Global Thermoplastic Starch Market Size, Share Analysis Report By Manufacturing Type (Extrusion Molding, Injection Molding), By Application (Bags, Films, 3-D Printing, Others), By End-User (Packaging, Agriculture and Horticulture, Consumer Goods, Medical and Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160463

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

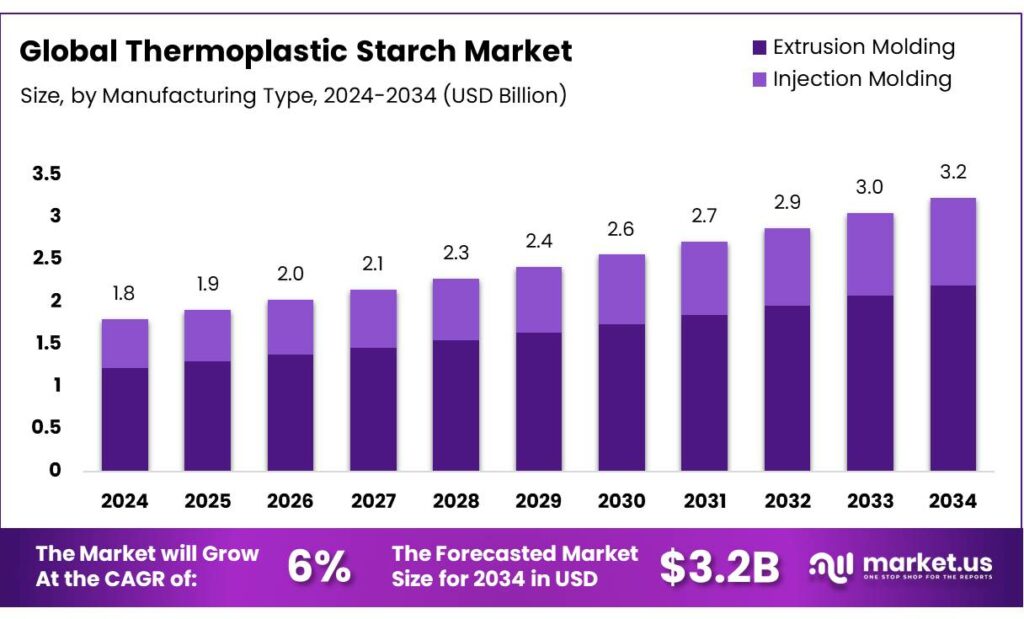

The Global Thermoplastic Starch Market size is expected to be worth around USD 3.2 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

Thermoplastic Starch (TPS) is a biodegradable polymer derived from native starch which is plasticized and processed via melt extrusion or injection. TPS retains biodegradability under appropriate composting conditions, while providing thermoplastic processability, and is often blended with other biopolymers to enhance mechanical characteristics. Use of starch-based bioplastics can reduce greenhouse gas (GHG) emissions by up to 80% relative to conventional plastics and reduce non-renewable energy consumption significantly.

Several driving factors underpin growth in TPS. First, regulatory pressure and plastic waste mitigation policies are accelerating demand for biodegradable alternatives. For instance, India’s Plastic Waste Management (PWM) Amendment Rules, 2021, phased out many single-use plastics and restricted carry bags under 120 microns thickness.

Extended Producer Responsibility (EPR) guidelines slated to take effect from April 2026 will further compel packaging producers to internalize waste costs. Second, governmental support and incentives are being proposed: a recent Assocham/EY policy draft recommends capital subsidies of up to 50% on eligible investments in bioplastics over five years.

Internationally, many countries under the European Green Deal and similar sustainability legislation are tightening restrictions on non-biodegradable plastics, thus favoring alternatives like TPS. In agriculture-driven countries, some governments and institutions are exploring use of surplus starch (e.g. rice or cassava) for bioplastic production—for instance, Thailand’s Plastics Institute was tasked to use 10,000 tonnes of government-stock rice for bioplastic production.

Key Takeaways

- Thermoplastic Starch Market size is expected to be worth around USD 3.2 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 6.0%.

- Extrusion Molding held a dominant market position, capturing more than a 68.3% share.

- Bags held a dominant market position in the Thermoplastic Starch market by application, capturing more than a 39.8% share.

