Global Solar Power Meters Market Size, Share and Report Analysis By Integration Type (On-grid Solar Power Meters, Off-grid Solar Power Meters, Handheld Solar Power Meters), By Product (Net Meter, Bi-Directional Meter, Dual Meter, Others), By Measurement (Current Measurement, Voltage Measurement, Power Measurement, Energy Measurement), By Technology (Digital, Analog), By End Use (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175336

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

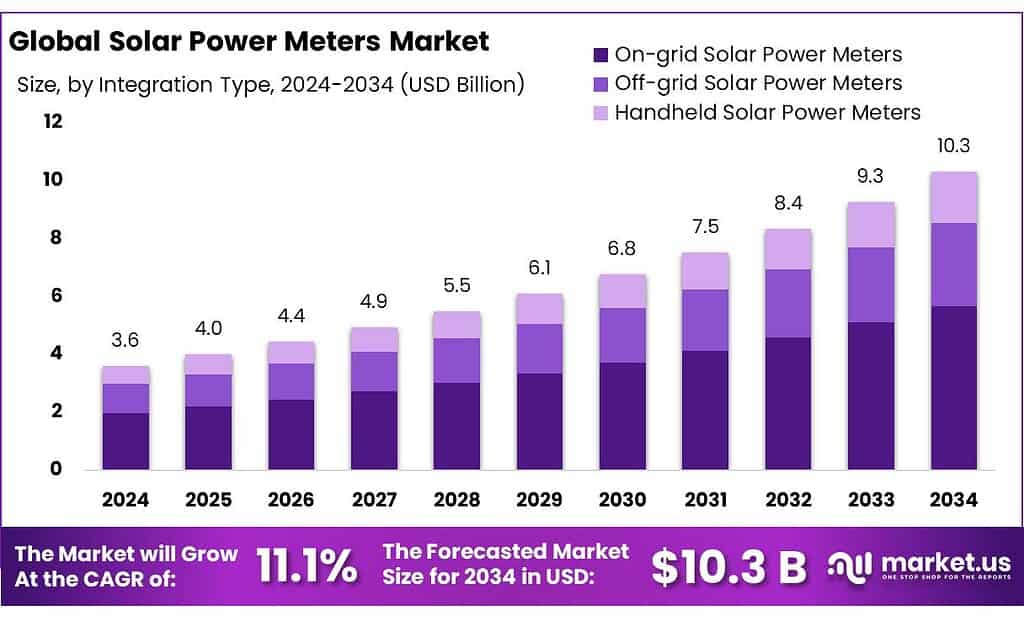

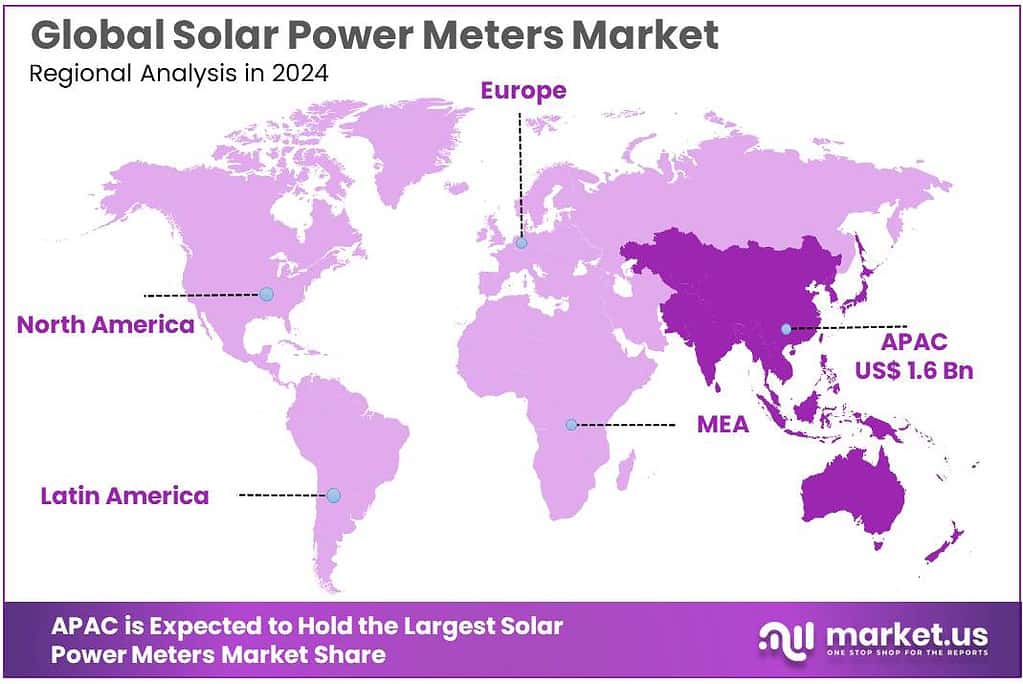

Global Solar Power Meters Market size is expected to be worth around USD 10.3 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 11.1% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 44.8% share, holding USD 1.6 Billion in revenue.

Solar power meters sit at the intersection of two fast-moving shifts: rapid solar PV deployment and the modernization of electricity grids. They include bidirectional net meters for rooftop solar, generation meters for utility-scale plants, and “revenue-grade” meters used for billing, settlement, and performance verification. Their role is becoming more critical as solar scales: IRENA reports solar PV capacity reached 1,865 GW globally by end-2024, with 451 GW added in 2024 alone.

The industrial scenario is shaped by record renewable buildouts and a parallel upgrade of metering infrastructure. The IEA estimates global renewable capacity additions rose to nearly 510 GW in 2023, a step-change that increases the need for accurate measurement, remote monitoring, and grid-balancing data.

- In Europe, policy-driven digitization is accelerating adoption: the European Commission notes 54% of European households had an electricity smart meter at end-2021, and 13 EU countries exceeded 80% penetration by end-2022. The same page highlights that, by 2030, investment in smart metering systems could reach €47 billion if 266 million smart meters are installed.

