Global Electrophysiology Market By Product Type (Ablation Catheters (Radiofrequency (RF) Ablation, Cryoablation, and Pulse Field Ablation), Laboratory Devices, Diagnostic Catheters, and Access Devices), By Application (Atrial Fibrillation (AF) and Non-Atrial Fibrillation), By End-user (Inpatient Facilities, Outpatient Facilities, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142490

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

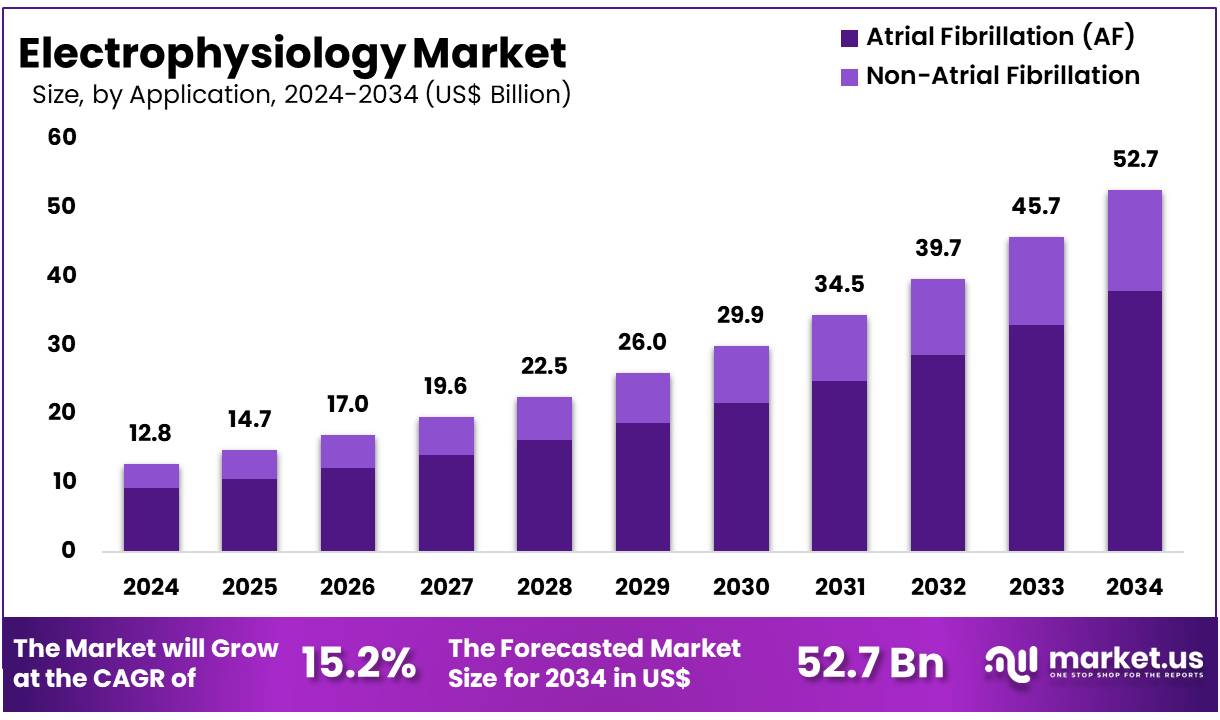

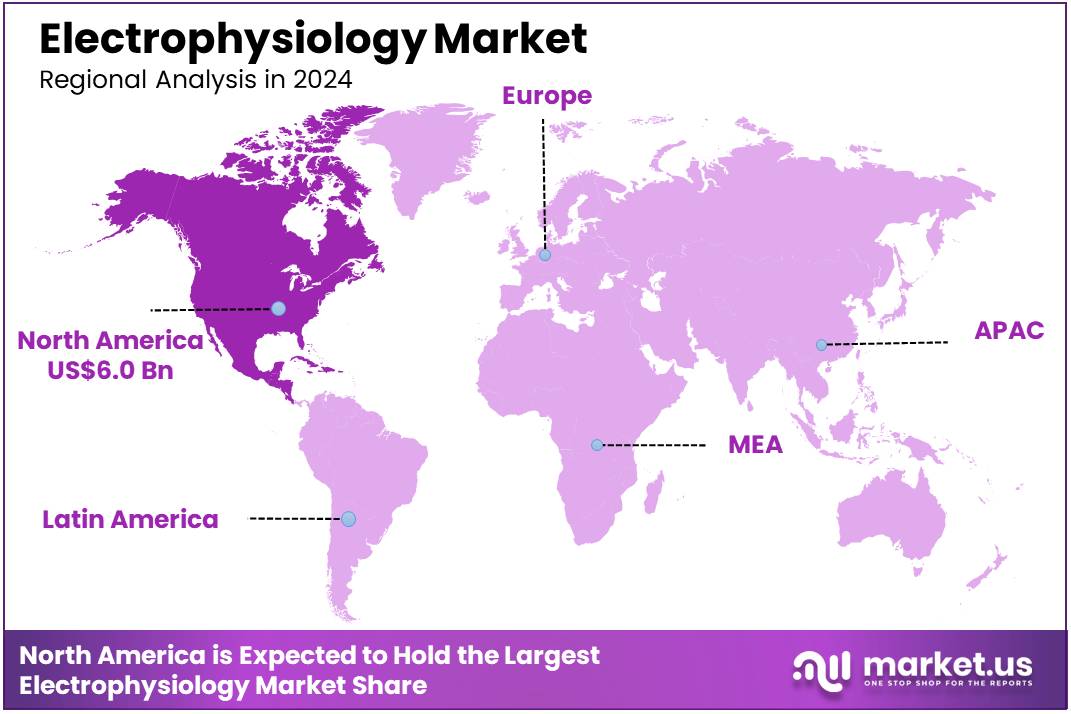

Global Electrophysiology Market size is expected to be worth around US$ 52.7 billion by 2034 from US$ 12.8 billion in 2024, growing at a CAGR of 15.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 46.7% share with a revenue of US$ 6.0 Billion.

Increasing demand for advanced treatments for cardiac arrhythmias and other heart-related conditions is driving the growth of the electrophysiology market. With rising global incidences of cardiovascular diseases and an aging population, healthcare systems are focusing more on electrophysiology as a solution for effective heart disease management.

Electrophysiology plays a crucial role in diagnosing and treating electrical abnormalities of the heart through procedures like catheter ablation, which helps restore normal heart rhythm. The development of advanced electrophysiology devices and technology, including high-density mapping systems, 3D mapping, and ablation catheters, has opened up new opportunities for physicians to perform minimally invasive procedures more effectively and safely.

In August 2023, Biosense Webster secured regulatory clearance for a range of atrial fibrillation ablation devices designed to enable catheter ablation procedures without relying on fluoroscopy. This development highlights the ongoing innovation in the electrophysiology space. Furthermore, the increasing adoption of robotic-assisted electrophysiology and the expansion of remote monitoring technologies are expected to enhance procedure accuracy and patient outcomes, driving the overall market growth.

Key Takeaways

- In 2024, the market for electrophysiology generated a revenue of US$ 12.8 billion, with a CAGR of 15.2%, and is expected to reach US$ 52.7 billion by the year 2033.

- The product type segment is divided into ablation catheters, laboratory devices, diagnostic catheters, and access devices, with ablation catheters taking the lead in 2023 with a market share of 48.7%.

- Considering application, the market is divided into atrial fibrillation (AF) and non-atrial fibrillation. Among these, atrial fibrillation (AF) held a significant share of 72.1%.

