Global Ultra-low-power Microcontroller Market By Peripheral Device (Analog Devices, Digital Devices), By Packaging Type (8-bit Packaging, 16-bit Packaging, 32-bit Packaging), By End-Use Industry (Consumer Electronics, Manufacturing, Automotive, Healthcare, Telecommunications, Aerospace & Defense), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 73332

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

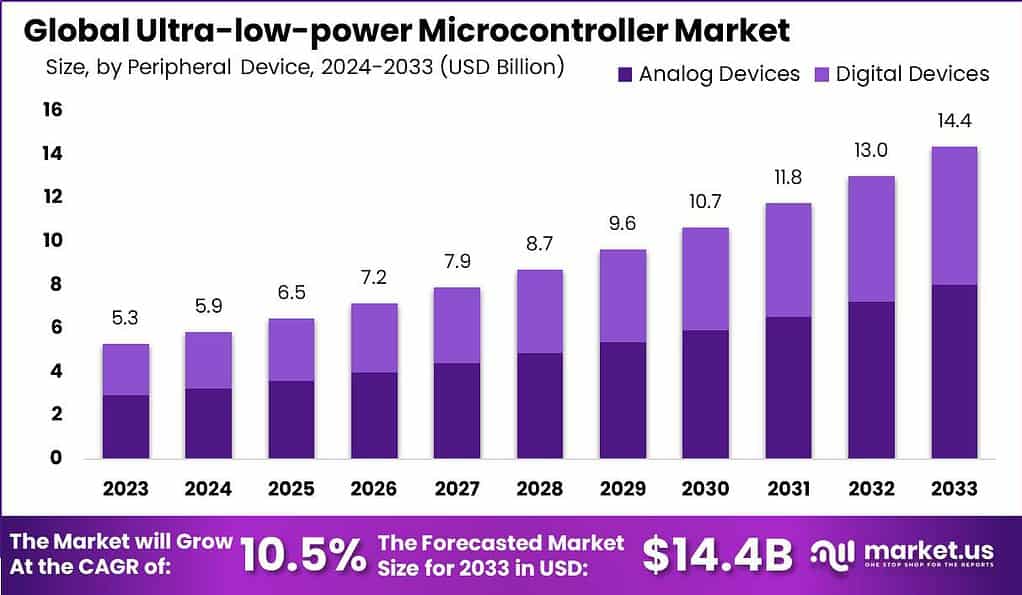

The Global Ultra-low-power Microcontroller Market size is expected to be worth around USD 14.4 Billion by 2033, from USD 5.3 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

An ultra low power microcontroller is a type of microcontroller that is specifically designed to operate with minimal power consumption. These microcontrollers are optimized for applications where power efficiency is a critical factor, such as battery-powered devices, Internet of Things (IoT) devices, wearable technology, and other energy-constrained systems. They are engineered to deliver high performance while consuming minimal power, allowing for extended battery life and reduced energy consumption.

The ultra-low-power microcontroller market refers to the industry involved in the development, manufacturing, and distribution of microcontrollers specifically designed for ultra-low-power applications. This market has witnessed significant growth in recent years due to the increasing demand for battery-operated devices, IoT deployments, and energy-efficient solutions across industries. The market comprises a wide range of microcontroller vendors offering products with varying power-saving capabilities, processing power, and peripheral integration.

Applications of ultra-low-power microcontrollers span across sectors such as consumer electronics, healthcare, industrial automation, smart home devices, and more. As the demand for energy-efficient devices continues to rise, the ultra-low-power microcontroller market is expected to expand further, driven by advancements in power management techniques, increasing IoT adoption, and the need for extended battery life in portable and wearable devices.

Analyst Viewpoint

The research analysis of the ultra-low-power microcontroller segment, several key companies have emerged as major players. These companies have a broad portfolio of ultra-low-power microcontrollers and have experienced notable growth in their stock prices over the past year.

Texas Instruments (NASDAQ: TXN) is a prominent semiconductor company known for its extensive lineup of ultra-low-power MCUs, such as the MSP430 and TM4C series. Over the past year, Texas Instruments’ shares have seen a growth of over 9%, indicating positive market performance and investor confidence.

