Global Rugby Apparel Market Size, Share, Growth Analysis By Product Type (Jerseys, Shorts, Socks, Base Layers, Training Wear), By End-User (Men, Women, Youth), By Application (Professional, Recreational), By Distribution Channel (Online Stores, Offline Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137417

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

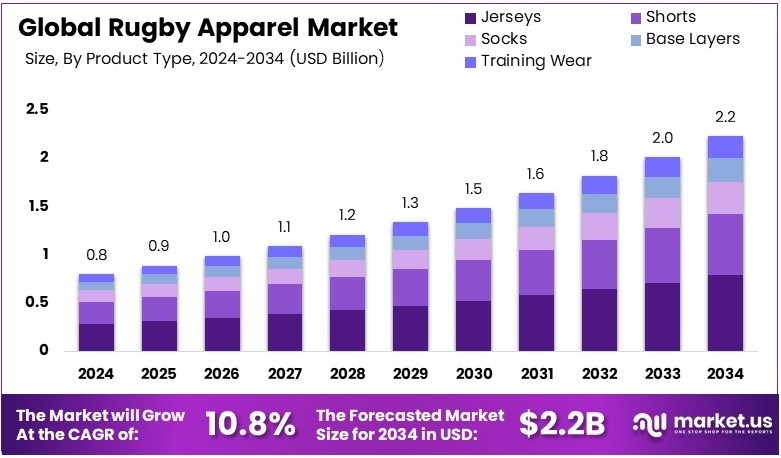

The Global Rugby Apparel Market size is expected to be worth around USD 2.2 Billion by 2034, from USD 0.8 Billion in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034.

Rugby apparel consists of clothing specifically designed for the sport of rugby. This includes jerseys, shorts, protective gear such as scrum caps and shoulder pads, and footwear. The apparel is engineered to withstand the physical nature of the game and provide comfort and protection to players.

The Rugby Apparel Market involves the production, distribution, and sale of rugby-specific clothing and gear. It caters to a diverse audience, ranging from amateur enthusiasts to professional athletes, and features products that emphasize durability, comfort, and performance.

Rugby apparel is integral to the sport, designed to meet the physical demands of rugby. With the sport now played by 8.46 million people globally, the apparel needs to be robust and functional, catering to a diverse and growing player base.

The rugby apparel market is expanding, driven by the sport’s increased popularity. In 2023, the number of rugby players rose by 11% from the previous year, indicating a rising demand for rugby-specific clothing and equipment.

Emerging rugby nations and the growing participation of women and girls are key growth drivers. This demographic shift presents new opportunities for market expansion and diversification of rugby apparel offerings to meet varied needs.

On a broader scale, the market is becoming more competitive as brands vie to cater to an increasing number of players and clubs. Locally, the surge in rugby popularity, especially in the United States with over 125,000 registered players and 2,600 rugby clubs, boosts local economies and sports-related businesses.

While specific government investments in rugby are not widely reported, the general growth in sports participation often benefits from public funding and regulatory support. This can lead to improved sportswear infrastructure and increased accessibility, further stimulating market growth.

Key Takeaways

- The Rugby Apparel Market was valued at USD 0.8 Billion in 2024, and is expected to reach USD 2.2 Billion by 2034, with a CAGR of 10.8%.

- In 2024, Jerseys dominated the product type segment with 42.3%, due to high demand for team and fan apparel.

- In 2024, Men dominated the end-user segment with 58.6%, indicating a larger male consumer base in rugby apparel.

- In 2024, Professional use dominated the application segment with 67.4%, signifying a focus on high-quality, performance-oriented products.

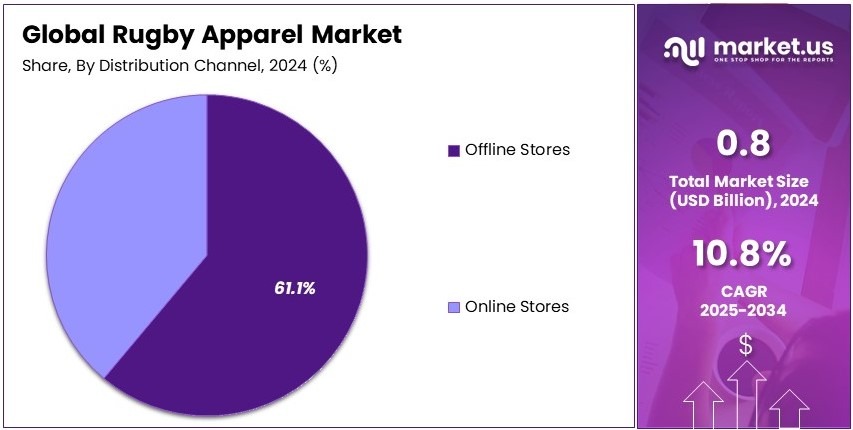

- In 2024, Offline stores dominated the distribution channel with 61.1%, reflecting traditional purchasing behaviors.

