Global RAN Automation Market Size, Share, Statistics Analysis Report By Component ((Solutions (RAN Intelligent Controllers (RICs)[Non-Real-Time RIC (Non-RT RIC), Near-Real-Time RIC (Near-RT RIC)]), (Software [AI/ML-Based Automation Tools, Network Optimization Tools, Traffic Management Solutions]), (Services (Professional Services [Implementation & Integration Services, Consulting & Training Services, Support & Maintenance]), Managed Services)), By Automation Level (Level 1: Manual Configuration & Monitoring, Level 2: Semi-Automation, Level 3: Full Automation), By Deployment Model (On-Premises, Cloud-Based), By Network Type (4G/LTE, 5G, Others), By End-User (Telecommunication Service Providers [Mobile Network Operators (MNOs), Internet Service Providers (ISPs)]), (Enterprises [Manufacturing, Retail, Healthcare, IT & Telecom, Media & Entertainment, Others (Energy & Utilities, etc.)]), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137093

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- RAN Automation US Market Size

- By Component

- By Automation Level

- By Deployment Model

- By Network Type

- By End-User

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

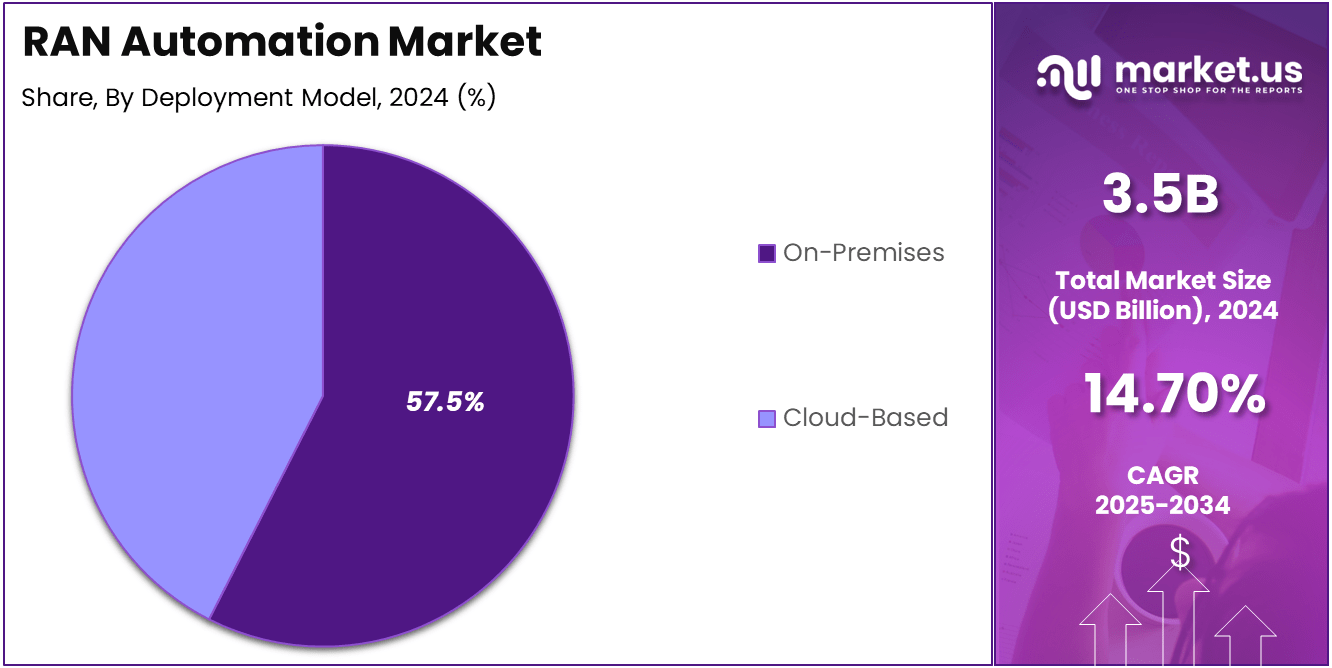

The Global RAN Automation Market size is expected to be worth around USD 13.8 Billion By 2034, from USD 3.5 Billion in 2024, growing at a CAGR of 14.70% during the forecast period from 2025 to 2034.

