Agentic AI for Financial Services Market Size, Share Analysis Report By Offering (Solution (Data Integration, Predictive Analytics, Autonomous Decision-Making, Automation of Routine Tasks, Others)), Services (Professional Services, Managed Services), By Deployment (Cloud Based, On Premises), By Technology (Machine Learning & Deep Learning, Computer Vision, Natural Language Processing (NLP), Blockchain-Enabled AI, Others), By Application (Personalized Financial Advisory, Fraud Detection and Prevention, Automated Trading Systems, Customer Service Automation, Risk Management, Loan and Credit Underwriting, Portfolio Management,Others (Regulatory Compliance, Insurance Claims Processing, etc.), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb. 2025

- Report ID: 138890

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- US Market Size and Growth Analysis

- Offering Analysis

- Deployment Analysis

- Technology Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Key Benefits for Stakeholders

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

The Global Agentic AI for Financial Services Market size is expected to be worth around USD 80.9 Billion By 2034, from USD 2.1 billion in 2024, growing at a CAGR of 43.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.4% share, holding USD 0.8 billion revenue.

Agentic AI represents a sophisticated form of artificial intelligence that excels in making autonomous decisions, learning from interactions, and adapting to new situations in real-time. This technology distinguishes itself from traditional AI by operating beyond predefined rules and algorithms. In the financial services sector, Agentic AI is leveraged to enhance various operations such as credit scoring, loan approvals, and transaction monitoring.

The market for Agentic AI in financial services is rapidly expanding, driven by its ability to automate intricate workflows and improve decision-making. Financial institutions are integrating Agentic AI to optimize operations, reduce errors, and personalize customer interactions. This technology is particularly valuable in managing data-intensive tasks like compliance checks and financial transactions, facilitating a shift towards deeper process autonomy.

The primary drivers of Agentic AI adoption in the financial sector include its potential to significantly enhance operational efficiency, improve accuracy in financial operations, and reduce the reliance on human intervention. The technology’s capability to learn and adapt in real-time allows financial services to stay ahead in a highly competitive and dynamic market environment.

Moreover, Agentic AI enables the development of new financial tools and services, such as adaptive asset management systems and personalized robo-advisors, which further stimulate its market demand. Demand for Agentic AI is growing as financial institutions seek innovative solutions to improve customer service and operational efficiency.

According to Market.us, the Global Agentic AI Market is projected to reach $196.6 billion by 2034, growing from $5.2 billion in 2024 at a strong CAGR of 43.8%. North America dominated in 2024, holding over 38% market share with revenue of $1.97 billion, while the U.S. market alone was valued at $1.58 billion, growing at a CAGR of 43.6%. The surge in adoption is fueled by businesses seeking automation and intelligent decision-making capabilities, positioning Agentic AI as a key driver of digital transformation.

Investment in Agentic AI is accelerating, particularly in financial services, where adoption rates have jumped from 19% to 31%. A report by Capgemini highlights that while only 10% of companies currently use AI agents, an overwhelming 82% plan to adopt them within three years. With AI investments expected to exceed $749 billion by 2028, businesses across industries are recognizing its potential to streamline operations and enhance efficiency, making it one of the fastest-growing technologies today

The expansion of Agentic AI offers numerous opportunities, especially in enhancing customer engagement and optimizing compliance operations. By automating routine tasks and enabling real-time decision-making, financial institutions can allocate more resources to strategic initiatives and innovation. Agentic AI also opens new avenues for creating personalized customer experiences and developing new business models in financial services.

Technological advancements in Agentic AI are centered around its ability to autonomously handle complex and evolving scenarios, which is crucial for the dynamic nature of financial markets. Improvements in AI-driven analytics, integration capabilities, and learning algorithms allow for more sophisticated applications in areas like risk management and client interaction.

Key Takeaways

- The Global Agentic AI for Financial Services Market is projected to reach a value of approximately USD 80.9 billion by 2034, growing from USD 2.1 billion in 2024. This represents a robust compound annual growth rate (CAGR) of 43.8% during the forecast period from 2025 to 2034.

- In 2024, North America led the market, securing a significant share of 41.4%, which equates to a revenue of around USD 0.8 billion. The U.S. market for agentic AI in financial services was valued at USD 0.7 billion in 2024, with expectations to expand at a CAGR of 42.5% over the next decade.