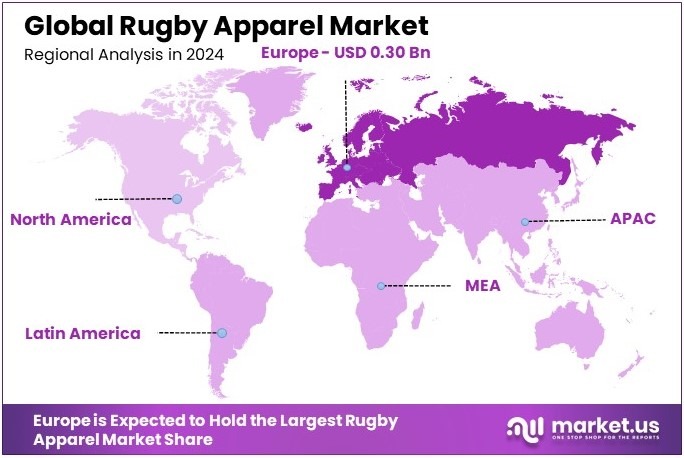

- In 2024, Europe dominated the region with 38.1% share and USD 0.30 Bn revenue, underscoring market concentration.

Product Type Analysis

Jerseys dominate with 42.3% due to their essential role in team identification and fan engagement.

In the Rugby Apparel Market, the product type segment includes jerseys, shorts, socks, base layers, and training wear. Jerseys hold the dominant position, primarily because they are crucial for player identification and are a popular item among fans, enhancing their market presence. The importance of jerseys extends beyond functionality; they also serve as a key element in fan merchandise, driving their high sales.

Shorts are essential for player comfort and mobility, designed to withstand the rigors of the game. While not as prominent as jerseys, they are a necessary component of the rugby kit, supporting the market with steady demand.

Socks, while smaller in contribution, are designed for performance and comfort, often enhanced with technology to reduce moisture and improve fit. Their role in the market is to provide essential equipment that players need for every match.

Base layers are increasingly popular for their performance-enhancing qualities, such as muscle compression and temperature regulation. Their market growth is driven by advances in material technology and the growing player focus on performance optimization.

Training wear includes a variety of apparel designed for practice sessions, crucial for player development and preparation. This segment is growing as players and teams invest more in sports equipment that enhances performance and comfort during practice.

End-User Analysis

Men dominate with 58.6% due to the higher visibility and popularity of men’s rugby at professional levels.

The end-user segment of the Rugby Apparel Market is categorized into men, women, and youth. Men’s rugby apparel leads this segment, largely because of the higher number of male participants and the greater visibility of men’s rugby in media and professional sports, which drives merchandise sales and market growth.

Women’s rugby is gaining traction, supported by increasing participation and growing media coverage. Women’s specific apparel needs are driving product development and market expansion in this segment.

Youth rugby apparel focuses on providing age-appropriate gear that supports the growth and development of young players. This segment benefits from the increasing popularity of rugby at school and club levels, promoting early engagement with the sport.

Application Analysis

Professional use dominates with 67.4% due to the high standards required for performance gear in competitive settings.

The application segment of the Rugby Apparel Market is divided into professional and recreational. Professional rugby apparel holds the largest share, driven by the demand for high-quality, durable, and performance-oriented apparel that meets the rigorous conditions of professional play.

Recreational apparel, while comprising a smaller portion of the market, is important for casual players and fans. This segment caters to those participating in rugby for enjoyment, emphasizing comfort and affordability.

Distribution Channel Analysis

Offline stores dominate with 61.1% due to the preference for trying on apparel before purchase, especially important in sports settings.

Distribution channels for rugby apparel are segmented into online and offline stores. Offline stores are predominant, as they offer the advantage of trying on apparel for fit and comfort before purchase, which is critical in sports where proper fit affects performance.

Online stores, though less dominant, are growing due to the convenience they offer. They are essential for reaching a wider audience, providing access to various brands and products that might not be available locally.

Key Market Segments

By Product Type

- Jerseys

- Shorts

- Socks

- Base Layers

- Training Wear

By End-User

- Men

- Women

- Youth

By Application

- Professional

- Recreational

By Distribution Channel

- Online Stores

- Offline Stores

Driving Factors

Participation and Technological Innovations Drives Market Growth

The Rugby Apparel Market is experiencing growth due to the increasing global popularity of rugby as a competitive sport, the growth of professional rugby leagues worldwide, rising participation of women, and the expansion of training programs in schools and universities. Technological advancements in apparel materials for performance also contribute significantly.

