Global Integrated Automated Supply Chain Market By Solution Type (Transportation Management System (TMS), Warehouse Management System (WMS), Demand Planning and Forecasting, Inventory Management System, Supplier Relationship Management (SRM)), By Industry Vertical (Manufacturing, Retail, Healthcare, Automotive, Food and Beverage), By Company Size (Small and Medium-sized Enterprises (SMEs, Large Enterprises), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov. 2023

- Report ID: 63349

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

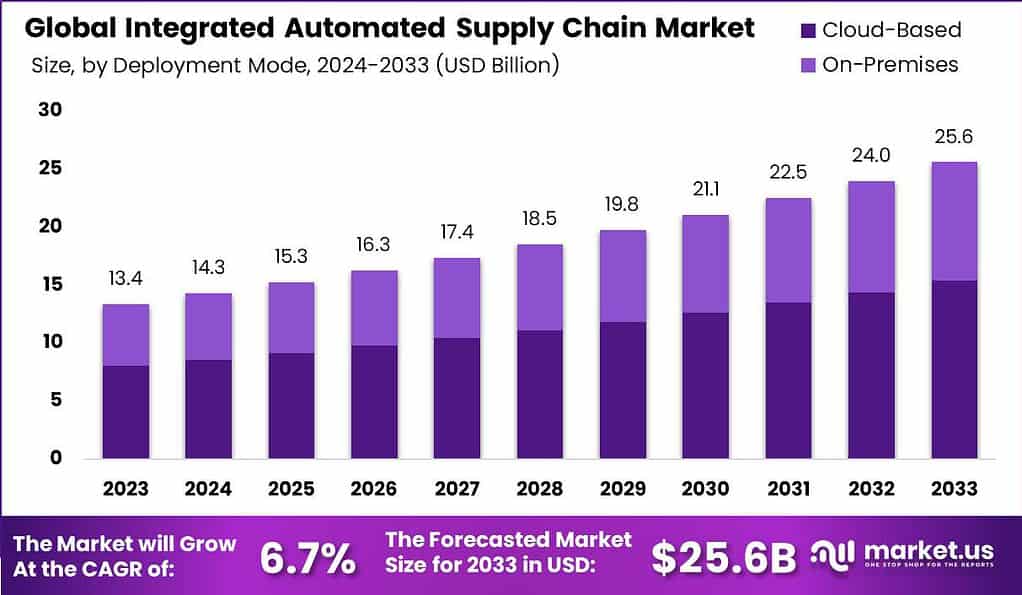

The Global integrated automated supply chain Market is anticipated to be USD 25.6 billion by 2033. It is estimated to record a steady CAGR of 6.7% in the Forecast period 2023 to 2033. It is likely to total USD 13.4 billion in 2023.

A integrated automated supply chain is one that makes use of technology to automate and connect different stages in the supply chain from procurement to manufacturing through logistics and distribution. This integration allows for continuous information flows, instantaneous analysis of data as well as automated decision-making improving efficiency, speed, and cost-effectiveness.

The automation of supply chains has been gaining significant popularity due to many reasons. The first is that businesses are searching for ways to improve the supply chain process in order to keep up with the demands of their customers while also decreasing costs and improving efficiency. Through automatizing manual tasks and utilizing data-driven insight, companies can improve efficiency and agility in operations.

Note: Actual Numbers Might Vary In Final Report

The benefits of a integrated automatized supply chain can be many. It provides real-time information on the state of inventory as well as demand patterns and production status, which allows for better planning and forecasting. Automation helps reduce human error as well as improves consistency in processes and frees up resources for more strategic tasks. It also improves resilience to disruptions in supply chain by allowing rapid response to disruptions and better risk management.

Key Takeaways

- Market Growth: The Global Integrated Automated Supply Chain market is projected to reach USD 25.6 billion by 2033, with a steady CAGR of 6.7%. In 2023, it is expected to be worth USD 13.4 billion.

- What is an Integrated Automated Supply Chain?: It’s a system that employs technology to automate and connect different phases of the supply chain, enhancing efficiency and minimizing manual involvement.

- Why the Growing Interest?: Businesses are adopting integrated automated supply chains to meet customer demands, reduce costs, and enhance efficiency. Automation streamlines manual tasks and provides data-driven insights.

- Benefits of Integration: Integrated automation offers real-time inventory updates, demand forecasting, reduced errors, improved consistency, resilience to disruptions, and better risk management.

- Solution Types: In 2023, Transportation Management Systems (TMS) played a pivotal role in streamlining transportation operations, capturing a market share exceeding 30%. Warehouse Management Systems (WMS) also contributed significantly to optimizing warehouse operations.