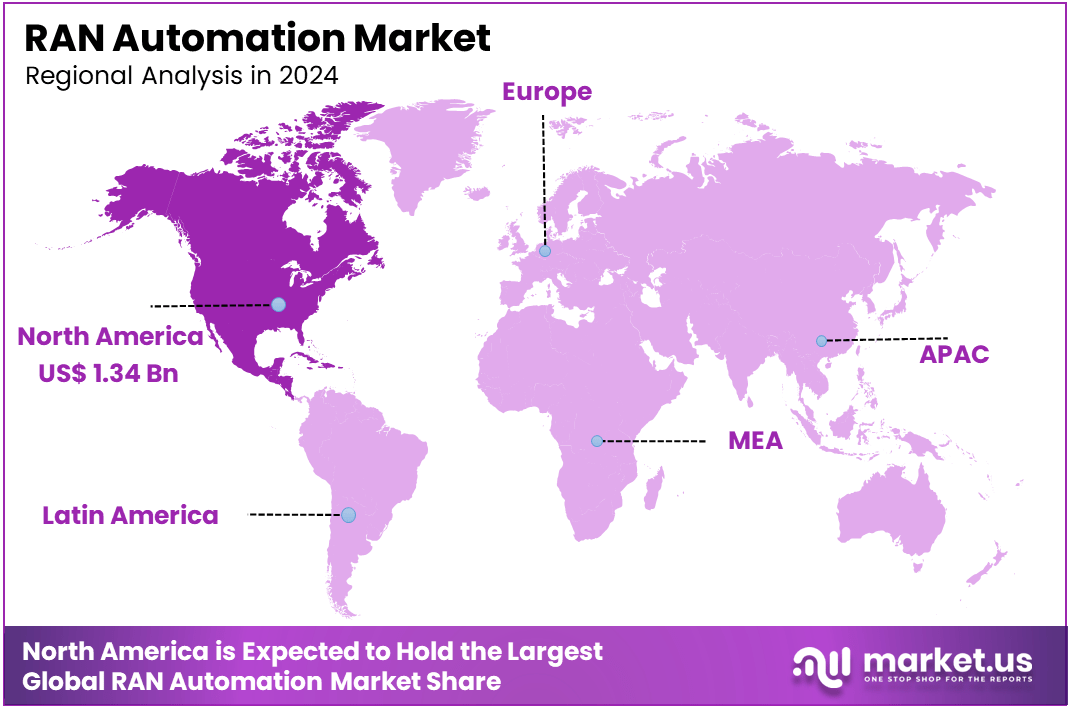

In 2024, North America held a dominant market position, capturing more than a 38.4% share, holding USD 1.34 Billion in revenue. Further, In North America, The United States Dominates the market size by USD 1.10 Billion holding a strong position steadily.

RAN (Radio Access Network) Automation refers to the process of automating the management and optimization of radio access networks, which are integral to the functioning of mobile telecommunications. RAN is responsible for the transmission of data between mobile devices and the core network.

RAN Automation focuses on streamlining network operations, improving efficiency, and reducing human intervention in tasks such as configuration, monitoring, fault management, and resource allocation. The aim is to reduce operational costs, increase network performance, and deliver a better end-user experience by utilizing artificial intelligence (AI), machine learning (ML), and automation technologies to manage increasingly complex and dense networks.

The RAN Automation market refers to the industry focused on developing and deploying automated solutions for managing and optimizing radio access networks. The market has been rapidly growing as telecom operators are increasingly looking for ways to handle the complexities introduced by next-generation wireless technologies like 5G.

Automation in RAN enables faster deployment, better network performance, real-time monitoring, and dynamic resource allocation, driving operational efficiencies and reducing costs for service providers. The market includes software solutions, AI-based automation tools, and integration services that assist operators in optimizing the performance, scalability, and maintenance of RAN infrastructure.

Several factors are driving the RAN Automation market forward. The biggest driver is the rapid global deployment of 5G networks, which require more efficient management and optimization of radio access networks due to their increased complexity and higher data traffic. Additionally, the demand for improved network performance, lower latency, and faster speeds is prompting operators to adopt automated solutions to enhance operational efficiency.

