Global Skid Mounted Unit Substations Market Size, Share Analysis Report By Type (Oil-Immersed, Dry-Type), By Voltage (11 kV-33 kV, 33 kV-400 kV, Above 400 kV), By Application (Power Utilities, Industrial, Commercial, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170185

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

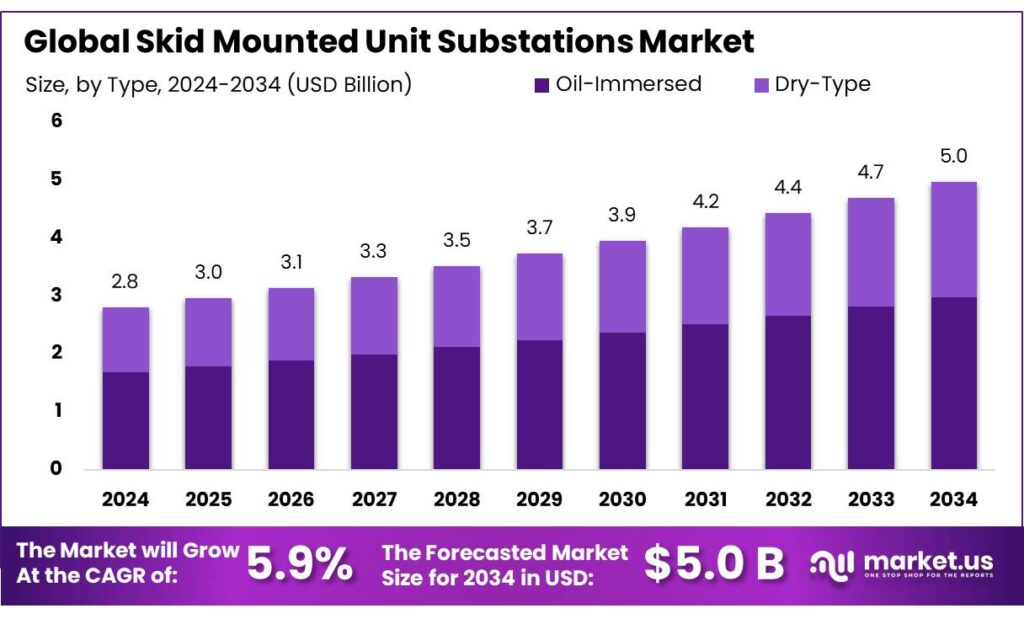

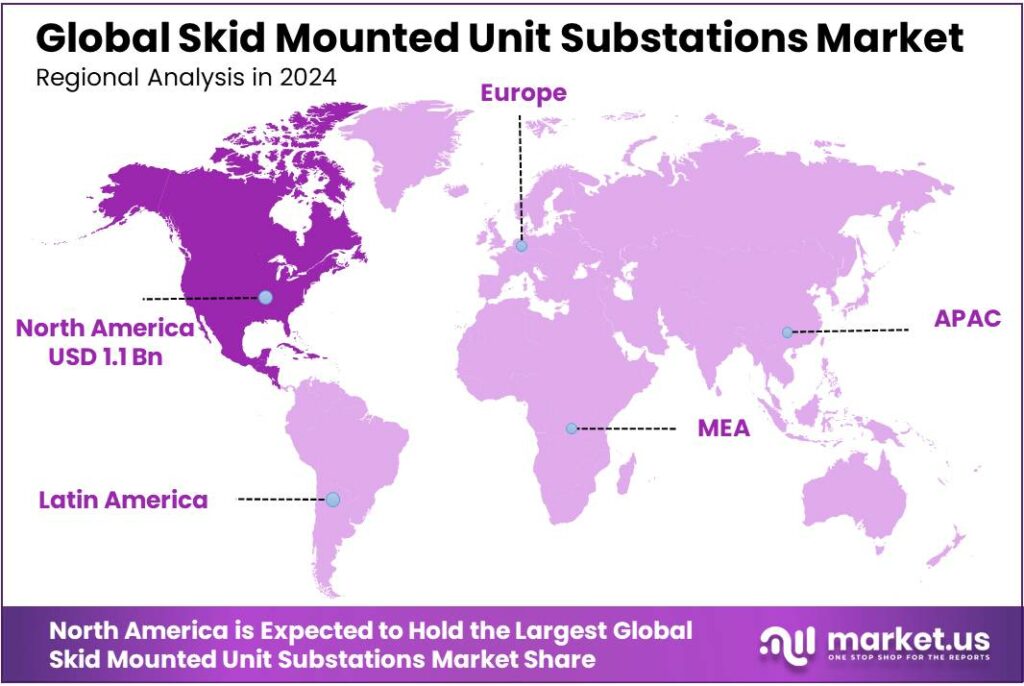

The Global Skid Mounted Unit Substations Market size is expected to be worth around USD 5.0 Billion by 2034, from USD 2.8 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.80%% share, holding USD 1.1 Billion revenue.

