US Prosthetics and Orthotics Market By Type, (Orthotics, (Spinal Orthotics, Upper Limb, Lower Limb), Prosthetics, (Upper Extremity, Lower Extremity, Modular Components, Liners, Sockets), By Technology, (Electric-powered, Conventional, Hybrid Orthopedic Prosthetics), By End Users (Hospitals, Rehabilitation Centre, Prosthetics Clinics, and Others), and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150582

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

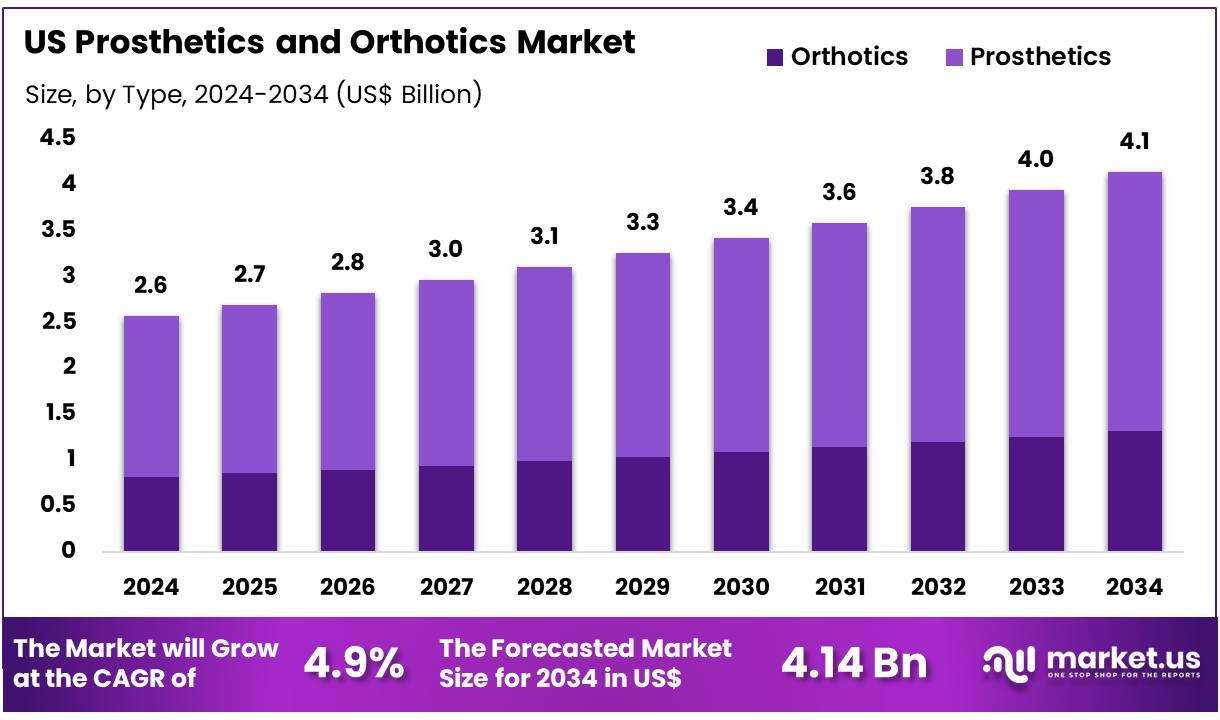

The US Prosthetics and Orthotics Market reach USD 2.57 Billion by 2024 And the market is anticipated to grow at a CAGR of 4.9% between 2024 and 2034, reaching USD 4.14 Billion by 2034.

The market is divided mainly into two segments orthotics and prosthetics. Orthotics accounted for the larger share in 2024, making up more than 68.3% of the market, as these devices are commonly used to support or correct musculoskeletal issues. Prosthetics, which include limb replacement devices, are the faster-growing segment due to technological innovations such as myoelectric limbs and 3D printing.

Key factors driving market growth include the increasing number of elderly people, higher incidences of chronic conditions like diabetes and vascular diseases that lead to amputations, and continuous advancements in prosthetic and orthotic technology that improve functionality and comfort.

However, the market faces challenges including the high costs of advanced devices, which may limit affordability despite insurance coverage, and disparities in access to care across different regions. Overall, the U.S. prosthetics and orthotics market is expected to expand as new technologies emerge and demand increases, but addressing affordability and accessibility will be critical for further growth.

