Global Point Of Purchase Packaging Market Size, Share, Growth Analysis By Product (Pallet display, Gravity free display, Dump bin displays, Clip Strip Displays, Sidekick display, Counter display, Floor display), By Material (Paper, Metal, Glass, Foam, Plastic), By End Use (Food & Beverages, Pharmaceuticals, Electronics, Automotive, Personal care, Others), By Distribution Channel(Hypermarket, Supermarket, Convenience Store, Departmental stores, Specialty stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143126

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

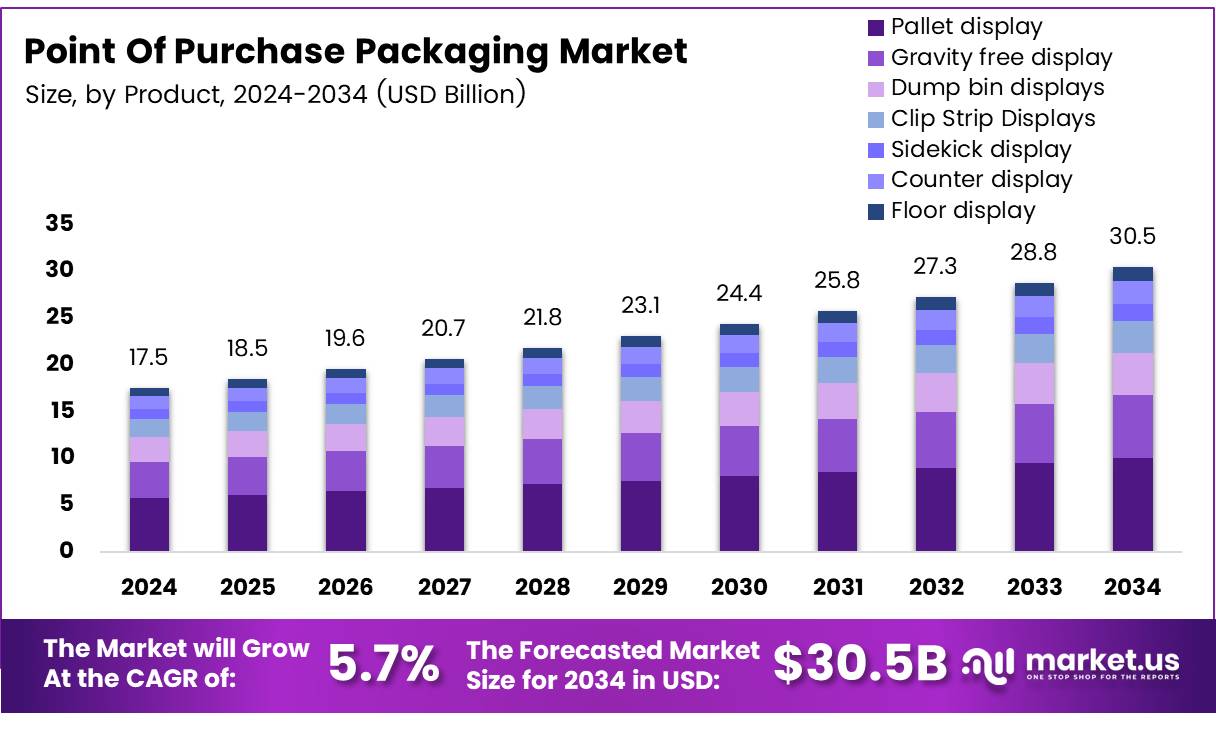

The Global Point Of Purchase Packaging Market size is expected to be worth around USD 30.5 Billion by 2034, from USD 17.5 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The Point Of Purchase (POP) Packaging Market comprises solutions specifically designed to enhance the visibility and attractiveness of products directly at their point of sale. This market is instrumental in influencing consumer purchasing decisions through innovative and strategic packaging designs that not only draw attention but also communicate brand values efficiently. POP packaging includes display stands, countertop displays, hanging signs, and interactive stations, among others.

POP packaging serves as a crucial marketing tool that directly impacts consumer behavior and sales conversions. The effectiveness of POP packaging is evident in its ability to enhance product visibility and facilitate impulse purchases. According to Business Dasher, 63% of consumers have repurchased a product because of its packaging design, underlining the significant role of aesthetic appeal in consumer decision-making.

