Global Road Haulage Market Size, Share, Growth Analysis By Service Type (Freight Transport, Container Transport, Refrigerated Transport, Parcel and Courier Services), By Vehicle Type (Light Commercial Vehicles, Heavy Commercial Vehicles), By Application (Domestic Haulage, International Haulage), By End-User Industry (Retail and FMCG, Automotive, Manufacturing, Construction, Oil and Gas, Healthcare and Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137735

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

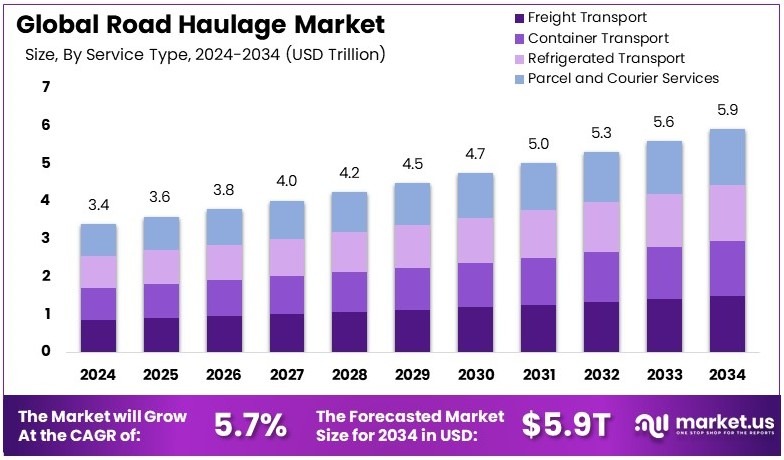

The Global Road Haulage Market size is expected to be worth around USD 5.9 Trillion by 2034, from USD 3.4 Trillion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Road haulage refers to the transportation of goods by road using trucks or lorries. It is a key part of the logistics chain, ensuring that products move efficiently from factories and warehouses to retail locations or end customers.

The road haulage market encompasses all activities related to the transportation of goods by road. It includes services offered by various companies that operate fleets of trucks to transport goods across different regions.

The road haulage industry significantly influences both the national and global economies. According to the US EPA, in 2022, trucks moved 72.6% of all U.S. freight tonnage, highlighting their critical role in the logistics chain.

Furthermore, trucking revenues accounted for 80.7% of the nation’s freight bill, underscoring the sector’s financial impact. Employment in this sector is robust, with over 8.4 million people working in trucking-related jobs, many within small businesses that bolster local communities.

Fuel consumption is a key operational factor, with the industry consuming approximately 54 billion gallons of fuel annually. This includes 39 billion gallons of diesel and 16 billion gallons of gasoline, indicating the scale of its energy requirements.

Additionally, the sector has experienced significant consolidation, demonstrated by DSV’s acquisition of DB Schenker in 2024 for over $12 billion, reflecting a trend towards fewer, but larger, market players.

Moreover, the global trade environment continues to provide growth opportunities for road haulage. According to the United Nations Conference on Trade and Development (UNCTAD), global trade reached a record $33 trillion in 2024, driven by a 3.3% growth in trade volume.

This expansion is supported by a 7% increase in services trade, contributing $500 billion to the total growth. In contrast, the goods trade grew by only 2%, remaining below its 2022 peak but still vital for the road haulage sector.

Consequently, the industry’s future looks promising yet challenging, with continuous demand for efficient transport solutions spurred by global trade dynamics. However, the sector also faces pressures from government regulations aimed at reducing environmental impacts, which necessitate innovations in fuel efficiency and operational practices. Thus, the road haulage market remains a dynamic component of the broader logistics industry, essential for supporting global supply chains and economic development.

Key Takeaways

- The Road Haulage Market was valued at USD 3.4 Trillion in 2024, and is expected to reach USD 5.9 Trillion by 2034, with a CAGR of 5.7%.

- In 2024, Domestic Road Haulage dominates the type segment with 63.8% due to its extensive logistical infrastructure and operational efficiency.

