Global Ready To Eat Snacks Market By Product Type (Dairy Products, Instant Breakfast and Cereals, Bakery and Confectionary, Meat and Poultry, Frozen Pizza, Pasta and Noodles, Others), By Packaging (Canned, Retort, Frozen or Chilled, Others), By End-user (Residential, Food Service, Institutional), By Distribution Channel (Online Store, Departmental and Convenience Store, Specialty Store, Supermarket and Hypermarket, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132608

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

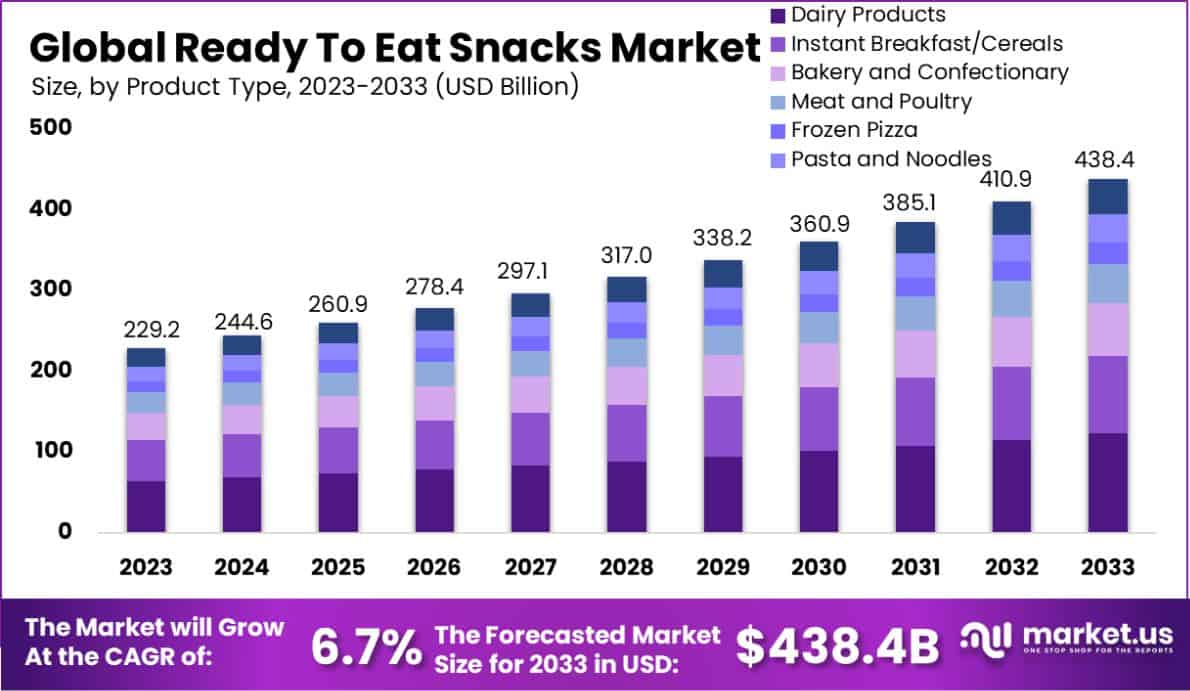

The Global Ready To Eat Snacks Market is expected to be worth around USD 438.4 billion by 2033, up from USD 229.2 billion in 2023, and grow at a CAGR of 6.7% from 2024 to 2033.

Ready To Eat (RTE) Snacks are pre-cooked and pre-packaged meals that consumers can eat without further preparation. These products offer convenience and are designed to save time, catering to the fast-paced lifestyles of modern consumers.

The RTE Snacks Market refers to the industry segment that deals with producing, distributing, and selling snacks that are ready for consumption without additional cooking. This market is driven by consumer demand for quick, convenient, and healthy snacking options, often influenced by busy lifestyles, rising disposable incomes, and the increasing prevalence of dual-income households.

The growth of the RTE snacks market can be attributed to the rising consumer preference for convenience foods coupled with increasing awareness about health-conscious snacking options. Enhanced distribution channels and innovative sustainable packaging solutions also contribute significantly to market expansion.

The Ready To Eat Snacks Market is witnessing a transformative shift, driven by changing consumer preferences towards convenience and quality. The Indian government’s recent initiative, with a substantial fund of ₹10,900 crore (approximately $1.3 billion), underscores a strategic push to invigorate the food processing sector, including ready-to-eat products. This scheme not only facilitates financial support but also fosters innovation within small and medium enterprises.

