Global STEM Toys Market Size, Share, Growth Analysis By Product Type (Science Toys, Technology Toys, Engineering Toys, Mathematics Toys, Robotics Kits, Coding Kits), By Age Group (0–3 Years, 4–7 Years, 8–12 Years, 13+ Years), By Sales Channel (Online Retail, Offline Retail, Educational Institutions), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144796

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

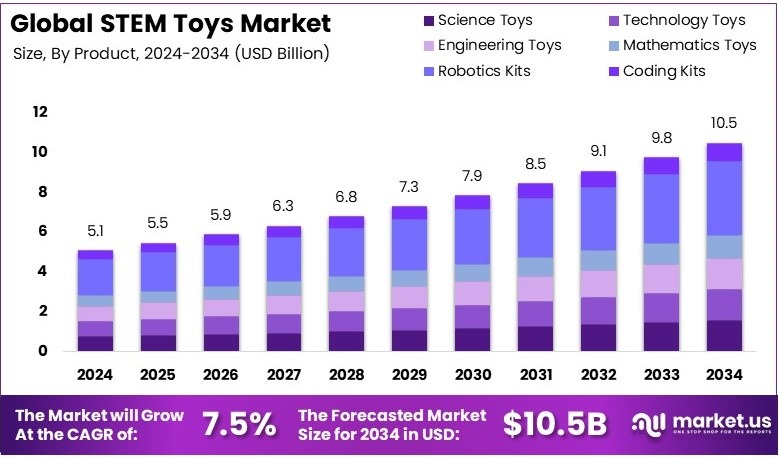

The Global STEM Toys Market size is expected to be worth around USD 10.5 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

STEM toys are educational products designed to teach concepts in science, technology, engineering, and mathematics. These toys encourage problem-solving, creativity, and critical thinking. They are suitable for children of different age groups. STEM toys often include building kits, coding games, and robotic models. They are used at home and in schools for interactive learning.

The STEM toys market involves the production, distribution, and sale of educational toys that focus on STEM subjects. It caters to parents, schools, and educational institutions. The market is driven by the growing importance of STEM education. Demand is fueled by increasing awareness of the need for early skill development in science and technology.

STEM toys are gaining significant traction as valuable educational tools. They are designed to enhance skills in science, technology, engineering, and math (STEM), preparing children for future careers. Parents and educators increasingly view these toys and games as essential for developing problem-solving and analytical abilities. The growth is primarily driven by the rising demand for hands-on learning experiences. Furthermore, the trend towards more interactive and experiential education significantly supports market expansion.

Moreover, the appeal of STEM toys goes beyond just parental interest. Educational policies focusing on practical, skills-based learning align well with the concept of STEM toys. For instance, many countries are promoting early STEM education through school curriculums and community programs.

Companies are now investing in products that integrate elements like coding, robotics, and problem-solving challenges. On the other hand, affordability and accessibility remain challenges, particularly in emerging markets. Addressing these issues can unlock new growth opportunities.

According to a survey by Microsoft, 50% of parents desire STEM-related careers for their children, yet only 24% are highly willing to invest extra resources to enhance their kids’ math and science skills. This disparity reveals an opportunity for the development of affordable and engaging STEM toys that can help bridge the gap between parental aspirations and practical investment.

Furthermore, another survey by U.S. Cellular and Girls Who Code indicates that while 86% of students and 94% of parents acknowledge the importance of STEM, less than one in five students participated in STEM extracurricular activities in the past year. This shortfall often stems from a lack of engaging, accessible opportunities, highlighting the need for more inclusive and attractive STEM toy options.

Meanwhile, early childhood education (ECE) is increasingly recognized for its critical role in cognitive development. Studies show that about 85% of a child’s brain development occurs within the first six years. Engaging children in activities like puzzles, games, and hands-on experiments significantly boosts cognitive skills.

Key Takeaways

- The STEM Toys Market was valued at USD 5.1 billion in 2024 and is expected to reach USD 10.5 billion by 2034, with a CAGR of 7.5%.

- In 2024, Robotics Kits dominate the type segment with 35.2%, driven by growing interest in coding and automation skills.

