Global Solar Tile Market Size, Share, Growth Analysis By Type (Standard Solar Tile, Dimpled Solar Tile, Eave-Mount Solar Tile), By Roofing Type (New Roofing, Reroofing), By Application (Residential Building, Commercial Building, Industrial Building), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141877

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

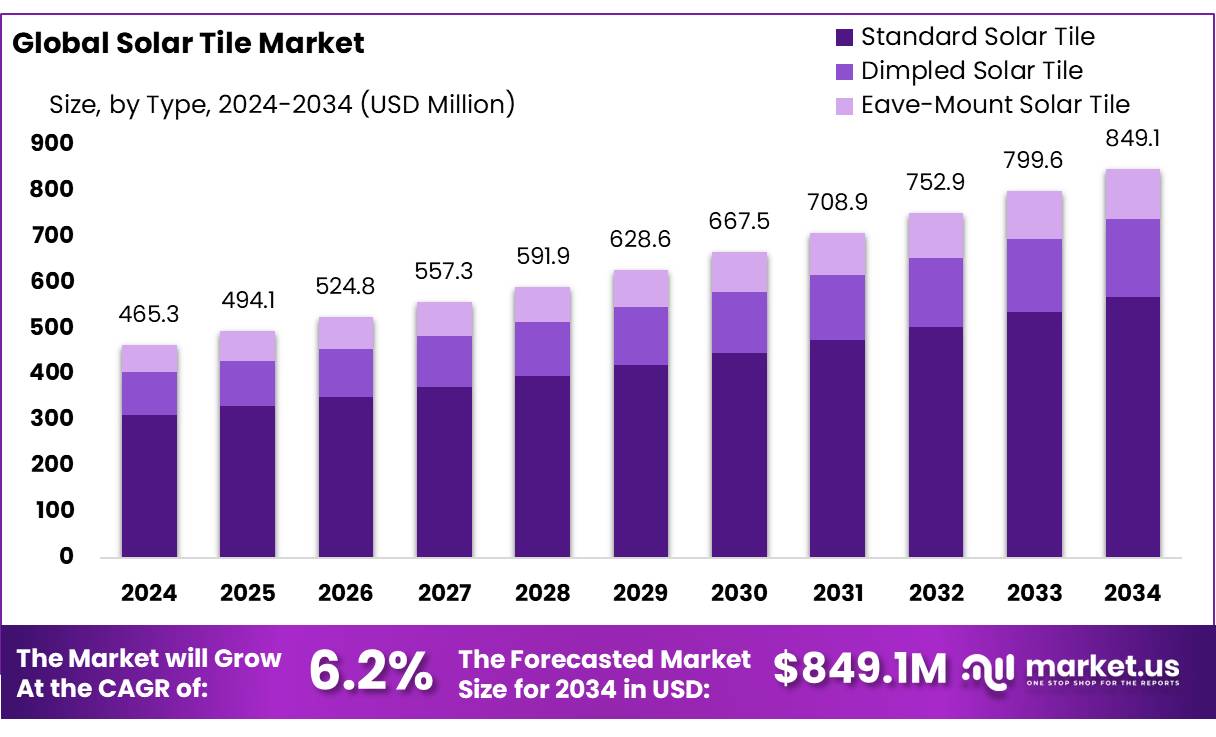

The Global Solar Tile Market size is expected to be worth around USD 849.1 Mn by 2034, from USD 465.3 Mn in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The solar tile market is currently undergoing a significant transformation, propelled by advancements in photovoltaic technologies and a growing focus on sustainable construction practices. Solar tiles, which are also referred to as photovoltaic tiles, are designed to integrate seamlessly with building roofs, serving both as traditional roofing and as a source of solar energy generation. This dual functionality is becoming increasingly popular among both homeowners and commercial enterprises who are seeking aesthetically appealing and energy-efficient roofing options.

Globally, the solar tile market has seen substantial growth in recent years. The International Energy Agency (IEA) highlights that solar energy will be crucial moving forward, with predictions of a significant rise in photovoltaic installations by 2030. This expected increase is a key driver behind the expansion of the solar tile sector. Manufacturers are focusing on creating high-efficiency tiles that not only blend with traditional roofing materials but also enhance visual appeal while maintaining practical functionality.

Key growth drivers for the solar tile market include various governmental policies and incentives. These include tax rebates, feed-in tariffs, and grants. In the United States, for instance, the government provides a Solar Investment Tax Credit (ITC), which offers a 26% tax credit on solar systems installed on both residential and commercial properties. Additionally, European nations are setting ambitious renewable energy goals, which are further encouraging the uptake of solar tiles.