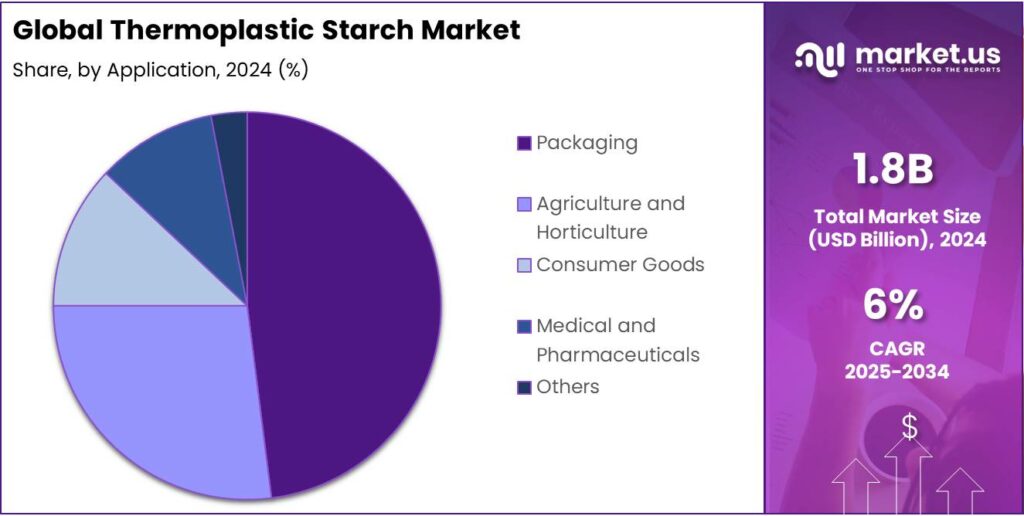

- Packaging held a dominant market position in the Thermoplastic Starch market by end-user, capturing more than a 48.9% share.

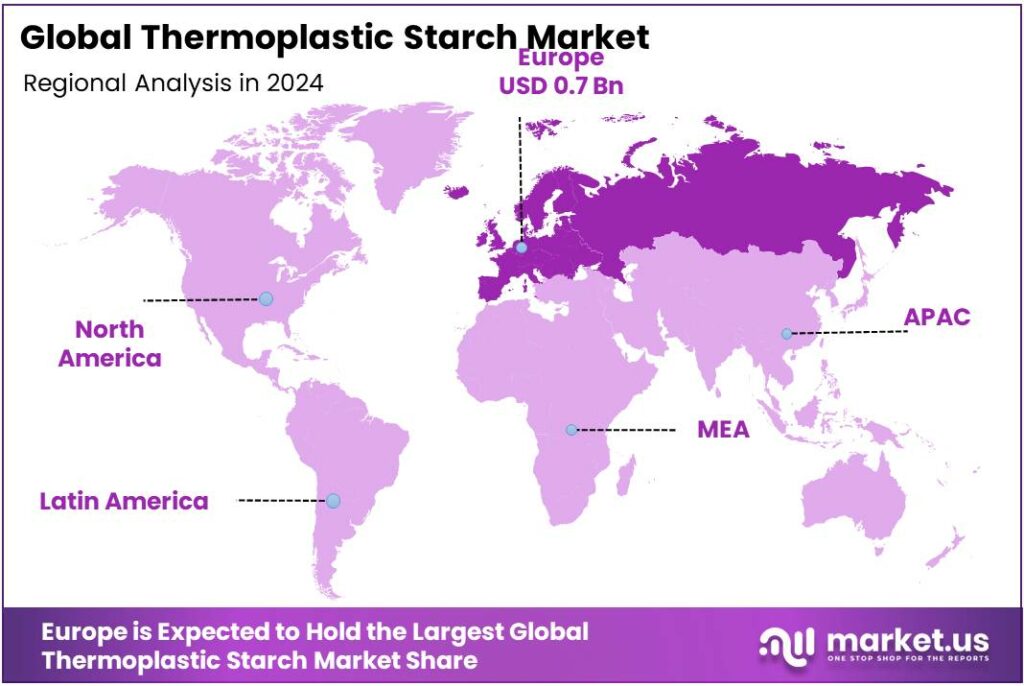

- Europe held a leading position in the Thermoplastic Starch market, capturing a 43.9% share, with the market valued at approximately USD 0.7 billion.

By Manufacturing Type Analysis

Extrusion Molding dominates with 68.3% due to its efficiency and versatility.

