Global Computer Aided Engineering Market By Type (Computational Fluid Dynamics (CFD), Finite Element Analysis (FEA), Optimization & Simulation, and Multibody Dynamics), By End-Use (Electronics, Automotive, Medical devices, Defense & Aerospace, and Industrial Equipment), By Deployment Model (Cloud-Based and On-Premise), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov. 2023

- Report ID: 66526

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

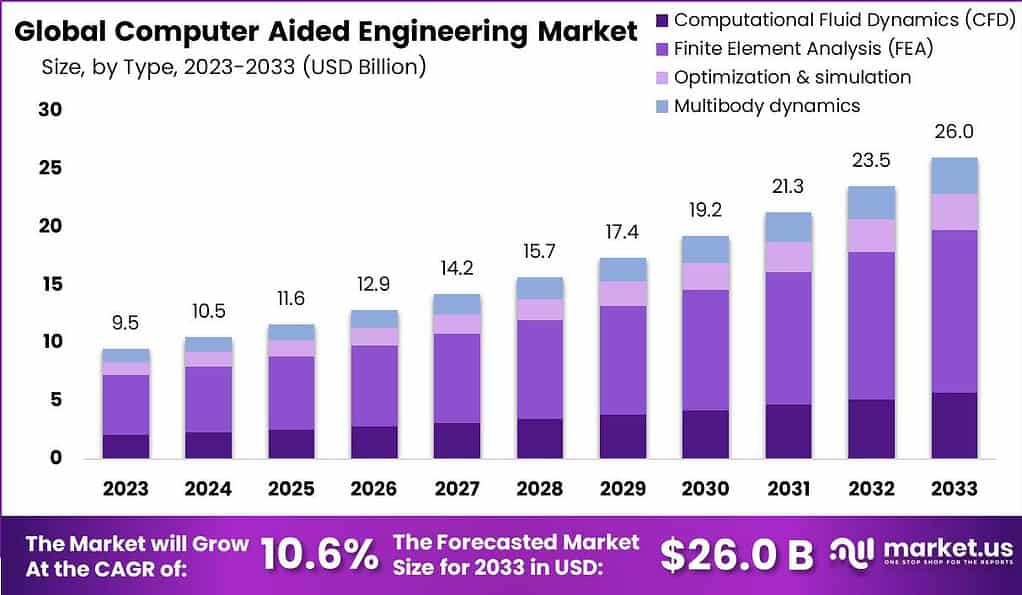

The Global Computer Aided Engineering Market is anticipated to be USD 26 billion by 2033. It is estimated to record a steady CAGR of 10.6% in the Forecast period 2023 to 2033. It is likely to total USD 9.5 billion in 2023.

The CAE (Computer Aided Engineering) is a technology that allows engineers to use computers to simulate and analyze how a product or system will behave before its physical construction begins. CAE helps engineers gain an insight into how design choices and parameters will impact performance, durability, safety and other vital aspects.

The CAE market covers an industry that provides software, tools and services related to computer-aided engineering (CAE). This market includes software developers, technology providers and consulting firms that supply CAE to engineers and designers across various industries such as automotive, aerospace, manufacturing and construction.

Note: The figures presented here are subject to change in the final report

Key Takeaways

- Market Size and Growth: The Computer Aided Engineering (CAE) market is projected to reach USD 26 billion by 2033, with an impressive Compound Annual Growth Rate (CAGR) of 10.6%. In 2023, it’s expected to be USD 9.5 billion.

- Definition of CAE: CAE, or Computer-Aided Engineering, is a technology that allows engineers to use computers to simulate and analyze the behavior of products or systems before their physical construction begins. This technology aids in understanding how design choices impact performance, safety, and other crucial aspects.

- Market Coverage: The CAE market encompasses software, tools, and services related to computer-aided engineering. It serves various industries, including automotive, aerospace, manufacturing, and construction.

- Type Analysis: In 2023, Finite Element Analysis (FEA) dominates the CAE market with a market share of over 54%. FEA is highly adaptable and vital for predicting product behavior across industries.

- End-Use Analysis: The automotive industry leads in CAE adoption with a share of over 28%. CAE benefits various industries, including electronics, medical devices, defense, and industrial equipment.

