Global Temperature Controlled Packaging Solutions Market Size, Share, Growth Analysis By Product (Insulated Shipper, Insulated Container, Refrigerants), By Type (Passive Systems, Active Systems), By Application (Food & Beverages, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143834

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

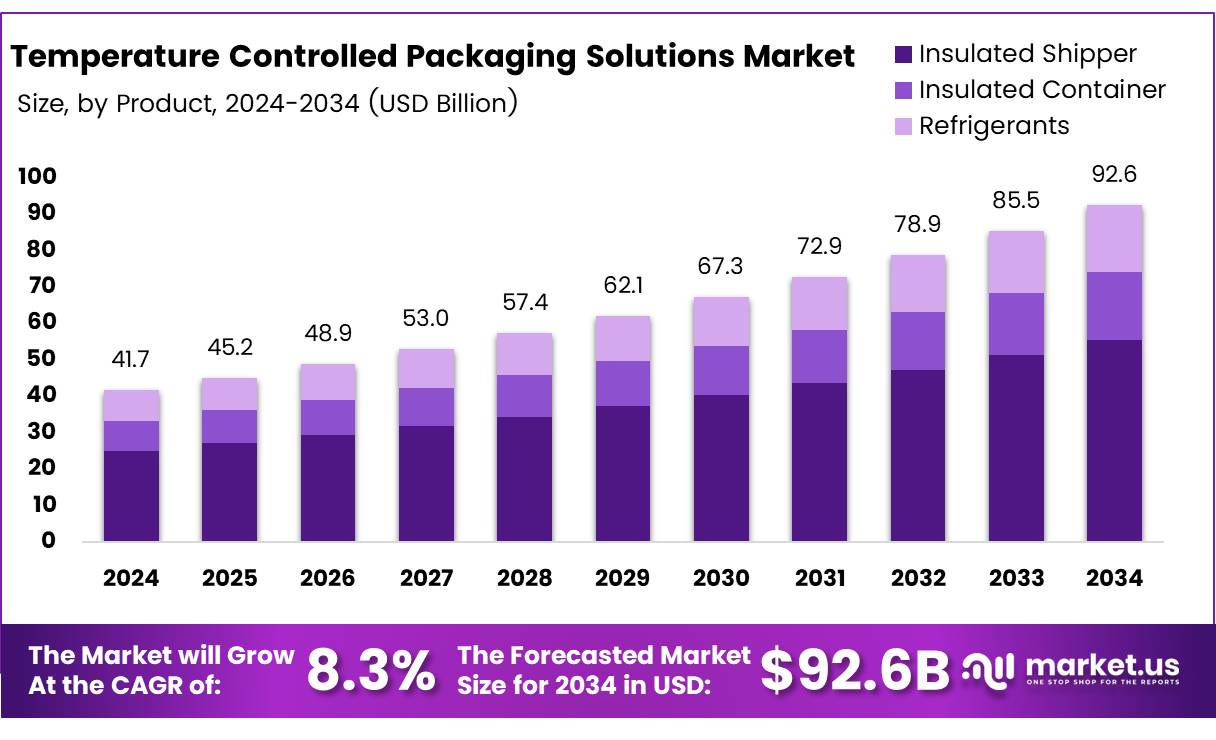

The Global Temperature Controlled Packaging Solutions Market size is expected to be worth around USD 92.6 Billion by 2034, from USD 41.7 Billion in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034.

The Temperature Controlled Packaging Solutions market is a vital segment within the logistics and packaging industries, primarily serving sectors that demand precise temperature control for the integrity of their products, such as pharmaceuticals, food and beverages, and cosmetics.

This market utilizes advanced materials and technologies to develop packaging solutions that maintain a controlled environment, thereby ensuring product quality during transit. The advent of biologics, growth in the cold chain logistics, and the increasing global trade of perishable products have notably driven the market’s expansion.

Temperature Controlled Packaging Solutions represent a critical innovation in maintaining product integrity and shelf life, especially in highly regulated industries like pharmaceuticals and food safety. With the ongoing enhancements in material science and cooling technology, these solutions are becoming more efficient and increasingly aligned with global sustainability trends.