- In 2024, Heavy Commercial Vehicles dominate the vehicle type segment due to their capacity and versatility in large-scale transportation.

- In 2024, Food & Beverages dominate the application segment as demand drives frequent and large shipments across diverse channels.

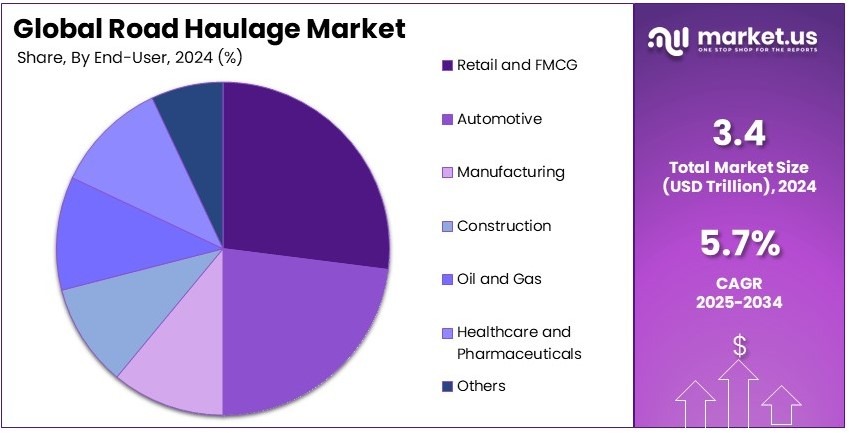

- In 2024, Retail and FMCG dominate the end-user industry segment indicating high consumption needs and stable market growth.

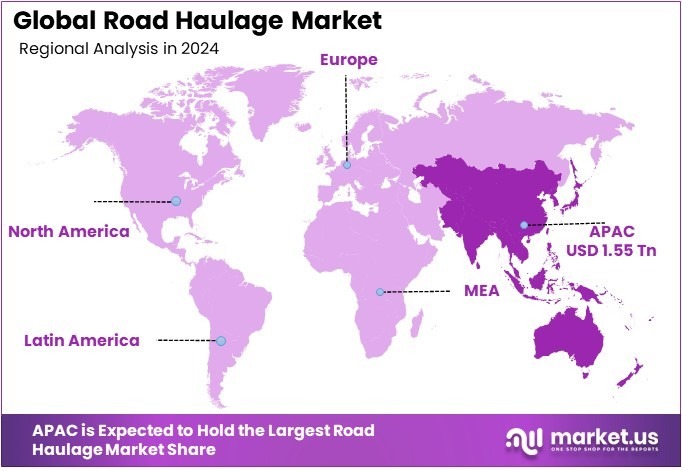

- In 2024, Asia Pacific dominates the region with 45.6% share, significantly contributing to USD 1.55 Trillion revenue growth.

Type Analysis

Domestic Road Haulage dominates with 63.8% due to its critical role in interconnecting local markets and supporting regional economies.

The Road Haulage market can be intricately segmented to reflect varying transport needs across industries. In the “Type Analysis,” Domestic Road Haulage emerges as the dominant sub-segment. This segment’s prominence is highlighted by its substantial share of 63.8%.

The key to its dominance lies in the essential service it provides, ensuring the smooth transport of goods across short to moderate distances within a country. This is pivotal for the distribution of a wide range of goods, from daily consumer products to raw materials, thus facilitating an interconnected market and bolstering local economies.

On the contrary, International Haulage, while crucial, commands a smaller segment of the market. It deals with the complexities of cross-border trade, including customs, international regulations, and longer transit times. However, its role is indispensable in global trade, linking domestic markets to international opportunities and enhancing the scope for business expansions and foreign market penetration.

Vehicle Type Analysis

Heavy Commercial Vehicles lead the segment due to their capacity to transport significant volumes over long distances efficiently.

When exploring the “Vehicle Type Analysis,” Heavy Commercial Vehicles (HCVs) stand out. Their leading position is primarily due to their robust design and larger capacity, which are essential for hauling substantial loads.