The U.S. Department of Energy notes that demand for solar energy has climbed more than 40% in the past five years, spurring a wave of innovation in solar roofing technologies. Anticipated to continue its upward trajectory, the global market for solar tiles is poised for significant growth in the foreseeable future. This growth is expected to be driven by the increasing adoption of green technologies alongside favorable governmental policies.

Key Takeaways

- The global solar tile market is projected to grow from USD 465.3 million in 2024 to USD 849.1 million by 2034.

- The market is expected to expand at a CAGR of 6.2% from 2025 to 2034.

- Standard Solar Tiles held a dominant 67.2% market share in 2024.

- New Roofing dominated the market with a 59.1% share in 2024.

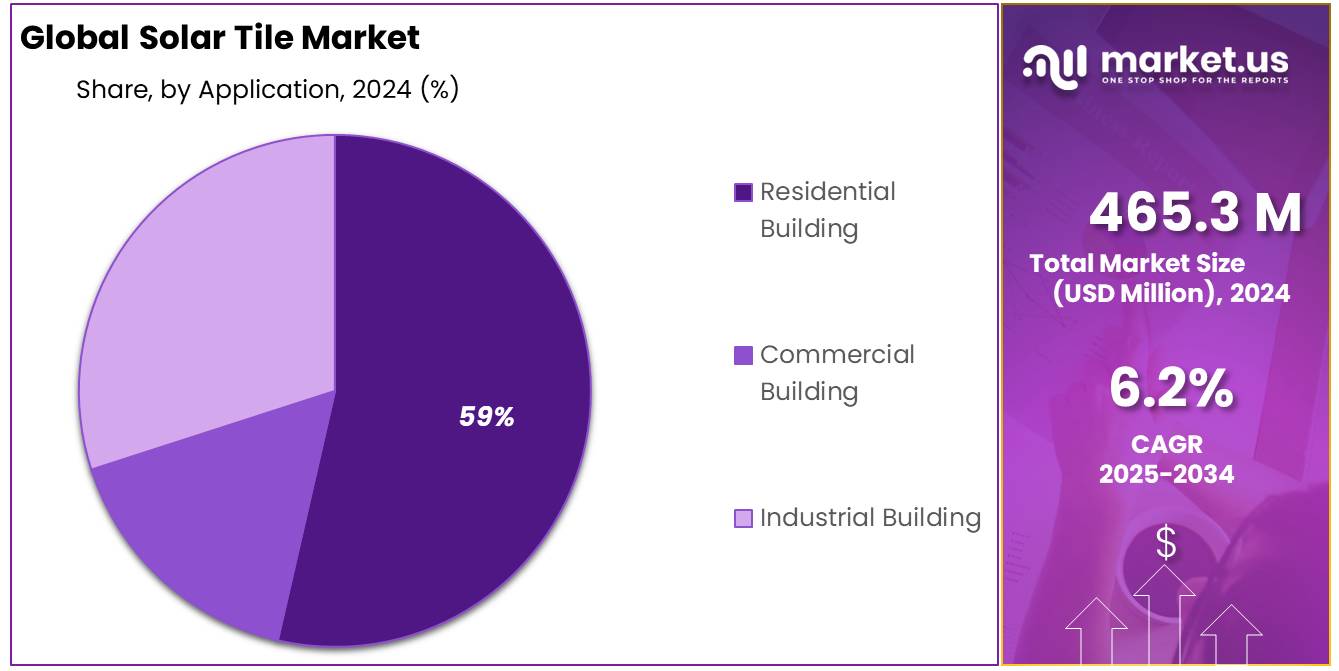

- Residential Buildings held a 59.1% share in 2024, making it the largest segment.

