US Robo Taxi Market Size, Share, Growth Analysis By Propulsion Type (Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Vehicle), By Application (Passenger, Goods), By Component Type (LiDAR, Sensor, Camera, Radar), By Level of Autonomy (Level 4, Level 5), By Service Type (Car Rental, Station-based), By Vehicle Type (Cars, Shuttles/Vans), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150628

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

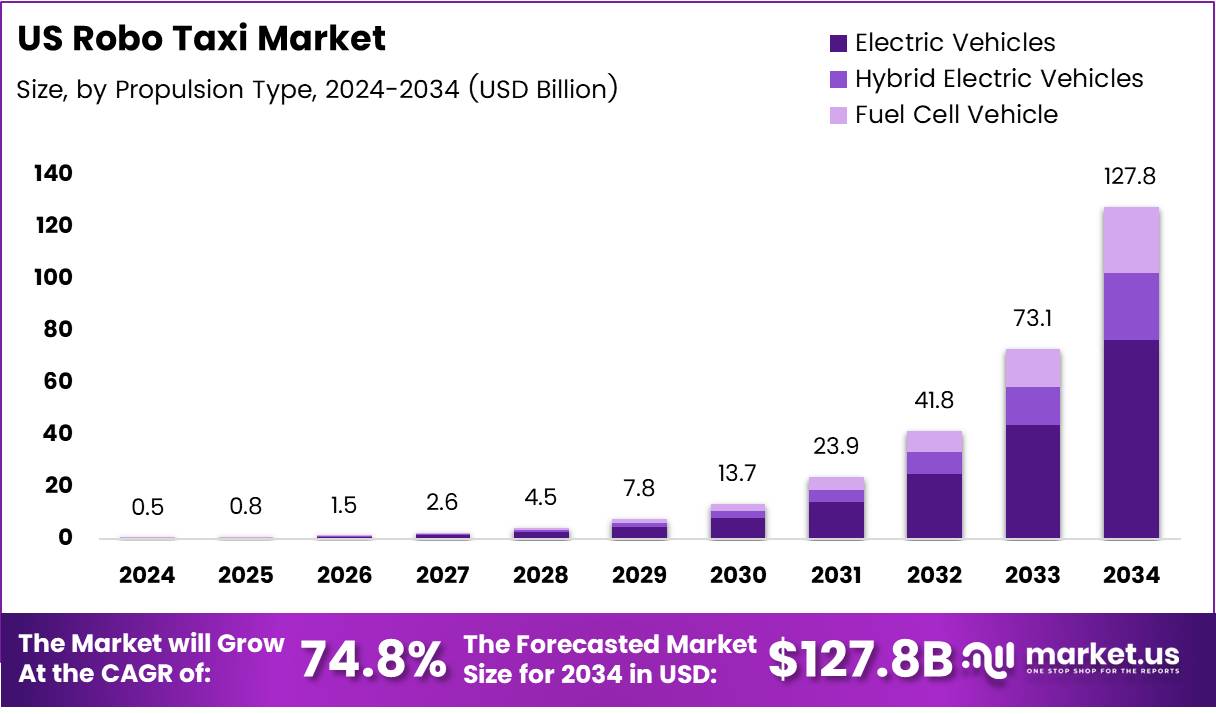

The US Robo Taxi Market size is expected to be worth around USD 127.8 Billion by 2034, from USD 0.48 Billion in 2024, growing at a CAGR of 74.8% during the forecast period from 2025 to 2034.

The US Robo Taxi Market is a rapidly evolving sector driven by advancements in autonomous vehicle technology. Robo taxis, which are self-driving cars providing on-demand transportation services, are expected to revolutionize urban mobility in the coming years.

The market is characterized by the increasing adoption of autonomous vehicles, supported by significant investments and regulatory developments from both the government and private players.

Growth in the US Robo Taxi market has been significant, with Waymo leading the charge. According to SPGlobal, Waymo’s US paid weekly robotaxi rides reached 100,000 in 2025, up from 50,000 per week in May 2024.