In 2024, Extrusion Molding held a dominant market position, capturing more than a 68.3% share of the Thermoplastic Starch market by manufacturing type. This prominence is largely attributed to the method’s ability to efficiently process starch-based materials into films, sheets, and packaging components while maintaining consistent quality and reducing production time. The technique allows for uniform mixing of plasticizers, resulting in thermoplastic starch products with enhanced flexibility and durability, which are increasingly preferred by packaging and disposable product manufacturers.

Continued adoption of extrusion molding is expected to consolidate its market lead, supported by growing demand for biodegradable packaging solutions across food, medical, and consumer goods sectors. The scalability of extrusion molding processes also makes it cost-effective for large-volume production, reinforcing its position as the primary manufacturing method in the TPS industry.

By Application Analysis

Bags dominate with 39.8% due to high demand in sustainable packaging.

In 2024, Bags held a dominant market position in the Thermoplastic Starch market by application, capturing more than a 39.8% share. The preference for TPS-based bags is driven by increasing environmental awareness and the global push to reduce single-use plastics. These biodegradable bags are widely used in retail, groceries, and food packaging, offering an eco-friendly alternative without compromising durability or convenience.

The demand for TPS bags is expected to rise further, fueled by government regulations promoting sustainable materials and consumer preference for green products. The adaptability of thermoplastic starch in producing various bag sizes and thicknesses also supports its continued dominance in the market, making it the leading application segment in the TPS industry.

By End-User Analysis

Packaging dominates with 48.9% due to its widespread adoption in sustainable solutions.

In 2024, Packaging held a dominant market position in the Thermoplastic Starch market by end-user, capturing more than a 48.9% share. The growth in this segment is primarily driven by the increasing demand for eco-friendly and biodegradable packaging solutions across food, retail, and consumer goods industries. Thermoplastic starch offers an effective alternative to conventional plastics, combining durability with environmental sustainability, which aligns with the global push to reduce plastic waste.

the packaging sector is expected to maintain its leading position, supported by government initiatives promoting sustainable materials and rising consumer preference for green packaging options. The versatility of TPS in creating films, bags, and containers further strengthens its adoption in the packaging industry, making it the most significant end-user segment in the market.

Key Market Segments

By Manufacturing Type

- Extrusion Molding

- Injection Molding

By Application

- Bags

- Films

- 3-D Printing

- Others

By End-User

- Packaging

- Agriculture and Horticulture

- Consumer Goods

- Medical and Pharmaceuticals

- Others

Emerging Trends

Nanocellulose and Nano-Enabled Reinforcement of TPS

A recent trend pushing thermoplastic starch (TPS) forward is the incorporation of nanocellulose or nano-fillers into starch matrices to boost mechanical strength, barrier properties, and thermal stability. Traditional TPS can be brittle and quite sensitive to moisture, but adding nanoscale cellulose fibers or crystals helps reinforce the structure without sacrificing biodegradability. A 2025 review article discusses how nano-enabled modifications are increasingly studied to overcome TPS’s inherent weaknesses.

Governments and sustainability policies help nudge this trend. With stricter rules on plastic waste and rising interest in circular bioeconomies, materials that combine biodegradability with strength are increasingly attractive to regulators, brand owners, and funders. In food packaging especially, calls for better barrier, mechanical, and shelf-life performance push TPS systems to evolve—and nano-reinforced blends offer a route forward.

In parallel, modeling and simulation work is validating these approaches. For instance, scientists have developed a MARTINI coarse-grained force field for TPS-nanocellulose composites, enabling prediction of modulus, density, chain interactions, and composite morphology. This helps kit design without costly trial experiments.

On a more human note: this trend feels like a natural evolution—not trying to reinvent starch, but giving it help (nano-support) so it can better carry its load in the material world. Instead of discarding TPS as too weak, researchers are finding clever, low-impact ways to make it stronger. If this scaling continues, TPS with nanocellulose could bridge the gap between environmental ideals and practical performance—helping industry adopt greener plastics without conceding too much on function.

Drivers

Accelerating Shift Away from Single-Use Plastics

One of the biggest reasons thermoplastic starch (TPS) is gaining traction is because the world is pushing hard to reduce reliance on single-use plastics — especially in food packaging — and regulators, NGOs, and consumers are demanding real change.

Plastic pollution is already a global crisis. The United Nations Environment Programme (UNEP) says 19-23 million tonnes of plastic waste leak into aquatic ecosystems annually. Much of this comes from mismanaged single-use items. When regulators ban or restrict those items, industries feel the pressure to find substitutes. TPS is one of the materials that gets attention in policy debates around bioplastics.