The POP Packaging Market is poised for growth, driven by increasing retailer awareness of the impact of packaging on consumer purchasing behavior and the rising competition among brands to secure consumer attention in retail settings. Opportunities abound in the development of innovative, sustainable packaging solutions that cater to the environmental consciousness of modern consumers.

According to Shorr, a majority of consumers (90%) prefer buying from brands that offer sustainable packaging, and a significant proportion of Millennials (59%) and Gen Z (56%) have consciously chosen products with sustainable packaging in the past six months. These trends highlight a clear market shift towards sustainability, which is likely to accelerate further.

The POP Packaging Market is experiencing substantial growth, fueled by the evolving retail landscape and the increasing emphasis on sustainable and visually appealing packaging.

Government investments and regulations also play pivotal roles in shaping market dynamics by encouraging the adoption of eco-friendly materials and practices. This regulatory environment, combined with consumer demand for sustainability, offers substantial opportunities for innovation in packaging technologies and materials.

Government initiatives aimed at reducing plastic waste are prompting companies to explore and invest in alternative materials. These regulations not only ensure environmental compliance but also open up new avenues for growth through the development of recyclable and biodegradable packaging solutions. The alignment of consumer preferences with governmental environmental goals creates a favorable scenario for market expansion and innovation within the POP Packaging sector.

Key Takeaways

- The global Point Of Purchase Packaging Market is projected to grow from USD 17.5 Billion in 2024 to USD 30.5 Billion by 2034, with a CAGR of 5.7%.

- Pallet Display holds a dominant position in the By Product Analysis segment due to its effectiveness in merchandise presentation and space optimization.

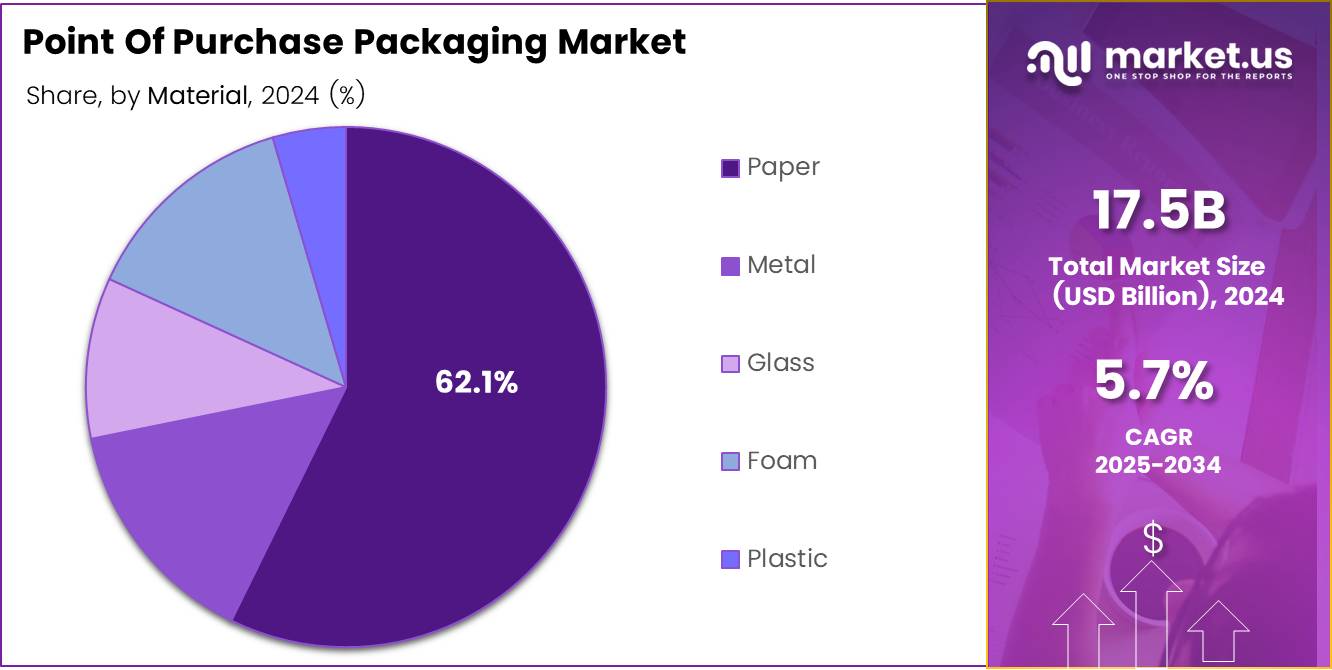

- Paper is the leading material in the By Material Analysis segment, comprising 62.1% of the market, favored for its sustainability and cost-efficiency.