- The Solution segment dominated the market in 2024, accounting for more than 67.2% of the overall market share.

- In terms of deployment model, the On Premises segment was the leading market driver, capturing over 58.9% of the market share in 2024.

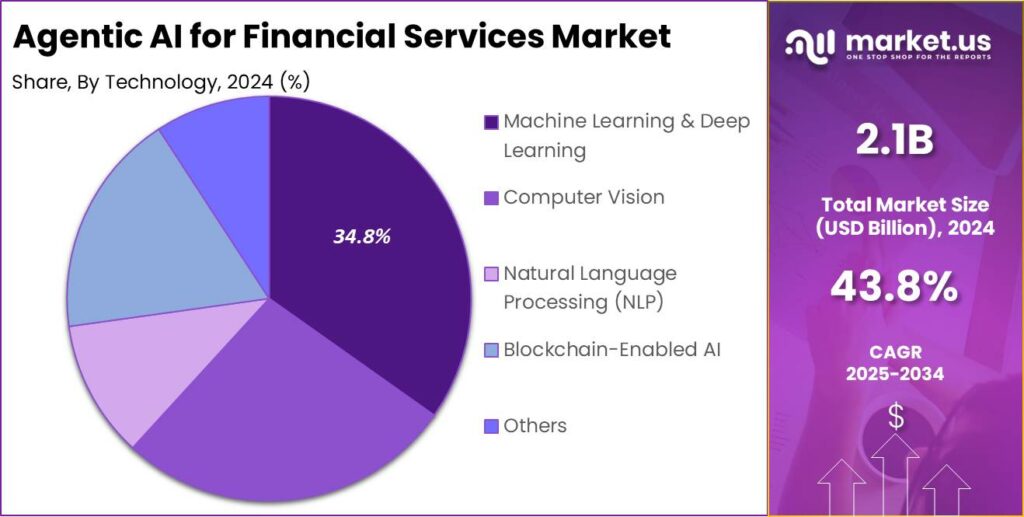

- Furthermore, Machine Learning & Deep Learning technologies led the market in 2024, contributing to more than 34.8% of the total market share.

US Market Size and Growth Analysis

The leadership of the United States in the Agentic AI market for financial services is underscored by its substantial market valuation and aggressive growth forecasts. As of 2024, the US market for Agentic AI in financial services was valued at approximately USD 0.7 billion, with projections to expand at a compound annual growth rate (CAGR) of 42.5%.

This robust growth trajectory is reflective of broader trends within the sector, where Agentic AI is increasingly seen as a pivotal technology for enhancing operational efficiency and decision-making processes in real time.

Several factors contribute to the United States’ dominant position in this innovative market. Firstly, there is a significant presence of leading technology firms and startups in the region, which drives continuous innovation and the development of new AI applications. These companies are pivotal in advancing AI technology, thus fostering a conducive environment for the rapid deployment of Agentic AI solutions.

Moreover, substantial investments in AI research and development, supported by both private and public sectors, amplify this growth. Initiatives like “Project Stargate,” which involve massive funding commitments from major tech entities, are testament to the scale of investment flowing into AI development in the US.

In 2024, North America held a dominant market position in the Agentic AI for Financial Services sector, capturing more than a 41.4% share with revenue reaching USD 0.8 billion. This leadership can be attributed to several factors that uniquely position the region at the forefront of technological innovation and adoption.

Firstly, North America benefits from a robust ecosystem of technology giants and innovative startups, concentrated particularly in the United States and Canada. These companies are not only pioneers in AI research but also in its application to financial services, driving both the development and early adoption of Agentic AI technologies. This has established a competitive market that continually pushes the boundaries of what AI can achieve in terms of automation and intelligence.

Moreover, the region enjoys substantial investments in AI from both the private and public sectors. Significant funding initiatives from federal and state governments, alongside private investments from venture capital, support research and implementation of AI technologies. These investments facilitate rapid technological advancements and the scaling of AI applications across the financial industry.

