Global Tartaric Acid Market Size, Share, and Business Benefits By Source (Grapes and Sun-dried raisins, Maleic Anhydride, Others), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162156

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

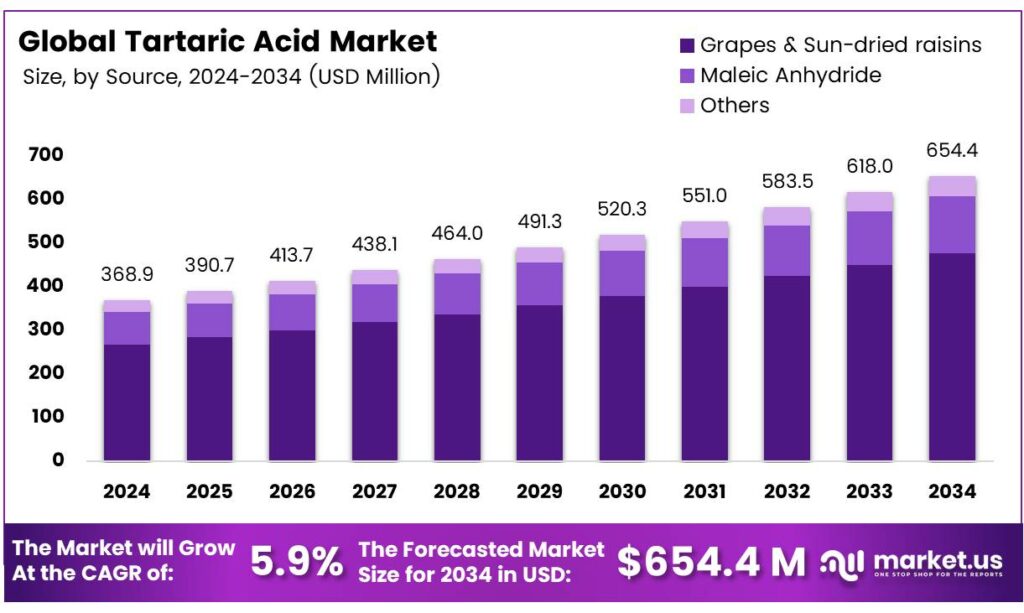

The Global Tartaric Acid Market size is expected to be worth around USD 654.4 Million by 2034, from USD 368.9 Million in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Tartaric acid, a white crystalline organic acid, is naturally found in many plants, particularly grapes. As an alpha-hydroxy-carboxylic acid, it is diprotic, aldaric, and a dihydroxyl derivative of succinic acid. It has two stereocenters, existing as enantiomers and an achiral meso compound. Commonly present in fruits, it is used as a resolving agent for racemic amines. Its chemical structure, C4H6O6, features substituted hydroxy groups on both the first and second carbons.

Tartaric acid shows promise as an antihypertensive agent, though its potential remains underexplored. In studies, intravenous administration at 50 µg/kg reduced mean arterial pressure by 51.5% in normotensive and 63.5% in hypertensive rats, partially inhibited by atropine and L-NAME. Oral administration in hypertensive rats at 10 mg/kg for two weeks lowered MAP by 65 mmHg, comparable to verapamil. In vitro, it relaxed phenylephrine and high K+-induced contractions, indicating endothelium-dependent vasodilation via muscarinic receptor-linked nitric oxide pathways and calcium channel antagonism.

- In BalbC mice (18-25 g), tartaric acid’s effects were tested across six groups of five, fasted overnight. Doses ranged from 50 to 450 mg/kg orally, with control groups receiving saline. Sodium thiopental induced anesthesia, and cannulation of the carotid artery and jugular vein facilitated measurements via a PowerLab system. Responses to acetylcholine and norepinephrine were recorded before administering tartaric acid (1-50 µg/kg intravenously). Atropine pretreatment confirmed muscarinic receptor involvement in tartaric acid’s hypotensive effects.

