Global Startup Accelerator Market Size, Share, Statistics Analysis Report By Type (Non-corporate Accelerator, Corporate-run Accelerator), By Application (Technology, Pharmaceutical, Electronic, Other), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139732

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Scope

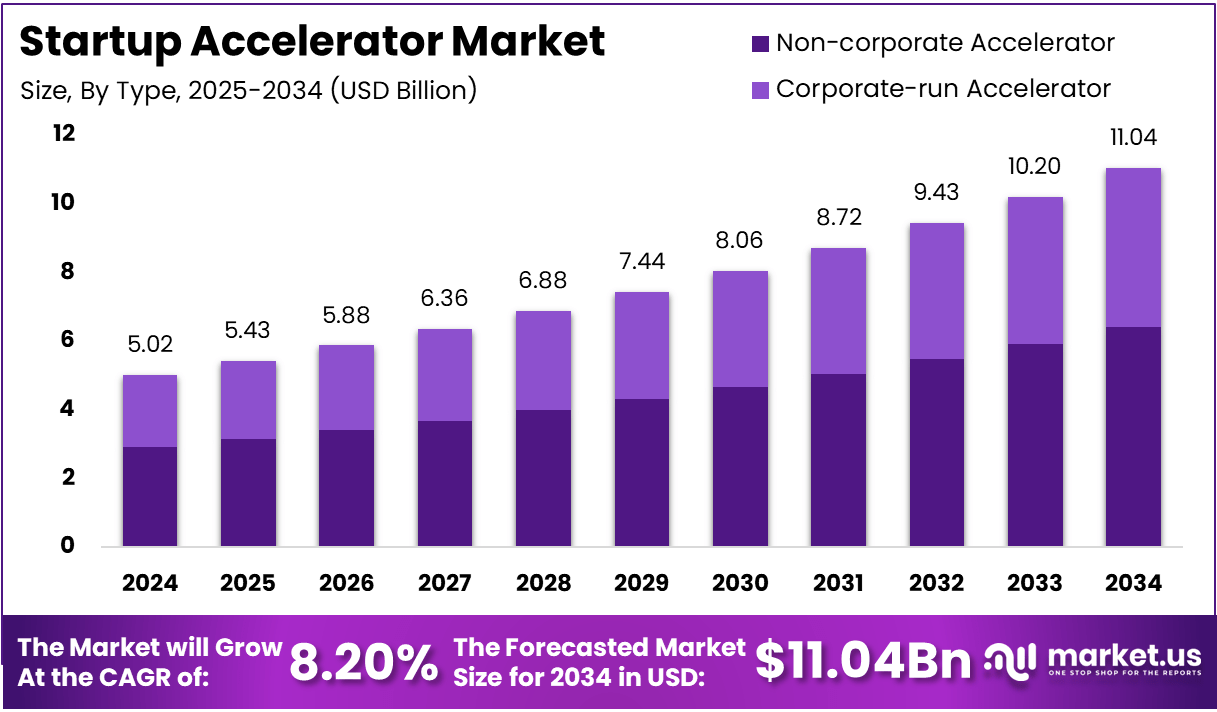

The Global Startup Accelerator Market is expected to be worth around USD 163.3 Billion By 2034, up from USD 5.02 Billion in 2024. It is expected to grow at a CAGR of 8.20% from 2025 to 2034.

