Global Toys And Games Market By Product Type (Games and Puzzles, Electronic Games, Construction Toys, Dolls and Accessories, Outdoor and Sports Toys, Others), By Age Group (Below 8 Years, 9–15 Years, 15+ Years), By Material, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134184

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

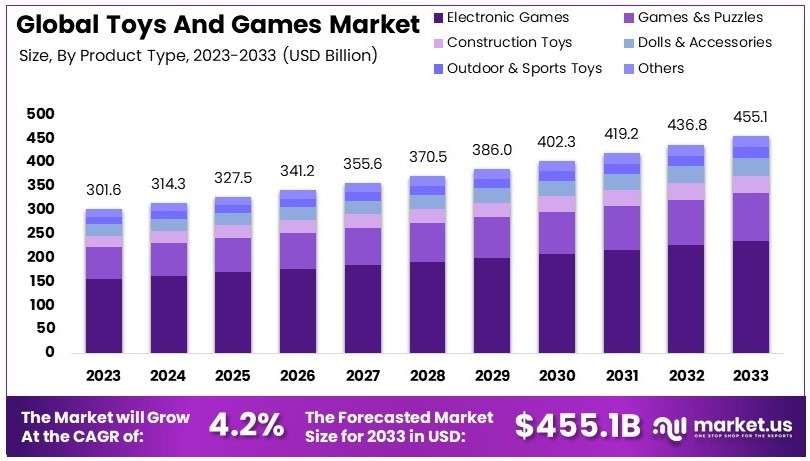

The Global Toys And Games Market size is expected to be worth around USD 455.1 Billion by 2033, from USD 301.6 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

Toys and games are products designed for play and entertainment, catering to children and adults. These include dolls, action figures, puzzles, and outdoor play items. They help in developing creativity, cognitive skills, and physical activity. Moreover, toys and games are integral to leisure and educational activities.

The toys and games market focuses on the production, distribution, and sale of these items. It covers a wide range of products, addressing different age groups and preferences. Additionally, the market supports innovation in design and materials, ensuring products meet safety standards and consumer expectations.

The toys and games industry continues to grow, driven by innovation and rising consumer demand. In 2023, 94% of parents recognized the importance of toys in child development, according to the Toy Association. Additionally, educational toys align with the 15% rise in STEM enrollment over five years, as reported by the National Center for Education Statistics (NCES), creating opportunities for skill-focused products.

Market competitiveness remains intense, with global players introducing sustainable and smart toys. Simultaneously, China dominates production with 90% of global toy factories, while the U.S. imports 97% of its toys, according to industry data from the Toy Association. Consequently, supply chain efficiency and cost management are key for maintaining market leadership and ensuring consistent consumer satisfaction.

Broader regulations, like the European Union’s AI Act expected in 2024, focus on data privacy in connected toys, ensuring safe usage. Locally, early education programs in the UK saw 59% enrollment among children aged 3-5 in 2022, according to the UK Department for Education, boosting demand for age-appropriate educational toys that combine play and learning.

Global partnerships are advancing innovation, as seen in Mattel’s collaboration with ToyTalk for privacy-focused toys. Furthermore, early childhood investment is crucial, with 80% of neural development occurring by age three, as highlighted by the World Health Organization (WHO) and UNICEF. Thus, the market shows significant potential for growth in both educational and developmental product segments.

Key Takeaways

- The Toys and Games Market was valued at USD 301.6 billion in 2023 and is projected to reach USD 455.1 billion by 2033, with a CAGR of 4.2%.

- In 2023, Electronic Games dominated the product type segment with a 51.7% share, driven by their interactive and educational appeal.

- In 2023, the 15 Years and Above age group led the market with a 42.5% share, reflecting the increasing popularity of games among older consumers.

- In 2023, Plastic was the dominant material type, attributed to its affordability and versatility in toy manufacturing.