- Deployment Models: Cloud-based solutions dominated with a market share of over 60% in 2023. They offer scalability, accessibility, and cost-efficiency. On-premises solutions, while still relevant, had a smaller market share.

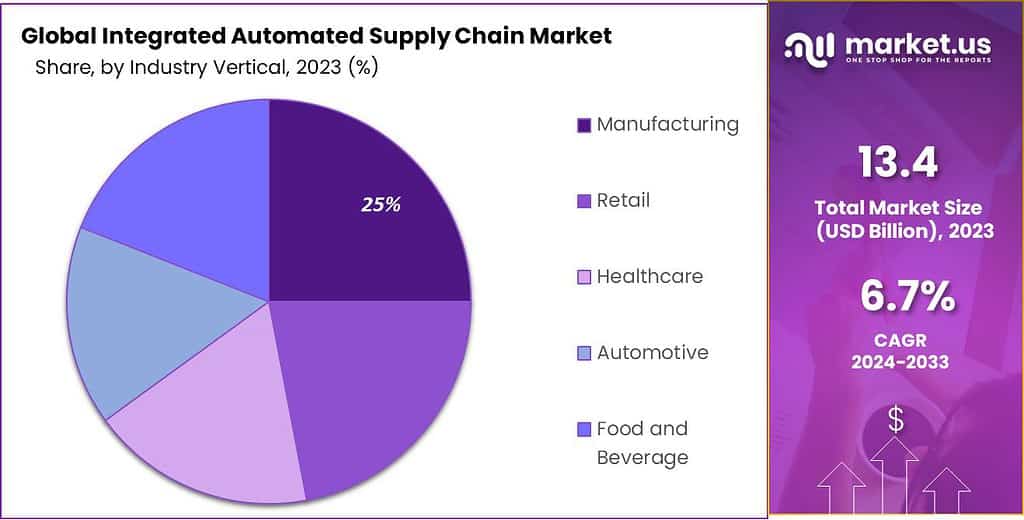

- Industry Verticals: Manufacturing led the market with a market share of over 25%, driven by a focus on efficiency and process optimization. Retail, Healthcare, Automotive, and Food and Beverage industries also adopted integrated automation.

- Company Size Matters: Large enterprises accounted for over 57% of the market share in 2023, leveraging their resources for automation. Small and Medium-sized Enterprises (SMEs) are gradually recognizing the benefits of automation.

- Driving Factors: Key drivers include efficiency, cost savings, meeting consumer demands, globalization, and digital transformation.

- Challenges: Challenges include implementation costs, integration complexities, resistance to change, and cybersecurity concerns.

- Growth Opportunities: Growth opportunities lie in SME adoption, integration of IoT and AI, sustainability focus, and industry-specific solutions.

- Key Trends: Real-time supply chain visibility, autonomous vehicles, resilience and risk mitigation, and collaborative supply chains are key trends.

- Regional Analysis: North America dominated the market with over 36% market share in 2023, followed by Europe. The Asia-Pacific region exhibited remarkable growth, driven by manufacturing and digitalization.

- Key Players: Major players in the market include KUKA Aktiengesellschaft, KION GROUP AG, KNAPP AG, Toyota Industries Corporation, and more.

Solution Type

In 2023, the Integrated Automated Supply Chain market showcased a notable dominance within its Solution Types, with the Transportation Management System (TMS) Segment capturing a commanding market share exceeding 30%. This remarkable position can be attributed to the pivotal role TMS plays in streamlining and optimizing transportation operations within supply chains. Organizations across various industries have increasingly recognized the significance of efficient logistics and transportation management for cost savings and improved customer service.

TMS solutions offer real-time visibility, route optimization, and cost-effective transportation planning, making them indispensable in today’s competitive market landscape. As global trade continues to evolve, the Transportation Management System (TMS) Segment is poised to maintain its stronghold, facilitating the seamless movement of goods and ensuring the efficiency of supply chain networks.

Meanwhile, the Warehouse Management System (WMS) Segment also played a crucial role in the integrated automated supply chain market. WMS solutions are vital in enhancing warehouse operations, optimizing inventory, and improving order fulfillment processes. In 2023, this segment contributed significantly, responding to the growing demand for efficient warehousing and distribution services. With the continued expansion of e-commerce and the need for rapid order processing, the Warehouse Management System (WMS) Segment is expected to further solidify its position in the supply chain automation landscape.