STMicroelectronics (NYSE: STM), a European-based semiconductor company, has established a strong presence in the ultra-low-power MCU market, particularly in IoT and industrial applications. With a stock price increase of around 20% in the last 12 months, STMicroelectronics has demonstrated robust market performance.

Microchip (NASDAQ: MCHP) has expanded its ultra-low-power microcontroller offerings through strategic acquisitions, including Microsemi. Microchip now claims to offer the lowest active and standby power 8-bit, 16-bit, and 32-bit MCUs. The company’s shares have grown nearly 25% year-over-year, indicating positive market sentiment.

Renesas (OTCMKTS: RNECF), a Japanese chipmaker, provides ultra-low-power MCUs for smart home, industrial, and automotive applications. Renesas’ stock has witnessed significant growth of around 45% over the past year, reflecting strong market performance and investor confidence.

NXP Semiconductors (NASDAQ: NXPI) is a major supplier of MCUs for the automotive and IoT industries. The company offers ultra-low-power series such as the LPC800 ARM Cortex-M0+ MCUs. NXP Semiconductors’ shares have grown over 15% in the last 12 months, indicating positive market performance.

Cypress Semiconductor (NASDAQ: CY), now a part of Infineon following its acquisition in 2020, is known for its ultra-low-power PSoC MCUs used in IoT devices. Infineon’s stock has shown an increase of about 25% year-over-year, demonstrating positive market sentiment.

Silicon Labs (NASDAQ: SLAB) focuses on ultra-low-power IoT wireless and MCU solutions. The company’s stock price has increased approximately 13% over the last year, suggesting steady market growth and positive investor sentiment.

Analog Devices (NASDAQ: ADI) offers ultra-low-power MCUs such as the ADuCM360, as well as precision analog and mixed-signal ICs. Analog Devices’ stock has grown over 18% year-over-year, indicating positive market performance.

Key Takeaways

- The ultra-low-power microcontroller market is estimated to witness substantial growth, with a projected worth of around USD 14.4 billion by 2033, marking a significant increase from USD 5.3 billion in 2023. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 10.5% during the forecast period spanning from 2024 to 2033.

- Peripheral Device: Analog Devices segment holds a dominant market position, accounting for over 55.7% share in 2023. Analog Devices play a crucial role in providing accurate analog signal processing capabilities, making them preferred for various industries.

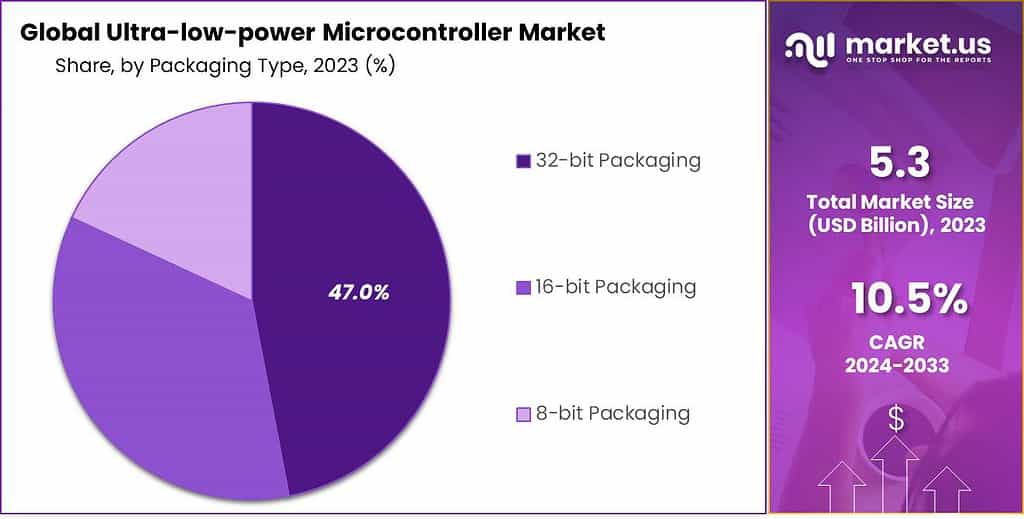

- Packaging Type: The 32-bit Packaging segment holds the majority share, with over 47.0% in 2023. The preference for 32-bit microcontrollers stems from their enhanced processing capabilities and flexibility to handle advanced tasks.

