Global Silanes Market Report By Product Type (Mono/Chloro Silane, Amino Silane), By Application (Paints & Coatings, Fiberglass & Mineral Wool, Polyolefin Compounds, Adhesives & Sealants, Sol-gel System, Fillers & Pigments, Silicones, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123806

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

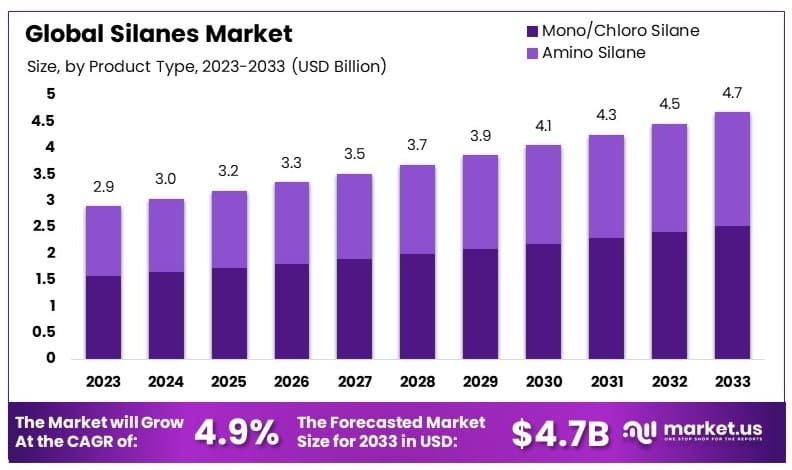

The Global Silanes Market size is expected to be worth around USD 4.7 Billion by 2033, from USD 2.9 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

The silanes market involves silicon-based compounds used as coupling agents, adhesives, and sealants. Silanes improve the bonding of organic and inorganic materials. They are crucial in industries like construction, automotive, and electronics.

The silanes market is experiencing significant growth, driven by increased investments and supportive governmental policies. In India, a substantial commitment has been made with a USD 200 million investment in 2023 aimed at enhancing domestic silane production. This initiative is part of the broader “Make in India” campaign, which seeks to bolster the country’s manufacturing sector and reduce dependency on imports. This strategic investment is expected to catalyze advancements in local manufacturing capacities and technological competencies.

Simultaneously, key industry players like Dow and BASF are intensifying their efforts in research and development to innovate silane formulations. Notably, Grasim Industries Limited has initiated an expansion project in Gujarat, India, set to double its production capacity for advanced silanes and epoxy resins by 2024. Such private sector investments underscore the market’s potential for high-value chemical manufacturing and the growing demand for specialized chemical solutions.

In the United States, regulatory frameworks established by the Environmental Protection Agency (EPA) ensure the safe use and disposal of silanes, reflecting a growing emphasis on environmental and safety standards. Further, the U.S. government’s investment exceeding USD 70 billion in the energy transition—including electric vehicle (EV) infrastructure and clean energy projects under the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA)—is poised to expand the use of silanes in various green and high-tech applications.

Key Takeaways

- Silanes Market was valued at USD 2.9 billion in 2023 and is expected to reach USD 4.7 billion by 2033, with a CAGR of 4.9%.

- Mono/Chloro Silane dominates the product type segment with 53.6% due to its versatile applications.

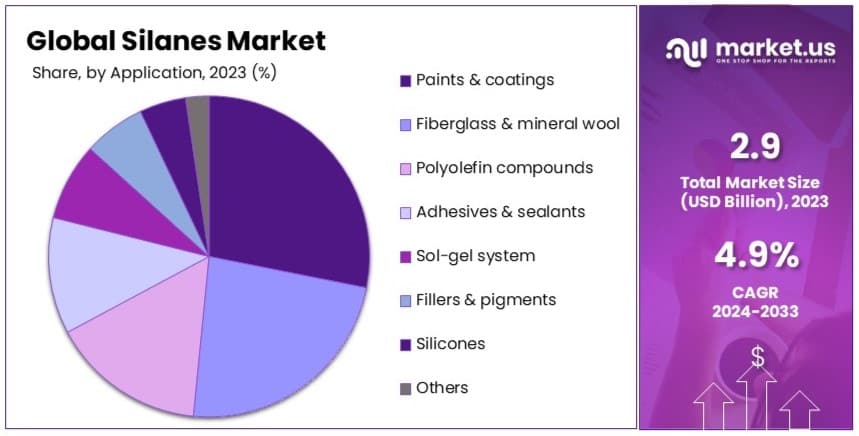

- Paints & Coatings leads the application segment with 28.2%, driven by its extensive use in surface protection.

