Global Seafood Packaging Market Size, Share, Growth Analysis By Material (Plastic, Paper, Metal, Others), By Seafood Type (Fish, Molluscs, Crustaceans, Others), By Product Type (Bags & Pouches, Trays, Cans, Boxes, Shrink Films, Others), By Application (Processed, Fresh & Frozen), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151390

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

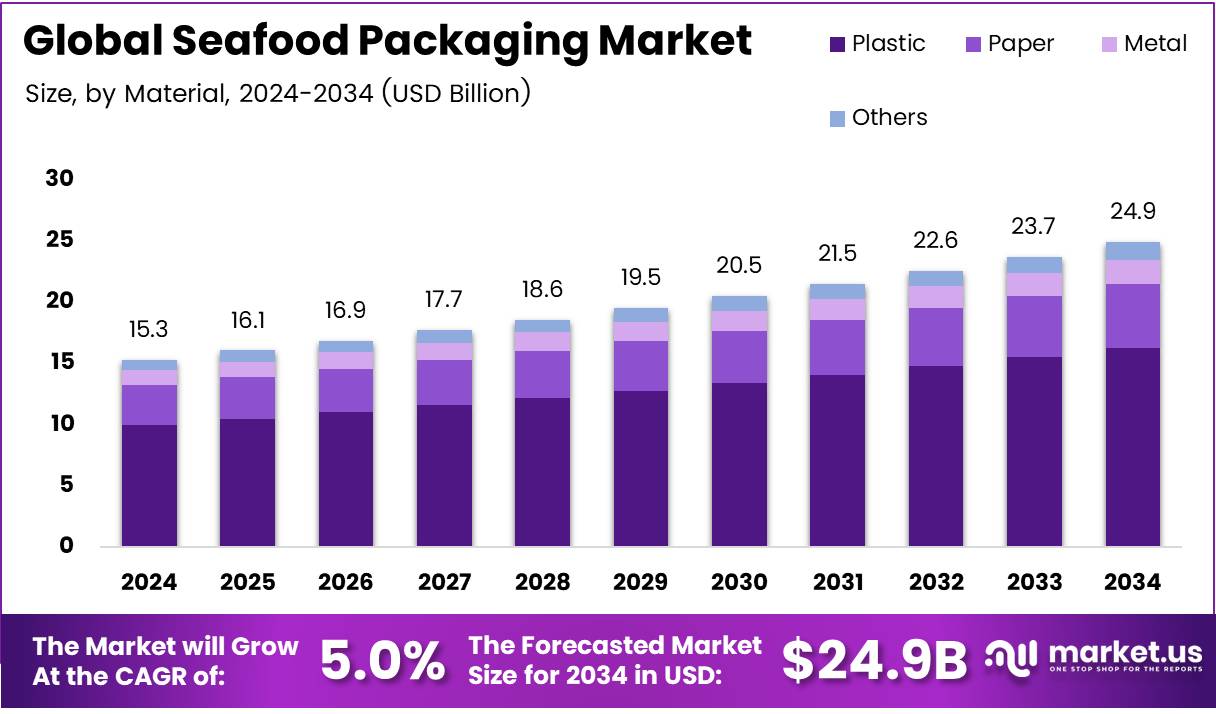

The Global Seafood Packaging Market size is expected to be worth around USD 24.9 Billion by 2034, from USD 15.3 Billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

The Seafood Packaging Market plays a critical role in preserving the quality and safety of seafood products across global supply chains. Packaging solutions, such as vacuum packaging, modified atmosphere packaging (MAP), and eco-friendly containers, help minimize spoilage and extend shelf life. Efficient packaging ensures seafood reaches consumers in optimal condition, maintaining freshness and nutritional value.

Furthermore, seafood packaging addresses major supply chain challenges. Notably, 30% of seafood is lost or wasted due to spoilage, according to recent statistics. Innovative packaging technologies are actively mitigating this loss by providing advanced sealing, temperature control, and anti-microbial features. As a result, companies are increasingly investing in research and development to reduce product wastage and optimize profits.