Offering Analysis

In 2024, the Solution segment held a dominant position within the agentic AI for financial services market, capturing more than a 67.2% share. This leadership can be attributed to the segment’s comprehensive range of offerings, which include data integration, predictive analytics, autonomous decision-making, and the automation of routine tasks. These solutions are increasingly adopted by financial institutions seeking to enhance efficiency and decision-making accuracy.

The prominence of the Solution segment is further bolstered by the critical role of predictive analytics and data integration in financial environments. Predictive analytics helps institutions anticipate market trends, customer behavior, and potential risks with greater precision, thereby facilitating more informed strategic decisions. Meanwhile, data integration plays an essential part in consolidating disparate data sources, which is crucial for achieving a holistic view of financial operations and customer insights.

Autonomous decision-making and automation of routine tasks also contribute significantly to the segment’s growth. These technologies enable financial services firms to reduce human error and operational costs by automating standard processes and decision-making. As a result, firms can allocate more resources to strategic initiatives rather than maintaining day-to-day operations, enhancing overall productivity and competitiveness.

Deployment Analysis

In 2024, the On Premises segment held a dominant market position within the agentic AI for financial services market, capturing more than a 58.9% share. This significant market share can be attributed to the high level of control and security that on-premises solutions offer to financial institutions.

These institutions often deal with highly sensitive data and are subject to stringent regulatory requirements, making the on-premises deployment model a preferable choice. The preference for on-premises solutions in financial services is further supported by their ability to offer enhanced data security and compliance with regulatory standards.

Financial institutions are able to maintain complete control over their hardware and data storage, significantly reducing the risk of data breaches and external attacks. This is crucial in an industry where trust and security are paramount.

Moreover, the on-premises model allows for greater customization and integration with existing systems. Financial institutions often have complex legacy systems and require solutions that can be seamlessly integrated without disrupting ongoing operations. On-premises deployment provides the necessary flexibility to adapt AI technologies to specific organizational needs, which can be a challenge with cloud-based solutions.

Technology Analysis

In 2024, the Machine Learning & Deep Learning segment held a dominant market position in the agentic AI for financial services market, capturing more than a 34.8% share. This dominance can be largely attributed to the essential role these technologies play in enhancing decision-making and predictive capabilities within the financial sector.

Machine learning and deep learning enable financial institutions to derive insights from large volumes of data, ranging from market trends to customer behavior, thereby driving more informed and effective decision-making processes. The significant impact of machine learning and deep learning extends to various applications, including risk assessment, fraud detection, and customer service personalization.

These technologies are adept at identifying patterns and anomalies in data that would typically elude human analysts. As a result, they significantly enhance the accuracy and efficiency of financial operations, reducing risks and improving outcomes for financial service providers and their customers alike.

Furthermore, the ongoing advancements in AI algorithms and computational power continue to expand the capabilities and accessibility of machine learning and deep learning solutions. This progress supports their adoption across a wider range of financial services, from small fintech startups to major banks and investment firms.

The ability of these technologies to adapt and learn from new data also ensures continuous improvement in their applications, making them an indispensable asset in the evolving financial landscape. As the financial industry increasingly moves towards data-driven decision-making, the machine learning and deep learning segment is expected to maintain its leadership position.

Application Analysis

In 2024, the Personalized Financial Advisory segment held a dominant market position within the agentic AI for financial services market, capturing more than a 27.9% share. This leadership is primarily driven by the increasing demand for tailored financial advice among consumers, who seek more personalized and effective financial planning and investment strategies.

Agentic AI technologies, particularly those leveraging machine learning and natural language processing, enable the delivery of customized financial advice at scale, thereby meeting these consumer demands efficiently. The rise of the Personalized Financial Advisory segment can also be attributed to advancements in AI that allow for more sophisticated analysis of individual financial data.

These technologies can assess a wide array of variables, including spending habits, investment preferences, and risk tolerance, to offer unique insights and recommendations that are specifically tailored to each user. This level of personalization enhances customer satisfaction and loyalty, as clients receive advice that is accurately aligned with their personal financial goals and situations.

Moreover, the integration of AI into financial advisory services significantly reduces the costs associated with traditional financial advising. By automating the analysis and advice-generation processes, financial institutions can offer these services at a lower price point, making personalized financial advice accessible to a broader audience.

