Global Smart Inhalers Market by Product Type (Inhalers and Nebulizers), by Indication (Asthma, Chronic Obstructive Pulmonary Disease (COPD), Other Indications), By End User (Hospitals, Homecare Settings, Other End-Users), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2032

- Published date: Dec 2023

- Report ID: 104286

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

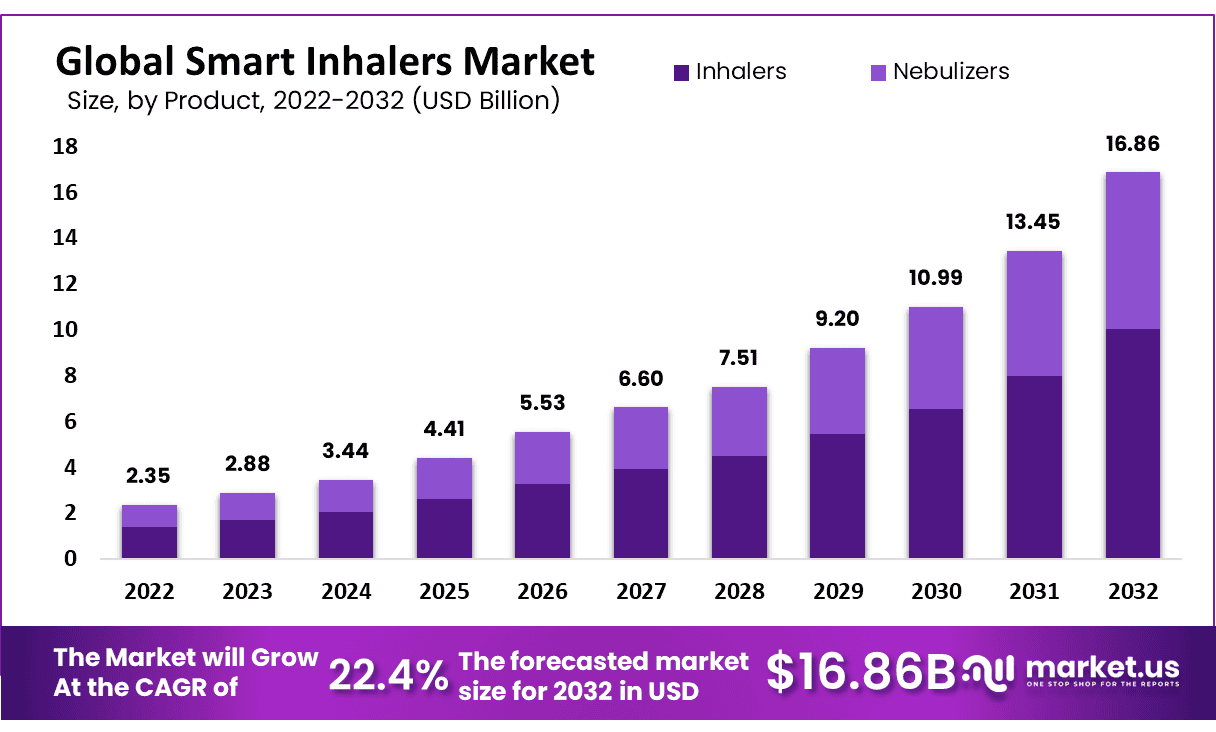

Global Smart Inhaler Market size is expected to be worth around USD 16.86 Billion by 2032 from USD 2.88 Billion in 2023, growing at a CAGR of 22.4% during the forecast period from 2024 to 2032.

Growth of the smart inhaler market is predicted to increase because of the increasing prevalence of chronic respiratory diseases (CRDs) and improved clinical products, and according to WHO, 262 million individuals had asthma in 2019. In addition, chronic Obstructive Lung Disease (COPD) is responsible for 3.23 million deaths worldwide in 2019. Hence, it had a major global impact due to the Covid-19 pandemic.

