Global Remote Patient Monitoring Software and Services Market By Type (Software- On-premise, Cloud-based; Services), By Application (Cancer, Cardiovascular Disease, Diabetes, Sleep Disorder, Neurological Disorders, Respiratory Diseases, Mental Health, Others), By End-User (Healthcare Providers- Hospitals, Ambulatory Care Centers, Long-term Care and Assisted Living Facilities, Others; Healthcare Payers; Patients), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 105725

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

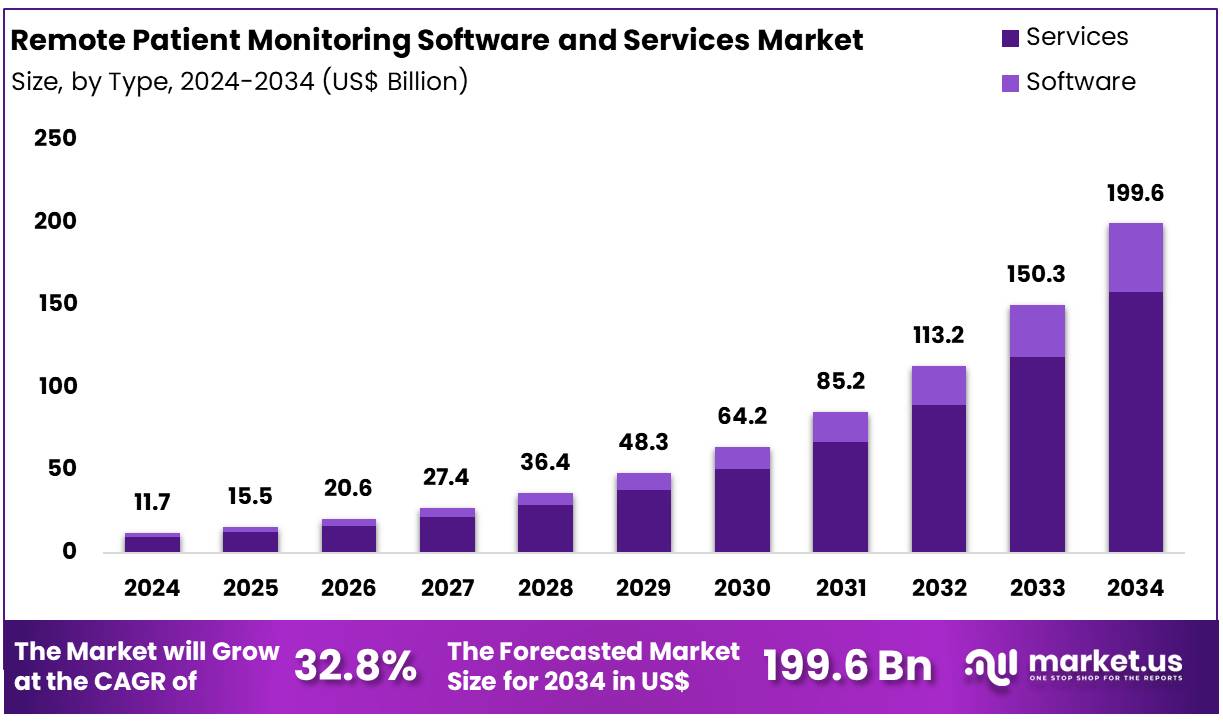

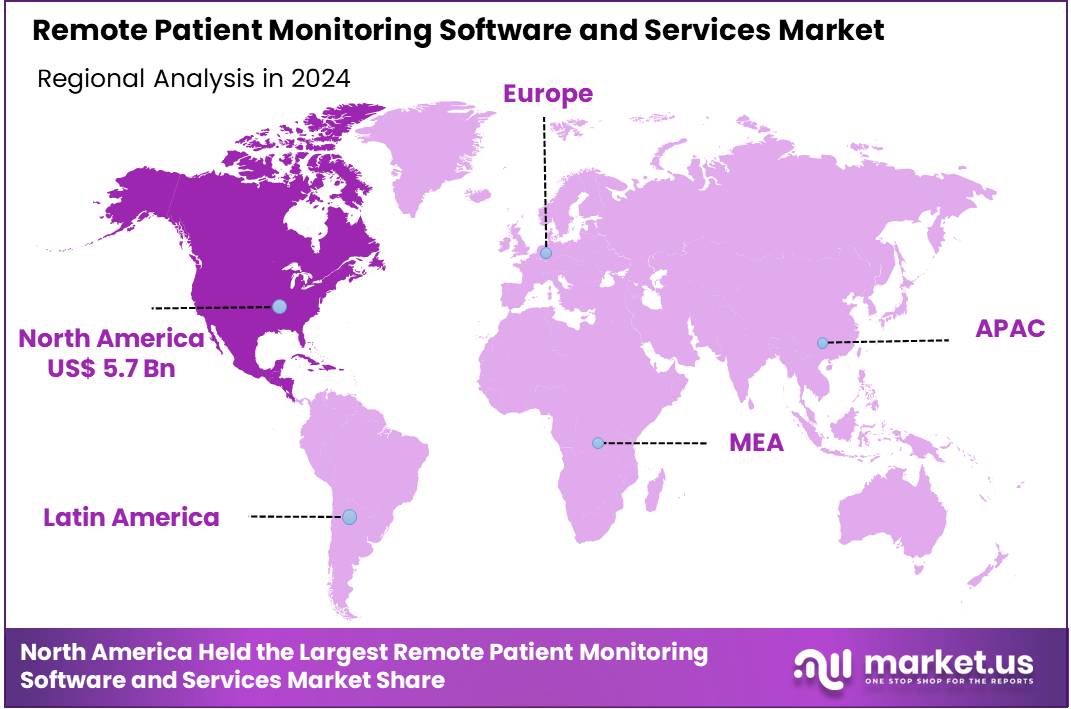

Global Remote Patient Monitoring (RPM) Software and Services Market size is forecasted to be valued at US$ 199.6 Billion by 2034 from US$ 11.7 Billion in 2024, growing at a CAGR of 32.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 48.5% share with a revenue of US$ 5.7 Billion.

Rising prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular diseases has led to the growth of the market. One of the few healthcare delivery strategies that has the potential to significantly enhance global health outcomes is remote patient monitoring, according to the World Health Organization (WHO). RPM can enhance medical diagnosis and treatment choices while assisting patients in managing their own care by employing smart devices to monitor patients’ acute and chronic medical issues.

Virtual, home-based clinical trials are also built on RPM. Such studies have the potential to increase recruitment diversity, enhance patient adherence to trial protocols, and expedite the transmission of trial data because they are more convenient for participants. The US government relaxed regulations in the wake of the COVID-19 outbreak to make it easier