This growth underscores the increasing acceptance of robo taxis among consumers and highlights the potential for autonomous ride-hailing services to become mainstream. The growing consumer confidence in autonomous vehicle technology, combined with expanding infrastructure, contributes to the surge in demand.

Opportunities in the market are vast, driven by a combination of technological advancements and consumer demand for more efficient, cost-effective, and sustainable transportation solutions. As highlighted by CleanTechnica, the safety benefits of robo taxis are becoming evident, with the sector reporting an 88% reduction in property damage claims and a 92% reduction in bodily injury claims.

These reductions emphasize the safety potential of autonomous vehicles compared to traditional taxis and ride-sharing options. With ongoing technological improvements, robo taxis are expected to reduce the incidence of accidents, lower insurance costs, and improve the overall safety profile of urban transportation.

The US government has recognized the potential of autonomous vehicles and robo taxis, with a focus on ensuring regulatory frameworks support innovation while ensuring public safety.

Various states have already implemented pilot programs and regulatory measures that allow companies like Waymo to operate and scale their operations. This collaboration between the government and private companies paves the way for further expansion of the market.

Key Takeaways

- The US Robo Taxi Market size is expected to reach USD 127.8 Billion by 2034, from USD 0.48 Billion in 2024, growing at a CAGR of 74.8% from 2025 to 2034.

- In 2024, Electric Vehicles (EVs) held a dominant market position in the By Propulsion Type segment, with a share of 70.3%.

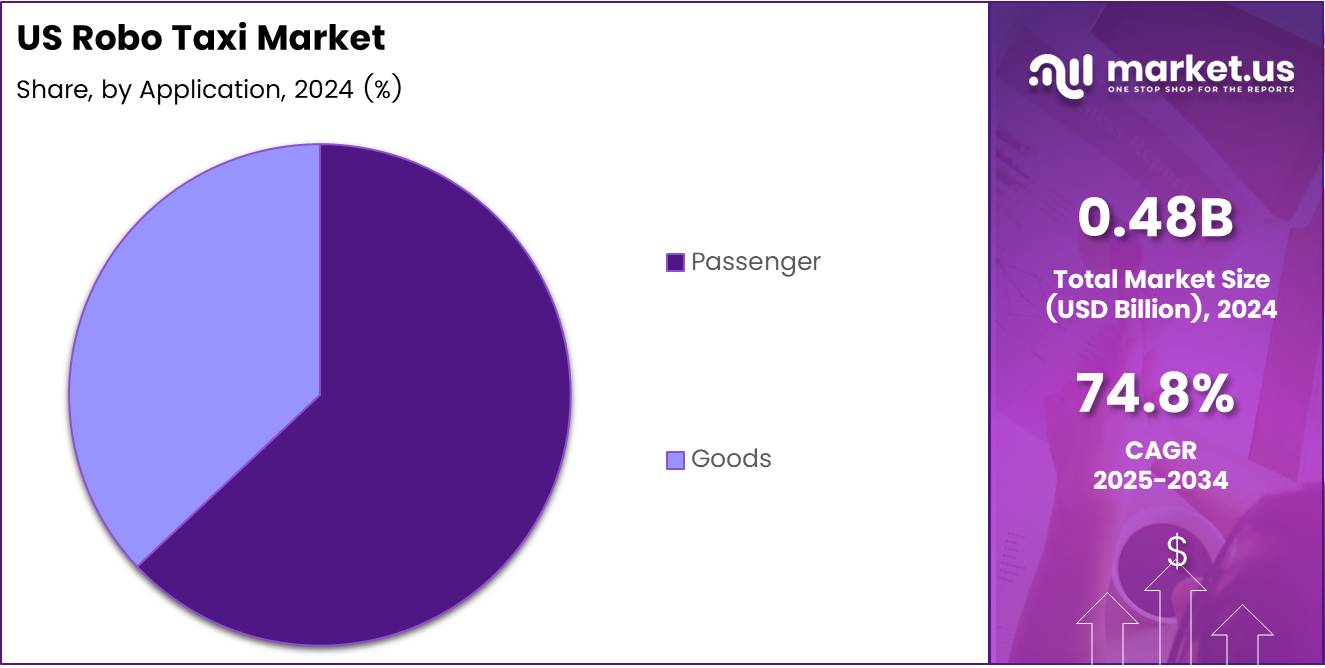

- In 2024, the Passenger segment dominated the By Application Analysis, accounting for 85.6% of the market.