Venture capital allocations ranging from ₹5 crore to ₹25 crore (approximately $600,000 to $3 million) are tailored to bolster innovative food businesses, positioning them for accelerated growth and competitive advantage. Furthermore, the provision of a 15% subsidy on loans for technology upgrades is a significant boon for ready-to-eat snack manufacturers, enhancing their production capabilities and efficiency.

Such governmental incentives are pivotal in enhancing product quality and operational efficiencies, thereby catalyzing market growth and sustainability in the ready-to-eat snack segment. As these companies harness these benefits, the market is set to expand, reflecting an increased alignment with global food safety and quality standards.

According to qpos.co.in, this initiative is poised to significantly impact the landscape, promoting a robust infrastructure for innovation and quality enhancement in the ready-to-eat snacks market.

Demand for RTE snacks is propelled by the growing number of consumers seeking nutritional and quick eating options. This demand is further bolstered by the trend of on-the-go consumption, urbanization, and the rising number of working professionals who prefer convenient meal solutions.

The market presents opportunities to expand healthy and organic snack options, which are becoming increasingly popular among health-aware consumers. Additionally, there is potential for growth in emerging markets where urbanization and income levels are on the rise, creating a broader consumer base for RTE snacks.

Key Takeaways

- The Global Ready To Eat Snacks Market is expected to be worth around USD 438.4 billion by 2033, up from USD 229.2 billion in 2023, and grow at a CAGR of 6.7% from 2024 to 2033.

- Bakery and confectionery products hold a significant 26.3% share in the Ready To Eat Snacks Market.

- Frozen or chilled packaging dominates, accounting for 52.3% of the market’s distribution format.

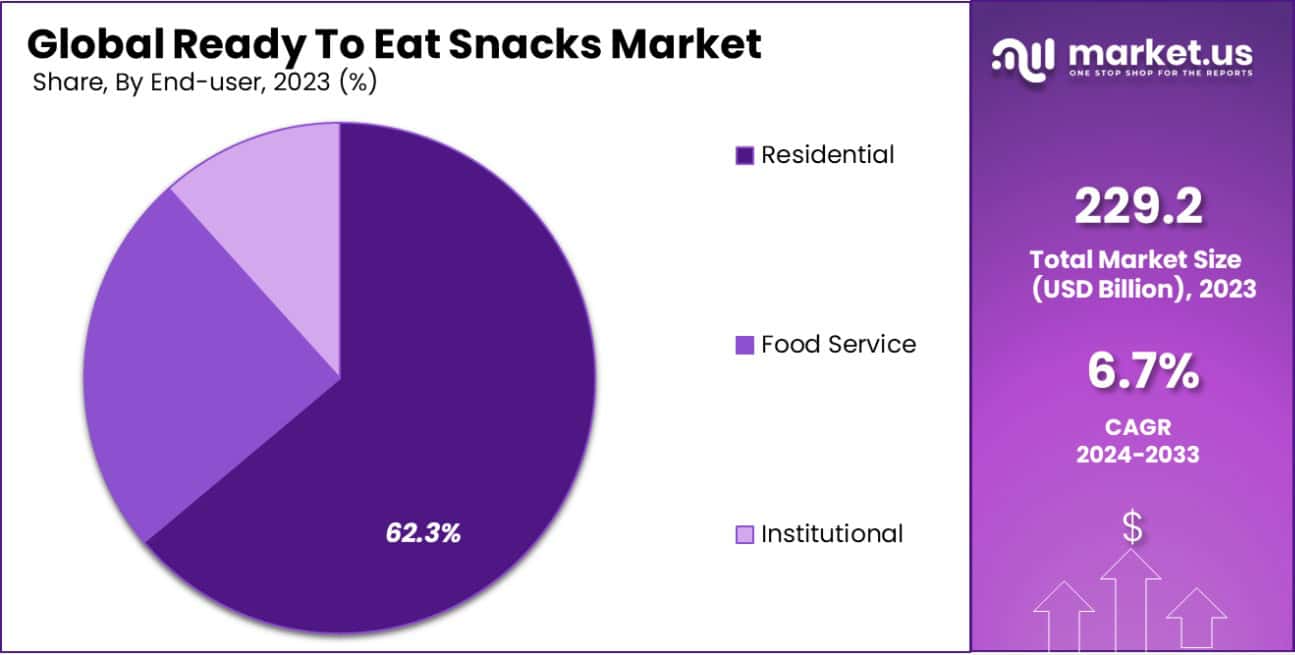

- The residential sector emerges as the primary end-user, capturing 62.3% of the market demand.