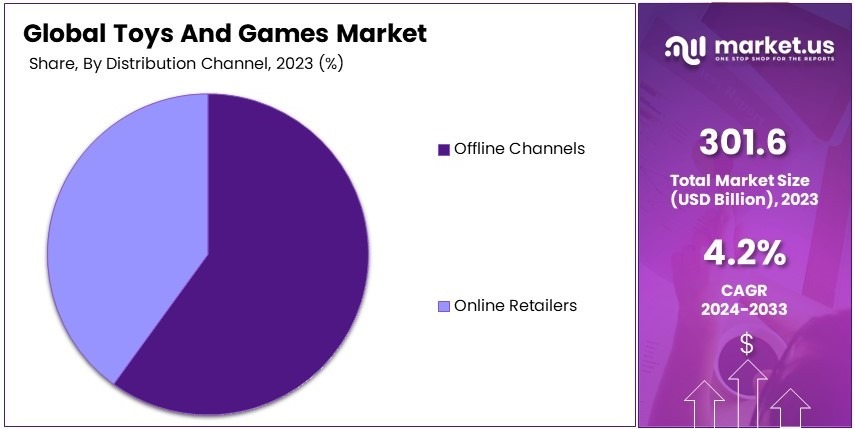

- In 2023, the Offline distribution channel held a 53.2% share, as consumers preferred physical store purchases.

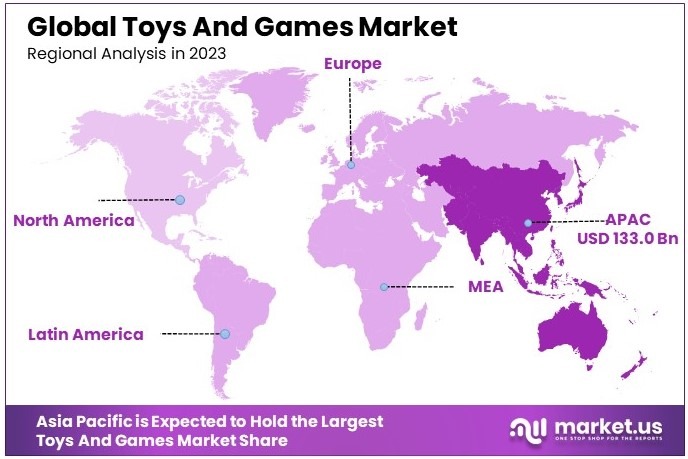

- In 2023, the Asia-Pacific region dominated the market with a 44.1% share, amounting to USD 133.00 billion, driven by a strong manufacturing base and consumer demand.

Product Type Analysis

Electronic Games dominate with 51.7% due to technological advancements and high consumer engagement.

In the Product Type segment of the Toys and Games Market, Electronic Games lead significantly. This sub-segment has thrived due to the increasing integration of technology in toys, appealing to both children and adults. Electronic games provide interactive experiences, often combining education with entertainment, which sustains high levels of user engagement and broadens their appeal.

Games and Puzzles maintain steady popularity by offering cognitive benefits and family-friendly activities. Construction toys foster creativity and motor skills, especially among younger children, while Dolls and Accessories continue to appeal primarily to the below 8 years age group.

Outdoor and Sports Toys promote physical activity, crucial for health, making them essential in the market mix. However, the dynamic nature and wide demographic appeal of electronic games secure their dominant position.

Age Group Analysis

15 Years and Above dominate with 42.5% due to a growing interest in sophisticated gameplay.

The 15 Years and Above age group leads the Age Group segment, primarily driven by a maturing player base that seeks more complex and challenging games. This demographic often pursues gaming as a sustained hobby rather than a casual pastime, influencing their preferences for products offering depth and replayability, such as advanced electronic games and intricate puzzles.

The Below 8 Years segment is mainly engaged with toys that are educational and developmentally appropriate, whereas the 9-15 Years group tends to gravitate towards interactive and multiplayer experiences which can include both electronic and traditional games.

However, the 15+ category’s preference for sophisticated and engaging gameplay significantly influences market trends and product development.

Material Analysis

Plastic dominates due to its durability and cost-effectiveness.

