Global Synthetic Magnesium Silicate Market Size, Share, And Industry Analysis Report By Form (Powder, Granules, Dispersion), By Grade (Food Grade, Pharmaceutical Grade, Industrial Grade), By Application (Personal Care, Pharmaceuticals, Food & Beverage, Plastics, Coatings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177618

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

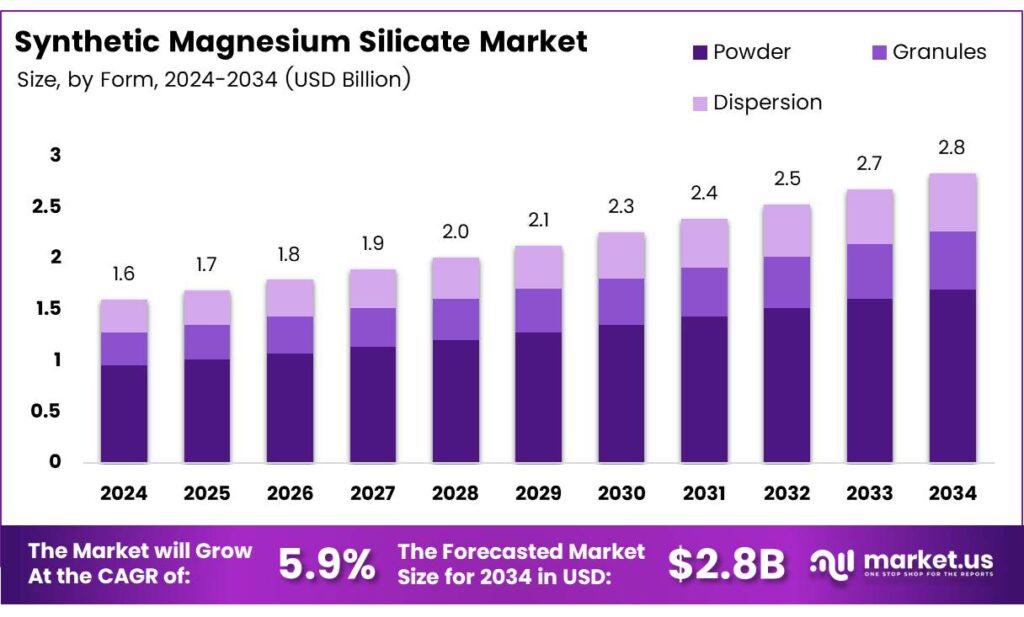

The Global Synthetic Magnesium Silicate Market size is expected to be worth around USD 2.8 billion by 2034 from USD 1.6 billion in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034.

Synthetic magnesium silicate represents engineered mineral compounds produced through controlled precipitation processes. Manufacturers create these materials by combining magnesium salts with silicate solutions under specific conditions. The resulting products serve critical functions across pharmaceuticals, food processing, personal care, and industrial applications.

This versatile material delivers exceptional performance in anti-caking, flow enhancement, and absorption applications. Industries utilize synthetic variants for superior purity compared to naturally mined alternatives. Moreover, controlled manufacturing enables precise particle size distribution and surface area optimization for targeted applications.

- Magnesium silicate-based tissue substitutes demonstrate temperature stability from 0 to 100°C. These materials resist microbial invasion and maintain structural integrity after needle biopsy procedures. However, clinical reports document rare cases where patients develop urolithiasis, with stones containing up to 98% silicate content.

Personal care formulations leverage magnesium silicate for oil absorption and texture modification properties. Cosmetic manufacturers incorporate the ingredient in face powders, dry shampoos, and skincare products. Furthermore, industrial sectors utilize these materials in paint formulations, plastics processing, and coating systems for rheology control.

Market expansion reflects growing demand for clean-label food additives and pharmaceutical excipients. Emerging economies drive consumption through expanding packaged food industries and healthcare infrastructure development. Therefore, manufacturers focus on developing ultra-fine particle variants and high-purity grades for premium applications across diverse end-use sectors.