The growing demand for advanced prosthetics and orthotics is a major driver of the market, as healthcare systems place greater emphasis on rehabilitation and improving the quality of life for individuals with limb loss or mobility impairments. Prosthetic applications now go beyond conventional limb replacements to include innovative devices such as finger and partial hand prostheses, designed to address the specific needs of patients with specialized challenges.

Key Takeaways

- By Type, the market is segmented into Orthotics and Prosthetics. Orthotics held major market share of 68.30% which is attributed to the rising prevalence of musculoskeletal disorders and an aging population. Conditions such as arthritis, diabetic foot complications, and sports injuries are driving demand for orthotic devices that improve mobility and provide support.

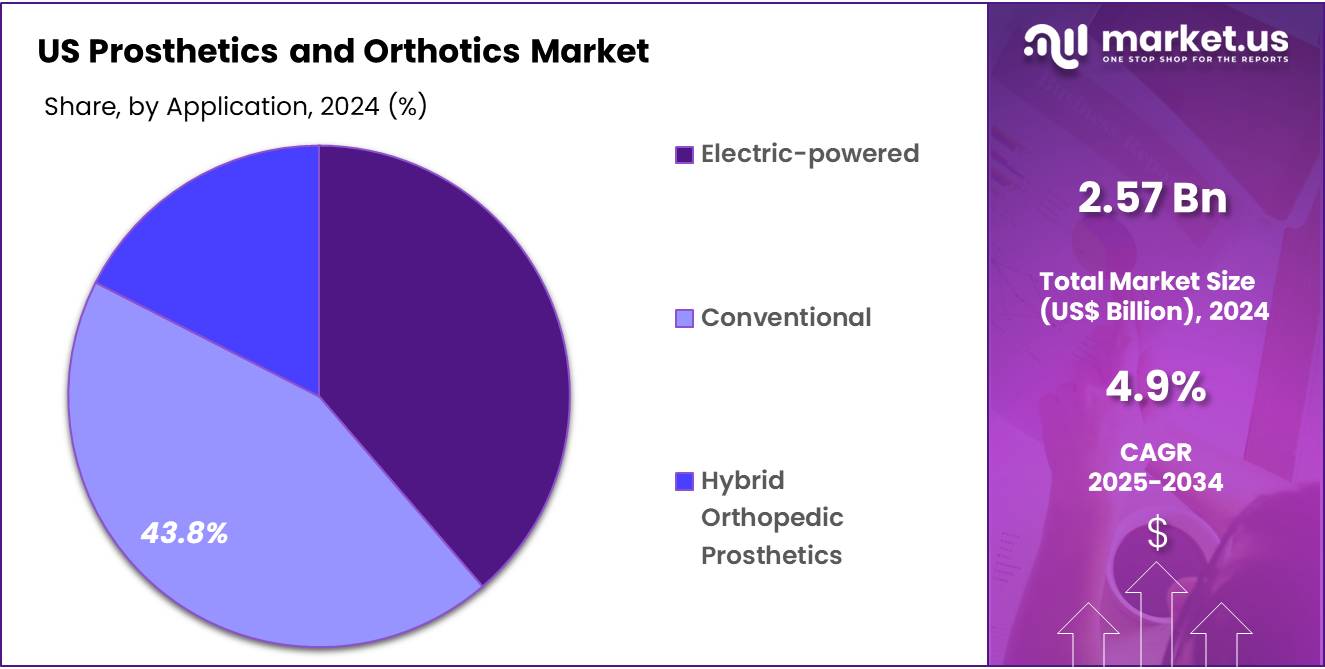

- By Technology, segment includes Electric-powered, Conventional and Hybrid Orthopedic Prosthetics. Conventional prosthetics with 43.8% market share continue to be widely preferred due to their affordability, durability, and ease of use, particularly in regions where access to advanced solutions may be limited.

- By End User, the market is divided into Hospitals, Rehabilitation Centre, Prosthetics Clinics and Others. Hospitals serve as the primary centres for prosthetic and orthotic care with 45.8% market share, offering comprehensive services including prosthetic fitting, post-operative care, and physical therapy. The increasing number of traumatic injuries, chronic diseases, and amputations has led to a higher demand for prosthetic and orthotic services in hospital settings.