- In 2024, LiDAR technology led the By Component Type Analysis segment, holding a share of 58.2%.

- In 2024, Level 4 autonomy held a dominant position in the By Level of Autonomy Analysis segment, with a share of 72.4%.

By Propulsion Type Analysis

Electric Vehicles dominate with 70.3% due to their eco-friendly and efficient technology.

In 2024, Electric Vehicles (EVs) held a dominant market position in the By Propulsion Type Analysis segment of the US Robo Taxi Market, with a share of 70.3%. The high growth of EVs can be attributed to the increasing demand for sustainable transportation solutions and the growing shift towards clean energy.

EVs offer zero-emission benefits and are considered ideal for autonomous vehicle applications due to their reliance on electric power, which fits well with the Robo Taxi concept.

Hybrid Electric Vehicles (HEVs) also show substantial growth, though with a smaller share compared to pure EVs. The integration of both electric and gasoline engines offers extended range capabilities, making HEVs an attractive option for operators seeking a balance between environmental impact and cost-effectiveness.

Fuel Cell Vehicles (FCVs) are anticipated to continue as a niche player due to their ability to produce electricity from hydrogen, although their higher production and infrastructure costs limit widespread adoption in the Robo Taxi market.

By Application Analysis

Passenger segment dominates with 85.6% due to the growing demand for autonomous ride-hailing services.

In 2024, the Passenger segment held a dominant market position in the By Application Analysis segment of the US Robo Taxi Market, with a share of 85.6%. The surge in demand for autonomous ride-hailing services is a primary driver of this growth, as Robo Taxis offer a more cost-effective, convenient, and eco-friendly alternative to traditional taxi services. The ability to cater to an individual’s daily commute needs has fueled the growing preference for Robo Taxis in urban environments.

The Goods segment, while growing, is anticipated to hold a smaller share due to the focus on passenger transport. The primary use case for Robo Taxis in the goods segment would likely be for last-mile deliveries. However, the infrastructure and regulatory challenges surrounding the transportation of goods via autonomous vehicles limit the segment’s growth potential in the near term.

By Component Type Analysis

LiDAR dominates with 58.2% due to its critical role in precise environmental mapping.

In 2024, LiDAR held a dominant market position in the By Component Type Analysis segment of the US Robo Taxi Market, with a share of 58.2%.

LiDAR technology plays a vital role in autonomous driving systems, providing precise 3D mapping of the vehicle’s surroundings. This accuracy is essential for the safe operation of Robo Taxis, as it helps detect obstacles, pedestrians, and other vehicles in real-time.

Sensor technology is anticipated to maintain a strong position, though its share is projected to be lower than LiDAR. Sensors such as radar and cameras complement LiDAR by offering additional data points for detecting objects in various environmental conditions.

Radar technology excels in adverse weather situations, such as fog and rain, while cameras provide visual cues for object recognition and classification. Despite their importance, neither sensors nor cameras are expected to surpass LiDAR in terms of overall market share.

By Level of Autonomy Analysis

Level 4 dominates with 72.4% due to its high degree of automation and regulatory approval.

In 2024, Level 4 autonomy held a dominant market position in the By Level of Autonomy Analysis segment of the US Robo Taxi Market, with a share of 72.4%. Level 4 Robo Taxis are capable of operating autonomously within specific geofenced areas, offering a high degree of automation and reduced need for human intervention. This level of autonomy has already gained regulatory approval in several regions, allowing for wider deployment in urban environments.