Skid Mounted Unit Substations are factory-built power “rooms” assembled on a skid or steel base—typically integrating MV switchgear, transformer, LV distribution, protection relays, metering, and auxiliary systems. Their main value is speed and predictability: instead of building a substation piece-by-piece on site, EPCs can install a tested module, reduce civil work, and shorten commissioning timelines—especially in projects where delays are costly.

The IEA notes that industry consumed 42% of the world’s final electricity in 2023, making industrial reliability and expansion a core grid challenge. At the same time, global electricity demand rose 4.3% in 2024 and is expected to keep growing at close to 4% through 2027, driven by electrification, industrial activity, air-conditioning, and data centres. In this context, skid solutions help owners add capacity quickly, standardize designs across multiple sites, and reduce construction risk through factory QA/QC and pre-commissioning tests.

A practical (and often overlooked) demand lever comes from food and cold-chain infrastructure, where uptime directly protects product value. FAO highlights that 13.2% of food is lost after harvest and before retail, and 19% is wasted at retail/food service/households. For cold storage, refrigerated logistics, and high-throughput food processing, resilient onsite distribution—often via packaged substations feeding compressors, ammonia systems, and automation—helps reduce spoilage exposure during grid disturbances.

- Government grid-modernization programs further expand the addressable market. In India, the Ministry of Power’s Revamped Distribution Sector Scheme (RDSS) has an outlay of ₹3,03,758 crore (FY 2021-22 to FY 2025-26). Recent government updates also note about ₹37,000 crore of central grant has been released so far under RDSS. Such spending typically translates into new feeders, strengthened substations, automation, and improved reliability—conditions that favor modular, repeatable substation builds for industrial parks, rural cold-chain nodes, and fast-track capacity additions.

Key Takeaways

- Skid Mounted Unit Substations Market size is expected to be worth around USD 5.0 Billion by 2034, from USD 2.8 Billion in 2024, growing at a CAGR of 5.9%.

- Oil-Immersed held a dominant market position, capturing more than a 59.8% share.

- 11 kV-33 kV held a dominant market position, capturing more than a 51.4% share.

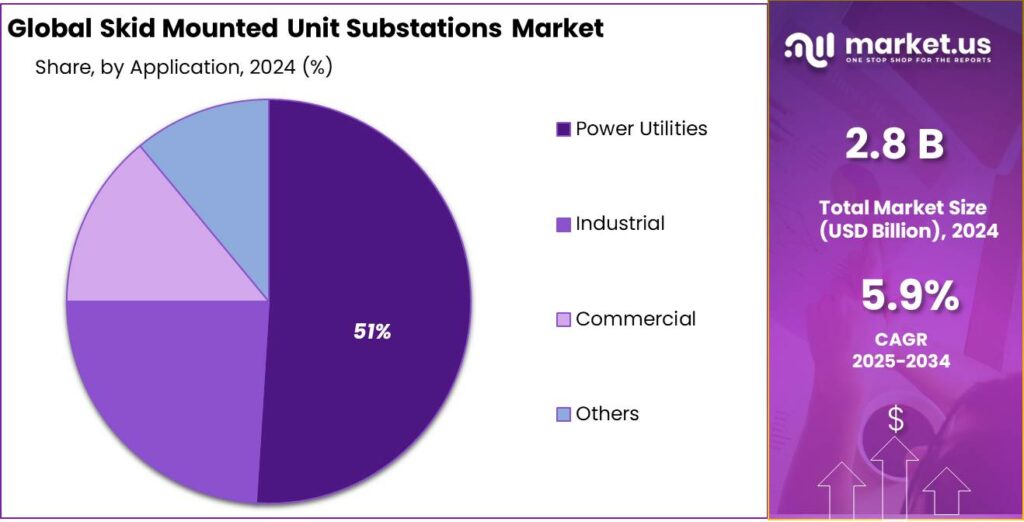

- Power Utilities held a dominant market position, capturing more than a 51.2% share.

- North America held a dominant regional position in the skid-mounted unit substation market, accounting for 39.80% of global value and generating approximately USD 1.1 billion.

By Type Analysis

Oil-immersed leads with 59.8% owing to proven reliability and lower capital cost.

