Global Urinary Tract Infection Testing Market By Infection Type (Cystitis, Urethritis, Pyelonephritis) By Product Type (Laboratory based testing kits and platforms, Over-the-counter/Home test kits) By Test Type (Urinalysis, Urine culture, Susceptibility testing) By Patient Type (Children, Adults, Geriatric) By Gender (Women, Men) By End-User(Hospitals & Clinics, Diagnostic laboratories/Reference labs, Homecare Settings, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164771

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

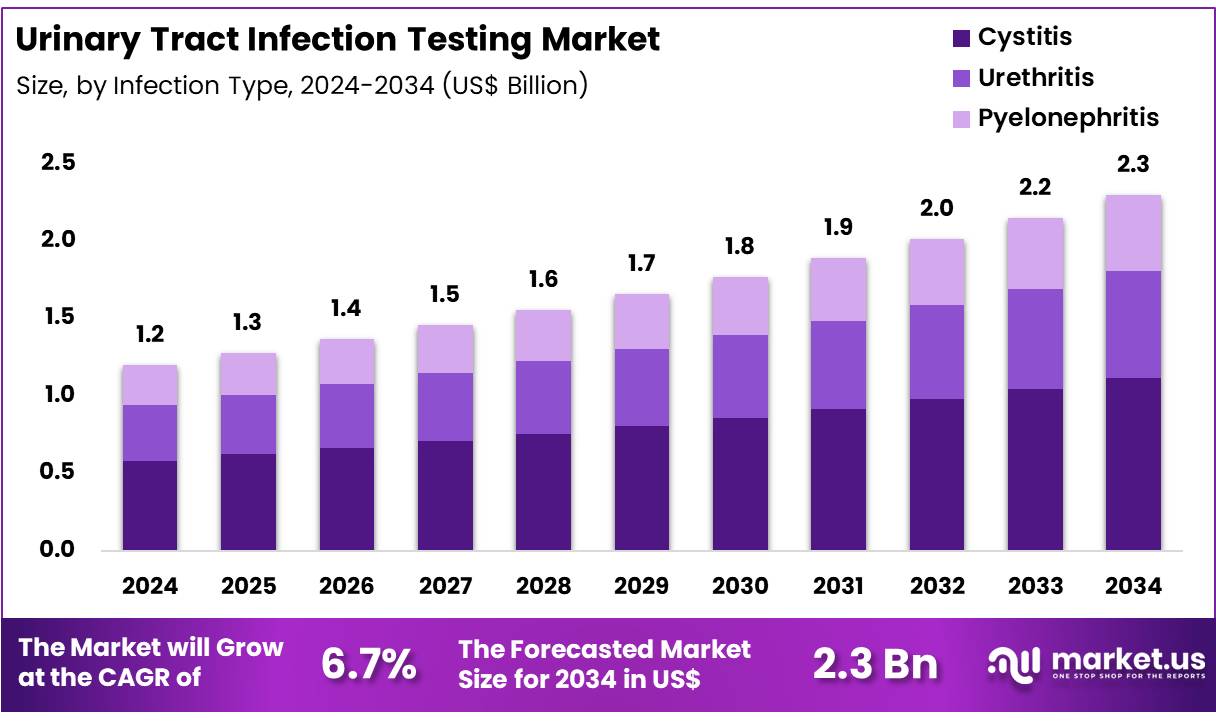

Global Urinary Tract Infection Testing Market size is expected to be worth around US$ 2.3 Billion by 2034 from US$ 1.2 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 35.2% share with a revenue of US$ 422.4 Million.

The demand for urinary tract infection testing is being sustained by the high and ongoing burden of disease, particularly among women. It is reported by public health authorities that nearly half of all women will experience a bladder infection at least once, and a significant number will face recurrent episodes. This persistent incidence ensures continuous testing requirements across primary care, urgent care, and pharmacy-based services.

Population aging is strengthening this trend. The proportion of inpiduals aged 60 years and above is rising globally, increasing exposure to age-related risk factors such as urinary incontinence, pelvic organ prolapse, and catheter use. These conditions elevate the likelihood of infections and lead to greater utilization of dipstick tests, microscopic examinations, urine cultures, and susceptibility assessments in both outpatient and hospital environments.

The expanding prevalence of comorbidities, particularly diabetes, is enlarging the testing pool. Diabetes rates have increased sharply worldwide, with the highest burden seen in many low and middle income regions. Inpiduals with diabetes face higher UTI risk due to compromised immunity and glycosuria. As these trends persist, routine evaluation of urinary symptoms and earlier diagnostic testing are being emphasized in clinical protocols, increasing demand for diagnostic consumables and laboratory capacity.