Plastic is the leading material in the Toys and Games Market, favored for its durability, versatility, and cost-effectiveness. It is widely used across all toy categories due to its ability to be molded into a vast range of shapes and its long-lasting nature, making it ideal for everything from intricate electronic game components to robust outdoor toys.

Wood offers an eco-friendly alternative with a niche appeal, primarily in educational toys and puzzles. Fabric is predominantly used in dolls and some educational toys for younger children, providing softness and safety.

While metal is less common, typically reserved for certain outdoor toys or specialty collectibles. Despite these variations, the widespread use of plastic across multiple product types cements its dominance in the market.

Distribution Channel Analysis

Offline Sales dominate with 53.2% due to the experiential buying process and instant gratification.

Offline channels are the most significant Distribution Channel in the Toys and Games Market. These include supermarkets and hypermarkets, specialty stores, and traditional stores. The tactile nature of toy shopping and the instant gratification that comes with in-store purchases give offline channels an edge over online retailers.

Specialty stores are particularly important, offering expert advice and a curated selection which appeals to consumers seeking specific products or quality assurance.

Online retailers provide convenience and a broad selection, making them a growing force in the market, especially for busy families and price-sensitive consumers. However, the ability to touch, feel, and explore toys directly before purchase keeps many consumers loyal to offline shopping experiences, securing their lead in the distribution landscape.

Key Market Segments

By Product Type

- Games and Puzzles

- Electronic Games

- Construction Toys

- Dolls and Accessories

- Outdoor and Sports Toys

- Others

By Age Group

- Below 8 Years

- 9-15 Years

- 15+ Years

By Material

- Plastic

- Wood

- Fabric

- Metal

- Others

By Distribution Channel

- Online Retailers

- Offline Channels

- Supermarkets and Hypermarkets

- Specialty Stores

- Traditional Stores

- Others

Drivers

Increasing Focus on Educational Toys Drives Market Growth

The growing focus on educational toys is a key driver in the toys and games market. Parents are increasingly seeking products that not only entertain but also enhance their children’s cognitive and motor skills.

Educational toys designed to teach concepts like math, language, and problem-solving are becoming highly popular. Another factor driving growth is the rising demand for licensed merchandise. Toys based on popular franchises, movies, and TV shows attract a loyal consumer base, boosting sales significantly.

The demand for sustainable and eco-friendly toys is also propelling market growth. Parents and manufacturers alike are becoming conscious of environmental impact, leading to a rise in toys made from recyclable and biodegradable materials.

Additionally, the expansion of online retail platforms has revolutionized toy shopping. E-commerce platforms offer convenience, competitive pricing, and a wide range of products, making toys more accessible to a global audience. These combined factors create a strong foundation for sustained growth in the toys and games market.

Restraints

High Manufacturing Costs Restraint Market Growth

High manufacturing costs for premium toys significantly restrain the growth of the toys and games market. The use of high-quality materials and intricate designs often results in increased production expenses, impacting pricing and market accessibility.

Another major restraint is the growing competition from digital entertainment options like video games and streaming services. These alternatives often capture a larger share of consumer spending, particularly among older children and teenagers.

Stringent safety regulations also pose challenges to toy manufacturers. Compliance with these standards requires rigorous testing and certification processes, increasing costs and time-to-market. Furthermore, limited consumer spending in emerging economies restricts growth in these regions.

Families with lower disposable incomes are less likely to invest in non-essential or premium toys, hindering market expansion. Together, these factors create hurdles that slow the market’s full potential growth.

Opportunity

Demand for STEM-Based Toys Provides Opportunities

The rising demand for STEM-based toys presents significant growth opportunities for the market. These toys, designed to teach science, technology, engineering, and mathematics, align with educational trends that emphasize practical learning.

Parents are increasingly prioritizing toys that support skill development and future career readiness. Customization and personalized products also offer lucrative opportunities. Consumers are willing to pay a premium for toys that reflect individual preferences, creating a niche market.

Additionally, developing markets with large child populations present untapped potential. These regions offer significant opportunities for affordable and accessible toys, provided manufacturers invest in localized designs and distribution.