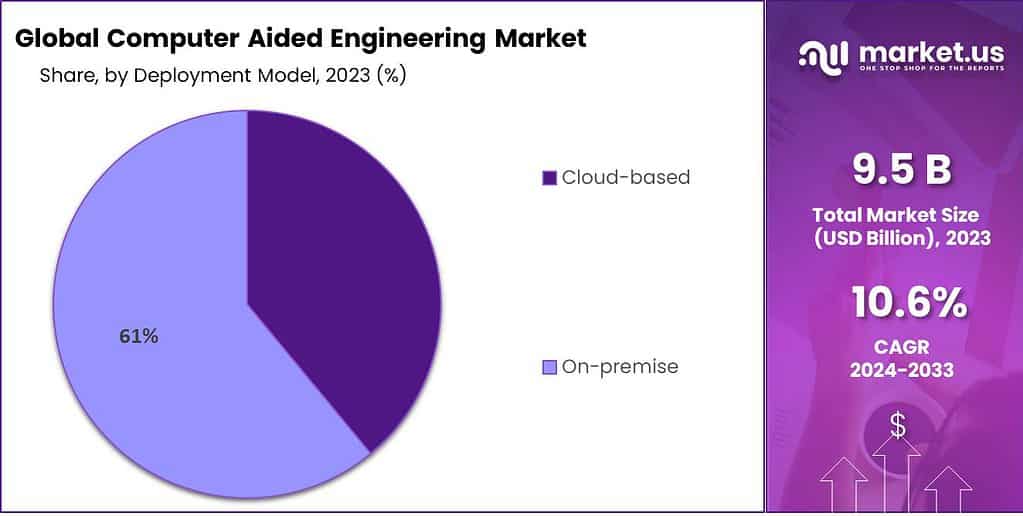

- Deployment Models: On-premise deployment holds a dominant market share of over 61% in 2023, emphasizing data security and control. Cloud-based solutions are growing but face security concerns.

- Driving Factors: The adoption of CAE is driven by the need for rapid product development, cost and resource efficiency, regulatory compliance, and globalization with remote collaboration.

- Restraining Factors: High implementation costs, data security concerns, complexity, and interoperability challenges are hindrances to CAE adoption.

- Growth Opportunities: CAE is expanding into new industry verticals like healthcare and energy. Cloud-based solutions, AI and machine learning integration, and simulation-driven design are promising growth areas.

- Key Market Trends: Trends include the use of digital twin technology, a focus on sustainability in design, real-time simulation, and collaborative CAE platforms.

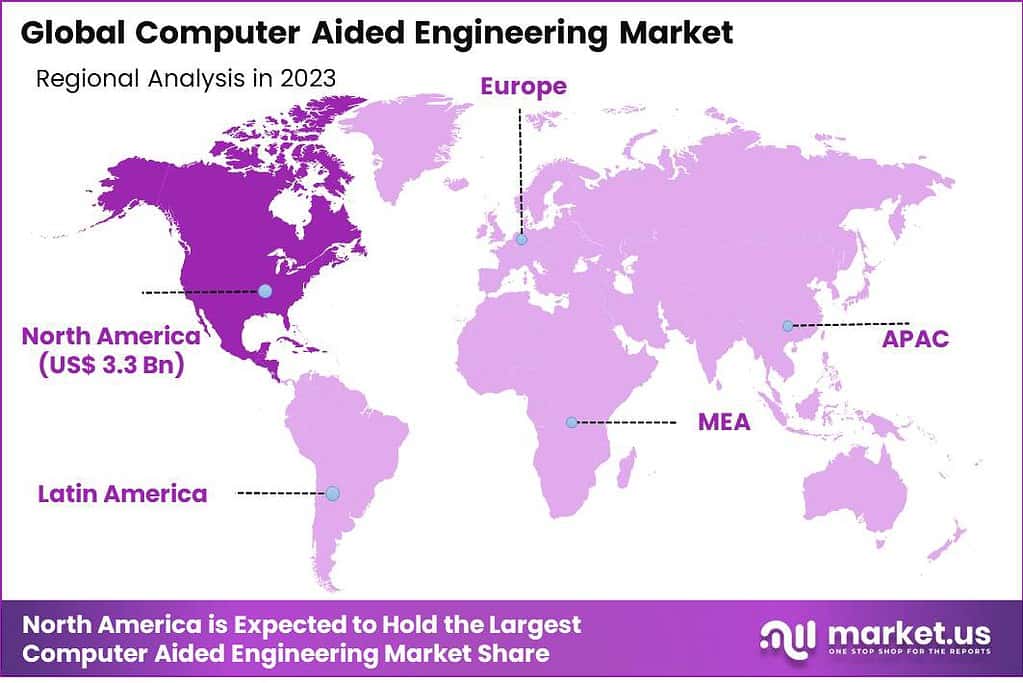

- Regional Analysis: In 2023, North America leads with a market share of over 35%, driven by robust engineering sectors. Asia-Pacific, particularly China and India, shows significant growth potential.

