Global RFID Blood Monitoring Systems Market By Product Type (RFID Readers, RFID Tags and Software), By Function (Inventory & Supply Chain Control, Quality & Condition Monitoring and Transfusion Safety & Patient Matching), By End-User (Blood Banks and Hospitals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178651

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

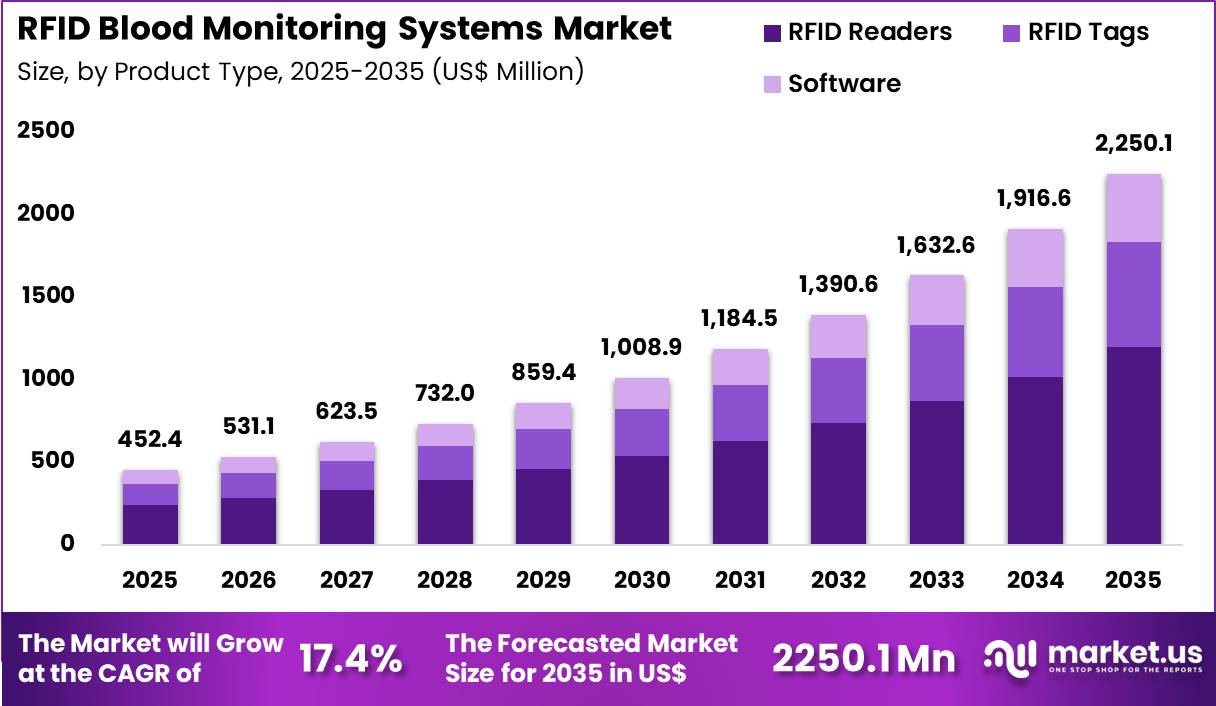

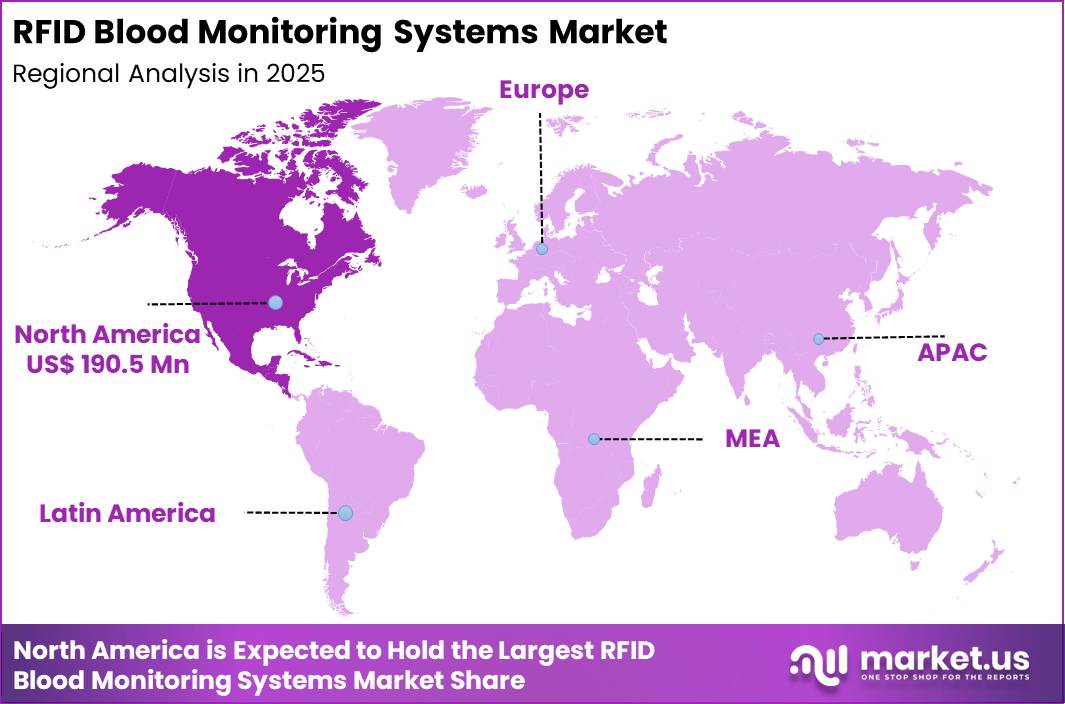

The Global RFID Blood Monitoring Systems Market size is expected to be worth around US$ 2250.1 Million by 2035 from US$ 452.4 Million in 2025, growing at a CAGR of 17.4% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 42.1% share with a revenue of US$ 190.5 Million.

Increasing focus on patient safety and supply chain efficiency drives the RFID blood monitoring systems market as healthcare providers adopt technologies that ensure accurate tracking and temperature control throughout the blood lifecycle. Blood banks increasingly utilize RFID tags on donation bags to monitor collection, processing, and storage conditions, preventing spoilage and maintaining viability for transfusion in surgical and trauma cases.

These systems support hospital inventory management by automating stock levels and expiration alerts, enabling seamless replenishment for high-volume procedures like cardiac surgeries and oncology treatments. Clinicians apply RFID-enabled systems in transfusion services to verify compatibility at the bedside, reducing errors during administration for anemic patients or those undergoing chemotherapy.

Emergency departments leverage the technology for rapid traceability in mass casualty events, ensuring contaminated or expired units remain isolated from critical care applications. Pharmaceutical manufacturers integrate RFID monitoring into plasma-derived product workflows, safeguarding integrity from collection to fractionation for hemophilia therapies

Manufacturers pursue opportunities to embed advanced sensors for real-time humidity and vibration detection, expanding applications in cold chain logistics for rare blood types and cellular therapies. Developers advance AI-integrated platforms that predict supply shortages, broadening utility in predictive analytics for hospital blood utilization planning.

These innovations facilitate hybrid systems combining RFID with blockchain for tamper-proof traceability, optimizing donor-to-recipient chains in organ transplant support. Opportunities emerge in sustainable, reusable tag designs that reduce electronic waste while maintaining performance.

Companies invest in user-friendly interfaces that streamline staff training, enhancing adoption across diverse care settings. Recent trends emphasize wireless, battery-free RFID solutions and interoperability with electronic health records, positioning the market for growth in value-based healthcare focused on precision and reliability.