Meanwhile, government regulations strongly influence market dynamics. Many countries have implemented strict guidelines to ensure food safety, traceability, and environmental sustainability. For instance, in Norway, used EPS packaging has a certified return rate of 99%, according to EUMEPS. This reflects the country’s robust recycling infrastructure and the industry’s commitment to circular economy principles. Such frameworks encourage manufacturers to adopt recyclable and biodegradable materials.

Simultaneously, shifting consumer preferences are reshaping the seafood packaging landscape. According to Parcel Industry, 73% of U.S. consumers view compostable products as highly sustainable. This growing demand for eco-friendly packaging drives innovation in biodegradable films, bio-plastics, and paper-based solutions. Brands adopting sustainable packaging gain a competitive advantage by aligning with consumer values.

The global seafood packaging sector is also witnessing growth due to increasing seafood consumption and export activities. The U.S. Department of Agriculture’s FAS reported that U.S. Fish and Seafood Exports reached $4.93 billion in 2024, with final 2025 data pending. This export volume fuels demand for high-quality, export-compliant packaging solutions that ensure product integrity during long-distance transportation.

Moreover, government investments are fostering market expansion. Several nations are funding cold chain infrastructure, research grants for sustainable materials, and policies promoting seafood industry growth. Such initiatives create lucrative opportunities for packaging companies to develop advanced, compliant solutions tailored to both domestic and international markets.

Additionally, the rise of e-commerce and direct-to-consumer seafood delivery is accelerating demand for robust, leak-proof, and temperature-sensitive packaging. Players are introducing smart packaging technologies, including time-temperature indicators and QR code tracking, to ensure transparency and build consumer trust.

Key Takeaways

- The Global Seafood Packaging Market is projected to reach USD 24.9 Billion by 2034, from USD 15.3 Billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

- In 2024, Plastic dominated the By Material Analysis segment with a 65.3% market share due to its superior barrier properties and versatility.

- Fish led the By Seafood Type Analysis segment in 2024, holding a 58.9% share, driven by its global culinary popularity and consumption.

- Bags & Pouches captured the largest share in the By Product Type Analysis segment in 2024, with 39.7%, favored for their resealability and vacuum sealing properties.

