Global Specialty Insurance Market Size, Share, Statistics Analysis Report By Type (Political Risk and Credit Insurance, Entertainment Insurance, Art Insurance, Livestock and Aquaculture Insurance, Marine, Aviation and Transport (MAT) Insurance, Others), By Distribution Channel (Brokers, Non-brokers), By End User (Business, Individuals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144827

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

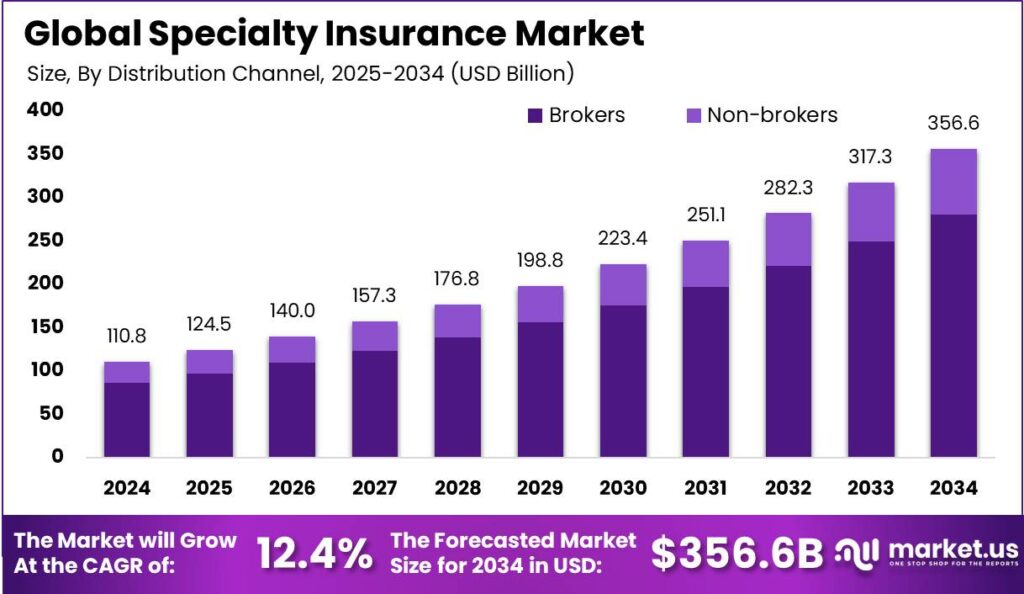

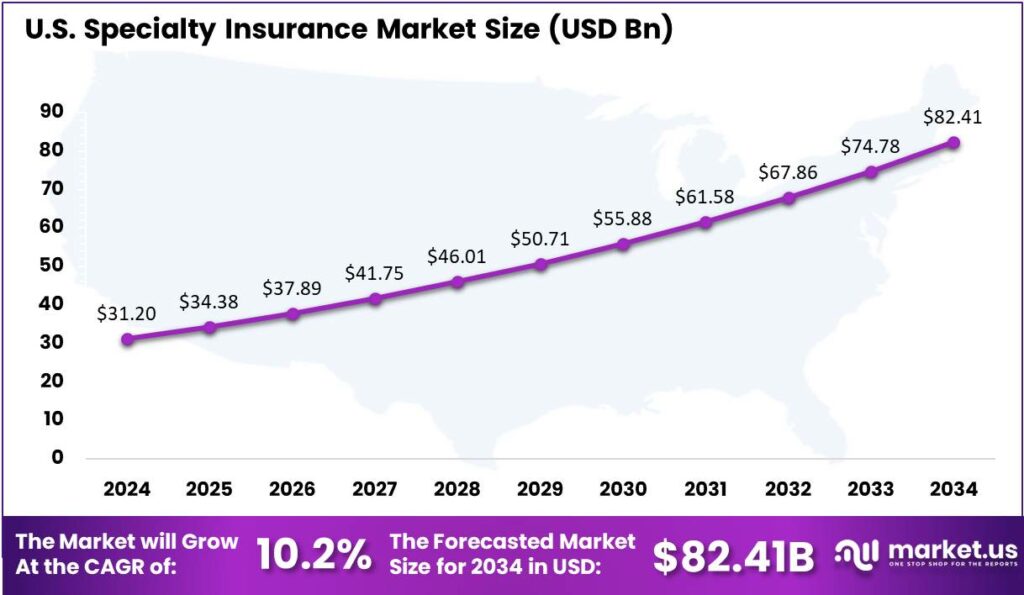

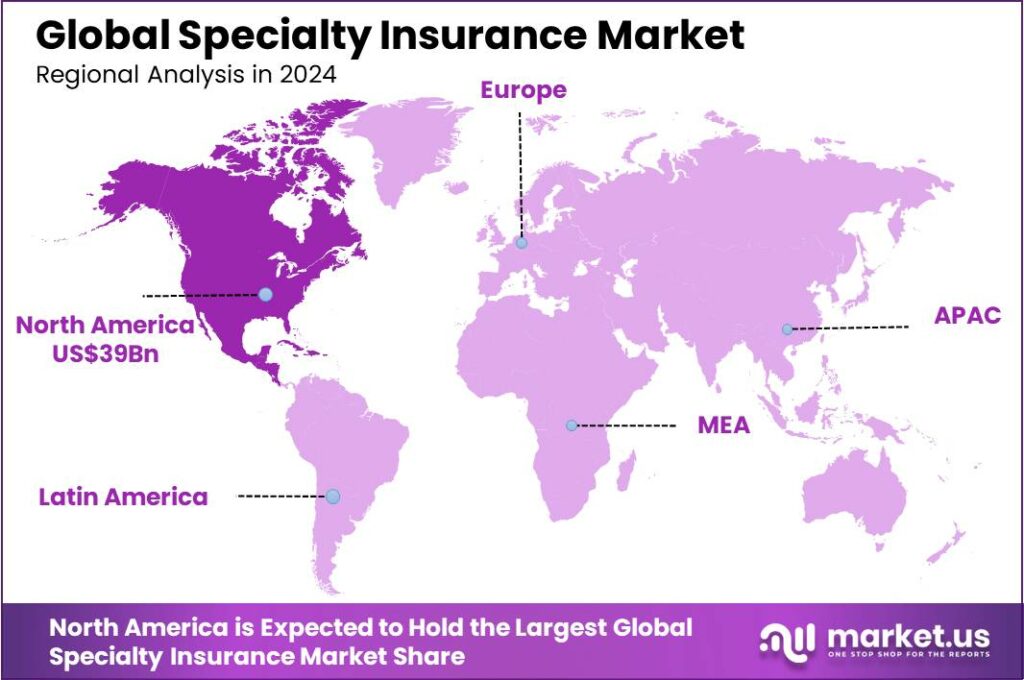

The Global Specialty Insurance Market size is expected to be worth around USD 356.6 Billion By 2034, from USD 110.8 Billion in 2024, growing at a CAGR of 12.40% during the forecast period from 2025 to 2034. In 2024, North America dominated the Specialty Insurance sector with a 35.2% market share and revenues of approximately $39 billion. The U.S. Specialty Insurance Market was valued at $31.2 billion and is projected to grow at a CAGR of 10.2%.

The specialty insurance market caters to a wide array of niche industries and unique personal or business needs, offering policies that address risks typical insurance does not cover. This market segment is diverse, covering everything from film production and technology errors and omissions to fine art and kidnap and ransom scenarios. Each policy is crafted to manage the specific risks associated with its focus area, reflecting a deep understanding of the sector it serves