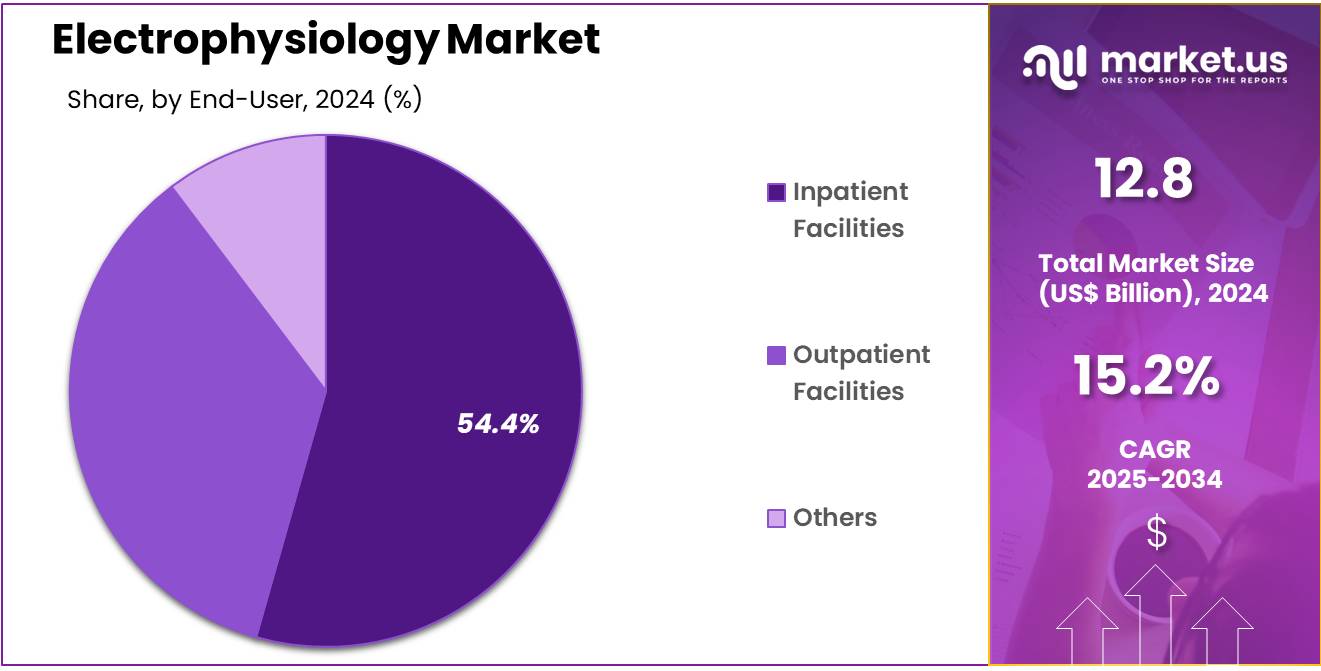

- Furthermore, concerning the end-user segment, the market is segregated into inpatient facilities, outpatient facilities, and others. The inpatient facilities sector stands out as the dominant player, holding the largest revenue share of 54.4% in the electrophysiology market.

- North America led the market by securing a market share of 46.7% in 2024.

Product Type Analysis

The ablation catheters segment led in 2024, claiming a market share of 48.7% as the demand for effective treatments for arrhythmias rises. Ablation catheters, including radiofrequency (RF) ablation, cryoablation, and pulse field ablation, are anticipated to see widespread adoption due to their ability to offer minimally invasive solutions for patients with various heart rhythm disorders.

The increasing prevalence of atrial fibrillation (AF) and other arrhythmias, combined with the need for more precise and efficient treatment options, is likely to drive the growth of this segment. Technological advancements in ablation catheter designs, which improve procedural outcomes and reduce recovery times, are projected to further fuel this segment’s expansion. As healthcare providers increasingly focus on providing personalized treatments, the demand for advanced ablation catheters in electrophysiology is expected to continue growing.

Application Analysis

The atrial fibrillation (AF) held a significant share of 72.1% due to the increasing prevalence of AF worldwide. As one of the most common types of arrhythmia, AF is expected to drive demand for advanced diagnostic and treatment solutions, including catheter ablation and drug therapies. The rising aging population and the growing number of patients with underlying risk factors such as hypertension, diabetes, and cardiovascular diseases are likely to contribute to the expansion of this segment.

Additionally, advancements in electrophysiology technologies, which allow for better mapping, monitoring, and treatment of AF, are expected to enhance the effectiveness of AF therapies, further fueling the growth of this segment. As healthcare systems focus on improving patient outcomes and reducing hospitalizations, the AF segment is anticipated to continue its upward trajectory.

End-user Analysis

The inpatient facilities segment had a tremendous growth rate, with a revenue share of 54.4% as hospitals remain the primary setting for complex electrophysiology procedures. Inpatient facilities are likely to continue driving the demand for electrophysiology services due to their capacity to handle high-acuity patients and advanced procedures such as catheter ablation for arrhythmias.

The increasing prevalence of heart diseases, especially arrhythmias like atrial fibrillation, is expected to further fuel the growth of this segment. As healthcare systems focus on improving procedural outcomes and patient care, hospitals are projected to adopt advanced electrophysiology equipment to support more efficient diagnostics and treatment of arrhythmias.