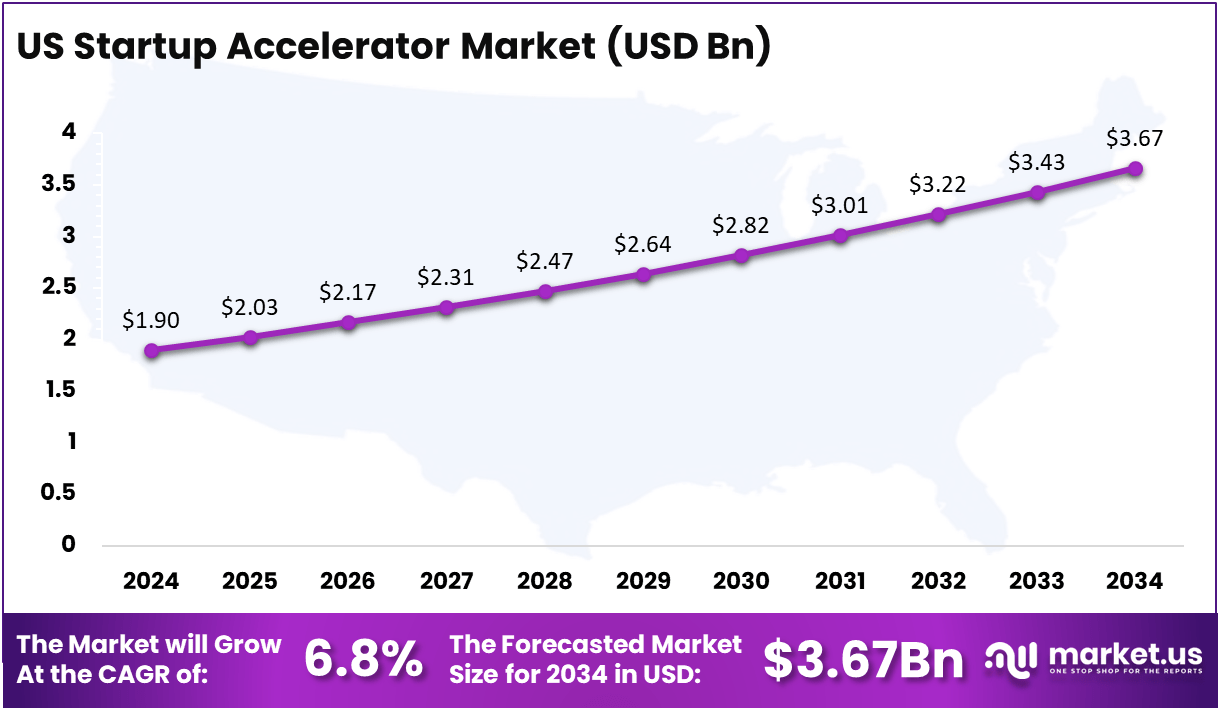

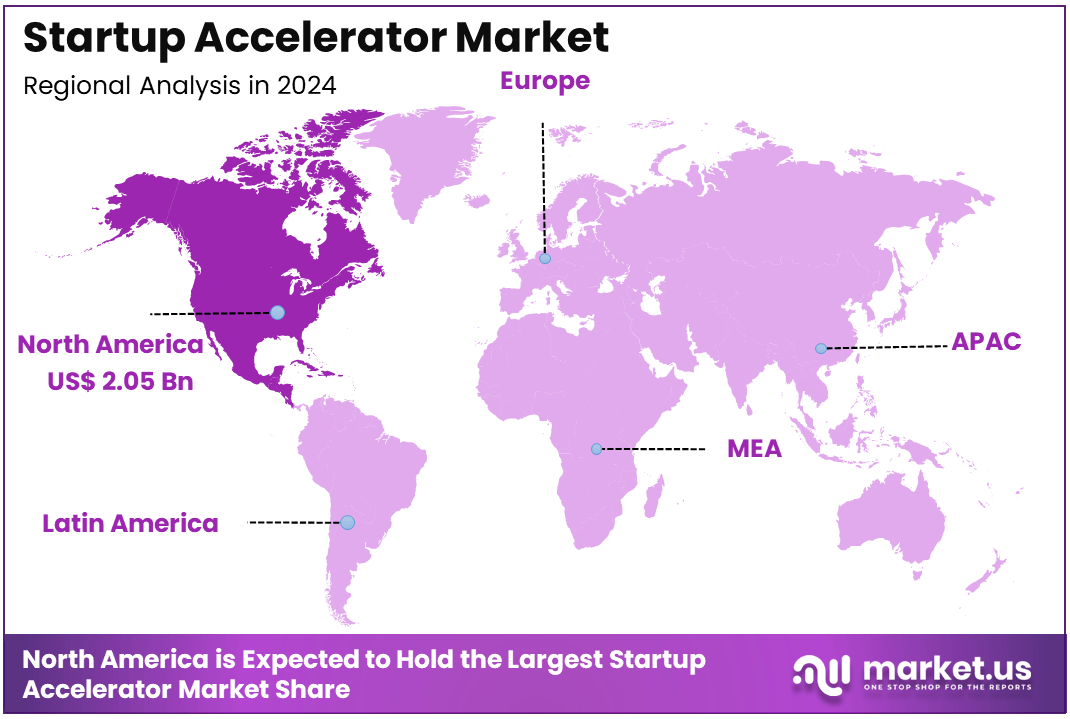

In 2024, North America held a dominant market position, capturing over a 41% share and earning USD 2.05 Billion in revenue. Further, the United States dominates the market size by USD 1.9 Billion, holding a strong position steadily with a CAGR of 6.8%.

The Startup Accelerator Market refers to the industry that supports early-stage startups by offering mentorship, investment, and resources to help these companies grow. Startup accelerators typically provide a structured program for startups, ranging from a few weeks to several months, during which the companies receive intensive guidance in areas such as business development, marketing, finance, and product development. These accelerators may also offer access to funding, networking opportunities, and the potential for partnerships with established businesses.

The global startup accelerator market has grown rapidly over the last decade, driven by the increasing number of entrepreneurs and innovation-driven startups worldwide. Accelerators act as catalysts, helping startups gain the momentum they need to succeed.

Many of these programs also focus on specific sectors such as technology, healthcare, or sustainability, giving entrepreneurs the necessary tools to scale their businesses quickly. The growing recognition of accelerators as valuable players in the startup ecosystem is propelling this market forward.

Key Takeaways

- Market Growth: The Startup Accelerator Market is projected to grow from USD 5.02 billion in 2024 to USD 11.04 billion by 2034, with a solid CAGR of 8.20%.

- Market Type: The Non-corporate accelerator segment is expected to hold a dominant share, contributing 58% to the overall market in 2024.