Tartaric acid is widely used in food, pharmaceuticals, and industry. In food, it’s found in cream of tartar and baking powder, reacting with sodium bicarbonate to produce carbon dioxide for rising baked goods. It’s also used in silvering mirrors, tanning leather, and producing Rochelle Salt, a laxative. It aids glucose determination, while its esters, diethyl tartarate and dibutyl tartrate, are used in lacquer production and textile dyeing. These diverse applications highlight tartaric acid’s versatility beyond its therapeutic potential.

Key Takeaways

- The Global Tartaric Acid Market is projected to grow from USD 368.9 million in 2024 to USD 654.4 million by 2034, at a CAGR of 5.9%.

- Grapes and Sun-dried raisins accounted for over 72.8% of the tartaric acid market share in 2024, driven by sustainable extraction from winemaking residues.

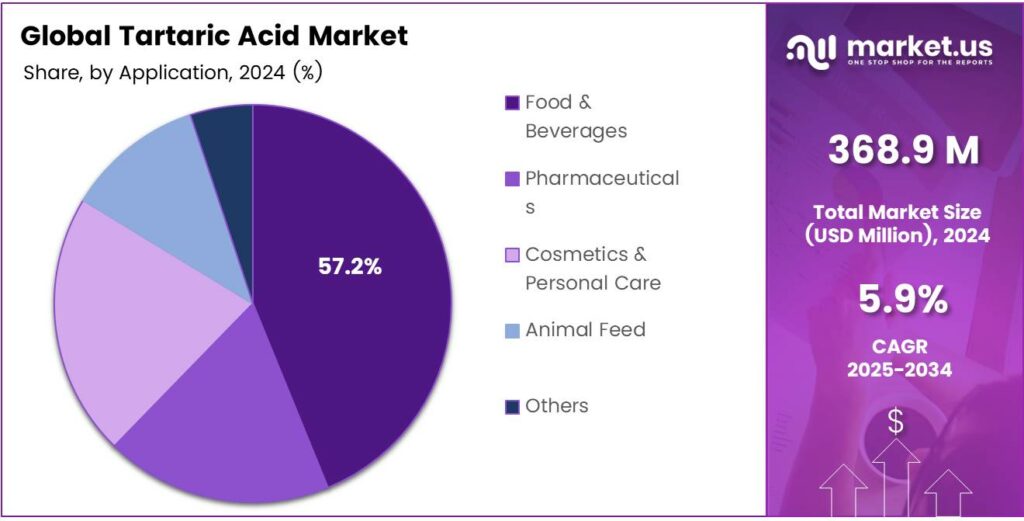

- The Food and Beverages sector held a 57.2% share in 2024, using tartaric acid as a natural acidulant, stabilizer, and flavor enhancer.