Type Analysis

Orthotics accounted for the largest share of 68.3% in the U.S. prosthetics and orthotics market, driven primarily by the rising incidence of musculoskeletal disorders and an aging population susceptible to bone-related conditions. Orthotic devices such as braces, supports, and shoe inserts are increasingly used to correct posture, reduce pain, and improve mobility for individuals suffering from arthritis, scoliosis, diabetic foot ulcers, and injuries. The geriatric population, which often experiences degenerative joint diseases and reduced mobility, represents a core user base.

Additionally, increasing participation in sports has led to a surge in sports injuries, further fueling orthotic adoption. Unlike prosthetics, orthotics are not limited to amputees and cater to a broader demographic, making them more widely applicable. Hospitals, rehabilitation centers, and outpatient clinics prefer orthotics due to their non-invasive nature and relatively low cost. The prevalence of chronic conditions and efforts by insurers to reimburse orthotic treatments also contribute to this segment’s sustained dominance.

Technology Analysis

Conventional prosthetics lead the U.S. market in terms of technology type with 43.8% market share due to their widespread availability, cost-efficiency, and minimal maintenance requirements. These devices, typically body-powered or mechanically controlled, are favored by users who prioritize durability and basic functionality over advanced features. Conventional systems are particularly popular among elderly amputees and individuals in rural areas who may not have access to advanced electric-powered or hybrid devices.

Many patients also opt for these prosthetics due to insurance constraints or personal comfort with mechanical systems. Unlike electric-powered devices, conventional prosthetics do not rely on batteries or complex electronics, reducing the risk of malfunction and maintenance needs. In addition, training and adaptation are simpler, as these devices often mimic natural movements through harnesses or body motion.

As a result, they remain a go-to choice for first-time users and those recovering from lower-limb amputations. The affordability and reliability of conventional prosthetics contribute significantly to their market leadership.

End User Analysis

Hospitals dominated the U.S. prosthetics and orthotics market with 45.8% share, holding a majority share due to their central role in surgical interventions, post-operative rehabilitation, and long-term patient care. These institutions often serve as the first point of contact for patients requiring prosthetic or orthotic solutions, especially after traumatic injuries, diabetic complications, or congenital conditions.

Hospitals typically have in-house specialists including orthopedic surgeons, rehabilitation therapists, and prosthetists, enabling a coordinated approach to device fitting, therapy, and follow-up. In comparison to standalone clinics or rehabilitation centers, hospitals benefit from better infrastructure, access to advanced diagnostic tools, and higher patient footfall, which boosts their utilization rates.

Additionally, reimbursement from both private insurers and Medicare is often easier to navigate in hospital settings. As the rate of amputations related to diabetes and vascular diseases continues to rise in the U.S., hospitals are becoming even more integral to the continuum of care, reinforcing their dominant position in the market.

Key Market Segments

By Type

- Orthotics

- Spinal Orthotics

- Upper Limb

- Lower Limb

- Prosthetics

- Upper Extremity

- Lower Extremity

- Modular Components

- Liners

- Sockets

By Technology

- Electric-powered

- Conventional

- Hybrid Orthopedic Prosthetics

By End User

- Hospitals

- Rehabilitation Centre

- Prosthetics Clinics

- Others

Drivers

Rising Incidence of Diabetes and Vascular Diseases

A major driver for the U.S. prosthetics and orthotics market is the increasing prevalence of diabetes and peripheral vascular diseases, which are leading causes of limb amputations. According to the CDC, over 38 million Americans had diabetes in 2023, and diabetic foot complications often result in lower-limb amputations. As the disease burden grows, the demand for both prosthetic limbs and orthotic support systems is accelerating.

For example, lower-limb prosthetics are frequently used after below-the-knee amputations resulting from unhealed diabetic ulcers. Similarly, foot orthoses are prescribed to redistribute pressure and prevent further complications. This chronic condition, prevalent among aging and obese populations, has created a recurring need for prosthetic and orthotic devices. Healthcare providers, especially in rural and underserved areas, are increasingly integrating these services into standard diabetes management programs. This growing patient base is fueling consistent market demand and encouraging innovation in limb preservation and mobility restoration solutions.