Additionally, the growing availability of specialized electrophysiology labs in hospitals is likely to contribute to the expansion of this segment, ensuring that patients have access to cutting-edge treatments in inpatient settings.

Key Market Segments

Product Type

- Ablation Catheters

- Radiofrequency (RF) Ablation

- Cryoablation

- Pulse Field Ablation

- Laboratory Devices

- Diagnostic Catheters

- Access Devices

Application

- Atrial Fibrillation (AF)

- Non-Atrial Fibrillation

End-user

- Inpatient Facilities

- Outpatient Facilities

- Others

Drivers

Increasing Prevalence of Cardiac Arrhythmias is Driving the Market

The rising incidence of cardiac arrhythmias, particularly atrial fibrillation, has significantly propelled the electrophysiology market. Atrial fibrillation affects millions worldwide and is associated with severe complications such as stroke and heart failure. According to the Centers for Disease Control and Prevention (CDC), by 2030, an estimated 12.1 million people in the United States will have atrial fibrillation.

This growing patient population necessitates advanced diagnostic and therapeutic solutions, leading to increased adoption of electrophysiology procedures. Electrophysiology offers precise mapping and ablation techniques to manage arrhythmias effectively, reducing the risk of adverse outcomes.

As awareness and diagnosis rates improve, healthcare providers are increasingly relying on electrophysiology to enhance patient care. Consequently, the market is experiencing robust growth, driven by the urgent need to address the escalating burden of cardiac arrhythmias.

Restraints

High Costs of Electrophysiology Procedures are Restraining the Market

Despite the clinical benefits, the high costs associated with electrophysiology procedures pose a significant barrier to market expansion. Advanced electrophysiology equipment and technologies require substantial investment, leading to increased procedural costs. For instance, the cost of catheter ablation, a common electrophysiology procedure, can range from US$20,000 to US$50,000 per patient.

These expenses can be prohibitive, especially in regions with limited healthcare funding or for patients without adequate insurance coverage. Additionally, the need for specialized training and infrastructure further escalates operational costs for healthcare facilities.

This financial burden may deter both providers and patients from opting for electrophysiology interventions, limiting market growth. To overcome this restraint, efforts are being made to develop cost-effective technologies and streamline procedures, aiming to make electrophysiology more accessible and affordable.

Opportunities

Technological Advancements are Creating Growth Opportunities

Innovations in electrophysiology technologies are opening new avenues for market growth. The development of advanced mapping systems, ablation catheters, and imaging modalities has enhanced the precision and safety of electrophysiology procedures. For example, the integration of three-dimensional (3D) mapping systems allows for detailed visualization of cardiac anatomy, improving the accuracy of ablation therapies.

As companies invest in research and development, the introduction of innovative products is expected to further drive market expansion. These advancements not only improve patient outcomes but also enhance the efficiency of healthcare delivery, making electrophysiology an increasingly attractive field for investment.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the electrophysiology market, presenting both challenges and opportunities. Economic downturns can lead to reduced healthcare budgets, limiting investments in advanced medical technologies, including electrophysiology equipment. Geopolitical tensions may disrupt global supply chains, causing delays in the production and distribution of essential devices.

Trade restrictions and tariffs can increase manufacturing costs, subsequently raising prices for end-users. However, increased government healthcare spending in response to public health concerns can boost demand for cardiac care solutions. Additionally, international collaborations and trade agreements can facilitate market expansion by opening new avenues for distribution and innovation.

As emerging economies invest in healthcare infrastructure, the demand for electrophysiology services is expected to rise, presenting growth opportunities for market players. While challenges persist, the global emphasis on improving cardiac health and the adoption of advanced technologies are poised to drive positive growth in the electrophysiology market.

Latest Trends

Strategic Collaborations are a Recent Trend in the Market

The electrophysiology market has witnessed a surge in strategic collaborations among key industry players, aiming to enhance product offerings and expand market reach. For instance, in October 2024, Boston Scientific reported a 131% increase in sales within its electrophysiology segment, amounting to US$439 million for the third quarter. This growth was partly attributed to the company’s strategic initiatives and partnerships focused on advancing electrophysiology technologies.

