Global Therapeutic Nuclear Medicine Market By Therapy (Alpha-emitters, Beta-emitters and Brachytherapy isotopes), By Clinical Indication (Oncology, Bone metastases, Thyroid disease and Other therapeutic areas), By End-User (Hospitals & Cancer Centers, Radiopharmacies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170830

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

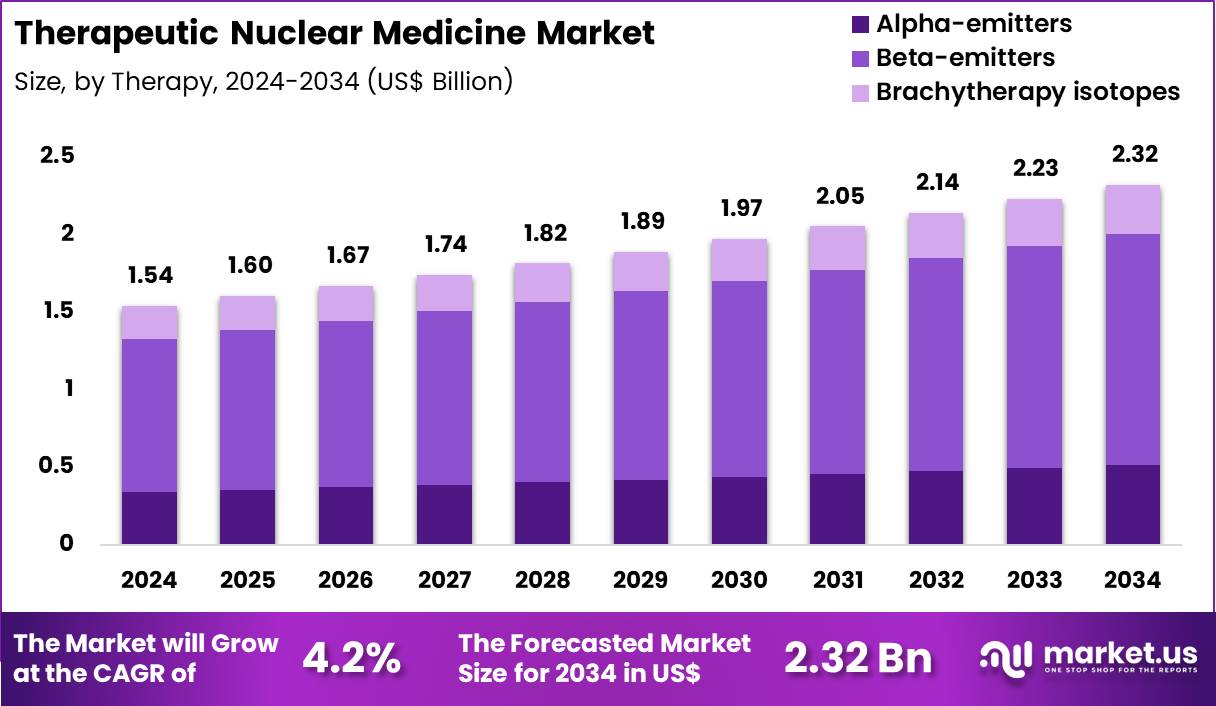

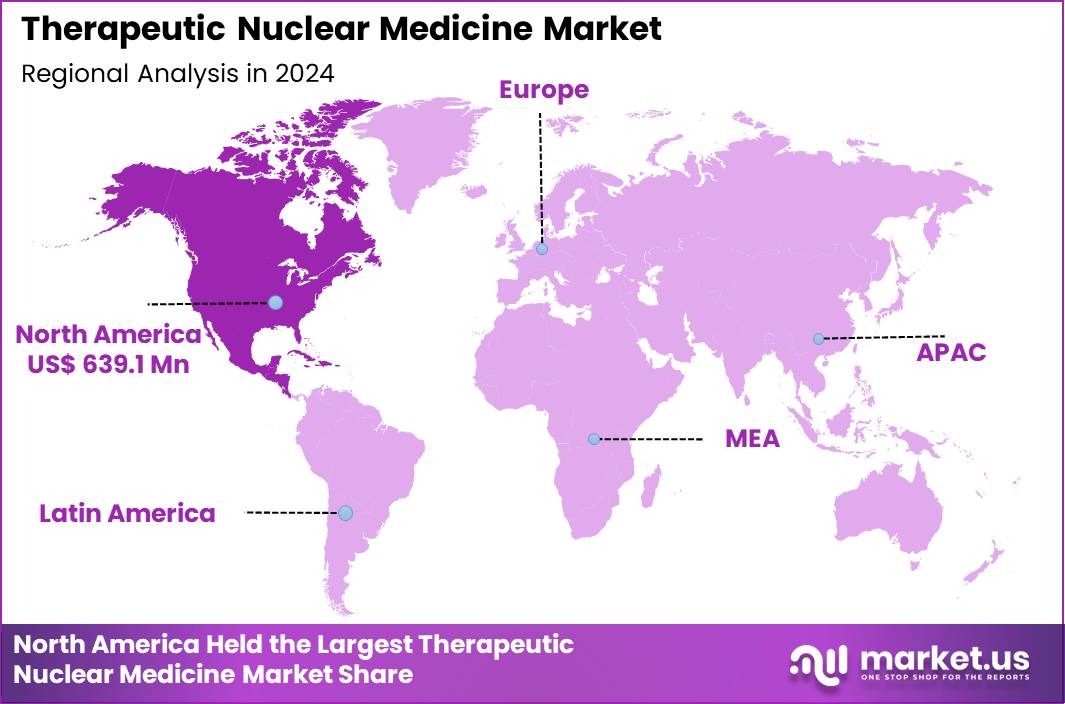

The Global Therapeutic Nuclear Medicine Market size is expected to be worth around US$ 2.32 Billion by 2034 from US$ 1.54 Billion in 2024, growing at a CAGR of 4.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.5% share with a revenue of US$ 639.1 Million.

The Therapeutic Nuclear Medicine Market represents a rapidly advancing segment within precision oncology and targeted radiopharmaceutical therapy. Growth is driven by expanding radioligand therapy (RLT) adoption, increasing incidence of metastatic cancers, rising preference for minimally invasive treatments, and the development of novel radioisotopes with improved tumor-targeting abilities.

Therapeutic radiopharmaceuticals are now routinely used in prostate cancer, neuroendocrine tumors, bone metastases, and thyroid disorders, supported by rising diagnostic imaging volumes and expanding theranostic applications.

