Global Trehalose Market Size, Share, And Business Benefits By Source (Natural, Synthetic), By Product Type (Powder, Liquid), By Application (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Nutritional Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148168

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

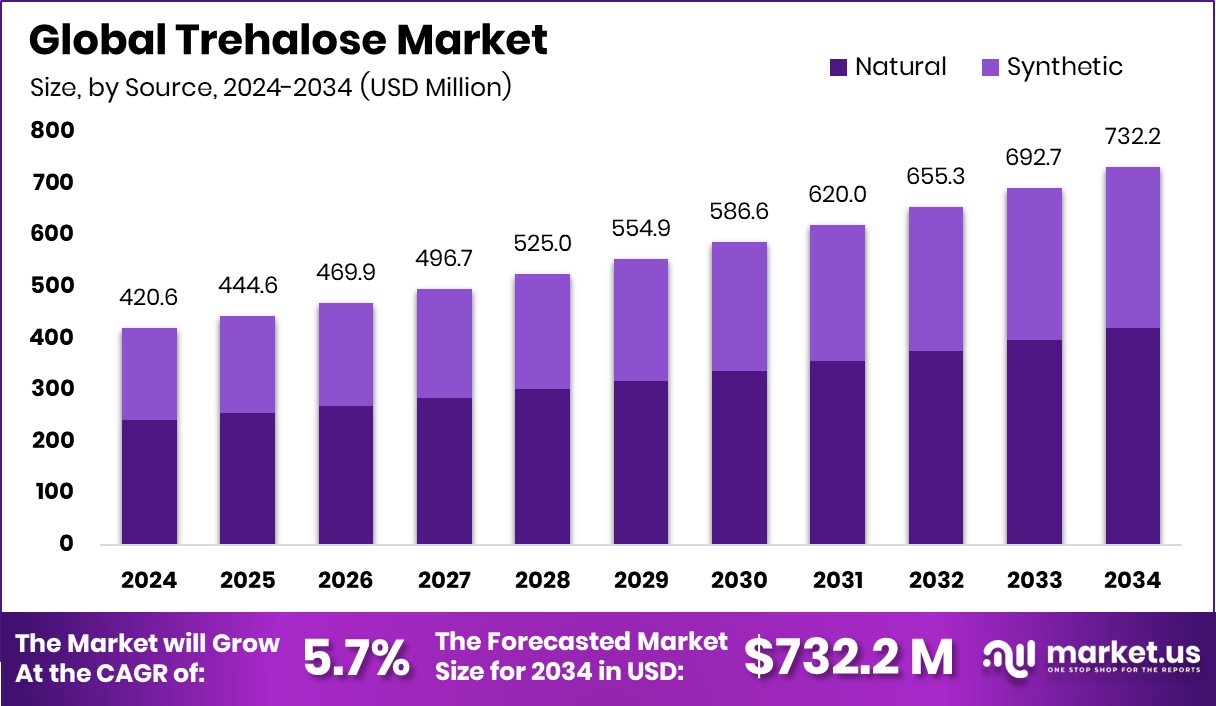

Global Trehalose Market is expected to be worth around USD 732.2 Million by 2034, up from USD 420.6 Million in 2024, and grow at a CAGR of 5.7% from 2025 to 2034. With 43.9% market share, Asia-Pacific secured USD 184.6 Mn in Trehalose sales.

Trehalose is a naturally occurring disaccharide composed of two glucose molecules. It is known for its exceptional stability and ability to retain moisture, making it a popular ingredient in food, pharmaceuticals, and cosmetics. Trehalose is found in mushrooms, yeast, and some plants and is often synthesized for commercial applications. It is widely used as a sugar alternative due to its low glycemic index and potential health benefits, such as protecting cells from dehydration and oxidative stress.

The trehalose market involves the production, distribution, and utilization of trehalose in various industries, including food and beverages, pharmaceuticals, and personal care. The market is driven by growing consumer demand for healthier sugar substitutes and the rising popularity of functional foods. Increasing awareness about the benefits of trehalose, such as its moisture-retaining properties and antioxidant capabilities, is further propelling market growth.

The global trehalose market is experiencing significant growth due to the rising demand for natural sweeteners. With increasing health consciousness, consumers are opting for low-calorie alternatives, boosting the adoption of trehalose in food and beverage products. Moreover, its unique moisture-retaining and stabilizing properties make it a preferred ingredient in the pharmaceutical and cosmetic sectors.