Key Market Segments

By Offering

- Solution

- Data Integration

- Predictive Analytics

- Autonomous Decision-Making

- Automation of Routine Tasks

- Others

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud Based

- On Premises

By Technology

- Machine Learning & Deep Learning

- Computer Vision

- Natural Language Processing (NLP)

- Blockchain-Enabled AI

- Others

By Application

- Personalized Financial Advisory

- Fraud Detection and Prevention

- Automated Trading Systems

- Customer Service Automation

- Risk Management

- Loan and Credit Underwriting

- Portfolio Management

- Others (Regulatory Compliance, Insurance Claims Processing, etc.)

Driver

Enhanced Operational Efficiency and Cost Reduction

One of the primary drivers of Agentic AI in financial services is the substantial enhancement in operational efficiency and cost reduction it offers. Agentic AI automates complex, data-intensive tasks such as fraud detection, credit scoring, and regulatory compliance, which traditionally consume considerable human resources.

By handling these processes, Agentic AI allows financial institutions to redeploy their human capital towards more strategic, value-adding activities. Additionally, the integration of these AI systems leads to reduced operational costs by streamlining workflows and minimizing the need for manual intervention, which in turn can significantly lower error rates and operational risks.

Restraint

Ethical and Governance Challenges

Despite its benefits, the deployment of Agentic AI in financial services is not without restraints. Prominent among these are the ethical and governance challenges it presents. The autonomous nature of Agentic AI, capable of making decisions with minimal human oversight, raises substantial concerns regarding accountability and transparency.

Financial institutions must develop robust ethical frameworks and governance structures to ensure these AI systems operate within regulatory compliance and ethical boundaries. The challenge lies in balancing innovation with control, ensuring that while these systems provide efficiency and customer value, they do not compromise ethical standards or expose the institutions to new risks.

Opportunity

Transformation of Customer Interactions

Agentic AI presents a significant opportunity to transform customer interactions within the financial sector. By analyzing vast amounts of data, these AI systems can deliver highly personalized customer experiences, from tailored financial advice to proactive financial management.

Agentic AI’s ability to understand and predict customer needs can lead to more engaging and satisfying interactions, enhancing customer loyalty and trust. Moreover, the seamless integration of these systems across various customer service touchpoints can provide a consistent and holistic service experience, driving customer satisfaction and retention.

Challenge

Integration and Adaptation

The integration and adaptation of Agentic AI into existing financial systems represent a major challenge. Financial institutions must upgrade their technological infrastructures to support the advanced capabilities of Agentic AI. Additionally, there is a need for significant workforce transformation, where employees are reskilled to collaborate effectively with these autonomous systems.

The challenge extends to ensuring that the AI systems continuously adapt to changing financial environments and regulations while maintaining high accuracy and compliance. Effective management of these aspects is critical to leveraging the full potential of Agentic AI in transforming financial services.

Growth Factors

Agentic AI is poised to drive significant growth within the financial services industry by enhancing operational efficiency and customer engagement. One of the primary growth factors is the technology’s ability to automate complex processes and decision-making tasks. This not only reduces the burden on human employees but also improves accuracy and speed, particularly in areas like fraud detection, risk assessment, and compliance monitoring.

Additionally, Agentic AI enables financial institutions to offer more personalized services, such as tailored financial advice and dynamic risk management, which can significantly enhance customer satisfaction and loyalty. The integration of Agentic AI also facilitates a more efficient data management system, consolidating information from multiple sources to provide a unified, real-time view of operations.

Emerging Trends

Several key trends are shaping the adoption and evolution of Agentic AI in financial services. Firstly, there is an increasing shift towards creating more human-AI collaboration, where AI systems work alongside human teams to enhance capabilities rather than replace them. This approach leverages the strengths of both humans and AI agents, promoting an integrated workflow that maximizes efficiency and innovation.

Another trend is the growing emphasis on ethical AI and governance. As financial institutions deploy more autonomous systems, the need for robust frameworks to ensure these systems operate transparently and fairly becomes crucial. This involves implementing strong governance structures to oversee AI actions and mitigate risks associated with autonomous decision-making.