- Supermarkets and hypermarkets are the leading distribution channels, representing 43.4% of market sales.

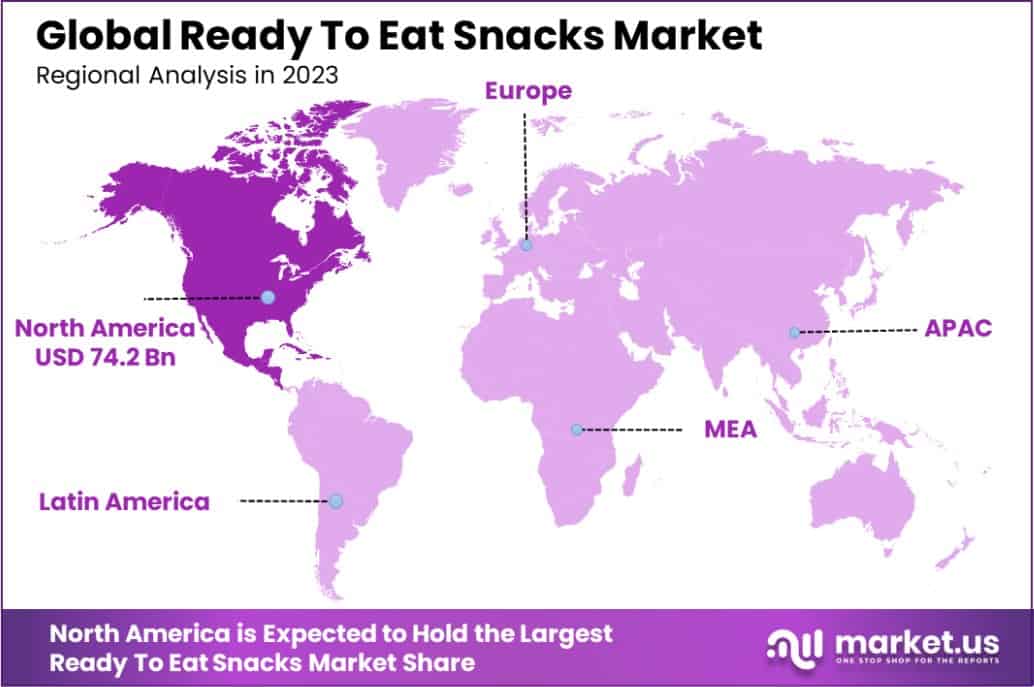

- In North America, the Ready To Eat Snacks Market holds a 32.4% share, valued at USD 74.2 billion.

By Product Type Analysis

Bakery and confectionery holds 26.3% market share in products.

In 2023, the “By Product Type” segment of the Ready To Eat Snacks Market was prominently led by Bakery and Confectionery, which captured a significant market share of 26.3%. This segment outperformed other categories, showcasing a strong preference among consumers for convenience coupled with indulgent eating experiences.

The demand in this category is primarily driven by the proliferation of innovative product offerings that cater to a broad range of taste preferences and dietary requirements.

Following closely, Dairy Products constituted a notable portion of the market, reflecting an increasing consumer inclination towards protein-rich and health-oriented snack options. Instant Breakfast/Cereals also demonstrated robust growth, driven by the rising consumer emphasis on nutritious and quick meal solutions, particularly among the urban demographic.

Meat and Poultry products maintained a steady market presence, appealing to consumers seeking high-protein, ready-to-eat options. Similarly, the Frozen Pizza and Pasta and Noodles segments benefited from the trend towards premiumization and variety, with consumers favoring products that offer a combination of convenience, quality, and taste.

These segments collectively illustrate the diverse consumer preferences that shape the dynamic Ready Eat Snacks Market, highlighting the importance of innovation and adaptation in sustaining market leadership and growth.

By Packaging Analysis

Frozen or chilled packaging dominates with a 52.3% market share.

In 2023, the “By Packaging” segment of the Ready To Eat Snacks Market was dominantly led by Frozen or Chilled products, which secured a commanding 52.3% share. This segment’s dominance underscores the growing consumer preference for snacks that offer both convenience and freshness, attributes that are particularly well-preserved through freezing or chilling.

The popularity of these products is driven by the increasing demand for longer shelf life and ease of preparation, catering to the fast-paced lifestyles of modern consumers.

Canned products also held a substantial portion of the market, appreciated for their convenience and long shelf stability. These products appeal to a segment of consumers who prioritize storage stability and convenience, making them a staple in emergency preparedness and quick meal solutions.

