Global Smart Meter Market Report By Product (Smart Electricity Meter, Smart Water Meter, Smart Gas Meter), By Technology (Advanced Metering Infrastructure, Auto Meter Reading), By End-User (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 18718

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

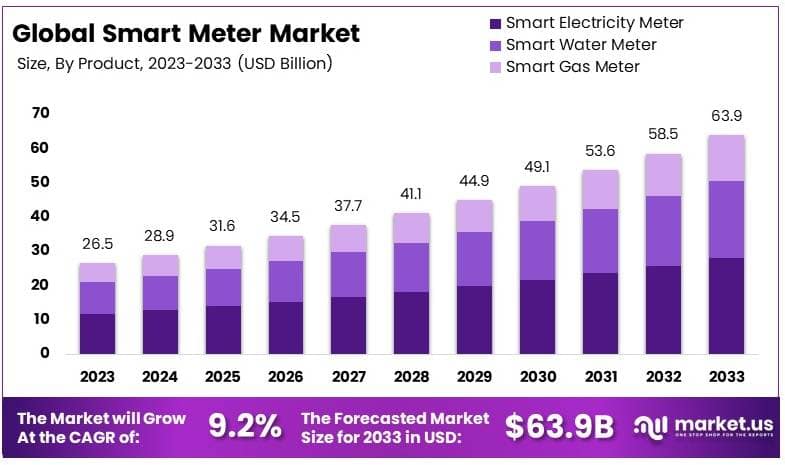

The Global Smart Meter Market size is expected to be worth around USD 63.9 Billion by 2033, from USD 26.5 Billion in 2023, growing at a CAGR of 9.2% during the forecast period from 2024 to 2033.

A smart meter is an advanced digital device that measures energy consumption in real-time. It provides two-way communication between consumers and utility companies, enabling accurate billing and better monitoring of energy usage.

Smart meters are equipped with remote communication features, allowing real-time data transmission to energy providers, which helps in reducing energy theft, enhancing grid efficiency, and promoting energy conservation.

The smart meter market refers to the industry encompassing the manufacturing, distribution, and deployment of smart meters across various regions. It includes a wide range of stakeholders, such as utility companies, meter manufacturers, software providers, and government bodies.

The global smart meter market is growing rapidly as utilities increasingly adopt digital technology for more efficient energy management. Smart meters, which enable two-way communication between utilities and consumers, are becoming essential in modernizing energy infrastructures.

By 2022, 72% of all electric meters in the U.S. were smart meters, with 119 million advanced metering infrastructure (AMI) installations, primarily serving residential customers. This reflects the strong adoption in developed markets.

In contrast, emerging economies like India are still in early stages, with Siemens partnering with Tata Power to install 200,000 smart meters, highlighting growing opportunities. The United Kingdom’s government target of smart meter installation in every household by 2025 further signals strong market expansion potential.

The shift toward urbanization—expected to reach 75% of the global population by 2050—creates an increasing demand for efficient energy distribution systems, particularly in densely populated urban centers. The rise of renewable energy, the push for smart grid modernization, and the need to reduce power theft are also significant drivers.

Government initiatives, such as Singapore’s “Smart Nation” and New York’s development of smart water quality sensors, showcase the broad potential of smart technology beyond just energy management. These advancements reflect how smart meters are becoming vital for various sectors, from utilities to urban infrastructure.

The market saturation level varies across regions. In the U.S., the high adoption rate of 72% suggests a maturing market with less room for growth compared to countries like India, where adoption is still low. Europe remains competitive, with governments pushing for full smart meter deployment.

The competitiveness in the market is also increasing as more technology companies, such as Siemens, Schneider Electric, and Itron, offer innovative solutions. As competition grows, companies will focus on value-added services, such as data analytics and predictive maintenance, to differentiate themselves in this increasingly crowded market.

On a local scale, smart meters benefit consumers through better control over energy consumption, potentially lowering bills, while helping utilities reduce power theft, as seen in India. In regions like New York, smart infrastructure projects, such as low-power wide-area networks (LPWAN), showcase how these technologies can modernize water and energy systems, improving urban living standards.