The growing focus on multi-generational games is another promising area. Games and toys designed to engage both children and adults foster family bonding, creating a broader consumer base. These opportunities highlight the dynamic potential of the toys and games market.

Challenges

Supply Chain Disruptions Challenge Market Growth

Supply chain disruptions have emerged as a major challenge in the toys and games market. Delays in raw material availability, caused by global events or logistical issues, can slow down production and delivery. Short product lifecycles add to these challenges, as shifting consumer preferences demand rapid innovation and frequent product updates.

The proliferation of counterfeit products further complicates the market landscape. These low-quality alternatives harm brand reputation and reduce revenue for legitimate manufacturers. Dependency on seasonal sales for revenue is another critical issue.

Toy sales often peak during holidays, making companies vulnerable to market fluctuations during off-peak seasons. These challenges underscore the need for efficient strategies to mitigate risks and ensure stability in the market.

Growth Factors

Urbanization and Social Media Marketing Are Growth Factors

Urbanization is a significant growth factor for the toys and games market, as families living in urban areas increasingly seek engaging indoor play solutions. With limited outdoor spaces and busy lifestyles, parents are investing in toys and games that entertain children while promoting learning and creativity.

Social media plays an increasingly pivotal role in marketing toys and games, driving consumer awareness and engagement. Platforms like Instagram, YouTube, and TikTok are used by brands to showcase products through influencer reviews, unboxing videos, and interactive content.

The expansion of independent toy brands has also contributed to market growth. These brands focus on niche products, such as sustainable toys, STEM-based games, or culturally inspired designs, catering to diverse consumer preferences.

Finally, the rising demand for hybrid digital-physical toys is transforming the market. These toys combine traditional elements with app-based or digital features, appealing to tech-savvy consumers who enjoy interactive play.

Emerging Trends

Integration of AR in Toys Is Latest Trending Factor

The integration of augmented reality (AR) and virtual reality (VR) in toys is transforming the industry. These technologies create immersive experiences, blending digital and physical play to captivate tech-savvy consumers.

Collectible and limited-edition toys are also trending, driven by consumer interest in unique and exclusive items that hold long-term value.

Subscription-based toy services are gaining popularity, offering curated packages that deliver variety and convenience to families. This model encourages repeat purchases and builds customer loyalty.

The increased focus on gender-neutral toys reflects changing societal attitudes toward inclusivity and diversity, broadening the market appeal. These trends are reshaping the toys and games industry, driving innovation and consumer engagement.

Regional Analysis

Asia Pacific Dominates with 44.1% Market Share

Asia Pacific holds the dominant share of the Toys and Games Market with 44.1%, valued at a significant portion of the global market. This dominance is primarily driven by the region’s large population, rapid urbanization, and increasing disposable incomes. Countries like China, India, and Japan lead the charge, with a strong demand for both traditional and modern toys.

Key factors contributing to Asia Pacific’s dominance include a growing middle class and a high birth rate, which boosts the demand for toys. Additionally, the region’s manufacturing capabilities allow for cost-effective production of a wide range of toys, making them accessible to consumers worldwide. Strong local brands and the increasing presence of international brands also play a key role in this dominance.

The market dynamics in Asia Pacific are influenced by the region’s diverse cultures and preferences. Regional preferences for educational toys, coupled with the increasing interest in high-tech and interactive toys, support continuous market expansion. The region’s strong export capacity also enables it to serve international markets effectively, enhancing its global market presence.

Regional Mentions

- North America: North America remains a strong market, driven by high disposable incomes and consumer demand for premium and educational toys. The region also benefits from strong e-commerce penetration.

- Europe: Europe focuses on sustainability, with a growing demand for eco-friendly toys. The region has a strong tradition of high-quality manufacturing and innovative toy designs.

- Middle East & Africa: The Middle East and Africa are witnessing growth due to increasing investments in the retail sector and rising disposable income, driving demand for toys.

