies intends to optimize its digital products, improve user interactions, and boost overall customer satisfaction.

In 2024, North America held a dominant market position in the Global Usability Testing Tools Market, capturing more than a 32.14% share, holding USD 0.48 billion in revenue. This dominance is due to the strong technological infrastructure, high adoption of digital transformation, and a highly competitive business environment.

The rising demand stems from the focus on exceptional user experience, regulatory requirements for accessibility, and digital advancements in industries like e-commerce, healthcare, and finance. Furthermore, a culture of innovation, early adoption of AI-powered testing tools, and extensive use of cloud-based solutions have solidified the region’s leadership in shaping market trends and driving growth in usability testing.

For instance, In March 2024, Nanoflex Robotics deployed North America’s first remote-ready robotics system for vascular interventions, reinforcing the region’s leadership in advanced technology adoption. This move reflects a broader trend across North America, where rising demand for usability testing tools supports sectors like healthcare.

Type Analysis

In 2024, the Quantitative segment held a dominant market position, capturing a 72.84% share of the Global Usability Testing Tools Market. This dominance is due to the growing emphasis on data-driven decision-making, as organizations seek objective, measurable insights into user behavior and product performance.

Quantitative usability testing tools allow businesses to efficiently collect and analyze large datasets, providing clear metrics like task completion rates and time-on-task. This approach facilitates rapid iteration, performance benchmarking, and ROI demonstration, making it especially appealing to businesses focused on scaling user experience optimization.

For Instance, in March 2025, Lookback continues to enhance its platform for qualitative user research. The tool now supports both moderated and unmoderated studies across mobile and desktop platforms, facilitating real-time collaboration among teams. Its integration with the AI assistant “Eureka” aids in generating insights from testing sessions, streamlining the analysis process.

Deployment Analysis

In 2024, the Cloud segment held a dominant market position, capturing a 61.35% share of the Global Usability Testing Tools Market. The demand for this segment has been driven by the need for scalable, flexible, and cost-effective solutions that facilitate remote collaboration and quick deployment.

These tools allow businesses to access advanced features, integrate seamlessly with other platforms, and leverage global tester panels without significant infrastructure costs. Cloud solutions also enable real-time data analysis through AI-powered analytics, making them highly attractive to organizations focused on optimizing user experience at scale while maintaining operational efficiency.

For instance, In May 2025, AccelQ, a cloud-based usability testing platform, advanced its capabilities by integrating AI-driven automation into its testing processes. This enhancement allows for faster test execution and more precise insights into user interactions. By analyzing behavioral patterns and test data in real time, AccelQ delivers actionable feedback that helps optimize user experiences and improve overall product performance.

Application Analysis

In 2024, the Mobile Applications segment held a dominant market position, capturing a 68.43% share of the Global Usability Testing Tools Market. This dominance is driven by the rapid growth in mobile device usage and the widespread adoption of mobile-first strategies across industries.

As businesses focus on optimizing mobile app experiences to increase engagement and retention, usability testing tools tailored for mobile applications are becoming essential. These tools provide quick, iterative feedback to ensure apps are intuitive and perform well.

The rise of mobile commerce, banking, and social media platforms has further grown the demand for specialized mobile usability testing solutions, making them critical for meeting user expectations and enhancing overall customer satisfaction.

For instance, In November 2021, Lookback remained a key usability testing platform, supporting both moderated and unmoderated research on mobile and desktop. Its real-time feedback capture and collaborative tools enabled teams to make quick, data-driven decisions. By offering flexible testing options, Lookback helped businesses enhance user experiences and improve product design efficiency.

Enterprise Size Analysis

In 2024, The Large Enterprise segment held a dominant market position, capturing a 69.15% share of the Global Usability Testing Tools Market. This dominance is driven by large organizations’ extensive resources and complex digital ecosystems, which create a need for comprehensive usability testing solutions.

These enterprises invest significantly in advanced tools to ensure optimal user experiences across various products, meet regulatory standards, and support global operations. Their focus on customer satisfaction, brand reputation, and data-driven decisions further accelerates the adoption of tailored usability testing platforms.

