Global Specialty Medical Chairs Market By Product Type (Rehabilitation Chairs (Pediatric Chairs, Geriatric Chairs, Bariatric Chairs and Others), Examination Chairs (Mammography Chairs, Dialysis Chairs, Cardiac Chairs, Blood Drawing Chairs and Birthing Chairs) and Treatment Chairs (Ophthalmic Chairs, Dental Chairs, ENT Chairs and Others)), By End-User (Hospitals, Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174978

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

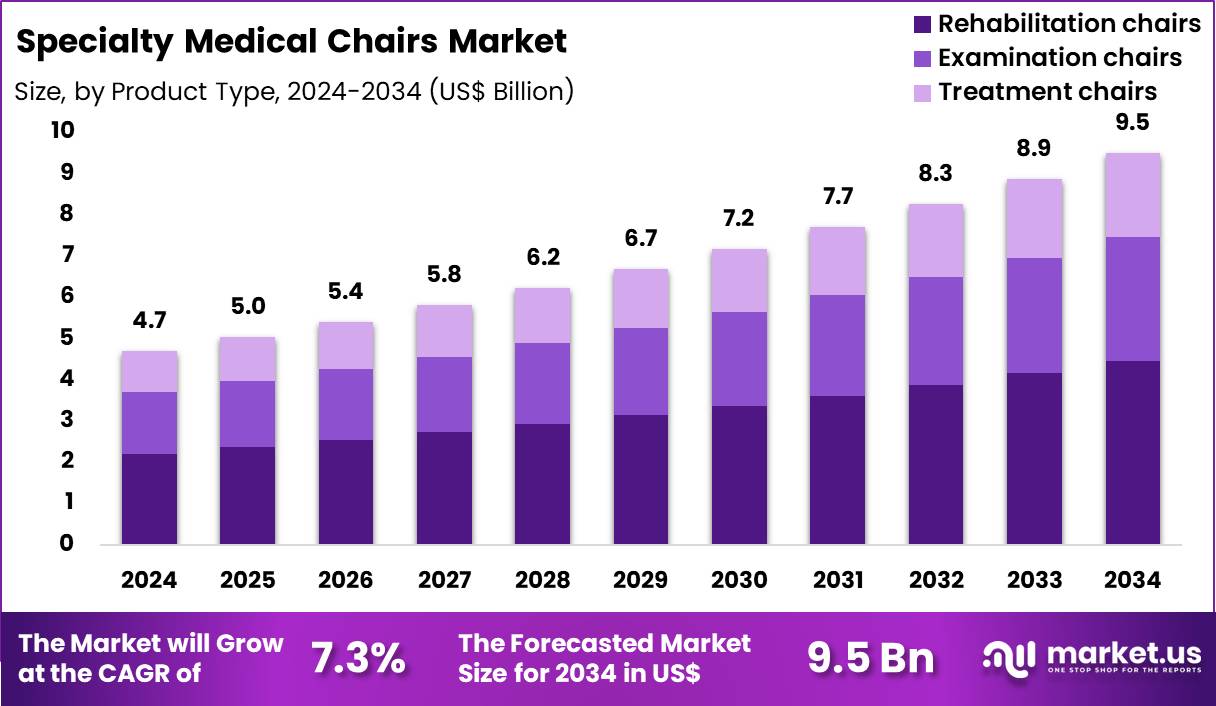

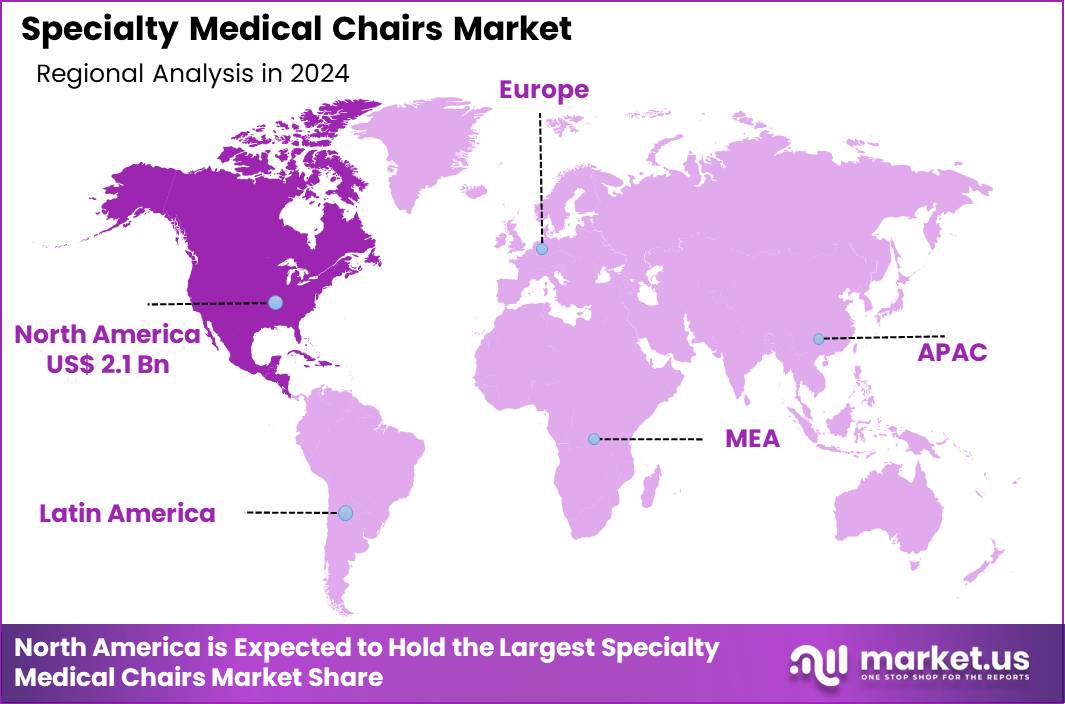

The Global Specialty Medical Chairs Market size is expected to be worth around US$ 9.5 Billion by 2034 from US$ 4.7 Billion in 2024, growing at a CAGR of 7.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 45.1% share with a revenue of US$ 2.1 Billion.

Increasing demand for specialized patient positioning and support during diagnostic, therapeutic, and rehabilitative procedures drives the Specialty Medical Chairs market as healthcare providers seek ergonomic solutions that enhance clinical efficiency and patient comfort.

Orthopedic surgeons utilize powered examination chairs with adjustable height, tilt, and leg support to facilitate precise joint assessments and minor interventions in outpatient settings. These chairs support dialysis treatments by providing extended reclining positions and integrated armrests that accommodate vascular access sites for prolonged sessions.

Rehabilitation specialists employ bariatric and tilt-in-space chairs to manage mobility-impaired patients during physical therapy, preventing pressure injuries while enabling safe transfers and positioning changes. Dentists and oral surgeons apply specialized reclining chairs with integrated lighting and instrument delivery systems to optimize access during complex extractions and implant placements.

Manufacturers pursue opportunities to integrate smart features such as pressure-sensing surfaces and automated positioning controls, expanding applications in wound care and long-term care facilities where prolonged seating requires continuous monitoring to prevent shear and friction injuries. Developers advance modular designs that allow quick reconfiguration for multi-specialty use, supporting ambulatory surgery centers performing endoscopy, urology, and minor orthopedic procedures.

These innovations facilitate adoption in pediatric and geriatric care, where adjustable chairs with safety harnesses and gentle motion assist safe positioning for imaging and therapy. Opportunities emerge in eco-friendly materials and antimicrobial upholstery that address infection control priorities in high-acuity environments.

Companies invest in wireless connectivity for remote adjustment and data logging, enabling integration with electronic health records to track patient positioning history. Recent trends emphasize user-centric ergonomics and infection prevention, positioning specialty medical chairs as essential components in value-based care models focused on patient safety and procedural efficiency.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.7 Billion, with a CAGR of 7.3%, and is expected to reach US$ 9.5 Billion by the year 2034.

- The product type segment is divided into rehabilitation chairs, examination chairs and treatment chairs, with rehabilitation chairs taking the lead with a market share of 46.9%.