- End-Use Industry: The Consumer Electronics segment leads the market, capturing more than a 37.1% share in 2023. This dominance is driven by the surging demand for smart and portable electronic devices worldwide.

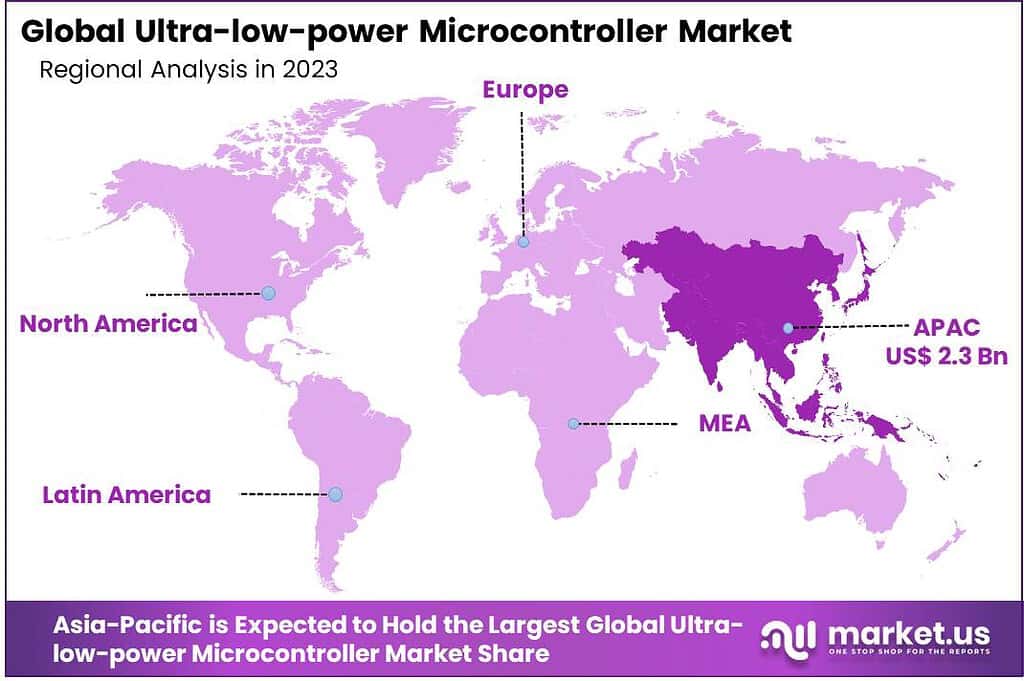

- The Asia-Pacific (APAC) region dominates the ultra-low-power microcontroller market, capturing over 43.5% share in 2023. APAC’s leadership is driven by its strong presence in the electronics manufacturing sector, large consumer base, and emphasis on energy efficiency and sustainability.

Based on Peripheral Device

In 2023, the Analog Devices segment held a dominant market position in the ultra-low-power microcontroller market, capturing more than a 55.7% share.

Analog Devices play a crucial role in the ultra-low-power microcontroller market, as they enable the processing and conversion of real-world signals into digital data for further analysis and control. These devices are essential for applications that require precise measurement and control of analog signals, such as temperature sensing, voltage monitoring, and audio processing.

The Analog Devices segment’s dominance is driven by its ability to provide accurate, reliable, and efficient analog signal processing capabilities, making it a preferred choice for various industries. Furthermore, the Analog Devices segment offers a wide range of peripherals and features that cater to the diverse needs of the ultra-low-power microcontroller market.

These devices often include analog-to-digital converters (ADCs), digital-to-analog converters (DACs), operational amplifiers, and other analog components that enhance the microcontroller’s functionality. The availability of such comprehensive analog peripherals enables designers and developers to integrate complex analog functionalities into their applications seamlessly.

Additionally, the Analog Devices segment’s leadership can be attributed to its focus on power efficiency. Ultra-low-power microcontrollers are designed to operate in battery-powered or energy-constrained environments, where minimizing power consumption is crucial.

Analog Devices in this segment are optimized for low-power operation, offering power-saving features such as low-power modes, power gating, and efficient voltage regulation. This focus on power efficiency aligns well with the market’s growing demand for energy-efficient solutions, driving the adoption of analog devices in ultra-low-power microcontrollers.