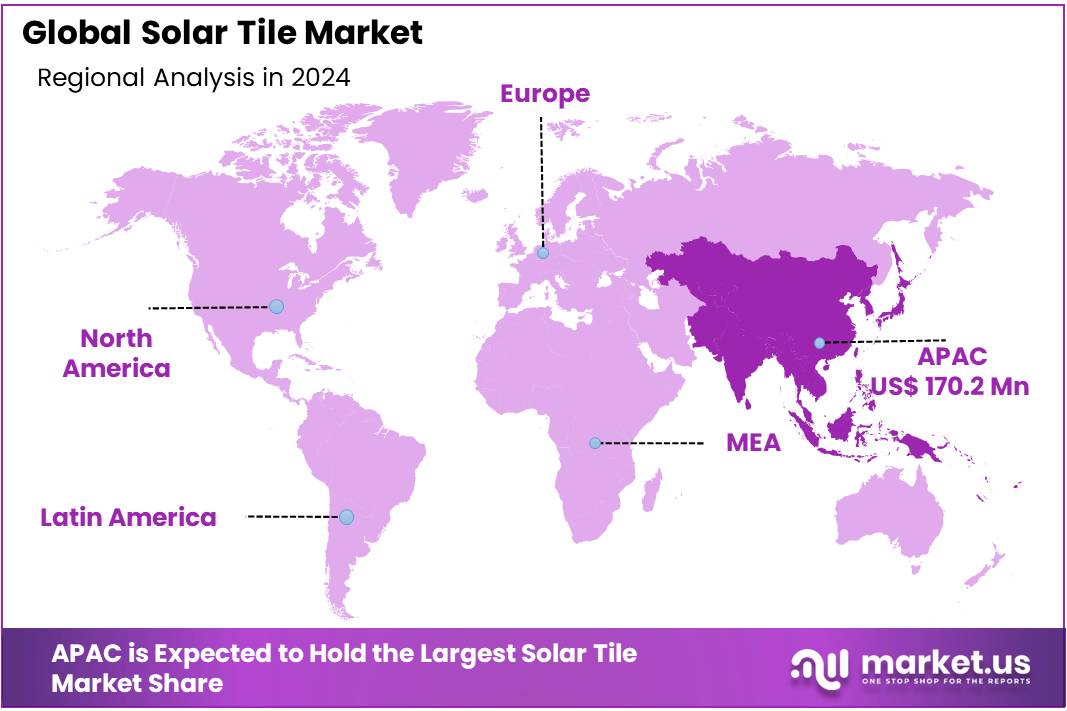

- The Asia-Pacific (APAC) region dominated the market with a 36.5% share in 2024, valued at approximately USD 170.2 million.

By Type

In 2024, Standard Solar Tiles held a dominant market position, capturing more than a 67.2% share in the solar tile market. This segment benefits significantly from its integration capabilities with existing roofing materials, making it a preferred choice for residential and commercial buildings seeking aesthetically pleasing solar solutions. The ease of installation and the seamless blend with traditional roofing tiles have enhanced its popularity among end users who prioritize minimalistic and efficient design.

Moreover, the durability and efficiency of standard solar tiles have contributed to their strong market performance. Manufacturers have continually improved the photovoltaic cell technology embedded in these tiles, offering higher energy conversion rates compared to earlier models. This advancement has attracted more environmentally conscious consumers, driving up sales in various regions.

By Roofing Type

In 2024, New Roofing held a dominant market position in the solar tile sector, capturing more than a 59.1% share. This segment primarily caters to the construction of new buildings that incorporate solar technology right from the design phase. The growing demand for new roofing solar tiles is driven by the increasing number of eco-friendly building projects that aim to maximize energy efficiency from the outset.

Builders and architects are increasingly opting for solar tiles in new constructions due to their dual functionality as both a roofing material and a renewable energy generator. This integration is not only cost-effective but also aligns with global trends towards sustainable development. Moreover, new roofing solar tiles are designed to blend seamlessly with modern architectural styles, which enhances their appeal in both residential and commercial markets.

By Application

In 2024, Residential Buildings held a dominant market position in the Solar Tile Market, capturing more than 59.1% market share. The growing adoption of solar energy in residential spaces has been fueled by rising electricity costs, increasing awareness of sustainable living, and government incentives promoting solar installations. Homeowners are increasingly turning to solar tiles as an aesthetic and energy-efficient alternative to traditional solar panels, driving their demand across urban and suburban housing developments.

The trend is expected to continue in 2025, with more residential buildings integrating solar tile technology into rooftops. Advancements in solar tile efficiency, coupled with improved durability and better energy conversion rates, are making them a preferred choice for homeowners looking for long-term savings on energy bills. Additionally, rising concerns about energy independence and power outages are pushing more residential consumers to adopt solar tile systems, further strengthening the market.

Key Market Segments

By Type

- Standard Solar Tile

- Dimpled Solar Tile

- Eave-Mount Solar Tile

By Roofing Type

- New Roofing

- Reroofing

By Application

- Residential Building

- Commercial Building

- Industrial Building

Drivers

Government Incentives Boosting Solar Tile Adoption

For instance, in the United States, the federal government offers a Solar Investment Tax Credit (ITC), which has been instrumental in increasing solar installations across the country. The ITC allows homeowners and commercial entities to deduct 26% of the cost of installing a solar energy system from their federal taxes, significantly reducing the upfront costs associated with solar tiles. According to the Solar Energy Industries Association (SEIA), this incentive has helped the U.S. solar industry grow by more than 10,000% since its implementation in 2006, with an average annual growth rate of 50% over the last decade.