For instance, improved stretchable and breathable fabrics enhance comfort and durability, which is crucial during intense matches. As more women enter the sport, brands are creating designs that cater specifically to their needs. The support from academic institutions in developing young talent further fuels the demand for high-quality, innovative rugby apparel.

Manufacturers are better positioned to capture new customer segments and meet diverse demands, contributing to steady revenue growth. The focus on performance-enhancing fabrics and inclusive designs reflects an industry adapting to its audience. This approach supports sustained investment in research and development, ensuring that new technologies continue to advance, thereby solidifying market growth.

Restraining Factors

Seasonality and Market Challenges Restraints Market Growth

The Rugby Apparel Market faces restraints from the seasonal nature of rugby sports, limited penetration in non-traditional markets, the impact of counterfeit products on brand loyalty, and intense competition among leading brands. These challenges can disrupt steady growth and create uncertainty in demand. Seasonal fluctuations often lead to periods of low sales, as demand drops during off-peak seasons.

The slow adoption of rugby in certain regions limits market penetration and growth potential. Issues with counterfeit products erode consumer trust, making it difficult for established brands to maintain revenue and brand reputation.

Intense competition among leading brands pressures companies to continually innovate while keeping prices competitive. These factors compel manufacturers to adopt strategic planning and diversified marketing to mitigate risks.

For example, many brands now focus on digital channels and online sales to stabilize demand year-round. Tackling counterfeits through quality assurance and consumer education is vital. By addressing these restraints, companies can create more resilient business models. This enables them to navigate seasonal declines and competitive pressures, ultimately sustaining long-term growth despite inherent market challenges.

Growth Opportunities

Sustainable and Inclusive Designs Provides Opportunites

Opportunities in the Rugby Apparel Market arise from the development of eco-friendly and sustainable jerseys, rising demand for women-specific apparel, growth of youth training programs, and adoption of smart fabrics for enhanced performance. These trends open new avenues for manufacturers to innovate and capture diverse segments. Eco-friendly jerseys made from sustainable materials appeal to environmentally conscious consumers.

Brands that offer women-specific designs meet the growing participation of women in rugby, providing tailored apparel that fits their requirements. The expansion of youth rugby training programs creates demand for durable and comfortable gear for young players. Introducing smart clothing that adapt to body temperature improves player performance and safety. These fabrics also offer moisture-wicking and stretchability, which are key for intense training sessions.

The focus on sustainable and inclusive designs not only meets regulatory and social expectations but also attracts new customers. Manufacturers capitalizing on these trends can differentiate themselves. By investing in research and development, companies can create products that are both high-performing and environmentally friendly.

Emerging Trends

Advanced Materials Trends Latest Trending Factor

Trending factors shaping the Rugby Apparel Market include the use of advanced stretchable and breathable fabrics, integration of smart sensors for performance tracking, popularity of retro-inspired jerseys, and growth of gender-inclusive apparel lines. These trends influence how products are designed, marketed, and adopted by players. Advanced fabrics that offer superior comfort and durability cater to the demands of professional athletes.

The integration of smart sensors in apparel provides real-time data on player movement and health, a feature increasingly sought after in high-performance environments. Retro-inspired jerseys tap into nostalgia while offering modern comfort, appealing to long-time fans and players. The rise of gender-inclusive apparel lines reflects a shift towards more diverse and accepting market offerings.

As brands adopt these trends, they set new standards for product quality and innovation. The focus on performance and inclusivity not only meets current demands but also anticipates future needs. Companies investing in these advanced materials and designs can expect to attract a wider audience. This proactive approach ensures a competitive edge, keeping products relevant and appealing.

Regional Analysis

Europe Dominates with 38.1% Market Share

Europe leads the Rugby Apparel Market with a 38.1% share, amounting to USD 0.30 billion. This dominant market presence is driven by the region’s deep-rooted rugby tradition and extensive club and school systems that nurture the sport from a grassroots level.

The key factors contributing to Europe’s high market share include the popularity of rugby in countries like England, France, and Ireland, and the extensive infrastructure supporting the sport. High levels of sponsorship and strong fan engagement also play crucial roles in driving demand for rugby apparel.

The market dynamics are further influenced by the regional focus on quality and innovation in sports apparel, which caters to both amateur and professional players. European manufacturers are known for their high-quality fabrics and cutting-edge designs that enhance performance and comfort.

Looking ahead, Europe’s influence in the global Rugby Apparel Market is expected to continue growing. With rugby’s increasing popularity and the ongoing development of professional leagues, there is potential for further market expansion. This growth is likely to be supported by continuous innovations in apparel technology and sustainability practices that appeal to a broader consumer base.

