Global Stethoscope Market By Product Type (Acoustic Stethoscopes, Smart Stethoscopes and Electronic Stethoscopes), By Distribution Channel (Hospital Pharmacies, Retail Stores and Online Stores), By End-User (Hospitals & Clinics, Home Healthcare and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174912

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

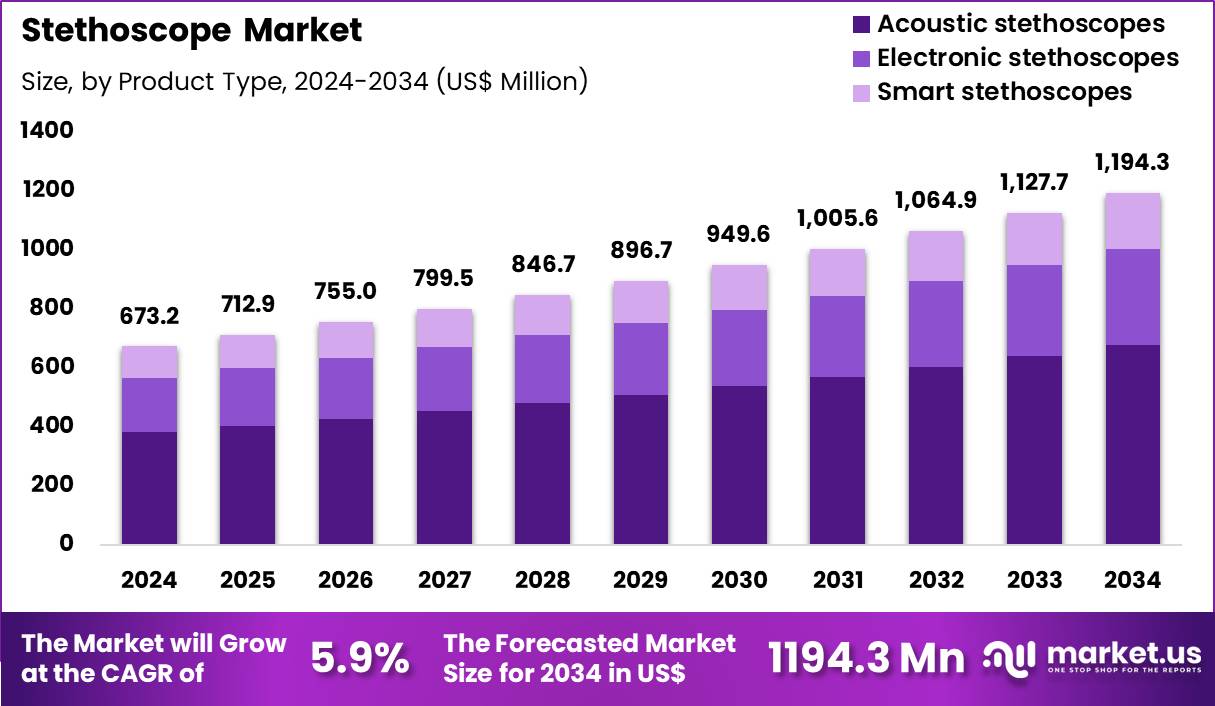

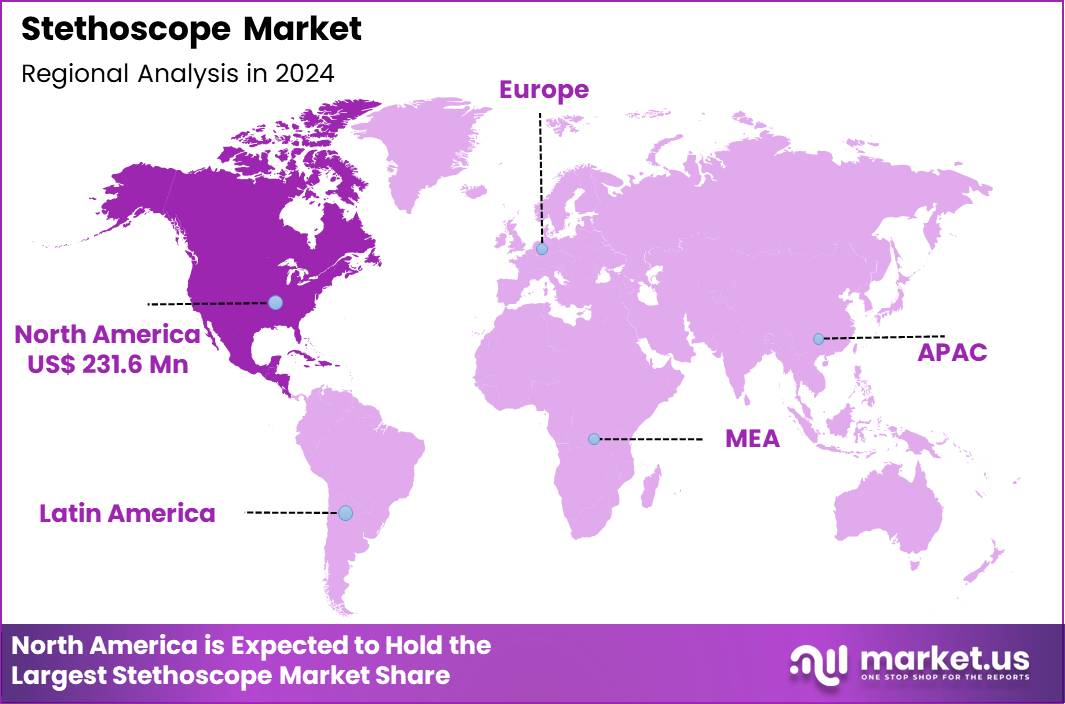

The Global Stethoscope Market size is expected to be worth around US$ 1194.3 Million by 2034 from US$ 673.2 Million in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 34.4% share with a revenue of US$ 231.6 Million.

Growing adoption of digital health technologies propels the stethoscope market as clinicians seek enhanced auscultation tools that improve diagnostic accuracy and workflow efficiency in routine examinations. Primary care physicians utilize electronic stethoscopes to amplify subtle heart murmurs during cardiac assessments, detecting valvular abnormalities or congenital defects in pediatric and adult patients. These devices support pulmonary evaluations by filtering ambient noise to isolate breath sounds, aiding diagnosis of asthma, pneumonia, or chronic obstructive pulmonary disease exacerbations.

Emergency responders apply portable stethoscopes for rapid vital sign checks in trauma scenarios, identifying pneumothorax or hemothorax through diminished lung sounds. Specialists in cardiology employ advanced models with recording capabilities to document abnormal rhythms and share findings with multidisciplinary teams for valvular heart disease management.