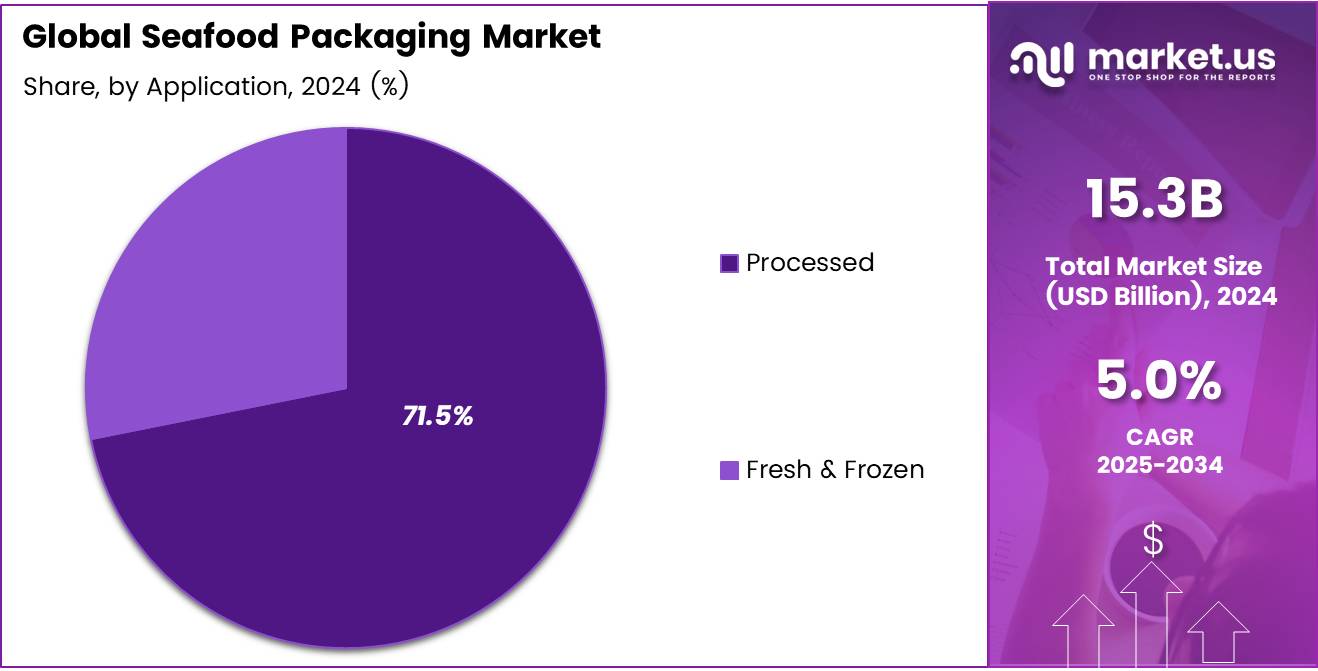

- In 2024, the Processed category held a dominant share of 71.5% in the By Application Analysis segment, driven by the demand for ready-to-eat seafood products.

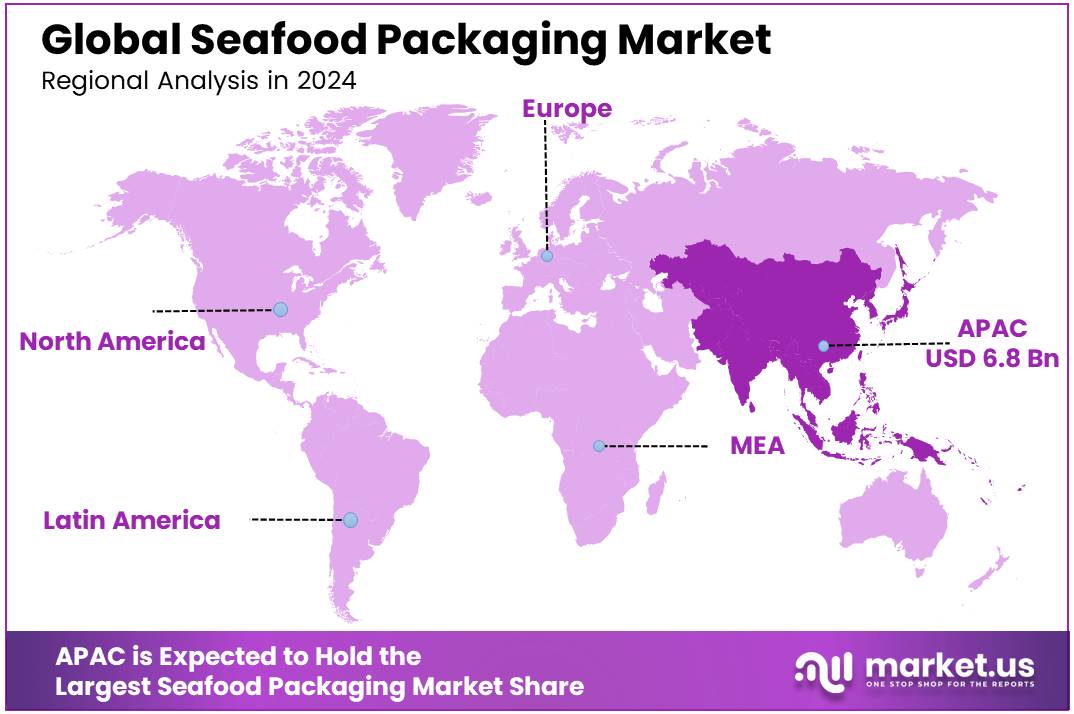

- The Asia Pacific region accounted for 44.9% of the seafood packaging market, valued at USD 6.8 Billion, due to strong manufacturing and increasing seafood consumption.

Material Analysis

Plastic dominates with 65.3% due to its durability and cost-efficiency.

In 2024, Plastic held a dominant market position in By Material Analysis segment of Seafood Packaging Market, with a 65.3% share. The superior barrier properties of plastic against moisture, oxygen, and contaminants make it a preferred choice for preserving seafood freshness over extended periods. Its versatility in shaping, sealing, and printing further enhances its adoption.

Paper packaging follows plastic due to growing environmental concerns. Its biodegradable nature and ease of recycling appeal to sustainability-focused consumers and businesses. Although its market share remains lower than plastic, paper is gradually gaining ground in eco-friendly niches.