The growth of the specialty insurance market can be attributed to increasing awareness of the financial implications of unforeseen risks and the inadequacy of standard insurance policies in certain scenarios. As industries evolve and new risks emerge, such as cyber threats or regulatory changes, the demand for customized insurance solutions that can mitigate these specific risks continues to rise.

Technological advancements are a significant driver behind the specialty insurance market’s growth. The use of big data analytics, AI, and IoT devices helps insurers better understand and price the risks associated with insuring unique items and activities. These technologies enable more precise risk assessment and more efficient policy customization, enhancing the appeal of specialty insurance.

Businesses and individuals increasingly adopt specialty insurance due to the growing complexity of the regulatory environment and the heightened potential for financial losses from uncovered events. Specialty insurance provides a safety net that standard policies do not, filling gaps in coverage that could otherwise lead to significant financial distress.

The demand for specialty insurance is rising due to the increasing value of assets requiring protection and the growing recognition of unique risks in personal and business contexts. This trend is evident in sectors like technology, where rapid innovation leads to new liabilities, and in global trade, where traditional coverage may not suffice for emerging market risks.

Key Takeaways

- The Global Specialty Insurance Market size is expected to be worth around USD 356.6 Billion by 2034, up from USD 110.8 Billion in 2024, growing at a CAGR of 12.40% during the forecast period from 2025 to 2034.

