Global Metal Packaging Market Size, Share, Growth Analysis By Material (Aluminum, Steel), By Product Type (Cans, Barrels & Drums, Caps & Closures, Others), By End Use (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Paints & Varnishes, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143447

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

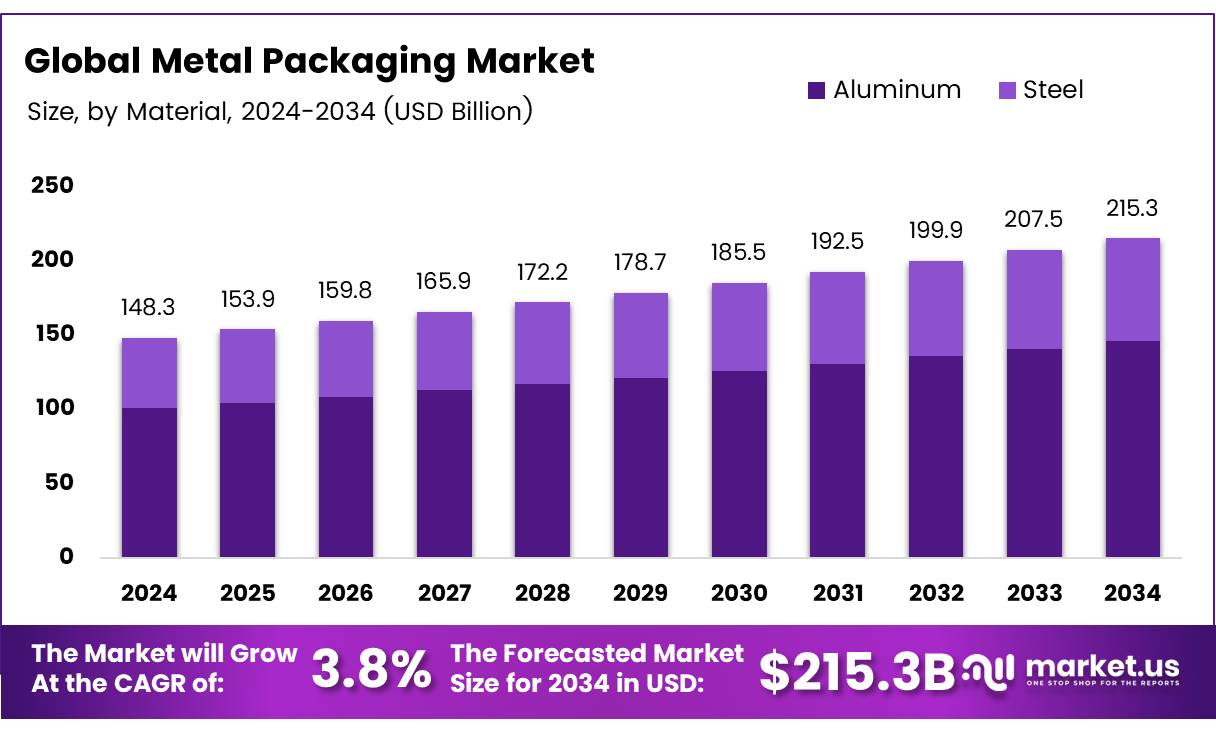

The Global Metal Packaging Market size is expected to be worth around USD 215.3 Billion by 2034, from USD 148.3 Billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

Metal packaging constitutes a critical segment within the packaging industry, known for its durability, recyclability, and sustainability. Comprising primarily steel and aluminum, this market caters extensively to the food, beverage, personal care, and pharmaceutical sectors, among others.

According to industry sources, metal packaging enjoys high recycling rates, contributing significantly to environmental sustainability. Metal Packaging Europe highlights that 80.5% of steel packaging and 76% of aluminum beverage cans are recycled in Europe, underscoring metal as the most recycled packaging material.