Furthermore, the integration of IoT devices for real-time tracking and temperature monitoring is setting new standards in the industry, offering unprecedented control over logistics operations.

The market for Temperature Controlled Packaging Solutions is poised for substantial growth, driven by the expanding global pharmaceutical industry and the rising demand for quality perishable goods. Government investments in healthcare and food safety infrastructure, coupled with stringent regulations on product transportation conditions, have further catalyzed the development of more sophisticated packaging solutions.

According to Rocket Industrial, 82% of consumers across various age groups are willing to pay more for sustainable packaging, indicating a significant opportunity for companies to invest in eco-friendly materials and designs.

Additionally, a 2024 Forbes article highlighted that 32% of businesses saw an increase in revenue after enhancing their packaging strategies, underscoring the direct impact of effective temperature-controlled packaging on financial performance.

The regulatory landscape for Temperature Controlled Packaging Solutions is increasingly stringent, with governments worldwide enacting tougher standards to ensure the safety and efficacy of transported goods. This regulatory pressure compels companies to innovate continually, not only to comply with the laws but also to gain competitive advantage.

As firms strive to align with these regulations, they simultaneously address the growing consumer demand for sustainability, as evidenced by the 90% of Gen-Z consumers willing to pay more for such products, according to Meteor Space. The intersection of consumer preferences and regulatory requirements creates a fertile ground for strategic development and investment in the temperature controlled packaging solutions market.

Key Takeaways

- The global Temperature Controlled Packaging Solutions Market will reach USD 92.6 billion by 2034, with a CAGR of 8.3% (2025–2034).

- Insulated Shipper led the product segment, capturing a 47.3% market share in 2024.

- Passive Systems dominated the type segment in 2024 with a notable share of 64.2%, driven by their cost-effectiveness and reliability.