Retort packaging, though smaller in market share compared to its counterparts, continues to gain traction due to its ability to extend the shelf life of ready-to-eat foods without the need for refrigeration, thereby supporting the demand for portable and convenient eating options.

The variety within the packaging types highlights the diverse consumer needs and preferences, influencing product development and innovation strategies in the Ready To Eat Snacks Market.

By End-user Analysis

Residential users lead, consuming 62.3% of ready-to-eat snacks.

In 2023, the “By End-user” segment of the Ready To Eat Snacks Market was overwhelmingly dominated by the Residential sector, which held a substantial market share of 62.3%. This dominant position reflects a significant consumer shift towards convenience-driven eating habits within the home environment, accelerated by the ongoing trends of work-from-home arrangements and increased time spent indoors.

The residential segment’s preference for ready-to-eat products underscores the importance of quick, easy-to-prepare meals that do not compromise on taste or quality.

The Food Service sector also maintained a strong presence in the market, catering to on-the-go consumers and those preferring quick-service dining experiences. This sector adapts continuously to consumer tastes, often incorporating ready-to-eat snacks into menus to enhance variety and meet customer expectations for swift service.

Meanwhile, the Institutional segment, encompassing settings such as schools, hospitals, and corporate environments, exhibited a steady demand for ready-to-eat snacks, driven by the need for convenient and safe food options that adhere to health and safety standards.

Each end-user category highlights unique consumer dynamics and preferences, influencing product offerings and marketing strategies within the Ready To Eat Snacks Market.

By Distribution Channel Analysis

Supermarkets/hypermarkets distribute 43.4% of ready-to-eat snacks.

In 2023, the “By Distribution Channel” segment of the Ready To Eat Snacks Market was predominantly led by Supermarkets/Hypermarkets, which secured a notable market share of 43.4%. This channel’s leadership can be attributed to its extensive variety and accessibility, offering consumers a wide range of ready-to-eat snack options under one roof.

Supermarkets and hypermarkets have successfully catered to consumer preferences for one-stop shopping experiences where they can access both specialty items and everyday goods.

Following behind, the Online Store segment demonstrated significant growth, driven by the increasing consumer shift towards e-commerce platforms that offer convenience through home delivery services. This trend has been accelerated by technological advancements and the expanding digital infrastructure that makes online shopping more accessible and reliable.

Departmental and Convenience Stores also held a substantial market presence, favored for their accessibility and the quick shopping experience they offer, especially in urban areas. Meanwhile, Specialty Stores, which focus on niche markets and cater to specific consumer preferences, maintained a steady demand by offering specialized products that are not typically found in larger retail formats. Each distribution channel uniquely caters to evolving consumer needs, shaping the competitive landscape of the Ready To Eat Snacks Market.

Key Market Segments

By Product Type

- Dairy Products

- Instant Breakfast and Cereals

- Bakery and Confectionary

- Meat and Poultry

- Frozen Pizza

- Pasta and Noodles

- Others

By Packaging

- Canned

- Retort

- Frozen or Chilled

- Others

By End-user

- Residential

- Food Service

- Institutional

By Distribution Channel

- Online Store

- Departmental and Convenience Store

- Specialty Store

- Supermarket and Hypermarket

- Others

Driving Factors

Increasing Demand for Convenience Foods

The Ready To Eat Snacks Market is significantly driven by the escalating demand for convenience foods among consumers leading fast-paced lifestyles. With more individuals seeking quick and easy meal solutions that require minimal preparation time, the market has seen a surge in consumer interest.

This trend is particularly pronounced among urban populations and working professionals who prioritize time-saving options without compromising on taste and quality.

Growth in Health Awareness and Dietary Choices

Another key factor propelling the Ready To Eat Snacks Market is the growing consumer awareness of health and dietary preferences. As people become more health-conscious, there is a rising demand for snacks that are not only convenient but also offer nutritional benefits.

This shift has led manufacturers to innovate and expand their product lines to include options that are low in calories, high in protein, and include organic or natural ingredients, catering to a broader audience seeking healthier snack alternatives.

Expansion of Retail Distribution Channels

The expansion of retail distribution channels, including online stores, supermarkets, and hypermarkets, plays a crucial role in the growth of the Ready To Eat Snacks Market. The availability of these snacks across diverse retail platforms has made them more accessible to a wider audience, enhancing consumer convenience.

