Global Thermoplastic Polyurethane Market Size, Share, And Business Benefits By Product Type (Polyester TPU, Polyether TPU, Polycaprolactone TPU), By Application (Injection Molding, Extrusion, Adhesives and Sealants, Paints and Coatings), By End User (Footwear, Automotive, Medical, Electrical and Electronics, Construction, Heavy Engineering), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167177

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

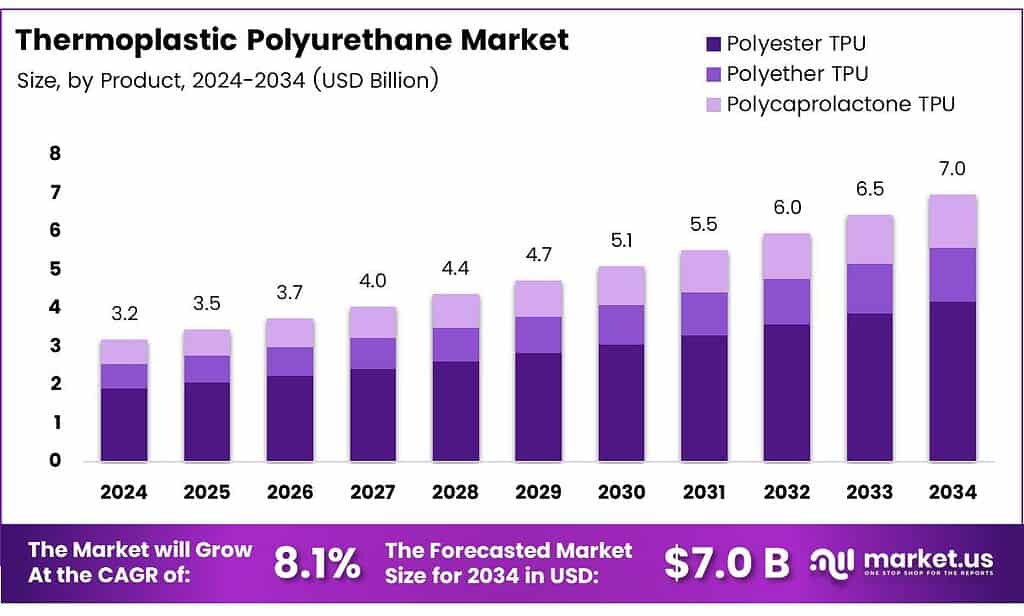

The Global Thermoplastic Polyurethane Market size is expected to be worth around USD 7.0 billion by 2034, from USD 3.2 billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

Thermoplastic polyurethane (TPU) is a versatile polymer known for flexibility, durability, and chemical resistance, making it suitable for automotive parts, footwear, medical devices, cables, and 3D printing applications. The Thermoplastic Polyurethane Market represents the growing commercial ecosystem supporting production, demand, material innovation, and downstream adoption across industrial, consumer, and specialty applications.

The market is shifting as industries prioritize lightweight materials, sustainability goals, and high-performance polymers. TPU performs well in demanding environments, helping manufacturers reduce component weight without sacrificing strength. As industries move toward electrification and new mobility systems, TPU is increasingly used in EV interiors, wire coatings, and flexible sealing systems.

- In research and material testing, differential scanning calorimetry techniques help verify performance characteristics. DSC Q2000 systems evaluate TPU material structure using a 10°C/min heating rate between 20°C and 240°C with a 6–8 mg sample size, ensuring consistent thermal behavior profiling. TPU demonstrates durability across -40°C to over 125°C, supporting its use in outdoor equipment, automotive wiring, and industrial hoses. Its ease of processing and reusability reduce waste compared with traditional elastomers and thermoset materials.

Growth is further influenced by increasing interest in circular material flows. TPU can be melted, reshaped, and reused, addressing waste reduction targets in packaging, textiles, and sporting goods. This recyclability advantage supports sustainability-driven procurement strategies, aligning with regulatory frameworks encouraging low-carbon or recyclable materials in industrial manufacturing and consumer goods.