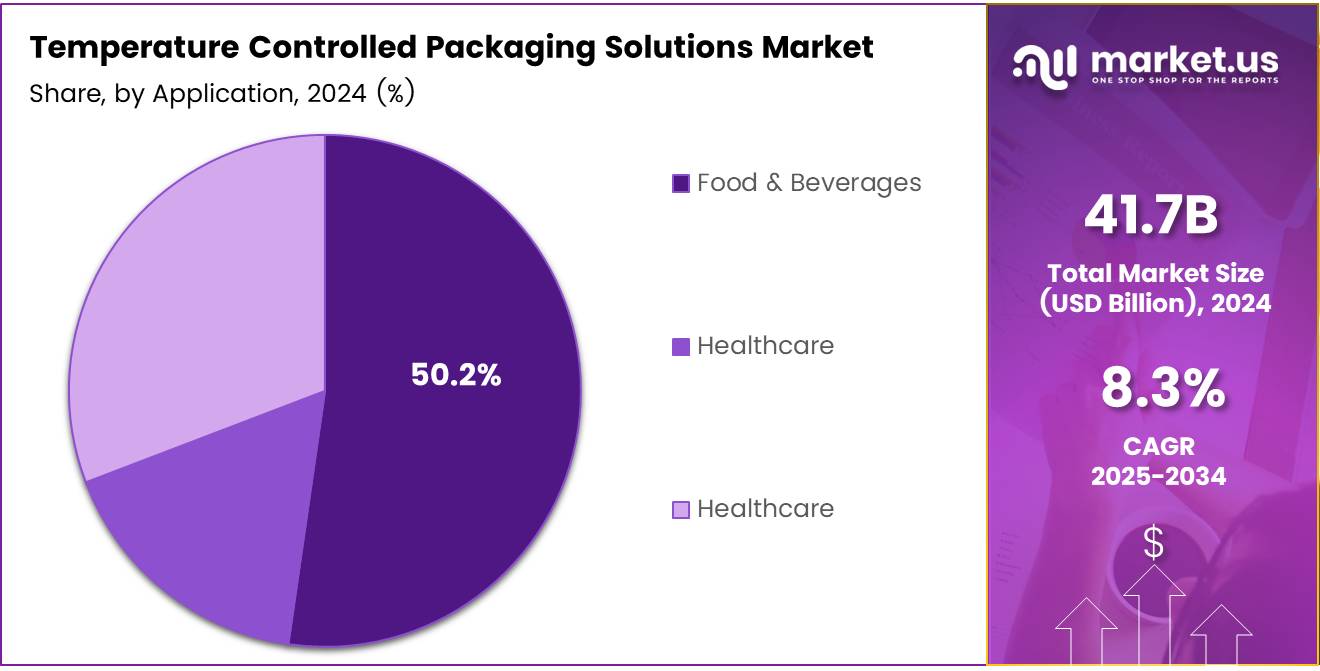

- Food & Beverages emerged as the largest application segment, holding a substantial 50.2% share in 2024.

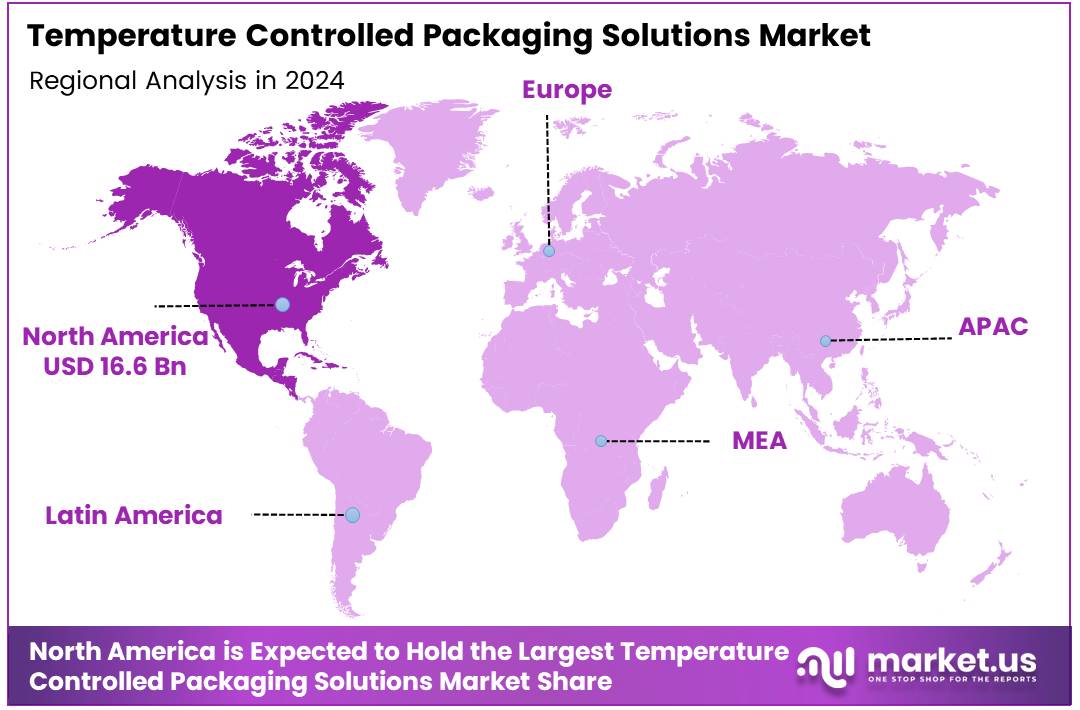

- North America held the largest regional market share of 40.5% in 2024, valued around USD 16.6 billion, due to robust pharmaceutical infrastructure and strict regulatory compliance.

Product Analysis

Insulated Shipper Leads with 47.3% in Temperature Controlled Packaging Solutions

In 2024, the Insulated Shipper maintained a leading position within the By Product Analysis segment of the Temperature Controlled Packaging Solutions Market, commanding a 47.3% share. This segment has seen substantial growth due to the increasing demand for reliable and efficient solutions for transporting temperature-sensitive goods.

Insulated shippers, known for their cost-effective and robust thermal protection, are preferred in industries such as pharmaceuticals, food and beverages, and biotechnology, where maintaining precise temperature control is critical.