Demand Planning and Forecasting, another integral component of integrated supply chain solutions, witnessed increasing adoption due to its role in enhancing inventory management and reducing stockouts. In 2023, this segment demonstrated growth as businesses recognized the importance of accurate demand forecasting to minimize excess inventory costs. Likewise, the Inventory Management System Segment played a pivotal role in optimizing stock levels, reducing carrying costs, and ensuring product availability. Its contribution to efficient supply chain operations cannot be overstated.

Lastly, the Supplier Relationship Management (SRM) Segment continued to evolve, addressing the importance of fostering strong supplier relationships for supply chain resilience. Effective SRM solutions enable organizations to collaborate closely with their suppliers, improving communication, and ensuring a stable supply of goods. As the integrated automated supply chain market advances, each of these Solution Types will continue to adapt and innovate, catering to the ever-changing demands of businesses striving for supply chain excellence.

Deployment Model

In 2023, the Integrated Automated Supply Chain market exhibited a clear distinction in market share between its Deployment Model segments, with the Cloud-Based Segment emerging as the dominant force by capturing an impressive market share of over 60%. This significant dominance underscores the prevailing trend of organizations increasingly embracing cloud-based solutions for their supply chain automation needs. Cloud-based deployment has many advantages such as scalability and accessibility and cost-efficiency. It allows businesses to implement fully integrated solutions for supply chains quickly without the need to make large infrastructure investments on premises.

Furthermore, cloud-based models facilitate real-time data sharing and collaboration among supply chain stakeholders, enhancing overall agility and responsiveness. As the global business landscape continues to prioritize digital transformation and flexibility, the Cloud-Based Segment is poised to maintain its prominent position in the integrated automated supply chain market.

Conversely, the On-Premises Segment, while still relevant, faced a relatively smaller market share in 2023. On-premises deployments entail hosting supply chain solutions within an organization’s own infrastructure, providing a higher degree of control over data and processes. However, this model can be associated with higher upfront costs, longer implementation timelines, and increased maintenance overhead. Despite these considerations, some enterprises with specific security or compliance requirements continue to opt for on-premises deployment.

Nevertheless, as cloud technology matures and security concerns are addressed, the On-Premises Segment is expected to experience a gradual decline in market share as more businesses leverage the benefits offered by cloud-based integrated supply chain solutions.

Industry Vertical

In 2023, the Integrated Automated Supply Chain market showcased a clear hierarchy among its Industry Vertical segments, with the Manufacturing Segment firmly establishing its dominance by securing a substantial market share of over 25%. This commanding position can be attributed to the manufacturing sector’s unwavering focus on efficiency, cost reduction, and process optimization. Integrated supply chain solutions play a pivotal role in streamlining manufacturing operations, ensuring just-in-time inventory management, and enhancing production planning. As manufacturing organizations continue to embrace Industry 4.0 principles and automation, the demand for integrated automated supply chain solutions remains robust, solidifying the Manufacturing Segment’s position at the forefront of this market.

Simultaneously, the Retail Sector exhibited notable market presence in 2023, driven by the industry’s evolving consumer demands and the need for efficient inventory management and order fulfillment. Integrated automated supply chain solutions enable retailers to synchronize their supply chains with consumer preferences, optimize stock levels, and enhance the customer experience. This segment’s contribution to the market reflects the retail industry’s agility in adapting to shifting market dynamics.

The Healthcare Industry, with its critical emphasis on patient care and pharmaceutical supply chain management, also demonstrated significant growth within the integrated automated supply chain market. Healthcare organizations increasingly rely on supply chain automation to ensure timely access to essential medical supplies, medicines, and equipment while maintaining stringent quality and compliance standards.

Similarly, the Automotive Sector leveraged integrated supply chain solutions to enhance production efficiency, reduce lead times, and manage complex global supply networks. As the automotive industry continues to evolve towards electric and autonomous vehicles, supply chain automation remains pivotal for sustaining competitiveness.

Lastly, the Food and Beverage Industry witnessed notable adoption of integrated automated supply chain solutions to optimize inventory, ensure product freshness, and adhere to food safety regulations. This segment’s growth reflects the industry’s commitment to delivering quality products while managing supply chain complexities.

Note: Actual Numbers Might Vary In Final Report

Company Size

In 2023, the Integrated Automated Supply Chain market exhibited a notable distinction in market share between its Company Size segments, with the Large Enterprises Segment firmly establishing its dominance by capturing an impressive market share of over 57%. This commanding position can be attributed to the robust resource capabilities and extensive operations of large enterprises, which enable them to invest significantly in integrated supply chain automation.

Large enterprises recognize the critical role of streamlined supply chain processes in achieving operational efficiency, cost reduction, and competitive advantage. Their ability to implement comprehensive integrated solutions across complex supply networks positions them as leaders in adopting and benefiting from the latest advancements in supply chain automation technologies.