Antimicrobial resistance is emerging as a critical structural driver. WHO data show that approximately one in five E. coli UTIs exhibited reduced susceptibility to key antibiotics in 2020. Global surveillance in 2023 indicated that one in six confirmed bacterial infections was resistant to treatment, with gram-negative organisms posing rising threats. These patterns heighten the need for culture-based methods, rapid susceptibility testing, and follow-up diagnostics to support stewardship.

National health authorities are strengthening diagnostic stewardship programs, and evolving care delivery models, including pharmacy-led assessment pathways, are expanding access. These initiatives improve testing quality, reinforce appropriate use, and increase reliance on validated point-of-care and laboratory-based UTI diagnostics.

Key Takeaways

- Market Size: Global Urinary Tract Infection Testing Market size is expected to be worth around US$ 2.3 Billion by 2034 from US$ 1.2 Billion in 2024.

- Market Growth: The market growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

- Infection Type Analysis: Cystitis is estimated to account for 48.6% of the global market share in 2024.

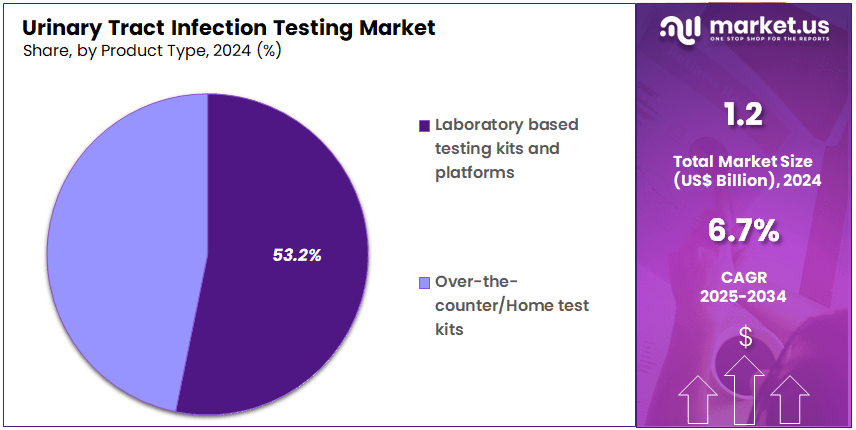

- Product Type Analysis: The Laboratory-based testing kits and platforms are expected to account for 53.2% of the market share in 2024

- Test Type Analysis: By test type Segment urinalysis is projected to hold 41.5% of the market share in 2024.

- Patient Type Analysis: The geriatric segment is observed to dominate the market, accounting for an estimated 43% share in 2024.

- Gender Analysis: Women are estimated to account for 75.2% of the global market share in 2024.

- End-Use Analysis: Hospitals and clinics have been observed to dominate the market, accounting for an estimated 36.4% share in 2024.