- In 2024, 8–12 Years leads the age group segment with 40.3%, as children in this range actively engage in STEM learning.

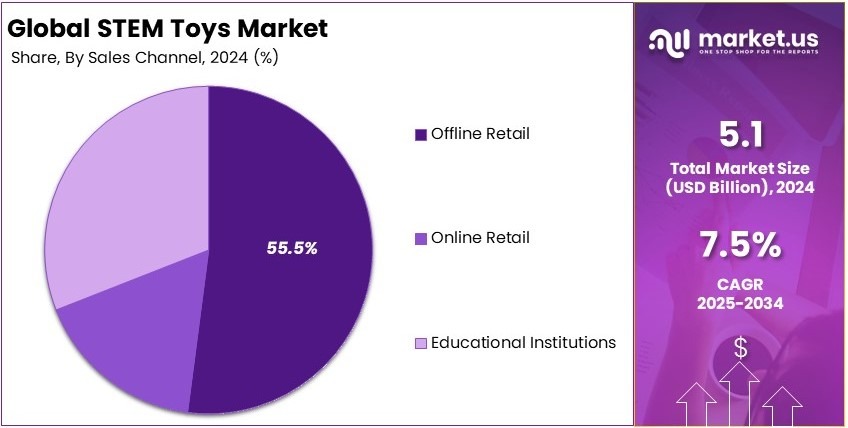

- In 2024, Offline Retail holds the highest share at 55.5%, benefiting from hands-on demonstrations and parental preferences.

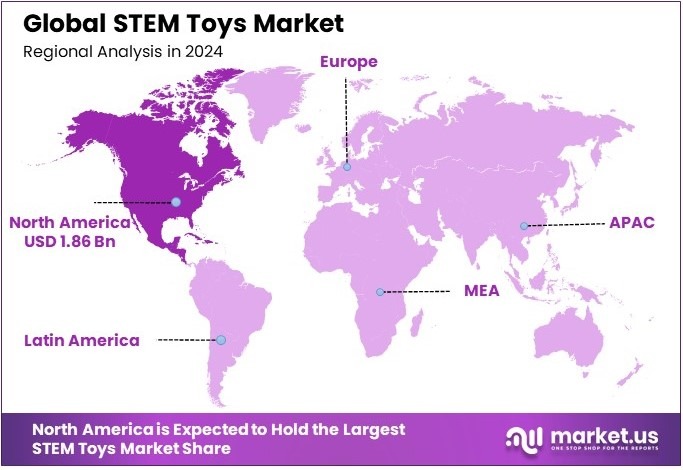

- In 2024, North America dominates with 36.4% and is valued at USD 1.86 billion, supported by strong educational initiatives and tech adoption.

Business Environment Analysis

The STEM toys market is experiencing high market saturation with numerous brands competing for consumer attention. Established players dominate the market, making it challenging for new entrants to stand out. However, this saturation creates opportunities for innovation in specific segments. New companies can focus on unique product features or targeted marketing strategies to capture interest.

Furthermore, the target demographic for STEM toys is primarily parents, schools, and educational institutions, with a focus on children aged 3-12. The increasing demand for educational toys that foster creativity and learning is driving growth in this market. In particular, regions like North America, Europe, and Asia-Pacific are key markets where parents are seeking educational solutions for their children.

As the market grows, product differentiation becomes a crucial factor for success. Brands can set themselves apart by offering products that provide unique educational value, such as those focusing on coding or robotics. approx 40% of consumers are willing to pay a premium for toys that encourage problem-solving skills and creativity, making differentiation an essential strategy for capturing consumer interest.

Subsequently, a thorough value chain analysis highlights the importance of efficient production and distribution in the STEM toys market. Key players are investing in improving manufacturing processes and logistics. Raw material sourcing and distribution networks are crucial for minimizing costs and ensuring that products reach customers in a timely manner.

Finally, adjacent markets like educational technology and children’s learning apps are gaining relevance. Many STEM toy companies are expanding into these areas, with many firms diversifying into digital learning tools. This convergence between physical toys and digital learning resources is a growing trend, offering new growth prospects in the educational sector.