The sector benefits from the increasing availability of medical isotopes such as Lu-177, I-131, Ra-223, Y-90, and Ac-225, each enabling highly targeted cellular disruption while minimizing damage to surrounding tissues. Healthcare systems increasingly adopt these therapies due to their proven survival benefits and quality-of-life improvements.

For example, Lu-177-PSMA therapy has demonstrated significant reductions in tumor burden in advanced prostate cancer, while Ra-223 has shown extended survival in metastatic bone involvement. Governments across North America, Europe, and Asia are also investing in isotope-production facilities to reduce dependency on international supply chains and strengthen oncology treatment capacity.

For instance, in November 2025, UCLA Health established the Department of Nuclear Medicine and Theranostics, the first dedicated department of its kind in the United States. This new entity aims to advance patient-centered care by unifying cutting-edge imaging with therapeutic innovation, accelerating scientific breakthroughs, and strengthening UCLA Health’s precision health capabilities.

Key Takeaways

- In 2024, the market generated a revenue of US$ 54 Billion, with a CAGR of 4.2%, and is expected to reach US$ 2.32 Billion by the year 2034.

- The Therapy segment is divided into Alpha-emitters, Beta-emitters, and Brachytherapy isotopes, with Beta-emitters taking the lead in 2024 with a market share of 64.2%