for clinicians to deliver remote care across state lines. The American Hospital Association is advocating for the permanent implementation of telehealth flexibility regulations, which were first thought to be a temporary solution, due to the nationwide scarcity of clinicians, particularly in rural areas.

Between 2019 and 2021, RPM reimbursements from the US Centers for Medicare & Medicaid Services grew 19 times, from $5.5 million to over $101 million. As of March 2023, RPM services were covered by 34 state Medicaid programs; however, many programs have limitations on their use, such as only paying home health agencies, limiting the types of clinical conditions that can be monitored, and limiting the number of monitoring devices that can be used.

Some target disease facts and figures:

- Approximately 1.28 billion persons between the ages of 30 and 79 suffer from hypertension across the globe, with two-thirds residing in low- and middle-income nations.

- Around 46% of adults suffering from hypertension are thought to be ignorant of their condition.

- Just 42% of persons with hypertension receive a diagnosis and treatment.

- According to the most recent International Diabetes Federation (IDF) Diabetes Atlas (2025), 11.1%, or 1 in 9, of adults aged 20 to 79 have diabetes, and more than 40% are not aware that they have the disease.

- According to IDF forecasts, 1 in 8 adults, or 853 million people, will have diabetes by 2050, a 46% rise.

Key Takeaways

- In 2024, the market for remote patient monitoring software and services generated a revenue of US$ 11.7 Billion, with a CAGR of 32.8%, and is expected to reach US$ 199.6 billion by the year 2034.

- Based on Type segment, services held the largest market share of 79.1% in 2024.

