Global Security Market Size, Share, Statistics Analysis Report By System (Access Control Systems, Alarms & Notification Systems, Intrusion Detection Systems, Video Surveillance Systems, Barrier Systems, Others), By Service (System Integration & Consulting, Risk Assessment & Analysis, Managed Security Services, Maintenance and Support), By End-use (Government, Military & Defence, Transportation, Commercial, Industrial, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144873

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

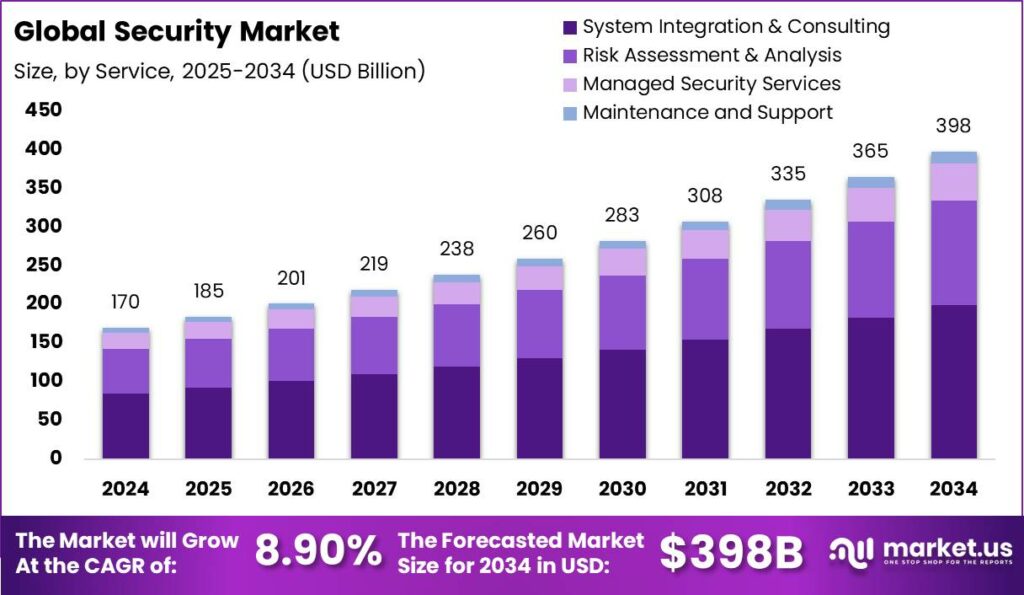

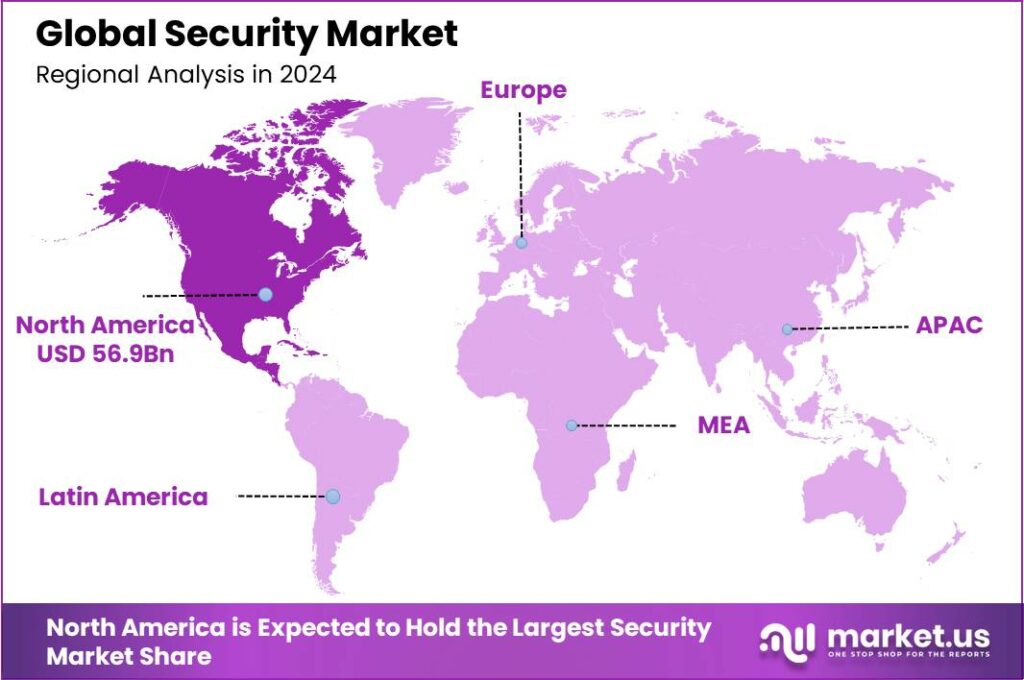

The Global Security Market size is expected to be worth around USD 398 Billion By 2034, from USD 169.55 Billion in 2024, growing at a CAGR of 8.90% during the forecast period from 2025 to 2034. North America maintained a dominant position in the global security market in 2024, holding over 33.6% of the market with revenues amounting to USD 56.9 billion.

The security market refers to the industry that provides these security solutions. It is a dynamic field characterized by rapid technological advancements and a diverse range of products and services. The market includes large multinational corporations, specialized security firms, and innovative startups. These entities compete and collaborate in a sector driven by the need to address evolving security threats and regulatory requirements.

The primary drivers of the security market include heightened global security threats, such as terrorism and cyberattacks, and a general increase in awareness about the importance of security. Investments in infrastructure development, particularly in emerging markets, also contribute significantly to the growth of this sector.

Investing in security systems offers significant business benefits including risk mitigation, enhanced brand reputation, and operational resilience. Companies that prioritize security can prevent financial losses due to theft or data breaches, while also gaining competitive advantage by building trust with their customers and partners.