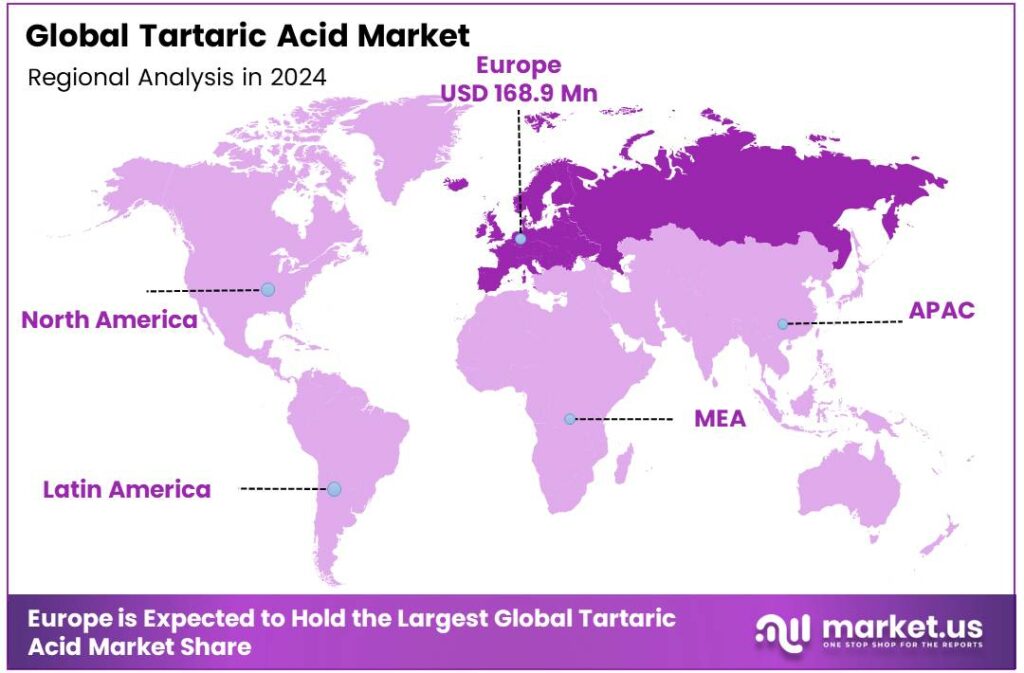

- Europe led the market in 2024 with a 45.8% share, valued at USD 168.9 million, due to its winemaking heritage in Italy, France, and Spain.

By Source

Grapes and Sun-Dried Raisins Hold 72.8% Share

In 2024, Grapes and Sun-dried raisins held a dominant market position, capturing more than 72.8% share in the global tartaric acid market. These natural sources are widely recognized for their high tartaric acid content and eco-friendly extraction process. Grapes, especially those from winemaking residues, offer a sustainable route for producing natural tartaric acid, which aligns with the growing demand for clean-label and bio-based ingredients across food.

The dominance of grape-derived tartaric acid is expected to remain strong, driven by its extensive use in wine stabilization, bakery leavening agents, and pharmaceutical formulations. Sun-dried raisins continue to play a supplementary role, particularly in natural acidulant extraction processes in smaller-scale or regional industries.

The combination of availability, natural purity, and minimal processing requirements keeps this segment cost-effective and environmentally preferred. Moreover, ongoing sustainability initiatives in major producing regions like Europe and the Asia-Pacific are reinforcing the adoption of grape and raisin-based tartaric acid as industries shift away from synthetic alternatives.

By Application

Food and Beverages Hold 57.2% Share

In 2024, Food and Beverages held a dominant market position, capturing more than 57.2% share in the global tartaric acid market. This strong presence is mainly due to tartaric acid’s wide use as a natural acidulant, stabilizer, and flavor enhancer in food and drink formulations. It provides a sharp, refreshing taste in fruit-based beverages, confectionery, jams, and bakery products.

By 2025, this segment is expected to sustain its leadership as clean-label and plant-derived ingredients gain more traction among health-conscious consumers. Food processors and beverage manufacturers are increasingly replacing synthetic acids with naturally sourced tartaric acid, particularly from grapes.

Additionally, the expanding global bakery and wine industries, along with new product innovations in functional drinks, are fueling long-term consumption. The consistent regulatory acceptance of tartaric acid as a safe food additive by global food authorities further supports its continued dominance in the food and beverage application segment.

Key Market Segments

By Source

- Grapes and Sun-dried raisins

- Maleic Anhydride

- Others

By Application

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Animal Feed

- Others

Emerging Trends

Upcycled, Natural Sourcing from Wine By-Products (Emerging Trend)

- A major emerging trend in tartaric acid is pivoting to upcycled, natural sourcing from wine by-products—lees and grape pomace. The International Organisation of Vine and Wine (OIV) estimates global wine consumption at 214.2 million hectolitres in 2024, the lowest in decades, while vinified output in the EU reached 138.3 mhl in 2024 after weather and disease impacts.

In the United States, tartaric acid is affirmed GRAS for direct use in food with no specific upper limit beyond current good manufacturing practice, supporting broad application in beverages, confectionery, and bakery. In Europe, safety benchmarks are clear: EFSA maintains an acceptable daily intake (ADI) of 30 mg/kg body weight/day for L(+) tartaric acid, providing predictable specifications for buyers that prefer naturally sourced acids.