In many countries, governments are issuing rules or targets to phase out or reduce single-use plastics. For example, in the European Union, packaging accounts for about 36 % of all plastics produced, with “single-use” food & beverage containers forming a large share. Under the EU’s Single-Use Plastics Directive, many disposable plastic items are banned or required to be substituted by alternatives, which opens room for materials like TPS.

Another driver is brand reputation. Food and beverage companies know that consumers increasingly value sustainability. If a brand can say “our packaging is made from biodegradable starch,” that story resonates. Many food-industry players now set “zero plastic waste” or “100 % compostable packaging” goals, and TPS becomes one of the feasible tools to meet those goals.

Restraints

Price Volatility & Unpredictable Feedstock Costs

One big challenge slowing down the adoption of thermoplastic starch (TPS) is the volatility in starch and raw crop prices, which makes planning and cost control very difficult for producers. Starch doesn’t come from a dedicated “plastic crop” in most cases — it’s derived from food crops (corn, wheat, cassava, potatoes). Because of that, its price and supply are tied to the fluctuations in global and local food markets. For example, the FAO has long warned that “recent bouts of extreme price volatility in global agricultural markets” pose rising threats to food security and increase risk for sectors dependent on agricultural inputs.

To put numbers to this: in the roots and tubers sector (from which many starch sources come), exports from Thailand and Vietnam alone are projected to reach 19 million tonnes (Mt) in medium term to serve starch and bio-industries. That scale means that any shift in demand or supply (even a few percent) can ripple into price changes. Because TPS developers buy starch as a raw material, they are exposed to whatever price swings happen in the food and agricultural commodity markets.

In India, the government acts to stabilize food grain markets and procures large volumes of staples; for example, in the 2024/25 marketing year, rice procurement is estimated at ~ 55 million metric tonnes (MMT)—well above the government’s required ~ 40.5 MMT for distribution programs. This sort of large-scale procurement influences domestic grain and starch markets. When governments step in to buy or release stocks, they can compress or inflate prices unexpectedly.

These interventions, plus weather events, export bans, or logistical disruptions, can cause sudden cost increases for starch. And TPS processors often operate on tight margins; a 10-20 % jump in starch cost may force them to raise product prices or absorb losses. Moreover, when prices are unpredictable, investors hesitate, production scaling slows, and supply contracts become risky.

Opportunity

Valorization of Food & Agricultural Waste as Feedstock

One of the most promising opportunities for thermoplastic starch (TPS) lies in converting food and agricultural waste streams into starch or polysaccharide feedstock rather than relying solely on first-crop starch sources. This “waste to material” pathway not only reduces pressure on land and food systems, but also adds value to residues that are often underutilized or disposed. Globally, it is estimated that 1.3 billion tonnes of food is wasted each year. Many waste fractions—peels, pulp, husks, rejected produce—contain starch, cellulose, hemicellulose, or fermentable sugars.

By extracting starch or converting carbohydrate residues into starch-like precursors, TPS producers can reduce dependency on food crop starch, stabilize costs, and improve sustainability. For example, residues from cassava, potato peel, banana peel, or tapioca waste in food processing can be tapped. Such valorization also aligns with national and global waste reduction goals. For instance, India’s national waste management policies push for better utilization of organic waste and reducing landfill burden.

From a commercial lens, using waste feedstock can provide a distinguishing brand story: “made from food waste” resonates with consumers and may command a premium or improved acceptance from regulators or NGOs. Since the base waste volumes are large, even converting a small share can yield meaningful feedstock volume. Suppose a region generates 1 million tonnes of potato processing waste per year; capturing even 1 % for starch extraction (i.e. 10,000 t) could supply a small TPS facility.

Governments and institutions can support this opportunity. For example, extension programs could subsidize waste collection logistics, set up decentralized starch extraction units in food clusters, or offer tax breaks for industries using waste feedstock in bioplastic production. With regulatory pressure mounting to reduce packaging waste and the push for circular economy models, TPS made from agricultural waste fits neatly into sustainable packaging strategies. For instance, the market for eco-friendly food packaging was valued at USD 199.99 billion in 2024, highlighting strong demand for materials that reduce environmental footprint.

Regional Insights

Europe dominates with 43.9% share, valued at USD 0.7 billion, due to strong demand for sustainable materials.