Type Analysis

Robotics Kits dominate with 35.2% due to their integration with advanced technology and real-world application.

The STEM Toys Market is segmented by various product types, with Robotics Kits emerging as the most dominant sub-segment. Robotics Kits account for 35.2% of the market share, driven by their appeal to children interested in technology and engineering. These kits not only engage users with hands-on activities but also enhance critical thinking and problem-solving skills by mimicking real-world engineering challenges.

In the industry of Science Toys, they are essential for introducing basic scientific concepts to young learners, making up a substantial part of the market. They encourage curiosity and observational skills by allowing children to conduct experiments that demonstrate fundamental principles of physics, chemistry, and biology.

Technology Toys, focusing on electronic and digital devices, play a crucial role in introducing children to the basics of circuitry, programming, and digital interaction. Although not the dominant sub-segment, they are vital for developing digital literacy from a young age.

Engineering Toys are designed to foster an understanding of mechanical and structural principles. By building structures and mechanisms, children develop spatial awareness and an understanding of geometric concepts, which are fundamental in many engineering disciplines.

Lastly, Mathematics Toys and Coding Kits are instrumental in developing numerical and computational skills, respectively. Mathematics Toys help in grasping basic arithmetic and geometry, while Coding Kits introduce children to computer programming, algorithms, and logic, all of which are critical in today’s technology-driven world.

Age Group Analysis

8–12 Years dominate with 40.3% due to their targeted cognitive development stage and school curriculum alignment.

The 8–12 Years segment leads the STEM Toys Market, representing 40.3% of the age-based segmentation. This dominance is attributed to the alignment of these toys with school curricula and the cognitive development stage of children within this age group. Toys designed for this segment are more complex, catering to the advanced thinking and problem-solving abilities that develop in pre-teens.

The 0–3 Years segment focuses on sensory and motor skill development, using bright colors, textures, and simple designs to stimulate early learning. Although these toys are crucial for early development stages, they do not contribute as significantly to the STEM-specific market.

For children aged 4–7 Years, STEM toys are designed to introduce basic concepts of science and mathematics through play. These toys are simpler and more focused on learning through interaction and fun, which is essential at this developmental stage.

The 13+ Years segment includes more sophisticated toys, often incorporating real-world applications and more complex problem-solving scenarios. These toys are crucial for teenagers developing more advanced skills in technology and engineering, preparing them for higher education and careers in STEM fields.

Sales Channel Analysis

Offline Retail dominates with 55.5% due to its physical shopping experience and the benefit of immediate product access.

Offline Retail holds the largest share in the Sales Channel segment of the STEM Toys Market, with 55.5%. This dominance is bolstered by the tactile and immediate nature of shopping in-store, which allows customers to physically interact with the product before purchasing, providing a critical advantage in decision-making.

Online Retail, although not the dominant segment, plays a crucial role due to its convenience and the broader access it provides to various brands and products that might not be available locally.

Educational Institutions, while essential for the educational integration of STEM toys, do not hold the dominant position but significantly influence the market by embedding STEM learning into academic settings.

Key Market Segments

By Product Type

- Science Toys

- Technology Toys

- Engineering Toys

- Mathematics Toys

- Robotics Kits

- Coding Kits

By Age Group

- 0–3 Years

- 4–7 Years

- 8–12 Years

- 13+ Years

By Sales Channel

- Online Retail

- Offline Retail

- Educational Institutions

Driving Factors

Increasing Emphasis on Educational Value Drives Market Growth

The STEM toys market is experiencing significant growth due to the increasing focus on early childhood education and cognitive development. Parents and educators recognize the importance of hands-on learning for building essential skills. STEM toys that encourage problem-solving, creativity, and critical thinking are gaining popularity as a result.

Furthermore, there is a growing awareness among parents about the importance of STEM skills for future career opportunities. As technology becomes more integral to everyday life, parents want to prepare their children for tech-driven jobs. This awareness has fueled demand for toys that teach coding, robotics, and other technical skills.