The global landscape of metal packaging is driven by its robust nature and the increasing consumer demand for sustainable packaging solutions. As reported by Nam Viet Packaging, approximately 400 million tonnes of scrap metal are recycled annually worldwide. This high recyclability rate not only supports global sustainability efforts but also enhances the circular economy in the packaging sector.

The metal packaging market is poised for growth, propelled by several key factors. The increasing governmental focus on sustainable packaging solutions has led to heightened regulatory measures that favor materials with high recyclability, such as metal.

In Europe, the recycling achievements for metal packaging are particularly notable, with aluminum beverage can recycling reaching a record 510,000 tonnes, saving an estimated 4.2 million tonnes of CO2eq annually, according to UNESDA.

This regulatory environment, coupled with growing consumer awareness regarding environmental impact, presents significant growth opportunities for the metal packaging industry. Companies are increasingly leveraging advanced technologies to enhance the recyclability of metal packages and minimize the ecological footprint of their packaging solutions. The commitment to sustainability is not only a regulatory compliance measure but also a substantial market differentiator in the increasingly eco-conscious global market.

Government policies play a crucial role in shaping the metal packaging market. Investments in recycling infrastructure and the imposition of stringent environmental regulations are driving the adoption of sustainable packaging materials. The high recycling rates reported by Metal Packaging Europe and UNESDA reflect the successful integration of policy measures with industry practices.

These regulatory frameworks are designed to reduce waste and promote the use of materials that can be effectively recycled, thereby supporting the sustainability goals of various nations. The metal packaging industry benefits from these policies, as they not only help in maintaining ecological balance but also bolster market growth through increased consumer trust and preference for sustainable products.

Key Takeaways

- Global Metal Packaging Market is projected to grow from USD 148.3 Billion in 2024 to USD 215.3 Billion by 2034, at a CAGR of 3.8%.

- Aluminum dominates the material segment with a 66.3% share in 2024, favored for its light weight, corrosion resistance, and recyclability.

- Cans are the leading product type, holding a 50.2% market share in 2024, due to their extensive use in food, pharmaceuticals, and personal care industries.