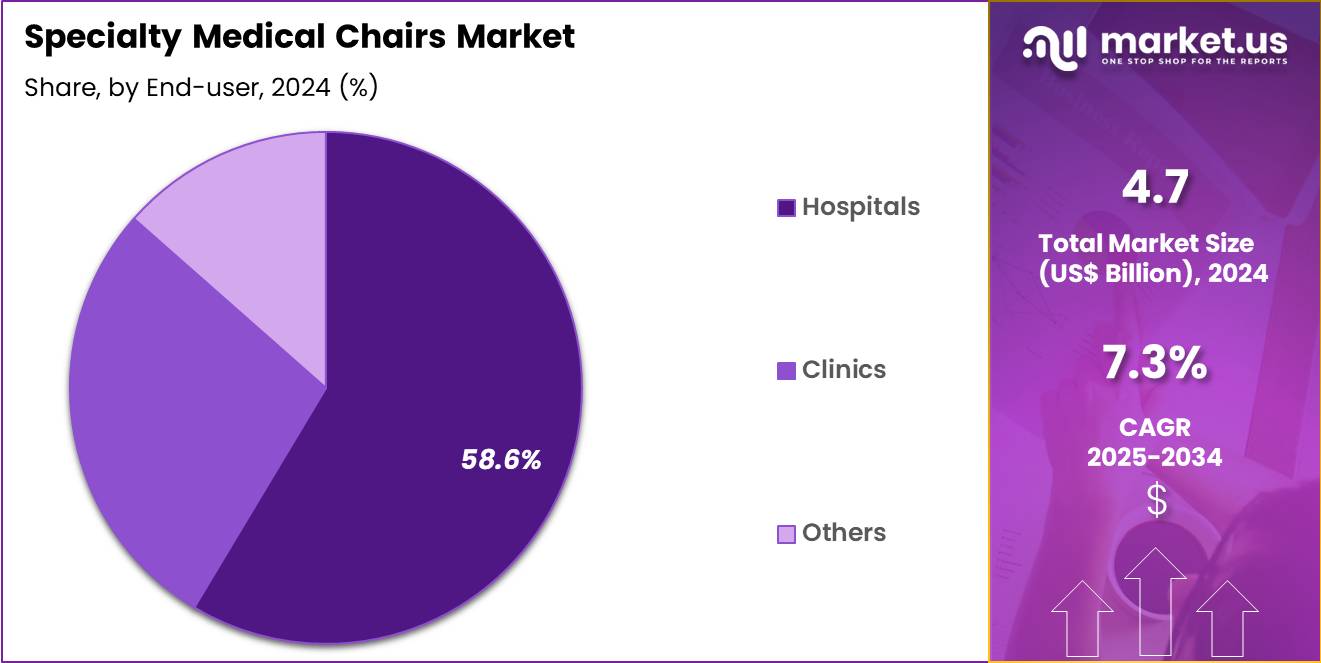

- Considering end-user, the market is divided into hospitals, clinics and others. Among these, hospitals held a significant share of 58.6%.

- North America led the market by securing a market share of 45.1%.

Product Type Analysis

Rehabilitation chairs accounted for 46.9% of growth within the product type category and represent the most demanded product group in the Specialty Medical Chairs market. Rising orthopedic and neurological rehabilitation volumes increase daily usage in hospitals and therapy centers. Aging populations drive higher incidence of stroke, arthritis, and mobility impairment, strengthening chair demand. Post-surgical recovery programs rely heavily on safe seating and positioning support.

Rehabilitation chairs improve patient transfer efficiency and reduce caregiver strain. Adjustable backrests and leg supports enhance comfort during extended therapy sessions. Hospitals prioritize chairs that support physiotherapy and occupational therapy workflows. Increased focus on early mobilization in inpatient care raises chair utilization. Bariatric and heavy-duty variants expand use across diverse patient profiles.

Infection control requirements encourage procurement of easy-to-clean chair materials. Electric and hydraulic adjustments support safer patient handling. Rehabilitation chairs integrate well into outpatient rehab departments. Growing prevalence of chronic musculoskeletal conditions increases long-term rehabilitation demand. Improved patient comfort supports therapy adherence and session duration.

Hospitals invest in ergonomic rehabilitation infrastructure to improve outcomes. Higher rehabilitation staffing levels support chair usage expansion. Technological upgrades such as tilt-in-space designs improve clinical value. Procurement cycles favor durable, long-life equipment for high-traffic use.