In November 2023, the TRICORDER program led by researchers at Imperial College London deployed AI-enabled smart stethoscopes across 100 general practitioner clinics with funding support from the National Institute for Health Care Research. The initiative focused on strengthening early detection of heart failure in primary care by equipping clinicians with advanced auscultation tools and decision support capabilities, demonstrating the practical value of AI-assisted diagnostics in everyday healthcare environments.

Manufacturers pursue opportunities to integrate artificial intelligence algorithms that analyze auscultatory data in real time, expanding applications in telemedicine consultations for remote cardiac and respiratory monitoring. Developers advance wireless connectivity features that transmit high-fidelity sounds to cloud platforms, facilitating collaborative reviews in complex cases like congenital heart defects or interstitial lung diseases. These innovations enable automated anomaly detection in fetal monitoring during prenatal visits, enhancing early identification of arrhythmias.

Opportunities emerge in wearable stethoscope prototypes that allow continuous auscultation in post-operative recovery, alerting to complications such as pleural effusions or atelectasis. Companies invest in noise-cancellation technologies and ergonomic designs that improve usability for extended wear in high-volume clinics assessing cardiovascular and pulmonary conditions.

Recent trends emphasize hybrid analog-digital models that maintain traditional functionality while incorporating smartphone integration, supporting point-of-care education and training in medical schools for auscultatory skill development across specialties.

Key Takeaways

- In 2024, the market generated a revenue of US$ 673.2 Million, with a CAGR of 5.9%, and is expected to reach US$ 1194.3 Million by the year 2034.

- The product type segment is divided into acoustic stethoscopes, smart stethoscopes and electronic stethoscopes, with acoustic stethoscopes taking the lead with a market share of 56.7%.