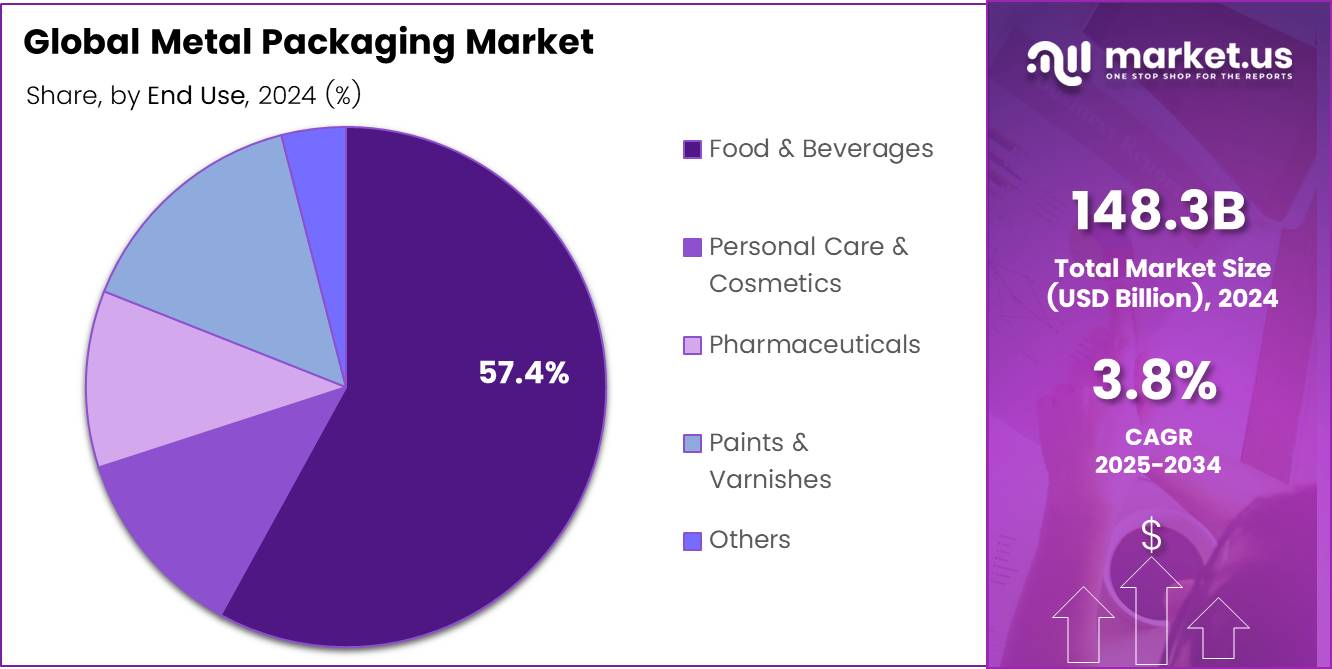

- The Food & Beverages sector is the largest end user, commanding 57.4% of the market in 2024, driven by the need for durable and sustainable packaging.

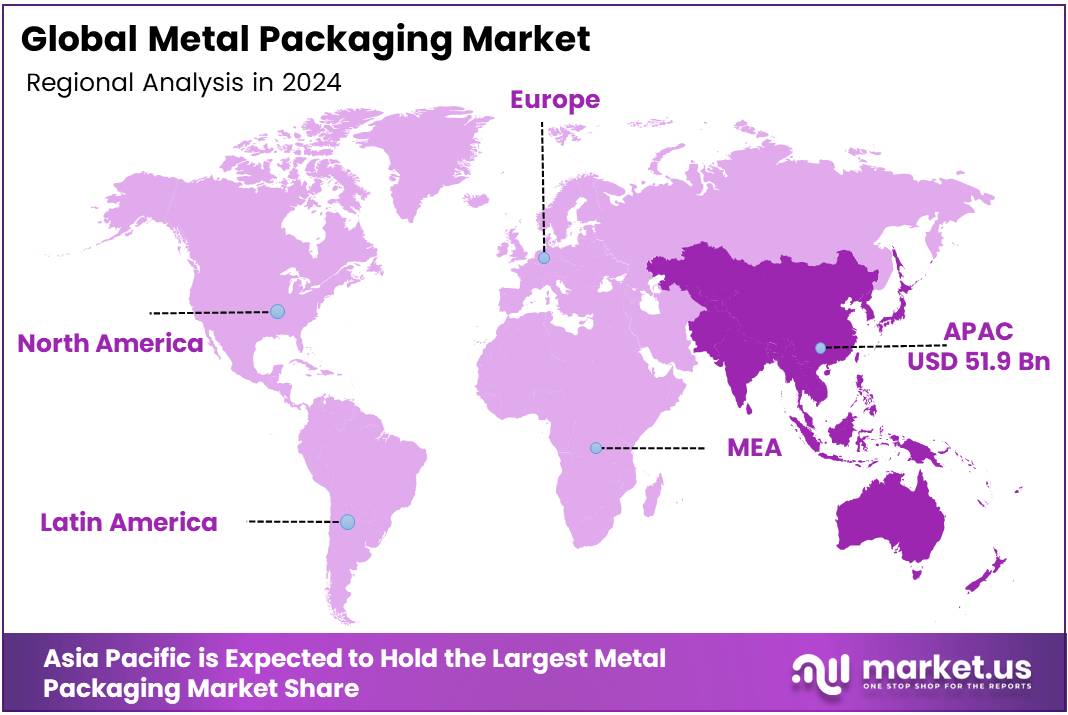

- Asia Pacific is the leading region in the metal packaging market, holding a 35.7% share valued at USD 51.9 billion.