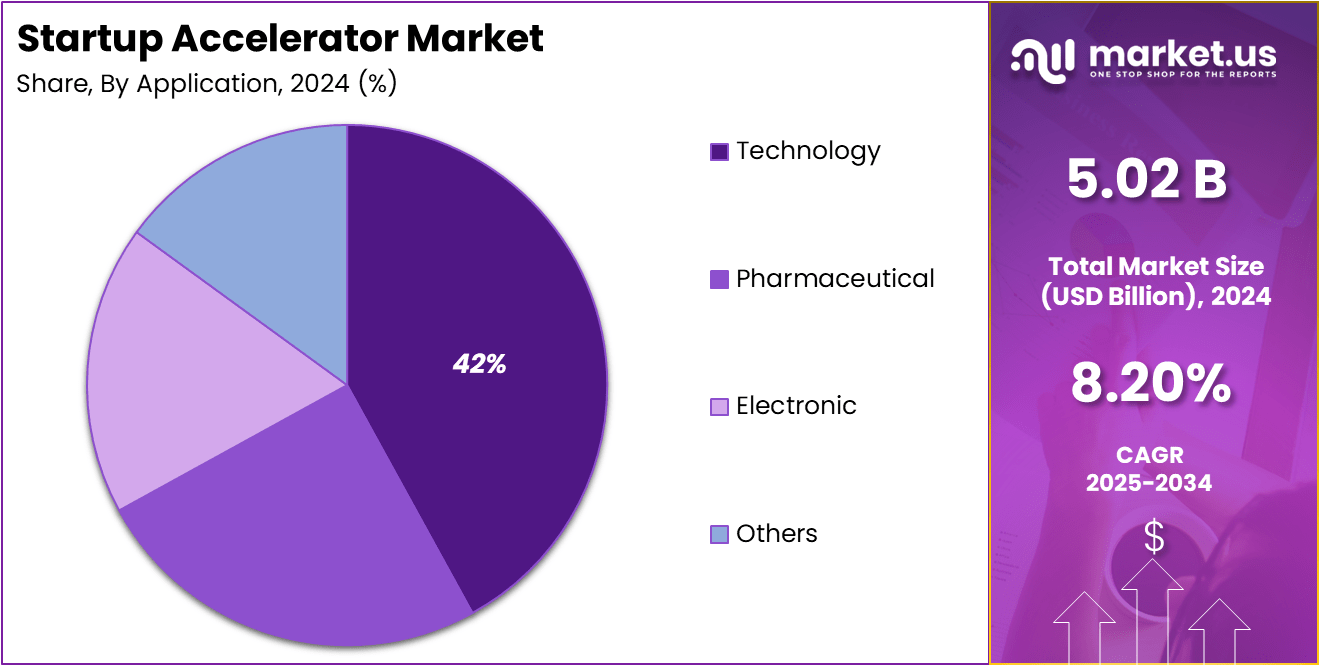

- Market Application: The Technology sector leads the application areas, representing 42% of the total market share.

- Regional Insights: North America is the largest market, capturing 41% of the global market share in 2024.

- US Market Value: The US Startup Accelerator Market is valued at USD 1.9 billion in 2024 and is poised for consistent growth.

- US CAGR: The US market is projected to grow at a CAGR of 6.8% during the forecast period.

Key Statistics

- In 2022, the 50 most active accelerators collectively backed 7,794 accelerator deals, a 14% year-over-year (YoY) increase and a 34% increase compared to 2020.

- The median annual deal count for top accelerators jumped 41% YoY, reaching 83 in 2022.

- Among top accelerators that disclose funding amounts, the majority (63%) typically gave $100K or less in each accelerator deal from 2020 to 2022.

- As of July 2021, seed money accelerator Y Combinator has logged 351 startup exits.

- Y Combinator provides $150,000 in exchange for 6% equity. Note that there is a $37,500 fee to participate in the program.

- Y Combinator has funded over 2,600 companies, including Canva, Reddit and Talkdesk.

Analyst Overview

Several factors are driving the growth of the startup accelerator market. First, the increasing number of startups worldwide has led to greater demand for support systems that can help new businesses thrive. As the barriers to entrepreneurship decrease, accelerators offer an essential platform to help startups with initial seed funding, business strategy, and scaling challenges.

Second, increased investor interest in startups is fueling this market. With the success of programs like Y Combinator and Techstars, investors are more inclined to participate in accelerators, knowing that they can discover promising investment opportunities early.

The demand for startup accelerators is growing as more entrepreneurs realize the value of professional guidance and networking. Startups are becoming more specialized, and accelerators offer tailored support, which boosts demand for programs in specific verticals like fintech, biotech, and clean energy.

The demand is particularly strong in emerging markets where the startup ecosystem is still maturing, and founders need extra guidance. Additionally, established corporations are increasingly partnering with accelerators to identify potential acquisitions or innovation opportunities, further driving demand in this market.

There are significant opportunities in the startup accelerator market, particularly in underrepresented regions like Latin America, Asia-Pacific, and Africa, where the startup ecosystem is still in its nascent stages. In these regions, new accelerators are emerging to fill the gap and offer resources that might not have been available locally.

Moreover, with the rise of digital accelerators, virtual programs are gaining popularity, allowing entrepreneurs from all over the world to access mentorship and funding without geographical limitations. Another opportunity is the growing trend of corporate accelerators, where large companies collaborate with accelerators to support and invest in promising startups that align with their strategic goals.

The role of technology in the startup accelerator market is becoming increasingly important. Many accelerators are integrating AI-driven tools, data analytics, and cloud-based platforms to offer more effective and personalized support to startups. These technologies help accelerators streamline operations, track startups’ progress, and match them with the most suitable mentors and investors.

Additionally, virtual accelerators are leveraging online platforms and digital communication tools to provide global accessibility, breaking down geographical barriers and enabling startups from anywhere to participate. As accelerators continue to innovate, their ability to provide tailored, scalable solutions to startups will only increase.

Regional Analysis

US Market Size

In 2024, North America holds a dominant position in the Startup Accelerator Market, accounting for a significant share of the global market. The region is projected to maintain this leadership throughout the forecast period, with North America capturing 41% of the market share. This dominance is largely driven by the presence of well-established tech hubs, a robust entrepreneurial ecosystem, and a high rate of venture capital funding in countries like the United States and Canada.