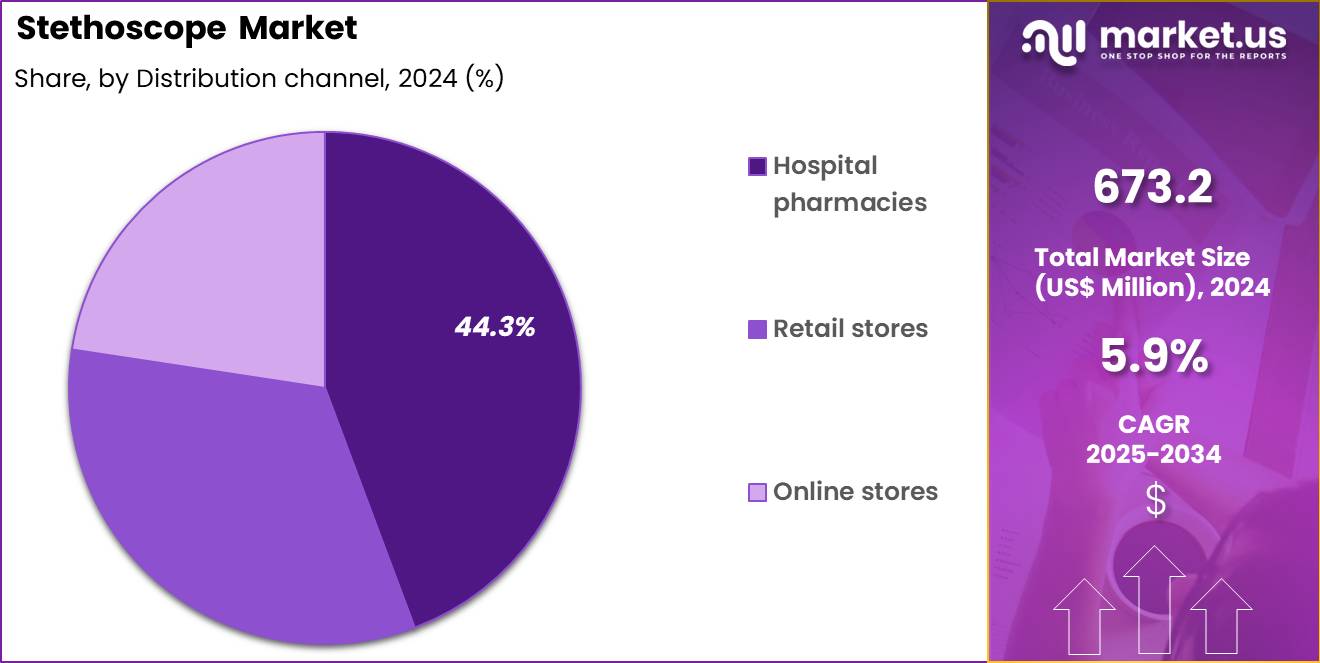

- Considering distribution channel, the market is divided into hospital pharmacies, retail stores and online stores. Among these, hospital pharmacies held a significant share of 44.3%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, home healthcare and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 61.8% in the market.

- North America led the market by securing a market share of 34.4%.

Product Type Analysis

Acoustic stethoscopes contributed 56.7% of growth within product type and stay central to everyday clinical assessment in the stethoscope market. Doctors and nurses use them throughout the day because they deliver instant sound feedback without batteries, pairing, or charging routines. Training institutions continue to push steady demand since medical students typically purchase an acoustic model first.

Hospitals favor acoustic options for general wards because they handle frequent use, cleaning cycles, and rough handling better than many digital devices. Clinicians also trust acoustic stethoscopes during quick triage, when they need immediate chest and heart checks before ordering tests. Affordable pricing encourages wider ownership, so departments keep spare units to prevent workflow delays.

Manufacturers keep improving tubing quality, diaphragm sensitivity, and chestpiece ergonomics, which increases upgrade and replacement purchases. Pediatric and adult variants support broad usage across cardiology, emergency care, and internal medicine. Large patient loads in respiratory and cardiac cases increase auscultation frequency, reinforcing recurring utilization. Infection prevention rules drive regular disinfection, which increases replacement demand when parts degrade.

Many providers prefer acoustic devices for bedside rounds because they fit easily into pockets and tolerate long shifts. Procurement teams also select acoustic models to standardize clinical tools across staff levels. Rural and resource-limited facilities rely on acoustic stethoscopes because they avoid dependency on digital infrastructure.