Conversely, Small and Medium-sized Enterprises (SMEs), while constituting a substantial portion of the market, held a comparatively smaller share in 2023. SMEs often face budget constraints and resource limitations, which can influence their adoption of integrated supply chain solutions.

Nevertheless, as the market matures and cloud-based solutions become more within reach for small and medium enterprises (SMEs), these businesses are progressively acknowledging the benefits of automation for streamlining their supply chain operations. The path for this segment is anticipated to be marked by growth, with SMEs increasingly embracing integrated automated supply chain solutions to boost their competitiveness and align with shifting market requirements. Despite the market being largely controlled by large enterprises, SMEs are positioned to play a substantial role in driving its expansion in the foreseeable future.

Driving Factors

- Efficiency and Cost Savings: Integrated automated supply chain solutions drive efficiency by optimizing inventory management, reducing lead times, and minimizing operational costs, compelling businesses to adopt these technologies.

- Consumer Demands: Meeting evolving consumer demands for faster deliveries, personalized experiences, and real-time visibility into order status fuels the adoption of supply chain automation to ensure responsiveness and customer satisfaction.

- Globalization: The expansion of businesses into global markets necessitates supply chain automation to manage complex supply networks, mitigate risks, and ensure the timely flow of goods across borders.

- Digital Transformation: The broader digital transformation initiatives across industries push organizations to embrace integrated automation as a foundational element in modernizing their supply chain operations and remaining competitive.

Restraining Factors

- Implementation Costs: The initial investment needed for integrated automated supply chain solutions can be considerable, potentially acting as a deterrent for certain organizations, especially small and medium-sized enterprises (SMEs), contemplating adoption.

- Challenges in Integration: The process of integrating new automation technologies with existing legacy systems can be intricate and time-intensive, potentially causing a slowdown in the adoption timeline.

- Resistance to Change: Organizational resistance to change and the need for workforce training can hinder the seamless implementation of integrated automation within supply chains.

- Cybersecurity Concerns: As supply chains become more digitally connected, the risk of cyber threats and data breaches increases, prompting concerns about security and data protection.

Growth Opportunities

- Adoption by SMEs: Small and medium-sized businesses present a significant growth opportunity because they are beginning to are recognizing the advantages of automated systems that integrate. They are looking for efficient solutions that are tailored to their requirements.

- Integration of IoT and AI: Incorporating Internet of Things (IoT) and Artificial Intelligence (AI) technologies to automatize supply chain processes holds the promise of improved forecasting analytics and monitoring in real time and improved capacity for decision-making.

- Focus on Sustainability: The growing focus on sustainability and environmental issues creates opportunities for automation of the supply chain to improve processes, cut the waste generated and decrease carbon footprints.

- Industry-Specific Solutions: Tailoring integrated automation solutions to specific industries, such as healthcare or automotive, creates opportunities to address unique supply chain challenges and compliance requirements.

Key Market Trends

- Supply Chain Visibility: Real-time supply chain visibility through technologies like blockchain and RFID is a key trend, enabling organizations to track and trace products and enhance transparency.

- Autonomous Vehicles and Drones: The adoption of autonomous vehicles and drones for last-mile delivery and warehouse operations is gaining traction, reshaping supply chain logistics.

- Resilience and Risk Mitigation: The COVID-19 pandemic underscored the need for supply chain resilience, driving the trend of risk mitigation strategies and diversified sourcing.

- Collaborative Supply Chains: Collaborative and multi-tier supply chains are becoming more prevalent, fostering closer relationships among suppliers, manufacturers, and distributors to optimize end-to-end processes.

Key Market Segments

Solution Type

- Transportation Management System (TMS)

- Warehouse Management System (WMS)

- Demand Planning and Forecasting

- Inventory Management System

- Supplier Relationship Management (SRM)

Deployment Model

- Cloud-Based

- On-Premises

Industry Vertical

- Manufacturing

- Retail

- Healthcare

- Automotive

- Food and Beverage

Company Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Regional Analysis

In 2023, the global Integrated Automated Supply Chain market exhibited distinct regional dynamics, with North America asserting its dominance by capturing a substantial market share of over 36%. The demand for integrated automated supply chain Market in Asia Pacific was valued at USD 4.8 billion in 2023 and is anticipated to grow significantly in the forecast period. This commanding position can be attributed to North America’s early and widespread adoption of advanced automation technologies in supply chain operations.