Government and insurer focus on reducing disability burden supports rehabilitation investments. The segment is projected to remain dominant due to rising rehabilitation volumes and functional care needs. Overall growth reflects mobility restoration priorities and hospital rehabilitation expansion.

End-User Analysis

Hospitals represented 58.6% of growth within the end-user category and dominate the Specialty Medical Chairs market due to high patient volume and diverse clinical departments. Hospitals require specialized chairs across rehabilitation, examination, and treatment environments. Surgical and trauma admissions increase demand for post-acute seating support. Inpatient rehabilitation programs expand chair requirements in wards and therapy units.

Hospitals prioritize safety features such as locking wheels and stable armrests to prevent falls. Centralized procurement supports bulk purchasing and faster replacement cycles. Teaching hospitals adopt advanced chair designs to meet clinical training and care standards. Infection prevention protocols drive demand for antimicrobial and wipeable surfaces. Hospitals handle patients with complex mobility needs, increasing chair utilization intensity.

Oncology, dialysis, and infusion services increase demand for comfortable treatment seating. Emergency and outpatient departments require high-throughput durable chairs. Expansion of hospital infrastructure increases room and unit capacity, supporting new chair installations. Hospitals invest in ergonomic equipment to reduce staff injury risks. Regulatory accreditation encourages standardized patient handling equipment.

Preventive maintenance programs in hospitals extend chair lifespan while sustaining recurring upgrades. Multidisciplinary care models increase chair usage across departments. Hospitals integrate chair positioning into patient safety and recovery protocols. Growth in chronic disease admissions supports continuous equipment demand. The segment is expected to retain dominance due to clinical centralization and capital investment capacity. Overall growth reflects increasing patient loads and modernization of hospital facilities.

Key Market Segments

By Product Type

- Rehabilitation chairs

- Pediatric chairs

- Geriatric chairs

- Bariatric chairs

- Others

- Examination chairs

- Mammography chairs

- Dialysis chairs

- Cardiac chairs

- Blood drawing chairs

- Birthing chairs

- Treatment chairs

- Ophthalmic chairs

- Dental chairs

- ENT chairs

- Others

By End-User

- Hospitals

- Clinics

- Others

Drivers

Increasing aging population is driving the market.

The global rise in the elderly demographic significantly boosts demand for specialty medical chairs used in procedures for age-related health issues. Enhanced life expectancy contributes to more individuals requiring chairs for dialysis, rehabilitation, and examinations. According to the World Health Organization, the number of people aged 60 and older worldwide reached 1.1 billion in 2023. This expansion necessitates ergonomic designs tailored to geriatric care in hospitals and clinics.

Governments are investing in healthcare infrastructure to accommodate this shift, further stimulating market growth. Manufacturers are innovating with adjustable features to ensure safety and comfort for older patients. The correlation between aging and chronic conditions like arthritis amplifies the need for specialized seating solutions.

Clinical settings prioritize chairs that facilitate mobility and reduce injury risks during treatments. This demographic trend supports sustained investment in product development by key industry players. Overall, the aging population remains a core catalyst for market expansion in diverse regions.

Restraints

High costs of technologically advanced chairs is restraining the market.

The premium pricing of specialty medical chairs equipped with advanced features limits adoption in budget-constrained facilities. Manufacturing complexities involving durable materials and electronic components elevate production expenses. Smaller clinics often prioritize basic equipment over high-end models due to financial limitations. Regulatory compliance for safety standards adds further cost burdens on suppliers.

In regions with underdeveloped healthcare funding, affordability issues hinder market penetration. Providers may delay upgrades, opting for maintenance of existing chairs to control expenditures. Insurance policies sometimes exclude coverage for sophisticated chair variants, affecting procurement decisions. This restraint impacts overall sales volumes, particularly among independent practitioners. Efforts to introduce cost-effective alternatives are underway but face quality assurance challenges. Consequently, high costs continue to impede broader accessibility and growth.

Opportunities

Rising healthcare infrastructure in emerging Asia-Pacific markets is creating growth opportunities.