- In 2024, the Political Risk and Credit Insurance segment held a dominant market position within the specialty insurance market, capturing more than a 28.7% share.

- In 2024, the Brokers segment held a dominant position in the specialty insurance market, capturing more than a 78.6% share.

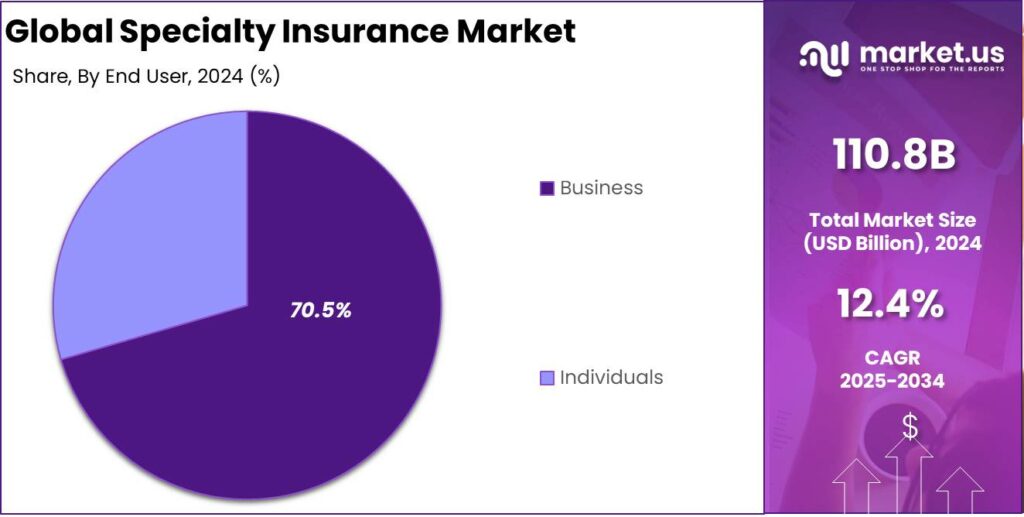

- In 2024, the Business segment held a dominant market position in the Specialty Insurance sector, capturing more than a 70.5% share.

- In 2024, North America held a dominant market position in the Specialty Insurance sector, capturing more than a 35.2% share, with revenues amounting to approximately $39 billion.

- In 2024, the U.S. Specialty Insurance Market was estimated to be valued at $31.2 billion. It is projected to grow at a CAGR of 10.2%.

Key Takeaways

The specialty insurance market presents significant investment opportunities, particularly in underexplored or newly emerging sectors such as renewable energy, cannabis, and cyber security. Investors can capitalize on the first-mover advantage in markets where standard coverage providers may hesitate to enter due to unfamiliarity with the risks involved.

Key factors influencing the specialty insurance market include regulatory changes, economic fluctuations, technological advancements, and societal attitudes towards risk. Each of these elements can either constrain or propel market growth, depending on their nature and the market’s ability to adapt.

Innovations in AI, data analytics, and IoT are revolutionizing the specialty insurance sector by enabling more accurate risk assessments and more efficient policy management. These technological advancements allow insurers to offer more competitive pricing and tailored coverage options, significantly enhancing customer satisfaction and industry standards.

The regulatory environment for specialty insurance is complex and varies significantly by jurisdiction. Insurers must navigate a maze of local, national, and international regulations, which can affect everything from policy design to claims processing. Staying abreast of regulatory changes is crucial for insurers to ensure compliance and maintain market competitiveness.

U.S. Specialty Insurance Market

In 2024, the U.S. Specialty Insurance Market was estimated to be valued at $31.2 billion. It is projected to grow at a compound annual growth rate (CAGR) of 10.2%. Specialty insurance, distinct from standard insurance products, caters to unique or high-risk coverage needs that are not typically addressed by mainstream policies.

This market segment includes various types of insurance, such as cyber, environmental liability, and professional liability. Demand is driven by growing awareness of industry-specific risks and the need for tailored insurance solutions to address unique challenges.

The robust growth of the U.S. Specialty Insurance Market can be attributed to several key factors. Firstly, the digital transformation across industries has escalated the risks of cyber threats, thereby fueling the demand for cyber insurance solutions. Additionally, regulatory changes and heightened industry standards are compelling businesses to adopt comprehensive risk management strategies, which include specialized insurance covers.