The Insulated Container follows closely, offering enhanced durability and longer thermal resistance, ideal for long-distance and international shipments. These containers are engineered to handle a variety of environmental conditions, making them indispensable for global logistics operations.

Refrigerants play a vital role by maintaining the required temperatures within packaging solutions. Advanced refrigerant solutions, including phase change materials and dry ice, are increasingly adopted to improve the efficiency of temperature control, particularly in extreme conditions and over extended periods.

Together, these products form a comprehensive suite of solutions that address the diverse needs of the temperature-controlled logistics market, highlighting the importance of innovation and customization in sustaining market growth and meeting consumer expectations.

Type Analysis

Passive Systems Lead the Charge with 64.2% Market Share in Temperature Controlled Packaging

In 2024, the Temperature Controlled Packaging Solutions Market witnessed a significant dominance by Passive Systems in the By Type Analysis segment, securing a 64.2% share. This commanding presence is attributed to the systems’ cost-efficiency and reliability in maintaining required temperatures without external energy inputs.

Passive systems, utilizing advanced insulating materials and gel packs, have proven indispensable in the pharmaceutical and biologics sectors, where maintaining product integrity during transit is critical.

On the other hand, Active Systems, though they account for a smaller portion of the market, play a crucial role in scenarios requiring precise temperature controls over extended periods. These systems, equipped with electric or battery-powered energy sources, offer adjustable control mechanisms that are vital for sensitive and high-value products.

Both technologies are pivotal in the broader strategy of companies looking to minimize risk and ensure compliance with increasingly stringent global regulations on product transportation. The ongoing advancements and investments in material science and cooling technologies are expected to drive further efficiencies in this market, potentially reshaping competitive dynamics in upcoming years.

Application Analysis

Temperature Controlled Packaging Thrives in Food & Beverages Sector with 50.2% Market Share

In 2024, the Food & Beverages sector significantly outpaced other applications in the Temperature Controlled Packaging Solutions Market, seizing a commanding 50.2% share. This segment encompasses a diverse range of products including grocery items, chocolates, both alcoholic and non-alcoholic beverages, dairy products, and perishable proteins such as fish, meat, and seafood.

The critical need for maintaining specific temperature ranges during transportation to ensure freshness and compliance with safety standards drives this substantial market uptake. The robust demand highlights the sector’s reliance on advanced packaging solutions that can effectively manage temperature fluctuations, crucial for preserving taste, texture, and nutritional value.

Meanwhile, the Healthcare segment also leverages these packaging solutions, particularly for pharmaceuticals, blood supplies, clinical trials, drug testing, pathology, and organ transplantation. This application is essential for the integrity and efficacy of medical products and biological materials, where even minor deviations in temperature can compromise quality and safety.

The Others category, which includes various industrial and consumer goods requiring temperature control, continues to explore and integrate these packaging technologies to enhance product longevity and quality, further broadening the market landscape.

Key Market Segments

By Product

- Insulated Shipper

- Insulated Container

- Refrigerants

By Type

- Passive Systems

- Active Systems

By Application

- Food & Beverages

- Grocery

- Chocolates

- Non-Alcoholic Beverages

- Alcoholic Beverages

- Dairy Products

- Fish, Meat, and Seafood

- Healthcare

- Pharmaceuticals

- Blood

- Clinical Trials

- Drug Testing

- Pathology

- Organ Transplantation

- Others

Drivers

Rising Demand for Perishable Goods Spurs Growth in Temperature-Controlled Packaging Solutions

In the rapidly evolving market for temperature-controlled packaging solutions, several key factors are driving significant growth. The increasing global appetite for perishable goods, including foods, pharmaceuticals, and biological products, necessitates advanced packaging solutions that maintain critical temperature levels throughout transportation, ensuring product safety and integrity.

This demand is further amplified by the burgeoning pharmaceutical sector, where the distribution of temperature-sensitive vaccines and medications continues to expand, necessitating robust, reliable packaging.

Additionally, stringent regulatory standards worldwide mandate the use of effective temperature-controlled packaging to comply with safety protocols for transporting sensitive products. The expansion of e-commerce also plays a crucial role, as it requires innovative packaging solutions capable of preserving product quality across a broader range of goods, from groceries to healthcare items.