Material Analysis

Aluminum Emerges as Leader with 66.3% Market Share in Metal Packaging Materials

In 2024, Aluminum held a dominant market position in the By Material Analysis segment of the Metal Packaging Market, securing a 66.3% share. This substantial market presence can be attributed to aluminums unique properties, including its lightweight nature, resistance to corrosion, and complete recyclability. These characteristics make aluminum an environmentally friendly option, appealing to industries aiming to reduce their environmental footprint while ensuring product durability.

Conversely, steel, utilized in various packaging applications, accounted for a significant portion of the market. Its use is driven by its robustness and ability to protect goods from contamination, making it indispensable in the food and medical sectors. However, the preference for aluminum is reinforced by its versatility and lower energy consumption during recycling, aligning with global sustainability trends.

Both materials play crucial roles in the Metal Packaging Market, but aluminums advantages in sustainability and efficiency give it a competitive edge, as reflected in its majority market share. As industries continue to prioritize eco-friendly practices, aluminums prominence in the market is expected to grow, underscoring its pivotal role in shaping sustainable packaging solutions.

Product Type Analysis

Cans Lead with 50.2 Market Share in Metal Packaging

In 2024, cans held a dominant market position in the By Product Type Analysis segment of the Metal Packaging Market, securing a 50.2% share. This predominant status can be attributed to their widespread application across numerous industries including food and beverage, pharmaceuticals, and personal care.

The resilience and recyclability of cans further bolster their appeal, aligning with increasing consumer and regulatory demands for sustainable packaging solutions.

Following cans, barrels and drums accounted for a significant portion of the market. These containers are primarily utilized for bulk storage and transport of liquids and granular materials, benefiting from their durability and capacity to handle large volumes.

Caps and closures also play a crucial role in the metal packaging industry. They are essential for ensuring product integrity and safety, and their design innovations have enhanced their utility across various packaging types.

The Others category, which includes various forms of small containers and specialty packaging, captures the remainder of the market. This segment benefits from niche applications where specific customization and protective qualities are required.

End Use Analysis

Food & Beverages Sector Leads with 57.4% in End-Use Analysis

In 2024, the Food & Beverages sector maintained a commanding presence in the Metal Packaging Market, capturing 57.4% of the market share in the By End Use Analysis segment. This significant share can be attributed to the sectors stringent requirements for sustainable and durable packaging solutions that ensure product safety and extend shelf life.

Metal packaging, favored for its robustness and excellent barrier properties, aligns well with the industrys needs, offering protection against contaminants and light, thereby preserving the nutritional quality and flavor of food products.

The Personal Care & Cosmetics segment also leveraged metal packaging, driven by consumer preferences for eco-friendly and recyclable packaging options. This trend reflects the sectors ongoing commitment to sustainability and its impact on purchasing decisions.

In the Pharmaceuticals sector, metal packaging’s role is underscored by its critical function in protecting sensitive medical products from environmental factors, thereby ensuring their efficacy and safety for end users.

The Paints & Varnishes industry continues to rely on metal packaging for its superior protection against air and moisture, which can significantly affect product stability and quality.

Other industries, including chemicals and agro-based sectors, also utilize metal packaging to enhance the safety and integrity of their products, benefiting from its durability and recyclability. This widespread adoption across various sectors underscores the versatile and pivotal role of metal packaging in meeting diverse industry requirements.

Key Market Segments

By Material

- Aluminum

- Steel

By Product Type

- Cans

- Barrels & Drums

- Caps & Closures

- Others

By End Use

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Paints & Varnishes

- Others

Drivers

Rising Demand in the Food & Beverage Industry Fuels Metal Packaging Market Growth

The growth of the metal packaging market can be attributed primarily to the expanding food and beverage industry, where there is a rising demand for packaged products, including canned and bottled goods. Technological advancements in metal packaging, such as improved durability, innovative designs, and enhanced sealing methods, have further increased the attractiveness of metal containers.

These containers offer superior protection and preservation, extending the shelf life of food and beverage products significantly. Additionally, factors like increasing disposable incomes and urbanization are contributing to greater consumption of packaged goods.