The market is poised for continued growth, driven by ongoing innovations in insurance products and the integration of advanced technologies like AI and big data analytics. These developments are improving risk assessment and enabling insurers to better tailor products, boosting the market’s growth potential and ability to respond to emerging risks.

In 2024, North America held a dominant market position in the Specialty Insurance sector, capturing more than a 35.2% share, with revenues amounting to approximately $39 billion. This prominence can be largely attributed to the region’s mature financial markets and the substantial presence of key industry players.

The North American market is characterized by its robust regulatory framework, which has propelled the development and adoption of various specialty insurance products. Moreover, the heightened awareness among corporations regarding the potential risks in their operations has significantly driven the demand for tailored insurance solutions.

The European region also demonstrates a strong performance in the specialty insurance market, driven by stringent regulatory standards and a heightened focus on corporate governance. Innovations in insurance products, particularly in response to the region’s diverse business landscape and complex regulatory requirements, have fostered growth.

The Asia-Pacific (APAC) region is experiencing rapid growth in specialty insurance due to a growing middle class, increased industrialization, and infrastructure investments. As businesses expand, demand for tailored insurance products rises, further boosted by advancements in AI and machine learning for risk assessment.

Meanwhile, Latin America and the Middle East & Africa (MEA) are emerging markets with significant growth potential. Economic development and regulatory changes are increasing awareness of specialty insurance, with businesses recognizing the need for coverage that addresses local and operational challenges.

Type Analysis

In 2024, the Political Risk and Credit Insurance segment held a dominant market position within the specialty insurance market, capturing more than a 28.7% share. This leading position can be attributed to the heightened geopolitical uncertainties and the increasing number of businesses operating in politically volatile regions.

Companies, especially those involved in international trade, are seeking political risk insurance to safeguard against losses stemming from political instability, such as expropriation, currency inconvertibility, and government interference. Credit insurance has also become critical as businesses look to manage the risk of customer default, particularly in an economically fluctuating global market.

The Entertainment Insurance segment caters specifically to the needs of the entertainment industry, covering everything from film and television production to live performances and events. This type of insurance is crucial for managing the unique risks associated with entertainment production, such as cast injuries, equipment damage, and shooting delays.

Art insurance covers valuable artwork against risks like theft, damage, and transportation challenges. The expanding global art market, along with more exhibitions and transactions, has increased demand for this specialized coverage. Collectors, galleries, museums, and auction houses benefit from art insurance to manage high restoration costs and title dispute claims.

Distribution Channel Analysis

In 2024, the Brokers segment held a dominant position in the specialty insurance market, capturing more than a 78.6% share. This substantial market share can be attributed to the critical role brokers play in navigating complex specialty insurance landscapes. Brokers possess the expertise to understand unique and nuanced risks, making them invaluable to clients requiring specialized insurance solutions.

Brokers’ expertise is especially crucial in specialty insurance due to the complexity of the risks involved. These professionals possess the expertise to analyze complex, technical risk details that differ across industries and situations. This skill set enables them to negotiate better terms, ensuring comprehensive coverage that aligns with their client’s specific risk profile and needs.

Moreover, the trust and personal relationships that brokers build with their clients further cement their leading position in the specialty insurance market. For businesses and individuals, having a knowledgeable advocate in the insurance process is invaluable, fostering trust, higher client retention, and more referrals, which strengthens brokers’ market share.

Additionally, Brokers have successfully adapted to technological advancements, using new tools and data analytics to improve efficiency and offer faster, more accurate policy customization. Their proactive embrace of technology not only meets but often exceeds customer expectations, solidifying their leadership in the specialty insurance market.

End User Analysis

In 2024, the Business segment held a dominant market position in the Specialty Insurance sector, capturing more than a 70.5% share. This substantial portion of the market can primarily be attributed to the complex risk landscapes that modern businesses navigate, which necessitate specialized insurance products.

Businesses are increasingly adopting specialty insurance to mitigate risks that could disrupt operations and cause financial losses. The globalization of operations has introduced new challenges, such as compliance with international regulations and exposure to political risks, further driving the demand for tailored insurance products.

The rise in startups and new business ventures, especially in the tech sector, has also contributed to the growth of the Business segment in the specialty insurance market. These new enterprises often face significant uncertainties and require robust risk management strategies from their inception, making specialty insurance a critical component of their operational framework.

The Individual segment, though smaller, is vital in the specialty insurance market, with high-net-worth individuals or those with unique needs seeking specialized coverage. However, businesses dominate the market due to the scale and complexity of their risks, and this trend is expected to continue as businesses face evolving global challenges.