The demand for trehalose is rising in the food industry, particularly in bakery and confectionery products. Its ability to stabilize proteins and maintain the structure of food products under extreme conditions is enhancing its popularity. Additionally, the growing inclination towards clean-label products and natural ingredients is encouraging food manufacturers to incorporate trehalose as a healthier alternative to traditional sweeteners.

Key Takeaways

- Global Trehalose Market is expected to be worth around USD 732.2 Million by 2034, up from USD 420.6 Million in 2024, and grow at a CAGR of 5.7% from 2025 to 2034.

- Natural trehalose dominates the market with a 57.4% share, driven by consumer preference.

- Powdered trehalose holds a commanding 67.9% market share, favored for versatile applications.

- The food and beverage sector captures a 46.3% share, utilizing trehalose for improved product stability.

- Trehalose Market in Asia-Pacific reached USD 184.6 Mn, representing a 43.9% share.

By Source Analysis

Natural trehalose holds a significant 57.4% market share globally.

In 2024, Natural held a dominant market position in the By Source segment of the Trehalose Market, with a 57.4% share. The significant share underscores the growing demand for naturally sourced trehalose, driven by increasing consumer preference for natural and clean-label ingredients in food and beverage formulations.

The rising adoption of natural trehalose as a multifunctional ingredient in various end-use industries, such as confectionery, bakery, and pharmaceuticals, further solidifies its market dominance.

The sustained emphasis on natural sourcing is anticipated to maintain its leading position, as consumers increasingly prioritize product transparency and health-conscious consumption patterns.

By Product Type Analysis

Powdered trehalose dominates with a 67.9% share in the market.

In 2024, Powder held a dominant market position in the By Product Type segment of the Trehalose Market, with a 67.9% share. The extensive utilization of powdered trehalose across diverse applications, including food processing, pharmaceuticals, and cosmetics, significantly contributed to its market leadership.

The superior stability, easy handling, and extended shelf life of powdered trehalose have propelled its widespread adoption, especially in functional foods and nutraceuticals. The continued demand for convenient, easy-to-use ingredient forms is expected to reinforce the dominance of the powder segment, further driving its market share in the coming years.

By Application Analysis

The food and beverages sector captures 46.3% of the trehalose market.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Trehalose Market, with a 46.3% share. The extensive use of trehalose as a stabilizer, preservative, and texture enhancer in various food and beverage products has been a major driver of its market dominance.

The increasing demand for functional ingredients in confectionery, bakery, and dairy applications further underscores the segment’s significant share. Additionally, the growing consumer inclination toward natural sweeteners and low-calorie alternatives has bolstered the adoption of trehalose in the food and beverage sector, solidifying its market leadership.

Key Market Segments

By Source

- Natural

- Synthetic

By Product Type

- Powder

- Liquid

By Application

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceuticals

- Nutritional Products

- Others

Driving Factors

Rising Demand for Natural Sweeteners and Stabilizers

The growing consumer shift towards natural and clean-label products is significantly propelling the demand for trehalose. As a natural sweetener with a low glycemic index, trehalose is gaining traction in food and beverage applications, especially in confectionery, bakery, and dairy products. Its multifunctional properties as a stabilizer, moisture retainer, and texture enhancer further boost its use in processed foods.

Additionally, increasing awareness of the health benefits associated with natural sweeteners is pushing manufacturers to incorporate trehalose into their product formulations. The trend towards healthier, low-calorie alternatives is expected to maintain a strong momentum for trehalose, positioning it as a preferred ingredient in both mainstream and specialty food products.

Restraining Factors

High Production Costs Limit Market Penetration

The relatively high production costs of trehalose compared to conventional sweeteners pose a significant restraint to its market expansion. The complex extraction and processing methods, which involve the enzymatic conversion of starch, contribute to its elevated cost structure. This cost factor makes trehalose less competitive against cheaper alternatives like sucrose and high-fructose corn syrup, limiting its adoption, particularly in cost-sensitive markets.

Moreover, the price volatility of raw materials further exacerbates the cost challenges, impacting profit margins for manufacturers. Consequently, the high cost barrier restricts the wider application of trehalose, especially in large-scale food processing and mass-market products, thereby curbing its market penetration potential in the near term.

Growth Opportunity

Expanding Applications in Pharmaceuticals and Nutraceuticals Sector

The pharmaceutical and nutraceutical industries present significant growth opportunities for trehalose, driven by its unique properties as a stabilizer and moisture retainer. Trehalose is increasingly being utilized in drug formulations to enhance the stability of proteins and vaccines, particularly in freeze-dried products. Its ability to protect cells and biomolecules from stress conditions makes it ideal for applications in injectable drugs and biologics.