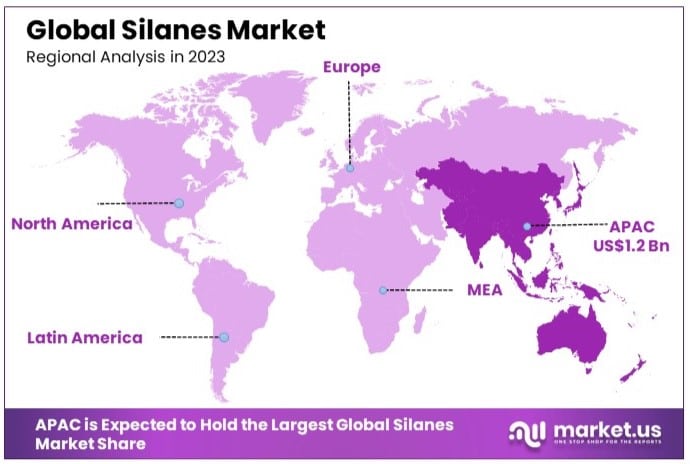

- APAC holds 43.4%, indicating a strong industrial base and demand in the region.

Driving Factors

Increasing Demand from the Construction Industry Drives Market Growth

The construction sector’s growing reliance on silanes significantly propels the Silanes Market. Silanes, particularly types like vinyltrimethoxysilane and gamma-aminopropyltriethoxysilane, are crucial in enhancing the properties of concrete and other building materials. Their application as coupling agents and adhesion promoters helps in improving the durability and performance of construction materials.

The global urbanization trend, coupled with increased investments in infrastructure and rising population, necessitates advanced construction materials, thereby boosting silane demand. As a result, the market sees an upsurge, aligning with the growing construction activities estimated to expand steadily. The integration of silanes ensures that modern construction meets both efficiency and durability standards, pushing the boundaries of architectural capabilities and supporting market expansion.

Expanding Use in the Automotive Industry Drives Market Growth

Silanes are integral to the automotive industry, enhancing the quality and efficiency of automotive components such as tires and rubber parts. As a coupling agent, silanes like bis(3-triethoxysilylpropyl)tetrasulfide (TESPT) improve the bond between rubber and fillers like silica, which is pivotal in manufacturing high-performance tires.

This application directly contributes to better fuel efficiency and reduced rolling resistance in vehicles, aligning with the industry’s shift towards more sustainable and efficient automotive solutions. With major tire manufacturers like Michelin and Bridgestone utilizing these compounds, the demand for silanes witnesses significant growth. As the automotive sector continues to innovate and expand, the role of silanes in meeting these advanced material requirements becomes increasingly critical, fostering market growth.

Growing Demand from the Electronics Industry Drives Market Growth

In electronics, the demand for silanes is escalating due to their essential role in enhancing the performance and longevity of electronic components. Silanes such as vinyltrimethoxysilane are utilized in creating silicone-based encapsulants and coatings, offering crucial properties like moisture resistance, insulation, and thermal stability.

These characteristics are indispensable in the production of semiconductors, printed circuit boards, and various electronic devices. As the electronics industry continues to grow, driven by advancements in technology and an increasing reliance on electronic devices, the need for protective and performance-enhancing materials like silanes is more pronounced. This demand fosters substantial growth in the Silanes Market, underscored by the industry’s ongoing innovation and expansion into new technological territories.

Restraining Factors

Stringent Environmental Regulations Restrain Market Growth

The production and use of certain silanes are subject to stringent environmental regulations due to concerns over their potential health and environmental impacts. Some organosilanes are classified as hazardous materials because of their flammability or toxicity.

Compliance with these regulations increases production costs and can limit the use of specific silanes in certain applications or regions. For example, stringent regulations may require additional safety measures and environmental controls, which are costly and complex. This can reduce the attractiveness of silanes for manufacturers and end-users, ultimately restraining market growth.

Availability and Fluctuations in Raw Material Prices Restrain Market Growth

The production of silanes depends on raw materials like silicon, methanol, and ethanol, which are derived from petrochemical sources. Fluctuations in the prices of these raw materials can significantly impact the cost of silane production.

Factors such as supply disruptions, geopolitical tensions, and changes in oil and gas prices drive this volatility. When raw material prices rise, production costs increase, leading to pricing pressures and reduced profitability for silane manufacturers. This financial instability can hinder market growth by making it difficult for manufacturers to maintain competitive pricing and stable operations.