Key Takeaways

- The Global Synthetic Magnesium Silicate Market is projected to grow from USD 1.6 billion in 2024 to USD 2.8 billion by 2034 at a CAGR of 5.9%

- The Powder form leads with 67.4% market share, driven by superior flowability and dispersibility

- The Food Grade segment accounts for 51.9% share due to expanding processed food applications

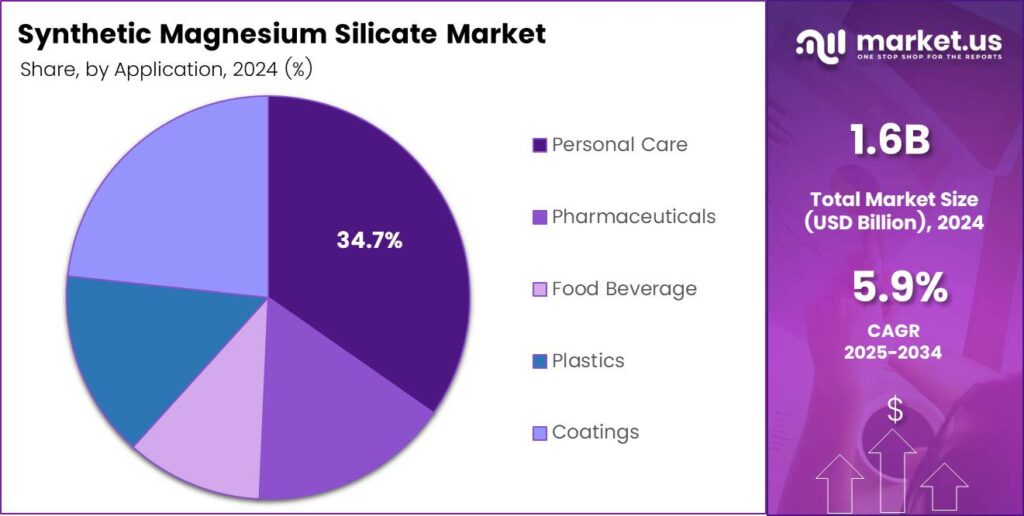

- Personal Care application holds 34.7% shar,e reflecting rising cosmetic product demand

- Pharmaceutical excipient applications expand rapidly for tablet and capsule formulations

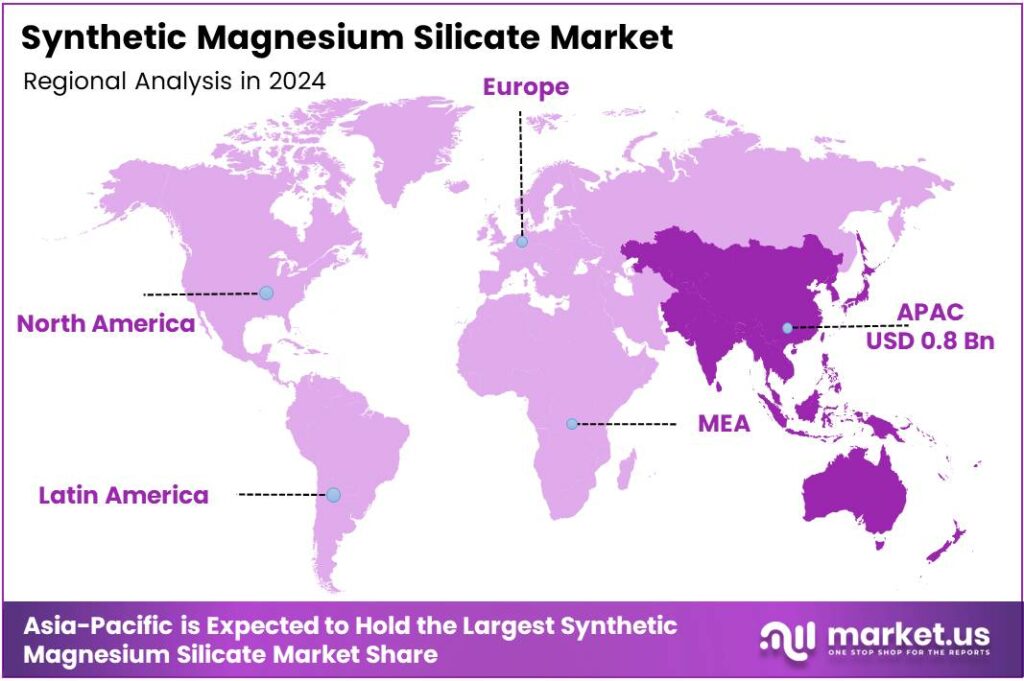

- Asia Pacific dominates the market with 47.2% share, valued at USD 0.8 billion in 2025

By Form Analysis

Powder dominates with 67.4% due to superior processing versatility and application flexibility.