According to WHO, In 2022, the prevalence of diabetes among adults aged 18 and older rose to 14%, doubling from 7% in 1990. Notably, 59% of individuals aged 30 and above living with diabetes were not receiving any form of medication to manage their condition. Treatment access remained especially limited in low- and middle-income nations. In 2021, diabetes was identified as the primary cause of 1.6 million deaths, with nearly 47% of those fatalities occurring in individuals under the age of 70.

Additionally, diabetes was responsible for approximately 530,000 deaths from kidney disease and contributed to nearly 11% of all cardiovascular-related deaths due to elevated blood glucose levels. Since the year 2000, mortality associated with diabetes has been on the rise. However, in contrast, global efforts to combat major noncommunicable diseases namely cardiovascular disease, cancer, chronic respiratory illness, and diabetes have led to a 20% decline in the likelihood of dying from any of these conditions between the ages of 30 and 70 from 2000 to 2019.

Moreover, according to the CDC, heart disease remains the foremost cause of death among men, women, and individuals across most racial and ethnic backgrounds in the United States. On average, one person dies from cardiovascular disease every 33 seconds. In 2022 alone, heart disease was responsible for 702,880 deaths, accounting for approximately 1 in every 5 deaths nationwide. Beyond the human toll, the economic burden is substantial between 2019 and 2020, heart disease incurred costs of around US$ 252.2 billion. This figure encompasses healthcare expenses, prescription medications, and productivity losses associated with premature mortality.

Restraints

High Cost of Advanced Prosthetic Devices

One of the major restraints in the U.S. market is the high cost associated with advanced prosthetic devices, particularly myoelectric and computer-controlled limbs. These prosthetics can range from US$20,000 to over US$100,000, depending on the technology and customization required. While insurance coverage exists, it often does not fully reimburse patients, especially for technologically sophisticated models or replacements after wear and tear.

For instance, the LUKE Arm (developed by Mobius Bionics) offers advanced motion and sensory feedback but remains unaffordable for many veterans and civilians alike without substantial financial support. This cost barrier restricts access, especially for individuals without comprehensive insurance plans. Moreover, the cost of repairs, maintenance, and upgrades further compounds financial burden.

Many patients end up settling for less advanced, mechanical prosthetics due to affordability. Consequently, this cost disparity hampers equitable access and limits the overall adoption of next-generation prosthetics, particularly in lower-income or uninsured populations.

Opportunities

Integration of 3D Printing in Prosthetic Manufacturing

The growing adoption of 3D printing in the fabrication of prosthetics and orthotics presents a transformative opportunity for the U.S. market. This technology allows for cost-effective, highly customized solutions that can be manufactured quickly and tailored to the exact anatomical specifications of the user. Companies like Unlimited Tomorrow are leveraging 3D scanning and printing to produce low-cost bionic arms, such as the TrueLimb, for under US$10,000, compared to traditional devices costing triple that amount.

For children who rapidly outgrow prosthetics, 3D printing offers a scalable, economical solution. Additionally, hospitals and rehabilitation centers are investing in in-house 3D printing labs to reduce delivery times and improve accessibility. This shift not only enhances affordability but also shortens the design-to-deployment cycle.

As technology evolves, materials like carbon fiber composites and thermoplastics are improving the strength and comfort of 3D-printed devices, opening new frontiers in mass customization and democratized prosthetic care. Gaza currently holds the highest per capita number of child amputees globally, with over 23,000 children having suffered conflict-related injuries. Thousands of these children now face lifelong disabilities and are in urgent need of sustained rehabilitation and mobility support.

In May 2025, a new initiative, backed by over US$250,000 in funding through a collaboration between UNICEF Aotearoa and the Federation of Islamic Associations of New Zealand (FIANZ), has enabled the launch of a pilot project. This includes plans for a prosthetic production facility in Jordan that will use advanced 3D printing technology to create much-needed artificial limbs.

UNICEF is coordinating with top global prosthetics manufacturers and local hospital and physiotherapy teams to provide comprehensive support for each child, tailored to their specific medical and rehabilitation needs. Despite severe challenges at the Gaza border and disruptions from renewed airstrikes, UNICEF aims to deliver care through partnerships with regional hospitals and rehabilitation centers, ensuring continued access to essential services for affected children.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a growing influence on the U.S. prosthetics and orthotics market, particularly through shifts in healthcare funding, global supply chains, and insurance policies. Economic slowdowns or inflationary pressures increase the cost of raw materials like carbon fiber, silicone, and titanium key components in advanced prosthetic limbs thereby raising production and retail costs. For instance, post-pandemic inflation led to higher manufacturing and logistics expenses, impacting pricing and accessibility for end-users.