Simple maintenance, such as replacing ear tips or diaphragms, extends usable life while sustaining accessory demand. Clinical familiarity continues to shape purchasing behavior, especially among senior practitioners. The segment is projected to remain the top contributor because it combines reliability, low operating burden, and universal applicability.

Distribution Channel Analysis

Hospital pharmacies accounted for 44.3% of growth within distribution channels and lead stethoscope sales through institutional supply routes. Most hospitals prefer internal sourcing because they control product quality, approved brands, and availability for new hires. Central distribution also supports smoother onboarding, since staff often receive essential tools during joining or rotation. Bulk purchasing agreements reduce per-unit cost and improve supply stability, which helps hospitals avoid shortages during peak patient months.

Hospital pharmacy counters serve as fast-access points for clinicians who need immediate replacement due to loss, damage, or ward transfer. Standardized stock across departments improves consistency in clinical assessment, especially in large multi-specialty facilities. Infection control practices increase turnover when devices wear out from repeated cleaning. Teaching hospitals increase pharmacy-led distribution because trainees require reliable equipment for daily rounds and examinations.

Inventory tracking helps departments manage allocations and prevent unnecessary over-ordering. Hospital procurement teams also prefer this channel to reduce counterfeit risk compared to fragmented retail supply. Support services, such as warranty handling and supplier coordination, strengthen the role of internal purchasing.

In many settings, hospital billing systems link equipment supply to department budgets, which encourages pharmacy-managed distribution. Larger hospitals often keep multiple acoustic and specialty variants to meet pediatric, ICU, and cardiology needs. Continuous staff movement across wards increases frequent purchase and replacement cycles. The segment is anticipated to remain strong because institutional buying concentrates volume and protects workflow continuity.

End-User Analysis

Hospitals and clinics generated 61.8% of growth within end-users and remain the primary demand base for stethoscopes due to nonstop examination activity. Clinicians depend on auscultation during initial assessment, routine monitoring, and discharge decision-making. Busy outpatient clinics drive repeat usage because each consultation begins with basic heart and lung evaluation. Emergency departments raise device demand further because triage teams require rapid physical checks during high patient inflow.

Cardiovascular disease and respiratory infections increase the volume of daily chest examinations, pushing regular device usage across departments. Hospitals employ large numbers of physicians, nurses, interns, and paramedics, which expands total device ownership. Rotation-based staffing increases replacements because individuals often carry personal stethoscopes between units. Clinics also purchase stethoscopes in sets for consultation rooms to avoid delays from shared equipment.

Hygiene policies encourage frequent cleaning, which gradually affects tubing and ear tips, supporting ongoing replacement demand. Specialty areas such as pediatrics, cardiology, and ICU require different chestpiece designs, expanding product mix within the same facility. Health screening programs increase routine check-ups, strengthening baseline consumption.

Hospital administrators prioritize consistent, dependable tools because they support faster decisions at the bedside. The shift toward early diagnosis and quick clinical action keeps auscultation relevant even with rising imaging use. The segment is expected to stay dominant because hospitals and clinics concentrate patient volume, clinical staff, and day-to-day examination routines.

Key Market Segments

By Product Type

- Acoustic stethoscopes

- Smart stethoscopes

- Electronic stethoscopes

By Distribution Channel

- Hospital pharmacies

- Retail stores

- Online stores

By End-User

- Hospitals & Clinics

- Home healthcare

- Others

Drivers

Rising prevalence of cardiovascular diseases is driving the market.

The escalating global incidence of cardiovascular diseases significantly propels the demand for diagnostic tools such as stethoscopes in clinical settings. Improved screening programs and awareness initiatives contribute to earlier detection, necessitating reliable auscultation devices for routine examinations.

According to the American College of Cardiology, cardiovascular diseases caused 19.2 million deaths worldwide in 2023, marking an increase from 13.1 million in 1990. This surge underscores the critical role of stethoscopes in monitoring heart conditions across diverse patient populations. Healthcare providers increasingly rely on these instruments for initial assessments in primary care and emergency departments.

The correlation between aging populations and higher cardiovascular risks further amplifies market expansion. Government organizations emphasize preventive cardiology, supporting the integration of advanced stethoscopes in public health strategies. Key manufacturers are enhancing product features to address this growing diagnostic need effectively. Overall, this driver fosters innovation and broader adoption in global healthcare systems.