Global cybercrime costs are projected to reach $10.5 trillion annually by 2025, according to Cobalt. This figure reflects a steady annual growth rate of 15%, underscoring the escalating financial impact on businesses and governments alike. In 2024, cybercrime is expected to cost the world $9.5 trillion, indicating a slight deviation from the projected growth curve.

The average global cost of a data breach in 2023 was $4.45 million, a 15% increase over three years, pointing to a sharp rise in both frequency and severity of incidents. According to Forbes, 2,365 cyberattacks were recorded globally in 2023, affecting 343.3 million individuals. The number of breaches has surged by 72% since 2021, breaking previous records.

The average cost of a data breach in 2024 rose to $4.88 million, further intensifying the economic strain on enterprises. Email remains the leading attack vector, with 35% of malware delivered via this channel, and 94% of organizations reporting email-related security incidents. Losses from business email compromise alone reached $2.9 billion in 2023.

Organizations adopt advanced security technologies primarily to protect against sophisticated cyber threats, ensure compliance with regulatory requirements, and enhance operational efficiencies. The integration of AI and IoT in security systems allows for smarter, more proactive security measures.

Demand for security solutions is driven by the need to protect against an increasing array of threats, including cyber threats, physical intrusions, and technological vulnerabilities. The commercial sector, including industries such as banking, technology, and defense, exhibits particularly strong demand due to the critical nature of the assets they manage.

Key Takeaways

- The global security market size is projected to reach USD 398 billion by 2034, growing from USD 169.55 billion in 2024, at a CAGR of 8.90% during the forecast period from 2025 to 2034.

- In 2024, the Video Surveillance Systems segment captured the largest market share, holding more than 47.3% of the market.

- The System Integration & Consulting segment also led the market in 2024, accounting for over 50.2% of the total market share.