Key Takeaways

- The Global Thermoplastic Polyurethane Market is projected to reach USD 7.0 billion by 2034, growing from USD 3.2 billion in 2024, at a CAGR of 8.1% between 2025 and 2034.

- Polyester TPU leads the market with a dominant share of 57.2%.

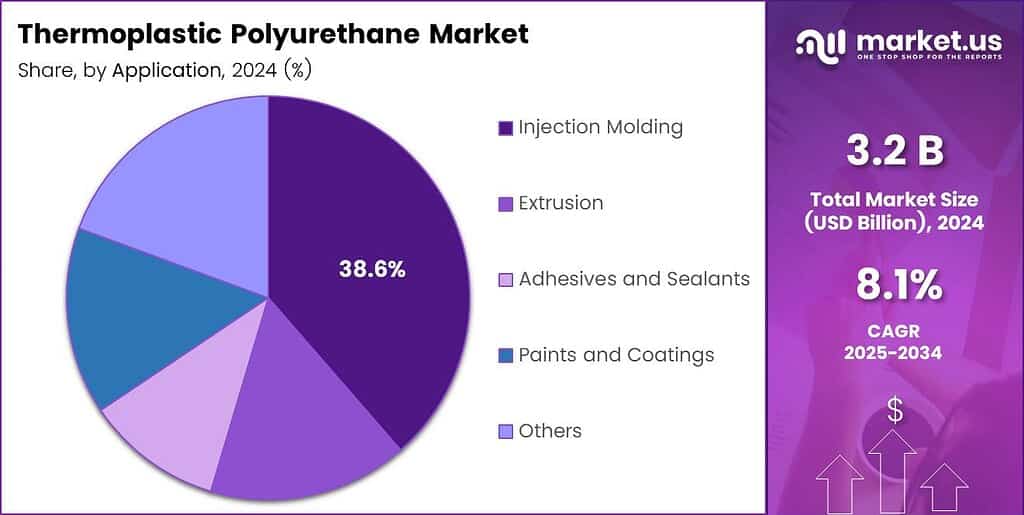

- Injection Molding holds the highest adoption rate with a share of 38.6%.

- The Footwear segment leads consumption with a market share of 34.1%.