Key Takeaways

- In 2025, the market generated a revenue of US$ 452.4 million, with a CAGR of 17.4%, and is expected to reach US$ 2250.1 million by the year 2035.

- The product type segment is divided into RFID readers, RFID tags and software, with RFID readers taking the lead with a market share of 53.2%.

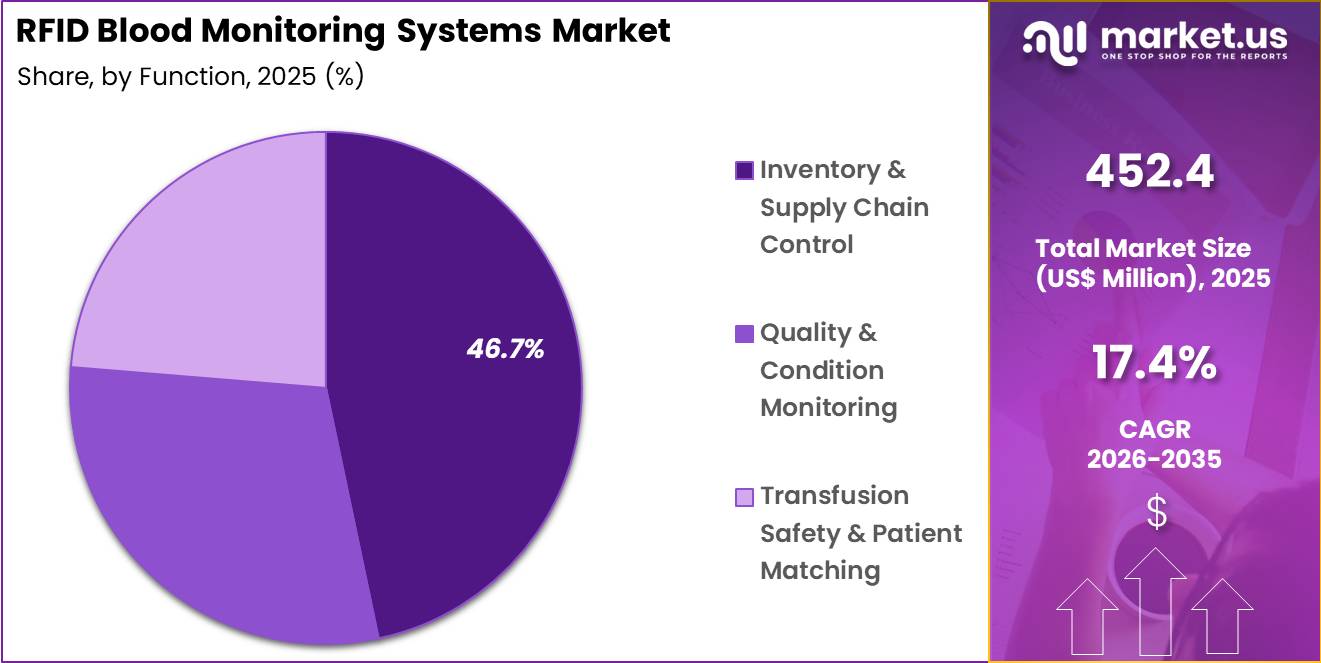

- Considering function, the market is divided into inventory & supply chain control, quality & condition monitoring and transfusion safety & patient matching. Among these, inventory & supply chain control held a significant share of 46.7%.

- Furthermore, concerning the end-user segment, the market is segregated into blood banks and hospitals. The blood banks sector stands out as the dominant player, holding the largest revenue share of 78.5% in the market.

- North America led the market by securing a market share of 42.1%.

Product Type Analysis

RFID readers accounted for 53.2% of growth within product type and led the RFID blood monitoring systems market due to their central role in scanning, tracking, and validating blood units across storage and distribution points. Blood banks rely on fixed and handheld readers to capture real-time inventory data and minimize manual entry errors. Increased demand for automated traceability strengthens investment in reader infrastructure. Integration with existing laboratory information systems further enhances operational visibility.