Key Takeaways

- The Smart Meter Market was valued at USD 26.5 billion in 2023 and is expected to reach USD 63.9 billion by 2033, with a CAGR of 9.2%.

- In 2023, Smart Electric Meters dominated the product segment, driven by widespread adoption in utilities for real-time monitoring.

- In 2023, Advanced Metering Infrastructure (AMI) led the technology segment, enabling better data analytics and efficiency for utilities.

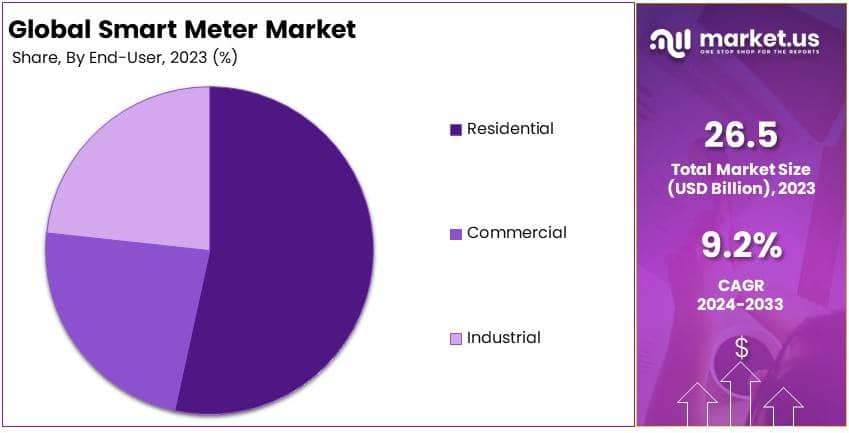

- In 2023, Residential was the leading end-user, highlighting the growing demand for smart meters in households.

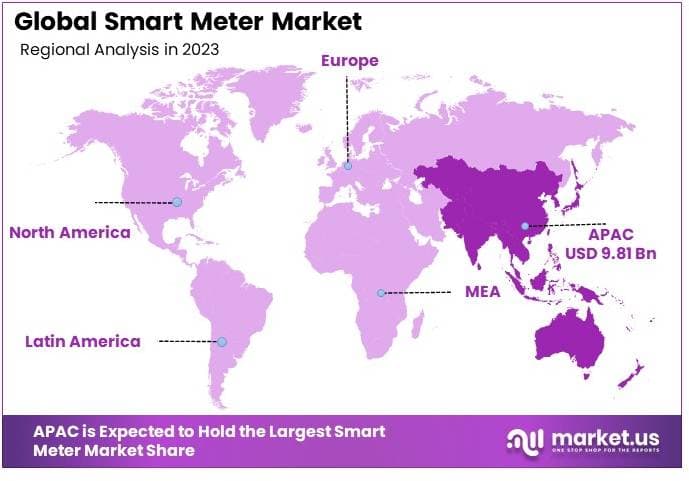

- In 2023, Asia Pacific dominated the market with 37.0%, supported by rising investments in smart grids and infrastructure.

Type Analysis

Smart electricity meters dominate due to their crucial role in modernizing grid operations and enhancing energy efficiency.

The smart meter market is extensively segmented by product type, wherein smart electricity meters, smart water meters, and smart gas meters constitute the primary categories. Among these, smart electricity meters emerge as the dominant sub-segment. These devices are pivotal in enabling real-time data tracking and energy usage optimization, which are essential for both consumers and utility providers.

Smart electricity meters facilitate significant improvements in energy efficiency and grid reliability by supporting demand response and reducing peak loads. Their integration with renewable energy sources further underscores their importance in a transitioning energy sector.

Smart water meters, although less predominant than their electrical counterparts, play a vital role in water conservation efforts by detecting leaks and providing data for water usage management. The deployment of these meters is gradually increasing, driven by the rising awareness of sustainable and smart water management practices.

Smart gas meters, while occupying a smaller fraction of the market, are crucial for ensuring safety and improving the accuracy of gas consumption measurements. These meters help in the early detection of leaks and enhance the operational efficiencies of gas utilities.

Technology Analysis

Advanced Metering Infrastructure (AMI) dominates due to its comprehensive capabilities in real-time data transmission and utility management.