Product Type Analysis

Mono/Chloro Silane dominates with 53.6% due to its extensive use in electronics and solar industries.

The Silanes market is segmented by product type, with Mono/Chloro Silane leading at 53.6%. This dominance is driven by its extensive use in the electronics and solar industries. Mono/Chloro Silane is a key component in the production of semiconductors and photovoltaic cells. Its high purity and reactivity make it essential for creating high-quality silicon wafers and solar panels.

Mono/Chloro Silane is highly valued for its role in the deposition process of silicon layers. This process is crucial for manufacturing electronic components, including integrated circuits and microchips, which are fundamental to modern technology. The growing demand for electronic devices, such as smartphones, laptops, and other consumer electronics, drives the market for Mono/Chloro Silane. Additionally, the increasing adoption of solar energy as a renewable power source boosts the demand for Mono/Chloro Silane in the solar industry.

Amino Silane is another important sub-segment in the Silanes market. Although it is not as dominant as Mono/Chloro Silane, it plays a crucial role in the production of adhesives and sealants. Amino Silane enhances the bonding properties of adhesives, making them more effective in various industrial applications. Its ability to improve adhesion between different materials makes it valuable in the automotive, construction, and aerospace industries.

Amino Silane is also used in surface treatment applications. It helps to modify the surface properties of materials, improving their performance and durability. This sub-segment’s growth is driven by the increasing demand for high-performance materials in various industries. The use of Amino Silane in enhancing the properties of coatings and composites further supports its market growth.

Application Analysis

Paints & Coatings dominate with 28.2% due to their widespread use in construction and automotive industries.

In the application segment, Paints & Coatings hold a significant 28.2% share of the Silanes market. This dominance is driven by their widespread use in the construction and automotive industries. Silanes are used as coupling agents and adhesion promoters in paints and coatings, enhancing their durability, weather resistance, and adhesion to various substrates.

In the construction industry, Silane-based coatings protect buildings and infrastructure from environmental damage, such as moisture, UV radiation, and pollutants. This protection extends the lifespan of structures and reduces maintenance costs. The growing demand for durable and long-lasting construction materials supports the market for Silanes in paints and coatings.

In the automotive industry, Silane-based coatings are used to enhance the performance and appearance of vehicles. They provide excellent corrosion resistance, scratch resistance, and improved adhesion of paint to the car body. The increasing production of vehicles and the need for high-performance coatings drive the demand for Silanes in this application.

Fiberglass & mineral wool is another major application area for Silanes. These materials are used extensively in insulation products, which are crucial for energy efficiency in buildings and industrial applications. Silanes improve the bonding of fiberglass and mineral wool fibers, enhancing their mechanical properties and thermal insulation performance. The demand for energy-efficient insulation materials drives the market for Silanes in this segment.

Polyolefin compounds also utilize Silanes to improve their properties. Silanes act as cross-linking agents, enhancing the strength, flexibility, and heat resistance of polyolefin materials. These improved materials are used in various applications, including pipes, cables, and automotive parts. The demand for high-performance polyolefin products supports the growth of the Silanes market in this application.

Adhesives & sealants, sol-gel systems, fillers & pigments, and silicones are other important applications for Silanes. In adhesives and sealants, Silanes enhance bonding strength and durability. In sol-gel systems, they are used to create advanced materials with unique properties. Fillers & pigments benefit from Silanes’ ability to improve dispersion and compatibility, while silicones use Silanes as key intermediates in their production.

Key Market Segments

By Product Type

- Mono/Chloro Silane

- Amino Silane

By Application

- Paints & Coatings

- Fiberglass & Mineral Wool

- Polyolefin Compounds

- Adhesives & Sealants

- Sol-gel System

- Fillers & Pigments

- Silicones

- Others

Growth Opportunities

Increasing Focus on Sustainability and Eco-friendly Materials Offers Growth Opportunity

The trend towards sustainable and eco-friendly materials is growing across various industries. Silanes derived from bio-based sources or produced through environmentally friendly processes present a significant growth opportunity. Researchers are exploring the use of bio-based silanes derived from agricultural waste or renewable feedstocks.

These innovations cater to the increasing demand for sustainable materials in sectors like construction, automotive, and packaging. As environmental concerns rise, the adoption of eco-friendly silanes is expected to grow. This shift not only aligns with global sustainability goals but also opens new market opportunities for manufacturers focusing on green chemistry.