Together, these factors synergistically propel the temperature-controlled packaging solutions market forward, addressing both emerging needs and regulatory requirements.

Restraints

Environmental Concerns May Hinder Growth in the Temperature-Controlled Packaging Solutions Market

Environmental concerns are significant restraints in the temperature-controlled packaging solutions market. The extensive use of disposable packaging materials and various refrigerants in these systems raises sustainability challenges and attracts stringent regulatory scrutiny.

These packaging solutions are crucial for maintaining the integrity of temperature-sensitive products during storage and transport. However, their environmental footprint, stemming from waste and potential pollution, is increasingly problematic. This aspect is particularly pressing as both consumers and regulatory bodies push for more environmentally friendly practices and materials.

Such environmental pressures are poised to limit market expansion unless innovative, sustainable alternatives are developed and adopted widely. This tension between necessity and sustainability defines a key battleground for the future of this market.

Growth Factors

Embracing Biodegradable Innovations for Sustainable Growth in Temperature Controlled Packaging

In the rapidly evolving temperature controlled packaging solutions market, a prominent growth opportunity lies in the innovation of biodegradable materials. This strategic shift caters to the increasing environmental awareness and tightening regulations, which demand more sustainable packaging options.

By developing packaging solutions that are not only effective in maintaining temperature integrity but also environmentally friendly, companies can distinguish themselves in a competitive market. Such innovations are expected to attract businesses that are committed to sustainability, offering a significant competitive edge.

Additionally, these biodegradable solutions help reduce waste and the ecological footprint of logistics, aligning with global efforts towards sustainability. This approach not only meets market demands but also positions companies as responsible and forward-thinking, potentially unlocking new customer segments and enhancing brand loyalty.

Emerging Trends

Embracing Sustainability Drives Demand for Temperature-Controlled Packaging Solutions

In the temperature-controlled packaging solutions market, a notable shift toward sustainability is steering the industry’s trajectory. This trend is fueled by heightened consumer consciousness and stricter regulatory mandates promoting the use of environmentally friendly materials. Companies are increasingly integrating reusable and recyclable components in their packaging designs to cater to this growing demand.

Alongside sustainability, technological advancements are playing a critical role in the market’s evolution. Technologies such as blockchain are enhancing transparency in supply chains, while artificial intelligence aids in predictive analytics, optimizing logistics efficiency.

Moreover, the complexity of healthcare logistics continues to grow, with a rising need for sophisticated packaging solutions to handle sensitive biologics and specialty pharmaceuticals that require stringent temperature control.

Additionally, rapid urbanization and lifestyle shifts are boosting the demand for convenience foods and personal care products, which often necessitate controlled temperature conditions during transport, further expanding the market for innovative packaging solutions.

Regional Analysis

North America Leads Temperature Controlled Packaging Solutions Market with 40.5% Share

The Temperature Controlled Packaging Solutions Market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each displaying unique market dynamics and growth potential.

North America dominates the market, holding a significant 40.5% share, which is valued at approximately USD 16.6 billion. This dominance can be attributed to robust pharmaceutical and biotechnology sectors, stringent regulations regarding the shipment of biologics, and a well-established cold chain infrastructure. The region’s focus on sustainable and advanced packaging solutions also drives the adoption of innovative temperature-controlled packaging.

Regional Mentions:

Europe follows, with a strong emphasis on regulatory compliance and the presence of prominent pharmaceutical and food export industries. Advanced logistics and transportation facilities further bolster the region’s capacity to manage sensitive products requiring temperature control. The market in Europe is characterized by high demand for both active and passive temperature-controlled packaging systems.

The Asia Pacific region is witnessing rapid growth due to expanding pharmaceutical manufacturing and export, particularly in countries like China and India. Rising consumer demand for perishable food products and healthcare products in Asia Pacific is expected to significantly drive the market. The region benefits from improvements in logistics infrastructure and an increase in cross-border trade activities.