Within North America, the United States holds the largest market share, valued at USD 1.9 billion in 2024. The US continues to drive innovation and the growth of startup accelerators due to its thriving tech industry, large-scale investments, and a favorable regulatory environment that supports new business ventures. Furthermore, the US market is expected to experience a CAGR of 6.8%, indicating sustained growth and a stable trajectory in the coming years.

This robust performance is supported by a strong network of corporate partners, investors, and entrepreneurs, all of which contribute to the expansion of startup accelerators. The dynamic startup culture in cities like Silicon Valley, New York, and Austin is expected to fuel the continued demand for acceleration programs, helping both early-stage and mature startups scale their operations efficiently.

North America Market Size

In 2024, North America held a dominant market position in the Startup Accelerator Market, capturing more than a 41% share, which translates to approximately USD 2.05 billion in revenue. This significant market share can be attributed to the region’s thriving entrepreneurial ecosystem, high level of investment in startups, and a robust infrastructure that supports accelerator programs.

The United States, in particular, is a major driver of this dominance, with its Silicon Valley tech hub, a growing number of accelerators, and ample access to venture capital funding, positioning it as the global leader in fostering new business ventures.

The North American market’s leadership is further strengthened by a strong network of established corporations, universities, and research institutions, which collaborate closely with startup accelerators. This ecosystem not only provides financial backing but also valuable mentorship and strategic advice to startups. Additionally, the region’s regulatory environment encourages innovation and entrepreneurship, making it easier for accelerators to scale their operations.

Furthermore, the North American market is expected to maintain steady growth, with the United States continuing to lead, supported by an expected CAGR of 6.8%. The growing demand for technology-driven startups and the need for scalable solutions is driving the expansion of accelerator programs, ensuring North America remains a powerhouse in the global startup accelerator landscape.

By Type

In 2024, the Non-corporate Accelerator segment held a dominant market position, capturing more than a 58% share of the Startup Accelerator Market. This leadership can be attributed to the growing popularity of independent accelerators that offer startups flexibility, mentorship, and access to a broader network outside the influence of large corporations.

Non-corporate accelerators, often founded by entrepreneurs, venture capitalists, or educational institutions, focus on providing early-stage companies with resources and guidance without being tied to the agenda of a specific corporate entity.

These accelerators are especially appealing to startups seeking impartial advice and more personalized support that aligns with their unique business needs. Furthermore, non-corporate accelerators typically have more diverse portfolios and are more open to nurturing startups from various industries, making them attractive to a wider range of entrepreneurs.

Their independence from corporate influence allows for a more creative and experimental approach to business development, which has proven valuable in helping innovative companies thrive. This approach is anticipated to continue driving the growth and dominance of non-corporate accelerators in the market, further solidifying their key role in fostering entrepreneurship globally.

By Application

In 2024, the Technology segment held a dominant market position, capturing more than a 41% share of the Startup Accelerator Market. This segment’s leadership is driven by the rapid pace of technological advancements and the high demand for innovative solutions in areas such as software development, artificial intelligence, cloud computing, and IoT (Internet of Things). The technology sector is a hotspot for startups due to its potential for scalability and global impact. As a result, accelerators focusing on technology startups are in high demand.

Technology startups benefit from specialized mentoring, funding, and resources that enable them to develop cutting-edge products and services. These startups often require access to a network of tech experts, investors, and industry leaders, all of which technology-focused accelerators provide. Moreover, the increasing trend of digital transformation across industries has led to a surge in demand for tech-based startups, further bolstering the role of technology-focused accelerators.

As innovation continues to drive the global economy, the technology segment is expected to maintain its dominant position, attracting a significant portion of startup accelerator investments and resources. The opportunities in this sector are vast, making it a prime area for entrepreneurial growth and development.

Key Market Segments

By Type

- Non-corporate Accelerator

- Corporate-run Accelerator

By Application

- Technology

- Pharmaceutical

- Electronic

- Other

Driving Factors

Increasing Investment in Tech Startups

One of the key driving factors for the Startup Accelerator Market is the surge in investment in tech startups. Over the past few years, tech startups have seen unprecedented levels of funding from venture capitalists, angel investors, and even corporate investors.