Emerging Applications in Renewable Energy and Energy Storage Offers Growth Opportunity

The renewable energy and energy storage sectors are experiencing rapid growth, driven by the global shift towards clean energy sources. Silanes find applications in these sectors, such as in the production of solar panels, wind turbine blades, and battery components.

For example, aminosilanes are used as coupling agents in the manufacturing of glass fiber-reinforced composites for wind turbine blades, enhancing their strength and durability. This application ensures that silanes play a critical role in improving the efficiency and longevity of renewable energy systems. As the demand for clean energy solutions increases, the silanes market is poised for substantial growth.

Trending Factors

Increasing Demand for Lightweight and High-performance Materials Are Trending Factors

There is a growing trend towards developing and using lightweight and high-performance materials across industries like automotive, aerospace, and construction. Silanes play a crucial role in enabling the production of advanced composites and hybrid materials with enhanced mechanical properties and reduced weight.

This trend is driven by the need for materials that offer both performance and efficiency. As industries seek to innovate and improve their product offerings, the demand for silanes in creating lightweight, high-strength materials is expected to rise, marking it as a significant trending factor in the market.

Emphasis on Energy Efficiency and Sustainability Are Trending Factors

With the increasing focus on energy efficiency and sustainability, there is a growing demand for materials and products that contribute to these goals. Silanes are used in applications that enhance energy efficiency, such as in the production of low rolling resistance tires and high-performance insulation materials.

These applications align with global efforts to reduce energy consumption and environmental impact. As industries and consumers prioritize energy-efficient solutions, the use of silanes in these applications is likely to grow. This trend highlights the importance of silanes in supporting sustainable practices and energy efficiency, making it a trending factor in the market.

Regional Analysis

APAC Dominates with 43.4% Market Share

The Asia-Pacific (APAC) region holds 43.4% of the global silanes market, valued at USD 1.2 billion. Major drivers include rapid industrial growth and strong demand from the automotive and construction sectors. Increasing investments in research and development and favorable government policies also boost the market.

APAC’s large population and robust economic growth drive high demand for silanes. The region’s significant manufacturing base, particularly in China and India, enhances market performance. Low production costs and availability of raw materials provide competitive advantages.

APAC’s market share is expected to grow. Continued industrialization and rising investments in various sectors will likely increase the region’s influence. Technological advancements and stricter environmental regulations may further shape the market’s future.

North America: 25% Market Share

North America holds a 25% share of the global silanes market, valued at approximately USD 690 million. High demand in the automotive, electronics, and construction industries drives growth. Advanced manufacturing technologies and strong regulatory frameworks support market performance.

Europe: 20% Market Share

Europe accounts for 20% of the global market, valued at around USD 552 million. The region’s strong automotive and construction sectors drive market demand. Emphasis on sustainable practices and investments in research and development enhance market performance.

Middle East & Africa: 7% Market Share

The Middle East and Africa hold a 7% share of the global market, valued at about USD 193 million. Growth is driven by expanding construction activities and industrial development. Increasing investments in various sectors contribute to market dynamics.

Latin America: 4.6% Market Share

Latin America accounts for 4.6% of the global market, valued at approximately USD 127 million. Industrialization and the growth of the automotive and construction sectors influence market growth. Economic development and rising applications in various industries support market dynamics.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Silanes Market features prominent companies known for their strategic positioning and innovative solutions. KCC Corporation and OCI Company Ltd lead the market with their extensive product ranges and strong global presence. Dow Inc. and Momentive Performance Materials Inc. emphasize advanced research and development, driving innovation in silane applications.

Evonik Industries AG and Wacker Chemie AG are recognized for their high-quality production and strong customer relationships, ensuring consistent market influence. Shin-Etsu Chemical Co. Ltd and China Bluestar International Chemical Co. Ltd hold significant positions with efficient production capabilities and robust supply chains.

Dalian Onichem Co. Ltd and Tokuyama Corporation focus on specialized silane products, catering to specific industrial needs. Power Chemical Corporation and Nanjing Shuguang Silane Chemical Co. Ltd provide reliable and efficient solutions, enhancing their market presence. BRB International B.V., Nanjing Union Silicon Chemical Co. Ltd, and Nanjing Wanda Chemicals Co. Ltd emphasize sustainability and eco-friendly products.