Key demand drivers are distributed solar growth and utility push toward advanced metering infrastructure (AMI). As net metering and energy sharing expand, utilities require meters that can measure import/export separately, timestamp usage, and support dynamic tariffs. In the United States, EIA reports about 119 million AMI (smart) meter installations in 2022, representing 72% of total electric meters—an installed base that supports granular billing and faster interconnection workflows for solar customers. From a standards perspective, accuracy expectations are also rising: IEC 62053-22 defines static watt-hour meter accuracy classes including 0.1S, 0.2S, and 0.5S, commonly referenced for higher-precision energy measurement in billing and settlement contexts.

Government initiatives are reinforcing the pipeline. In India, the government reported 4.76 crore smart meters installed to date under various schemes, alongside large-scale RDSS-linked rollouts. For solar access, MNRE issued an SOP on 23 Feb 2023 to support virtual and group net metering mechanisms—structures that typically require robust metering and accounting to allocate credits correctly. In the U.S., the IEA highlights that the Inflation Reduction Act’s tax credits helped drive a record 32 GW of PV additions in 2023, which indirectly expands the addressable market for compliant solar metering across interconnections and plant operations.

Key Takeaways

- Solar Power Meters Market size is expected to be worth around USD 10.3 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 11.1%.

- On-grid Solar Power Meters held a dominant market position, capturing more than a 55.2% share.

- Bi-Directional Meter held a dominant market position, capturing more than a 39.1% share.

- Energy Measurement held a dominant market position, capturing more than a 39.4% share.

- Digital held a dominant market position, capturing more than an 84.2% share.