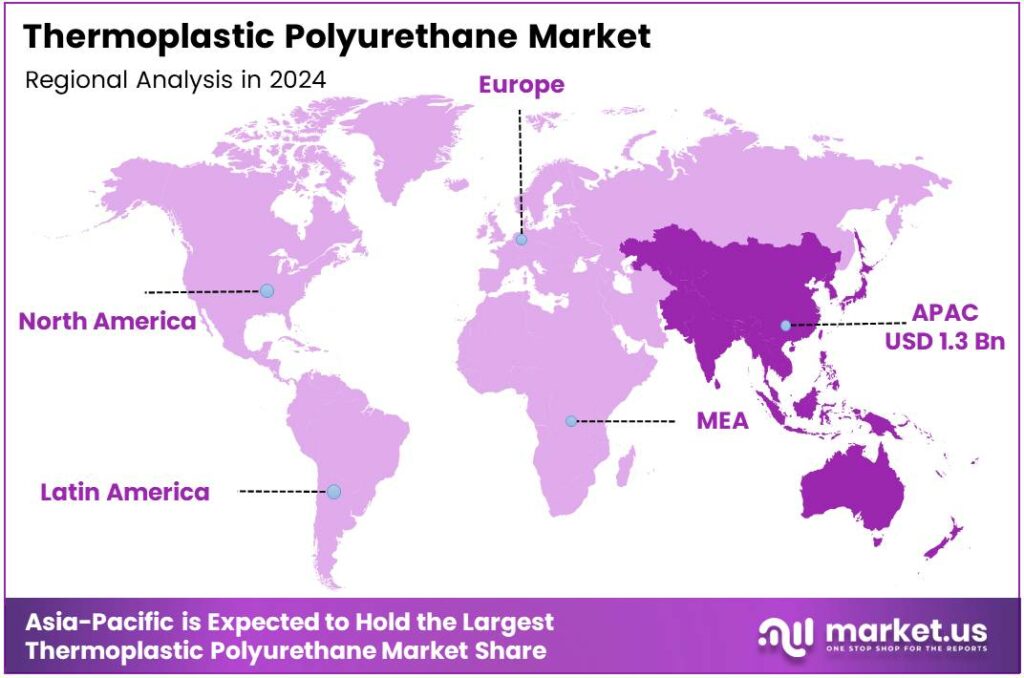

- The Asia-Pacific region accounts for the largest share of the market at 41.9%, valued at USD 1.3 billion in 2024.

By Product Type Analysis

Polyester TPU dominates with 57.2% due to its versatility and mechanical strength.

In 2024, Polyester TPU held a dominant market position in the By Product Type analysis segment of the Thermoplastic Polyurethane Market, with a 57.2% share. Its strong abrasion resistance and high load-bearing capacity make it suitable for automotive parts, industrial belts, and performance footwear. Industries prefer it for toughness and chemical resistance.

Polyether TPU is growing steadily because it offers better hydrolysis resistance and flexibility at low temperatures. It performs well in environments with constant moisture exposure, making it ideal for cables, medical devices, and outdoor protective parts. Manufacturers also value its durability and consistency in dynamic applications such as hoses and pneumatic systems.

Polycaprolactone TPU is used where biodegradability and precision molding are required. The material attracts demand from medical fields, primarily for implants and 3D-printed components. Its high crystallinity allows low melting temperatures and improved thermal stability, enabling cleaner processing and efficient manufacturing with reduced waste.

By Application Analysis

Injection Molding dominates with 38.6% due to its scalable and precise manufacturing.

In 2024, Injection Molding held a dominant market position in the By Application analysis segment of the Thermoplastic Polyurethane Market, with a 38.6% share. Its use in automotive interiors, consumer goods, and footwear supports scalability and accuracy. Quick cycle time and design freedom increase adoption across mass-manufacturing industries.

Extrusion applications continue to expand because TPU adapts well to films, sheets, and hoses. Producers benefit from extrusion’s continuous processing capability, improving cost efficiency. Industries leverage this segment for wire coatings, industrial tubing, and conveyor belts requiring consistency, abrasion resistance, and high elasticity in demanding environments.

Adhesives and Sealants remain essential where bonding strength and durability are key performance factors. TPU-based formulations offer superior elasticity and resistance to oils, fuels, and vibration. This drives strong adoption across automotive assembly, construction joints, and consumer repair materials where high bonding reliability is required.

By End User Analysis

Footwear dominates with 34.1% driven by comfort and design flexibility.

In 2024, Footwear held a dominant market position in the By End User analysis segment of the Thermoplastic Polyurethane Market, with a 34.1% share. Brands prefer TPU for cushioning, wear resistance, and lightweight design. It supports performance, durability, and visual customization across casual, athletic, and safety footwear applications.

Automotive uses TPU in instrument panels, cables, seals, and energy-absorbing parts. The material’s strength, flexibility, and heat resistance support long-term use in vehicle interiors and exterior protective components. Growing electric vehicle adoption also increases demand for durable wire insulation and lightweight material solutions.

Medical applications include catheters, tubing, prosthetics, and flexible surgical components. TPU is preferred due to its biocompatibility, chemical stability, and ease of sterilization. Hospitals and device manufacturers rely on consistent molding quality and smooth surface texture, supporting safety and comfort in patient-contact applications.