Milliken Chemical, Supreme Silicones, Air Liquide Advanced Materials Inc., Qufu Chenguang Chemical Co. Ltd, Nitrochemie AG, Gelest Inc., and WD Silicone Co. Ltd contribute with specialized and high-performance silane products, driving market growth.

These companies collectively drive the Silanes Market through innovation, strategic global positioning, and a commitment to quality and sustainability, ensuring their leadership and market influence.

Market Key Players

- KCC Corporation

- OCI Company Ltd

- Dow Inc.

- Momentive Performance Materials Inc.

- Evonik Industries AG

- Wacker Chemie AG

- Shin-Etsu Chemical Co. Ltd.

- China Bluestar International Chemical Co. Ltd,

- Dalian Onichem Co. Ltd.

- Tokuyama Corporation

- Power Chemical Corporation

- Nanjing Shuguang Silane Chemical Co. Ltd.

- BRB International B.V.

- Nanjing Union Silicon Chemical Co. Ltd.

- Nanjing Wanda Chemicals Co. Ltd.

- Miliken Chemical

- Supreme Silicones

- Air Liquide Advanced Materials Inc.

- Qufu Chenguang Chemical Co. Ltd.

- Nitrochemie AG

- Gelest Inc.

- WD Silicone Co. Ltd.

Recent Developments

- August 2023: Evonik Industries expanded its rubber silanes production in China at the Evonik Lanxing (Rizhao) Chemical Industrial Co., Ltd. This expansion aims to meet the growing demand for sustainable solutions within the tire and rubber industry. The facility focuses on enhancing efficiency, reducing waste, and lowering CO2 emissions. Evonik reported a 2022 revenue of €18.5 billion, reflecting its robust position in the specialty chemicals sector.

- 2023: According to the American Chemistry Council, the U.S. chemical industry saw a slight increase in plastic resins production by 0.5%, attributed to stronger exports. However, basic chemicals, petrochemicals, and organic intermediates observed a decline. Overall, the U.S. chemical industry faced a 2.5% decline in output, with a forecasted rebound in 2024.

Report Scope

Report Features Description Market Value (2023) USD 2.9 Billion Forecast Revenue (2033) USD 4.7 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Mono/Chloro Silane, Amino Silane), By Application (Paints & Coatings, Fiberglass & Mineral Wool, Polyolefin Compounds, Adhesives & Sealants, Sol-gel System, Fillers & Pigments, Silicones, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape KCC Corporation, OCI Company Ltd, Dow Inc., Momentive Performance Materials Inc., Evonik Industries AG, Wacker Chemie AG, Shin-Etsu Chemical Co. Ltd., China Bluestar International Chemical Co. Ltd,, Dalian Onichem Co. Ltd., Tokuyama Corporation, Power Chemical Corporation, Nanjing Shuguang Silane Chemical Co. Ltd., BRB International B.V., Nanjing Union Silicon Chemical Co. Ltd., Nanjing Wanda Chemicals Co. Ltd., Miliken Chemical, Supreme Silicones, Air Liquide Advanced Materials Inc., Qufu Chenguang Chemical Co. Ltd., Nitrochemie AG, Gelest Inc., WD Silicone Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Global Silanes Market by 2033?The Global Silanes Market is expected to reach USD 4.7 billion by 2033. The expected CAGR is 4.9% during the forecast period from 2024 to 2033.

Which region holds the largest market share in the Global Silanes Market?The Asia-Pacific (APAC) region holds the largest market share at 43.4%.

Who are some of the key players in the Global Silanes Market?Key players include KCC Corporation, OCI Company Ltd, Dow Inc., Momentive Performance Materials Inc., Evonik Industries AG, and Wacker Chemie AG.

-

-

- KCC Corporation

- OCI Company Ltd

- Dow Inc.

- Momentive Performance Materials Inc.

- Evonik Industries AG

- Wacker Chemie AG

- Shin-Etsu Chemical Co. Ltd.

- China Bluestar International Chemical Co. Ltd,

- Dalian Onichem Co. Ltd.

- Tokuyama Corporation

- Power Chemical Corporation

- Nanjing Shuguang Silane Chemical Co. Ltd.

- BRB International B.V.

- Nanjing Union Silicon Chemical Co. Ltd.

- Nanjing Wanda Chemicals Co. Ltd.

- Miliken Chemical

- Supreme Silicones

- Air Liquide Advanced Materials Inc.

- Qufu Chenguang Chemical Co. Ltd.

- Nitrochemie AG

- Gelest Inc.

- WD Silicone Co. Ltd.