- The Food & Beverages sector dominates the By End Use Analysis segment, driven by demand for eco-friendly packaging in supermarkets and hypermarkets.

- Hypermarkets lead in the By Distribution Channel Analysis segment, offering extensive product variety and widespread consumer reach.

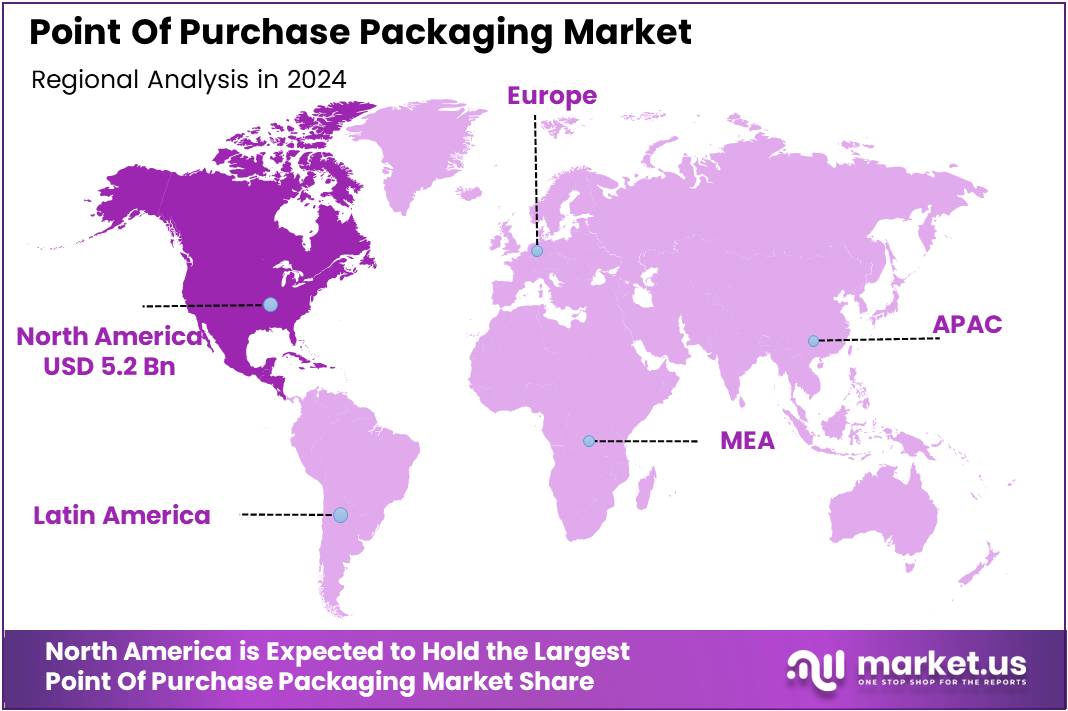

- North America is the largest regional market for POP packaging, holding a 30.7% share, valued at USD 5.2 billion, predominantly influenced by the retail and consumer goods sectors.

Product Analysis

In 2024, Pallet Display Leads the Point Of Purchase Packaging Market with a Dominant Share in the By Product Analysis Segment

In 2024, the Point Of Purchase Packaging Market witnessed Pallet Display maintaining a dominant position in the By Product Analysis segment, underscoring its pivotal role in enhancing retail visibility and customer interaction. This preference can be attributed to the effectiveness of Pallet Displays in facilitating bulk merchandise presentation and optimizing space utilization, which significantly drives consumer purchases at points of sale.

Following closely, Gravity Free Displays and Dump Bin Displays have also seen substantial adoption, each serving unique roles in product promotion. Gravity Free Displays, known for their dynamic design, attract customers through their interactive presentation, while Dump Bin Displays offer convenient access and spontaneous purchase triggers by effectively showcasing loose bulk items.

Clip Strip Displays, though smaller in scale, leverage high-traffic areas by displaying impulse purchase items alongside primary products, enhancing visibility and maximizing retail space. Sidekick Displays complement these by being attached to existing shelving to promote related products or new introductions adjacent to main aisles.

Counter Displays and Floor Displays also contribute significantly to market dynamics, with the former being crucial at point-of-sale locations for last-minute purchases, and the latter providing versatile, stand-alone promotional spaces capable of adapting to varied retail environments.