In addition, educational technology integration has enhanced the appeal of STEM toys. Interactive and programmable toys allow children to experiment with coding, robotics, and electronics in an engaging way. These toys not only provide entertainment but also foster practical skills.

Subscription-based STEM toy kits have also emerged as a key growth factor. They offer continuous learning and keep children engaged with new challenges regularly. Parents appreciate the structured and progressive nature of these kits, as they ensure consistent skill development.

Restraining Factors

High Costs and Competition Restraints Market Growth

Despite the growing popularity, the STEM toys market faces challenges that hinder its growth. One major issue is the high cost of advanced and programmable STEM toys. Many of these products, equipped with robotics and AI features, are priced beyond the average consumer’s budget. This limits accessibility, particularly for families from low to middle-income backgrounds.

Additionally, competition from traditional and digital gaming platforms poses a challenge. Video games and other non-educational toys often capture children’s attention more easily, diverting demand away from STEM-focused products.

Another significant barrier is the difficulty in aligning STEM toys with school curricula. Educational institutions in different regions follow varied teaching methods, making it hard for manufacturers to create universally compatible products. This lack of standardization reduces the adoption rate among schools and educational bodies.

Furthermore, safety concerns regarding electronic STEM toys can restrict market growth. Regulatory compliance can be complex, and any product recall can damage a brand’s reputation. These factors collectively create hurdles that need to be addressed for sustained market expansion.

Growth Opportunities

Technological Advancements Provide Opportunities

The evolution of AI-powered and augmented reality (AR) toys presents new opportunities for the STEM toys market. These technologies allow for more immersive and personalized learning experiences. For instance, AI-driven robots that teach coding in a playful manner are gaining traction.

Additionally, AR-enabled STEM toys enable children to interact with digital elements in the real world, making learning more engaging and interactive. Expanding the range of gender-neutral and inclusive STEM toys also offers a growth avenue. Historically, STEM toys have been marketed mainly to boys, but a shift toward inclusivity can attract a broader customer base.

Moreover, the rising demand for DIY and robotics kits reflects a desire for hands-on learning. These kits allow children to build and customize their projects, fostering creativity and problem-solving.

Collaborations between toy manufacturers and educational institutions further enhance market potential. Schools increasingly seek toys that align with modern educational goals, creating a bridge between play and formal learning. These opportunities are pivotal for driving the future of the STEM toys market.

Emerging Trends

Coding and Robotics Are Latest Trending Factor

The rising popularity of coding and robotics-based STEM toys is shaping the market trends. These toys encourage hands-on learning, allowing children to build robots or code simple programs. As coding becomes a fundamental skill, toys that make programming fun and accessible are increasingly valued.

Additionally, there is a growing demand for eco-friendly and recyclable materials in toy manufacturing. Consumers are becoming more environmentally conscious, prompting brands to create sustainable options without compromising educational value.

Personalized and adaptive learning toys are also trending. AI-powered toys that adjust difficulty levels based on a child’s progress are gaining popularity. They offer tailored experiences that keep children engaged longer.

Furthermore, interactive STEM toys that incorporate blockchain or NFT-based digital rewards are emerging. These toys integrate the digital world with physical play, attracting tech-savvy families. The combination of coding, robotics, sustainability, and digital integration keeps the STEM toy market dynamic and forward-looking.

Regional Analysis

North America Dominates with 36.4% Market Share in the STEM Toys Market

North America holds a significant position in the STEM Toys Market with a 36.4% share and valuation of USD 1.86 Bn. This dominance is propelled by its strong educational infrastructure, a high focus on STEM education from an early age, and substantial consumer spending power.

The region’s commitment to innovation and education, coupled with the presence of major toy manufacturers who continuously develop and market STEM-related toys, drives its market leadership. Moreover, the cultural emphasis on educational enrichment activities that prepare children for technology-driven futures supports sustained demand for STEM toys.

Looking forward, the influence of North America on the global STEM Toys Market is expected to remain robust. As technological advancements continue and the emphasis on STEM education persists, North American companies are likely to innovate further, potentially increasing the region’s market share.

Regional Mentions:

- Europe: Europe maintains a solid market presence in the STEM Toys sector, bolstered by educational policies that support early STEM learning. Countries like Germany and the UK are notable for their robust educational systems that integrate STEM learning tools from primary levels.