- Key Players: Prominent companies in the CAE market include ANSYS, Autodesk, Altair Engineering, Dassault Systemes, and others. These companies continually innovate and invest in R&D to stay competitive.

Type Analysis

In 2023, the Computer Aided Engineering (CAE) market exhibited notable segmentation among its types, with the Finite Element Analysis (FEA) Segment firmly establishing its dominance by capturing an impressive market share of over 54%. This commanding position underscores the pivotal role of FEA in the realm of computer-aided engineering.

Finite Element Analysis is an invaluable tool. It helps us simulate and understand how complex systems and parts behave across industries such as aerospace, automotive and manufacturing. People love using it because its adaptability enables it to predict how things will react depending on different situations – this enables engineers to make more efficient designs faster while cutting development times down considerably while guaranteeing top performance of their product(s).

As industries increasingly prioritize efficiency, safety, and innovation in product development, the dominance of the FEA Segment reflects the profound impact of this analytical tool in shaping the future of engineering and design. Simultaneously, other types of CAE solutions like Computational Fluid Dynamics (CFD), Optimization & Simulation, and Multibody Dynamics also play pivotal roles in various engineering domains. CFD, for instance, focuses on fluid and thermal analysis, crucial for industries like aerospace and automotive.

Optimization & Simulation aids in design optimization and process improvement, while Multibody Dynamics is essential for studying the motion and interactions of interconnected mechanical systems. Each of these CAE types, while specialized, contributes collectively to the comprehensive computer-aided engineering ecosystem, empowering engineers and innovators to push the boundaries of design, efficiency, and product performance across a wide range of industries.

End-Use Analysis

In 2023, the Computer Aided Engineering (CAE) market displayed discernible segmentation among its end-use industries, with the Automotive Segment securing a dominant market position, capturing a substantial share of over 28%. This commanding presence underscores the pivotal role of CAE in the automotive sector, where it is instrumental in revolutionizing product design and development.

Automotive manufacturers rely on CAE solutions for simulation and analysis of complex mechanical and structural components, optimizing vehicle performance, safety, and fuel efficiency. The demand for CAE in the automotive industry continues to surge as manufacturers seek to meet stringent regulatory standards, reduce time-to-market, and enhance vehicle sustainability.

Simultaneously, other end-use industries such as Electronics, Medical Devices, Defense & Aerospace, and Industrial Equipment also benefit significantly from CAE technologies. Electronics companies leverage CAE for thermal management and electromagnetic simulation, while the medical device sector employs it for precise and safe product design. Defense & Aerospace entities utilize CAE for aircraft and defense system development, and the Industrial Equipment sector relies on CAE to enhance machinery performance and reliability.

These diverse applications demonstrate CAE’s versatility in addressing complex engineering challenges across various industries, driving innovation, and elevating product quality and performance standards. While the Automotive Segment holds a dominant position, CAE continues to play a pivotal role in advancing engineering and design practices in a wide range of end-use industries worldwide.

Deployment Model Analysis

In 2023, the Computer Aided Engineering (CAE) market demonstrated a distinctive segmentation in terms of deployment models, with the On-premise Segment firmly securing a dominant market position, capturing an impressive share of over 61%. This commanding presence highlights the enduring relevance of on-premise CAE solutions in industries where data security, control, and performance optimization are paramount.

On-premise deployment allows organizations to have complete control over their CAE infrastructure, providing complete privacy of engineering data and computational workloads within secure environments. This level of control and data protection is especially essential in industries like defense, aerospace and manufacturing where confidentiality and compliance are top priorities. The prominence of the On-premise Segment reflects the continued preference of certain sectors for traditional CAE deployment models that provide a high degree of autonomy and customization.