Similarly, in Europe, countries like Germany have introduced feed-in tariffs that guarantee a fixed premium price for solar-generated electricity, providing a stable financial return for solar tile investors. The German Federal Network Agency reports that these policies have led to the installation of solar power systems capable of generating several gigawatts annually.

Moreover, emerging economies are not far behind. India, for example, has launched the Smart Cities Mission, which includes plans to develop 100 smart cities all equipped with sustainable energy solutions, including solar tiles. The government of India offers subsidies and financial assistance for solar installations in residential, institutional, and commercial sectors, aiming to increase the country’s solar capacity significantly.

These government policies and incentives are crucial in lowering the barriers to solar tile adoption, making them a more feasible and attractive option for a wide range of users. The ongoing commitment of various governments to reduce carbon footprints and promote renewable energy clearly plays a central role in driving the solar tile market forward.

Restraints

High Installation Costs Limiting Solar Tile Market Growth

One of the significant factors restraining the growth of the solar tile market is the high cost of installation. Solar tiles are more technologically advanced than traditional solar panels and often require specialized installation techniques, which can significantly increase the overall costs. This makes them less accessible for a broad segment of potential users, particularly in regions with lower economic stability.

For example, according to a report by the National Renewable Energy Laboratory (NREL), the average installation cost of solar tile systems is about 25% higher than that of traditional solar panel systems. This cost discrepancy can be a substantial barrier for homeowners and small businesses considering a switch to renewable energy but deterred by initial expenses.

Moreover, the aesthetics and integration of solar tiles into existing buildings, while a selling point, also contribute to these higher costs. Each tile must be individually fitted and integrated into the roof, requiring more labor and time than standard panel installations. The specialized skills needed for this process are not as widely available, which can add to the overall cost due to the limited number of qualified contractors.

Government initiatives aimed at subsidizing renewable energy technologies have helped mitigate some of these costs, but these programs can vary widely by region and may not always cover a significant portion of the upfront expenses associated with solar tiles. For instance, while some European countries offer substantial incentives for solar technology adoption, the level of support in the United States can vary drastically between states, impacting the overall adoption rate of solar tiles.

Opportunity

Expanding Urbanization and Smart City Projects: A Growth Avenue for Solar Tiles

A major growth opportunity for the solar tile market stems from the rapid urbanization and the increasing number of smart city projects around the world. As cities expand and new urban areas are developed, the integration of sustainable building materials such as solar tiles is becoming more prevalent. This trend is supported by governmental initiatives that promote the incorporation of renewable energy solutions in urban planning.

For instance, the European Union has been actively supporting the Smart Cities and Communities European Innovation Partnership (EIP-SCC). This initiative aims to enhance urban life through more sustainable integrated solutions that include energy, transport, and ICT. According to the European Commission, this initiative has mobilized millions of euros since its inception, aiming to retrofit existing infrastructure and integrate new technologies like solar tiles in urban developments.

Similarly, in Asia, countries like China and India are heavily investing in smart cities, with China planning to develop over 100 new smart cities by 2025. The Indian government has also launched the Smart Cities Mission, aiming to develop 100 smart cities as a model for urban development, which includes the use of solar-powered systems as a key component of their energy solutions.

These projects represent significant opportunities for the growth of the solar tile market. As urban environments continue to evolve, the demand for innovative, energy-efficient building materials is expected to rise. The aesthetic appeal and functional benefits of solar tiles make them an ideal choice for these futuristic urban projects, blending environmental sustainability with modern urban design.

The continued governmental backing for smart cities and sustainable urban development is crucial, as it not only fosters the growth of renewable energy technologies but also opens up new markets for solar tiles within these evolving urban landscapes.

Trends

Aesthetic Integration: The Rising Trend in Solar Tile Design

One of the latest trends in the solar tile market is the focus on aesthetic integration, which is reshaping how solar energy solutions are perceived and adopted in residential and commercial properties. This trend emphasizes solar tiles designed to blend seamlessly with traditional roofing materials, offering a visually appealing alternative to the conventional solar panel arrays.

Manufacturers are increasingly prioritizing the development of solar tiles that not only perform efficiently but also enhance the architectural design of buildings. For example, companies are now producing solar tiles in various colors and textures to match the existing roofing, making solar options more attractive to homeowners concerned about curb appeal.