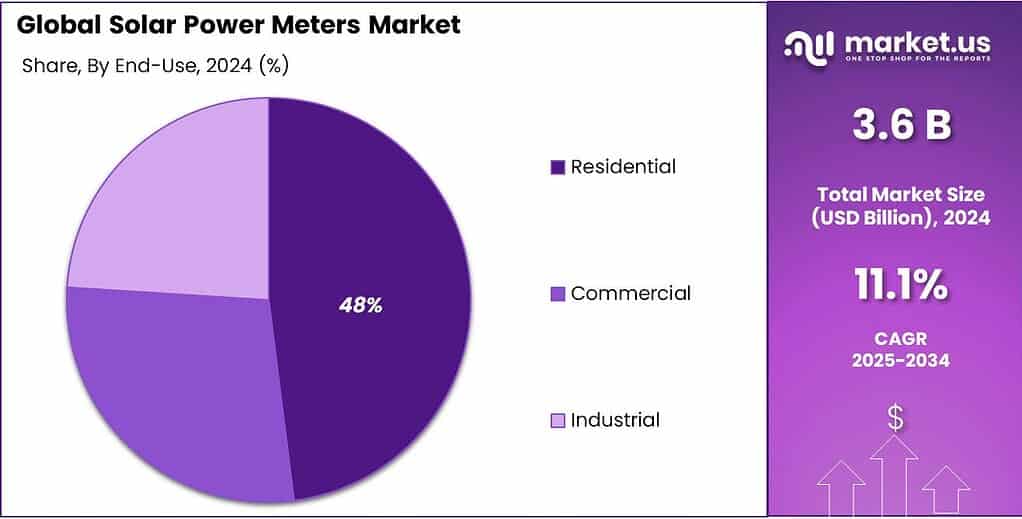

- Residential held a dominant market position, capturing more than a 48.6% share.

- Asia Pacific dominates the Solar Power Meters market with a 44.8% share, valued at USD 1.6 Bn.

By Integration Type Analysis

On-grid Solar Power Meters dominate the market with a strong 55.2% share, reflecting their growing role in modern grid-connected solar systems.

In 2024, On-grid Solar Power Meters held a dominant market position, capturing more than a 55.2% share, driven by the surge in rooftop solar installations and utility-scale grid-connected projects. These meters are essential for measuring both imported and exported electricity, helping consumers benefit from net-metering and real-time billing. Their wide acceptance comes from the growing preference for grid-tied solar systems, which are easier to integrate and offer stronger financial paybacks for households, small businesses, and industrial users.

By Product Analysis

Bi-Directional Meter leads the market with a strong 39.1% share, reflecting its essential role in modern solar energy flow measurement.

In 2024, Bi-Directional Meter held a dominant market position, capturing more than a 39.1% share, driven by their necessity in grid-connected solar systems where both import and export of electricity must be accurately tracked. As rooftop solar adoption expanded across residential and commercial sectors, these meters became a foundational component for net metering, time-of-use billing, and performance verification. Consumers increasingly relied on them to ensure they received fair credit for excess power supplied back to the grid, making bi-directional metering a critical technological requirement.

By Measurement Analysis

Energy Measurement leads the market with a solid 39.4% share, reflecting its crucial role in accurate solar performance assessment.

In 2024, Energy Measurement held a dominant market position, capturing more than a 39.4% share, driven by the rising need for precise tracking of electricity generation and consumption across residential, commercial, and industrial solar systems. As solar installations expanded rapidly, end users and utilities relied heavily on accurate energy measurement to validate performance, calculate savings, and ensure transparent billing. This segment became essential for net-metering and solar settlement processes, where every kilowatt-hour exported or consumed must be recorded correctly.

By Technology Analysis

Digital technology dominates with an impressive 84.2% share, driven by its accuracy, reliability, and smart monitoring features.

In 2024, Digital held a dominant market position, capturing more than an 84.2% share, reflecting its widespread acceptance as the standard technology in modern solar power metering. As solar installations grew across residential, commercial, and industrial sectors, users increasingly preferred digital meters for their precision, ease of reading, and ability to record real-time solar generation and consumption data. Their user-friendly interfaces and compatibility with smart grid systems helped reinforce their strong leadership in the market.