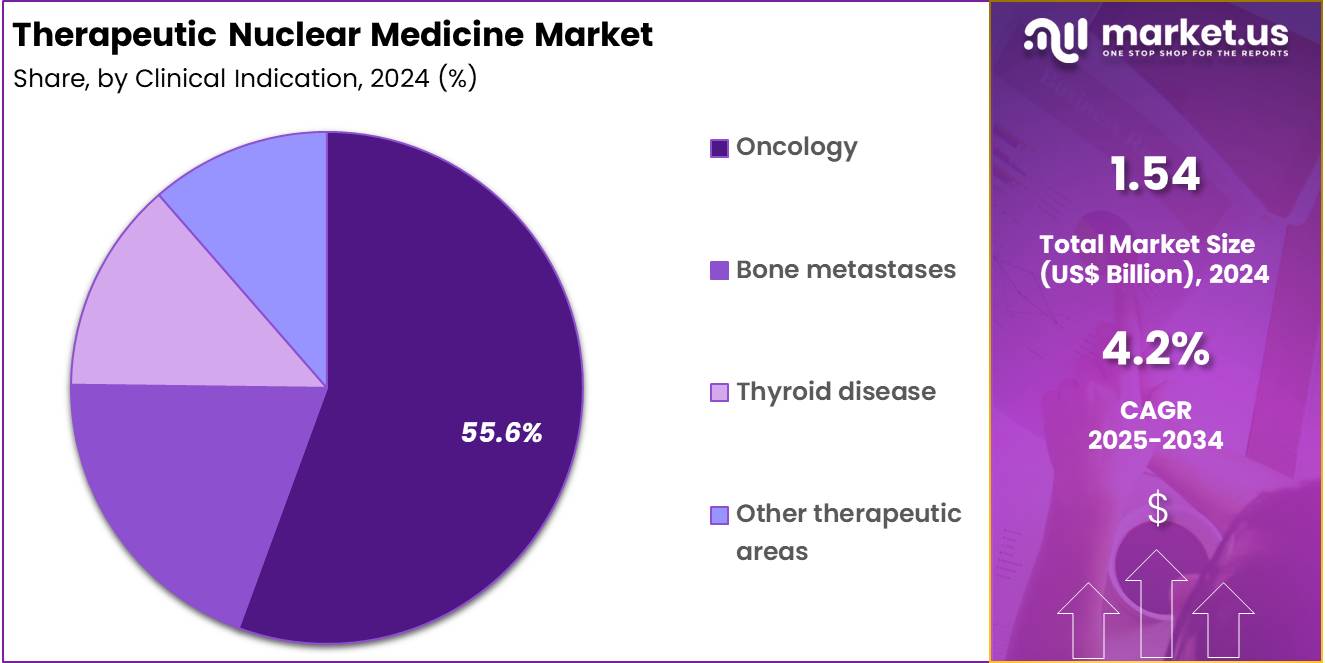

- The Clinical Indication segment is divided into Oncology, Bone metastases, Thyroid disease, and Other therapeutic areas, with Oncology taking the lead in 2024 with a market share of 55.6%

- The End-User segment is divided into Hospitals & Cancer Centers, Radiopharmacies, and Others, with Hospitals & Cancer Centers taking the lead in 2024 with a market share of 57.3%

- North America led the market by securing a market share of 41.5% in 2024.

Therapy Analysis

Beta-emitters represent the core of therapeutic nuclear medicine with dominating the therapy segment with 64.2% market share because of their well-established clinical utility and regulatory maturity. Widely used isotopes such as Lu-177 and Y-90 support treatment protocols for metastatic prostate cancer, neuroendocrine tumors, liver metastases, and follicular lymphoma. Global procedure volumes continue to rise; for example, thousands of Lu-177-DOTATATE treatments are administered annually for neuroendocrine tumors, supported by strong clinical outcomes showing improved progression-free survival.

Y-90 microsphere therapies are routinely used in interventional oncology for liver tumors, with radioembolization procedures increasing across North America, Europe, and parts of Asia. Educational guidelines released by the Society of Nuclear Medicine and Molecular Imaging (SNMMI) have further accelerated the adoption of beta-based radioligand therapy by standardizing clinical workflows.

In September 2024, Sanofi advanced its strategy to develop novel therapies for rare cancers by securing an exclusive licensing agreement with RadioMedix, Inc., a U.S. clinical-stage biotech specializing in PET imaging and targeted alpha therapy, and Orano Med, a French clinical-stage company developing lead-212 (212Pb) radioligand treatments.

Alpha-emitters are gaining momentum due to their high linear energy transfer (LET), which enables potent cancer-cell destruction with minimal collateral tissue exposure. Agents such as Ra-223 are widely employed in metastatic castration-resistant prostate cancer with bone involvement, demonstrating significant reduction in skeletal-related events. Emerging alpha-targets, including Ac-225-PSMA, have shown promising response rates even in heavily pretreated patients.