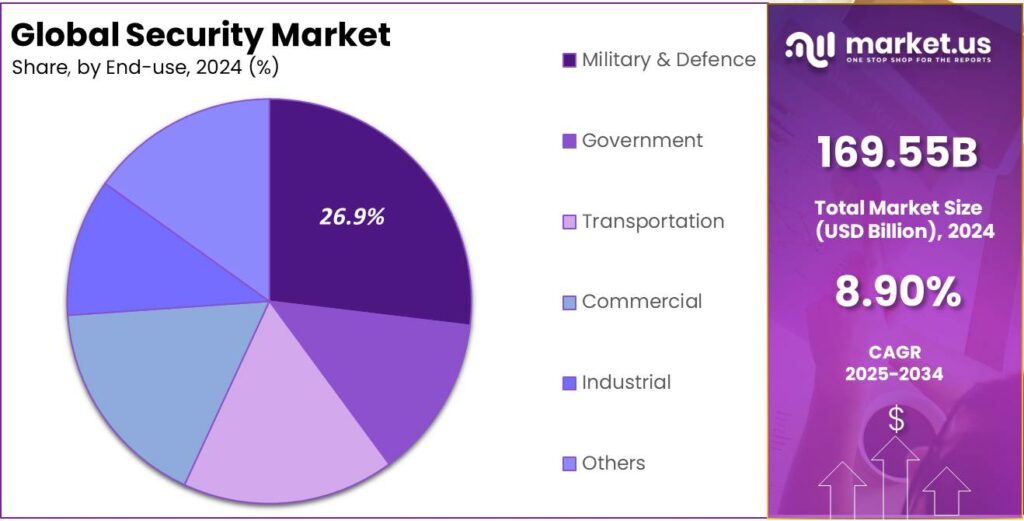

- The Military & Defence segment dominated the global security market in 2024, securing more than 26.9% of the market share.

- North America maintained a dominant position in the global security market in 2024, holding over 33.6% of the market with revenues amounting to USD 56.9 billion.

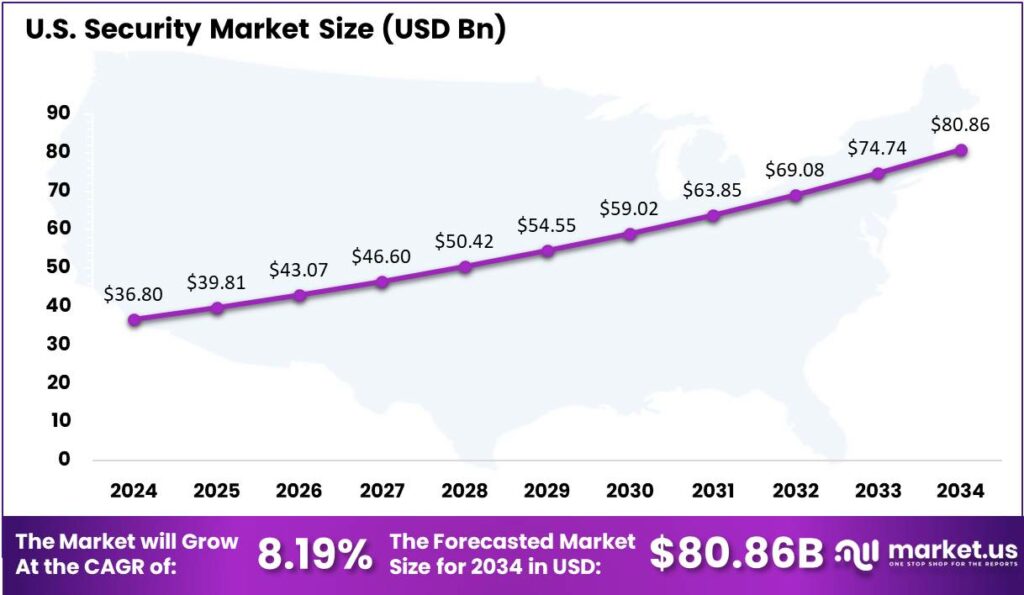

- The U.S. security market was valued at USD 36.8 billion in 2024, and it is expected to grow at a CAGR of 8.19%.