In 2025, Powder held a dominant market position in the By Form segment of the Synthetic Magnesium Silicate Market, with a 67.4% share. Manufacturers prefer powder variants for exceptional flowability and uniform particle distribution characteristics. The form integrates seamlessly into food processing, pharmaceutical tableting, and cosmetic formulation systems.

Granules serve specialized applications requiring controlled release and enhanced handling properties. This form reduces dust generation during industrial processing operations significantly. Manufacturers utilize granular variants in coating systems and plastics compounding, where free-flowing characteristics prove essential

Dispersion formats provide ready-to-use formulations for liquid-based applications efficiently. These pre-dispersed systems eliminate lengthy mixing procedures in cosmetic and coating manufacturing. The form delivers uniform particle distribution in aqueous and non-aqueous systems instantly. Furthermore, dispersion variants reduce processing time and energy consumption for manufacturers seeking streamlined production workflows.

By Grade Analysis

Food Grade dominates with 51.9% due to expanding processed food manufacturing and clean-label trends.

In 2025, Food Grade held a dominant market position in the By Grade segment of the Synthetic Magnesium Silicate Market, with a 51.9% share. Regulatory compliance and stringent purity requirements drive adoption in food additive applications. Manufacturers utilize this grade as anti-caking agents in powdered seasonings, instant beverage mixes, and bakery ingredients.

Pharmaceutical Grade meets exacting specifications for drug formulation and medical device applications. This grade undergoes rigorous testing for heavy metals, microbial contamination, and particle size distribution. Pharmaceutical companies incorporate the material in tablet coatings, capsule formulations, and controlled-release drug delivery systems.

Industrial Grade serves cost-sensitive applications in paints, coatings, plastics, and ceramic manufacturing sectors. Manufacturers prioritize functional performance over ultra-high purity for these non-ingestible applications. The grade delivers effective rheology control, anti-settling properties, and reinforcement in polymer composite systems.

By Application Analysis

Personal Care dominates with 34.7% due to rising cosmetic product innovation and premium skincare demand.

In 2025, Personal Care held a dominant market position in the By Application segment of the Synthetic Magnesium Silicate Market, with a 34.7% share. Beauty manufacturers leverage the material for oil absorption, texture enhancement, and sensory modification in cosmetic formulations. The ingredient appears in face powders, dry shampoos, mineral makeup, and skincare products for mattifying effects. Additionally, natural and clean beauty trends drive the adoption of mineral-based ingredients over synthetic alternatives.

Pharmaceuticals utilize magnesium silicate as an essential excipient in solid dosage form manufacturing. The material functions as a glidant, an anti-adherent, and da isintegrant in tablet and capsule production processes. Pharmaceutical companies value controlled particle characteristics for consistent drug release profiles and bioavailability. Moreover, regulatory acceptance across major markets facilitates global product registration and commercialization efforts.

Food & Beverage applications encompass anti-caking functionality in powdered products and processing aid roles. Manufacturers incorporate the material in spice blends, instant drink mixes, confectionery items, and seasoning formulations. The ingredient prevents moisture absorption and maintains free-flowing characteristics during storage and handling. Furthermore, food-grade certifications ensure consumer safety and regulatory compliance across international markets.

Plastics processors add magnesium silicate for reinforcement, nucleation, and property enhancement in polymer systems. The material improves dimensional stability, heat resistance, and mechanical strength in thermoplastic and thermoset applications. Manufacturers utilize the additive in automotive components, packaging materials, and consumer goods manufacturing. Additionally, the ingredient supports sustainability initiatives through improved recyclability and reduced material consumption.

Coatings formulations benefit from rheology control, anti-settling, and opacity enhancement properties of magnesium silicate. Paint manufacturers incorporate the material in architectural coatings, industrial finishes, and protective coating systems. The additive prevents pigment separation during storage and improves application characteristics significantly. Moreover, the ingredient contributes to VOC reduction and environmental compliance in waterborne coating technologies.

Key Market Segments

By Form

- Powder

- Granules

- Dispersion

By Grade

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

By Application

- Personal Care

- Pharmaceuticals

- Food & Beverage

- Plastics

- Coatings

Drivers

Expanding Food Processing Industry Drives Market Growth Through Anti-Caking Agent Demand

Rising demand for anti-caking agents in processed food manufacturing accelerates synthetic magnesium silicate adoption globally. Food manufacturers face challenges maintaining powder flowability in seasonings, instant beverages, and bakery ingredients during production. Magnesium silicate prevents moisture absorption and clumping in hygroscopic food products effectively.