Growth strengthens as regulatory authorities emphasize end-to-end traceability and documentation accuracy. High-throughput blood centers deploy multiple readers to manage peak collection and dispatch cycles.

Improvements in reader sensitivity and multi-tag scanning capability increase efficiency. Expansion of regional blood networks also elevates infrastructure deployment. The segment is expected to remain dominant as digital tracking becomes essential to safe blood management.

Function Analysis

Inventory and supply chain control generated 46.7% of growth within function and emerged as the leading segment due to the need for real-time stock visibility and expiry management. Blood banks manage perishable inventory that requires strict temperature and time controls. RFID-enabled systems reduce wastage by improving rotation accuracy and minimizing misplacement. Centralized dashboards support demand forecasting and rapid redistribution.

Growth accelerates as healthcare systems prioritize cost containment and resource optimization. Increasing blood donation campaigns expand inventory volumes that require structured oversight. Integration with cold-chain monitoring enhances compliance with storage standards.

Data analytics capabilities improve planning accuracy. The segment is anticipated to maintain leadership as efficient supply chain control remains critical to blood safety and availability.

End-User Analysis

Blood banks contributed 78.5% of growth within end-user and dominated the RFID blood monitoring systems market due to their responsibility for collection, processing, storage, and distribution of blood products. These facilities handle large volumes of units daily, which increases reliance on automated identification systems. Centralized processing hubs require accurate tracking to prevent loss and ensure compliance. Operational complexity strengthens demand for RFID integration.

Growth continues as national blood services modernize infrastructure and implement digital traceability frameworks. Quality assurance programs emphasize precise tracking from donor to recipient. Investment in donor management and inventory control systems further supports RFID adoption.

Collaboration between blood banks and hospitals enhances data exchange. The segment is projected to remain the primary growth driver as blood banks continue to anchor safe and efficient transfusion supply chains.

Key Market Segments

By Product Type

- RFID Readers

- RFID Tags

- Software

By Function

- Inventory & Supply Chain Control

- Quality & Condition Monitoring

- Transfusion Safety & Patient Matching

By End-User

- Blood Banks

- Hospitals

Drivers

Increasing global blood donations is driving the market.

The global increase in blood donations has heightened the need for RFID blood monitoring systems to ensure accurate tracking and reduce errors in transfusion processes. Enhanced donor recruitment campaigns and improved collection infrastructure have contributed to this growth. Healthcare organizations are adopting RFID to manage larger inventories and maintain chain of custody for blood products.

The correlation between donation volumes and transfusion safety underscores the role of these systems in preventing mix-ups. Government agencies are promoting voluntary donations to address shortages, further amplifying demand for monitoring technologies.

RFID systems enable real-time visibility from donation to transfusion, supporting efficient supply chain management. National blood services report steady rises in collection rates, prompting greater investment in traceability tools.

Key suppliers are developing systems optimized for high-volume blood centers. This driver aligns with efforts to enhance patient safety in transfusion medicine. According to the World Health Organization, approximately 118.54 million blood donations are collected worldwide annually, with 40% from high-income countries home to 16% of the population.

Restraints

High implementation costs are restraining the market.

The significant upfront investment required for RFID blood monitoring systems, including tags, readers, and software integration, limits adoption in resource-constrained facilities. Installation involves extensive staff training and infrastructure modifications, adding to overall expenses.

Smaller blood banks often prioritize basic inventory methods over premium RFID solutions due to budget limitations. Regulatory compliance for data security and system validation further elevates implementation burdens. In public health systems, funding priorities favor essential supplies over advanced tracking technologies.

Providers may delay upgrades, opting for manual processes to control spending. This restraint is particularly pronounced in low-income regions with limited capital for digital upgrades. Industry efforts to offer scalable, modular systems provide partial relief but do not fully resolve cost issues.