This distribution network has been further strengthened by the growth of e-commerce, which allows consumers to easily purchase snacks from the comfort of their homes, thus driving market growth.

Restraining Factors

High Cost of Healthy Snack Alternatives

A significant restraining factor in the Ready To Eat Snacks Market is the high cost associated with healthy snack alternatives. These products often command a premium price due to the use of high-quality, organic ingredients and more complex production processes.

This pricing can deter budget-conscious consumers, limiting the market’s growth potential among broader demographics who might otherwise be interested in healthier snack options.

Concerns Over Preservatives and Food Safety

Consumer concerns regarding the use of preservatives and food safety standards in ready-to-eat snacks pose challenges to market growth. There is growing skepticism about the nutritional content and the health impact of processed foods, which can contain artificial additives and preservatives.

This skepticism can influence purchasing decisions, particularly among health-conscious consumers who are wary of long ingredient lists and prefer fresh, less processed food options.

Fluctuations in Raw Material Prices

The market is also affected by fluctuations in the prices of raw materials, which can lead to inconsistent production costs and affect profitability for manufacturers. Ingredients used in ready-to-eat snacks, such as grains, sugars, and oils, are subject to price volatility due to factors like climatic changes, trade policies, and economic instability.

These fluctuations can result in unpredictable costs and supply chain disruptions, posing a significant challenge to maintaining stable product pricing and availability in the market.

Growth Opportunity

Expanding Market in Emerging Economies

Emerging economies present significant growth opportunities for the Ready To Eat Snacks Market. As disposable incomes rise and urbanization continues, more consumers in these regions are looking for convenient, quick food options.

This shift provides a fertile ground for market players to introduce ready-to-eat snack products tailored to local tastes and dietary preferences, tapping into new consumer segments and potentially boosting market share in rapidly developing areas.

Innovations in Snack Products and Packaging

There’s a growing opportunity for innovation within the Ready To Eat Snacks Market, particularly in terms of product and smart packaging. Companies that can introduce unique flavors, healthier ingredients, and environmentally friendly packaging options are likely to attract a broader consumer base.

Innovations such as resealable and biodegradable packages enhance convenience and appeal to environmentally conscious consumers, potentially driving higher product uptake and customer loyalty.

Integration with Digital and E-commerce Platforms

The integration of e-commerce and digital sales platforms offers a significant growth opportunity for the Ready To Eat Snacks Market. By leveraging online marketing and sales, brands can expand their reach beyond traditional retail confines, directly targeting consumers with personalized marketing, promotional offers, and more.

Furthermore, the use of data analytics from digital sales can help companies better understand consumer preferences and tailor their products accordingly, potentially leading to increased sales and market penetration.

Latest Trends

Surge in Plant-Based and Vegan Snack Options

The Ready To Eat Snacks Market is witnessing a notable trend toward plant-based and vegan options, reflecting broader dietary shifts among consumers. As awareness about animal welfare and environmental concerns increases, more individuals are opting for snacks that align with a vegan lifestyle.

This trend is prompting snack manufacturers to diversify their offerings to include snacks made from non-animal sources, which are not only ethical but also often perceived as healthier alternatives.

Adoption of Global Flavors and Cuisines

There’s a rising trend in the Ready To Eat Snacks Market toward incorporating global flavors and cuisines into product lines. As consumers become more adventurous with their taste preferences, driven by globalization and cultural exchanges, they are increasingly seeking snacks that offer international tastes.

This trend has led manufacturers to experiment with bold, ethnic flavors ranging from spicy to savory, catering to a palate seeking diversity and novelty.

Focus on Functional Snacks for Health Benefits

Functional snacks are gaining traction in the Ready To Eat Snacks Market, driven by consumer desire for foods that offer more than just convenience. These snacks are enhanced with vitamins, minerals, proteins, and other nutrients to provide health benefits beyond basic nutrition.

The demand for snacks that support lifestyle needs like energy boost, weight management, or digestive health is growing, leading companies to develop products that meet these specific health considerations, thereby aligning with the wellness-focused trends dominating consumer preferences.

Regional Analysis

In 2023, North America held a 32.4% share of the Ready To Eat Snacks Market, valued at USD 74.2 billion.

The Ready To Eat Snacks Market showcases significant regional diversity, with North America leading the charge with a dominant share of 32.4%, equivalent to USD 74.2 billion. This market strength is largely driven by the United States, where a fast-paced lifestyle and high consumer spending power fuel demand for convenient and quick snack options.

Europe follows, characterized by a robust demand for healthier snack alternatives, reflecting the region’s increasing health consciousness and preference for organic and non-GMO products.