Level 5 autonomy, which represents full self-driving capabilities without any human oversight, is projected to continue growing, but it faces technological, regulatory, and safety challenges.

While Level 5 offers greater flexibility, its widespread adoption is hindered by the need for extensive testing and the slow pace of regulatory approval. As a result, Level 4 is expected to remain the dominant technology for Robo Taxis in the near future.

Key Market Segments

By Propulsion Type

- Electric Vehicles

- Hybrid Electric Vehicles

- Fuel Cell Vehicle

By Application

- Passenger

- Goods

By Component Type

- LiDAR

- Sensor

- Camera

- Radar

By Level of Autonomy

- Level 4

- Level 5

By Service Type

- Car Rental

- Station-based

By Vehicle Type

- Cars

- Shuttles/Vans

Drivers

Advancements in Autonomous Driving Technology Drive Market Growth

In the US, continuous advancements in autonomous driving technology are fueling the growth of the robo taxi market. Companies are heavily investing in AI-powered navigation systems, LIDAR sensors, and real-time data processing tools to enhance the accuracy and safety of driverless vehicles. These innovations help robo taxis operate efficiently even in complex urban environments.

At the same time, there is rising consumer interest in sustainable and eco-friendly transportation options. Robo taxis, especially those running on electric platforms, are being viewed as viable alternatives to traditional vehicles. This shift is largely driven by growing environmental awareness and the need to reduce carbon emissions in metropolitan areas.

Government support plays a key role in accelerating the market. Initiatives such as federal grants, state-level pilot programs, and easing of regulatory barriers are encouraging companies to scale up testing and deployment of autonomous fleets. This favorable policy environment is vital to market expansion.

Additionally, the expansion of smart city infrastructure across major US cities supports robo taxi integration. Developments in IoT-enabled traffic management, dedicated AV lanes, and urban mobility hubs are making cities more compatible with autonomous transportation systems, paving the way for long-term growth in this sector.

Restraints

High Initial Investment and Operational Costs Limit Market Growth

The robo taxi industry in the US faces significant financial hurdles due to the high cost of development, testing, and deployment of autonomous vehicle technology. Building a single Level 4 or 5 autonomous vehicle requires substantial investment in hardware, software, and safety validation, making scalability a challenge for new entrants.

Moreover, regulatory and legal complexities add uncertainty to the market. Each state has its own set of rules regarding autonomous vehicles, and the lack of federal standardization often delays large-scale rollouts. Companies must navigate these diverse frameworks, which increases compliance costs.

Public perception also remains a major restraint. Concerns over safety, including recent accidents involving autonomous vehicles, have led to public hesitation in adopting robo taxi services. Until these systems gain higher trust, widespread consumer adoption may remain limited.

Lastly, the infrastructure needed to support autonomous fleets—such as 5G connectivity, smart traffic systems, and vehicle charging stations—is not yet fully available across the country. This limited infrastructure slows down the progress of robo taxi operations, especially outside major urban areas.

Growth Factors

Integration of AI and Machine Learning Creates Market Opportunities

The integration of AI and machine learning is unlocking new growth avenues in the US robo taxi market. Advanced algorithms enable better decision-making, predictive maintenance, and real-time route optimization, which enhances both passenger safety and service efficiency. This is driving investor interest and accelerating adoption.

Strategic partnerships between tech companies and automotive giants are further strengthening the market. Collaborations allow for resource sharing, joint development of AV platforms, and faster commercialization. These alliances also help overcome R\&D challenges and speed up pilot testing in controlled environments.

Urban areas with high traffic congestion offer a significant opportunity for robo taxis. Cities like New York, San Francisco, and Los Angeles are ideal for autonomous vehicle deployment, where robo taxis can ease traffic burdens and offer an alternative to traditional ride-hailing.