Smart inhalers are in high demand due to key industry participants’ growing interest in developing these devices and R&D initiatives. More companies incorporate digital technologies into their product lines to enhance medication efficacy and better manage asthma and COPD symptoms. Aptar Pharma recently unveiled HeroTracker Sense, a major player, transforming traditional metered-dose inhalers into smart ones.

Recent research indicates that smart inhalers may make it easier for patients to manage their symptoms and stay compliant with treatment regimens. For example, a 2020 Cleveland Clinic study discovered that those suffering from COPD who used Propeller smart inhalers experienced a 35% reduction in hospital visits – amounting to an overall 35% drop.

Key Takeaways

- Market Size: Global Smart Inhaler Market Market size is expected to be worth around USD 16.86 Billion by 2032 from USD 2.88 Billion in 2023.

- Market Growth: The market growing at a CAGR of 22.4% during the forecast period from 2024 to 2032.

- Product Analysis: The inhalers segment dominated the market in 2022 and expected to grow during the forecast period.

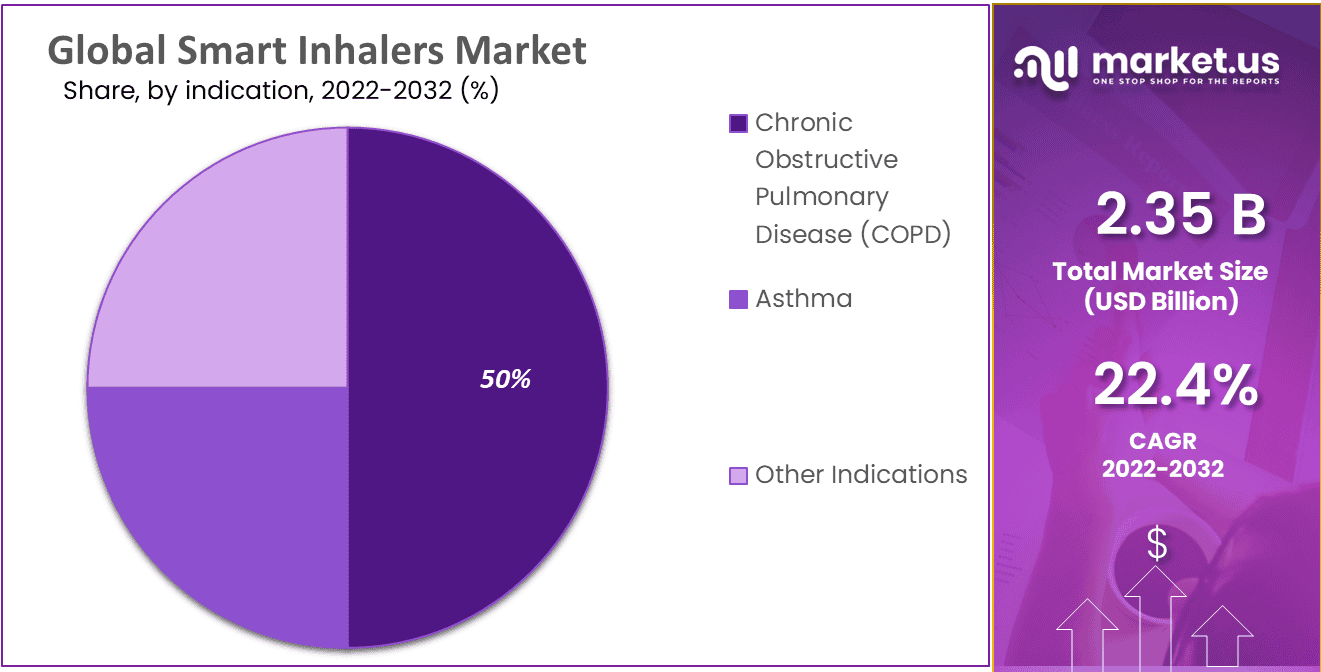

- Indication Analysis: The Chronic Obstructive Pulmonary Disease counted for the most extensive revenue percentage at over 50% in 2022.