- According to FAO specifications, magnesium silicate undergoes alkaline fusion testing with potassium hydroxide and boric acid for quality verification. Manufacturers analyze magnesium and silica content through ICP-AES techniques at analytical wavelengths of 279.553 nm and 251.611 nm, respectively. These rigorous quality control procedures ensure food-grade materials meet international safety standards for consumer protection.

Expanding pharmaceutical excipient applications in tablet and capsule formulations creates substantial growth opportunities. Pharmaceutical manufacturers require materials with precise particle characteristics and consistent performance for drug delivery systems. Moreover, increasing use of personal care products for oil absorption and texture enhancement diversifies market applications.

Restraints

Regulatory Scrutiny and Raw Material Volatility Limit Market Expansion

Stringent regulatory scrutiny over mineral-based food additives constrains market growth across developed economies. Government agencies impose comprehensive testing requirements for heavy metals, microbial contamination, and particle size specifications on food-grade materials. Manufacturers invest significantly in compliance documentation, analytical testing, and certification processes for market access.

Volatility in raw material supply and purification costs affects profit margins throughout the value chain. Magnesium salt and silicate precursor pricing fluctuates based on mining output, energy costs, and transportation logistics. Manufacturers face challenges securing consistent quality feedstocks at competitive prices for large-scale production.

Clinical safety concerns emerge from documented cases of magnesium silicate-related health effects in specific applications. Japanese medical literature reports urolithiasis development in patients consuming magnesium silicate supplements with stones containing 98% silicate content. These isolated incidents prompt additional research requirements and label warnings that impact consumer perception.

Growth Factors

Innovation and Emerging Market Demand Accelerate Industry Expansion

Expanding applications in eco-friendly agrochemical formulations create new revenue streams for synthetic magnesium silicate producers. Agricultural companies develop sustainable pesticide and fertilizer carriers using mineral-based excipients for controlled release functionality. The material enhances product stability, reduces environmental impact, and improves application efficiency in modern farming systems.

Rising demand from emerging economies’ packaged food industries drives volume growth across Asia Pacific and Latin America. Urbanization and changing dietary patterns increase the consumption of convenience foods, instant meals, and processed snacks. Middle-class expansion in developing nations creates opportunities for premium food products requiring advanced processing aids.

Development of high-purity grades for nutraceutical processing addresses growing health supplement market requirements. Manufacturers engineer ultra-pure variants with enhanced bioavailability and pharmaceutical-equivalent specifications for premium applications. Increasing utilization in advanced ceramics and specialty glass manufacturing expands industrial demand beyond traditional sectors.

Emerging Trends

Advanced Engineering and Sustainability Shape Market Evolution

Shift toward ultra-fine particle size engineered variants transforms product performance across multiple applications. Manufacturers develop nano-scale magnesium silicate materials with enhanced surface area and absorption capacity for premium formulations. These advanced variants deliver superior functionality in cosmetics, pharmaceuticals, and high-performance coatings compared to conventional grades.

- Integration in clean-label and low-moisture food formulations reflects consumer demand for transparent ingredient lists. According to the European Chemicals Agency (ECHA), the microplastics restriction prevents the release of approximately 500,000 tonnes of microplastics over 20 years. This regulatory framework accelerates the adoption of mineral-based alternatives in food processing applications.

Adoption of sustainable and biodegradable cosmetic products positions magnesium silicate as an eco-friendly beauty ingredient. Cosmetic brands develop natural makeup and skincare lines featuring mineral-based components for environmentally conscious consumers. Technological advancements in synthetic precipitation processes improve manufacturing efficiency and reduce environmental footprint significantly.

Regional Analysis

Asia Pacific Dominates the Synthetic Magnesium Silicate Market with a Market Share of 47.2%, Valued at USD 0.8 Billion

Asia Pacific leads global synthetic magnesium silicate consumption due to extensive manufacturing activity and large consumer populations. The region accounts for 47.2% market share with a valuation reaching USD 0.8 billion in 2025. China, Japan, and India drive demand through expanding pharmaceutical production, processed food manufacturing, and cosmetic industries.

North America demonstrates steady growth driven by pharmaceutical innovation and premium personal care product development. United States pharmaceutical companies utilize high-purity grades for advanced drug delivery systems and specialty excipient applications. Canadian food processors adopt magnesium silicate in clean-label products meeting stringent regulatory standards.