The demand for RAN Automation solutions is primarily fueled by the increasing volume of data traffic, the rise of 5G networks, and the growing need for self-healing and self-optimizing networks. Telecom providers are seeking automation to ensure that their networks can handle the ever-growing demand for bandwidth and low-latency services, particularly in urban areas with high-density mobile usage.

There are several opportunities in the RAN Automation market, particularly in emerging economies where telecom infrastructure is rapidly expanding. The shift towards 5G technology in these regions creates a substantial opportunity for automation vendors to assist telecom operators in optimizing their networks.

The RAN Automation market has seen several technological advancements, particularly in AI and machine learning, which are becoming integral to RAN management. AI enables predictive network optimization, allowing networks to adapt to changing traffic conditions, while machine learning algorithms can identify potential failures before they occur, minimizing downtime. Additionally, the adoption of edge computing is helping to reduce latency by processing data closer to the user.

RAN automation is a rapidly evolving field, particularly with the advent of 5G technology. Current statistics reveal that approximately two-thirds of Communication Service Providers (CSPs) have automated less than 20% of their RAN tasks. However, there is a significant push towards increased automation, with 31% of CSPs targeting to automate between 51% and 75% of their RAN processes by 2027, and 21% aiming for 76% to 85% automation.

Investment in RAN automation is expected to surge, particularly in the Open RAN sector. The global spending on RIC (RAN Intelligent Controller), SMO (Service Management and Orchestration), and x/rApps is projected to grow at a staggering CAGR of over 125% between 2024 and 2027. By the end of this period, annual investments in Open RAN automation are anticipated to reach nearly $700 million, up from approximately $50 million in 2024.

The broader market for RAN automation software and services, which encompasses various solutions including SON (Self-Organizing Networks) and third-party platforms, is also set for growth, with an expected CAGR of around 8% during the same timeframe. This reflects a significant shift as CSPs increasingly recognize the potential of AI and automation technologies to enhance network management and operational efficiency.

Moreover, a notable portion of current RAN AI trials—about 25%—is being conducted by CSPs who have previously managed their RANs entirely manually, indicating a growing willingness to embrace automation technologies. As these trends continue, the landscape of RAN automation is poised for transformative changes over the coming years.

Key Takeaways

- Market Growth: The RAN Automation market is projected to grow from USD 3.5 billion in 2024 to USD 13.8 billion by 2034, reflecting a robust CAGR of 14.70% over the forecast period.

- Dominant Component: The Solutions segment holds a significant share, accounting for 64.0% of the market in 2024, driven by the increasing demand for automated tools and platforms to manage RAN operations.

- Automation Level: Level 1: Manual Configuration & Monitoring leads the market with a 38.6% share, indicating a preference for simpler, less automated solutions in the early stages of adoption.

- Deployment Model: The On-Premises deployment model dominates with a 57.5% market share in 2024, as organizations prefer keeping sensitive network operations within their infrastructure.

- Network Type: The 4G/LTE network type accounts for 40.0% of the market, as telecom operators continue to optimize their existing 4G infrastructure alongside the rollout of 5G.

- End-User: Telecommunication Service Providers are the leading end-users, capturing 68.4% of the market, due to their need for efficient, automated RAN management to scale operations and improve service delivery.

- Regional Insight: North America holds a dominant market share of 38.4% in 2024, driven by significant investments in automation technology and the presence of leading telecom operators.

RAN Automation US Market Size

In 2024, North America held a dominant market position in the RAN Automation market, capturing more than a 38.4% share, with a revenue of USD 1.34 billion. This leading position is largely due to the region’s advanced telecommunication infrastructure and high demand for next-generation networks, such as 5G.

North America is home to some of the world’s largest telecommunication service providers, which are early adopters of automation technologies to optimize their network operations. The increased need for faster, more reliable mobile services, alongside a greater focus on reducing operational costs, is driving the demand for RAN automation solutions in this region.

The region benefits from a well-established technological ecosystem, including innovation hubs in the U.S. and Canada, where telecom operators, network equipment manufacturers, and software providers actively collaborate to implement automation across various network layers.

This collaborative environment supports the rapid deployment of automation technologies, helping operators enhance network performance and reduce the complexity of network management. Moreover, North America’s significant investments in the 5G rollout are accelerating the need for RAN automation tools capable of handling the increased network traffic and higher service demands.