In 2024, Oil-Immersed held a dominant market position, capturing more than a 59.8% share. This dominance was driven by the technology’s proven reliability in heavy-duty applications, efficient cooling characteristics, and generally lower initial capital expenditure compared with dry-type alternatives. Oil-immersed skid substations were preferred where high load capacity, long service intervals and robustness to harsh environments were required, notably in mining, utilities and large industrial sites.

Procurement in 2024 favoured vendors able to supply turnkey, factory-tested skid units that reduced onsite assembly time and commissioning risk. Given these factors, the oil-immersed segment was expected to retain leadership into 2025 as operators prioritised uptime, lifecycle cost control and established maintenance practices.

By Voltage Analysis

11 kV–33 kV dominates with 51.4% as demand rises for medium-voltage distribution efficiency.

In 2024, 11 kV-33 kV held a dominant market position, capturing more than a 51.4% share. This segment benefited from strong adoption across industrial facilities, renewable energy plants, construction sites, and utility distribution networks where medium-voltage flexibility and stable load handling were essential.

The preference for 11 kV-33 kV skid-mounted substations in 2024 was supported by accelerated grid modernisation programs and the need for compact, pre-assembled solutions that reduced installation time. These substations were widely used to integrate distributed generation assets, manage peak loads, and strengthen feeder circuits. Their suitability for both temporary and permanent deployment further increased procurement activity.

By Application Analysis

Power Utilities dominate with 51.2% as grid operators prioritise rapid deployment and resilience.

In 2024, Power Utilities held a dominant market position, capturing more than a 51.2% share. This leadership was driven by large-scale investment programs to replace aging distribution assets, expand feeder capacity, and integrate distributed generation; skid-mounted substations were favoured because they can be factory-assembled, factory-tested and delivered ready for quick commissioning, reducing onsite labour and outage windows.

Procurement by utilities in 2024 emphasised lifecycle cost, ease of maintenance, and compliance with grid-code requirements, which made prefabricated skid units attractive for both permanent network upgrades and emergency or seasonal reinforcement. The role of skid substations in supporting rural electrification, renewable interconnection and rapid restoration after faults was notable, and regulatory funding and capital expenditure cycles strengthened order books during the year.

Key Market Segments

By Type

- Oil-Immersed

- Dry-Type

By Voltage

- 11 kV-33 kV

- 33 kV-400 kV

- Above 400 kV

By Application

- Power Utilities

- Industrial

- Commercial

- Others

Emerging Trends

Smart skid substations: built-in monitoring, remote control, and digital protection

A clear latest trend in skid mounted unit substations is the shift from “just a packaged electrical room” to a digitally enabled, remotely managed power node. Buyers now ask for units that arrive with protection relays already engineered, remote I/O wired, and communications ready for plant SCADA—so the substation becomes something operators can see and manage, not just a box that sits in the yard. This is happening because electrical systems are getting more complex, and site teams are under pressure to reduce unsafe switching and unnecessary visits.

- The IEA reports global electricity demand increased by 4.3% in 2024. When demand rises this fast, utilities and large consumers push harder for equipment that can be commissioned quickly and run with fewer surprises. At the policy level, resilience funding is reinforcing the digital direction: the U.S. Department of Energy says that through the first and second rounds of its GRIP program it has announced $7.6 billion for 105 selected projects across all 50 states and D.C. While those projects are not “skid substations” by name, they accelerate the same outcomes—more modernization, more monitoring, and more systems that need interoperable communications.

On the technical side, a lot of this modernization is built around IEC 61850, the standard widely used for substation communications and data models. Academic reviews describe IEC 61850’s key operational benefit as improving interoperability and reliability by standardizing protocols and information models across devices. In the real world, that translates into skid packages where protection, control, and monitoring data can be integrated faster into the plant’s control room, and where future upgrades are easier because you’re not locked into one custom wiring scheme.

This trend is also landing strongly in countries investing in distribution upgrades. India’s Revamped Distribution Sector Scheme (RDSS) has an outlay of ₹3,03,758 crore for FY 2021–22 to FY 2025–26, aimed at improving reliability and efficiency in distribution. As networks modernize, industrial customers increasingly align their own onsite electrical systems with that direction—meaning more communication-ready, monitored, safer-to-operate substations instead of basic “metal boxes with switchgear.”

Drivers

Fast, reliable power for cold-chain and “always-on” industry

One of the biggest drivers for skid mounted unit substations is simple: many modern facilities can’t afford long, messy electrical buildouts—or shaky power—because every hour of delay has a real cost. A skid mounted unit substation arrives as a factory-built, pre-wired, and pre-tested package, so the site team is not assembling a substation piece-by-piece in the field. That matters when projects are racing the calendar: new warehouses, food parks, processing lines, and refrigerated distribution hubs often have fixed commissioning windows tied to contracts, seasonal demand, and permits.