Metal packaging, with its exceptional strength and airtight sealing capabilities, is widely used for canned seafood products. Its ability to offer extended shelf life without refrigeration supports its demand, though higher costs limit its widespread application compared to plastic.

The Others category, encompassing innovative materials like bioplastics and composites, represents emerging alternatives driven by regulatory pressures and consumer demand for green solutions. Although currently holding a smaller market share, ongoing innovations suggest potential growth in coming years.

Seafood Type Analysis

Fish dominates with 58.9% due to its broad consumption and processing versatility.

In 2024, Fish held a dominant market position in By Seafood Type Analysis segment of Seafood Packaging Market, with a 58.9% share. Fish remains the most widely consumed seafood category globally, leading to significant packaging demand across fresh, frozen, and processed segments. Its wide variety of species, coupled with global culinary popularity, sustains robust growth.

Molluscs, including clams, mussels, and oysters, contribute a substantial segment of the market. Their delicate texture and perishability demand specialized packaging solutions that maintain product integrity during transport and storage.

Crustaceans such as shrimp, crabs, and lobsters hold a competitive share as well. Their high export value and premium positioning drive the need for advanced packaging to preserve freshness and prevent contamination during long-distance shipping.

The Others category includes specialty seafood items such as sea urchins and cephalopods. Although niche, this segment benefits from premium packaging solutions designed for high-end markets and gourmet consumers, maintaining consistent demand in specialized regions.

Product Type Analysis

Bags & Pouches dominate with 39.7% driven by their flexibility and cost-effectiveness.

In 2024, Bags & Pouches held a dominant market position in By Product Type Analysis segment of Seafood Packaging Market, with a 39.7% share. Their lightweight design, resealability, and ability to support vacuum sealing make them ideal for preserving seafood freshness, extending shelf life, and reducing transportation costs.

Trays are widely used for fresh seafood displays in retail environments. They offer excellent product visibility, ease of stacking, and compatibility with modified atmosphere packaging (MAP) technologies, enhancing their appeal for retailers and consumers alike.

Cans remain essential for shelf-stable seafood products. Their ability to provide long-term storage without refrigeration sustains strong demand, especially in regions with limited cold-chain infrastructure.

Boxes play a critical role in bulk packaging and logistics. Their sturdy design supports the safe transportation of large seafood quantities, particularly for export and wholesale distribution.

Shrink Films offer a tight and protective layer around seafood products, ensuring minimal exposure to air and contaminants. Their usage is expanding, particularly in automated packaging lines, for both retail-ready and industrial seafood packaging.

The Others category includes emerging packaging formats addressing sustainability, branding, and advanced preservation techniques, showing gradual adoption in niche markets.

Application Analysis

Processed dominates with 71.5% driven by rising convenience food trends and global trade.

In 2024, Processed held a dominant market position in By Application Analysis segment of Seafood Packaging Market, with a 71.5% share. The growing demand for ready-to-eat, easy-to-prepare seafood products fuels the need for advanced processed seafood packaging solutions. These offerings cater to busy lifestyles, urbanization, and the expanding foodservice sector.

Fresh & Frozen seafood remains vital, serving consumers who prioritize quality and nutritional value. Advanced freezing techniques and innovative packaging solutions help maintain freshness, texture, and taste, supporting consistent growth in both domestic and export markets.

Both segments require high-performance packaging that ensures product safety, extends shelf life, and meets regulatory standards. However, the processed segment continues to lead due to its scalability, value addition, and broader market reach across diverse consumer demographics.

Key Market Segments

By Material

- Plastic

- Paper

- Metal

- Others

By Seafood Type

- Fish

- Molluscs

- Crustaceans

- Others

By Product Type

- Bags & Pouches

- Trays

- Cans

- Boxes

- Shrink Films

- Others

By Application

- Processed

- Fresh & Frozen

Drivers

Rising Adoption of Modified Atmosphere Packaging for Extended Shelf Life Drives Market Growth

The seafood packaging market is growing as companies increasingly use modified atmosphere packaging (MAP). This technique changes the air inside the package to slow down spoilage, helping seafood stay fresh for a longer time. This reduces waste and allows retailers to sell products over a longer period.