With the global economy becoming increasingly digitized, investors are eager to support innovative tech-driven solutions. This growing influx of capital supports the acceleration of tech-focused startups, enabling them to scale quickly and enter the market with groundbreaking solutions.

Furthermore, government initiatives and public-private partnerships in many countries provide a favorable environment for tech startups, further fueling growth in the sector. The rapid adoption of emerging technologies such as artificial intelligence (AI), blockchain, cloud computing, and IoT has driven high demand for innovative products and services.

This investment boom results in more startups entering accelerator programs that provide the necessary funding, mentorship, and networking opportunities. As the demand for technology continues to expand, more accelerators focusing on these sectors are emerging, thus propelling the overall growth of the market.

Restraining Factors

High Competition Among Accelerators

A significant restraining factor in the Startup Accelerator Market is the intense competition among accelerator programs. With the growing number of accelerators globally, startups have a wide variety of options to choose from.

This creates an oversaturation of accelerator programs, making it more difficult for new accelerators to differentiate themselves. For startups, this abundance of choices can lead to confusion, making it hard for them to determine which accelerator will best meet their needs. The competition for investment and resources also means that accelerators must compete fiercely to secure the best startups.

Additionally, some accelerators may face challenges in retaining top-tier mentors, investors, and industry professionals, which can further affect their ability to provide significant value to startups. The pressure to maintain a high success rate and ensure startups exit with viable products and secure funding can be overwhelming. As the accelerator landscape continues to expand, it may become increasingly difficult for individual accelerators to stand out, and new market entrants will need to offer unique value propositions to thrive.

Growth Opportunities

Expanding Global Reach

The global expansion of startup accelerators presents a significant growth opportunity for the market. As the demand for innovation and new business models grows across industries and regions, accelerators are finding new opportunities in emerging markets, particularly in Asia-Pacific (APAC), Latin America, and Africa.

Many regions are witnessing rapid growth in entrepreneurship, with increasing numbers of individuals seeking to build startups. These regions are also seeing a rise in government and private sector investments that support new businesses and entrepreneurs.

For example, APAC is a fast-growing market for tech innovation, with countries like India, China, and Southeast Asian nations playing an increasingly important role in global startup ecosystems. As these regions continue to embrace digital transformation and technological innovation, they offer a fertile ground for accelerators to expand their reach.

Additionally, corporate-driven accelerators have the potential to leverage global networks and resources to support startups worldwide, especially in sectors like fintech, health tech, and edtech. Expanding into these untapped regions will provide accelerators with fresh opportunities to boost their portfolios and market share while contributing to the global startup ecosystem.

Challenging Factors

Funding and Resource Limitations

One of the most significant challenges in the Startup Accelerator Market is the limited availability of funding and resources. While investment in tech startups has risen substantially, many accelerators still face challenges in obtaining adequate capital to fund their programs.

Not all accelerators are equipped with the financial backing required to sustain long-term operations and provide sufficient resources to their startups. This limitation can prevent them from offering the level of mentorship, networking, and infrastructure that startups need to thrive. Moreover, accelerators focusing on specific sectors may encounter difficulties in securing sector-specific funding or partners who have expertise in those areas.

As a result, some accelerators may struggle to attract high-quality startups, limiting their ability to scale successfully. Additionally, the highly competitive landscape makes it difficult for new accelerators to gain a foothold without substantial funding. This creates a barrier for many entrepreneurs looking to enter the market. Therefore, ensuring sustainable funding and resource allocation is crucial for accelerators to maintain a competitive edge and provide value to their startups.

Growth Factors

Driving the Startup Accelerator Market

The Startup Accelerator Market is expanding rapidly, driven by several key factors that are fostering innovation and entrepreneurship across the globe. One of the primary growth drivers is the increasing availability of venture capital. As of 2023, global venture capital investment surged to USD 450 billion, with significant portions being funneled into accelerator programs that help early-stage companies scale quickly.