Material Analysis

Paper Dominates Point of Purchase Packaging Material with a 62.1% Market Share

In 2024, paper held a dominant market position in the By Material Analysis segment of the Point of Purchase (POP) Packaging Market, securing a 62.1% share. This substantial market share can be attributed to the increasing consumer preference for sustainable and recyclable materials, coupled with stringent regulations against non-biodegradable packaging solutions.

Paper’s versatility and cost-effectiveness also contribute to its prevalence in retail packaging solutions, facilitating its extensive adoption across various industries.

Metal, another significant material in the POP packaging market, is utilized primarily for its durability and premium aesthetic appeal, which is especially favored in the cosmetics and electronics sectors. Glass, while less prevalent, is chosen for its premium look and recyclability, making it ideal for luxury goods. Foam packaging continues to be valued for its protective properties, particularly in shipping fragile items.

Plastic, despite facing regulatory and environmental challenges, remains a key player due to its versatility and cost efficiency. Innovations in bioplastics are expected to revitalize its application in POP packaging by aligning with global sustainability trends. Collectively, these materials are shaping the dynamics of the POP packaging market, reflecting a complex interplay of consumer preferences, regulatory frameworks, and technological advancements.

End Use Analysis

Food & Beverages Spearhead the Point Of Purchase Packaging Market with Substantial Segment Share

In 2024, Food & Beverages held a dominant market position in the By End Use Analysis segment of the Point Of Purchase Packaging Market. This sector’s preeminence can be attributed to the escalating consumer demand for convenient and eco-friendly packaging solutions in supermarkets and hypermarkets. The surge in packaged food consumption, driven by an increasing global population and shifting dietary preferences, has significantly fueled the growth of point of purchase packaging solutions within this industry.

The Pharmaceuticals segment also shows promising growth, facilitated by stringent regulatory requirements for product safety and consumer health. Innovations in tamper-evident and child-resistant packaging are propelling this segment forward.

Meanwhile, the Electronics segment capitalizes on the need for highly durable and aesthetically pleasing packaging to attract tech-savvy consumers and protect sensitive components. This segment benefits from the rapid expansion of consumer electronics globally.

The Automotive and Personal Care sectors are not far behind, with each leveraging point of purchase packaging to enhance brand visibility and consumer engagement at retail locations. The packaging in these sectors is designed to withstand harsh handling while also providing clear branding and product information.

Lastly, the ‘Others’ category, encompassing various industries, adopts versatile packaging solutions tailored to specific market demands, further validating the adaptability and extensive application of point of purchase packaging across diverse market sectors.

Distribution Channel Analysis

Hypermarket Leads with Significant Share in Point Of Purchase Packaging Distribution Channels

In 2024, the Hypermarket segment held a dominant market position in the By Distribution Channel Analysis segment of the Point Of Purchase Packaging Market. Hypermarkets, due to their extensive reach and the ability to offer a wide variety of products under one roof, have become pivotal in the distribution of point of purchase packaging. These large retail facilities prioritize extensive consumer traffic which substantially benefits the visibility and accessibility of various packaging solutions, thereby driving sales and influencing purchase decisions.

Following hypermarkets, Supermarkets also play a crucial role but cater to a slightly different consumer base, focusing on convenience and accessibility. Convenience Stores, with their strategic location and extended hours, are essential for immediate and small-scale packaging needs, often complementing the broader market strategies seen in larger retail formats.

Departmental Stores and Specialty Stores, although smaller in market share compared to Hypermarkets and Supermarkets, significantly contribute to the diversity of the distribution channel landscape. Specialty Stores, in particular, provide targeted market segments with specialized packaging solutions that are tailored for niche markets, enhancing the overall growth of the Point Of Purchase Packaging Market.

These distribution channels collectively enhance the market dynamics by offering multiple touchpoints for consumers, thereby enriching the market landscape and contributing to the sustained growth of the Point Of Purchase Packaging Market.

Key Market Segments

By Product

- Pallet display

- Gravity free display

- Dump bin displays

- Clip Strip Displays

- Sidekick display

- Counter display

- Floor display

By Material

- Paper

- Metal

- Glass

- Foam

- Plastic

By End Use

- Food & Beverages

- Pharmaceuticals

- Electronics

- Automotive

- Personal care

- Others

By Distribution Channel

- Hypermarket

- Supermarket

- Convenience Store

- Departmental stores

- Specialty stores

Drivers

Surge in E-commerce and Retail Boosts POP Packaging Market

The point of purchase (POP) packaging market is experiencing significant growth, primarily driven by the increasing demand for retail and e-commerce packaging. As online shopping and organized retail expand, businesses are compelled to adopt attractive and functional POP packaging solutions that enhance product visibility and engage consumers effectively at the point of sale.