Brachytherapy isotopes, including I-125, Cs-131, and Pd-103, remain widely used in urological, gynecological, and head-and-neck cancers. Low-dose-rate (LDR) brachytherapy is frequently selected for prostate-cancer management due to its long-term disease-control outcomes and minimal hospitalization. High-dose-rate (HDR) brachytherapy using Ir-192 or Co-60 is preferred for cervical cancer, which accounts for significant treatment volume globally, particularly in regions with high disease prevalence.

Clinical Indication Analysis

Oncology constitutes the largest treatment segment due to the global burden of cancer, which surpassed 19 million annual cases according to major health agencies. Radioligand therapies have become essential in managing advanced-stage tumors, especially prostate cancer, which accounts for over 1.5 million new cases each year.

Lu-177-PSMA therapies have demonstrated meaningful reductions in tumor activity, while Lu-177-DOTATATE significantly improves survival outcomes in neuroendocrine tumors. Y-90 treatments continue to expand across interventional oncology for primary and secondary liver malignancies. Broad clinical adoption, combined with extensive diagnostic imaging integration, reinforces oncology as the dominant application of therapeutic nuclear medicine.

In March 2021, a study co-authored by the International Atomic Energy Agency (IAEA) reported that expanding global access to nuclear medicine and medical imaging could prevent nearly 2.5 million cancer deaths by 2030 and generate lifetime productivity gains of USD 1.41 trillion, amounting to a return of more than USD 200 for every USD 1 invested.

Bone metastases represent a major therapeutic segment because nearly 70% of patients with advanced breast or prostate cancer develop skeletal lesions. Agents such as Ra-223 are widely used to reduce bone pain, slow disease progression, and improve mobility. Sm-153 and Re-186 also remain relevant for palliative management across oncology departments. Thyroid disease continues to be a long-standing application of therapeutic nuclear medicine.

I-131 therapy is routinely administered for hyperthyroidism, Graves’ disease, and differentiated thyroid cancer. Approximately 200,000 thyroid-cancer cases are diagnosed annually, with radioiodine therapy forming the backbone of treatment for ablation and recurrence control. Other applications include hematologic malignancies, liver disorders, cardiovascular plaques, inflammatory joint diseases, and experimental treatments for neurological conditions.

End-User Analysis

Hospitals and cancer centers form the core treatment environment due to their advanced imaging systems, radiopharmacy infrastructure, radiation-safety units, and multidisciplinary oncology teams. These facilities conduct the majority of Lu-177-based therapies, Y-90 radioembolization procedures, and Ra-223 administrations.

Large tertiary centers often perform thousands of nuclear-medicine-guided oncology treatments each year. Increasing cancer-care volume, higher diagnostic throughput, and the expansion of nuclear-medicine departments in major hospitals continue to support this segment’s dominance. Integrated theranostic models combining PET imaging with targeted therapy further enhance procedural efficiency.

Radiopharmacies are becoming integral to therapeutic workflows by enabling decentralized production, dose preparation, and timely delivery of short-lived isotopes. In many regions, centralized radiopharmacies support multiple hospitals, ensuring GMP-compliant labeling and sterility assurance. Growth of diagnostic PET centers has accelerated the establishment of radiopharmacies capable of producing therapeutic isotopes including Lu-177 and Y-90.

Key Market Segments

By Therapy

- Alpha-emitters

- Beta-emitters

- Brachytherapy isotopes

By Clinical Indication

- Oncology

- Bone metastases

- Thyroid disease

- Other therapeutic areas

By End-User

- Hospitals & Cancer Centers

- Radiopharmacies

- Others

Drivers

Rising Global Cancer Burden and Accelerating Adoption of Targeted Radioligand Therapy

The rising global incidence of cancer remains a primary driver for the Therapeutic Nuclear Medicine Market, especially as advanced-stage disease becomes increasingly common. Health agencies report more than 19 million new cancer cases each year, with prostate, breast, lung, and gastrointestinal tumors forming the largest share.