This influx of capital is encouraging more startups to seek out accelerator programs for guidance, networking, and financial support. Additionally, the digital transformation of industries and the global shift toward remote work have opened new avenues for entrepreneurs to tap into underserved markets, further fueling demand for accelerators. With startup ecosystems thriving in regions like North America and Asia-Pacific, accelerators have become the go-to platform for nurturing ideas and supporting businesses in their early growth stages.

Emerging Trends

Shaping the Market

Several emerging trends are reshaping the Startup Accelerator Market. One of the most notable trends is the increasing focus on specialized accelerators. While traditional accelerators offer a broad range of services, today’s accelerators are often focused on specific industries, such as healthcare, fintech, or AI. This industry-specific approach allows accelerators to provide more tailored support and attract startups that align with their expertise.

Additionally, corporate-driven accelerators are gaining momentum, with large corporations partnering with accelerators to create innovation hubs within their industries. This trend is expected to grow as corporations look to integrate more agile startups into their ecosystems. Furthermore, AI-powered acceleration is becoming more common, allowing startups to benefit from data-driven insights and predictive analytics to optimize their growth strategies.

Business Benefits

Startup Accelerators

Participating in an accelerator offers significant business benefits to startups. Accelerators provide access to critical resources, including funding, mentorship, and networking opportunities. Accelerators have helped over 2,000 startups secure investments of more than USD 15 billion collectively over the past decade.

This financial support is often crucial for early-stage companies looking to scale and navigate the competitive business landscape. Additionally, accelerators offer guidance from seasoned mentors and access to industry experts, which helps startups avoid common pitfalls and accelerate their growth trajectory.

Another benefit is the exposure to a network of potential partners, customers, and investors, which significantly increases the likelihood of securing long-term business opportunities. By participating in these programs, startups also gain credibility, which is invaluable in gaining market trust and attracting further investment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

HAX Accelerator is a leading global startup accelerator focused on hardware startups. It has established itself as a major player by providing startups with not just capital but also technical expertise and access to manufacturing networks. Recently, HAX has made key strategic partnerships with prominent companies like Flextronics and Arrow Electronics, allowing startups to scale efficiently with access to advanced manufacturing capabilities.

AngelPad is a well-respected startup accelerator known for helping tech startups achieve early-stage success. Over the years, AngelPad has raised over USD 130 million in funding and helped launch over 150 companies. AngelPad stands out due to its personalized approach, offering startups not only funding but also mentorship from experienced entrepreneurs and investors. One of its major developments was launching its own AngelPad Fund, which helps companies accelerate their growth by offering follow-up funding.

Barcelona Ventures is a European accelerator that has gained recognition for its strategic focus on startups in the fintech, blockchain, and SaaS industries. The accelerator’s model combines seed funding with mentorship, office space, and strategic alliances with major corporations. In 2022, Barcelona Ventures announced a collaboration with Santander Bank, aiming to support startups in the financial technology sector.

Top Key Players in the Market

- HAX Accelerator

- AngelPad

- Barcelona Ventures

- Y Combinator

- Techstars

- 500 Startups

- Founders Factory

- MassChallenge

- Startupbootcamp

- Tech Wildcatters

- Women’s Startup Lab

- Other Key Players

Recent Developments

- In 2024, several leading startup accelerators have significantly expanded their global reach, particularly in emerging markets.

- In 2024, several accelerators have launched specialized programs aimed at fostering sustainable startups.

Report Scope

Report Features Description Market Value (2024) USD 5.02 Billion Forecast Revenue (2034) USD 11.04 Billion CAGR (2025-2034) 8.20% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Non-corporate Accelerator, Corporate-run Accelerator), By Application (Technology, Pharmaceutical, Electronic, Other) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape HAX Accelerator, AngelPad, Barcelona Ventures, Y Combinator, Techstars, 500 Startups, Founders Factory, MassChallenge, Startupbootcamp, Tech Wildcatters, Women’s Startup Lab, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HAX Accelerator

- AngelPad

- Barcelona Ventures

- Y Combinator

- Techstars

- 500 Startups

- Founders Factory

- MassChallenge

- Startupbootcamp

- Tech Wildcatters

- Women's Startup Lab

- Other Key Players