Conversely, the Cloud-based Segment, while steadily growing, held a comparatively smaller market share in 2023. Cloud-based CAE solutions can provide access, scalability, and collaboration benefits which makes them attractive to companies that are looking for flexibility and cost efficiency. However, concerns over security of data, particularly in highly-regulated industries which have led some businesses to select the use of on-premise installations.

However, as cloud technology improves and addresses security issues cloud-based segments are likely to expand in particular industries which collaboration and mobility are important driving factors. In summary, while the On-premise Segment maintains its dominance, the CAE market continues to evolve as organizations assess the trade-offs between on-premise and cloud-based deployment models, each catering to specific industry requirements and preferences.

Note: Actual Numbers Might Vary In The Final Report

Driving Factors

- Product Development Demands: The increasing need for rapid product development cycles and innovation in various industries drives the adoption of CAE solutions to streamline design and testing processes.

- Cost and Resource Efficiency: CAE tools enable organizations to reduce physical prototyping, testing, and manufacturing costs by simulating product behavior and performance in a virtual environment.

- Regulatory Compliance: Stringent regulatory standards in sectors like aerospace, automotive, and healthcare compel companies to adopt CAE for ensuring product compliance, safety, and reliability.

- Globalization and Remote Collaboration: The globalization of businesses and the rise of remote work necessitate collaborative and cloud-based CAE solutions, enabling teams to work seamlessly across geographical boundaries.

Restraining Factors

- High Implementation Costs: The initial investment in CAE software, hardware, and training can be substantial, especially for small and medium-sized enterprises (SMEs).

- Data Security Concerns: Industries handling sensitive data may have reservations about using cloud-based CAE solutions due to data security and intellectual property protection concerns.

- Complexity and Training: CAE tools can be complex to use, requiring specialized training, which may pose a challenge for organizations transitioning to these technologies.

- Interoperability Issues: Integrating CAE software with existing IT systems and other engineering tools can be challenging and may hinder smooth workflows.

Growth Opportunities

- Expanding Industry Verticals: CAE adoption is poised to expand into new industry verticals like healthcare, energy, and construction, offering growth opportunities beyond traditional sectors.

- Cloud-Based CAE: The growth of cloud-based CAE solutions offers scalability, accessibility, and cost-effectiveness, particularly for SMEs and industries seeking flexibility.

- AI and Machine Learning Integration: Integrating AI and machine learning capabilities into CAE tools enhances predictive modeling and optimization, offering growth potential in data-driven engineering.

- Simulation-Driven Design: A shift toward simulation-driven design approaches, where CAE is used from the initial stages of product development, creates opportunities for efficiency and innovation.

Key Market Trends

- Digital Twin Technology: The use of digital twins for real-time simulations and monitoring of physical assets is a key trend, enabling predictive maintenance and performance optimization.

- Sustainability Focus: CAE tools are increasingly used to support sustainable design practices, reducing environmental impact and enhancing corporate responsibility.

- Real-Time Simulation: Real-time simulation capabilities are gaining prominence, allowing engineers to make informed decisions and adjustments during product development processes.

- Collaborative CAE: Collaborative CAE platforms that facilitate interdisciplinary teamwork and information sharing are emerging as a trend, improving cross-functional collaboration and productivity.

Kеу Маrkеt Ѕеgmеntѕ

By Type

- Computational Fluid Dynamics (CFD)

- Finite Element Analysis (FEA)

- Optimization & simulation

- Multibody dynamics

By End-Use

- Electronics

- Automotive

- Medical devices

- Defense & aerospace

- Industrial equipment

- Other End-uses

By Deployment Model

- Cloud-based

- On-premise

Regional Analysis

In 2023, the global Computer Aided Engineering (CAE) market exhibited distinct regional dynamics, with North America securing a dominant market position by capturing a substantial share of more than 35%. The demand for Computer Aided Engineering Market in Asia Pacific was valued at USD 3.3 billion in 2023 and is anticipated to grow significantly in the forecast period. This commanding presence can be attributed to North America’s robust engineering and manufacturing sectors, where CAE tools are instrumental in driving innovation, product development, and efficiency.

The region’s emphasis on technological advancements, particularly in industries like aerospace, automotive, and electronics, fuels the adoption of CAE solutions. Moreover, stringent regulatory standards in these sectors necessitate the use of CAE for compliance and safety. North America’s leadership in CAE adoption underscores its commitment to staying at the forefront of engineering excellence.