Policy and industry sustainability goals are aligning with this pathway. EU circular-economy narratives actively encourage valorization of grape pomace, seeds, and lees into higher-value ingredients, cutting waste and emissions across the wine chain. This creates a dependable feedstock base for natural tartaric acid even when wine volumes fluctuate while helping producers meet packaging- and ingredient-related climate targets.

Drivers

Rising Demand for Clean-Label and Natural Ingredients

One of the strongest driving forces behind the growth of the tartaric acid market is the surging demand for clean-label, natural ingredients in the food and beverage industry. Consumers today are far more aware of what goes into their food, and they increasingly seek products that contain simpler ingredients. In a recent industry survey, 50% of food industry professionals identified clean label ingredients as the leading trend influencing reformulation and product development.

Food and beverage companies are reformulating to drop synthetics or chemical-sounding components, and a naturally derived acidulant helps satisfy the label-cleaning exercise while meeting functional needs such as pH adjustment, flavor modulation, and preservation. Regulatory frameworks help as well; for example, in many jurisdictions, tartaric acid is recognized as safe for food use, so product developers can confidently incorporate it into clean-label formulations.

Governments and regulatory bodies are supporting natural-ingredient usage and stricter labeling transparency. While not specific to tartaric acid, the broad push for clean-label formulations is backed by consumer protections and ingredient-transparency initiatives, which in turn gives confidence to manufacturers to reformulate around natural acidulants.

Restraints

Raw Material Supply Instability and Regulatory Burdens

One of the key restraints for the Tartaric Acid industry is instability in raw material supply, combined with tightening regulatory regimes. On the natural side, tartaric acid is commonly derived from grape-wine by-products such as lees and pomace. But global wine production is subject to weather, vine disease, and harvest fluctuations, making supply uneven and unpredictable.

On the synthetic side, production often relies on intermediates like Maleic Anhydride, which itself faces regulatory and environmental scrutiny. For example, the U.S. Environmental Protection Agency (EPA) notes that maleic anhydride is used widely in chemical manufacturing but is subject to stringent emissions, exposure, and hazardous-chemical rules. Furthermore, natural sourcing has its own constraint: the very raw material (grape waste) depends on wine-industry volumes.

During lower production years, availability falls, which can push up feedstock costs or force a shift to synthetic sources. As noted in a trade decision by the European Commission, synthetic tartaric acid is produced from maleic anhydride, whose availability is not dependent on climatic conditions, while natural tartaric acid is produced from calcium tartrate obtained from wine lees and therefore its availability varies according to the quality of the grape wine harvest.

Opportunity

Strong Regulatory Acceptance Large, Reliable Wine-Byproduct Feedstock

A key growth driver for tartaric acid is the combination of clear global safety authorizations and a large, steady supply of wine-industry byproducts. On safety, Europe provides firm guardrails that help food and beverage formulators scale usage with confidence. The European Food Safety Authority (EFSA) set a group acceptable daily intake (ADI) of 240 mg/kg body weight/day (as tartaric acid) for L(+)-tartaric acid and its tartrates.

In parallel, the Codex GSFA recognizes tartaric acid (INS 334) in multiple food categories under Good Manufacturing Practice, and explicitly aligns wine uses with the International Organisation of Vine and Wine (OIV) Code of Oenological Practice, which further streamlines cross-border compliance. On supply, wineries generate dependable volumes of lees and grape pomace, the preferred natural feedstock for tartaric acid recovery.

Even through recent demand softness, the sector remains vast. The OIV estimates global wine production at 226 million hectolitres, with consumption around 214 million hectolitres, both historically low, yet still enormous streams that continuously create recoverable residues for tartaric acid extraction. This scale underpins resilient raw-material availability and lowers the risk that food and beverage producers face when shifting from synthetic to natural acidulants.

Regional Analysis

Europe leads with a 45.8% share and a USD 168.9 Million market value.