Key Market Segments

By Type

- Political Risk and Credit Insurance

- Entertainment Insurance

- Art Insurance

- Livestock and Aquaculture Insurance

- Marine, Aviation and Transport (MAT) Insurance

- Others

By Distribution Channel

- Brokers

- Non-brokers

By End User

- Business

- Individuals

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Technological Advancements in Risk Assessment

The specialty insurance market is experiencing significant growth, driven in part by technological advancements that enhance risk assessment capabilities. The integration of artificial intelligence (AI), big data analytics, and machine learning has revolutionized insurers’ ability to evaluate complex and emerging risks with greater precision.

These technologies enable the analysis of vast datasets, uncovering patterns and correlations that were previously undetectable. As a result, insurers can develop more accurate underwriting models, leading to tailored coverage options and competitive pricing for clients. This technological evolution not only streamlines operations but also fosters innovation in product offerings, thereby attracting a broader clientele seeking customized insurance solutions.

Restraint

Limited Market Size

Despite the potential for growth, the specialty insurance market faces constraints due to its inherently limited size. Specialty insurance products are designed to address unique and non-standard risks, which naturally appeals to a narrower segment of the market.

This specialization means that the pool of potential policyholders is smaller compared to standard insurance lines. Consequently, insurers may encounter challenges in achieving economies of scale, leading to higher operational costs per policy.

Additionally, the niche nature of these products requires specialized underwriting expertise, further limiting the scalability of operations. This restraint underscores the importance for insurers to balance the pursuit of niche markets with the need for sustainable growth.

Opportunity

Emerging Risks in the Agricultural Sector

The agricultural sector presents a significant opportunity for the specialty insurance market. Farmers and agribusinesses are increasingly exposed to a variety of risks, including climate change-induced weather variability, pest infestations, and market price fluctuations.

Traditional insurance products often fail to address these specific challenges comprehensively. This gap in coverage creates a demand for specialized insurance solutions tailored to the unique needs of the agricultural industry.

By developing products such as crop insurance, livestock coverage, and weather-related risk policies, insurers can tap into this underserved market. Furthermore, advancements in agricultural technology and data analytics provide insurers with the tools to assess and price these risks more accurately, enhancing the attractiveness of entering this sector.

Challenge

Evolving Regulatory Landscape

Navigating the evolving regulatory landscape poses a significant challenge for specialty insurers. Regulations governing insurance practices are continually changing, influenced by factors such as political shifts, economic developments, and emerging risks.

Specialty insurers must remain vigilant and adaptable to ensure compliance with these regulations across different jurisdictions. This requires substantial investment in compliance infrastructure and expertise. Failure to adhere to regulatory requirements can result in severe penalties and reputational damage. Moreover, the complexity of managing compliance across multiple regions can divert resources from core business activities, impacting overall efficiency and profitability.

Emerging Trends

Specialty insurance is evolving with the increasing use of AI and ML to improve underwriting accuracy and streamline claims processing. These technologies help address new and complex risks in today’s dynamic environment. These technologies enable insurers to analyze vast datasets, leading to more precise risk assessments and streamlined operations.

Another significant development is the rise of InsurTech startups. These companies leverage advanced technologies to offer innovative solutions, such as personalized policies and real-time risk monitoring, thereby transforming traditional insurance models.

Additionally, the demand for cyber insurance has surged as businesses become more reliant on digital infrastructures. Specialty insurers are responding by providing coverage tailored to protect against cyber threats and data breaches, addressing a critical need in the market.

Business Benefits

- Customized Risk Management: Standard insurance policies often exclude specific risks inherent to certain industries. Specialty insurance fills these gaps by offering coverage designed for these unique exposures, ensuring businesses are protected against potential financial losses.

- Enhanced Financial Security: By addressing specialized risks, such as cyber threats or event cancellations, specialty insurance safeguards businesses from significant financial setbacks that could arise from unforeseen incidents.

- Legal Liability Protection: In the event of lawsuits related to niche operations or services, specialty insurance provides coverage that may not be available through general liability policies, thereby protecting the company’s assets and reputation.

- Operational Continuity: Specialty insurance policies can include provisions for business interruption, ensuring that companies can maintain operations and recover swiftly after incidents that disrupt normal activities.

- Market Competitiveness: Demonstrating comprehensive risk management through specialty insurance can enhance a business’s credibility, making it a more attractive partner to clients and stakeholders who value thorough preparedness.