At the same time, more consumers are choosing sustainable and eco-friendly packaging. They prefer packaging made from biodegradable materials that are better for the environment. This shift encourages companies to invest in green packaging solutions that reduce plastic waste.

Global aquaculture production is also rising, which means more fish and seafood products are being produced worldwide. With this growth, there is higher demand for packaging that can keep seafood safe and fresh during export to different countries. Exporters rely on effective packaging solutions to maintain product quality throughout long transportation times.

As aquaculture grows and consumer preferences evolve, seafood packaging companies are focusing on innovation to meet both environmental concerns and market needs. This ongoing demand for advanced packaging solutions will likely continue to drive market growth.

Restraints

Limited Cold Chain Infrastructure in Developing Economies Restricts Market Growth

In many developing countries, the lack of proper cold chain infrastructure makes it hard to store and transport seafood at safe temperatures. Without reliable refrigeration during shipping and storage, seafood spoils quickly, limiting how far and wide these products can be distributed.

Another challenge comes from the packaging materials themselves. Many seafood packages use multi-layer or composite structures to keep products fresh. However, these materials are difficult to recycle because they contain different types of plastics and other components bonded together.

The complexity of recycling multi-layer packaging raises environmental concerns and increases costs for recycling facilities. As consumers and regulators push for more sustainable solutions, this recycling challenge becomes a growing issue for seafood packaging companies.

Together, weak cold chain infrastructure and recycling difficulties create significant obstacles for the seafood packaging market, especially in emerging regions. These barriers limit the potential market growth despite rising demand for seafood products worldwide.

Growth Factors

Development of Edible and Water-Soluble Packaging Formats Creates Growth Opportunities

Innovations in edible and water-soluble packaging are opening exciting new possibilities for seafood packaging. These formats allow consumers to eat or dissolve the packaging, reducing waste entirely. Such solutions appeal to environmentally conscious customers and align with global sustainability goals.

The growth of e-commerce also presents fresh opportunities for seafood packaging. As more consumers order seafood online, there is a rising need for secure, insulated, and easy-to-handle packaging that maintains product freshness during shipping.

Blockchain technology is becoming an important tool in seafood packaging as well. By integrating blockchain, companies can offer full traceability, giving consumers confidence in the origin, handling, and safety of the seafood they purchase. This transparency can build trust and improve brand reputation.

Furthermore, the growing demand for ready-to-eat and portion-controlled seafood packs supports packaging innovation. Consumers seek convenience and healthier meal options, which drives the need for smaller, well-sealed packages that are easy to store and prepare. These combined factors create strong growth opportunities for the seafood packaging industry.

Emerging Trends

Adoption of Antimicrobial Coatings to Prevent Contamination Fuels Market Trends

Seafood packaging is adopting antimicrobial coatings to stop bacteria and other microorganisms from growing on seafood products. These coatings help extend shelf life and improve safety, which is especially important for sensitive seafood items prone to contamination.

At the same time, companies are using transparent packaging to let consumers easily see the freshness of the seafood before buying. Clear packaging builds confidence and enhances the product’s visual appeal, making it more attractive on store shelves.

Technology is also playing a bigger role in packaging. Many companies are adding QR codes to their packages. These codes let consumers access information about the seafood’s origin, handling, and safety by simply scanning with their smartphones. This boosts engagement and trust.

Finally, vacuum skin packaging is gaining popularity. This method tightly seals seafood, preserving its texture, color, and flavor while preventing air exposure. These trends reflect how companies are combining safety, convenience, and innovation to meet evolving consumer demands in the seafood packaging market.

Regional Analysis

Asia Pacific Dominates the Seafood Packaging Market with a Market Share of 44.9%, Valued at USD 6.8 Billion

The Asia Pacific region holds the largest share of the seafood packaging market, accounting for 44.9%, with a market value of USD 6.8 Billion. The growing demand for packaged seafood, especially in countries like China and Japan, is driving the market. Additionally, increasing seafood consumption and strong manufacturing capabilities in the region contribute to its dominant position.

North America Seafood Packaging Market Trends

North America is a significant player in the seafood packaging market, with the U.S. being the primary driver due to a high demand for processed and packaged seafood. The region benefits from strong regulatory frameworks ensuring product safety and sustainability, which is fostering growth. The growing preference for convenience and ready-to-eat seafood products is also supporting market expansion.