Based on Packaging Type

In 2023, the 32-bit Packaging segment held a dominant market position in the ultra-low-power microcontroller market, capturing more than a 47.0% share.

The 32-bit Packaging segment’s leading position is driven by the growing demand for higher processing power and advanced functionalities in various applications. As technology advances and applications become more complex, the need for microcontrollers with higher bit architectures, such as 32-bit, increases.

These microcontrollers offer enhanced processing capabilities, larger memory capacities, and greater flexibility, enabling them to handle more demanding tasks and support advanced features. The 32-bit Packaging segment’s dominance reflects the market’s preference for microcontrollers that can meet the evolving requirements of modern applications.

Furthermore, the 32-bit Packaging segment benefits from a broad ecosystem and support from industry-leading manufacturers and developers. The availability of a wide range of development tools, software libraries, and community support contributes to the segment’s leadership position.

Developers and engineers often choose 32-bit packaged microcontrollers for their projects due to the extensive resources and established ecosystem that facilitate efficient development and integration. The presence of a strong ecosystem and support network around 32-bit Packaging microcontrollers fosters innovation, accelerates time-to-market, and enables seamless integration into various applications.

Moreover, the 32-bit Packaging segment offers advantages in terms of energy efficiency and performance optimization. These microcontrollers are designed to provide a balance between computational power and power consumption, making them suitable for ultra-low-power applications.

The 32-bit architecture allows for efficient code execution, enabling better performance while minimizing power consumption. This energy-efficient characteristic aligns well with the market’s increasing emphasis on power efficiency and extends battery life, making 32-bit Packaging microcontrollers a preferred choice for battery-powered and energy-constrained applications.

Based on End-Use Industry

In 2023, the Consumer Electronics segment held a dominant market position in the ultra-low-power microcontroller market, capturing more than a 37.1% share. This significant market share can be attributed to the escalating demand for smart and portable electronic devices among consumers globally. The growth of smartphones, wearable technologies, smart home devices, and personal electronics has necessitated the integration of ultra-low-power microcontrollers.

These components are crucial for enhancing battery life and operational efficiency, enabling devices to perform complex tasks while consuming minimal power. The surge in IoT (Internet of Things) applications within consumer electronics further amplifies this demand, as manufacturers seek to innovate products that offer connectivity, versatility, and prolonged battery life without compromising performance.

The leadership of the Consumer Electronics segment in the ultra-low-power microcontroller market is further bolstered by advancements in technology and consumer preferences for energy-efficient devices. Manufacturers are continuously innovating to meet the growing consumer expectations for devices that offer convenience, connectivity, and extended usage times.

The rise of ultra-low-power microcontrollers has been a game-changer in this regard, facilitating the development of electronics that can operate for extended periods on a single battery charge. Additionally, government regulations and policies promoting energy conservation and sustainability have led to increased adoption of these microcontrollers in consumer electronics. The integration of ultra-low-power microcontrollers is not just a trend but a necessity in the design and development of future consumer electronics, ensuring this segment’s continued dominance in the market.

Key Market Segments

Based on Peripheral Device

- Analog Devices

- Digital Devices

Based on Packaging Type

- 8-bit Packaging

- 16-bit Packaging

- 32-bit Packaging

Based on End-Use Industry

- Consumer Electronics

- Manufacturing

- Automotive

- Healthcare

- Telecommunications

- Aerospace & Defense

- Other End-Use Industries

Driver

Rising Need for Energy Efficiency in Consumer Electronics

The escalating demand for energy efficiency in consumer electronics acts as a primary driver for the ultra-low-power microcontroller market. As consumers increasingly favor devices that offer longer battery life and enhanced performance without frequent recharging, manufacturers are compelled to integrate components that minimize power consumption.

Ultra-low-power microcontrollers meet this requirement by ensuring efficient power management, thereby extending the operational lifespan of portable electronics such as smartphones, wearable devices, and IoT gadgets. This shift towards energy-efficient products is not merely a consumer preference but is becoming a standard, driven by the global emphasis on sustainability and energy conservation.

As a result, the adoption of ultra-low-power microcontrollers in the consumer electronics sector is witnessing substantial growth, underpinning the market’s expansion and innovation in energy-efficient product development.