In 2024, Europe held a leading position in the Thermoplastic Starch market, capturing a 43.9% share, with the market valued at approximately USD 0.7 billion. The region’s dominance is primarily driven by stringent environmental regulations, rising awareness of plastic pollution, and government incentives supporting biodegradable materials. Countries such as Germany, France, and the Netherlands have implemented policies that encourage the replacement of conventional plastics with sustainable alternatives in packaging, retail, and consumer products. For instance, the European Union’s Single-Use Plastics Directive mandates a reduction in the use of conventional plastics, directly boosting the adoption of thermoplastic starch-based products.

The demand for TPS in Europe is largely concentrated in packaging applications, including bags, films, and disposable containers, which align with consumer preferences for eco-friendly products. By 2025, the market is projected to grow steadily, supported by both private sector initiatives and public awareness campaigns promoting circular economy practices. Europe’s advanced manufacturing infrastructure enables efficient production of TPS, allowing for high-quality biodegradable products at competitive prices. Additionally, the region’s robust recycling and composting frameworks further encourage the adoption of starch-based thermoplastics, as these materials can be effectively integrated into existing waste management systems.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Biome Bioplastics, headquartered in the UK, specializes in renewable and biodegradable polymers, including TPS for packaging, bags, and disposable products. In 2024, the company emphasized research into starch-based formulations with enhanced flexibility, processability, and compostability. Biome Bioplastics’ products are designed to meet strict European environmental standards and consumer demand for eco-friendly materials. By collaborating with converters and brands, the company supports large-scale adoption of TPS. Its focus on innovation and sustainability ensures Biome Bioplastics continues to play a significant role in the European thermoplastic starch market.

Danimer Scientific, headquartered in the US, is a global provider of biodegradable polymers, including thermoplastic starch blends for packaging and disposable items. In 2024, the company focused on scaling production capacity and improving TPS formulations for enhanced flexibility and biodegradability. Danimer’s products are aligned with regulatory mandates and growing consumer preference for sustainable packaging solutions. Strategic partnerships with converters and brand owners strengthen its market presence. With an emphasis on innovation and environmental stewardship, Danimer Scientific continues to be a prominent player in North America’s and global TPS markets.

BASF, a global chemical giant, has significantly expanded its thermoplastic starch offerings to address the growing demand for biodegradable plastics. In 2024, BASF emphasized TPS solutions for packaging, agricultural films, and consumer products. The company combines advanced polymer technology with renewable starch sources to enhance flexibility, durability, and compostability. Government incentives for eco-friendly materials in Europe and North America have further supported BASF’s market growth. With continuous R&D investment, BASF remains a key contributor to the TPS market, providing innovative and sustainable polymer solutions.

Top Key Players Outlook

- AGRANA

- BASF

- BioLogiQ Inc.

- Biome Bioplastics

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- Danimer Scientific

- Great Wrap

- Grupa Azoty

- Kuraray Co., Ltd

- Novamont S.p.A (Versalis S.p.A.)

- Rodenburg Biopolymers

Recent Industry Developments

In 2024 Danimer Scientific, the company faced financial challenges: by March 2025, it filed for Chapter 11 bankruptcy protection, citing weaker demand and cash flow pressures.

In 2024 AGRANA, amid falling raw material and energy input costs, AGRANA’s starch selling prices declined despite stable or higher volumes, putting pressure on margins (EBIT in the segment was only €31.9 million).

Report Scope

Report Features Description Market Value (2024) USD 1.8 Bn Forecast Revenue (2034) USD 3.2 Bn CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Manufacturing Type (Extrusion Molding, Injection Molding), By Application (Bags, Films, 3-D Printing, Others), By End-User (Packaging, Agriculture and Horticulture, Consumer Goods, Medical and Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGRANA, BASF, BioLogiQ Inc., Biome Bioplastics, BIOTEC Biologische Naturverpackungen GmbH & Co. KG., Danimer Scientific, Great Wrap, Grupa Azoty, Kuraray Co., Ltd, Novamont S.p.A (Versalis S.p.A.), Rodenburg Biopolymers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Thermoplastic Starch MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Thermoplastic Starch MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AGRANA

- BASF

- BioLogiQ Inc.

- Biome Bioplastics

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- Danimer Scientific

- Great Wrap

- Grupa Azoty

- Kuraray Co., Ltd

- Novamont S.p.A (Versalis S.p.A.)

- Rodenburg Biopolymers