Analyst’s Viewpoint

The security industry is observing a substantial rise in investment, particularly in innovative technologies like Secure Access Service Edge (SASE), which merges networking and security into a cloud-delivered service. This technology not only enhances security but also offers financial returns, potentially paying for itself in as little as six months.

The regulatory landscape is increasingly stringent, with bodies like the American National Standards Institute imposing tough mandates that ensure the safety and security of data and systems. These regulations are pivotal in shaping the strategies and operations of security companies, driving them to comply with national and international standards.

One notable advancement is the integration of artificial intelligence (AI) in threat detection and response systems. AI enhances the capability of security systems to predict, detect, and respond to threats with greater accuracy and speed. The use of AI in conjunction with automation is also reducing operational costs and improving efficiency in cybersecurity practices.

Business Benefits

Strong security measures play a pivotal role in building and maintaining trust with customers. By visibly prioritizing security, businesses can create an environment where customers feel secure, boosting their confidence in the company. A PwC survey revealed that 88% of consumers are more willing to share personal data with companies they trust.

Investing in comprehensive security measures can prevent significant financial losses that come from cyber threats and breaches. As per “The Connection” report, Organizations with advanced cybersecurity practices have reported a 43% higher average revenue growth compared to their less secure counterparts.

Tools like firewalls, antivirus software, and multi-factor authentication are essential for protecting business assets, ensuring the financial health of the company. Security plays a key role in workplace safety and regulatory compliance. Measures like access control and visitor management help monitor building access, improving safety and ensuring adherence to regulations. This reduces legal risks and strengthens the organization’s compliance.

Impact Of AI

- Enhanced Threat Detection: AI systems excel at identifying patterns and anomalies within vast datasets, enabling the early detection of sophisticated cyber threats that might elude traditional methods. This capability allows organizations to respond proactively, mitigating potential damage.

- Automated Incident Response: AI-driven tools can autonomously analyze and respond to security incidents, such as isolating compromised devices or blocking malicious traffic. This automation reduces response times and workload on human security teams.

- Improved Identity and Access Management: By analyzing user behavior and access patterns, AI enhances identity verification processes. This ensures that only authorized individuals gain access to sensitive information, thereby bolstering overall security.

- Phishing Detection and Prevention: AI algorithms can scrutinize communication content to detect and flag potential phishing attempts. This proactive approach helps prevent users from falling victim to deceptive schemes.

- Efficient Vulnerability Management: AI assists in identifying and prioritizing system vulnerabilities by analyzing patterns and predicting potential exploits. This enables organizations to address critical weaknesses promptly, enhancing their security posture.

U.S. Security Market

In 2024, the U.S. Security Market was estimated to have a value of $36.8 billion. It is projected to grow at a compound annual growth rate (CAGR) of 8.19%.

This growth can be attributed to several key factors, including heightened demand for advanced security solutions driven by increasing concerns over public and private security. Enhanced technological innovations, such as biometric security systems and AI-driven security solutions, also play a crucial role in propelling this market forward.

The market is also witnessing a substantial increase in investment from both government and private sectors, aimed at enhancing security infrastructure and capabilities. The market growth is fueled by significant investments in security services, surveillance equipment, and integrated security systems. Regulatory changes and stricter security protocols across industries are also driving further expansion.

The U.S. security market is poised for continued growth, fueled by technological advancements and rising security needs. Companies will find opportunities in smart security and integrated solutions. However, they must navigate privacy concerns and evolving regulations, requiring ongoing adaptation and strategic planning.

In 2024, North America held a dominant market position in the global security market, capturing more than a 33.6% share with revenues amounting to USD 56.9 billion. This leading position can be attributed to several factors that are specific to the region.

North America’s market growth is driven by major tech firms and the early adoption of advanced security solutions, such as AI and machine learning for improved threat detection and response. A strong legal framework enforcing strict security measures across sectors also increases the demand for comprehensive security solutions.