Key Market Segments

By Product Type

- Polyester TPU

- Polyether TPU

- Polycaprolactone TPU

By Application

- Injection Molding

- Extrusion

- Adhesives and Sealants

- Paints and Coatings

- Others

By End User

- Footwear

- Automotive

- Medical

- Electrical and Electronics

- Construction

- Heavy Engineering

- Others

Emerging Trends

Growing Demand for Lightweight and Durable Materials Drives Market Trends

The Thermoplastic Polyurethane (TPU) market is experiencing strong momentum as more industries shift toward lightweight and durable materials. A key trend is the rising use of TPU in automotive parts, footwear, and flexible films. This shift is driven by manufacturers looking for materials that combine strength, flexibility, and long service life.

- Governments are also actively backing lightweight materials. For instance, the U.S. DOE’s Vehicle Technologies Office is actively driving research into lightweight structural materials—targeting a reduction of vehicle body and chassis weight by up to 50%.

Sustainability is becoming a major focus, and bio-based TPU is gaining popularity. Industries are now exploring renewable TPU grades made from plant-based feedstocks to reduce carbon emissions. This aligns with tighter environmental rules and growing consumer preference for eco-friendly materials.

Drivers

Growing Demand for Lightweight and Durable Materials Drives Market Growth

The Thermoplastic Polyurethane (TPU) market is expanding as industries look for materials that are strong but also lightweight. TPU offers high elasticity and toughness, making it an ideal material for products that require flexibility and long-lasting performance. Its ability to replace heavier traditional plastics supports growth across automotive, electronics, and consumer goods industries.

Another major driver is the rising demand for sustainable and recyclable materials. TPU can be reused and processed multiple times, making it an attractive option for manufacturers seeking to minimize waste. As environmental regulations tighten, more companies are shifting toward TPU to meet compliance requirements and support eco-friendly product designs.

Advancements in 3D printing improve TPU usage in prototyping and customized product development. Its compatibility with additive manufacturing enables designers to create complex shapes without compromising material performance, further accelerating adoption. As industries move toward innovation and automation, TPU’s versatile material characteristics position it as a preferred choice for future applications.

Restraints

High Production and Raw Material Costs Limit Market Growth

The Thermoplastic Polyurethane (TPU) market faces a major restraint due to high production costs. TPU requires advanced equipment and energy-intensive processes, making it more expensive than other plastics like PVC or standard polyurethane. This cost gap often forces manufacturers, especially in price-sensitive markets, to choose cheaper alternatives over TPU despite its performance benefits.

- In the European Union, the use of di-isocyanates (key building blocks in TPU and PU elastomers) now triggers stringent requirements: any product containing ≥ 0.1% free di-isocyanate by weight can be sold only if workers involved have undergone certified training.

TPU faces competitive pressure from new bio-based materials and emerging elastomer technologies. These alternatives offer lower cost or better eco-performance, making them attractive substitutes. As a result, industries like footwear, automotive, and consumer goods may gradually shift away from TPU if cost and sustainability challenges are not addressed.

Growth Factors

Growing Demand for Lightweight and Flexible Materials Creates Strong Opportunities

Rising demand for lightweight and flexible materials in industries such as automotive, footwear, and electronics is creating major opportunities for Thermoplastic Polyurethane (TPU). As companies focus on weight reduction and better durability, TPU is becoming a preferred alternative to rubber, PVC, and traditional plastics due to its flexibility and long-life performance.

Another strong opportunity comes from the expansion of electric vehicles. TPU is widely used in EV charging cables, battery covers, wire insulation, and interior parts. As EV adoption grows globally, manufacturers are increasing their use of TPU because it supports heat resistance, abrasion strength, and long-lasting elasticity.

Sustainability is also creating a new avenue for TPU growth. The shift toward recyclable materials, eco-friendly footwear, and low-carbon manufacturing is encouraging companies to replace older materials with TPU-based biodegradable and bio-based alternatives. This trend is expected to accelerate over the next few years.

Regional Analysis

Asia-Pacific Leads the Thermoplastic Polyurethane Market with a Market Share of 41.9%, Valued at USD 1.3 Billion

The Asia-Pacific region holds the largest share in the Thermoplastic Polyurethane (TPU) market and continues to expand due to high demand from automotive, electronics, footwear, and industrial manufacturing. The region’s strong manufacturing base and rapid industrialization further support the adoption of TPU-based materials. The market value of USD 1.3 billion and a dominant share of 41.9% reflect increasing production investments and government support for lightweight, durable, and recyclable materials.