- By Application, Cardiovascular Disease held significant revenue share of 15.8% in 2024.

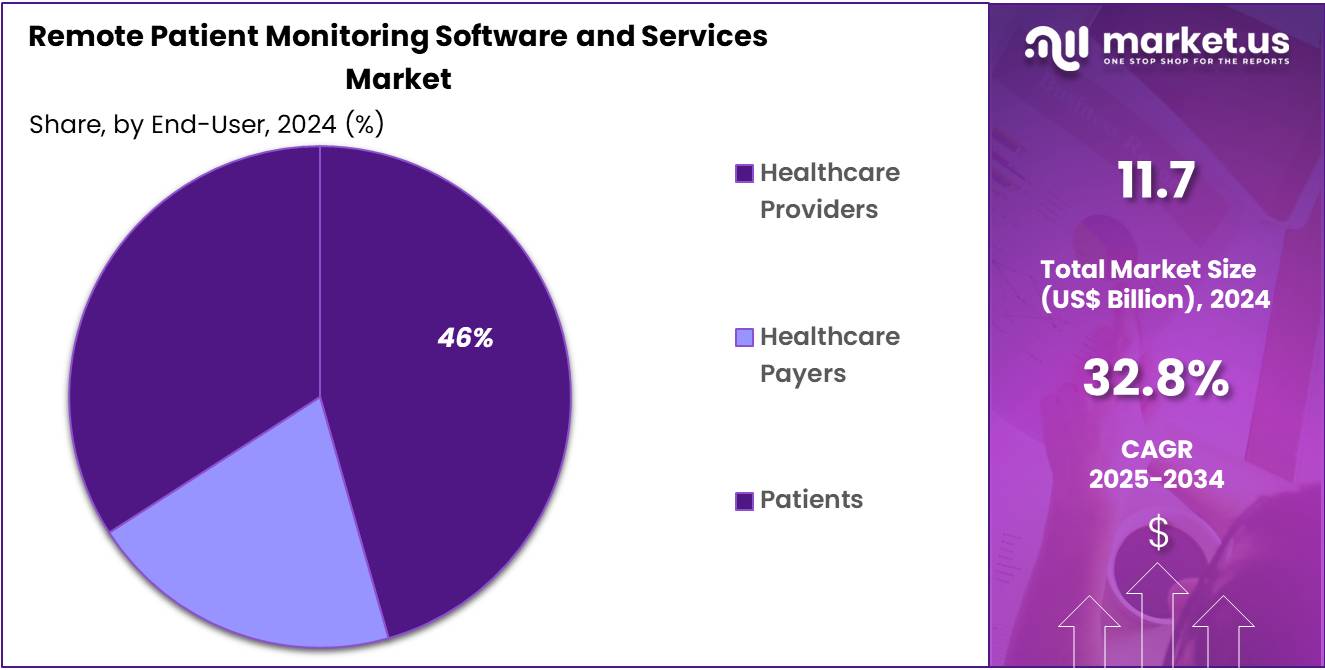

- By End-User, Healthcare Providers captured the maximum revenue share with 45.6% in 2024.

- North America held the largest share of 48.5% in 2024 in the global market.

Type Analysis

RPM services segment dominated the market with a revenue share of 79.1% in 2024. This demand is attributable to the cost-effective healthcare solutions. Some of the services include patient data management, clinical monitoring, audit support, billing support, emergency support, and medication management. Remote therapeutic monitoring (RTM), for example, records non-physiologic information about a therapeutic intervention. This contains information about the respiratory or musculoskeletal systems of a patient. Additionally, RTM can track treatment response (e.g., pain management) and adherence (e.g., drug compliance).

In addition, medication management, often known as titration, is the process of adjusting a patient’s medication dosage in response to how they react to a specific dosage. For this task, RPM works well. Clinicians can examine the data to ascertain medication tolerances and modify dosages after patients use wireless devices to evaluate health metrics. For certain patient types, remote monitoring and titration may improve patient care, according to a study by researchers at UC Davis Medical Center that compared the efficacy of remote medication management for cardiovascular patients to conventional care techniques.