Further, the United States dominates the market within North America, with a significant contribution of USD 1.10 billion in 2024. The country’s strong position in the RAN automation space is attributed to the presence of leading telecom giants such as AT&T, Verizon, and T-Mobile, who have been investing heavily in automation to enhance their 4G and 5G network deployments.

These telecom operators are actively integrating automation at various levels, including network monitoring, configuration, and troubleshooting, to improve operational efficiency and reduce manual intervention. Additionally, the supportive regulatory environment and ongoing investment in digital transformation initiatives further reinforce the US’s strong position in the market.

By Component

In 2024, the Solutions segment held a dominant market position, capturing more than 64.0% share, driven by the growing demand for RAN Intelligent Controllers (RICs), AI/ML-based automation tools, and network optimization solutions.

This segment’s leadership is primarily attributed to the critical role of RAN Intelligent Controllers in automating and optimizing radio access networks (RAN), a core function in the transition to 5G and beyond. Non-Real-Time RIC (Non-RT RIC) and Near-Real-Time RIC (Near-RT RIC) are at the forefront of enabling automated network management and enhancing operational efficiency in telecom networks.

The RAN Intelligent Controllers (RICs) offer network operators the ability to enhance both network performance and customer experience through intelligent automation and optimization. These tools support functionalities like dynamic resource allocation, traffic management, and quality of service enhancement.

Non-RT RIC focuses on long-term optimization and is essential for managing control functions, while Near-RT RIC plays a more responsive role, enabling real-time actions within the RAN. As mobile operators continue to deploy 5G, the adoption of RICs is expected to increase significantly.

Additionally, AI/ML-based automation tools have seen a rapid rise in demand, particularly for their ability to analyze vast amounts of data and make real-time decisions for network optimization. Network optimization tools and traffic management solutions also play a critical role in improving bandwidth efficiency and ensuring quality service during high traffic loads.

On the other hand, the Services segment is crucial for ensuring the successful implementation and integration of RAN automation solutions. This segment includes professional services such as consulting, implementation, integration, training, and managed services that support ongoing network maintenance and upgrades. These services ensure that telecom operators can maximize the potential of their RAN automation technologies.

By Automation Level

In 2024, the Level 1: Manual Configuration & Monitoring segment held a dominant market position, capturing more than 38.6% share, driven by its extensive use in traditional network management. At this stage, manual intervention is still essential for configuring, monitoring, and maintaining RAN infrastructure, especially in legacy network environments. Many operators rely on manual configuration as they continue transitioning from older systems to more automated models.

The manual configuration and monitoring approach is particularly common in early-stage RAN deployments and in markets where full automation is not yet feasible due to infrastructure limitations. This segment holds its position due to the familiarity and control it offers network operators, particularly in complex network environments where human oversight is still preferred for troubleshooting and issue resolution.

Despite the growth in semi-automation and full automation solutions, Level 1 remains significant because of its integration into legacy systems. Furthermore, this level of automation continues to play an essential role in maintaining existing network performance, particularly in regions where newer technology adoption is slower.

However, as the market moves toward greater automation, the share of Level 1 will gradually diminish, giving way to Level 2 and Level 3 solutions. These levels offer increased efficiency and reduced human intervention, which aligns with industry trends focusing on improved operational efficiency, scalability, and the evolution toward fully autonomous RAN systems in the coming years.

By Deployment Model

In 2024, the On-Premises segment held a dominant market position, capturing more than 57.5% of the market share, primarily due to its strong presence in large-scale telecommunication networks. On-premises deployment remains the preferred choice for many telecommunication service providers, as it offers higher levels of control, security, and customization.

These systems allow organizations to manage their RAN operations internally, without relying on third-party cloud services, which is crucial for businesses dealing with sensitive data or operating in regions with strict data sovereignty regulations. Another significant factor contributing to the dominance of the on-premises model is the high level of investment required for infrastructure setup.

Large enterprises, particularly those in the telecom industry, find it more beneficial to build their data centers and servers for hosting RAN automation solutions. This approach ensures greater performance reliability, reduces latency, and supports the customization of network management strategies tailored to their specific operational needs.