Such collaborations enable companies to leverage each other’s expertise, fostering innovation and accelerating the development of cutting-edge solutions. These alliances also facilitate access to new markets and customer bases, driving competitive advantage. As the demand for advanced electrophysiology procedures continues to rise, strategic partnerships are becoming a prevalent trend, contributing to the dynamic growth of the market.

Regional Analysis

North America is leading the Electrophysiology Market

North America dominated the market with the highest revenue share of 46.7% owing to the increasing prevalence of cardiovascular diseases and advancements in medical technology. The Centers for Disease Control and Prevention (CDC) reported that atrial fibrillation affected an estimated 12.1 million people in the United States in 2023, underscoring the rising demand for electrophysiological interventions.

Additionally, Boston Scientific’s electrophysiology segment reported a remarkable 131% increase in sales, reaching US$ 439 million in the third quarter of 2024, reflecting the heightened adoption of advanced electrophysiology devices.

This surge is further supported by the American Heart Association’s projection that nearly 45% of the U.S. population will experience some form of cardiovascular disease by 2035, emphasizing the critical need for effective diagnostic and therapeutic electrophysiological solutions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing incidence of atrial fibrillation and other cardiac arrhythmias in countries such as China, Japan, and India. For instance, the Chinese Society of Cardiology reported a significant rise in catheter ablation procedures, from approximately 100,019 in 2020 to 125,006 in 2021, indicating a growing demand for electrophysiological treatments.

Moreover, improvements in healthcare infrastructure and greater awareness of minimally invasive procedures are expected to further propel the adoption of electrophysiology technologies across the Asia-Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the electrophysiology market focus on technological advancements, strategic partnerships, and product innovations to drive growth. They invest in research and development to enhance catheter ablation systems, mapping technologies, and diagnostic tools for better patient outcomes.

Companies expand their market reach through mergers, acquisitions, and collaborations with healthcare institutions. Regulatory approvals and compliance with industry standards help strengthen their competitive position. Expansion into emerging markets and the adoption of AI-driven solutions further support revenue growth and improve procedural efficiency.

Abbott is a global healthcare company specializing in medical devices, diagnostics, nutrition, and pharmaceuticals. Headquartered in Abbott Park, Illinois, the company offers advanced cardiac electrophysiology solutions, including mapping systems, ablation catheters, and monitoring devices.

Its continuous investment in innovation enhances the accuracy and safety of heart rhythm management procedures. Abbott collaborates with hospitals and research institutions to develop next-generation therapies for cardiac disorders. With a strong global presence, the company focuses on improving patient care through cutting-edge medical technologies.

Top Key Players

- Siemens Healthcare AG

- MicroPort Scientific Corporation

- Medtronic

- General Electric Company

- Boston Scientific

- Biotronik

- Biosense Webster

- Abbott

Recent Developments

- In May 2023, Abbott received approval from the US Food and Drug Administration (FDA) for its TactiFlex Ablation Catheter, Sensor Enabled. This innovative catheter, featuring contact force technology and a flexible tip, is the first of its kind. It enhances the treatment of atrial fibrillation (AFib) by improving procedural efficiency and safety compared to earlier catheter models.

- In February 2022, Boston Scientific Corporation completed the acquisition of Baylis Medical Company Inc. This strategic move bolstered Boston Scientific’s portfolio by integrating Baylis Medical’s expertise in advanced transseptal access solutions, which are essential for catheter-based interventions on the heart’s left side.

Report Scope

Report Features Description Market Value (2024) US$ 12.8 billion Forecast Revenue (2034) US$ 52.7 billion CAGR (2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ablation Catheters (Radiofrequency (RF) Ablation, Cryoablation, and Pulse Field Ablation), Laboratory Devices, Diagnostic Catheters, and Access Devices), By Application (Atrial Fibrillation (AF) and Non-Atrial Fibrillation), By End-user (Inpatient Facilities, Outpatient Facilities, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthcare AG, MicroPort Scientific Corporation, Medtronic, General Electric Company, Boston Scientific, Biotronik, Biosense Webster, and Abbott Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens Healthcare AG

- MicroPort Scientific Corporation

- Medtronic

- General Electric Company

- Boston Scientific

- Biotronik

- Biosense Webster

- Abbott