Application Analysis

Based on application segment, cardiovascular disease gained significant share in the market holding 15.8% in 2024. In the European region, men are nearly 2.5 times more likely than women to die from cardiovascular diseases, according to the WHO/Europe report. Additionally, there is a geographic divide: in Eastern Europe and Central Asia, the likelihood of dying young (30–69 years old) from a CVD is about five times higher than in Western Europe.

Additionally, the opinions of nurses and doctors who did not employ noninvasive telemonitoring technology were assessed using a nationwide cross-sectional survey in Norway and Lithuania. They discovered that around half of medical professionals thought telemonitoring was helpful for following up with patients who had heart failure (58.0% in Norway and 55.5% in Lithuania).

On the other hand, concerns were raised when healthcare professionals with expertise in working with medical wearables for patients with cardiac arrhythmia, as well as the patients themselves, were asked about the management and quality of patient-generated data through telemonitoring. These concerns focused on the complexity of data analysis, the accuracy of wearable devices, and digital health literacy.

Another issue highlighted was the lack of integration with existing electronic medical record systems. As a solution, the authors suggested that establishing quality criteria involving all relevant stakeholders, including patients, healthcare providers, and manufacturers, could improve the accuracy of data collected by wearables.

End-User Analysis

In remote patient monitoring software and services market, healthcare providers dominated the market in 2024 capturing 45.6% share. The implementation of hospital-at-home and safe-discharge programs involves enrolling patients in post-discharge RPM initiatives, which are designed to reduce readmissions and enhance hospital capacity as per Accuhealth Technologies LLC.

High-risk COVID-19 patients who utilized RPM devices had decreased rates of hospitalization and death, as well as fewer ER visits and ICU hospitalizations, according to a 2021 Mayo Clinic study. Reductions in hospitalization rates account for a large portion of the cost savings ascribed to RPM. According to a 2021 study of COVID patients in Cleveland, Ohio, those who had remote monitoring after being discharged saw 77% fewer fatalities and 87% fewer hospitalizations.

As of 2021, 96% of nonfederal acute care hospitals and 78% of office-based physicians had implemented a certified EHR, as per the most recent HealthIT.gov data. Therefore, remote care services can theoretically be incorporated into patient records to give clinicians access to ongoing health status data, allow patients to submit that data without needing to visit the office or lab frequently, and help clinicians better coordinate care across various providers.

Key Market Segments

By Type

- Software

- On-premise

- Cloud-based

- Services

By Application

- Cancer

- Cardiovascular Disease

- Diabetes

- Sleep Disorder

- Neurological Disorders

- Respiratory Diseases

- Mental Health

- Others

By End-User

- Healthcare Providers

- Hospitals

- Ambulatory Care Centers

- Long-term Care and Assisted Living Facilities

- Others

- Healthcare Payers

- Patients

Drivers

Rising Prevalence of Chronic Diseases

Rising prevalence of chronic and target diseases is primarily driving the market growth. Chronic diseases such as heart disease, diabetes, and asthma are increasingly tied to unplanned emergency hospital use, according to research from the Centre for Online Health at The University of Queensland, Australia. RPM can help lighten the load on the healthcare system by detecting fluctuations in a patient’s health status, enabling clinicians to intervene before a hospital visit is needed.

Asthma is one of the most common chronic non-communicable diseases that affects over 260 million people and is responsible for over 450000 deaths each year worldwide, most of which are preventable according to Global Initiative for Asthma – GINA. As per Asthma and Allergy Foundation of America:

- Over 28 million people in the U.S. have asthma. This equals about 1 in 12 people.

- Over 23 million U.S. adults ages 18 and older have asthma.

- Asthma is more common in female adults than male adults. Around 11.0% of female adults have asthma, compared to 6.8% of male adults.

- It is a leading chronic disease in children. Currently, there are about 4.9 million children under the age of 18 with asthma.

As the average age of population worldwide trends higher, the ability to monitor and support older adults in their homes is crucial. As per WHO, globally, life expectancy at birth reached 73.3 years in 2024, an increase of 8.4 years since 1995. The number of people aged 60 and older worldwide is projected to increase from 1.1 in 2023 to 1.4 billion by 2030.