The U.S. government’s significant spending on national defense and homeland security, particularly in cybersecurity to protect critical infrastructure and counter cyber-attacks, is boosting the market. Additionally, private sector companies in North America are investing more in security technologies due to growing concerns over data breaches and cyber threats.

The region benefits from a highly developed technological infrastructure that supports advanced security systems. Combined with a skilled workforce in software development, cybersecurity, and systems engineering, this environment fosters continuous innovation and growth in the security sector.

System Analysis

In 2024, the Video Surveillance Systems segment held a dominant market position within the security market, capturing more than a 47.3% share. This substantial market share can be attributed to the widespread adoption of video surveillance across various sectors, including retail, healthcare, and government facilities.

Several factors contribute to the leading position of the Video Surveillance Systems segment over others like Access Control Systems, Alarms & Notification Systems, and Intrusion Detection Systems. Firstly, the surge in smart city projects globally has significantly driven the installation of advanced surveillance cameras across urban areas.

Additionally, technological advancements in camera technology and analytics software have transformed video surveillance into a more proactive security tool. Innovations such as facial recognition and motion detection allow for quicker responses to potential threats, making these systems more appealing to consumers seeking comprehensive security solutions.

The Video Surveillance Systems segment benefits from government policies that enhance public security infrastructure. Global investments in surveillance, driven by security legislation requiring high-quality systems in sensitive areas, combined with declining technology costs, have made advanced security systems more accessible, boosting segment growth.

Service Analysis

In 2024, the System Integration & Consulting segment held a dominant market position within the security market, capturing more than a 50.2% share. This segment’s leadership can be attributed to the increasing complexity of security systems and the growing need for integrated security solutions across various industries.

As organizations continue to adopt advanced technologies such as IoT and cloud computing, the demand for system integration services that can seamlessly consolidate disparate security functions has surged. These services not only ensure cohesive security operations but also enhance the overall efficacy and responsiveness of security infrastructures.

The preeminence of the System Integration & Consulting segment is further bolstered by the rising threat of cyber attacks, which necessitates expert consultation to safeguard critical data and infrastructure. Companies in this segment offer tailored advice to businesses on the best practices and technologies for protecting their assets.

Moreover, the System Integration & Consulting segment benefits from regulatory compliance requirements that mandate businesses to meet specific security standards. This regulatory environment has driven the need for specialized consulting services that can guide companies through the complexities of compliance, from initial risk assessment to implementation of compliant security solutions.

End-use Analysis

In 2024, the Military & Defence segment held a dominant market position in the global security market, capturing more than a 26.9% share. This prominence is driven by increasing geopolitical tensions and rising security threats, leading to significant investment in military and defense. Substantial government funding supports the enhancement of national defense infrastructure, including surveillance, reconnaissance, and cybersecurity.

The Military & Defence segment is at the forefront of adopting cutting-edge technologies, including unmanned systems, artificial intelligence, and cybersecurity solutions. The integration of these technologies enhances operational efficiencies and strategic capabilities, catering to the complex security needs of modern armed forces.

There is a growing emphasis on securing defense-related information and infrastructure from cyber threats, which has led to increased spending on cybersecurity measures. The military sector’s focus on safeguarding its digital and physical realms against sophisticated threats significantly contributes to its leading position in the security market.

The collaboration between governments and private sector companies in creating and deploying security solutions for military and defense strengthens this segment’s market position. These partnerships drive technological advancements and ensure the effective integration of solutions into military operations.

Key Market Segments

By System

- Access Control Systems

- Alarms & Notification Systems

- Intrusion Detection Systems

- Video Surveillance Systems

- Barrier Systems

- Others

By Service

- System Integration & Consulting

- Risk Assessment & Analysis

- Managed Security Services

- Maintenance and Support

By End-use

- Government

- Military & Defence

- Transportation

- Commercial

- Industrial

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Concerns Over Public Safety and Infrastructure Protection

The escalating apprehensions regarding public safety and the safeguarding of critical infrastructure have emerged as significant catalysts propelling the security solutions market. The surge in global security threats, including terrorism, cyber-attacks, and organized crime, has heightened the demand for comprehensive security measures.