North America shows steady demand driven by advanced processing technologies and the adoption of TPU across medical devices, 3D printing, and automotive interior applications. The region benefits from strong research initiatives and regulatory support for sustainable, high-performance materials. Increasing demand for recyclable polymers and performance-driven plastics continues to support regional growth.

Europe demonstrates solid progress in the TPU market, supported by stringent sustainability frameworks, circular economy initiatives, and increased interest in bio-based TPU. The region sees demand from sportswear, industrial machinery, and automotive lightweighting initiatives. Adoption of advanced coating, adhesive, and wire insulation applications strengthens market performance.

The U.S. market exhibits strong demand fueled by innovation in medical devices, wearable electronics, and aerospace applications. Robust R&D capabilities and preference for high-performance polymers drive consistent consumption. Increasing focus on sustainability and high-precision engineered materials continues to shape long-term market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Thermoplastic Polyurethane (TPU) market in 2024 continues to evolve with strong contributions from leading manufacturers focusing on advanced formulations, improved durability, and sustainability-focused material innovation. Market growth is influenced by increasing demand from automotive, footwear, electronics, and medical applications.

BASF SE plays a key role by expanding high-performance TPU solutions for demanding sectors such as automotive interiors, sports footwear, and industrial machinery. The company focuses on product quality, innovative material chemistry, and collaboration with downstream users to support long-term TPU demand.

COIM continues strengthening its TPU manufacturing capabilities with a focus on tailored grades for adhesives, film extrusion, and specialty molding applications. Its global presence and industry-focused approach allow the company to serve niche and large-scale end users efficiently.

Headway Polyurethane Co. Ltd. is positioned as a strategic contributor in Asia, benefiting from rising domestic demand across consumer goods, protective equipment, and industrial products. The company continues emphasizing cost-efficient production and high-performance material offerings.

Hexpol AB contributes to market momentum by advancing TPU compounds for sustainability-driven industries. With strong expertise in specialty elastomers and polymer modification, the company aligns material innovation with emerging circular economy objectives and high-value engineering applications.

Top Key Players in the Market

- BASF SE

- COIM

- Headway Polyurethane Co. Ltd.

- Hexpol AB

- Huntsman Corporation

- Lubrizol Corporation

- Miracll Chemical Co. Ltd.

- Polyone Corporation

Recent Developments

- In 2024, BASF launched Haptex 4.0, a polyurethane-based synthetic leather solution that is fully recyclable using PET fabric, reducing the need for multi-layer separation in production and disposal. Additionally, BASF partnered with Jiangsu Worldlight to unveil a polyurethane-based photovoltaic module frame at CHINAPLAS.

- In 2024, Headway Polyurethane Co. Ltd., a Chinese manufacturer specializing in polyurethane resins and TPU pellets, has limited publicly available details on recent developments specific. The company continues to supply solvent-based, waterborne, and solvent-free polyurethane products, including TPU for films and technical applications.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 7.0 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Polyester TPU, Polyether TPU, Polycaprolactone TPU), By Application (Injection Molding, Extrusion, Adhesives and Sealants, Paints and Coatings, Others), By End User (Footwear, Automotive, Medical, Electrical and Electronics, Construction, Heavy Engineering, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BASF SE, COIM, Headway Polyurethane Co. Ltd., Hexpol AB, Huntsman Corporation, Lubrizol Corporation, Miracll Chemical Co. Ltd., Polyone Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Thermoplastic Polyurethane MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Thermoplastic Polyurethane MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- COIM

- Headway Polyurethane Co. Ltd.

- Hexpol AB

- Huntsman Corporation

- Lubrizol Corporation

- Miracll Chemical Co. Ltd.

- Polyone Corporation