Despite traceability benefits, economic barriers slow widespread deployment across diverse blood services. Maintenance requirements for hardware and software updates contribute to ongoing financial strain.

Opportunities

Expansion into emerging healthcare markets is creating growth opportunities.

The rapid development of healthcare infrastructure in emerging economies presents avenues for RFID blood monitoring systems to improve blood supply chain efficiency. Governmental investments in transfusion services support the integration of digital tracking to reduce wastage and errors. Increasing awareness of blood safety standards drives demand for RFID in new hospital and blood bank facilities.

Partnerships with local distributors facilitate regulatory navigation and customized implementations. The large patient populations in these regions amplify potential for system deployment in high-volume centers. Educational programs for healthcare workers promote standardized use of RFID in quality assurance. This opportunity enables global firms to diversify beyond mature markets.

Key corporations are establishing regional operations to optimize supply and lower transportation costs. Overall, emerging expansions align with efforts to enhance transfusion safety in developing areas. Strategic initiatives can secure notable positions in these dynamic healthcare landscapes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic shifts directly influence the RFID blood monitoring systems market by shaping healthcare capital allocation and operational spending across blood banks and hospitals. Persistent cost inflation increases prices for microchips, readers, labels, and networking infrastructure, which forces administrators to re-evaluate technology rollouts.

Higher borrowing costs restrict expansion plans for digital traceability programs, especially in smaller regional centers. Geopolitical instability affects semiconductor availability and global electronics logistics, creating procurement bottlenecks and unpredictable delivery cycles.

Current US tariffs on imported RFID components and related hardware elevate system acquisition costs, which reduces short term purchasing flexibility and pressures vendor profitability. These financial constraints can slow implementation timelines and delay modernization in budget sensitive facilities.

At the same time, supply uncertainty pushes providers to invest in domestic sourcing, system standardization, and long term supplier partnerships. With regulatory emphasis on blood safety and traceability continuing to strengthen, the market retains strong strategic relevance and long term growth potential.

Latest Trends

Integration of RFID with IoT for real-time monitoring is a recent trend in the market.

In 2024, the fusion of RFID with Internet of Things platforms has advanced real-time blood product tracking from collection to administration. These integrated systems enable automated alerts for temperature deviations and expiration dates. Manufacturers have focused on sensor-enhanced tags compatible with IoT networks for seamless data transmission.

Clinical applications benefit from improved visibility in supply chains, reducing manual errors. Research published in 2024 highlighted the convergence of smart RFID with predictive analytics for enhanced inventory management. This development addresses challenges in maintaining cold chain integrity during transport.

The trend emphasizes interoperability with hospital information systems for comprehensive traceability. Regulatory adaptations support deployment in blood centers with validation protocols. Industry collaborations refine data analytics for proactive issue resolution. These innovations aim to elevate safety standards while optimizing resource utilization in transfusion services.

Regional Analysis

North America is leading the RFID Blood Monitoring Systems Market

North America held a 42.1% share of the RFID Blood Monitoring Systems market in 2024, supported by strong emphasis on transfusion safety and inventory accuracy across hospitals and blood banks. Healthcare providers increasingly adopted radio frequency identification to track blood bags in real time and reduce labeling or storage errors.

Stringent regulatory compliance requirements encouraged facilities to modernize traceability workflows. Large hospital networks integrated RFID platforms with laboratory information systems to enhance visibility from collection to transfusion. Rising surgical volumes and trauma cases strengthened the need for precise blood management.

Investment in smart hospital infrastructure further accelerated implementation across advanced care centers. A relevant supporting indicator comes from the American Red Cross, which reported collecting about 4.5 million blood donations annually in recent reporting years, underscoring the scale of blood handling operations that require secure tracking technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The RFID Blood Monitoring Systems market in Asia Pacific is expected to grow steadily during the forecast period as governments enhance transfusion safety standards and digitize hospital supply chains. Expanding healthcare infrastructure increases the number of blood banks and transfusion centers across emerging economies.