Geopolitically, U.S.-China trade tensions and tariff impositions on imported medical devices or components have disrupted supply chains, compelling U.S. manufacturers to seek domestic or alternative sourcing options. This realignment may strain production cycles but also creates opportunities for localized manufacturing innovations, such as 3D printing and smart material development. Moreover, shifts in U.S. healthcare policy, particularly under the Affordable Care Act or changes to Medicare and VA reimbursements, directly affect patient access to prosthetic and orthotic care.

Military conflicts and veterans returning from overseas deployments have historically increased demand for prosthetic services, pushing forward innovation in limb restoration and rehabilitation. Simultaneously, immigration policy and skilled labor shortages may impact clinical staffing for orthotists and prosthetists, especially in rural areas. Collectively, these macroeconomic and geopolitical variables are reshaping investment, delivery, and innovation strategies within the sector.

Latest Trends

AI and Sensor Integration in Smart Prosthetics

The integration of artificial intelligence (AI) and smart sensors into prosthetics is an emerging trend transforming user experience and functional outcomes. Smart prosthetics can adapt in real time to a user’s movements and environment using embedded sensors and machine learning algorithms. For example, the Ottobock C-Leg 4 uses microprocessors to analyze walking patterns and adjust knee resistance accordingly, improving gait stability and reducing falls.

Another example is the Empower Ankle by Össur, which simulates muscle activity and provides powered push-off during walking. These intelligent systems offer enhanced mobility and energy efficiency, especially for above-knee amputees. Furthermore, cloud connectivity allows real-time data collection and remote device monitoring, enabling clinicians to fine-tune settings without requiring frequent in-person visits.

While still relatively expensive, growing investments in AI-driven prosthetics signal a shift toward more personalized, responsive, and data-informed mobility solutions. This trend is expected to gain further traction with advancements in wearable tech and neural interfacing. In July 2024, In a study involving seven patients, MIT researchers discovered that individuals who underwent this innovative surgical procedure were able to walk faster, navigate obstacles more effectively, and climb stairs more naturally compared to those with conventional amputations.

Developed in partnership with Brigham and Women’s Hospital, the approach combines a novel surgical technique with a neuroprosthetic interface, enabling prosthetic legs to be controlled directly by the body’s nervous system. The procedure involves reconnecting muscles in the residual limb, allowing patients to regain “proprioceptive” feedback awareness of their prosthetic limb’s position and movement in space—resulting in a more natural and responsive gait.

Key Players Analysis

Leading companies in the market are Össur, Ottobock, Hanger Clinic (Hanger Inc.), College Park Industries, Proteor USA, Advanced Arm Dynamics, Blatchford, Freedom Innovations, Zimmer Biomet, Fillauer, Mobius Bionics, Ohio Willow Wood, Esper Bionics, Comprehensive Prosthetics & Orthotics, Rebound Orthotics & Prosthetics, Advanced Prosthetics and Orthotics, LLC, Northwest Orthotics & Prosthetics, Human Designs, Master’s Orthotics and Prosthetics LLC, Prosthetic & Orthotic Solutions LLC, and Others.

Össur, headquartered in Iceland, is a global leader in non-invasive orthopedics, known for its cutting-edge innovations in prosthetic limbs and orthotic solutions. In the U.S., the company holds a strong market presence through its advanced prosthetic technologies such as the Rheo Knee, Proprio Foot, and Empower Ankle, which utilize artificial intelligence and sensor-based systems for dynamic user adaptability. Össur also offers a range of orthotic braces addressing spinal, osteoarthritis, and injury-related conditions.

Ottobock, based in Germany, is another dominant force in the prosthetics and orthotics sector with a well-established footprint in the United States. Known for innovations like the C-Leg, Genium, and Myoelectric upper-limb solutions, Ottobock specializes in microprocessor-controlled prosthetics that enhance gait control, mobility, and user safety.