- Asia Pacific: The Asia Pacific region shows rapid growth in the STEM Toys Market, driven by rising educational standards and increasing middle-class disposable income. Countries like China and Japan are investing heavily in educational toys to boost STEM learning among the youth.

- Middle East & Africa: In the Middle East and Africa, increasing awareness about the importance of STEM education is gradually transforming the market. Initiatives to modernize educational infrastructure are paving the way for greater adoption of STEM toys.

- Latin America: Latin America is experiencing a growing interest in STEM education, with countries like Brazil and Mexico leading the way in integrating STEM toys into educational curricula to enhance learning and problem-solving skills among students.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The STEM toys market is driven by leading companies that set industry trends through innovation and educational focus. The top four companies in this market are LEGO Group, Hasbro, Inc., Mattel, Inc., and Learning Resources Ltd. These key players dominate through their strong brand presence, diverse product offerings, and strategic innovation.

LEGO Group is the market leader, known for its versatile building kits that promote creativity and problem-solving. LEGO’s robotics and coding series, like LEGO Mindstorms and LEGO Education sets, blend play with learning. The brand’s global reach and continuous innovation keep it at the forefront of the STEM toys market. Additionally, partnerships with educational institutions bolster its credibility in the learning space.

Hasbro, Inc. is another major player, offering a range of educational toys that integrate technology and interactive features. Its products, such as coding robots and science kits, appeal to both parents and educators. Hasbro leverages popular franchises to make STEM learning more relatable and engaging for children.

Mattel, Inc. stands out with its focus on interactive and tech-based learning. Brands like Fisher-Price, under Mattel, introduce STEM concepts to younger audiences. Mattel’s collaboration with technology companies helps integrate modern features like augmented reality and app connectivity into their products.

Learning Resources Ltd. is recognized for its educational toys tailored to classroom use. The company focuses on hands-on learning with products like coding robots and math manipulatives. These toys are widely used in schools, making Learning Resources a trusted name among educators.

Together, these companies drive innovation and market growth. They continually evolve their product lines to meet changing educational needs. By leveraging brand loyalty and technological advancements, they maintain strong positions in the STEM toys market. Their focus on interactive and engaging learning tools supports their leadership in this competitive landscape.

Major Companies in the Market

- LEGO Group

- Hasbro, Inc.

- Mattel, Inc.

- Learning Resources Ltd.

- Melissa & Doug, LLC

- Ravensburger AG

- VTech Holdings Limited

- Fisher-Price (a subsidiary of Mattel)

- Thames & Kosmos

- SmartLab Toys

Recent Developments

- Lego: On March 2025, Lego announced plans to invest further in digital gaming and collaborations with brands like Nike and Formula One. This initiative targets tweens (ages 9-12) to maintain their interest amid growing competition from social media platforms. In 2024, Lego reported a 13% increase in sales, reaching 74.3 billion Danish kroner.

- Spin Master and Melissa & Doug: On January 2024, Spin Master Corp. completed its acquisition of Melissa & Doug, a well-recognized brand in early childhood play, for $950 million in cash. This strategic move aims to enhance Spin Master’s position in the educational toy market.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 10.5 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Science Toys, Technology Toys, Engineering Toys, Mathematics Toys, Robotics Kits, Coding Kits), By Age Group (0–3 Years, 4–7 Years, 8–12 Years, 13+ Years), By Sales Channel (Online Retail, Offline Retail, Educational Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LEGO Group, Hasbro, Inc., Mattel, Inc., Learning Resources Ltd., Melissa & Doug, LLC, Ravensburger AG, VTech Holdings Limited, Fisher-Price (a subsidiary of Mattel), Thames & Kosmos, SmartLab Toys Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LEGO Group

- Hasbro, Inc.

- Mattel, Inc.

- Learning Resources Ltd.

- Melissa & Doug, LLC

- Ravensburger AG

- VTech Holdings Limited

- Fisher-Price (a subsidiary of Mattel)

- Thames & Kosmos

- SmartLab Toys