This trend is particularly evident and rapid in developing regions. In 2050, 80% of older people will be living in low- and middle-income countries. RPM systems designed to support older people include motion detectors, temperature sensors, and bed monitors that can alert remote caregivers and emergency responders if help is needed.

As per NCBI, based on a yearlong study called the Pregnancy Remote Monitoring study, where the participants gained experience using a blood pressure monitor, activity tracker, and weight scale that gathered data during prenatal care. As per the study, 77% of the midwives and 67% of the obstetricians felt that remote monitoring benefited their patients, especially the patients at high risk.

Restraints

Data Privacy and Security Concerns

Data privacy and cybersecurity remain key concerns in the implementation of remote patient monitoring (RPM) systems. Healthcare providers adopting RPM must ensure that patient data is securely stored and only accessible to authorized personnel. The increasing use of wearables, mobile health applications, and cloud-based platforms heightens the risk of data breaches and cyberattacks.

Regulatory frameworks, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States, mandate strict standards for safeguarding health information. Compliance with HIPAA is essential to prevent legal liabilities and protect the integrity of healthcare IT systems. Notably, HIPAA violations can result in penalties of up to US$ 1.9 million per infraction.

The Bipartisan Policy Center has called for the U.S. Department of Health and Human Services (HHS) to evaluate whether existing privacy policies adequately address these emerging threats. It has also urged a review of cybersecurity safe harbor laws, which provide legal protections to entities that actively improve their cybersecurity posture. Additionally, the Center recommends collaboration between HHS and the Office of the National Coordinator for Health Information Technology to develop standards ensuring RPM system compatibility with electronic health records (EHRs).

Multi-factor authentication (MFA) is a key method to bolster data security. By requiring two or more steps to verify user identity, MFA significantly reduces the risk of unauthorized access. Implementing MFA can help healthcare organizations avoid contributing to the over 3,000 daily cybersecurity complaints received by the FBI.

A recent example of the threat landscape is the ransomware attack on Episource, a medical billing company. The breach exposed the personal and health data of over 5.4 million individuals. The attack, which occurred between January 27 and February 6, 2025, allowed hackers to access and extract sensitive information.

Opportunities

Advancements in AI and Wearable Technology

Smartwatches and fitness trackers have become the go-to wearables for tracking health, allowing users to monitor vital stats such as heart rate, sleep patterns, calories burned, steps taken, sun exposure, and more. A 2023 survey, partially funded by the US National Heart, Lung, and Blood Institute, found that nearly one in three people use wearable devices to keep track of their health and fitness. Moreover, over 80% of respondents said they would be open to sharing their health data with their healthcare providers.

Some of the latest and most innovative wearable technologies include:

- BioIntelliSense BioSticker: This wearable sensor patch tracks vital signs like temperature, respiratory rate, and heart rate variability, providing continuous monitoring both in clinical settings and at home.

- Oura Ring: A smart ring that tracks sleep quality, heart rate variability, and activity levels, offering valuable insights into overall health and recovery, while helping users fine-tune their wellness routines.

- Bardy Diagnostics CAM Patch: A lightweight ECG patch worn on the chest for up to two weeks that continuously monitors the heart, diagnosing arrhythmias and remotely tracking heart health.

Looking ahead, 2024 is set to be a landmark year for wearable tech, with Apple and Garmin maintaining their lead in offering health-focused wearables. However, the entry of innovative startups is showing that there is still plenty of room for growth in this space.

For example, in January 2025, a new wearable sensor called CortiSense introduced for at-home cortisol monitoring, aimed at helping users manage stress and prevent burnout by easily tracking cortisol levels. In July 2024, KORE, an IoT company from Georgia, and mCare Digital, an Australian tech firm focused on independent living, launched the mCareWatch 241, a smartwatch designed for virtual patient monitoring. This device features an SOS button for emergency assistance, GPS tracking, heart rate monitoring, fall detection, speed dialing, reminders, and more—all through a mobile app and web dashboard.

Additionally, in January 2024, Blue Spark Technologies, Inc. launched VitalTraq™, a pioneering multi-sensor platform for remote patient monitoring. VitalTraq™ includes one of the most advanced contactless vital sign measurement sensors, Remote Photoplethysmography (rPPG), allowing patients to capture heart rate, heart rate variability, blood pressure, and respiratory rate with just a 30-60 second selfie scan, all without physical contact. This breakthrough technology promises to revolutionize how health data is collected and shared.