Additionally, the development of vehicle-to-infrastructure (V2I) systems is a game-changer. These technologies allow robo taxis to communicate with traffic lights, road signs, and city sensors in real time, improving safety and reducing delays. Cities investing in smart mobility infrastructure are creating the perfect ecosystem for robo taxi operations to thrive.

Emerging Trends

Rise of Mobility-as-a-Service (MaaS) Platforms Influences Market Trends

Mobility-as-a-Service (MaaS) is becoming a major trend influencing the US robo taxi market. These platforms integrate various modes of transportation—including robo taxis—into a single digital service, allowing users to plan and pay for travel seamlessly. This trend supports a shift away from car ownership toward shared, autonomous travel.

At the same time, there is an increasing focus on electric robo taxis as part of broader clean energy goals. Electric autonomous vehicles reduce greenhouse gas emissions and align with government sustainability targets. Major players are actively investing in all-electric fleets to meet future mobility demands.

5G technology adoption is also playing a pivotal role in shaping the future of robo taxis. With ultra-low latency and high-speed connectivity, 5G enables real-time communication between vehicles and infrastructure, which is critical for safe and smooth autonomous driving.

Lastly, there is a growing emphasis on improving the safety and reliability of autonomous systems. Developers are focusing on redundancy protocols, fail-safe mechanisms, and extensive testing to earn public trust and regulatory approval. As safety improves, acceptance and usage of robo taxis are expected to increase.

Key US Robo Taxi Company Insights

In 2024, Tesla Inc. remains a dominant player in the U.S. Robo Taxi market with its highly advanced autonomous driving systems, aiming to integrate fully self-driving capabilities into its fleet of vehicles. The company’s strong brand recognition and vast infrastructure for electric vehicles provide a competitive edge in the market.

Nuro, focusing on last-mile autonomous delivery, continues to push boundaries in the robo-taxi segment by developing small, self-driving vehicles designed for local deliveries. Its emphasis on efficiency in urban transportation has positioned it as a key player in reshaping the landscape of autonomous mobility.

Zoox, Inc., acquired by Amazon, focuses on creating fully integrated, purpose-built autonomous vehicles for ride-hailing. Its innovative approach to vehicle design, including bidirectional capabilities, ensures a strong foothold in the growing robo-taxi sector, meeting the increasing demand for sustainable urban transportation.

Gatik specializes in autonomous middle-mile transportation. By optimizing short, fixed-route deliveries with autonomous vehicles, Gatik supports the logistics industry’s shift toward automation, showcasing how this model can contribute to reducing costs and increasing reliability in the broader robo-taxi market.

Top Key Players in the Market

- Tesla Inc.

- Nuro

- Zoox, Inc.

- Gatik

- Aurora Operations, Inc.

- Aptiv

- Waymo LLC

- Cruise LLC

- Uber Technologies Inc.

- Lyft, Inc.

Recent Developments

- In June 2025, Tesla’s public robotaxi rides are set to begin on a tentative date of June 22, marking a major milestone in the company’s autonomous vehicle initiative, as announced by Elon Musk.

- In March 2025, Uber committed $100 million in investment to WeRide, aiming to expand its robotaxi fleet and strengthen its position in the growing autonomous taxi market.

Report Scope

Report Features Description Market Value (2024) USD 0.48 Billion Forecast Revenue (2034) USD 127.8 Billion CAGR (2025-2034) 74.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type (Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Vehicle), By Application (Passenger, Goods), By Component Type (LiDAR, Sensor, Camera, Radar), By Level of Autonomy (Level 4, Level 5), By Service Type (Car Rental, Station-based), By Vehicle Type (Cars, Shuttles/Vans) Competitive Landscape Tesla Inc., Nuro, Zoox, Inc., Gatik, Aurora Operations, Inc., Aptiv, Waymo LLC, Cruise LLC, Uber Technologies Inc., Lyft, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tesla Inc.

- Nuro

- Zoox, Inc.

- Gatik

- Aurora Operations, Inc.

- Aptiv

- Waymo LLC

- Cruise LLC

- Uber Technologies Inc.

- Lyft, Inc.