The rapid development of medical facilities in Asia-Pacific countries opens avenues for specialty chair deployments in new hospitals. Increasing government allocations to health sectors support the procurement of advanced equipment. The region’s growing middle class enhances affordability for private healthcare services utilizing such chairs.

Collaborations with local distributors facilitate compliance and market entry for international manufacturers. Training programs for medical staff promote the effective use of specialized seating in treatments. Urbanization drives demand for outpatient centers equipped with ergonomic chairs. Policy reforms aimed at universal health coverage bolster infrastructure investments.

Key players are establishing regional hubs to optimize supply chains and reduce logistics costs. This opportunity enables diversification beyond saturated developed markets. Strategic expansions can capture significant shares in high-potential economies.

Impact of Macroeconomic / Geopolitical Factors

Global economic recoveries stimulate demand for advanced healthcare facilities, propelling the specialty medical chairs market as providers upgrade equipment for dental, ophthalmic, and rehabilitation applications in thriving regions. Executives align strategies with demographic shifts toward longer lifespans, which amplifies procurement volumes and sustains innovation in ergonomic designs.

Unfortunately, widespread inflation across nations hikes manufacturing inputs like metals and electronics, requiring firms to adjust operational plans in budget-constrained settings. Geopolitical conflicts in supply-dominant areas fracture logistics for chair components, forcing international vendors to handle extended disruptions and elevated risks. Leaders adapt by integrating flexible supply frameworks with trusted allies, which bolsters continuity and reveals untapped efficiency potentials.

Current US tariffs on imported medical furniture from major exporters like China add substantial cost increments, testing affordability for importers reliant on overseas economies of scale. American companies counter this by advancing local fabrication initiatives, which generates specialized employment and harmonizes with evolving compliance standards. Cutting-edge developments in adjustable, patient-centric features reliably energize the sector’s path, unlocking resilient progress and superior value delivery for stakeholders everywhere.

Latest Trends

Integration of AI-powered ergonomic adjustments is a recent trend in the market.

In 2024, manufacturers introduced AI-driven systems in specialty chairs for real-time posture corrections during procedures. These innovations utilize sensors to monitor patient positioning and automatically adjust for optimal comfort. AI algorithms analyze data to minimize clinician intervention and enhance efficiency in clinical settings. Dental and ophthalmic chairs particularly benefit from precise, automated alignments reducing procedural times.

Research in 2024 emphasized the role of machine learning in predicting patient needs based on historical data. This trend aligns with broader healthcare digitization efforts for improved outcomes. Regulatory bodies approved several AI-integrated models, accelerating adoption in advanced facilities.

Industry collaborations focus on embedding biometric feedback for personalized adjustments. The development addresses ergonomic challenges in prolonged treatments for chronic patients. These advancements position AI as a transformative element in chair design for 2025 and beyond.

Regional Analysis

North America is leading the Specialty Medical Chairs Market

In 2024, North America held a 45.1% share of the global specialty medical chairs market, driven by the expansion of outpatient clinics and ambulatory surgery centers requiring ergonomic designs for dental, ophthalmology, and gynecology procedures to enhance patient comfort and procedural efficiency amid rising elective surgeries.

Healthcare providers increasingly adopted powered adjustable chairs with integrated imaging and lighting features to support minimally invasive techniques, supported by infection control protocols that favor easy-to-clean materials in high-volume settings. Innovations in bariatric-capable models addressed obesity-related challenges, aligning with clinical standards for safe positioning in orthopedic and ENT examinations.

Demographic aging amplified demands for reclining chairs in long-term care facilities, prompting integrated models with mobility aids for geriatric care. Manufacturers refined hydraulic systems for durability, facilitating broader integrations in telemedicine-enabled offices. Collaborative quality assessments tracked ergonomic outcomes, fostering confidence in pediatric applications.

Supply adaptations ensured compliant, modular units for rapid deployment in expansion projects. The Centers for Disease Control and Prevention reported that the percentage of adults age 18 and older with a dental exam or cleaning in the past year stood at 65.5% in 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project notable escalation in specialty medical chairs across Asia Pacific during the forecast period, as governments intensify investments in healthcare facilities to address surging chronic disease screenings amid urbanization. Clinicians incorporate adjustable models into ophthalmology suites, optimizing positioning for cataract surgeries in densely populated cities.