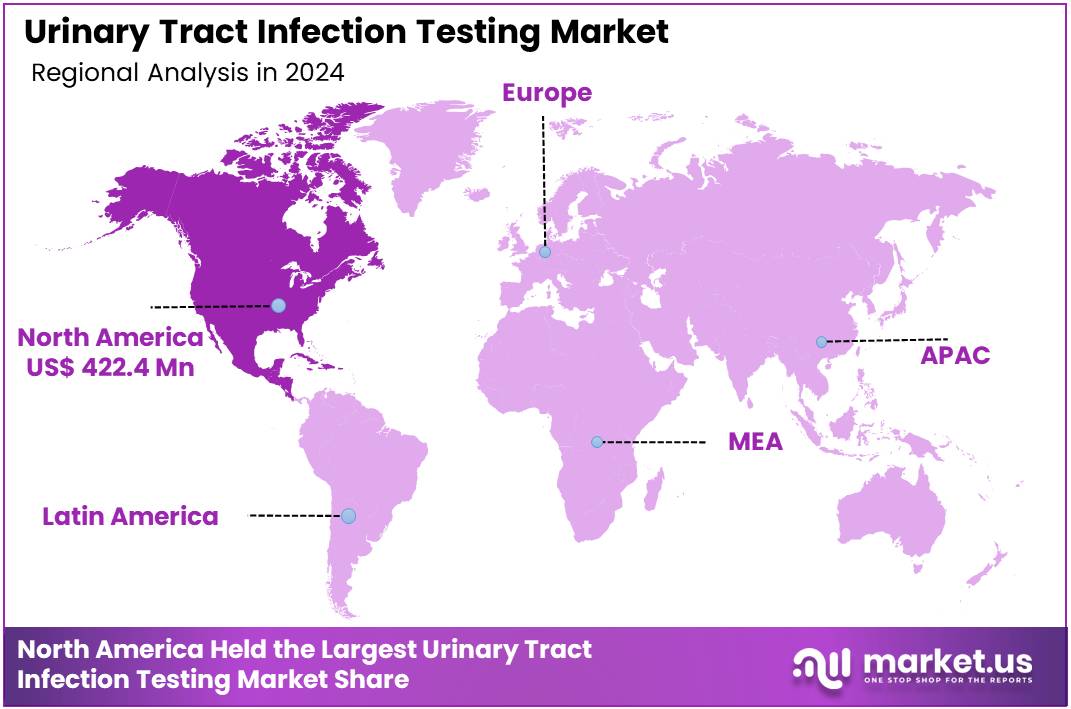

- Regional Analysis: In 2024, North America led the market, achieving over 35.2% share with a revenue of US$ 422.4 Million.

Infection Type Analysis

The market for urinary tract infection testing is segmented by infection type, and a clear dominance has been observed in cystitis-related testing. Cystitis is estimated to account for 48.6% of the global market share in 2024, and this position has been supported by its high prevalence among both women and older adults.

The growth of this segment has been attributed to rising incidence rates, increased diagnostic awareness, and the availability of rapid urine-based testing solutions. Cystitis testing is also frequently adopted in outpatient settings, which strengthens its overall contribution to market demand.

Testing for urethritis represents another significant segment. Its adoption is driven by concerns related to sexually transmitted infections and rising diagnostic recommendations among younger populations. The pyelonephritis segment is comparatively smaller; however, increased hospital admissions associated with complicated infections continue to support steady utilization. Together, these infection types define the broader clinical demand for UTI testing across care settings.

Product Type Analysis

The urinary tract infection testing market is categorized by product type, and laboratory-based testing kits and platforms are expected to account for 53.2% of the market share in 2024. This dominance has been supported by their higher diagnostic accuracy, broader testing capabilities, and widespread adoption across hospitals, diagnostic centers, and clinical laboratories.

The demand for culture-based methods and advanced analyzers has remained strong, as these systems provide comprehensive results essential for clinical decision-making. The growth of antibiotic resistance has further reinforced reliance on laboratory platforms for precise pathogen identification.

The over-the-counter and home test kit segment is expanding at a steady pace, supported by rising consumer preference for convenient and rapid self-testing. Increased awareness of recurrent infections among women and the growing availability of digital or app-connected home kits have contributed to this trend. Although smaller in scale, the segment is projected to experience sustained interest as point-of-care diagnostics advance.

Test Type Analysis

By test type Segment urinalysis is projected to hold 41.5% of the market share in 2024. This leading position has been driven by its role as the primary screening method in both clinical and home settings. The widespread use of dipsticks and automated urinalysis analyzers has supported consistent adoption, as these tools allow rapid detection of leukocytes, nitrites, and other infection indicators. The segment’s dominance can also be attributed to its low cost, ease of use, and suitability for high-volume testing across hospitals and diagnostic laboratories.

Urine culture represents the next major segment, used primarily for confirmatory diagnosis. Its demand has been sustained by the need to identify specific pathogens with high accuracy. Susceptibility testing is utilized to determine antimicrobial responsiveness, and its relevance has increased due to rising concerns over antibiotic resistance. Together, these test types form the core diagnostic workflow for UTI evaluation.

Patient Type Analysis

The patient type segment in the Urinary Tract Infection (UTI) testing market is structured around three primary groups: geriatric inpiduals, adults, and children. The geriatric segment is observed to dominate the market, accounting for an estimated 43% share in 2024. This dominance has been attributed to higher susceptibility among older adults due to weakened immune function, increased prevalence of chronic diseases, and greater dependency on long-term care facilities where infection risk is elevated. Testing demand in this group has remained consistently strong, supported by frequent clinical evaluations and routine diagnostic screenings.

The adult segment represents the second significant category, driven by rising UTI incidence among women, increased outpatient visits, and broader awareness of early diagnosis. The pediatric segment accounts for a comparatively smaller share, although testing needs persist due to congenital abnormalities and recurrent infections in young patients. Overall, each patient group contributes to sustained market growth through distinct clinical drivers.