Restraint

Manufacturing Complexities and Unsuitability for Power-Critical Applications

The manufacturing of ultra-low-power microcontrollers presents significant complexities, posing a restraint to their broader adoption. These complexities arise from the need for precise and advanced fabrication processes to ensure the microcontrollers achieve the desired power efficiency. Additionally, ultra-low-power microcontrollers may not always be suitable for power-critical applications that require high performance and computational power.

In scenarios where intense processing capabilities are essential, such as in certain industrial and high-performance computing applications, the power-saving features of ultra-low-power microcontrollers might lead to compromises in performance. This limitation restricts their applicability in sectors where energy efficiency is secondary to computational power, thereby hindering the market’s growth potential in these areas.

Opportunity

Growing Adoption of Power Electronics in EV Industry

The electric vehicle (EV) industry presents a significant opportunity for the expansion of the ultra-low-power microcontroller market. As the adoption of EVs accelerates globally, there is an increasing need for advanced power electronics that enhance energy efficiency, performance, and reliability. Ultra-low-power microcontrollers play a crucial role in managing power electronics systems, from battery management to control systems, ensuring optimal performance and extending the vehicle’s range.

The growth of the EV market, coupled with the push for greener transportation solutions, creates a burgeoning demand for these microcontrollers. Their ability to operate efficiently at low power levels makes them ideal for the EV industry’s requirements, positioning them as a key component in the development and success of electric vehicles.

Challenge

Lower Penetration of Ultra-low-power Microcontrollers than High- and Low-power Microcontrollers

A significant challenge facing the ultra-low-power microcontroller market is its lower penetration compared to high- and low-power microcontrollers. This disparity can be attributed to the established presence and widespread application of high- and low-power microcontrollers across various industries, where the emphasis may not solely be on power efficiency. Ultra-low-power microcontrollers, while advantageous for energy conservation, may not meet the performance requirements of all applications, limiting their adoption in certain sectors.

Moreover, the market for high- and low-power microcontrollers is supported by extensive product ranges and established supply chains, making it challenging for ultra-low-power variants to gain a foothold. Overcoming this challenge requires not only technological advancements that enhance the performance of ultra-low-power microcontrollers but also strategic market positioning to highlight their unique benefits in power-sensitive applications.

Regional Analysis

In 2023, the Asia-Pacific (APAC) region held a dominant market position in the ultra-low-power microcontroller market, capturing more than a 43.5% share. The demand for Ultra-low-power Microcontroller in Asia-Pacific (APAC) was valued at US$ 2.3 billion in 2023 and is anticipated to grow significantly in the forecast period.

This regional leadership can be attributed to several key factors that highlight its significance in the industry. APAC’s dominant market position in the ultra-low-power microcontroller market is driven by the region’s strong presence in the electronics manufacturing sector. APAC is home to several major electronics manufacturing hubs, including China, South Korea, Japan, and Taiwan, which are known for their production capabilities and technological advancements.

These countries have a robust ecosystem of semiconductor manufacturers, original equipment manufacturers (OEMs), and research and development facilities, fostering a favorable environment for the growth and adoption of ultra-low-power microcontrollers. The region’s dominance signifies the high demand for these microcontrollers in APAC’s thriving consumer electronics, automotive, and manufacturing industries.

Furthermore, APAC’s dominance can be attributed to the region’s large population and rising disposable incomes. This combination creates a significant consumer base that drives the demand for consumer electronics, smart devices, and other applications that utilize ultra-low-power microcontrollers.

With a growing middle class and an increasing appetite for the latest technology, APAC has become a lucrative market for ultra-low-power microcontrollers. The region’s strong economic growth, coupled with favorable government policies and initiatives to promote technological advancements, further contribute to the dominance of APAC in the market.

Moreover, APAC’s leadership is reinforced by the region’s focus on energy efficiency and sustainability. Governments and organizations in APAC are actively pursuing initiatives to reduce energy consumption and carbon emissions. Ultra-low-power microcontrollers play a vital role in achieving these objectives by enabling energy-efficient devices and systems.