Europe emphasizes regulatory compliance and sustainable ingredient sourcing across food, pharmaceutical, and cosmetic applications. German chemical companies invest in advanced purification technologies for pharmaceutical-grade material production, meeting European Pharmacopoeia specifications. French cosmetic brands incorporate mineral-based ingredients in natural beauty formulations for environmentally conscious consumers.

Latin America experiences growth through expanding middle-class consumption and local food processing industry development. Brazilian manufacturers increase adoption in seasoning, beverage, and bakery ingredient applications for domestic and export markets. The Mexican pharmaceutical sector utilizes imported high-purity grades while developing regional production capabilities.

Middle East & Africa show emerging potential driven by pharmaceutical manufacturing expansion and construction sector growth. GCC countries develop local pharmaceutical production facilities, reducing import dependency for essential excipient materials. South African food processors adopt international quality standards requiring certified anti-caking agents in packaged products.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Imerys maintains global leadership through integrated mineral processing operations and extensive application expertise across performance additives markets. The company leverages proprietary precipitation technologies, producing pharmaceutical-grade and food-grade magnesium silicate variants for regulated industries. Imerys operates manufacturing facilities strategically positioned near key consumption markets, ensuring reliable supply chain performance.

Tokuyama Corporation delivers high-purity synthetic magnesium silicate products servingthe pharmaceutical and semiconductor industries with stringent quality requirements. The Japanese manufacturer emphasizes advanced purification processes and analytical capabilities, ensuring consistent product specifications for critical applications. Tokuyama focuses on pharmaceutical excipient markets in the Asia Pacific while expanding its presence in personal care formulations.

PQ Corporation specializes in engineered silicate materials, offering comprehensive product portfolios for industrial and consumer applications globally. The company produces customized magnesium silicate grades optimized for specific end-use requirements across coatings, plastics, and personal care sectors. PQ Corporation operates integrated production facilities combining raw material processing with finished product manufacturing capabilities.

Huber Engineered Materials provides specialty mineral solutions emphasizing sustainable manufacturing practices and environmental responsibility across operational facilities. The company develops magnesium silicate products using controlled precipitation processes, ensuring reproducible particle characteristics and functional performance. Huber focuses on food-grade and pharmaceutical-grade markets requiring certified quality systems and comprehensive documentation.

Top Key Players in the Market

- Imerys

- Tokuyama Corp.

- PQ Corporation

- Huber Engineered Materials

- Tomoe Engineering

- Taurus Chemicals

- W. R. Grace & Co.-Conn

- Evonik Industries

- Kyowa Chemical Industry Co., Ltd.

- SPI Pharma

Recent Developments

- January 2025 – Imerys expanded its pharmaceutical excipient production capacity in Europe with advanced purification equipment, targeting growing demand for high-purity magnesium silicate in controlled-release drug formulations and biomedical applications.

- March 2025 – Evonik Industries launched a new ultra-fine powder grade synthetic magnesium silicate specifically engineered for premium cosmetic applications, featuring particle sizes below 5 microns for enhanced sensory characteristics in mineral makeup and skincare formulations.

- May 2025 – PQ Corporation partnered with a leading Asian pharmaceutical manufacturer to develop customized magnesium silicate excipients for generic drug production, supporting local manufacturing initiatives and reducing import dependency in emerging markets.

- July 2025 – Huber Engineered Materials received FDA certification for its pharmaceutical-grade magnesium silicate production facility in North America, enabling direct supply to US pharmaceutical companies for tablet coating and controlled-release applications.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Granules, Dispersion), By Grade (Food Grade, Pharmaceutical Grade, Industrial Grade), By Application (Personal Care, Pharmaceuticals, Food & Beverage, Plastics, Coatings) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Imerys, Tokuyama Corp., PQ Corporation, Huber Engineered Materials, Tomoe Engineering, Taurus Chemicals, W. R. Grace & Co.-Conn, Evonik Industries, Kyowa Chemical Industry Co., Ltd., SPI Pharma Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Synthetic Magnesium Silicate MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Synthetic Magnesium Silicate MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Imerys

- Tokuyama Corp.

- PQ Corporation

- Huber Engineered Materials

- Tomoe Engineering

- Taurus Chemicals

- W. R. Grace & Co.-Conn

- Evonik Industries

- Kyowa Chemical Industry Co., Ltd.

- SPI Pharma