Key Player Analysis

The key players in this market are those who provide tailored solutions for unique industries, such as aviation, cyber security, marine, and more.

Assicurazioni Generali S.p.A. is one of Europe’s largest and most reputable insurance providers, with a significant presence in the specialty insurance market. Generali offers a wide range of products, including marine, property, and liability coverage, focusing on innovative solutions for high-risk sectors. With a strong global presence, financial stability, and customer-focused approach, it leads the specialty insurance market.

Berkshire Hathaway Inc., led by renowned investor Warren Buffett, is a major player in specialty insurance. Through its subsidiary, Berkshire Hathaway Reinsurance Group, the company offers specialized products in areas such as excess liability, property, and casualty insurance. The company’s ability to underwrite large and complex risks sets it apart from competitors.

Tokio Marine HCC, part of Tokio Marine Group, is another key player known for its focus on specialty lines of business. The company offers a wide array of products, including professional liability, directors and officers (D&O) insurance, and accident and health coverage. Tokio Marine HCC stands out for its expertise in providing coverage for niche industries, such as entertainment, energy, and aviation.

Top Key Players in the Market

- Assicurazioni Generali S.p.A.

- Berkshire Hathaway Inc.

- Tokio Marine HCC

- Munich Re

- AXA

- PICC

- American International Group, Inc.

- Zurich

- Chubb

- Allianz

- Others

Top Opportunities for Players

The specialty insurance market presents several key opportunities for players within the industry.

- Technological Integration and Digitalization: Advancements in technology, including the use of blockchain and Internet of Things (IoT), are transforming the specialty insurance market by enabling real-time risk assessment and improved efficiency in claims processing and risk management. Companies that embrace these technologies can enhance their product offerings and customer service, thus gaining a competitive edge.

- Demand for Customized Insurance Solutions: There is a growing demand for insurance policies tailored to specific needs, particularly in sectors like healthcare, technology, and the arts. This demand is driven by unique industry risks that are not covered by standard insurance policies. Insurance providers that can offer customized solutions and comprehensive coverage will likely capture more market share.

- Regulatory Compliance and Industry-Specific Coverage: Increasingly stringent regulations across various industries are compelling businesses to seek specialty insurance that ensures compliance. This trend is particularly notable in sectors such as healthcare, finance, and energy. Insurers that can offer products meeting these specific regulatory demands will benefit from sustained growth.

- Expansion into Emerging Markets: The specialty insurance market in the Asia-Pacific region is poised for rapid growth, driven by economic expansion, a growing middle class, and increased awareness of the benefits of insurance. Market players that expand into these regions and tailor their products to local needs and risks are likely to see growth.

- Innovative Product Offerings and Market Differentiation: As risks evolve, there is a constant need for innovative insurance products. Recent examples include coverage for cyber risks, climate change-related events, and geopolitical risks. Companies that are quick to develop and offer new products addressing these emerging risks can differentiate themselves and attract new customers.

Industry News

- In March 2024, Allianz completed the acquisition of Tua Assicurazioni S.p.A. from Assicurazioni Generali S.p.A. for €280 million, strengthening its position in the Italian insurance market.

- In February 2025, Zurich North America established a new Specialties business unit by integrating its Construction, Surety, and Financial Lines businesses, aiming to enhance its specialty insurance offerings.

- In December 2024, PICC Property and Casualty Company Limited entered into a reinsurance framework agreement with PICC Reinsurance, continuing their business cooperation into 2025.

Report Scope

Report Features Description Market Value (2024) USD 110.8 Bn Forecast Revenue (2034) USD 356.6 Bn CAGR (2025-2034) 12.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Political Risk and Credit Insurance, Entertainment Insurance, Art Insurance, Livestock and Aquaculture Insurance, Marine, Aviation and Transport (MAT) Insurance, Others), By Distribution Channel (Brokers, Non-brokers), By End User (Business, Individuals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Assicurazioni Generali S.p.A., Berkshire Hathaway Inc., Tokio Marine HCC, Munich Re, AXA, PICC, American International Group, Inc., Zurich, Chubb, Allianz, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Specialty Insurance MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Specialty Insurance MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Assicurazioni Generali S.p.A.

- Berkshire Hathaway Inc.

- Tokio Marine HCC

- Munich Re

- AXA

- PICC

- American International Group, Inc.

- Zurich

- Chubb

- Allianz

- Others