Prostate cancer alone accounts for more than 1.5 million annual cases, and nearly half of these patients eventually develop metastatic or treatment-resistant disease. This has accelerated clinical reliance on radioligand therapy (RLT), particularly Lu-177-PSMA, which has demonstrated significant improvements in progression-free survival. Neuroendocrine tumors, though rarer, affect over 170,000 people globally, and Lu-177-DOTATATE remains a cornerstone therapy with high response rates.

Bone metastases affect up to 70% of patients with advanced breast or prostate cancer, driving increased administration of alpha-emitters such as Ra-223 for skeletal pain and fracture prevention. Rising oncology procedure volumes, growing PET-CT utilization for theranostic planning, and expanding clinical guidelines from organizations like SNMMI and EANM continue to reinforce nuclear medicine as a critical part of the global cancer-care ecosystem.

Restraints

Limited Isotope Production Capacity and Global Supply Chain Fragility

A major restraint in the Therapeutic Nuclear Medicine Market is the restricted global production capacity of key isotopes such as Lu-177, Ac-225, I-131, and Y-90. Many therapeutic isotopes are produced in fewer than 10 major reactors worldwide, several of which are over four decades old and subject to maintenance shutdowns. Any reactor outage can disrupt treatment schedules for thousands of cancer patients. Short half-lives also intensify supply-chain challenges; for example, isotopes with half-lives under 8 days require rapid, uninterrupted international transport.

Geopolitical tensions affecting air-cargo routes, customs delays, or export restrictions further complicate clinical access. During health emergencies, some countries temporarily restricted the export of medical isotopes, limiting availability for dependent regions. Production of emerging alpha-emitters such as Ac-225 is especially constrained; current global output supports only a fraction of clinical-trial demand.

Limited cyclotron infrastructure in developing countries also restricts local radiopharmaceutical manufacturing, forcing dependence on imports. These fragilities increase treatment delays, raise logistics costs, and constrain therapy expansion despite rising clinical demand.

Opportunities

Expansion of Theranostics and Development of Next-Generation Alpha Therapies

The greatest opportunity in therapeutic nuclear medicine lies in the rapid expansion of theranostics integrated diagnostic and therapeutic pathways using the same molecular target. PET imaging with Ga-68 or F-18 agents allows precise identification of tumor receptors, enabling personalized therapy selection with Lu-177, Ra-223, or emerging isotopes. The growing global network of PET-CT scanners now exceeding 50,000 units supports rapid adoption of this model. Next-generation alpha therapies represent another transformative opportunity.

Agents such as Ac-225-PSMA and Pb-212-targeted constructs have demonstrated tumor-response rates above 60% in early studies, even in chemotherapy-resistant cancers. Multiple phase I–III trials are underway across North America, Europe, and Asia evaluating alpha therapies for prostate cancer, glioblastoma, leukemia, and solid tumors with high metastatic potential.

Government programs, including national isotope-production initiatives in India, Canada, Germany, and the US, aim to increase alpha-isotope availability and reduce dependency on legacy reactors. The rising integration of AI-based dosimetry and precision imaging is also opening new pathways for individualized radiation-dose planning, improving both safety and patient outcomes.

In June 2025, Siemens Healthineers Molecular Imaging entered a research collaboration with Massachusetts General Hospital (MGH) to advance the use of theranostics. This approach, which uses one radiopharmaceutical for diagnosis and a related agent for targeted therapy, is already applied in cancers such as thyroid, prostate, and neuroendocrine tumors.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic volatility and geopolitical tensions exert substantial influence on the Therapeutic Nuclear Medicine Market due to its dependence on a fragile, globally distributed isotope-production ecosystem. Most therapeutic isotopes originate from fewer than 10 major research reactors worldwide, many located in Europe and North America, making the supply chain vulnerable to regional instability.

Reactor maintenance shutdowns have historically reduced isotope availability by 20–40%, delaying thousands of scheduled Lu-177, Ra-223, and I-131 treatments. Geopolitical disruptions affecting air freight such as restricted airspace over Eastern Europe or Middle East route diversions lengthen transport times for isotopes with short half-lives, some below 8 days, resulting in dose decay before arrival. Economic inflation also elevates production costs for enriched uranium, lutetium targets, shielding materials, and cold-chain logistics, increasing therapy expenses for hospitals already managing rising cancer loads.