Impact of Macroeconomic / Geopolitical Factors

Rise in healthcare spending and growth in healthcare IT infrastructure have impacted the remote patient monitoring software and services market significantly. As per industry reports, AI, traditional machine learning, and deep learning are expected to generate net savings of up to $360 billion in healthcare expenditures. With rise in healthcare costs, RPM services provide advantages reducing hospital readmissions and emergency room visits. Countries with high healthcare budget can leverage RPM services as a cost-effective alternative and ultimately reducing the burden on healthcare system.

A recent survey found that over half (54%) of large organizations consider vulnerabilities in their supply chains as the biggest challenge to achieving cyber resilience. When referring to “supply chain,” the report includes all the third-party vendors, suppliers, and service providers that companies rely on for their daily operations. This concern is especially pressing for healthcare facilities, where every connected device could potentially be exploited by cybercriminals.

Additionally, around 60% of organizations have stated that geopolitical tensions are influencing their cybersecurity strategies. A growing number of CEOs about one in three are increasingly worried about cyber espionage and intellectual property theft. For healthcare research institutions working on innovative treatments, the threat of data theft is not just a financial risk; it can jeopardize years of invaluable research and diminish their competitive edge in the rapidly evolving field of medical innovation.

Latest Trends

Integration of Telehealth

The healthcare sector is undergoing a major shift, due to the growing use of digital technologies. Among these innovations, RPM and telehealth have become key tools that are transforming how healthcare is delivered. While both offer distinct advantages, the real potential lies in integrating RPM with telehealth to create a more holistic approach to care. This combination not only boosts patient outcomes but also improves operational efficiency and helps reduce costs.

RPM devices collect continuous data from patients, offering a real-time snapshot of their health. When paired with telehealth, this data can be reviewed instantly during virtual consultations, enabling healthcare providers to offer immediate advice and interventions. For example, using Clarity Medical’s Recobro alongside the MyTelepatient app allows doctors to get instant updates on a patient’s condition and address any concerns right away.

In a recent partnership with Cadence, Mount Sinai Health Partners announced plans to roll out a virtual care and remote patient monitoring program across 30 hospitals and 200 care sites in six states over the year, 2024. An internal study involving 218 patients showed that those using RPM had better blood pressure control and fewer emergency room visits compared to those receiving traditional in-clinic care.

Cathleen Mathew, the director of condition management and population health at Mount Sinai Health Partners, noted that RPM patients had significantly lower rates of emergency department and inpatient visits over the course of 12 months—an important achievement in the organization’s population health goals.

Regional Analysis

North America is leading the Remote Patient Monitoring Software and Services Market

North America dominated the remote patient monitoring software and services market with 48.5% share in 2024. The growing prevalence of chronic diseases, along with a rising demand for cost-effective healthcare solutions, further fuels the adoption of RPM services. The region’s strong focus on technological innovation, coupled with a robust regulatory framework, positions North America as a leader in the healthcare digital transformation. Some of the key statistics about RPM adoption in the US:

- An article in the Harvard Health Letter reports that nearly 50 million people in the United States are currently using remote patient monitoring devices.

- A survey by MSI International reveals that 80% of Americans support the use of remote patient monitoring, with almost half of them strongly favoring its integration into healthcare.

- In a survey of around 300 consumers conducted by MSI, 65% to 70% expressed willingness to join a RPM program with their healthcare providers to track blood pressure, heart rate, blood sugar, and blood oxygen levels. The survey also asked American patients to rank the most valued benefits of RPM, with the following results:

- Convenience – 43%

- Efficiency – 39%

- Control over personal health – 37%

- Greater accuracy – 36%

- Peace of mind – 36%

- According to the University of Pittsburgh Medical Center, RPM contributed to a 76% reduction in its readmission rate.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific region is gaining traction over the years due to rising awareness about remote healthcare, technological advancements, and a large and aging population. The growing prevalence of chronic diseases, coupled with rising healthcare costs, is pushing the demand for remote monitoring solutions in countries like China, India, and Japan. Furthermore, the high mobile penetration and increasing adoption of smartphones in the region create fertile ground for RPM and telehealth services to thrive.