Governments and private entities are investing substantially in advanced security technologies to mitigate these risks and ensure the protection of assets and citizens. For instance, the integration of surveillance systems, access control mechanisms, and emergency response strategies has become paramount in urban planning and public event management.

A proactive approach aims to deter threats and strengthen the resilience of public spaces and essential services. The rise of smart city initiatives, using interconnected technologies to monitor urban environments, highlights the crucial role of security solutions in addressing modern safety challenges and protecting societal well-being.

Restraint

Privacy Concerns and Stringent Data Protection Regulations

The advancement and deployment of security solutions are increasingly encountering obstacles due to mounting privacy concerns and the enforcement of stringent data protection regulations. As surveillance technologies become more pervasive, individuals and advocacy groups are raising alarms about potential infringements on civil liberties and personal privacy.

The collection, storage, and analysis of vast amounts of personal data by security systems necessitate strict adherence to legal frameworks designed to protect individual rights. Balancing effective security with privacy rights is a significant challenge in deploying surveillance systems, especially in public spaces.

Opportunity

Rising Demand for Remote Monitoring and Surveillance Solutions

The growing need for remote monitoring and surveillance solutions presents a significant opportunity in the security market. Factors like remote work, business globalization, and the need for real-time asset oversight have increased demand for advanced security systems with remote capabilities.

Technological advancements in cloud computing, IoT, and HD video surveillance have enabled systems offering comprehensive, remote monitoring. Industries like retail, transportation, and critical infrastructure use these solutions to strengthen security, improve efficiency, and respond quickly to incidents.

The integration of artificial intelligence and machine learning further augments the effectiveness of remote surveillance by enabling predictive analytics and automated threat detection. This trend underscores a shift towards more flexible and responsive security strategies that align with the evolving needs of modern enterprises.

Challenge

Rapid Technological Changes and Risk of Obsolescence

The swift pace of technological evolution poses a significant challenge for the security solutions market, as products and systems risk becoming obsolete shortly after deployment. Continuous innovations in security technologies necessitate that organizations remain vigilant and adaptable to maintain effective defense mechanisms.

Additionally, the integration of new technologies into existing security infrastructures can be complex and resource-intensive, often requiring specialized expertise and significant financial outlay. Organizations must choose security solutions that address current concerns while being scalable for future developments.

The challenge is intensified by the need to defend against increasingly sophisticated cyber threats that evolve with technology. This highlights the importance of continuous learning and agility for both security providers and end-users in managing risks from rapid technological change.

Emerging Trends

One notable trend is the integration of Artificial Intelligence (AI) into security frameworks. AI enables proactive threat detection and real-time breach mitigation. However, cybercriminals also exploit this technology to create sophisticated malware, leading to a complex arms race between defenders and attackers.

Another emerging trend is the rise of Ransomware as a Service (RaaS). This model allows individuals with minimal technical expertise to launch ransomware attacks by purchasing ready-made malware from developers. The accessibility of RaaS has led to an increase in ransomware incidents, posing significant challenges for organizations worldwide.

The adoption of blockchain technology is also gaining traction in cybersecurity. Known for its role in cryptocurrency, blockchain’s decentralized and tamper-resistant nature makes it an attractive option for securing data transactions and enhancing transparency. Organizations are exploring blockchain to bolster their security infrastructures and protect against data breaches.

Key Player Analysis

The market is dominated by a few key players that have built a strong reputation through innovation, reliability, and comprehensive service offerings.

Johnson Controls is a global leader in the security industry, known for its wide range of integrated solutions. Their offerings include building security systems, energy management, and fire safety. With a focus on smart and connected security technologies, Johnson Controls provides scalable and flexible solutions to address the unique needs of both residential and commercial customers.