National authorities subsidize bariatric variants for public hospitals, equipping them to manage obesity-linked orthopedic examinations in micronutrient-deficient regions. Biotech developers customize powered recliners with enhanced stability, suiting humid environments for ENT procedures. Cross-national consortia evaluate ergonomic designs through trials, fostering safety for geriatric care in aging societies.

Pharmaceutical partnerships promote modular chairs with integrated monitors, ensuring affordability for rural expansions. Policy frameworks incentivize training on maintenance protocols, extending utility to peripheral clinics facing resource constraints. The World Health Organization estimates that untreated oral diseases affect 3.5 billion people globally in 2022, with the highest burden in Asia Pacific driving demand for dental infrastructure.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Specialty Medical Chairs market drive growth by designing procedure-specific seating systems that improve clinician ergonomics, patient comfort, and workflow efficiency in dental, ENT, ophthalmology, and outpatient surgery settings. Companies expand adoption through modular configurations, powered positioning, and accessory integration that supports higher procedure throughput and consistent patient handling.

Commercial strategies emphasize direct sales to clinics and hospitals, bundled service contracts, and financing models that ease capital procurement decisions. Innovation priorities focus on antimicrobial upholstery, easier cleaning, and durable actuators that meet infection-control and long-life performance expectations.

Market expansion targets regions scaling ambulatory care infrastructure and investing in specialty clinics to reduce hospital load. Midmark operates as a leading participant with a broad clinical equipment portfolio, strong distribution reach, and a reputation for reliable exam and procedure chairs that support modern outpatient care delivery.

Top Key Players

- Joerns Healthcare

- GF Health Products, Inc.

- Hill-Rom Holdings, Inc.

- Drive DeVilbiss Healthcare

- Stryker Corporation

- Medline Industries, Inc.

- Invacare Corporation

- Graham-Field Health Products, Inc.

- Arjo AB

- Paramount Bed Holdings Co., Ltd.

Recent Developments

- In January 2024, Medtronic plc introduced a new range of specialty surgical seating solutions designed to support advanced spinal procedures. The chairs are engineered to work in conjunction with robotic guidance and intraoperative imaging systems, allowing surgeons to maintain precise patient positioning while improving workflow efficiency in complex spine surgeries.

- In March 2024, Invacare Corporation formed a strategic collaboration with ErgoSphere to strengthen its presence in the specialty seating segment. Through this partnership, Invacare expanded access to ergonomically optimized surgical and clinical chairs, addressing growing demand for clinician comfort, patient safety, and long duration procedural support.

- In May 2024, Ethicon, part of Johnson and Johnson, secured FDA clearance for a newly developed specialty surgical chair tailored for bariatric procedures. The chair is designed to accommodate higher weight capacities and improve patient stability during weight loss surgeries, supporting safer surgical positioning and improved operating room ergonomics.

Report Scope

Report Features Description Market Value (2024) US$ 4.7 Billion Forecast Revenue (2034) US$ 9.5 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Rehabilitation Chairs (Pediatric Chairs, Geriatric Chairs, Bariatric Chairs and Others), Examination Chairs (Mammography Chairs, Dialysis Chairs, Cardiac Chairs, Blood Drawing Chairs and Birthing Chairs) and Treatment Chairs (Ophthalmic Chairs, Dental Chairs, ENT Chairs and Others)), By End-User (Hospitals, Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Joerns Healthcare, GF Health Products, Inc., Hill-Rom Holdings, Inc., Drive DeVilbiss Healthcare, Stryker Corporation, Medline Industries, Inc., Invacare Corporation, Graham-Field Health Products, Inc., Arjo AB, Paramount Bed Holdings Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Specialty Medical Chairs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Specialty Medical Chairs MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Joerns Healthcare

- GF Health Products, Inc.

- Hill-Rom Holdings, Inc.

- Drive DeVilbiss Healthcare

- Stryker Corporation

- Medline Industries, Inc.

- Invacare Corporation

- Graham-Field Health Products, Inc.

- Arjo AB

- Paramount Bed Holdings Co., Ltd.