For instance, In April 2025, Hotjar rolled out major upgrades to its Surveys and User Tests features, expanding how businesses gather and act on user feedback. These enhancements streamline usability testing, enabling quicker access to actionable insights. With improved platform capabilities, Hotjar continues to help organizations make data-driven decisions that enhance user experience and boost customer satisfaction.

Key Market Segments

By Type

- Qualitative

- Quantitative

By Deployment

- Cloud

- On-Premise

By Application

- Mobile Applications

- Web Applications

- Others

By Enterprise Size

- SMEs

- Large Enterprise

Usability Testing Tools: Market Dynamics

Analysis Type Description Emerging Trend The growing use of artificial intelligence for faster analysis and insights, along with a push for real-time collaboration and mainstream adoption of remote testing, is transforming how teams deliver more intuitive digital experiences. Driver The increasing focus on user-centered design is motivating organizations to adopt usability testing tools that help them craft smooth and satisfying digital products by seeing firsthand where users encounter friction. Restraint High costs and the complexity of many usability tools present barriers, especially for smaller organizations that may lack the necessary resources or training to use such solutions effectively. Opportunity Rising awareness around digital accessibility is creating opportunities for usability testing tools to help teams build more inclusive products, supporting users of varying abilities right from the design stage. Challenge Rapid technological advancement requires usability testers and product teams to continuously learn and adapt. Keeping up is particularly challenging for smaller groups with limited capacity as new devices and platforms continually emerge. Key Players Analysis

Lookback, Qualaroo, and Clicktale (Contentsquare) are known for enabling live feedback and behavior tracking. Feng-GUI and Morae (TechSmith) support visual attention and screen recording analysis. TryMyUI and Hotjar combine surveys with session replays. These tools are often used by UX teams to improve digital experiences.

Crazy Egg, Loop11, and Ethnio Inc focus on A/B testing, task flows, and real-time recruitment. Optimal Workshop Ltd and Optimizely offer strong experimentation features. UserTesting and UsabilityHub lead in video-based usability feedback. Their tools help validate designs quickly and effectively.

iPerceptions Inc (Astute), Usabilla, Userfeel Ltd, and UserZoom provide multichannel testing and survey tools. These platforms help collect large-scale feedback across web and mobile. Others in the market are adding AI and voice-based features. As user-centric design gains focus, innovation in usability testing tools continues to grow.

Top Key Players in the Market

- Lookback

- Qualaroo

- Clicktale (Contentsquare)

- Feng-GUI

- Morae (TechSmith)

- TryMyUI

- HotJar

- Crazy Egg

- Loop11

- Ethnio Inc

- Optimal Workshop Ltd

- Optimizely

- UserTesting

- UsabilityHub

- iPerceptions Inc (Astute)

- Usabilla

- Userfeel Ltd

- UserZoom

- Others

Recent Developments

- In September 2024, Crazy Egg integrated with Google Analytics 4 (GA4), enabling users to analyze and segment engagement metrics for A/B testing of page variants. This integration provides deeper insights into user interactions, allowing businesses to refine their digital products more effectively.

- In January 2021, Adobe introduced a series of user testing and feedback plugins aimed at enhancing the usability of their Creative Cloud suite. These plugins were designed to streamline the user testing process by allowing designers and developers to collect real-time feedback directly within their design workflows.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Qualitative, Quantitative), By Deployment (Cloud, On-Premise), By Application (Mobile Applications, Web Applications, Others), By Enterprise Size (SMEs, Large Enterprise) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lookback, Qualaroo, Clicktale (Contentsquare), Feng-GUI, Morae (TechSmith), TryMyUI, HotJar, Crazy Egg, Loop11, Ethnio Inc, Optimal Workshop Ltd, Optimizely, UserTesting, UsabilityHub, iPerceptions Inc (Astute), Usabilla, Userfeel Ltd, UserZoom, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Usability Testing Tools MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Usability Testing Tools MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lookback

- Qualaroo

- Clicktale (Contentsquare)

- Feng-GUI

- Morae (TechSmith)

- TryMyUI

- HotJar

- Crazy Egg

- Loop11

- Ethnio Inc

- Optimal Workshop Ltd

- Optimizely

- UserTesting

- UsabilityHub

- iPerceptions Inc (Astute)

- Usabilla

- Userfeel Ltd

- UserZoom

- Others