During global health emergencies, governments have previously imposed temporary export controls on medical isotopes, creating regional shortages and forcing treatment prioritization. Currency fluctuations in emerging markets affect procurement of imported radiopharmaceuticals, particularly in nations where over 70% of isotopes are sourced internationally.

Workforce shortages across nuclear-medicine departments further intensify operational challenges, with some regions reporting vacancy rates above 15% for radiopharmacists and technologists. Collectively, these macroeconomic and geopolitical pressures shape therapy accessibility, scheduling reliability, and long-term capacity planning across global cancer-care systems.

Latest Trends

Surge in Outpatient Radioligand Therapy and Decentralized Radiopharmacy Networks

A major trend shaping the Therapeutic Nuclear Medicine Market is the shift toward outpatient radioligand therapy programs supported by expanding decentralized radiopharmacy networks. With improved radiation-safety guidelines and low-toxicity profiles, many Lu-177-based therapies no longer require inpatient admission, reducing hospital burden and enabling treatment in high-volume outpatient oncology centers.

Countries such as the US, Germany, Australia, and South Korea have published updated radiation-release criteria allowing patients to return home safely after treatment. This shift has increased weekly therapy capacity by up to 40% in some centers. Meanwhile, radiopharmacies are rapidly proliferating to support just-in-time delivery of short-lived isotopes.

More than 1,500 radiopharmacies now operate globally, with significant growth in India, China, Brazil, and Eastern Europe. Automation technologies such as shielded synthesizers, dose-drawing robots, and AI-monitored quality systems are improving sterility and accuracy in dose preparation. These trends are reducing operational bottlenecks, expanding treatment reach, and enabling smoother integration of theranostics across routine cancer pathways.

Regional Analysis

North America is leading the Therapeutic Nuclear Medicine Market

North America remains the largest market with accounting for 41.5% market share for therapeutic nuclear medicine due to its advanced oncology infrastructure, high diagnostic-imaging penetration, and strong adoption of radioligand therapy across academic and community hospitals. The US alone performs more than 20 million nuclear-medicine procedures annually, supported by an installed base of over 8,000 PET and SPECT scanners.

Lu-177–based therapies for prostate and neuroendocrine tumors are widely integrated into treatment pathways, with major cancer centers conducting thousands of administrations each year. The region also leads in Y-90 radioembolization for liver cancers, supported by interventional oncology networks.

Regulatory frameworks such as FDA breakthrough-therapy designations accelerate clinical adoption of emerging radiopharmaceuticals, while the Department of Energy’s isotope program expands domestic production of Lu-177 and Ac-225 to reduce dependency on foreign reactors. Strong reimbursement structures, high cancer-prevalence rates, and established radiopharmacy networks collectively reinforce North America’s position as the dominant region in therapeutic nuclear medicine.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific represents the fastest-growing region, driven by rising cancer incidence, expanding nuclear-medicine departments, and significant government investment in isotope production and radiopharmaceutical supply. Countries such as China and India report over 8 million new cancer cases annually, creating substantial demand for targeted therapies including I-131, Lu-177, and Y-90.

India has rapidly scaled its cyclotron capacity, enabling production of diagnostic and therapeutic isotopes for both domestic and regional use. Japan and South Korea maintain some of the world’s most advanced PET-CT infrastructures, supporting theranostic adoption for neuroendocrine tumors and prostate cancer. Additionally, increasing medical tourism in Thailand, Malaysia, and Singapore fuels demand for outpatient radioligand therapy.

Several Asia Pacific governments now fund national programs to produce Ac-225 and other alpha isotopes, reducing reliance on imports. Combined with rising awareness, improving oncology-care access, and broader regulatory support, these factors position the region as the fastest-advancing market globally.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Novartis AG, Lantheus Holdings, Bayer AG, Telix Pharmaceuticals, Curium Pharma, Cardinal Health, GE HealthCare, Siemens Healthineers (radiopharmacy segment), Eckert & Ziegler, ABX Advanced Biochemical Compounds, ITM Isotope Technologies Munich, NorthStar Medical Radioisotopes, SOFIE Biosciences, Alpha Tau Medical, Radiopharm Theranostics, and Others.