In the technology segment of the smart meter market, Advanced Metering Infrastructure (AMI) and Automatic Meter Reading (AMR) are the two principal technologies. AMI stands out as the dominant technology, primarily because of its advanced capabilities in supporting two-way communication between meters and utility companies.

This technology enables not only the remote reading of meters but also facilitates remote control of connected devices, which significantly enhances operational efficiencies and customer service. The real-time data provided by AMI supports dynamic pricing, outage management, and personalized energy consumption strategies.

On the other hand, Automatic Meter Reading (AMR) technology, while still relevant, offers more limited functionality, focusing mainly on automating the meter reading process to reduce errors and labor costs associated with manual readings. Though AMR plays a critical role in transitioning utilities from traditional practices, its growth is somewhat overshadowed by the more comprehensive benefits offered by AMI.

End-User Analysis

The residential sector dominates the end-user segment with a substantial percentage due to the wide-scale deployment of smart meters.

The smart meter market is also categorized by different end-users, including residential, commercial, and industrial sectors. The residential sector is the most dominant, driven by the global push towards energy conservation and efficient resource management.

Residential smart meters are fundamental in empowering homeowners with the ability to monitor and manage their energy consumption more effectively, promoting sustainable habits and reducing energy costs. Additionally, these meters are instrumental in integrating residential renewable energy installations with the grid, thus supporting the broader adoption of green energy solutions.

The commercial sector, while incorporating smart meters at a growing rate, uses these technologies to optimize building management systems and reduce operational costs. Smart meters in commercial applications help in detailed energy usage monitoring, which can be critical for large-scale energy management strategies that include demand response and energy scheduling.

The industrial sector benefits significantly from the deployment of smart meters, particularly in terms of enhanced energy management and operational efficiency. These meters provide crucial data that help in optimizing manufacturing processes and improving the reliability of industrial operations.

However, the penetration rate in this sector is comparatively lower than in the residential sector, mainly due to the complex and varied nature of industrial energy needs.

Key Market Segments

By Product

- Smart Electricity Meter

- Smart Water Meter

- Smart Gas Meter

By Technology

- Advanced Metering Infrastructure

- Auto Meter Reading

By End-User

- Residential

- Commercial

- Industrial

Drivers

Government Initiatives and Mandates Drive Market Growth

The smart meter market is significantly driven by government initiatives, rising demand for energy efficiency, and technological advancements. Governments across the globe are introducing mandates and policies that promote the deployment of smart meters to manage energy consumption more effectively.

The growing demand for energy efficiency also contributes to the market’s expansion. Consumers and businesses alike are increasingly aware of the need to optimize energy usage to reduce costs and waste.

Technological advancements in the field of smart metering, including two-way communication, real-time data collection, and integration with IoT, further drive market growth. These innovations not only improve the accuracy of energy usage tracking but also enhance the overall user experience by offering advanced features like remote monitoring and control.

Additionally, the increasing focus on integrating renewable energy sources into national grids necessitates the use of smart meters to manage and balance the flow of energy efficiently. These driving factors collectively boost the growth of the smart meter market.

Restraints

High Initial Costs Restrain Market Growth

Despite the potential benefits, several restraining factors are hindering the growth of the smart meter market, including high initial costs, concerns over data privacy, and the lack of standardization. One of the primary barriers is the high upfront cost of installing smart meters, especially for utility companies and consumers in cost-sensitive regions.

Data privacy and security concerns also pose significant challenges. Since smart meters collect and transmit large amounts of personal consumption data, there are worries about how this data is stored, shared, and protected.

Another limiting factor is the lack of standardization in smart metering technologies. Different regions and utility providers use varying systems, making it difficult to achieve seamless integration across platforms. This fragmentation increases the complexity and cost of implementation.

Finally, limited awareness and slow adoption in developing regions due to a lack of understanding of the benefits of smart meters also restrain market growth. These factors together present obstacles to widespread adoption.

Opportunity

Expansion of Smart Cities Provides Opportunities

The development of smart cities around the world is creating significant demand for advanced metering infrastructure. Smart meters are a critical component of smart cities, enabling efficient energy management, enhanced connectivity, and real-time data collection, which are crucial for modern urban environments.