Hanger Clinic, a division of Hanger Inc., is the largest provider of prosthetic and orthotic patient care services in the U.S., operating over 800 clinics nationwide. Unlike device manufacturers, Hanger Clinic focuses on delivering customized care, fittings, and follow-up rehabilitation. It partners with leading prosthetic brands like Össur and Ottobock to offer state-of-the-art devices tailored to individual patient needs.

Top Key Players

- Össur

- Ottobock

- Hanger Clinic (Hanger Inc.)

- College Park Industries

- Proteor USA

- Advanced Arm Dynamics

- Blatchford

- Freedom Innovations

- Zimmer Biomet

- Fillauer

- Mobius Bionics

- Ohio Willow Wood

- Esper Bionics

- Comprehensive Prosthetics & Orthotics

- Rebound Orthotics & Prosthetics

- Advanced Prosthetics and Orthotics, LLC

- Northwest Orthotics & Prosthetics

- Human Designs

- Master’s Orthotics and Prosthetics LLC

- Prosthetic & Orthotic Solutions LLC

- Others

Recent Developments

- In April 2025, Phantom Neuro, a neurotechnology company focused on advancing human-machine interface solutions, announced the successful closure of an oversubscribed Series A funding round worth $19 million. The round was led by Ottobock, a global leader in prosthetics, orthotics, and exoskeleton technology. Existing backers such as Breakout Ventures, Draper Associates, LionBird Ventures, Time BioVentures, and Risk and Return reaffirmed their support, while new investors including Actual VC, METIS Innovative, e1 Ventures, Jumpspace, MainSheet Ventures, and Brown Advisory also joined the round.

- In July 2024, Medicare officially announced updates to its Local Coverage Determinations (LCDs), expanding access to microprocessor-controlled knees (MPKs) for individuals with lower mobility levels an often underrepresented group in access to advanced prosthetic solutions. These changes mark a pivotal shift in policy, enabling broader inclusion of patients who stand to benefit significantly from MPK technology. Ottobock, the world’s largest manufacturer of prosthetics and orthotics, has played a leading role in driving this change through more than 20 years of dedicated research and policy advocacy. The company remains committed to advancing equitable access to innovative prosthetic technologies for underserved populations.

- In April 2024, WillowWood, a prominent designer, manufacturer, and distributor of prosthetic solutions, announced a strategic partnership with Click Medical to introduce user-adjustable sockets to the prosthetics market. This collaboration integrates Click Medical’s proprietary RevoFit® Kit system featuring the Click® Reel, enabling enhanced fit customization and comfort for prosthetic users across the industry.

- In July 2023, WillowWood unveiled the Fiberglass META Shock X, the latest addition to its revolutionary META feet lineup. Designed to deliver exceptional energy return, balance, stability, and shock absorption, the META Shock X advances performance for prosthetic users. All META feet are built on the industry’s first unibody platform—completely free of hardware—resulting in a lightweight yet highly durable design that prioritizes both function and comfort.

Report Scope

Report Features Description Market Value (2024) US$ 2.57 Billion Forecast Revenue (2034) US$ 4.14 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type, (Orthotics, (Spinal Orthotics, Upper Limb, Lower Limb), Prosthetics, (Upper Extremity, Lower Extremity, Modular Components, Liners, Sockets), By Technology, (Electric-powered, Conventional, Hybrid Orthopedic Prosthetics), By End Users (Hospitals, Rehabilitation Centre, Prosthetics Clinics, and Others) Competitive Landscape Teladoc Health, Inc., Amwell, MDLive, Doctor on Demand, Lemonaid Health, HealthTap, American Well (Amwell), Babylon Health, 24/7 MedCare, Cureatr, SOC Telemed, One Medical, InTouch Health, Everlywell, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Prosthetics and Orthotics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

US Prosthetics and Orthotics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Össur

- Ottobock

- Hanger Clinic (Hanger Inc.)

- College Park Industries

- Proteor USA

- Advanced Arm Dynamics

- Blatchford

- Freedom Innovations

- Zimmer Biomet

- Fillauer

- Mobius Bionics

- Ohio Willow Wood

- Esper Bionics

- Comprehensive Prosthetics & Orthotics

- Rebound Orthotics & Prosthetics

- Advanced Prosthetics and Orthotics, LLC

- Northwest Orthotics & Prosthetics

- Human Designs

- Master's Orthotics and Prosthetics LLC

- Prosthetic & Orthotic Solutions LLC

- Others