The preference for energy-efficient solutions, coupled with favorable regulations and incentives, drives the adoption of ultra-low-power microcontrollers in APAC. This regional emphasis on sustainability aligns well with the market’s growing demand for energy-efficient and environmentally friendly technologies.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The ultra-low-power microcontroller market is characterized by the presence of several key players that contribute significantly to the industry’s growth and innovation. These companies play a pivotal role in driving technological advancements, product development, and market expansion. Their efforts are central to meeting the rising demand for energy-efficient and high-performance microcontrollers across various sectors, including consumer electronics, automotive, healthcare, and industrial applications.

Top Market Leaders

- Texas Instruments Inc.

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Analog Devices, Inc.

- Microchip Technology Inc.

- Renesas Electronics Corp.

- Infineon Technologies AG

- Seiko Epson Corporation

- Silicon Laboratories, Inc.

- ROHM Co., Ltd.

- Other Key Players

Recent Developments

1. Texas Instruments Inc.:

- September 2023: Launched the SimpleLink™ MSP432P microcontrollers with ultra-low-power features including ultra-low-leakage SRAM and low-power modes.

- June 2023: Announced the TM4C123GH6PM microcontroller with low-power features and integrated security capabilities.

- February 2023: Completed the acquisition of Micron Technology’s analog and power business, strengthening its portfolio for low-power applications.

2. NXP Semiconductors N.V.:

- November 2023: Announced the LPC55S6x family of ultra-low-power microcontrollers with high security features and integrated BLE connectivity.

- August 2023: Launched the i.MX RT1170 microcontroller with ultra-low-power modes and support for AI workloads.

- March 2023: Presented the KW38 series of Bluetooth® LE microcontrollers optimized for ultra-low-power battery-powered applications.

3. STMicroelectronics N.V.:

- October 2023: Introduced the STM32WB55 microcontrollers with ultra-low-power consumption and integrated Wi-Fi and Bluetooth® connectivity.

- July 2023: Released the STM32L5R series of microcontrollers with ultra-low-power features and extended temperature range for industrial applications.

- February 2023: Showcased the STM32WL family of ultra-low-power wireless microcontrollers for battery-powered IoT devices.

Report Scope

Report Features Description Market Value (2023) US$ 5.3 Bn Forecast Revenue (2033) US$ 14.4 Bn CAGR (2024-2033) 10.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Peripheral Device (Analog Devices, Digital Devices), By Packaging Type (8-bit Packaging, 16-bit Packaging, 32-bit Packaging), By End-Use Industry (Consumer Electronics, Manufacturing, Automotive, Healthcare, Telecommunications, Aerospace & Defense) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Texas Instruments Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Analog Devices Inc., Microchip Technology Inc., Renesas Electronics Corp., Infineon Technologies AG, Seiko Epson Corporation, Silicon Laboratories Inc., ROHM Co. Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an ultra-low-power microcontroller?An ultra-low-power microcontroller is a type of microcontroller designed to operate with minimal energy consumption, making it ideal for battery-powered or energy-efficient applications.

How big is Ultra-low-power Microcontroller Market?The Global Ultra-low-power Microcontroller Market size is expected to be worth around USD 14.4 Billion by 2033, from USD 5.3 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

What are the primary applications of ultra-low-power microcontrollers?These microcontrollers are commonly used in portable and battery-powered devices such as wearables, IoT devices, medical devices, and sensor nodes.

Who are the top players in the Ultra-low-power microcontroller market?The major vendors operating in the industry market include Texas Instruments Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Analog Devices Inc., Microchip Technology Inc., Renesas Electronics Corp., Infineon Technologies AG, Seiko Epson Corporation, Silicon Laboratories Inc., ROHM Co. Ltd., Other Key Players

What are the challenges associated with ultra-low-power microcontrollers?Designing ultra-low-power systems requires careful consideration of power management, sleep modes, and wake-up times, which can be complex and time-consuming.

Which region is expected to have the highest market share in Ultra low power microcontroller market?In 2023, the Asia-Pacific (APAC) region held a dominant market position in the ultra-low-power microcontroller sector, capturing more than a 43.5% share.

Ultra-low-power Microcontroller MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Ultra-low-power Microcontroller MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Texas Instruments Inc.

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Analog Devices, Inc.

- Microchip Technology Inc.

- Renesas Electronics Corp.

- Infineon Technologies AG

- Seiko Epson Corporation

- Silicon Laboratories, Inc.

- ROHM Co., Ltd.

- Other Key Players