- This speed advantage becomes even more valuable in food and cold-chain operations, where reliable power is the difference between saleable product and loss. FAO notes that 13.2% of food is lost after harvest and before retail stages, and an additional 19% is wasted at retail, food service, and household levels. These numbers are not “about substations” directly, but they explain why food companies invest in sturdier, more controllable infrastructure. Refrigeration plants, cold rooms, blast freezers, dairy processors, and high-throughput packaging lines run on electricity-heavy equipment—compressors, motors, drives, and automation.

Government programs aimed at improving grid quality and resilience add another push, because they increase the volume of upgrades and new connections that need to be delivered quickly. In India, the Ministry of Power’s Revamped Distribution Sector Scheme (RDSS) has an outlay of ₹3,03,758 crore to improve the quality, reliability, and affordability of power supply through a stronger distribution sector. When distribution utilities modernize feeders, substations, and metering, industrial customers also respond—expanding capacity, adding backup systems, and tightening power-quality requirements.

The same story shows up in resilience funding elsewhere. The U.S. Department of Energy says that across the first and second rounds of its GRIP selections, it has announced $7.6 billion for 105 selected projects across all 50 states and D.C. More grid hardening and modernization means more interconnections, more “edge” infrastructure, and more projects where time-to-energize is critical. Add to that global demand pressure—IEA reports global electricity demand rose 4.3% in 2024—and the need for fast, repeatable power infrastructure becomes even clearer.

Restraints

Long equipment lead times can break project schedules

A major restraining factor for skid mounted unit substations is not the design itself—it’s the availability of the heavy electrical “heart” inside the skid, especially transformers and certain high-voltage components. These packages are sold as fast-to-install solutions, but they can only move as quickly as their longest-lead item. When a project team orders a skid substation for a cold storage site, a food park, a mine, or a solar plant, they often expect a clear delivery window so civil works, cabling, and commissioning can be lined up.

- The U.S. Department of Energy’s Large Power Transformer Resilience report notes that lead times to acquire a large power transformer have become exceptionally long, with 36-month lead times “commonly quoted” and maximum lead times reaching 60 months in some cases. Even if a skid mounted unit substation uses a smaller transformer than a grid-scale LPT, the same supply-chain pressures ripple across the broader transformer ecosystem and can slow deliveries. Separately, the U.S. National Infrastructure Advisory Council highlights that large transformers have lead times ranging from 80 to 210 weeks.

The pressure is also being driven by demand growth and grid buildout. A recent Reuters report cites Wood Mackenzie data showing average delivery times in the U.S. reached 143 weeks for generator step-up transformers and 128 weeks for power transformers in Q2 2025, while demand for GSUs rose 274% between 2019 and 2025. When the market is that tight, suppliers tend to prioritize the largest utility or hyperscale orders, and smaller industrial buyers may face later delivery dates—again slowing skid substation uptake even when the technical case is strong.

This restraint matters in the food industry because power delays can translate into product risk. FAO notes that globally 13.2% of food is lost after harvest and before retail, and 19% more is wasted at retail, food service, and household levels. Cold-chain operators and processors are investing to protect inventory and meet stricter quality expectations, but if a packaged substation is stuck in a long equipment queue, facilities may be forced to run temporary power longer, limit throughput, or postpone commissioning—none of which helps reduce waste or improve reliability.

Opportunity

Packaged substations for fast-growing cold chain and food processing hubs

A major growth opportunity for skid mounted unit substations is the expansion of cold-chain and food processing infrastructure, where projects need dependable power quickly and often in places where building a traditional substation is slow and messy. Skid-mounted units fit these sites because they arrive as a factory-built, pre-wired package—so the developer can focus on civil works and connections instead of weeks of on-site assembly.

- FAO reports that 13.2% of food is lost in the supply chain after harvest and before retail, and 19% more is wasted at retail, food service, and household levels. When companies invest in packhouses, refrigerated warehouses, dairy plants, meat processing, and ready-to-eat lines, they are also investing in power systems that can keep temperatures stable and production predictable. A short outage can force rework, trigger sanitation re-starts, or risk spoilage. That’s why many new facilities prefer electrical architectures that are compact, repeatable, and easier to monitor—exactly the kind of environment where skid mounted substations can scale.