In 2024, Europe held a dominant position in the global tartaric acid market, accounting for 45.8% share with an estimated market value of USD 168.9 million. The region’s strong foothold stems from its long-standing winemaking traditions, particularly in countries such as Italy, France, and Spain, which are key sources of natural tartaric acid derived from grape by-products.

The European Union’s emphasis on sustainable waste utilization under the Circular Economy Action Plan has further encouraged industries to recover tartaric acid from wine lees and pomace, reducing environmental waste while ensuring steady feedstock availability. The region also benefits from clear regulatory support.

The European Food Safety Authority (EFSA) continues to classify L(+)-tartaric acid and its salts as safe additives under Regulation (EC) No 1333/2008, allowing broad application across food, beverages, and pharmaceuticals. European beverage producers, particularly in the sparkling wine and fruit-juice sectors, rely heavily on tartaric acid as a natural acidulant and stabilizer.

European manufacturers are expected to maintain leadership through process modernization and sustainable production. Initiatives such as the EU Green Deal and local circular-economy programs are incentivizing the conversion of winery residues into high-value organic acids, reinforcing regional self-sufficiency. Continuous investment in natural ingredient innovation, coupled with consumer preference for clean-label products, will sustain Europe’s prominence.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mazzari leverages its deep-rooted heritage in winemaking to specialize in high-quality, natural tartaric acid sourced from grape must. Its strength lies in controlling the supply chain from raw material to refined product, ensuring consistency for the demanding food and pharmaceutical industries. With a strong European base, Mazzari is recognized for its reliability and technical expertise.

Sarasa excels in the production and distribution of tartaric acid and its salts, serving the food, beverage, and pharmaceutical sectors. Its competitive edge comes from a flexible and customer-focused approach, offering tailored solutions and reliable supply. With a strategic location in a major wine-producing region, Sarasa ensures access to raw materials and has built a robust international export network, making it a formidable player in the market.

Alvinesa stands out as an integrated sustainability pioneer. The Spanish company operates a unique circular bio-refinery model, transforming grape seeds and skins from winemaking into valuable products, including tartaric acid. This process eliminates waste and reduces environmental impact. This commitment to upcycling provides Alvinesa with a stable, cost-effective raw material supply.

Top Key Players in the Market

- Distillerie Mazzari S.p.A.

- Comercial Química Sarasa S.L.

- Alvinesa

- Tártaros Gonzalo Castello, SL

- Industria Chimica Valenzana S.P.A.

- Thirumalai Chemicals Ltd.

- Distillerie Bonollo

- THE CHEMICAL COMPANY

- Henriette’s Herbal

Recent Developments

- In 2024, Alvinesa actively promoted its natural tartaric acid and grape-derived ingredients at key events, including Food Ingredients Europe, Vitafoods Europe, Vitafoods Asia, and Anuga (October 2025). These engagements focused on sustainable sourcing from grape waste, targeting nutraceutical and food sectors in Europe and Asia-Pacific.

- In 2024, the company partnered with an unnamed Italian research institute to develop a more cost-effective and eco-friendly method for extracting natural tartaric acid from grape pomace. This initiative aims to reduce production costs while minimizing environmental impact, supporting the company’s focus on Kosher and Halal certified natural tartaric acid for food and beverage uses.

Report Scope

Report Features Description Market Value (2024) USD 368.9 Million Forecast Revenue (2034) USD 654.4 Million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Grapes and Sun-dried raisins, Maleic Anhydride, Others), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Distillerie Mazzari S.p.A., Comercial Química Sarasa S.L., Alvinesa, Tártaros Gonzalo Castello, SL, Industria Chimica Valenzana S.P.A., Thirumalai Chemicals Ltd., Distillerie Bonollo, THE CHEMICAL COMPANY, Henriette’s Herbal Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Distillerie Mazzari S.p.A.

- Comercial Química Sarasa S.L.

- Alvinesa

- Tártaros Gonzalo Castello, SL

- Industria Chimica Valenzana S.P.A.

- Thirumalai Chemicals Ltd.

- Distillerie Bonollo

- THE CHEMICAL COMPANY

- Henriette’s Herbal