- Distribution Channel Analysis: The retail pharmacies are anticipated to experience the fastest growth rate of 19.2% during the forecast period.

- End-User Analysis: The Hospitals accounted for over 50% of the market share in 2022

- Regional Analysis: The retail pharmacies are anticipated to experience the fastest growth rate of 19.2% during the forecast period.

- Rapid Technological Advancements: Smart inhalers have experienced substantial market expansion as technology in healthcare has rapidly advanced, providing better management of respiratory conditions and providing opportunities to do so more cost-effectively.

- Improved Medication Adherence: Smart inhalers can improve patient adherence to treatment regimens by providing reminders, tracking inhaler usage data, and offering real-time feedback.

- Chronic Respiratory Conditions: This market caters primarily to people suffering from chronic respiratory conditions like asthma or COPD (Chronic Obstructive Pulmonary Disease), who find benefit in regular medication management.

By Product Analysis

Based on product type smart inhalers market is segmented into two types first is Inhalers and second is Nebulizers; among these two types inhalers segment dominated the market in 2022 and expected to grow during the forecast period because of smart inhalers’ benefits and increased use in developing countries. These inhalers are small and highly technologically advanced. The market will grow as patients switch to smart inhalers to manage the disease.

By Indication Analysis

Based on Indication smart inhalers market is segmented into Asthma and Chronic Obstructive Pulmonary Disease (COPD). Between these, the higher incidence of COPD worldwide meant that the COPD segment that is Chronic Obstructive Pulmonary Disease counted for the most extensive revenue percentage at over 50% in 2022.

According to WHO, the COPD segment was responsible for 3.23 million deaths in 2019. The WHO estimates that approximately 300 million people worldwide have asthma. This condition is on the rise by 50% every ten years. It is predicted that the asthma segment will increase at a rate in excess of18.3% increase in asthma hospitalizations over the forecast period, mainly in children under five years old.

Distribution Channel Analysis

The smart inhaler market is segmented based on the distribution channel into hospital pharmacies, retail pharmacies, and online pharmacies. Among these segments, hospital pharmacies accounted for 40.0% of the market share. Various factors drive this market’s growth, such as an aged geriatric population and rising Chronic Respiratory Diseases (CRDs).

Additionally, retail pharmacies are anticipated to experience the fastest growth rate of 19.2% during the forecast period. Retail pharmacies have become increasingly popular due to their convenience, flexibility, comfort, and ease of access. This trend is fueling the need in this market. Similarly, existing pharmacies are rapidly developing and updating to boost market penetration.

End-User Analysis

Based on end-user, ’s global smart inhaler market is segmented into Hospitals and Homecare Settings. Hospitals accounted for over 50% of the market share in 2022 because the public-private collaborations, rapid advancements in healthcare infrastructure, and improved access to healthcare services drove growth.

During the forecast period, the homecare setting segment is expected to grow at a CAGR of 20.2%. As healthcare prices continue to rise, more individuals with CRDs opt for home-based therapy. Additionally, geriatric patients show an increasing appreciation for this type of care.

Key Market Segments

By Product

- Inhalers

- Dry Powdered Inhalers (DPIs)

- Metered Dose Inhalers (MDI)

- Nebulizers

By Indication

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD)

- Other Indications

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By End-User

- Hospitals

- Homecare Settings

- Other End-Users

Drivers

The growing prevalence of Smart inhalation devices is due to many significant factors, such as the rising prevalence of acute respiratory conditions such as COPD and asthma, by the global disease burden. Their superior benefits have led them to gain popularity, with The Lancet Respiratory Medicine reporting in 2015 that 84% of New Zealand’s asthma-stricken children used digital inhalers. These factors helped fuel market development for smart inhalers over the forecast period.

Another factor responsible for the growth of the global smart inhaler market is that Bluetooth connections enable digital inhalers to be linked with smartphones and provide dosing restriction and dose monitoring capabilities.