Furthermore, the rising demand for functional ingredients in nutraceuticals, such as dietary supplements and functional beverages, further broadens its market scope. As pharmaceutical companies continue to innovate and expand product lines, the adoption of trehalose as a multifunctional ingredient is expected to accelerate, creating lucrative growth prospects.

Latest Trends

Growing Interest in Trehalose for Functional Foods

In 2024, a notable trend in the trehalose market is its increasing incorporation into functional food products. Trehalose, a naturally occurring sugar, is valued for its ability to stabilize proteins, retain moisture, and enhance the shelf life of various food items. These properties make it particularly appealing for manufacturers aiming to develop products that align with health-conscious consumer preferences.

The demand for functional foods—those offering health benefits beyond basic nutrition—is on the rise, and trehalose’s unique characteristics position it as a suitable ingredient in this segment. Its application spans a range of products, including energy bars, fortified beverages, and dietary supplements.

As consumers continue to seek out foods that support overall well-being, the role of trehalose in functional food formulations is expected to expand, contributing to the growth of the trehalose market.

Regional Analysis

Asia-Pacific dominated the Trehalose Market in 2024, capturing 43.9%, worth USD 184.6 Mn.

In 2024, Asia-Pacific emerged as the dominant region in the Trehalose Market, capturing a substantial 43.9% share, translating to USD 184.6 Mn. The region’s leadership is attributed to the increasing demand for functional ingredients in food and beverage products, coupled with the expanding pharmaceutical and nutraceutical sectors.

Countries like China and Japan have witnessed rising consumption of trehalose due to its stabilizing and moisture-retaining properties in processed foods and pharmaceutical formulations. Meanwhile, North America and Europe maintained significant market shares, driven by the growing application of trehalose in dietary supplements and confectionery products.

The Middle East & Africa and Latin America segments displayed moderate growth, supported by the rising focus on functional foods and clean-label ingredients, positioning these regions as emerging markets for trehalose.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill Inc, a prominent multinational corporation, continued to leverage its extensive expertise in food ingredients and supply chain management to strengthen its position in the trehalose market. The company’s focus on sustainability and innovation has enabled it to meet the growing demand for natural sweeteners and functional ingredients, aligning with consumer preferences for clean-label products. Cargill’s strategic investments in research and development have facilitated the expansion of its trehalose offerings, catering to diverse applications in food and beverage, pharmaceuticals, and cosmetics.

Life Sciences Advanced Technologies maintained its reputation for high-quality trehalose products, particularly in the pharmaceutical and biotechnology sectors. The company’s commitment to producing high-purity trehalose powder and sterile solutions has been instrumental in supporting applications that require stringent quality standards. By focusing on niche markets and specialized applications, Life Sciences Advanced Technologies has carved out a significant presence in the trehalose industry.

Maruyama Mfg., while traditionally recognized for its contributions to agricultural machinery, has demonstrated adaptability by exploring opportunities within the trehalose market. The company’s emphasis on precision engineering and quality manufacturing positions it well to meet the specific requirements of trehalose production equipment. Maruyama’s potential involvement in the trehalose supply chain reflects a strategic diversification, aiming to capitalize on the growing demand for functional ingredients in various industries.

Top Key Players in the Market

- Cargill Inc

- Life Sciences Advanced Technologies

- Maruyama Mfg

- Mitsubishi Corporation

- Penta Manufacturer

- Shandong Fuyang Biotechnology

- Sinozyme Biotechnology

Recent Developments

- In July 2024, Mitsubishi Corporation entered into a strategic partnership with Neste to develop supply chains for renewable chemicals and plastics. This collaboration aims to support Japanese brands in industries such as food and beverage, apparel, and consumer electronics by providing sustainable, bio-based materials. While trehalose is not directly mentioned, the focus on renewable chemicals could influence the development and application of bio-based ingredients like trehalose in various products

Report Scope

Report Features Description Market Value (2024) USD 420.6 Million Forecast Revenue (2034) USD 732.2 Million CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Natural, Synthetic), By Product Type (Powder, Liquid), By Application (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Nutritional Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill Inc, Life Sciences Advanced Technologies, Maruyama Mfg, Mitsubishi Corporation, Penta Manufacturer, Shandong Fuyang Biotechnology, Sinozyme Biotechnology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill Inc

- Life Sciences Advanced Technologies

- Maruyama Mfg

- Mitsubishi Corporation

- Penta Manufacturer

- Shandong Fuyang Biotechnology

- Sinozyme Biotechnology