Regional Mentions:

- North America: North America shows growing interest in rugby, reflected in rising participation rates and the expansion of professional leagues. This growth is boosting the demand for specialized rugby apparel, driving market development in the region.

- Asia Pacific: The Rugby Apparel Market in Asia Pacific is expanding due to increasing popularity in countries like Japan and Hong Kong. The market benefits from new investments in rugby infrastructure and a growing fanbase, which are likely to boost future sales.

- Middle East & Africa: While rugby is less popular in this region, initiatives to introduce the sport and develop local leagues are underway. These efforts are expected to gradually increase the demand for rugby apparel as the sport gains traction.

- Latin America: Rugby’s popularity is slowly rising in Latin America, with countries like Argentina and Brazil leading the way. This increase is reflected in the growing demand for rugby apparel, which is expected to rise as the sport becomes more mainstream.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Rugby Apparel Market is significantly shaped by four key players: Adidas AG, Nike, Inc., Canterbury of New Zealand, and Puma SE. These companies are influential in defining industry standards and driving innovation within the market.

Adidas AG is a leading figure in the market, known for its high-quality rugby apparel that combines functionality with style. Adidas focuses on incorporating advanced fabrics and technologies to enhance player performance and comfort, ensuring their products meet the demands of both amateur and professional players.

Nike, Inc., another major player, is celebrated for its innovative approach to sportswear. Nike’s rugby apparel is designed with cutting-edge technology that optimizes durability and enhances athletic performance. Their commitment to research and development continues to elevate their offerings, making them a favorite among players globally.

Canterbury of New Zealand specializes in rugby apparel and is renowned for its deep roots in the rugby world. Their products are distinguished by their robustness and ergonomic designs that support rigorous physical activity, making Canterbury a trusted brand for rugby uniforms and training gear.

Puma SE completes the top four with its dynamic approach to sports fashion and functionality. Puma combines aesthetic appeal with practical design, focusing on lightweight materials and comfort, catering effectively to the modern rugby player’s needs.

Together, these companies drive the Rugby Apparel Market through their commitment to quality, innovation, and understanding of players’ needs. Their efforts in advancing apparel technology and enhancing the overall player experience play a crucial role in their market dominance. By continuously adapting to market trends and consumer preferences, these leaders not only sustain their positions but also influence the future direction of the market globally.

Major Companies in the Market

- Adidas AG

- Nike, Inc.

- Canterbury of New Zealand

- Puma SE

- Under Armour, Inc.

- Gilbert Rugby

- BLK Sport

- Macron S.p.A.

- O’Neills Irish International Sports Co. Ltd.

- Decathlon S.A.

- Asics Corporation

- Kooga Rugby

- VX3 Apparel

Recent Developments

- Adidas and New Zealand Rugby: In June 2024, Adidas and New Zealand Rugby unveiled new jersey designs for the All Blacks and Black Ferns, celebrating a 25-year collaboration. The jerseys feature a traditional black base with silver detailing and an all-white collar, symbolizing their enduring partnership.

- British and Irish Lions: In November 2024, the British and Irish Lions revealed a new darker red jersey for their upcoming Australia tour. The design incorporates a woven pattern symbolizing the union of four nations with a traditional ‘grandad’ collar, aimed at enhancing fan engagement.

- Rugby Australia and Fanatics: In May 2024, Rugby Australia partnered exclusively with Fanatics to launch an official online store, The Wallaby Shop. The platform offers a comprehensive range of merchandise for the Wallabies, Wallaroos, and Super Rugby teams, extending through major events such as the 2025 Women’s Rugby World Cup and the 2027 Rugby World Cup.

Report Scope

Report Features Description Market Value (2024) USD 0.8 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Jerseys, Shorts, Socks, Base Layers, Training Wear), By End-User (Men, Women, Youth), By Application (Professional, Recreational), By Distribution Channel (Online Stores, Offline Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adidas AG, Nike, Inc., Canterbury of New Zealand, Puma SE, Under Armour, Inc., Gilbert Rugby, BLK Sport, Macron S.p.A., O’Neills Irish International Sports Co. Ltd., Decathlon S.A., Asics Corporation, Kooga Rugby, VX3 Apparel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adidas AG

- Nike, Inc.

- Canterbury of New Zealand

- Puma SE

- Under Armour, Inc.

- Gilbert Rugby

- BLK Sport

- Macron S.p.A.

- O'Neills Irish International Sports Co. Ltd.

- Decathlon S.A.

- Asics Corporation

- Kooga Rugby

- VX3 Apparel