Similarly, this equipment offers patient education tools that decrease errors in dosing, hospitalizations, and therapy costs. According to Propeller Health, in 2016, patients who used these inhalers saw a 60% deduction in doctor visits. As research continues on inhalation devices, their popularity will increase, which will bolster the market’s growth further.

Restraints

On the other hand, some factors are responsible for restraining the market, as COVID-19 has affected markets significantly. Its negative impact on the market was the interruption in supply chain management of the global smart inhaler market. Because of the presence of manual inhalers, the market’s growth may be determined despite their growing benefits. Another factor that could hinder adoption in developing nations is a lack of awareness about smart inhalers.

Opportunity

The global smart inhaler market players are aiming their focus on collaboration to fulfill the growing demand for smart inhaler manufacturers and are joining forces with software and digital companies. This collaboration promises partners numerous growth opportunities that could benefit the market over the coming years.

Trends

Increasing Technological Advancement

The growth of the global smart inhaler market is expected to increase forecast period 2023-2032 because of the increasing use of digital technology in medical devices and their capacity for treating diseases like asthma and COPD. There is an excellent opportunity for these inhalers. According to a CDC study, 26.5 million Americans were diagnosed with asthma in 2016. These factors will drive substantial market expansion for these inhalers over the coming years.

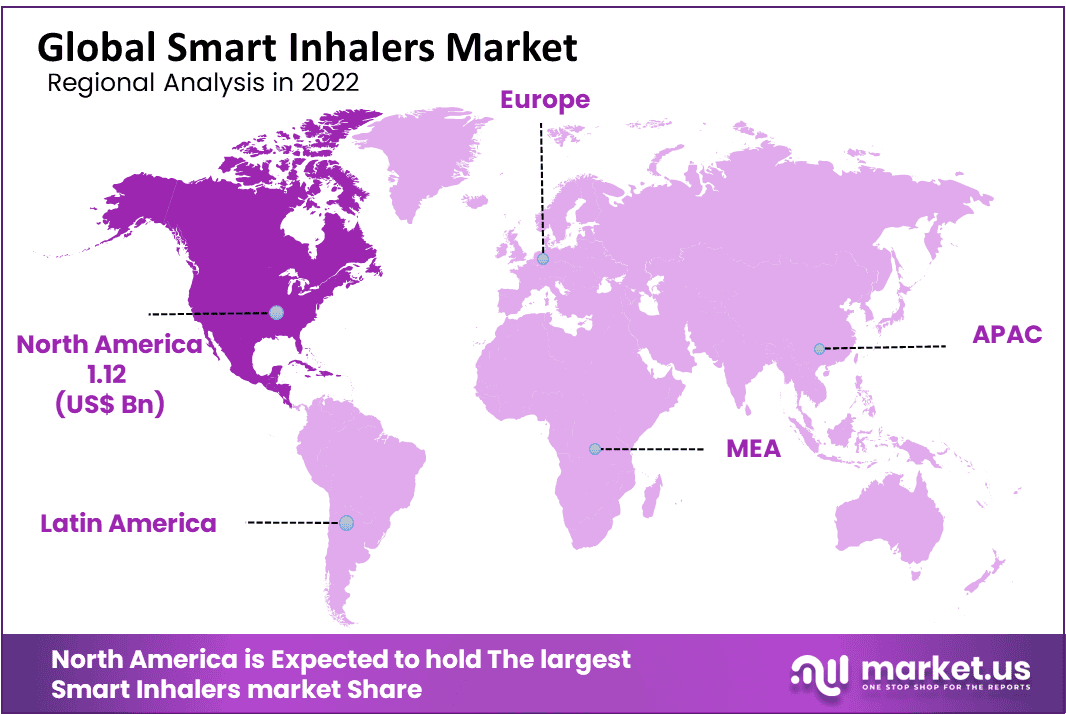

Regional Analysis

North America Maintained 48.0% Of The Market Share in 2022

Based on regional analysis, North America dominated with 48.0% of the market share in 2022 because of high levels of COPD and asthma in Canada and the U.S. Altogether; asthma affects more than 25 million Americans in North America – accounting for 10% of its citizens. Adherium Limited, a major player in respiratory eHealth and remote monitoring technology, announced in September 2021 that the U.S. FDA had consented to their Hailie Sensor, which contains physiological measures to track medicine use for COPD medication in America.