Hospitals prioritize automated tracking to minimize wastage and prevent mismatched transfusions. Rising road accidents and complex surgeries raise the demand for reliable blood inventory management. National health programs promote standardized labeling and traceability across public facilities. Local technology providers introduce cost effective tagging and monitoring solutions to broaden adoption.

A verifiable signal of regional demand appears in 2023 data from the World Health Organization, which reported that over 40% of global blood donations come from high and upper middle income countries, highlighting the critical importance of structured monitoring systems across expanding healthcare networks in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the RFID blood monitoring systems market grow by refining tag sensitivity, enhancing data integration, and expanding software capabilities that help blood banks and hospitals track inventory, ensure traceability, and reduce waste. They also strengthen value propositions by embedding real-time alerts, analytics dashboards, and compliance reporting tools that support quality assurance and regulatory adherence across complex supply chains.

Firms pursue strategic partnerships with blood service organizations, healthcare IT providers, and supply chain integrators to embed their technologies into broader clinical and operational workflows. Geographic expansion into North America, Europe, and high-growth Asia Pacific diversifies revenue streams and captures rising investments in smart healthcare logistics and patient safety initiatives.

Zebra Technologies Corporation exemplifies a diversified enterprise technology provider with a broad portfolio of RFID hardware, software, and services that support healthcare asset and specimen tracking, backed by extensive global sales and support operations.

The company advances its competitive agenda through disciplined investment in product innovation, targeted collaborations that extend interoperability, and a customer-centric commercialization strategy that aligns solutions with evolving institutional priorities.

Top Key Players

- LogTag North America Inc.

- InnerSpace (Stanley Healthcare)

- Mobile Aspects

- Cardinal Health

- GAO Group

- SATO Vicinity Pty. Ltd.

- Biolog-Id

- Terso Solutions, Inc.

- Honeywell

- Nordic ID

- TAGSY RFID

- Zebra Technologies

- Mediware Information Systems (WellSky)

- RFID Group

- Solstice Medical LLC

Recent Developments

- In January 2025, Avery Dennison, in collaboration with Becton Dickinson, announced plans to present an RFID-based digital identification solution for pre-filled syringes. The system integrates RFID tags directly into the syringe shield, enabling unit-level tracking and enhanced traceability throughout the pharmaceutical supply chain.

- In May 2025, Haier Biomedical highlighted its “U-Blood Network” digital platform at the Vietnam National Blood Transfusion Conference. The ecosystem incorporates RFID-enabled blood units that can be monitored across the entire transfusion workflow, supporting improved visibility, inventory management, and safety controls from collection to clinical use.

Report Scope

Report Features Description Market Value (2025) US$ 452.4 Million Forecast Revenue (2035) US$ 2250.1 Million CAGR (2026-2035) 17.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (RFID Readers, RFID Tags and Software), By Function (Inventory & Supply Chain Control, Quality & Condition Monitoring and Transfusion Safety & Patient Matching), By End-User (Blood Banks and Hospitals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LogTag, InnerSpace, Mobile Aspects, Cardinal Health, GAO Group, SATO Vicinity, Biolog-Id, Terso Solutions, Honeywell, Nordic ID, TAGSY, Zebra Technologies, Mediware, RFID Group, Solstice Medical. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  RFID Blood Monitoring Systems MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

RFID Blood Monitoring Systems MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- LogTag North America Inc.

- InnerSpace (Stanley Healthcare)

- Mobile Aspects

- Cardinal Health

- GAO Group

- SATO Vicinity Pty. Ltd.

- Biolog-Id

- Terso Solutions, Inc.

- Honeywell

- Nordic ID

- TAGSY RFID

- Zebra Technologies

- Mediware Information Systems (WellSky)

- RFID Group

- Solstice Medical LLC