Restraints

High cost of advanced digital stethoscopes is restraining the market.

The elevated pricing of digital stethoscopes equipped with features like amplification and connectivity restricts their uptake in cost-sensitive environments. Traditional acoustic models remain preferred in many facilities due to lower acquisition expenses and familiarity among practitioners. Budget constraints in public healthcare systems often lead to deferred purchases of sophisticated variants. Regulatory compliance and quality assurance add to the overall cost structure for manufacturers.

In regions with limited reimbursement policies, affordability issues hinder market penetration among smaller clinics. Providers may prioritize essential equipment over premium digital options to manage operational finances. This restraint affects scalability, particularly in developing economies with constrained resources.

Industry attempts to introduce mid-range models aim to alleviate pricing pressures partially. Despite technological benefits, the cost factor limits universal accessibility and adoption rates. Consequently, addressing economic barriers is essential for overcoming this market limitation.

Opportunities

Expansion of telemedicine services is creating growth opportunities.

The proliferation of telemedicine platforms opens avenues for integrating digital stethoscopes in remote patient consultations. Increasing investments in digital health infrastructure support the deployment of connected devices for virtual examinations. Rising demand for home-based monitoring solutions amplifies the potential for stethoscope applications in non-traditional settings. Partnerships between technology firms and healthcare providers facilitate seamless data transmission and analysis.

Government policies promoting telehealth adoption enhance reimbursement frameworks for related equipment. Educational programs for clinicians on remote auscultation techniques boost confidence in utilizing these tools. The large underserved rural populations benefit from improved access to specialist consultations via telemedicine.

Key players are developing compatible software to optimize stethoscope functionality in virtual environments. This opportunity aligns with global efforts to enhance healthcare equity through technology. Strategic initiatives can capture substantial market share in evolving digital ecosystems.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions steer investments toward diagnostic tools, bolstering the stethoscope market as healthcare facilities prioritize affordable auscultation devices amid rising patient volumes in developed nations. Executives align product strategies with increasing life expectancies, which heightens utilization of electronic stethoscopes in telemedicine applications across growing economies.

Regrettably, rampant international inflation amplifies costs for acoustic components and assembly labor, urging suppliers to refine pricing tactics in margin-pressured segments. Surging geopolitical disputes in electronics-exporting areas impede circuit board procurements, obliging global operators to manage inventory shortfalls in disrupted trade flows.

Innovators tackle these setbacks by forging adaptive joint ventures in secure regions, which optimizes resource flows and ignites fresh design collaborations. Current US tariffs on imported medical instruments from dominant sources like Asia add fiscal strains, challenging affordability for importers reliant on volume efficiencies.

Native manufacturers harness this environment by expanding U.S.-oriented production lines, which cultivates engineering talent and harmonizes with quality assurance demands. Revolutionary enhancements in noise-cancellation features perpetually uplift the industry’s vitality, assuring progressive accessibility and substantial value generation for healthcare practitioners worldwide.

Latest Trends

Integration of artificial intelligence in digital stethoscopes is a recent trend in the market.

In 2024, advancements in AI algorithms have enabled digital stethoscopes to detect heart abnormalities with greater precision during examinations. Eko Health received FDA clearance in April 2024 for its AI tool that identifies low ejection fraction in seconds using stethoscope data. This innovation facilitates early heart failure screening in primary care settings without additional equipment. AI integration allows for real-time analysis of auscultatory sounds, reducing diagnostic errors.

Manufacturers are embedding machine learning to differentiate between normal and pathological heart rhythms effectively. Clinical trials in 2024 demonstrated improved accuracy in murmur detection through these enhanced devices. The trend emphasizes user-friendly interfaces that provide immediate feedback to clinicians.

Regulatory approvals in 2024 for AI-assisted features have accelerated product commercialization. Industry collaborations focus on refining algorithms using extensive cardiac sound databases. These developments aim to transform routine checkups into proactive diagnostic sessions for cardiovascular health.

Regional Analysis

North America is leading the Stethoscope Market

In 2024, North America held a 45.1% share of the global specialty medical chairs market, driven by the expansion of outpatient clinics and ambulatory surgery centers requiring ergonomic designs for dental, ophthalmology, and gynecology procedures to enhance patient comfort and procedural efficiency amid rising elective surgeries. Healthcare providers increasingly adopted powered adjustable chairs with integrated imaging and lighting features to support minimally invasive techniques, supported by infection control protocols that favor easy-to-clean materials in high-volume settings.