Additionally, there is an increasing demand for real-time energy monitoring solutions. Consumers and businesses are looking for ways to track their energy consumption in real-time to optimize usage and reduce costs. Smart meters that offer these capabilities provide a clear opportunity for growth in this sector.

The integration of smart meters with IoT further enhances the market’s potential. IoT-connected smart meters enable better communication between devices, allowing for smarter, automated energy management.

As IoT continues to evolve, the demand for smart meters with IoT capabilities will likely increase. The rising need for grid modernization and automation also provides an opportunity for market players to capitalize on, as utilities seek to upgrade their systems to handle the complexities of modern energy distribution.

Challenges

Complex Integration with Existing Infrastructure Challenges Market Growth

The smart meter market faces several challenges, including the complex integration with existing infrastructure, regulatory issues, and managing large volumes of data. One of the primary challenges is the difficulty of integrating smart meters into outdated or incompatible utility infrastructures.

Regulatory and compliance issues also present challenges. The smart meter market is heavily regulated, with different countries and regions having varying requirements for data security, privacy, and environmental standards.

Another challenge is managing and analyzing the vast amounts of data generated by smart meters. As these devices provide real-time data on energy usage, utilities need advanced analytics and data management tools to process and interpret this information effectively.

Additionally, there is a limited workforce skilled in implementing and maintaining smart meters, which can slow down market growth. Utilities and service providers often struggle to find and retain employees with the necessary technical expertise to handle these advanced systems.

Growth Factors

Growth in Distributed Energy Resources Is Growth Factor

The smart meter market is supported by several growth factors, including the expansion of distributed energy resources (DERs), the global development of smart grids, and rising investments in utility infrastructure.

Distributed energy resources, such as solar panels and wind turbines, are becoming more common, creating a need for smart meters that can manage and monitor the flow of energy from these sources into the grid.

The expansion of smart grids globally is another key growth factor. As utilities invest in modernizing their grids, smart meters become essential for tracking energy flow, optimizing grid performance, and ensuring reliable energy delivery. These grids rely on smart meters to provide real-time data on energy usage and distribution, helping to improve overall grid efficiency.

Rising investments in utility infrastructure, particularly in developing countries, further boost the demand for smart meters. Governments and private sectors are increasingly allocating funds to upgrade energy systems, and smart meters are an integral part of these infrastructure improvements.

Emerging Trends

Adoption of Advanced Analytics and AI in Smart Meters Is Latest Trending Factor

The use of advanced analytics and artificial intelligence in smart meters allows for more precise data analysis, enabling utilities and consumers to make better-informed decisions regarding energy usage.

The shift towards prepaid smart meters is also gaining momentum. Prepaid meters give consumers more control over their energy consumption by allowing them to pay for energy in advance, which has proven to be particularly popular in regions with low-income households or areas looking to reduce energy theft.

Two-way communication capabilities in smart meters are another growing trend. These meters allow for real-time interaction between consumers and energy providers, enabling faster response times to outages and more efficient energy distribution.

Furthermore, the increasing use of mobile applications for energy monitoring is making it easier for consumers to track and manage their energy consumption on-the-go, driving further interest in smart meters.

Regional Analysis

Asia Pacific Dominates with 37.0% Market Share

Asia Pacific holds a dominant 37.0% share of the Smart Meter Market, valued at USD 9.81 billion. This strong market presence is driven by rapid urbanization, government initiatives promoting smart infrastructure, and the rising demand for energy management solutions. Major economies like China and Japan lead this region in adopting smart metering technologies to enhance energy efficiency and grid management.

The region’s large population and increasing energy consumption have created a demand for advanced metering systems, which provide real-time data for utility providers and consumers. Government policies supporting smart grids and energy conservation are also key contributors to the market’s growth.

Asia Pacific’s dominance in the Smart Meter Market is expected to continue growing as countries in the region further invest in smart city projects and renewable energy integration, solidifying their leadership in the global market.

Regional Mentions:

- North America: North America has a significant presence in the Smart Meter Market, driven by advanced infrastructure and strong regulatory support. The region’s focus on reducing energy consumption and enhancing grid reliability fosters continuous market growth.

- Europe: Europe is a key player in the Smart Meter Market, with a focus on sustainability and energy efficiency. Government regulations promoting smart meters and green energy integration contribute to the region’s steady market expansion.