Honeywell International, Inc. is another major player in the security market. The company’s security solutions range from video surveillance and access control systems to advanced threat detection technologies. Known for its innovation, Honeywell integrates cutting-edge technologies such as AI and machine learning into their security products, making them highly effective at preventing and responding to security threats.

ZABAG Security Engineering GmbH is a key player in the security industry, with a focus on high-quality, customized security systems. Known for its expertise in engineering complex security solutions, ZABAG specializes in areas such as perimeter protection, access control, and video surveillance.

Top Key Players in the Market

- Johnson Controls

- Honeywell International, Inc.

- ZABAG Security Engineering GmbH

- Teledyne FLIR LLC

- Axis Communications AB

- ASSA ABLOY

- Apex Fabrication & Design, Inc.

- Apex Perimeter Protection

- Anixter Inc.

- Perimeter Protection Germany GmbH

Top Opportunities for Players

The security industry is poised to leverage significant growth opportunities driven by technological advancements and evolving market needs.

- Integration of Artificial Intelligence in Identity Security Solutions: Organizations are increasingly adopting AI-driven identity security solutions to enhance governance, real-time fraud detection, and operational efficiency. This trend is not only improving security measures but also boosting operational efficiency across various departments.

- Secure-by-Design Principles: There is a growing emphasis on integrating security at every stage of product and system development. This approach not only minimizes vulnerabilities but also enhances trust and compliance with stringent regulatory requirements, attracting security-conscious customers.

- Automated Incident Detection and Response: The use of AI and machine learning is transforming the way incidents are detected and responded to. This automation allows for quicker response times and less reliance on manual processes, which in turn can help bridge the gap in cybersecurity skills within organizations.

- Digital Transformation in Public Safety Operations: The rise of IoT, AI, and 5G technologies is enabling more efficient and responsive public safety operations. This transformation is making safety operations more connected and intelligent, which enhances community trust and operational transparency.

- Biometric Technologies for Enhanced Security Compliance: As regulations around privacy and security tighten, biometric technologies are becoming crucial for robust identity verification processes. These technologies help in meeting global compliance standards and enhancing security, particularly in sensitive industries.

Recent Developments

- In January 2024, Johnson Controls has launched the Ilustra Standard Gen3 security camera series, with over 75% of its components sourced from India. This move supports the government’s Make-in-India initiative, reflecting the company’s commitment to localizing its security solutions.

- In April 2024, Axis Communications launched Axis Cloud Connect, a cloud-based platform designed to simplify video surveillance management.

- In September 2024, ASSA ABLOY acquired Level Lock, a technology solutions business based in Redwood City, California. This acquisition aims to enhance ASSA ABLOY’s position in the smart lock market.

Report Scope

Report Features Description Market Value (2024) USD 169.55 Bn Forecast Revenue (2034) USD 398 Bn CAGR (2025-2034) 8.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By System (Access Control Systems, Alarms & Notification Systems, Intrusion Detection Systems, Video Surveillance Systems, Barrier Systems, Others), By Service (System Integration & Consulting, Risk Assessment & Analysis, Managed Security Services, Maintenance and Support), By End-use (Government, Military & Defence, Transportation, Commercial, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Johnson Controls, Honeywell International, Inc., ZABAG Security Engineering GmbH, Teledyne FLIR LLC, Axis Communications AB, ASSA ABLOY, Apex Fabrication & Design, Inc., Apex Perimeter Protection, Anixter Inc., Perimeter Protection Germany GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Johnson Controls

- Honeywell International, Inc.

- ZABAG Security Engineering GmbH

- Teledyne FLIR LLC

- Axis Communications AB

- ASSA ABLOY

- Apex Fabrication & Design, Inc.

- Apex Perimeter Protection

- Anixter Inc.

- Perimeter Protection Germany GmbH