Europe Seafood Packaging Market Trends

Europe holds a substantial share in the seafood packaging market, driven by increasing consumer demand for high-quality, sustainable seafood. The region’s focus on eco-friendly packaging solutions, particularly in countries like the UK, France, and Germany, is a key trend. Stringent environmental regulations also encourage the adoption of sustainable packaging materials.

Middle East and Africa Seafood Packaging Market Trends

The Middle East and Africa market for seafood packaging is witnessing steady growth, driven by an increasing appetite for imported seafood products in the region. The growing adoption of modern retail channels and the rise of supermarkets and hypermarkets are significantly contributing to the demand for packaged seafood. Additionally, the focus on improving food safety standards is promoting market expansion.

Latin America Seafood Packaging Market Trends

In Latin America, the seafood packaging market is experiencing moderate growth, with Brazil being a key contributor. As consumer preferences shift towards convenient, ready-to-eat seafood options, demand for innovative packaging solutions is increasing. Additionally, the rising export of seafood products to international markets is fueling the need for efficient and durable packaging.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Seafood Packaging Company Insights

In 2024, AEP Industries Inc. continues to play a pivotal role in the seafood packaging market, leveraging its robust portfolio of flexible films and bags. The company’s innovative solutions are tailored to meet the growing demand for sustainable and functional packaging materials in the seafood sector.

Amcor plc is another dominant player, known for its high-quality packaging solutions. The company has been focusing on developing eco-friendly alternatives, including recyclable and biodegradable packaging options, which resonate with the seafood market’s increasing demand for sustainability.

Berry Global maintains a strong presence with its diverse range of packaging solutions, catering to the seafood industry’s need for both durability and aesthetic appeal. The company’s continuous focus on innovation in product design and material technology has allowed it to remain competitive in this fast-evolving market.

Clondalkin Group is recognized for its extensive experience in producing flexible packaging, including for the seafood industry. The company’s sustainable packaging solutions and commitment to reducing carbon footprints make it a preferred partner for environmentally conscious seafood companies.

These companies are driving market growth through their commitment to innovative, sustainable solutions that align with consumer demand for both functionality and eco-friendliness in seafood packaging. Their continued investment in research and development is expected to enhance their positions in the market throughout 2024.

Top Key Players in the Market

- AEP Industries Inc.

- Amcor plc

- Berry Global

- Clondalkin Group

- Constantia Flexibles (Wendel)

- CoolSeal USA

- Coveris

- Crown

- DOW

- DS Smith

- DuPont USA

- FFP Packaging Ltd.

- Frontier Packaging

- Key Container

- Printpack

Recent Developments

- In March 2025, Kaldvík confirmed the acquisition of a fish box producer and a fish processing plant. This acquisition aims to expand its production capacity and enhance its supply chain capabilities in the seafood industry.

- In January 2025, Berlin Packaging acquired Rixius AG. The deal strengthens Berlin Packaging’s position in the European market, broadening its portfolio of packaging solutions for various industries.

- In March 2025, Cornelis Vrolijk completed the acquisition of a Dutch seafood processor. This strategic move is expected to reinforce Cornelis Vrolijk’s processing and distribution capabilities in the European seafood sector.

Report Scope

Report Features Description Market Value (2024) USD 15.3 Billion Forecast Revenue (2034) USD 24.9 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Paper, Metal, Others), By Seafood Type (Fish, Molluscs, Crustaceans, Others), By Product Type (Bags & Pouches, Trays, Cans, Boxes, Shrink Films, Others), By Application (Processed, Fresh & Frozen) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AEP Industries Inc., Amcor plc, Berry Global, Clondalkin Group, Constantia Flexibles (Wendel), CoolSeal USA, Coveris, Crown, DOW, DS Smith, DuPont USA, FFP Packaging Ltd., Frontier Packaging, Key Container, Printpack Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AEP Industries Inc.

- Amcor plc

- Berry Global

- Clondalkin Group

- Constantia Flexibles (Wendel)

- CoolSeal USA

- Coveris

- Crown

- DOW

- DS Smith

- DuPont USA

- FFP Packaging Ltd.

- Frontier Packaging

- Key Container

- Printpack