- Middle East & Africa: The Middle East and Africa are gradually adopting smart metering technologies, with efforts concentrated on improving utility services and energy management. Investments in smart grids are a primary driver for growth in this emerging market.

- Latin America: Latin America is expanding its smart meter market share, focusing on modernizing energy infrastructure. Initiatives aimed at improving energy distribution and efficiency, especially in larger economies like Brazil, are crucial to the region’s growth.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Smart Meter Market is highly competitive, with major players such as Neptune Technology Group Inc., Honeywell International Inc., Siemens AG, and Itron Inc. These companies, along with others, drive innovation and growth in the global market. The market is primarily influenced by rising energy management needs and regulatory support for smart grid implementation.

Key players offer a wide range of products, including advanced electricity, water, and gas meters. These smart meters integrate data analytics, real-time monitoring, and remote control features, enabling utility companies to optimize energy usage and reduce costs.

Leading companies focus on partnerships with utility providers, government contracts, and long-term service agreements. Their positioning is enhanced by strong relationships with customers and constant technological advancements that cater to regulatory and consumer needs.

Major players, such as Siemens AG and Schneider Electric SA, have strong presences across North America, Europe, and Asia Pacific. Emerging markets like Latin America and the Middle East & Africa are witnessing growing investments from key players seeking expansion.

Smart meter manufacturers prioritize R&D to enhance data accuracy, energy efficiency, and cybersecurity features. Investments in IoT-enabled solutions and artificial intelligence (AI) integration are central to their innovation strategies.

Key players dominate through technological innovation, strategic partnerships, strong regional presences, and comprehensive service offerings. Their focus on sustainable, cost-effective, and energy-efficient solutions gives them a competitive edge in this growing market.

Top Key Players in the Market

- Neptune Technology Group Inc.

- Honeywell International Inc.

- Siemens AG

- Kaifa Technology

- Suntront Technology

- Wasion Group

- Aichi Tokei Denkei

- Badger Meter

- Sensus

- Itron Inc

- Landis+Gyr

- Schneider Electric SA

- Other Key Players

Recent Developments

- Oakter: In May 2024, Oakter introduced the OakMeter, a cutting-edge smart energy meter aimed at revolutionizing energy consumption management. The OakMeter integrates advanced technologies such as Advanced Metering Infrastructure (AMI), real-time data analytics, and Internet of Things (IoT) capabilities, allowing for two-way communication with utility servers and real-time data transmission.

- Kerala Water Authority: In March 2024, the Kerala Water Authority announced its plan to implement prepaid water meters across the state. The initiative aims to improve water management, reduce wastage, and enhance billing transparency.

- Adani Transmission: In December 2022, Adani Transmission established a new subsidiary, BEST Smart Metering Ltd (BSML), to manage its smart meter business. This move aligns with India’s Revamped Distribution Sector Scheme (RDSS), which targets the installation of 250 million prepaid smart meters by FY 2025-26.

- Avanci: In October 2023, Avanci launched its 4G smart meter patent licensing program, with EDMI as its first licensee. This initiative simplifies licensing for cellular technologies used in smart meters by offering a single license that covers essential patents from multiple licensors. The program is projected to encompass over 160 million smart meters in the next decade.

Report Scope

Report Features Description Market Value (2023) USD 26.5 Billion Forecast Revenue (2033) USD 63.9 Billion CAGR (2024-2033) 9.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Smart Electricity Meter, Smart Water Meter, Smart Gas Meter), By Technology (Advanced Metering Infrastructure, Auto Meter Reading), By End-User (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Neptune Technology Group Inc., Honeywell International Inc., Siemens AG, Kaifa Technology, Suntront Technology, Wasion Group, Aichi Tokei Denkei, Badger Meter, Sensus, Itron Inc., Landis+Gyr, Schneider Electric SA, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Neptune Technology Group Inc.

- Honeywell International Inc.

- Siemens AG

- Kaifa Technology

- Suntront Technology

- Wasion Group

- Aichi Tokei Denkei

- Badger Meter

- Sensus

- Itron Inc

- Landis+Gyr

- Schneider Electric SA

- Other Key Players