Government-backed food-processing programs are adding volume to this buildout, especially in emerging markets. India’s Ministry of Food Processing Industries has repeatedly used cluster-led schemes to push processing capacity closer to farms and consumption centers. Press information from India’s government shows a large program footprint—e.g., a March 2025 release notes 1,608 projects sanctioned, including 41 Mega Food Parks, and mentions ₹4,600 crore further approved up to 31 Mar 2026.

The IEA reports global electricity demand increased by 4.3% in 2024, a step up from 2.5% growth in 2023. More load growth means more new connections, upgrades, and “edge” distribution assets that must be deployed without long outages. Public resilience funding also supports this direction: the U.S. Department of Energy’s GRIP program states it has announced $7.6 billion for 105 selected projects through its first and second rounds.

Regional Insights

North America leads with 39.80% share and roughly USD 1.1 billion in 2024

In 2024, North America held a dominant regional position in the skid-mounted unit substation market, accounting for 39.80% of global value and generating approximately USD 1.1 billion in revenues. This leadership was supported by a pronounced programme of grid modernisation, accelerated industrial electrification and ongoing replacement of legacy distribution assets across the United States and Canada. Utility capital expenditure and private-sector investment in sectors such as oil & gas, mining and large-scale manufacturing drove demand for factory-assembled, pre-tested skid substations that shorten onsite commissioning and limit outage windows.

Procurement decisions in 2024 favoured turnkey suppliers able to combine transformer, switchgear and protection systems into single, transportable units that meet strict safety and grid-code requirements; this preference reduced overall project timelines and lowered installation risk for remote and constrained sites. The region’s well-established supplier and service ecosystem — including OEM distribution networks, local testing facilities and aftermarket maintenance capacity — supported faster deployment and higher replacement rates compared with less mature markets. Additionally, the push to integrate distributed generation and to improve resilience against extreme weather events led to stronger uptake of mobile and permanent skid solutions for feeder reinforcement and rapid restoration.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB Ltd. — ABB reported USD 32.9 billion in revenues and orders of USD 33.7 billion in FY-2024; the company employed roughly 110,000 people and delivered strong operational EBITA margins. ABB’s electrification and power-distribution offerings — including transformers, switchgear and integrated skid solutions — underpin its relevance to skid-mounted substation projects for utilities and industry.

Siemens AG — Siemens posted €75.9 billion in revenue for fiscal 2024 and reported ~312,000 employees worldwide. Its Smart Infrastructure and Energy businesses supply automation, medium-voltage switchgear and grid control systems that support skid-mounted substation deployments focused on reliability, digital monitoring and rapid commissioning.

CG Power & Industrial Solutions Ltd — CG Power reported consolidated revenue figures in the range of INR 11,069 crore (per recent filings) with improving profitability metrics; the firm supplies transformers, switchgear and turnkey substation packages adapted for local utility and industrial requirements. Its near-term order flow reflected infrastructure modernisation demand.

WEG S.A. — WEG recorded R$38.0 billion in net revenue for 2024 and employs ~47,000 people across 17 manufacturing countries. WEG’s transformer, motor and electrification product range is positioned to support skid-mounted substation projects that require global production scale and export capability.

Top Key Players Outlook

- ABB Ltd.

- Siemens AG

- Eaton Corporation Plc

- General Electric Company

- Mitsubishi Electric Corporation

- Toshiba Corporation

- CG Power and Industrial Solutions Limited

- WEG SA

- Elgin Power Solutions

- Meidensha Corporation

Recent Industry Developments

In 2024, ABB reported USD 32.9 billion in revenues and USD 33.7 billion in orders, supported by an operating EBITA of USD 5,968 million and a global workforce of roughly 110,000 employees; these figures indicate the scale and investment capacity behind its skid-mounted substation offerings.

In 2024, Mitsubishi Electric reported consolidated revenue of ¥5,257.9 billion and an operating profit of ¥328.5 billion, figures that reflect substantial scale and investment capacity for packaged substation solutions.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Bn Forecast Revenue (2034) USD 5.0 Bn CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Oil-Immersed, Dry-Type), By Voltage (11 kV-33 kV, 33 kV-400 kV, Above 400 kV), By Application (Power Utilities, Industrial, Commercial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., Siemens AG, Eaton Corporation Plc, General Electric Company, Mitsubishi Electric Corporation, Toshiba Corporation, CG Power and Industrial Solutions Limited, WEG SA, Elgin Power Solutions, Meidensha Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Skid Mounted Unit Substations MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Skid Mounted Unit Substations MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Siemens AG

- Eaton Corporation Plc

- General Electric Company

- Mitsubishi Electric Corporation

- Toshiba Corporation

- CG Power and Industrial Solutions Limited

- WEG SA

- Elgin Power Solutions

- Meidensha Corporation