The region’s mature infrastructure, technological innovation, and robust industrial base have paved the way for the integration of automated solutions across diverse industries. Moreover, stringent regulatory standards and a heightened focus on supply chain optimization have driven the rapid adoption of integrated automation in North America.

In contrast, Europe demonstrated a competitive landscape within the integrated automated supply chain market, holding a significant market share. European countries’ emphasis on sustainability, stringent quality standards, and complex cross-border logistics have propelled the adoption of supply chain automation.

The Asia-Pacific (APAC) region exhibited remarkable growth, reflecting its status as a burgeoning market for integrated automation. APAC’s dynamic manufacturing sector, rapid digitalization, and increasing investments in automation technologies contributed to its substantial market presence.

Latin America, while holding a smaller market share, showcased potential for growth, particularly in countries with expanding manufacturing sectors. The Middle East and Africa presented opportunities for integrated automation adoption, driven by investments in infrastructure and a growing awareness of the benefits of supply chain optimization.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Integrated Automated Supply Chain Market Key Player Analysis involves evaluating and analyzing the leading companies operating in the market. This analysis focuses on understanding the market position, product offerings, strategies, and competitive landscape of key players in the integrated automated supply chain industry. It helps stakeholders gain insights into the strengths, weaknesses, opportunities, and threats associated with these players.

Top Key Players

- KUKA Aktiengesellschaft

- KION GROUP AG

- KNAPP AG

- Toyota Industries Corporation

- Murata Machinery Ltd.

- TGW Logistics Group

- WITRON Logistik

- Informatik GmbH

- EXOTEC Solutions SAS

- AutoStore AS

- Westfalia Technologies Inc.

- Other Key Players

Recent Development

- In 2023, Manhattan Associates expanded its warehouse automation portfolio by introducing novel solutions for robotic picking, packing, and sorting.

- Also in 2023, Siemens expanded its digital supply chain solutions portfolio, with a focus on digital twins, predictive maintenance, and augmented reality.

- In 2022, SAP expanded its cloud-based Supply Chain Management (SCM) portfolio by introducing new solutions for supply chain planning, execution, and visibility.

- During 2022, Oracle made significant investments in its Oracle Cloud Supply Chain Management (SCM) platform, incorporating additional features for supply chain planning, manufacturing, and logistics.

Report Scope

Report Features Description Market Value (2023) US$ 13.4 Bn Forecast Revenue (2032) US$ 25.6 Bn CAGR (2023-2032) 6.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution Type (Transportation Management System (TMS), Warehouse Management System (WMS), Demand Planning and Forecasting, Inventory Management System, Supplier Relationship Management (SRM)), By Industry Vertical (Manufacturing, Retail, Healthcare, Automotive, Food and Beverage), By Company Size (Small and Medium-sized Enterprises (SMEs, Large Enterprises) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape KUKA Aktiengesellschaft, KION GROUP AG, KNAPP AG, Toyota Industries Corporation, Murata Machinery Ltd., TGW Logistics Group, WITRON Logistik, Informatik GmbH, EXOTEC Solutions SAS, AutoStore AS, Westfalia Technologies Inc., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an Integrated Automated Supply Chain?An Integrated Automated Supply Chain refers to a system where technology is used to automate and connect various stages of the supply chain, from procurement and manufacturing to distribution and logistics, enhancing efficiency and reducing manual intervention.

Why is there a growing interest in Integrated Automated Supply Chain solutions?Businesses are increasingly adopting these solutions to optimize supply chain processes, meet customer demands, reduce costs, and enhance productivity through automation and data-driven insights.

How big is Integrated Automated Supply Chain Market?The Global integrated automated supply chain Market is anticipated to be USD 25.6 billion by 2033. It is estimated to record a steady CAGR of 6.7% in the Forecast period 2023 to 2033. It is likely to total USD 13.4 billion in 2023.

What are the primary benefits of an Integrated Automated Supply Chain?Benefits include improved accuracy, speed, and cost-effectiveness. These solutions offer real-time visibility into inventory, demand patterns, and production status, leading to better forecasting, planning, and overall operational efficiency.

What are the challenges associated with implementing Integrated Automated Supply Chain solutions?Challenges may include the initial substantial investment required, integration complexities with existing systems, and the potential for a slowdown in the adoption process.

Integrated Automated Supply Chain MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Integrated Automated Supply Chain MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- KUKA Aktiengesellschaft

- KION GROUP AG

- KNAPP AG

- Toyota Industries Corporation

- Murata Machinery Ltd.

- TGW Logistics Group

- WITRON Logistik

- Informatik GmbH

- EXOTEC Solutions SAS

- AutoStore AS

- Westfalia Technologies Inc.

- Other Key Players