HCVs are preferred for long-haul transport, making them indispensable in scenarios where large quantities of goods need to be moved, whether for manufacturing inputs or distribution of finished goods. Their efficiency and reliability support economies of scale, reducing transportation costs per unit and enhancing logistical efficiency.

Light Commercial Vehicles (LCVs), although smaller in capacity, are vital for flexibility and accessibility in urban settings. They are typically used for shorter routes and lighter loads, excelling in last-mile deliveries and services that require maneuverability in tight spaces. Commercial Vehicles contribute significantly to the efficiency of urban logistics and are integral in meeting the rising demands of e-commerce and same-day delivery services.

Application Analysis

Food & Beverages in Application Analysis holds a significant share due to the growing demand for perishable goods and the expansion of grocery delivery services.

In the “Application Analysis,” the Food & Beverages segment captures a substantial market share, driven by the increasing consumer demand for fresh and quality perishable goods.

This demand fuels the need for efficient, timely, and reliable road haulage services, which are critical in maintaining the integrity of food products throughout the supply chain. The rise in grocery delivery services and the expansion of food retail also significantly contribute to this segment’s growth.

Other key applications include Industrial Products, where road haulage is crucial in transporting heavy machinery and industrial goods.

This segment benefits from the robustness of HCVs, which are capable of handling such demanding loads. Similarly, Consumer Goods transportation relies on road haulage to ensure the widespread distribution of products, directly influencing consumer market accessibility and business growth across regions.

End-User Industry Analysis

The Retail and FMCG sector leads the End-User Industry segment due to its reliance on efficient distribution channels to meet consumer demands rapidly.

In the “End-User Industry Analysis,” the Retail and Fast-Moving Consumer Goods (FMCG) sector is highlighted as the most significant. This sector’s dependency on rapid and efficient distribution systems places a premium on effective road haulage services, which are tailored to handle the fast turnover rates and high volume requirements of FMCG products.

The ability to swiftly transport goods from warehouses directly to retail shelves or consumers’ doors is fundamental in this sector, where timing and freshness often dictate market success.

Conversely, sectors like Automotive and Manufacturing also rely heavily on road haulage but for different reasons. The Automotive sector utilizes these services for the timely delivery of parts and finished vehicles, emphasizing the need for punctual and safe transport.

Manufacturing, on the other hand, depends on the consistent supply of raw materials and the distribution of manufactured goods, both facilitated effectively by road haulage.

Key Market Segments

By Service Type

- Freight Transport

- Container Transport

- Refrigerated Transport

- Parcel and Courier Services

By Vehicle Type

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Application

- Domestic Haulage

- International Haulage

By End-User Industry

- Retail and FMCG

- Automotive

- Manufacturing

- Construction

- Oil and Gas

- Healthcare and Pharmaceuticals

- Others

Driving Factors

Surging Need for Reliable Delivery Drives Market Growth

Many manufacturers and retailers now depend on swift transport to keep shelves stocked. This demand pushes road haulage firms to operate faster fleet management. In turn, transport providers invest in modern vehicles and route planning. This approach helps minimize delays and wins customer confidence.

Web-based shopping continues to expand in major cities worldwide. Delivery windows shorten as consumers expect quick arrival of goods. For this reason, logistics operators rely more on trucks for last-mile services. This growth spurs heightened demand for skilled drivers and optimized routes.

Many companies trade internationally to reach bigger markets. As a result, they need smooth cross-border transportation to ensure steady inventory. Road haulage firms tackle customs rules and route constraints to keep freight moving. This factor broadens revenues and strengthens ties with global partners.

Technological tools, such as GPS tracking, help companies monitor their fleets in real time. This visibility reduces idle time and boosts operational efficiency. For example, dispatch centers can reroute trucks to avoid traffic. These advances lower costs and help build trust with clients.

Restraining Factors

Maintaining large truck fleets can be costly. Companies often pay more for repairs, spare parts, and regular inspections. For this reason, smaller operators may struggle to sustain quality standards. This issue can lead to less competition and fewer service choices for customers.