Innovations in bariatric-capable models addressed obesity-related challenges, aligning with clinical standards for safe positioning in orthopedic and ENT examinations. Demographic aging amplified demands for reclining chairs in long-term care facilities, prompting integrated models with mobility aids for geriatric care. Manufacturers refined hydraulic systems for durability, facilitating broader integrations in telemedicine-enabled offices.

Collaborative quality assessments tracked ergonomic outcomes, fostering confidence in pediatric applications. Supply adaptations ensured compliant, modular units for rapid deployment in expansion projects. The Centers for Disease Control and Prevention reported that the percentage of adults age 18 and older with a dental exam or cleaning in the past year stood at 65.5% in 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project notable escalation in specialty medical chairs across Asia Pacific during the forecast period, as governments intensify investments in healthcare facilities to address surging chronic disease screenings amid urbanization. Clinicians incorporate adjustable models into ophthalmology suites, optimizing positioning for cataract surgeries in densely populated cities.

National authorities subsidize bariatric variants for public hospitals, equipping them to manage obesity-linked orthopedic examinations in micronutrient-deficient regions. Biotech developers customize powered recliners with enhanced stability, suiting humid environments for ENT procedures. Cross-national consortia evaluate ergonomic designs through trials, fostering safety for geriatric care in aging societies.

Pharmaceutical partnerships promote modular chairs with integrated monitors, ensuring affordability for rural expansions. Policy frameworks incentivize training on maintenance protocols, extending utility to peripheral clinics facing resource constraints. The World Health Organization estimates that untreated oral diseases affect 3.5 billion people globally in 2022, with the highest burden in Asia Pacific driving demand for dental infrastructure..

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Stethoscope market drive growth by improving acoustic performance, noise isolation, and ergonomic designs that support accurate assessment in high-pressure clinical environments. Companies expand adoption by introducing digital and amplified models that enable sound recording, remote consultation support, and integration with modern connected-care workflows.

Commercial strategies emphasize strong hospital and medical school relationships, ensuring consistent procurement and brand preference among new clinicians. Innovation priorities focus on durable materials, lightweight construction, and user-customizable components that extend product life and comfort during long shifts.

Market expansion targets emerging healthcare systems increasing primary care capacity and investing in frontline diagnostic tools. 3M, through its Littmann portfolio, operates as a leading participant with a long-standing reputation in auscultation technology, global distribution strength, and continued product innovation that sustains leadership across professional healthcare settings.

Top Key Players

- 3M Littmann

- ADC (American Diagnostic Corporation)

- Welch Allyn (Hill-Rom)

- MDF Instruments

- Omron Healthcare

- Heine Optotechnik

- Ultrascope

- Prestige Medical

- Riester GmbH

- Spirit Medical

Recent Developments

- In March 2024, ChestPal introduced a newly developed digital stethoscope in the United States, expanding the availability of smart auscultation devices in the domestic market. The launch reflects growing demand for connected diagnostic tools that support enhanced sound quality, data capture, and integration with digital health platforms in routine clinical practice.

- In February 2024, Sparrow brought to market a smartphone based stethoscope that received FDA clearance, combining consumer mobile technology with clinically reliable acoustic performance. By enabling high quality heart and lung sound capture through a mobile device, the rollout supports wider adoption of portable diagnostic solutions across both professional and remote care settings.

Report Scope

Report Features Description Market Value (2024) US$ 673.2 Million Forecast Revenue (2034) US$ 1194.3 Million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Acoustic Stethoscopes, Smart Stethoscopes and Electronic Stethoscopes), By Distribution Channel (Hospital Pharmacies, Retail Stores and Online Stores), By End-User (Hospitals & Clinics, Home Healthcare and Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape 3M Littmann, ADC (American Diagnostic Corporation), Welch Allyn (Hill-Rom), MDF Instruments, Omron Healthcare, Heine Optotechnik, Ultrascope, Prestige Medical, Riester GmbH, Spirit Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Littmann

- ADC (American Diagnostic Corporation)

- Welch Allyn (Hill-Rom)

- MDF Instruments

- Omron Healthcare

- Heine Optotechnik

- Ultrascope

- Prestige Medical

- Riester GmbH

- Spirit Medical