Novartis AG remains the market leader in radioligand therapy (RLT), with established commercial products such as Lutathera (Lu-177 DOTATATE for neuroendocrine tumors) and Pluvicto (Lu-177 PSMA-617 for metastatic prostate cancer), anchoring their position in both neuroendocrine and prostate oncology. Their broad R&D pipeline including next-generation actinium-based therapies (e.g. Ac-225–PSMA constructs) signals a strong commitment to long-term leadership in theranostics.

Bayer AG entered the therapeutic nuclear medicine space through acquisition of a key alpha-emitters asset and markets Xofigo (Radium-223 dichloride) for bone-metastatic prostate cancer. Lantheus Holdings has built capability across diagnostics and therapy, leveraging its radiopharma heritage and imaging-to-therapy “find, fight and follow” strategy. Telix Pharmaceuticals focuses on precision oncology via targeted radiopharmaceuticals, with a portfolio emphasizing both diagnostic and therapeutic agents.

Top Key Players

- Novartis AG

- Lantheus Holdings

- Bayer AG

- Telix Pharmaceuticals

- Curium Pharma

- Cardinal Health

- GE HealthCare

- Siemens Healthineers (radiopharmacy segment)

- Eckert & Ziegler

- ABX Advanced Biochemical Compounds

- ITM Isotope Technologies Munich

- NorthStar Medical Radioisotopes

- SOFIE Biosciences

- Alpha Tau Medical

- Radiopharm Theranostics

- Others

Recent Developments

- In December 2025, Thor Medical ASA, an emerging provider of alpha-emitters for advanced precision oncology, entered a five-year supply agreement with RadioMedix, Inc., a U.S.-based clinical-stage biotech specializing in targeted radiopharmaceuticals. The agreement covers the provision of thorium-228 (Th-228) to support future diagnostic and therapeutic development.

- In March 2025, the U.S. FDA expanded the indication for Novartis’s Lu-177 PSMA-targeted radioligand therapy Pluvicto to include patients with PSMA-positive metastatic castration-resistant prostate cancer eligible to delay chemotherapy, based on robust Phase III trial outcomes.

- In March 2025, Novartis announced that the U.S. FDA had approved Pluvicto® (lutetium Lu 177 vipivotide tetraxetan) for patients with PSMA-positive metastatic castration-resistant prostate cancer (mCRPC) who previously received androgen receptor pathway inhibitor therapy and are suitable candidates for delaying chemotherapy.

- In December 2023, Lantheus Holdings, Inc. and POINT Biopharma Global Inc. reported statistically significant topline findings from the Phase 3 SPLASH trial, which assessed the efficacy and safety of 177Lu-PNT2002, a PSMA-targeted radioligand therapy, in patients with metastatic castration-resistant prostate cancer (mCRPC) who had progressed following androgen receptor pathway inhibitor treatment.

Report Scope

Report Features Description Market Value (2024) US$ 1.54 Billion Forecast Revenue (2034) US$ 2.32 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy (Alpha-emitters, Beta-emitters and Brachytherapy isotopes), By Clinical Indication (Oncology, Bone metastases, Thyroid disease and Other therapeutic areas), By End-User (Hospitals & Cancer Centers, Radiopharmacies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis AG, Lantheus Holdings, Bayer AG, Telix Pharmaceuticals, Curium Pharma, Cardinal Health, GE HealthCare, Siemens Healthineers (radiopharmacy segment), Eckert & Ziegler, ABX Advanced Biochemical Compounds, ITM Isotope Technologies Munich, NorthStar Medical Radioisotopes, SOFIE Biosciences, Alpha Tau Medical, Radiopharm Theranostics, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Therapeutic Nuclear Medicine MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Therapeutic Nuclear Medicine MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Novartis AG

- Lantheus Holdings

- Bayer AG

- Telix Pharmaceuticals

- Curium Pharma

- Cardinal Health

- GE HealthCare

- Siemens Healthineers (radiopharmacy segment)

- Eckert & Ziegler

- ABX Advanced Biochemical Compounds

- ITM Isotope Technologies Munich

- NorthStar Medical Radioisotopes

- SOFIE Biosciences

- Alpha Tau Medical

- Radiopharm Theranostics

- Others