In Asia Pacific, the market is rapidly expanding, driven by urbanization and changing dietary habits, particularly in emerging economies like China and India. This region is poised for significant growth due to its large population and growing middle class, who are increasingly adopting Western eating habits.

Meanwhile, the Middle East & Africa, though smaller in comparison, is experiencing growth influenced by increasing disposable incomes and the urbanization of populous countries such as Saudi Arabia and the UAE.

Latin America also presents a growing market, with Brazil and Mexico leading in consumption. The preference for convenience combined with traditional flavors is spurring the development of localized ready-to-eat snack offerings. Overall, North America’s commanding market share and high valuation set a strong precedent for growth and innovation across the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Ready To Eat Snacks market continues to thrive, fueled by changes in consumer eating habits and a heightened demand for convenience foods. Among the key players, companies like Nestlé, Kellogg’s, and Conagra Brands, Inc. stand out for their substantial market influence and innovative product offerings.

Nestlé, with its vast portfolio of quick-serving snacks and dedication to quality and nutritional value, remains a dominant force. The company has successfully expanded its reach by integrating organic and non-GMO ingredients into its products, aligning with the global shift towards healthier eating habits. Nestlé’s strategic acquisitions and partnerships have also broadened its distribution channels, strengthening its market presence across various regions.

Kellogg’s continues to capitalize on the trend towards on-the-go breakfast and snack solutions. With popular brands under its belt, Kellogg’s has introduced a variety of new products aimed at health-conscious consumers, including snacks with added proteins and low-calorie options. The company’s focus on diversifying its snack range to include gluten-free products and vegan options has helped it cater to a wider audience, driving growth in a competitive market.

Conagra Brands, known for its robust portfolio of edible products, has been focusing on innovation in snack foods by introducing bold flavors and convenient packaging solutions. Their products cater to the demand for both indulgence and health, featuring snacks that are flavorful yet mindful of dietary concerns.

These companies, by leveraging their strong brand identities and extensive distribution networks, continue to shape the Ready To Eat Snacks market, adapting to evolving consumer preferences and reinforcing their market positions through continuous product innovation and strategic marketing initiatives.

Top Key Players in the Market

- Amy’s Kitchen

- Atkins Nutritionals, Inc.

- California Pizza Kitchen

- Campbell Soup Company

- Conagra Brands, Inc.

- Danone

- Dr. Oetker

- General Mills

- Kellogg’s

- Kraft Heinz

- McCain Foods Ltd.

- MTR Foods Private Limited

- Nestlé

- Nomad Foods

- Tyson Foods

- Unilever

- Vietnam Hanfimex Corporation

Recent Developments

- In 2024, CPK will launch three innovative dishes, enhancing their menu’s appeal and variety. This move is part of CPK’s strategy to adapt to evolving consumer preferences and to cement its presence in the competitive Ready To Eat food market.

- In 2023, Atkins has been actively involved in expanding its product lines to cater to evolving dietary preferences, focusing on low-sugar and high-protein options that support weight management and healthy lifestyles.

Report Scope

Report Features Description Market Value (2023) USD 229.2 Billion Forecast Revenue (2033) USD 438.4 Billion CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dairy Products, Instant Breakfast and Cereals, Bakery and Confectionary, Meat and Poultry, Frozen Pizza, Pasta and Noodles, Others), By Packaging (Canned, Retort, Frozen or Chilled, Others), By End-user (Residential, Food Service, Institutional), By Distribution Channel (Online Store, Departmental and Convenience Store, Specialty Store, Supermarket and Hypermarket, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amy’s Kitchen, Atkins Nutritionals, Inc., California Pizza Kitchen, Campbell Soup Company, Conagra Brands, Inc., Danone, Dr. Oetker, General Mills, Kellogg’s, Kraft Heinz, McCain Foods Ltd., MTR Foods Private Limited, Nestlé, Nomad Foods, Tyson Foods, Unilever, Vietnam Hanfimex Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ready To Eat Snacks MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Ready To Eat Snacks MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amy's Kitchen

- Atkins Nutritionals, Inc.

- California Pizza Kitchen

- Campbell Soup Company

- Conagra Brands, Inc.

- Danone

- Dr. Oetker

- General Mills

- Kellogg's

- Kraft Heinz

- McCain Foods Ltd.

- MTR Foods Private Limited

- Nestlé

- Nomad Foods

- Tyson Foods

- Unilever

- Vietnam Hanfimex Corporation