By End Use Analysis

Residential segment leads with a strong 48.6% share, driven by rising rooftop solar adoption and supportive energy policies.

In 2024, Residential held a dominant market position, capturing more than a 48.6% share, supported by rapid growth in rooftop solar installations across urban and semi-urban regions. Households increasingly adopted solar systems to cut electricity costs, gain energy independence, and participate in net-metering programs—all of which require accurate and reliable solar power meters. As homeowners became more aware of the financial benefits of solar, the demand for high-quality metering solutions grew significantly, pushing the residential category to the top of the market.

Key Market Segments

By Integration Type

- On-grid Solar Power Meters

- Off-grid Solar Power Meters

- Handheld Solar Power Meters

By Product

- Net Meter

- Bi-Directional Meter

- Dual Meter

- Others

By Measurement

- Current Measurement

- Voltage Measurement

- Power Measurement

- Energy Measurement

By Technology

- Digital

- Analog

By End Use

- Residential

- Commercial

- Industrial

Emerging Trends

Smart, connected meters are becoming the new normal for solar—moving from simple kWh counters to real-time grid devices

A clear latest trend in solar power meters is the fast move toward digital, connected, and utility-integrated metering—the kind that supports two-way energy flow, remote reading, and data-driven billing. Solar users increasingly want simple visibility, while utilities need reliable interval data to manage feeders where power now flows both ways. This trend is tightly linked to the wider expansion of smart metering and grid digitization, because modern solar metering works best when it plugs into a smart-meter ecosystem rather than sitting as a standalone device.

In the United States, the scale of smart metering shows how quickly the market is shifting. The U.S. Energy Information Administration (EIA) reports that in 2022, electric utilities had about 119 million advanced metering infrastructure (AMI) installations—around 72% of total electric meters. Residential customers accounted for about 88% of AMI installations, and about 73% of total residential meters were AMI meters.

Europe is moving in the same direction, with policy pressure behind it. The European Commission notes that 54% of European households had an electricity smart meter at the end of 2021, and in 13 EU countries the penetration rate was over 80% at the end of 2022. It also highlights that by 2030, investment in smart metering systems could reach €47 billion if 266 million smart meters are installed.

India shows how the trend is also expanding through government-led scale programs, which creates a large upgrade pathway for solar-compatible meters. A Government of India release states that under the Revamped Distribution Sector Scheme (RDSS), 20.33 crore smart meters have been sanctioned, and 4.76 crore smart meters have been installed in the country under various schemes.

Drivers

Growing Solar Installations Drive the Need for Accurate Solar Power Meters

One of the biggest real-world reasons solar power meters are becoming increasingly essential is the remarkable growth in solar power installations around the world — a trend driven by strong government policies, cost reductions in solar technology, and rising consumer demand for clean energy. While many people focus on how solar panels reduce electricity bills, the unseen backbone that makes that possible with fairness and accountability is the solar power meter. These meters measure not just how much energy solar systems generate, but how much is consumed versus exported back to the grid.

Across the globe, solar photovoltaic (PV) power is growing at an unprecedented rate. By the end of 2024, the total installed capacity of solar PV reached around 1,865 GW, with 451 GW added in that year alone. This massive expansion — larger than at any previous period — means millions of new solar systems are feeding electricity into national grids or powering homes directly. Without precise meters that can track every kilowatt-hour efficiently and transparently, utilities would struggle to balance supply and demand, and consumers might not get proper credit for the excess energy they export to the grid.

National governments are supporting this expansion in very concrete terms. For example, India’s cumulative solar installed capacity surpassed 132.85 GW by November 2025, a dramatic rise from previous years and reflecting the nation’s push toward clean power. This growth didn’t happen by accident. The Indian government has set ambitious targets — such as achieving 500 GW of non-fossil fuel capacity by 2030 — and has backed them with initiatives like the PM Surya Ghar Muft Bijli Yojana, rooftop solar incentives, and financial support schemes that make solar accessible to ordinary households.