This shift has led to a heightened demand for metal packaging solutions across rapidly urbanizing regions, reflecting a broader trend of growing middle-class populations who favor convenience and quality in consumer goods.

Restraints

Environmental Concerns Slow Metal Packaging Market Growth

The metal packaging market faces significant restraints primarily due to the environmental impact of metal mining. The process of extracting metals involves activities that can significantly harm the environment, which becomes a crucial concern as sustainability becomes a central priority for consumers and regulatory bodies. This shift towards environmentally friendly practices could reduce the demand for metal packaging solutions, impacting market growth.

Additionally, the market’s expansion is challenged by the presence of alternative packaging materials such as plastic, glass, and paper-based options. These materials often offer cost-effective and lighter packaging solutions that are attractive to manufacturers seeking to reduce expenses and meet consumer preferences for convenience and sustainability.

As a result, the competitive pressure from these alternatives may further restrict the growth opportunities for metal packaging, compelling companies in this sector to innovate and possibly explore more sustainable metal sourcing and production techniques.

Growth Factors

Expansion in Emerging Markets Drives Metal Packaging Market Growth

The metal packaging market is poised for substantial growth, particularly in emerging markets like India, China, and Africa, where the rapid urbanization and burgeoning middle class are escalating demand across food, beverage, and personal care industries. This expansion is further fueled by a rising consumer inclination towards sustainable and eco-friendly packaging solutions, making metal an attractive option due to its recyclability and durability.

Moreover, the integration of smart packaging technologies that enhance product monitoring for quality and freshness offers a significant leap forward for metal packaging applications. Additionally, there is an increasing opportunity for customization and design innovation within metal packaging to meet specific branding and marketing needs of companies, thereby enhancing consumer appeal and differentiation in crowded markets.

These trends collectively signal robust opportunities for growth and innovation within the metal packaging sector, positioning it as a key player in the global push towards sustainable and advanced packaging solutions.

Emerging Trends

Increasing Demand for Sustainable Packaging Drives Metal Packaging Market Growth

The metal packaging market is experiencing significant growth, primarily influenced by the rising demand for sustainable and green packaging solutions. This trend is driven by consumers’ increasing awareness of environmental issues and their preference for recyclable materials, including metal.

Concurrently, the industry is witnessing a shift toward lightweight metal packaging, especially in the beverage sector, aimed at reducing material usage, transportation costs, and overall carbon footprint. The expansion of e-commerce has further propelled the need for robust and secure packaging, prompting advancements in metal packaging to enhance durability and protection.

Additionally, innovations in coating and printing technologies are enabling more intricate designs and improved functionality, making metal packaging an increasingly attractive option for businesses seeking both aesthetic appeal and environmental responsibility.

Regional Analysis

Asia Pacific Leads Metal Packaging Market with 35.7% Share, Valued at USD 51.9 Billion Due to High Demand for Sustainable Packaging

The metal packaging market is segmented into various regions, each exhibiting distinct growth patterns and market dynamics. Among these, Asia Pacific emerges as the dominating region, commanding a substantial 35.7% market share with a valuation of USD 51.9 billion. This robust performance can be attributed to the rising consumer demand for sustainable and recyclable packaging solutions, coupled with rapid industrialization and urbanization across major economies such as China, India, and Japan.

Regional Mentions:

In North America, the market is driven by stringent regulations regarding sustainable packaging materials and a significant shift toward canned food products among consumers. Technological advancements in metal packaging techniques, such as lightweight packaging and improved barrier properties, also contribute to market growth in this region.

Europe’s metal packaging market benefits from a well-established food and beverage industry, which demands high-quality, durable packaging solutions. The region’s focus on reducing plastic waste has further propelled the adoption of metal packaging, supported by favorable government policies and consumer awareness regarding environmental sustainability.

The Middle East & Africa region shows promising growth potential, largely due to the increasing consumption of canned foods and beverages. The market in this region is expected to expand as economies stabilize and consumer spending power increases. Packaging innovations and investments in food processing industries are key drivers behind this growth.