Additionally, the global expansion of financial services facilitated by Agentic AI is breaking down language and regional barriers, enabling institutions to offer their services on a much larger scale. This global reach is supported by AI’s ability to manage and analyze data across different markets and customer bases, making financial services more inclusive and accessible.

Key Benefits for Stakeholders

The deployment of Agentic AI in financial services offers numerous benefits for various stakeholders. For customers, the primary advantage is the significant enhancement in the quality of service. Agentic AI’s ability to process vast amounts of information in real time allows for more accurate and personalized financial advice, proactive risk management, and efficient transaction processing.

For financial institutions, Agentic AI drives cost efficiency and operational effectiveness. By automating routine and complex tasks, these institutions can reduce overhead costs and allocate resources to more strategic areas, potentially increasing profitability and market responsiveness.

Lastly, Agentic AI contributes to innovation in financial products and services. By harnessing the power of advanced analytics and machine learning, financial institutions can develop new products that meet the evolving needs of their customers. Additionally, these AI systems can help institutions adapt quickly to market changes and regulatory requirements, maintaining compliance and staying ahead of competitors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Key Players Analysis in the Agentic AI for Financial Services market typically examines the major companies that are significantly impacting the sector through innovations, strategic market positioning, and adoption of AI-driven solutions to enhance financial services.

Microsoft has emerged as a dominant player in the Agentic AI market, leveraging its Azure AI platform to integrate Agentic AI capabilities into financial services. The company has focused on acquisitions like Nuance Communications, which enhances its AI-driven customer engagement tools. Microsoft has also launched new products, including advanced AI models for fraud detection and compliance automation tailored for the banking sector.

Alphabet, through Google Cloud, is revolutionizing financial services with its Agentic AI offerings. The company has introduced innovative tools, such as adaptive asset management systems and real-time transaction monitoring, which utilize its advanced machine learning capabilities. Alphabet’s focus on acquiring startups specializing in AI-driven financial solutions has bolstered its competitive edge.

Amazon has made significant strides in Agentic AI for financial services through its AWS platform. The company has launched products like AI-powered fraud detection systems and automated credit scoring tools that cater to financial institutions’ needs. Amazon also focuses on mergers and acquisitions, acquiring smaller AI firms to enhance its capabilities in predictive analytics and customer engagement.

Top Key Players in the Market

- Akira AI

- Everest Global, Inc.

- UiPath

- Aisera

- Cognizant

- International Business Machines Corporation (IBM)

- Anaptyss

- Zetaris

- moData

- Endava

- Others

Recent Developments

- In January 2025, Citi launched advanced Agentic AI-powered virtual financial assistants capable of autonomous decision-making for wealth management and personalized customer engagement. These assistants aim to optimize savings goals and provide dynamic investment portfolios.

- In December 2024, IBM introduced an Agentic AI solution tailored for real-time compliance monitoring in financial services. This tool autonomously detects fraud and anomalies while adapting to regulatory changes.

- In November 2024, UiPath expanded its automation platform by integrating Agentic AI capabilities to streamline complex banking operations such as invoice processing and fund reconciliations.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 80.9 Bn CAGR (2025-2034) 43.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Solution (Data Integration, Predictive Analytics, Autonomous Decision-Making, Automation of Routine Tasks, Others)), Services (Professional Services, Managed Services), By Deployment (Cloud Based, On Premises), By Technology (Machine Learning & Deep Learning, Computer Vision, Natural Language Processing (NLP), Blockchain-Enabled AI, Others), By Application (Personalized Financial Advisory, Fraud Detection and Prevention, Automated Trading Systems, Customer Service Automation, Risk Management, Loan and Credit Underwriting, Portfolio Management,Others (Regulatory Compliance, Insurance Claims Processing, etc.) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Akira AI, Everest Global Inc., UiPath, Aisera , Cognizant, International Business Machines Corporation (IBM), Anaptyss, Zetaris, moData, Endava, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agentic AI For Financial Services MarketPublished date: Feb. 2025add_shopping_cartBuy Now get_appDownload Sample

Agentic AI For Financial Services MarketPublished date: Feb. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akira AI

- Everest Global, Inc.

- UiPath

- Aisera

- Cognizant

- International Business Machines Corporation (IBM)

- Anaptyss

- Zetaris

- moData

- Endava

- Others