With this wave of installations, solar power meters have become central to every stakeholder’s interests. Households that invest in solar panels need meters to record how much electricity they generate and how much they feed back to the grid so that utilities can deliver accurate net-metering credits on their bills. Utilities, in turn, need reliable data to manage increasingly complex grids where power flows both ways — from the utility to the customer and back from the customer’s solar system to the grid.

Restraints

High rollout costs and “last-mile” complexity restrain Solar Power Meter adoption

One major restraining factor for solar power meters—especially bi-directional and smart, grid-interactive models—is the high total cost of rollout and the practical complexity of installing and keeping meters fully functional at scale. The meter itself is only one piece of the expense. Utilities and suppliers often must also fund installation labor, communications networks, system integration, testing, and ongoing maintenance. This becomes a real brake in price-sensitive markets, where the added metering cost can slow rooftop solar approvals or delay upgrades from basic meters to advanced, data-enabled devices.

Government audit findings on national metering programs show how quickly these costs accumulate. In Great Britain, the National Audit Office (NAO) reported that the government’s 2019 estimate put the smart meter rollout cost at £13.5 billion over 2013–2034, with costs largely borne by suppliers and then passed through to consumers via energy bills. or solar-linked metering, this matters because bidirectional measurement, remote reading, and settlement-grade accuracy often ride on the same upgrade path as broader smart metering and grid digitalization.

Operational performance issues add another layer of friction, because they affect trust and perceived value. The same NAO summary notes that 9% of installed smart meters—around three million out of 32.4 million—were not operating in smart mode as of end-March 2023, making them effectively similar to traditional meters in day-to-day function. When customers experience a meter that is installed but not fully “smart,” or when connectivity problems reduce features like automatic readings, it creates hesitation about paying for more advanced solar-compatible metering.

In 2024–2025, this cost-and-complexity restraint is also visible in the scale of investment governments expect is required just to modernize metering. The European Commission notes that, by 2030, investment in smart metering systems could reach an aggregated €47 billion if 266 million smart meters are installed. Even when the long-term benefits are compelling, the upfront bill and the effort to coordinate utilities, vendors, installers, and data systems can slow progress—particularly where grid operators are already managing backlogs in solar interconnections.

Opportunity

Smart, bidirectional metering for fast-growing distributed solar is a clear growth opportunity

A major growth opportunity for solar power meters is the fast shift toward distributed, grid-connected solar—rooftops, community solar, and small commercial systems—where two-way measurement is no longer optional. As more consumers generate their own electricity, utilities need meters that can record import and export energy accurately, at the right time interval, and often with remote communication. This opportunity is expanding simply because the solar base is expanding at speed: global solar PV capacity reached 1,865 GW by the end of 2024, and 451 GW was added in 2024 alone, the largest annual addition for any renewable source.

What makes this a practical opportunity—rather than a theoretical one—is the way solar electricity is now becoming a meaningful part of everyday power supply. The IEA reports solar PV generation increased by a record 320 TWh in 2023, up 25% year-on-year, showing how quickly solar output is scaling and how important accurate measurement is for grid stability and settlement. As solar becomes a bigger slice of the power mix, utilities push harder for data-rich meters that help them forecast loads, spot losses, and manage voltage on feeders that now experience reverse power flow during sunny hours.

India highlights how quickly this opportunity can turn into volume. The Government of India reported that 4.76 crore smart meters (about 47.6 million) have been installed so far under various schemes, while 20.33 crore smart meters (about 203.3 million) have been sanctioned under the Revamped Distribution Sector Scheme (RDSS). Even when these are not “solar-only” meters, the rollout matters because rooftop solar and net-metering work best when the distribution system already has modern metering, reliable billing, and better energy accounting.

The United States shows another angle of growth: community solar and rapid annual solar additions are increasing the need for metering and allocation at scale. SEIA’s “2024 Year in Review” notes community solar installed 1,745 MWdc in 2024, a 35% increase over 2023. In the same direction, U.S. solar additions were described as record-setting in 2024, totaling 50 GW of new solar capacity, reflecting how quickly grid-connected solar is expanding and how many new interconnections require compliant metering.