This shift towards aesthetics is driven by consumer demand for energy solutions that do not compromise the style of their homes. A 2023 survey by the Building Research Establishment in the UK highlighted that over 60% of homeowners are more likely to adopt solar energy if the installation blends with their home’s design.

Governmental initiatives also support this trend. In the United States, the Department of Energy (DOE) has funded projects under the Solar Energy Technologies Office (SETO) that focus on improving the visual integration of solar technology into building architectures. These initiatives aim to reduce the ‘soft costs’ associated with solar adoption, such as customer acquisition and system design, by making solar tiles more appealing to a broader audience.

Regional Analysis

The Asia-Pacific (APAC) region, which held a substantial 36.5% market share, valued at approximately $170.2 million. APAC’s dominance can be attributed to rapid urbanization, extensive government subsidies for solar energy projects, and the presence of major solar tile manufacturers who benefit from lower production costs in this region.

In the solar tile market, North America has emerged as a significant player, driven by robust investments in renewable energy and supportive government policies. Within this region, the United States leads in the adoption of solar tiles, fueled by state-level incentives such as tax credits and rebates, alongside a growing consumer preference for sustainable building materials.

North America’s solar tile market is characterized by a high degree of innovation and technological advancement, with companies continually developing more efficient and aesthetically pleasing solar tile solutions. This has been pivotal in overcoming initial market resistance due to the higher costs associated with solar tile installations compared to traditional solar panel systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Autarq specializes in producing circular solar tiles that blend seamlessly into traditional roof designs. Their products are distinguished by a unique aesthetic that does not compromise on functionality, offering homeowners an eco-friendly energy solution without altering the visual appeal of their homes. Autarq’s solar tiles are known for their durability and efficiency, positioning them as a top choice for those looking to integrate solar power with minimal disruption to their property’s appearance.

CertainTeed has established itself as a leader in the solar roofing market with its comprehensive range of solar products, including solar tiles. Their offerings are integrated into roofing shingles for easier installation and better aesthetics, making solar power more accessible and attractive for residential customers. CertainTeed continues to innovate with a focus on enhancing energy efficiency and expanding the lifespan of their solar roofing solutions.

Dyaqua stands out in the solar tile market with its commitment to invisible photovoltaics. Their products are designed to mimic traditional building materials like stone, wood, and concrete, making them ideal for historical renovations or aesthetically sensitive projects. Dyaqua’s technology focuses on merging energy efficiency with cultural heritage preservation, catering to a niche yet important segment of the market.

Ennogie is renowned for its solar roof system, which boasts a sleek, minimalist design that integrates smoothly with modern architecture. The company’s focus on high-efficiency solar roofs not only enhances the aesthetic appeal of buildings but also maximizes energy generation, thereby providing a significant return on investment over time. Ennogie’s commitment to design and functionality makes it a preferred choice in both new construction and renovations.

Top Key Players

- Autarq

- CertainTeed

- Dyaqua

- Ennogie

- GAF Energy

- GB-Sol

- Luma Solar

- Meyer Burger

- Midsummer

- Shinto

- Solarmass Energy

- SolteQ

- SunStyle

- SunTegra

- Tesla

Recent Developments

In 2024, Autarq’s solar tiles are priced between €25 and €30 each and are noted for their ability to cover up to 70% of a household’s electricity needs, which speaks to their efficiency and the potential cost savings they offer.

In 2024, Dyaqua, a trailblazer in the solar tile industry, has continued to carve out a unique niche with its Invisible Solar line, which is particularly suited for heritage buildings due to its aesthetically pleasing design that mimics traditional building materials like terracotta.

Report Scope

Report Features Description Market Value (2024) USD 465.3 Mn Forecast Revenue (2034) USD 849.1 Mn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Standard Solar Tile, Dimpled Solar Tile, Eave-Mount Solar Tile), By Roofing Type (New Roofing, Reroofing), By Application (Residential Building, Commercial Building, Industrial Building) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Autarq, CertainTeed, Dyaqua, Ennogie, GAF Energy, GB-Sol, Luma Solar, Meyer Burger, Midsummer, Shinto, Solarmass Energy, SolteQ, SunStyle, SunTegra, Tesla Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Autarq

- CertainTeed

- Dyaqua

- Ennogie

- GAF Energy

- GB-Sol

- Luma Solar

- Meyer Burger

- Midsummer

- Shinto

- Solarmass Energy

- SolteQ

- SunStyle

- SunTegra

- Tesla