Additionally, companies are investing heavily in POP displays as part of their marketing strategies to boost brand awareness and consumer engagement. Technological advancements in printing and packaging, such as digital printing, augmented reality (AR) packaging, and smart labels, are further enhancing the appeal and effectiveness of POP packaging.

Moreover, the shift towards environmental sustainability is influencing consumer preferences and pushing manufacturers to develop eco-friendly and recyclable POP packaging solutions. This confluence of factors is propelling the market forward, making POP packaging an essential element of modern retail strategy.

Restraints

Stringent Environmental Regulations Challenge POP Packaging Market Growth

The market for Point of Purchase (POP) packaging faces significant restraints due to stringent environmental regulations and supply chain disruptions.

Governments worldwide are imposing strict controls on the use of plastics and other non-biodegradable materials, compelling manufacturers to rethink their material choices and packaging designs. This shift is driven by growing environmental concerns and the urgent need to reduce waste in landfills. Moreover, the market is further strained by unpredictable disruptions in the supply chain.

Issues such as fluctuations in the availability of raw materials, delays in transportation, and logistical challenges have a direct impact on the production and distribution efficiency of POP packaging. These factors not only increase production costs but also force companies to navigate complex regulatory landscapes and operational hurdles, ultimately affecting their market competitiveness and growth prospects.

Growth Factors

Smart Packaging Solutions Enhance Customer Engagement and Brand Loyalty

In the point of purchase (POP) packaging market, there are significant growth opportunities that stakeholders can leverage to boost their market presence and profitability.

The adoption of smart packaging solutions, such as QR codes, RFID technology, and IoT-based packaging, stands out as a key driver. This technology not only enhances customer interaction but also strengthens brand engagement by providing additional product information and improving the consumer experience.

Additionally, there is a growing demand for sustainable and biodegradable POP packaging. As consumers become more environmentally conscious, the market for eco-friendly materials is expanding, presenting ample opportunities for innovation in biodegradable and recyclable packaging solutions.

Furthermore, the market is witnessing potential growth in emerging economies, particularly in Asia-Pacific and Latin America, fueled by increasing consumption of retail and consumer goods.

Lastly, customization and personalization trends are reshaping the industry. Brands are actively seeking personalized POP packaging solutions to cater to specific demographics, thus enhancing customer loyalty and differentiating their products in a competitive market. These trends collectively offer robust avenues for growth and innovation within the POP packaging sector.

Emerging Trends

Enhancements in Printing Technology Boost Point of Purchase Packaging Appeal

In the rapidly evolving Point of Purchase (POP) packaging market, several key trends are significantly influencing its growth and transformation. The integration of high-quality graphics and 3D printing technologies has become a pivotal factor, allowing brands to develop POP displays that are not only visually striking but also highly engaging for consumers. This trend is particularly impactful as it caters to the increasing consumer demand for aesthetically pleasing shopping experiences.

Furthermore, the market is witnessing a surge in temporary and seasonal POP displays, which are being strategically utilized by brands for short-term promotional efforts during festivals, seasonal events, and limited-time marketing campaigns.

Moreover, with retail spaces becoming more competitive and shelf space at a premium, the development of compact and space-efficient display solutions is becoming essential. These displays are designed to be both effective in marketing products and efficient in their use of space, making them indispensable in today’s retail environments.

Regional Analysis

North America Leads POP Packaging with 30.7% Market Share, Valued at USD 5.2 Billion, Due to Advanced Retail and Consumer Engagement Strategies

The Point of Purchase (POP) Packaging Market is exhibiting distinct trends and dynamics across various regions including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Dominating the market with a 30.7% share, North America’s POP packaging sector is valued at approximately USD 5.2 billion, driven largely by the retail and consumer goods industries which leverage these solutions for enhanced in-store marketing and consumer engagement.

Regional Mentions:

In Europe, the market is characterized by a high demand for eco-friendly and sustainable packaging solutions, reflecting the region’s stringent environmental regulations and consumer preferences. This has encouraged innovation in biodegradable and recyclable materials, fostering growth in the sector.

The Asia Pacific region is witnessing the fastest growth in the POP packaging market, fueled by expanding retail landscapes and rising consumer expenditure in emerging economies such as China and India. The region’s growth is further supported by the increasing presence of global players and local enterprises, enhancing competitive dynamics and product availability.