The Ministry of Health and Family Welfare has rolled out several programs aimed at enhancing the public healthcare system’s efficiency with ICT and telehealth initiatives. For example, the National Tele-Mental Health Programme in India, which, with an average of 3,500 calls per day, has reached an important milestone of over 1 million calls received on its Tele-MANAS toll-free number. Launched by the Government of India in October 2022 to improve mental health service delivery across the country, the program now operates 51 Tele-MANAS centers across all states and Union Territories.

The helplines, 14416 and 1-800-891-4416, provide support in multiple languages, enabling smooth communication between callers and mental health professionals. In addition, in February 2024, Dozee, India’s first AI-driven, contactless Remote Patient Monitoring (RPM) and Early Warning System (EWS), unveiled a new feature Fall Prevention Alert (FPA). This innovative tool aims to revolutionize patient safety in hospitals, offering an advanced layer of protection for patients.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the Remote Patient Monitoring software and services market is marked by a blend of established healthcare companies and innovative tech firms that are continually evolving to meet the growing demand for remote healthcare solutions. These players focus on developing advanced software and integrating cutting-edge hardware to enhance patient care, improve health outcomes, and reduce healthcare costs. The market is highly competitive, with players emphasizing different strategies such as product differentiation, partnerships, and geographic expansion.

- “Care settings are progressively shifting from centralized environments to a model that includes home health, mobile locations, and rural areas, where reliable network connections are not always accessible,” stated Seema Verma, executive vice president and general manager of Oracle Health and Life Sciences.

Top Key Players

- Teladoc Health, Inc.

- Medtronic Plc.

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Caretaker Medical

- OMRON Healthcare

- BioIntelliSense

- ScienceSoft USA Corporation

- Athelas

- Biofourmis

- iHealth Labs

- Oracle

- ResMed

Recent Developments

- In June 2025, Oracle unveiled the general availability of Oracle Health Community Care, a cloud-based mobile extension of its Oracle Health Foundation electronic health record (EHR) system. This new offering allows caregivers to securely access and update detailed patient charts regardless of network conditions, enabling nurses, therapists, dietitians, social workers, and physicians to deliver care during in-home visits, in mobile clinics, or in emergency situations.

- In May 2025, Medtronic revealed a new strategic collaboration with Corsano Health B.V., an innovative MedTech company specializing in real-time remote patient monitoring solutions. Through this partnership, Medtronic will have exclusive rights to distribute Corsano Health’s advanced technology in Western Europe for hospital and hospital-at-home applications, boosting remote monitoring capabilities and enhancing patient care across various healthcare environments.

- In April 2024, Royal Philips announced a strategic collaboration with smartQare to integrate their advanced solution, viQtor, with Philips’ leading clinical patient monitoring platforms. This partnership aims to advance continuous patient monitoring both in-hospital and at home, initially focusing on Europe.

Report Scope

Report Features Description Market Value (2024) US$ 11.7 Billion Forecast Revenue (2034) US$ 199.6 Billion CAGR (2025-2034) 32.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Software- On-premise, Cloud-based; Services), By Application (Cancer, Cardiovascular Disease, Diabetes, Sleep Disorder, Neurological Disorders, Respiratory Diseases, Mental Health, Others), By End-User (Healthcare Providers- Hospitals, Ambulatory Care Centers, Long-term Care and Assisted Living Facilities, Others; Healthcare Payers; Patients) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teladoc Health, Inc., Medtronic Plc., GE Healthcare, Siemens Healthineers, Philips Healthcare, Caretaker Medical, OMRON Healthcare, BioIntelliSense, ScienceSoft USA Corporation, Athelas, Biofourmis, iHealth Labs, Oracle, ResMed Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Remote Patient Monitoring Software and Services MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Remote Patient Monitoring Software and Services MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Teladoc Health, Inc.

- Medtronic Plc.

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Caretaker Medical

- OMRON Healthcare

- BioIntelliSense

- ScienceSoft USA Corporation

- Athelas

- Biofourmis

- iHealth Labs

- Oracle

- ResMed