Regional Insights

Asia Pacific dominates the Solar Power Meters market with a 44.8% share, valued at USD 1.6 Bn, largely because the region is adding grid-connected solar faster than anywhere else and utilities are modernising metering to manage two-way power flows. In practical terms, every new rooftop or commercial solar connection increases demand for bi-directional and digital meters that can measure import/export energy for billing and net-metering credits.

This structural demand is strongest where solar deployment is deepest: globally, solar PV capacity reached 1,865 GW by end-2024, with 451 GW added in 2024 alone, and Asia is repeatedly identified by IRENA as the main engine of solar growth. China remains the anchor market within the region; the IEA notes China added 260 GW of solar PV capacity in 2023, illustrating the scale of new interconnections that require compliant metering and settlement-grade data.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ATP Instrumentation supports solar meter and electrical-testing workflows through instrument supply, calibration, and measurement solutions used by installers and maintenance teams. Company-profile sources list ATP as founded in 1990, with roughly 12 employees and about $6.1M in revenue. In the solar metering ecosystem, this type of specialist supplier helps bridge procurement and technical support for field deployments.

FLIR is best known for thermal imaging that solar teams use to detect hotspots, failed strings, and inverter issues—supporting higher-quality commissioning that complements accurate metering. As Teledyne FLIR, it traces back to 1978; it reported $1.923B revenue and 4,179 employees in 2020 (pre-acquisition reporting). This inspection layer often reduces performance disputes in measured generation.

General Tools serves the broader measurement-tool market that overlaps with solar installation and inspection needs. In an acquisition announcement, it is described as founded in 1922, employing about 60 people, and generating $68.2M net revenue in calendar year 2020 (with the deal valued at about $115M). These fundamentals show a stable platform for expanding measurement categories tied to solar work.

Top Key Players Outlook

- Amprobe

- ATP Instrumentation

- Canstar Blue Pty Ltd.

- FLIR Systems

- Fluke Corporation

- General Tools & Instruments

- Jaycar Electronics

- PCE Deutschland GmbH

- Solar Light Company, Inc.

- TES Electrical Electronic Corp.

Recent Industry Developments

In 2024–2025, Fluke Corporation supports the solar power metering workflow by equipping installers and O&M teams with field tools that verify PV output and safety before meter readings are trusted for billing or performance claims. A key example is Fluke’s SMFT-1000 PV tester platform, built for systems operating up to 1000 V DC, with PV-string open-circuit voltage measurement up to 1000 V and short-circuit current measurement up to 20 A DC, helping technicians confirm wiring, polarity, insulation resistance, and real operating conditions on-site.

Amprobe’s portfolio still features dedicated instruments such as the SOLAR-100, designed to measure irradiance up to 2000 W/m² with a 3½-digit display and 2000-count reading capacity—useful for checking whether a rooftop location is receiving strong sunlight before final panel placement.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 10.3 Bn CAGR (2025-2034) 11.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Integration Type (On-grid Solar Power Meters, Off-grid Solar Power Meters, Handheld Solar Power Meters), By Product (Net Meter, Bi-Directional Meter, Dual Meter, Others), By Measurement (Current Measurement, Voltage Measurement, Power Measurement, Energy Measurement), By Technology (Digital, Analog), By End Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amprobe, ATP Instrumentation, Canstar Blue Pty Ltd., FLIR Systems, Fluke Corporation, General Tools & Instruments, Jaycar Electronics, PCE Deutschland GmbH, Solar Light Company, Inc., TES Electrical Electronic Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amprobe

- ATP Instrumentation

- Canstar Blue Pty Ltd.

- FLIR Systems

- Fluke Corporation

- General Tools & Instruments

- Jaycar Electronics

- PCE Deutschland GmbH

- Solar Light Company, Inc.

- TES Electrical Electronic Corp.