Middle East & Africa region, though smaller in comparison, is experiencing gradual growth due to the increasing modernization of retail and a growing emphasis on consumer-centric marketing strategies. Economic diversification efforts, particularly in the Gulf Cooperation Council (GCC) countries, are likely to provide impetus to the market’s expansion.

Latin America shows a promising increase in demand for POP packaging solutions, propelled by the revitalization of retail sectors and growing urbanization. The focus is particularly on innovative designs that attract consumer attention and provide practical benefits such as product information and ease of access.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Point of Purchase (POP) Packaging market projected for 2024, several key players are poised to shape industry dynamics significantly. Among these, Sonoco Products Company and DS Smith stand out due to their robust global footprints and innovative product offerings.

Sonoco Products Company, with its extensive experience in diverse packaging solutions, is expected to leverage its expertise in sustainable packaging to meet the growing demand for eco-friendly options. The company’s commitment to innovation and sustainability can be seen in its development of recyclable and biodegradable materials, which are likely to appeal to environmentally conscious brands and consumers.

DS Smith, another prominent player, is anticipated to capitalize on its strength in high-quality, customizable POP displays. With a strong focus on technological advancements, DS Smith is likely to enhance its offerings with digital and interactive elements, thus meeting the modern retailers’ need for engaging and technologically integrated display solutions.

Both companies are also expected to benefit from strategic expansions and partnerships, enhancing their market reach and operational efficiencies. Their focus on customer-centric solutions and adaptability to rapidly changing retail environments will be crucial in their success.

Overall, the growth of the POP Packaging market in 2024 can be attributed to these players’ ability to innovate and adapt to consumer preferences and environmental considerations. As they continue to invest in new technologies and sustainable practices, Sonoco Products Company and DS Smith are well-positioned to lead the market towards more dynamic and responsible packaging solutions.

Top Key Players in the Market

- Sonoco Products Company

- Marketing Alliance Group

- Felbro, Inc.

- Smurfit Kappa

- Fencor Packaging Group Limited

- Menasha Packaging Company, LLC.

- siffron, Inc.

- International Paper

- Creative Displays Now

- DS Smith

- Georgia-Pacific

- Swisstribe Ltd

- Hawver Display

- WestRock Company

Recent Developments

- In October 2024, Notpla successfully secured £20 million in funding to expand their production of sustainable packaging materials, utilizing seaweed and plant-based resources. This investment underscores the market’s growing interest in environmentally friendly packaging solutions.

- In October 2024, Sorich, a startup specializing in pharmaceutical packaging, raised $1 million to enhance their development of innovative and secure packaging technologies for the healthcare sector. The funding aims to support their mission of improving safety and sustainability in pharmaceutical storage and transport.

- In December 2024, Movopack secured $2.5 million in funding to advance their eco-friendly packaging solutions for the e-commerce industry. This capital infusion is intended to help them scale their operations and meet the increasing demand for sustainable packaging options.

- In May 2024, Kelpi received £4.3 million in funding to bring their seaweed-based packaging products to the market. This financial backing highlights the industry’s commitment to adopting alternative materials that reduce environmental impact.

Report Scope

Report Features Description Market Value (2024) USD 17.5 Billion Forecast Revenue (2034) USD 30.5 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Pallet display, Gravity free display, Dump bin displays, Clip Strip Displays, Sidekick display, Counter display, Floor display), By Material (Paper, Metal, Glass, Foam, Plastic), By End Use (Food & Beverages, Pharmaceuticals, Electronics, Automotive, Personal care, Others), By Distribution Channel(Hypermarket, Supermarket, Convenience Store, Departmental stores, Specialty stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sonoco Products Company, Marketing Alliance Group, Felbro, Inc., Smurfit Kappa, Fencor Packaging Group Limited, Menasha Packaging Company, LLC., siffron, Inc., International Paper, Creative Displays Now, DS Smith, Georgia-Pacific, Swisstribe Ltd, Hawver Display, WestRock Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Point Of Purchase Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Point Of Purchase Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sonoco Products Company

- Marketing Alliance Group

- Felbro, Inc.

- Smurfit Kappa

- Fencor Packaging Group Limited

- Menasha Packaging Company, LLC.

- siffron, Inc.

- International Paper

- Creative Displays Now

- DS Smith

- Georgia-Pacific

- Swisstribe Ltd

- Hawver Display

- WestRock Company