Latin America’s market is witnessing gradual growth with an increasing emphasis on sustainable packaging solutions. The expansion of the food and beverage sector, along with rising consumer awareness about health and hygiene, particularly in countries like Brazil and Mexico, supports the adoption of metal packaging in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global metal packaging market is set to witness considerable growth in 2024, driven by increasing consumer demand for sustainable packaging solutions and the durability offered by metal packaging. Key players in this market are pivotal to shaping industry dynamics through innovative strategies and expansive product offerings.

Trivium Packaging stands out with its strong focus on sustainability and innovative design. The company’s commitment to recyclable products is likely to resonate well with the growing eco-conscious consumer base, potentially boosting its market share.

Ball Corporation is another significant contender, renowned for its extensive expertise in aluminum can production. Its global footprint and continuous investment in technology and capacity expansion are expected to enhance its competitive edge and address the surging demand effectively.

Crown Holdings, Inc. continues to lead with its diverse product portfolio, including food cans, aerosol cans, and metal closures. The company’s strategic global placements of manufacturing units facilitate rapid supply chain responses, thereby supporting swift market adaptations.

Sonoco Products Company and Silgan Holdings are key players in the food and beverage sector, with Sonoco excelling in flexible packaging and Silgan in leadership within metal food containers. Both companies are well-positioned to leverage their specialized capabilities to meet industry demands.

Ardagh Group SA and Mauser Packaging Solutions focus on broad product lines in food, beverage, and industrial applications, emphasizing robust and recyclable packaging solutions that align with global sustainability trends.

CCL Containers and DS Containers demonstrate strong capabilities in aerosol and general line packaging, which are critical for personal care and industrial applications.

Grief and Hindustan Tin Works Ltd., along with CANPACK, reflect a strategic focus on regional growth and capacity enhancements to cater to specific market needs effectively, particularly in emerging economies.

Top Key Players in the Market

- Trivium Packaging

- Ball Corporation

- Crown Holdings, Inc.

- Sonoco Products Company

- Silgan Holdings

- Ardagh Group SA

- Mauser Packaging Solutions

- CCL Containers

- DS Containers

- Grief

- Hindustan Tin Works Ltd

- CANPACK

Recent Developments

- In February 2025, the Massilly Group announced its acquisition of Hoffman Neopac’s Tin Business, a strategic move intended to diversify its product offerings and strengthen its position in the global packaging industry.

- In June 2024, Sonoco successfully acquired a European metal packaging platform for $3.9 billion, expanding its footprint and capabilities in the European market. This strategic move aims to enhance Sonoco’s product offerings and market reach.

- In October 2024, Sherwin-Williams acquired Henkel’s Metal Packaging Coatings business, a step that bolsters its portfolio in the coatings sector and reinforces its position as a market leader in industrial coatings.

- In December 2024, Sonoco completed the acquisition of Eviosys for €3.6 billion, marking a significant expansion in its capabilities and reinforcing its market presence in Europe through advanced metal packaging solutions.

Report Scope

Report Features Description Market Value (2024) USD 148.3 Billion Forecast Revenue (2034) USD 215.3 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Aluminum, Steel), By Product Type (Cans, Barrels & Drums, Caps & Closures, Others), By End Use (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Paints & Varnishes, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trivium Packaging, Ball Corporation, Crown Holdings, Inc., Sonoco Products Company, Silgan Holdings, Ardagh Group SA, Mauser Packaging Solutions, CCL Containers, DS Containers, Grief, Hindustan Tin Works Ltd, CANPACK Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Trivium Packaging

- Ball Corporation

- Crown Holdings, Inc.

- Sonoco Products Company

- Silgan Holdings

- Ardagh Group SA

- Mauser Packaging Solutions

- CCL Containers

- DS Containers

- Grief

- Hindustan Tin Works Ltd

- CANPACK