The Middle East & Africa, and Latin America regions, though smaller in comparison, are experiencing growth due to rising healthcare expenditures and the increasing need for food preservation. In these regions, the market is gradually adopting more sophisticated temperature-controlled solutions to meet the global standards of product safety and quality.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global temperature controlled packaging solutions market is poised for significant growth, driven by expanding regulatory demands and the increasing global distribution of temperature-sensitive pharmaceuticals and perishables. Among the prominent players in this sector, companies like Cold Chain Technologies, CSafe, and Deutsche Post DHL Group are expected to maintain their leadership through innovative and sustainable packaging solutions.

Cold Chain Technologies is anticipated to continue its trajectory as a frontrunner, capitalizing on its robust portfolio of validated temperature assurance solutions. The company’s continued investment in R&D and its strategic expansions into emerging markets are likely to strengthen its market position.

CSafe, known for its active temperature control containers, is expected to expand its reach and capabilities, particularly in the biopharma sector. The integration of advanced technologies for real-time monitoring and IoT solutions is projected to enhance its offerings, thereby increasing its attractiveness to global pharmaceutical companies.

AmerisourceBergen Corporation, leveraging its extensive distribution network, is poised to enhance its role in the market by integrating more advanced temperature-controlled logistics solutions. This integration aims to address the growing complexities in pharmaceutical supply chains, particularly with the increase in biologics and vaccines that require stringent temperature control.

Meanwhile, Deutsche Post DHL Group is set to leverage its global logistics network to offer comprehensive temperature-controlled logistics solutions. The company’s focus on sustainability and reducing carbon footprint in logistics is expected to resonate well with environmentally conscious clients, thereby supporting its growth in this market.

Top Key Players in the Market

- Cold Chain Technologies

- CSafe

- AmerisourceBergen Corporation

- DGR PACKAGING & SUPPLY PTE LTD

- Cryopak Industries Inc.

- APEX Packaging Corporation

- Valor Industries

- TPC Packaging Solutions

- Inbox Solutions

- PCI Pharma Services

- Deutsche Post DHL Group

- Envirotainer

- Sonoco Products Company

- Aeris

- DGP Intelsius

- Safe Box

Recent Developments

- In March 2025, Vytal Global secured €14.2 million to enhance and expand its technology-driven reusable packaging solutions. This funding aims to boost sustainability and reduce packaging waste across various sectors.

- In February 2025, Pulpex announced a £62 million Series D funding round to accelerate the commercialization of its innovative sustainable packaging technologies. The investment supports further development and scaling of eco-friendly paper-based bottles.

- In March 2025, Scotland received £9 million in funding to develop advanced power packaging solutions aimed at improving energy efficiency and sustainability. The funds are intended to support innovation in smart packaging technologies.

- In January 2025, PEC Packaging secured £2.5 million in funding from Skipton Business Finance to expand operations and enhance production capabilities. This investment is targeted towards improving efficiency and increasing competitiveness in sustainable packaging solutions.

Report Scope

Report Features Description Market Value (2024) USD 41.7 Billion Forecast Revenue (2034) USD 92.6 Billion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Insulated Shipper, Insulated Container, Refrigerants), By Type (Passive Systems, Active Systems), By Application (Food & Beverages, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cold Chain Technologies, CSafe, AmerisourceBergen Corporation, DGR PACKAGING & SUPPLY PTE LTD, Cryopak Industries Inc., APEX Packaging Corporation, Valor Industries, TPC Packaging Solutions, Inbox Solutions, PCI Pharma Services, Deutsche Post DHL Group, Envirotainer, Sonoco Products Company, Aeris, DGP Intelsius, Safe Box Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Temperature Controlled Packaging Solutions MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Temperature Controlled Packaging Solutions MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cold Chain Technologies

- CSafe

- AmerisourceBergen Corporation

- DGR PACKAGING & SUPPLY PTE LTD

- Cryopak Industries Inc.

- APEX Packaging Corporation

- Valor Industries

- TPC Packaging Solutions

- Inbox Solutions

- PCI Pharma Services

- Deutsche Post DHL Group

- Envirotainer

- Sonoco Products Company

- Aeris

- DGP Intelsius

- Safe Box