Gender Analysis

The gender segmentation of the Urinary Tract Infection (UTI) Testing Market has been shaped primarily by the higher clinical incidence observed among women. Women are estimated to account for 75.2% of the global market share in 2024, and this dominance has been attributed to anatomical and physiological factors that increase susceptibility to UTIs.

Recurrent infections, rising awareness regarding early diagnosis, and the expanding use of point-of-care testing have further intensified demand within this segment. The market growth has also been reinforced by increased screening in primary care settings and broader adoption of rapid diagnostic tools.

The men segment represents a smaller share of the market, driven mainly by age-related urinary complications, prostate-associated infections, and the gradual rise in chronic disease prevalence. Although the incidence rate in men is lower, steady growth has been observed as diagnostic technologies become more accessible and as awareness of UTI symptoms improves in male populations.

End-user Analysis

The end-user landscape for urinary tract infection testing has been shaped by the high reliance on clinical settings for accurate and rapid diagnostics. Hospitals and clinics have been observed to dominate the market, accounting for an estimated 36.4% share in 2024. This dominance can be attributed to the high patient inflow, greater availability of advanced diagnostic infrastructure, and the increased adoption of automated urine analyzers that support faster clinical decision-making.

Diagnostic laboratories and reference laboratories are also noted as significant end users, as large volumes of culture tests and urinalysis procedures are processed in these facilities due to their specialized capabilities. Homecare settings have recorded steady growth, driven by the rising demand for self-testing kits and increasing awareness of early infection detection.

The “Others” category, comprising urgent care centers, long-term care facilities, and ambulatory settings, continues to contribute to overall market expansion due to broader testing accessibility.

Key Market Segments

By Infection Type

- Cystitis

- Urethritis

- Pyelonephritis

By Product Type

- Laboratory based testing kits and platforms

- Over-the-counter/Home test kits

By Test Type

- Urinalysis

- Urine culture

- Susceptibility testing

By Patient Type

- Children

- Adults

- Geriatric

By Gender

- Women

- Men

By End-User

- Hospitals & Clinics

- Diagnostic laboratories/Reference labs

- Homecare Settings

- Others

Driving Factors

Demand growth is propelled by rising UTI incidence in aging populations and broader screening in primary care. Adoption of rapid point-of-care tests has reduced turnaround times and improved antibiotic stewardship, reinforcing physician preference. Reimbursement clarity in developed markets is strengthening unit economics, while hospital-acquired infection initiatives sustain baseline volumes.

Trending Factors

Market evolution is being shaped by decentralization. CLIA-waived lateral flow assays and compact analyzers are expanding use in urgent care, retail clinics, and homes. Integration with electronic health records and telehealth enables remote test-to-treat workflows. Multiplex molecular panels are moving downstream, improving sensitivity for recurrent infections and supporting algorithmic decision support.

Restraining Factors

Growth is being constrained by variable test accuracy and inconsistent sample collection that drive false negatives or contamination. Price pressure from commoditized dipsticks persists, limiting premium adoption in cost-sensitive markets. Reimbursement uncertainty in emerging economies and fragmented procurement dampen uptake. Stewardship programs can reduce testing by enforcing stricter pretest probability thresholds.

Opportunity

Expansion potential is created by home-based specimen collection and mail-in molecular models that address access barriers. Partnerships between diagnostics firms and pharmacy chains can enable same-visit diagnosis and dispensing. Data aggregation across platforms can support epidemiological surveillance and payer value evidence, unlocking outcomes-based contracts.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 35.2% share and holds US$ 422.4 Million market value for the year. The strong position of North America in the urinary tract infection (UTI) testing market can be attributed to several structural factors. The region benefits from advanced healthcare systems where diagnostic testing is widely accessible. High clinical awareness has supported early detection. This has resulted in consistent testing volumes across hospitals, clinics, and diagnostic centers.

A high prevalence of UTIs among women and older adults has also contributed to increased testing demand. According to public health sources, UTIs remain one of the most common bacterial infections in the region. This pattern has led to steady adoption of urinalysis, urine culture, and rapid point of care tests.

Continuous investment in laboratory automation has strengthened regional capacity. The presence of established diagnostic manufacturers has supported the availability of reliable test kits and instruments. Innovation in rapid diagnostic technologies has further reinforced growth. These innovations have improved turnaround time and enhanced clinical decision making.