Asia Pacific is expected to experience 22.2% growth during the forecast period due to an increasing geriatric population, growing healthcare infrastructure, CRD incidence, and rising government initiatives. According to the National Statistical Office Elderly in India Report 2021, India’s more aged population (those aged 60 or more) will rise by 41% between 2023 and 2032. rising from 138 million people in 2023 to 194 million by 2032.

Key Regions

North America

- The US

- Canada

- Mexico

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Market players increasingly concentrate on mergers, acquisitions, partnerships, and development to maintain their positions. Adherium Limited, a specialist in respiratory data management solutions and remote monitoring, announced in August 2022 a collaboration with Trudell Limited to assist COPD patients in the U.S.

Both companies will assess COPD patients after discharge from the hospital through Monaghan Medical, Aetonix’s subsidiary AeTouchAway platform, and Adherium’s Hailie sensor; all to reduce readmissions while improving patient outcomes and improving care quality.

Market Key Players

With the presence of many local and regional players, the market for smart inhalers is fragmented. Market players are subject to intense competition from top players, particularly those with strong brand recognition and high distribution networks. To stay on top of the market, companies have gained various expansion strategies such as partnerships and product launches.

The following are some of the major players in the global smart inhalers market industry

- Adherium Limited

- Aptar Group Inc.

- AstraZeneca, Inc.

- Cognita Labs, LLC

- GlaxoSmithKline Plc

- Novartis AG

- OPKO Health Inc.

- Philip Morris International Inc.

- Resmed Inc.

- Teva Pharmaceutical Industries Ltd.

- Other Key Players

Recent Development

- AstraZeneca, Inc.(May 2024): Partnered with Adherium for a clinical trial, integrating smart inhaler technology to optimize asthma management, utilizing Hailie sensors in the trial.

- Novartis AG (June 2024): Announced a collaboration with digital health companies to integrate AI algorithms into their smart inhaler products, aiming to predict asthma attacks and improve preventative care.

- Aptar Group Inc. (August 2024): Introduced a new nasal drug delivery device, enhancing the application of nasal sprays in treating respiratory diseases, a compatible enhancement for smart inhaler technologies.

- Adherium Limited (October 2023): Launched the new generation Hailie sensors that enhance physiological parameter monitoring for asthma and COPD treatments, integrating GlaxoSmithKline (GSK) inhalers

Report Scope

Report Features Description Market Value (2023) USD 2.88 Billion Forecast Revenue (2032) USD 16.86 Billion CAGR (2023-2032) 22.4% Base Year for Estimation 2023 Historic Period 2016-2022 Forecast Period 2024-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Inhalers, Dry Powdered Inhalers (DPIs), Metered Dose Inhalers (MDI), Nebulizers) By Indication (Asthma, Chronic Obstructive Pulmonary Disease (COPD), Other Indications) By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) By End-User (Hospitals, Homecare Settings, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Adherium Limited, Aptar Group Inc., AstraZeneca, Inc., Cognita Labs, LLC, GlaxoSmithKline Plc, Novartis AG, OPKO Health Inc., Philip Morris, International Inc., Resmed Inc., Teva Pharmaceutical Industries Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adherium Limited

- Aptar Group Inc.

- AstraZeneca, Inc.

- Cognita Labs, LLC

- GlaxoSmithKline Plc

- Novartis AG

- OPKO Health Inc.

- Philip Morris International Inc.

- Resmed Inc.

- Teva Pharmaceutical Industries Ltd.

- Other Key Players