Governments set strict rules to reduce pollution. Many haulers must upgrade engines or switch to cleaner fuels. This transition adds extra costs and administrative hurdles. Small firms may find it hard to remain profitable. As a result, market entry can decline.

Many qualified drivers leave the industry because of long hours and challenging work conditions. As a consequence, freight companies face staffing gaps that delay deliveries. This problem limits operators’ ability to grow and handle larger contracts. It also pressures wages, impacting profits.

Diesel and gasoline costs fluctuate based on global supply and demand. When prices spike, operators often raise their shipping rates to stay afloat. This move can discourage customers from choosing road transport. In turn, alternatives like rail or sea routes may look more appealing.

Growth Opportunities

Urban Last-Mile Solutions Provide Opportunities

Big cities around the world face heavy traffic and limited parking. This setting opens new routes for small trucks and vans. Road haulage firms can reach congested areas quickly, ensuring prompt deliveries. Businesses that master last-mile logistics gain a solid edge over competitors.

Automation is on the rise, and trucks with autonomous features can lower labor costs. By contrast, they also reduce driver fatigue and minimize accidents. As an example, some companies use semi-autonomous convoys on highways to improve safety. This movement boosts efficiency and reliability.

Adoption of electric and hydrogen-powered trucks grows as environmental concerns mount. These vehicles cut emissions and qualify for green incentives in places like California. Operators can save on taxes or road tolls, boosting overall profitability. This shift also appeals to eco-conscious consumers.

Blockchain technology allows real-time tracking of shipments. It can show exact pickup times and delivery checkpoints to reduce disputes. In this context, clients gain confidence in the authenticity of records. For this reason, road haulage operators adopting blockchain may secure long-term contracts.

Emerging Trends

Smart Vehicle Tracking Is Latest Trending Factor

Telematics allows real-time data collection on a truck’s location, engine performance, and driver behavior. By analyzing these insights, companies pinpoint areas for cost reduction and safety improvements. This technology also provides swift notifications for maintenance schedules. As a result, fleet health improves.

Sustainability is becoming a key market driver as governments encourage cleaner logistics. Haulers who adopt carbon-neutral methods reduce environmental impact and may gain tax breaks. In addition, eco-friendly branding attracts consumers who value green services. This shift supports long-term business success.

Many operators partner to fill empty truck space and split delivery costs. This approach, known as freight sharing, ensures vehicles run at maximum capacity. Similarly, it helps cut emissions per load. These partnerships may also open new routes and expand customer bases.

Some providers now offer subscription-based fleet services to lower upfront costs. In this model, clients pay a monthly fee for access to vehicles, support, and insurance. As an example, ride-sharing giants have tested similar programs for last-mile deliveries. This trend enhances flexibility.

Regional Analysis

Asia Pacific Dominates with 45.6% Market Share

Asia Pacific leads the Road Haulage Market with a substantial 45.6% share, representing over USD 1.55 trillion in economic activity. This dominance is driven by the region’s massive scale of manufacturing and export operations, coupled with extensive infrastructural developments and urbanization across major economies like China, India, and Japan.

The region’s strategic geographic positioning as a global manufacturing hub enhances its role in international trade, necessitating robust road haulage services. Moreover, governmental initiatives aimed at improving road infrastructure and liberalizing trade regulations further bolster the market.

Asia Pacific’s influence in the global Road Haulage Market is poised to grow. Continued economic growth, increasing e-commerce activities, and improvements in road infrastructure are likely to sustain the high demand for haulage services. The ongoing shift towards greener transportation solutions also presents opportunities for innovative haulage services in the region.

Regional Mentions:

- North America: North America holds a significant position in the Road Haulage Market, supported by advanced logistics and transportation infrastructure. The region focuses on integrating technology with haulage operations, enhancing efficiency and reducing operational costs.

- Europe: Europe maintains a strong market presence in road haulage, driven by stringent regulations on vehicle emissions and a high demand for timely deliveries. The region’s emphasis on sustainability and efficient logistics supports its stable market growth.