- Latin America: Latin America is seeing growth in the toy market, fueled by an expanding middle class and increasing urbanization. This growth is also driven by increasing demand for affordable toys.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Toys and Games Market is dominated by Hasbro, Inc., Mattel, Inc., LEGO Group, and Spin Master Ltd.. These companies excel through innovative designs, strong brand recognition, and wide distribution networks.

Hasbro, Inc. leads with its iconic toy lines and game franchises, including Transformers and Nerf. Its focus on leveraging digital platforms and licensing agreements enhances its global reach and appeal to modern audiences.

Mattel, Inc. is known for timeless brands like Barbie and Hot Wheels. By blending tradition with innovation, Mattel stays relevant across generations. The company also invests in sustainability by developing eco-friendly toys, aligning with consumer preferences.

LEGO Group excels in creativity and education, offering versatile building sets for all age groups. Its strong partnerships with entertainment franchises like Star Wars and Harry Potter boost its market appeal. LEGO also emphasizes digital integration, blending physical play with online experiences.

Spin Master Ltd. is recognized for its innovative toys like Paw Patrol and Hatchimals. The company invests heavily in R&D to deliver unique, trend-setting products. Its strategic focus on global markets and partnerships strengthens its market position.

These companies shape the Toys and Games Market through a mix of innovation, brand legacy, and strategic expansion, ensuring their continued leadership in the industry.

Top Key Players in the Market

- Hasbro, Inc.

- Mattel, Inc.

- LEGO Group

- Spin Master Ltd.

- Bandai Namco Holdings Inc.

- Funko, Inc.

- MGA Entertainment

- VTech Holdings Ltd.

- Fisher-Price (subsidiary of Mattel)

- Crayola LLC

Recent Developments

- Funskool India’s New Toy Range: In June 2024, Funskool India, a leading toy manufacturer, launched 18 new toys and games aimed at entertaining and educating children up to 14 years old. The products span categories such as Giggles, Games, Fundough, Handycraft, and Play & Learn, focusing on stimulating senses and developing cognitive and motor skills.

- Swiggy Instamart’s Toy Delivery Service: In August 2024, Swiggy Instamart partnered with Hamleys, an international toy retailer, to offer rapid delivery of a wide range of toys within just 10 minutes across major Indian cities. This collaboration aims to provide customers with quick access to toys, enhancing the convenience of online shopping.

- Bonkers Toys and Chuck E. Cheese Collaboration: In August 2024, Bonkers Toys and Chuck E. Cheese launched the Chuck E. Cheese Mystery Egg, the first licensed toy from the family entertainment brand. Available at Walmart and online on Amazon, this toy includes collectibles and redeemable e-tickets for Chuck E. Cheese locations, bringing the excitement of the brand into homes.

- Spin Master’s Tetris Product Line: In October 2024, Spin Master announced a collaboration with The Tetris Company to develop a new range of Tetris-inspired puzzles and games. The first wave of products is set to launch globally in Fall 2025, featuring board games, puzzles, and cards designed to capture the unique gameplay of Tetris.

Report Scope

Report Features Description Market Value (2023) USD 301.6 Billion Forecast Revenue (2033) USD 455.1 Billion CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Games and Puzzles, Electronic Games, Construction Toys, Dolls and Accessories, Outdoor and Sports Toys, Others), By Age Group (Below 8 Years, 9–15 Years, 15+ Years), By Material (Plastic, Wood, Fabric, Metal, Others), By Distribution Channel (Online Retailers, Offline Channels (Supermarkets and Hypermarkets, Specialty Stores, Traditional Stores, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hasbro, Inc., Mattel, Inc., LEGO Group, Spin Master Ltd., Bandai Namco Holdings Inc., Funko, Inc., MGA Entertainment, VTech Holdings Ltd., Fisher-Price (subsidiary of Mattel), Crayola LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hasbro, Inc.

- Mattel, Inc.

- LEGO Group

- Spin Master Ltd.

- Bandai Namco Holdings Inc.

- Funko, Inc.

- MGA Entertainment

- VTech Holdings Ltd.

- Fisher-Price (subsidiary of Mattel)

- Crayola LLC