Reimbursement frameworks have remained supportive. This has encouraged both patients and providers to adopt standardized testing protocols. The strong insurance coverage landscape has ensured predictable test volumes across care settings.

The high focus on antimicrobial stewardship programs has also increased reliance on accurate diagnostic testing. Such programs have emphasized the need for precise identification of causative pathogens to reduce inappropriate antibiotic use.

Overall, demand in North America is expected to remain stable. Sustained investments in diagnostic infrastructure and continued awareness of UTI complications are likely to support ongoing market expansion in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the urinary tract infection testing market is characterized by the presence of established diagnostic manufacturers along with emerging innovators specializing in rapid and point-of-care technologies. Competition has been shaped by continuous investment in assay accuracy, reduced turnaround time, and integration of automated analyzers.

The market has been influenced by rising adoption of molecular platforms, which has strengthened the position of firms with advanced R&D capabilities. Growth has also been supported by expanded product portfolios covering dipstick tests, culture media, and nucleic acid amplification formats.

Strategic activities, including portfolio persification, regulatory approvals, and global distribution expansion, have been observed as key approaches used to secure higher market penetration. Increased focus on antimicrobial resistance detection is expected to enhance competitive differentiation over the forecast period.

Market Key Players

- bioMérieux SA

- Thermo Fisher Scientific Inc.

- Healthy.io

- QIAGEN

- Accelerate Diagnostics, Inc.

- ACON Laboratories

- F. Hoffmann-La Roche Ltd.

- Danaher

- Siemens Healthcare GmbH

- Bio-Rad Laboratories, Inc.

- T2 Biosystems, Inc.

- Randox Laboratories Ltd.

- Sysmex Corporation

- BioGX, Inc.

- BIOTIA Inc.

- Germaine Laboratories, Inc.

- Abbott Laboratories

Recent Developments

- BioMérieux SA (January 2025): bioMérieux announced the acquisition of SpinChip Diagnostics ASA, a Norwegian diagnostics firm with an immunoassay-platform. The acquisition is aimed at strengthening their point-of-care immunoassay diagnostics, which could support UTI-testing workflows.

- Thermo Fisher Scientific Inc. (June 2025): The company is reported to plan the sale of its diagnostics unit (including its microbiology/ infectious-disease testing business) for about US$ 4 billion, which may impact its UTI-diagnostics segment and strategic alignment.

- QIAGEN N.V.(September 2025): QIAGEN secured U.S. FDA clearance for its higher-throughput “QIAstat-Dx Rise” automated syndromic testing system, which supports infectious-disease diagnostics (while not UTI-specific, expands infrastructure relevant for UTI panels).

- Siemens Healthcare GmbH (December 2023): Siemens launched the “Atellica® UAS 60 Analyzer,” a compact urine-sediment analyzer using full field-of-view digital imaging; although broader than only UTI, this instrument strengthens automated urinalysis, relevant for UTI detection workflows.

Report Scope

Report Features Description Market Value (2024) US$ 1.2 Billion Forecast Revenue (2034) US$ 2.3 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Infection Type (Cystitis, Urethritis, Pyelonephritis) By Product Type (Laboratory based testing kits and platforms, Over-the-counter/Home test kits) By Test Type (Urinalysis, Urine culture, Susceptibility testing) By Patient Type (Children, Adults, Geriatric) By Gender (Women, Men) By End-User(Hospitals & Clinics, Diagnostic laboratories/Reference labs, Homecare Settings, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape bioMérieux SA, Thermo Fisher Scientific Inc., Healthy.io, QIAGEN, Accelerate Diagnostics, Inc., ACON Laboratories, F. Hoffmann-La Roche Ltd., Danaher, Siemens Healthcare GmbH, Bio-Rad Laboratories, Inc., T2 Biosystems, Inc., Randox Laboratories Ltd., Sysmex Corporation, BioGX, Inc., BIOTIA Inc., Germaine Laboratories, Inc., Abbott Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Urinary Tract Infection Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Urinary Tract Infection Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- bioMérieux SA

- Thermo Fisher Scientific Inc.

- Healthy.io

- QIAGEN

- Accelerate Diagnostics, Inc.

- ACON Laboratories

- F. Hoffmann-La Roche Ltd.

- Danaher

- Siemens Healthcare GmbH

- Bio-Rad Laboratories, Inc.

- T2 Biosystems, Inc.

- Randox Laboratories Ltd.

- Sysmex Corporation

- BioGX, Inc.

- BIOTIA Inc.

- Germaine Laboratories, Inc.

- Abbott Laboratories