- Middle East & Africa: Middle East and Africa are experiencing growth in road haulage due to increasing infrastructure projects and trade routes expansion. Investments in road and port infrastructure, along with economic diversification efforts, are key growth drivers.

- Latin America: Latin America’s road haulage market benefits from gradual economic stabilization and investments in transport infrastructure. The region is enhancing its logistics capabilities to support its vital agricultural and mineral industries.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Road Haulage Market is highly competitive, with several major players driving growth through innovation, global reach, and operational efficiency. Among these, DHL Supply Chain, XPO Logistics, DB Schenker, and Kuehne + Nagel stand out as the top four companies shaping the industry’s landscape.

DHL Supply Chain leads with its extensive global network and advanced logistics solutions. The company’s focus on integrating technology, such as automation and AI-driven systems, enhances delivery efficiency and customer experience. DHL’s strategic investments in sustainability, including green fleets, position it as a market leader in eco-friendly transport.

XPO Logistics excels in freight brokerage and last-mile delivery services, leveraging its expertise in technology-driven supply chain solutions. The company’s strong presence in North America and Europe, combined with its innovative digital platforms, enables it to provide seamless transportation services to a diverse range of industries.

DB Schenker, a global leader in integrated logistics, offers robust road haulage services across multiple regions. Known for its reliability and customer-centric approach, DB Schenker heavily invests in digitalization and green logistics to meet evolving customer and regulatory demands. Its ability to adapt to complex supply chain requirements solidifies its market position.

Kuehne + Nagel specializes in end-to-end logistics solutions, including road transport, supported by its efficient global network. The company is recognized for its strong focus on digitalization, sustainability, and customer satisfaction. Its tailored solutions for industries like automotive and healthcare make it a critical player in the market.

These companies drive innovation, improve efficiency, and set industry benchmarks, contributing to the overall growth and evolution of the Road Haulage Market. Their focus on digital transformation and sustainability ensures continued leadership in an increasingly competitive landscape.

Major Companies in the Market

- DHL Supply Chain

- XPO Logistics

- DB Schenker

- Kuehne + Nagel

- DSV Panalpina

- UPS Supply Chain Solutions

- FedEx Freight

- J.B. Hunt Transport Services

- YRC Worldwide

- Ryder System

- CEVA Logistics

- Nippon Express

- C.H. Robinson Worldwide

Recent Developments

- DSV & DB Schenker: On September 2024, the Danish logistics company DSV announced plans to acquire Deutsche Bahn’s DB Schenker logistics division for over $12 billion in cash. This strategic move is expected to double DSV’s revenue and workforce, elevating its global market share to approximately 6-7%, surpassing competitors like DHL Global Forwarding and Kuehne + Nagel International. The acquisition is anticipated to be finalized by the second quarter of 2025.

- Roadrunner Transportation Systems & Investment Consortium: On December 2024, Roadrunner Transportation Systems underwent significant changes as an investment consortium led by Chris Jamroz and Milwaukee investor Ted Kellner acquired over 80% of the company.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Trillion Forecast Revenue (2034) USD 5.9 Trillion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Freight Transport, Container Transport, Refrigerated Transport, Parcel and Courier Services), By Vehicle Type (Light Commercial Vehicles, Heavy Commercial Vehicles), By Application (Domestic Haulage, International Haulage), By End-User Industry (Retail and FMCG, Automotive, Manufacturing, Construction, Oil and Gas, Healthcare and Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DHL Supply Chain, XPO Logistics, DB Schenker, Kuehne + Nagel, DSV Panalpina, UPS Supply Chain Solutions, FedEx Freight, J.B. Hunt Transport Services, YRC Worldwide, Ryder System, CEVA Logistics, Nippon Express, C.H. Robinson Worldwide Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DHL Supply Chain

- XPO Logistics

- DB Schenker

- Kuehne + Nagel

- DSV Panalpina

- UPS Supply Chain Solutions

- FedEx Freight

- J.B. Hunt Transport Services

- YRC Worldwide

- Ryder System

- CEVA Logistics

- Nippon Express

- C.H. Robinson Worldwide