Europe, while holding a significant market share, reflects a competitive landscape within the CAE market, driven by industries like automotive and industrial machinery. The Asia-Pacific (APAC) region demonstrates remarkable growth potential, with countries like China and India at the forefront, as they focus on industrial expansion, infrastructure development, and technological innovation. Latin America, although with a smaller market share, exhibits opportunities for CAE adoption, particularly in emerging economies looking to enhance their manufacturing capabilities.

The Middle East and Africa, while in the early stages of CAE adoption, showcase growth prospects driven by investments in infrastructure and engineering capabilities. In summary, the regional analysis of the CAE market in 2023 underscores North America’s dominant position, while recognizing the diverse dynamics and growth potential across other regions as CAE continues to reshape engineering and product development practices globally.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Computer-Aided Engineering (CAE) market is highly competitive and consists of several prominent players who offer a wide range of software solutions and services. These key players have established themselves as industry leaders by continuously innovating and providing comprehensive CAE tools to meet the evolving needs of engineers and designers.

To develop new products and keep ahead of their competitors, industry players invest in R&D. Through mergers and acquisitions, companies can acquire new software technologies. They want to build a customer base through investments in marketing and sales. The existing players have a strong customer base and continually improve their products through R&D, preventing start-ups from entering the market. These companies offer specialized services and products at high prices to their customers. This will ensure that buyers have low bargaining power. Through marketing and sales, they aim to build a loyal customer base.

Top Kеу Рlауеrѕ:

- ANSYS, Inc.

- Autodesk, Inc.

- Altair Engineering

- Dassault Systemes

- Exa Corporation

- Bentley Systems, Inc.

- ESI Group

- MSC Software Corporation

- Mentor Graphics Corporation

- Other Key Players

Recent Development

- In January 2023, Autodesk introduced its latest CAE software, Autodesk Simulation CFD. This software is crafted to assist engineers in simulating things like fluid flow, heat transfer, and other physical happenings.

- Moving to February 2023, Siemens PLM Software unveiled its newest CAE software, Siemens NX Nastran. This software is built to aid engineers in simulating issues related to structures, heat, and fluid dynamics.

- Fast forward to March 2023, Ansys rolled out its fresh CAE software, Ansys Discovery Live. This software is all about helping engineers easily and quickly simulate their product designs.

Report Scope

Report Features Description Market Value (2023) US$ 9.6 Bn Forecast Revenue (2032) US$ 26 Bn CAGR (2023-2032) 10.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Computational Fluid Dynamics (CFD), Finite Element Analysis (FEA), Optimization & Simulation, and Multibody Dynamics), By End-Use (Electronics, Automotive, Medical devices, Defense & Aerospace, and Industrial Equipment), By Deployment Model (Cloud-Based and On-Premise) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ANSYS Inc., Autodesk Inc., Altair Engineering, Dassault Systemes, Exa Corporation, Bentley Systems Inc., ESI Group, MSC Software Corporation, Mentor Graphics Corporation, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Computer-Aided Engineering (CAE)?Computer-Aided Engineering (CAE) is a set of simulation tools and software that engineers use to analyze and simulate the behavior of products and systems in a virtual environment. It aids in design validation, optimization, and performance prediction

How does CAE differ from other engineering tools?CAE focuses on using computer-based simulations to analyze and solve engineering problems, distinguishing it from traditional methods. It includes various tools like finite element analysis, computational fluid dynamics, and multibody dynamics.

How big is Computer Aided Engineering MarketThe Global Computer Aided Engineering Market is anticipated to be USD 26 billion by 2033. It is estimated to record a steady CAGR of 10.6% in the Forecast period 2023 to 2033. It is likely to total USD 9.5 billion in 2023.

What are the key benefits of using CAE in engineering processes?The primary benefits include improved product design, reduced development costs, faster time-to-market, and enhanced performance. CAE allows engineers to identify and address potential issues in the virtual stage, saving time and resources.

What are the trends in the CAE market?Current trends in the CAE market include the integration of artificial intelligence and machine learning for advanced simulations, cloud-based CAE solutions for improved accessibility, and a focus on simulation-driven design.

Computer Aided Engineering MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Computer Aided Engineering MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- ANSYS, Inc.

- Autodesk, Inc.

- Altair Engineering

- Dassault Systemes

- Exa Corporation

- Bentley Systems, Inc.

- ESI Group

- MSC Software Corporation

- Mentor Graphics Corporation

- Other Key Players