Despite the growing interest in cloud-based solutions, on-premises systems continue to lead the market as they provide more control over network performance and security. Additionally, many telecom providers are focused on gradually transitioning to cloud-based models as they modernize their infrastructure.

However, in the short term, on-premises deployment remains the more viable and preferred option for businesses looking to optimize their network operations while maintaining control over sensitive data and resources.

By Network Type

In 2024, the 4G/LTE segment held a dominant market position, capturing more than 40.0% of the market share. This dominance can be attributed to the widespread deployment and maturity of 4G/LTE networks across the globe.

While 5G is emerging as the next frontier, 4G/LTE still serves as the backbone of most mobile networks, especially in regions where 5G infrastructure is still being developed. Many service providers are focusing on optimizing their existing 4G/LTE networks, leveraging automation to enhance network efficiency, reduce operational costs, and improve user experience.

Another reason for the strong position of the 4G/LTE segment is its established role in supporting a wide variety of mobile services, including voice, video, and data communications. Telecom operators are heavily investing in RAN automation for their 4G/LTE networks to streamline operations and implement more dynamic network management capabilities.

By automating various aspects of the RAN, operators can ensure seamless connectivity and address the growing demand for mobile bandwidth. Moreover, the cost-effectiveness of optimizing existing 4G/LTE infrastructure rather than deploying entirely new 5G networks is driving the market’s preference for automation in 4G/LTE.

Automation enables operators to make data-driven decisions that help optimize spectrum usage, enhance load balancing, and reduce interference, all of which are crucial for maintaining service quality and customer satisfaction.

By End-User

In 2024, the Telecommunication Service Providers segment held a dominant market position, capturing more than 68.4% of the market share. The key driving factor behind this dominance is the ongoing digital transformation and growing demand for network automation among Mobile Network Operators (MNOs) and Internet Service Providers (ISPs). These service providers are under constant pressure to manage network complexity, optimize performance, and reduce operational costs.

Automation in RAN allows them to deliver higher service levels, improve customer experience, and ensure scalability across their extensive networks. With the expansion of 5G networks, the need for more automated, efficient, and agile operations has never been greater. This has further bolstered the demand for RAN automation solutions, making telecommunication service providers the largest adopters of such technology.

The adoption of RAN automation solutions by telecommunication service providers has been accelerated by their need for enhanced operational efficiency and reduced human intervention. With the rapid growth of data traffic, particularly in mobile broadband services, these providers are seeking innovative solutions that offer real-time network performance monitoring, seamless traffic management, and rapid troubleshooting.

Automation helps address these challenges, ensuring that service providers can handle a higher volume of users and data without compromising on network quality or performance. Additionally, the rise of virtualized networks and the integration of AI/ML capabilities into RAN have allowed for more proactive decision-making, helping MNOs and ISPs stay ahead of network demands.

Key Market Segments

By Component

- Solutions

- RAN Intelligent Controllers (RICs)

- Non-Real-Time RIC (Non-RT RIC)

- Near-real-time RIC (Near-RT RIC)

- RAN Intelligent Controllers (RICs)

- Software

- AI/ML-Based Automation Tools

- Network Optimization Tools

- Traffic Management Solutions

- Services

- Professional Services

- Implementation & Integration Services

- Consulting & Training Services

- Support & Maintenance

- Managed Services

- Professional Services

By Automation Level

- Level 1: Manual Configuration & Monitoring

- Level 2: Semi-Automation

- Level 3: Full Automation

By Deployment Model

- On-Premises

- Cloud-Based

By Network Type

- 4G/LTE

- 5G

- Others

By End-User

- Telecommunication Service Providers

- Mobile Network Operators (MNOs)

- Internet Service Providers (ISPs)

- Enterprises

- Manufacturing

- Retail

- Healthcare

- IT & Telecom

- Media & Entertainment

- Others (Energy & Utilities, etc.))

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Increasing Demand for 5G Networks and Automation in Telecommunication

The global rollout of 5G networks is a key driver for the RAN Automation market. As mobile network operators (MNOs) and internet service providers (ISPs) move towards 5G, they face the challenge of managing the increasing complexity and scale of their radio access networks (RAN).

RAN Automation allows for the efficient management of these networks, automating configuration, monitoring, and optimization tasks that are otherwise time-consuming and error-prone when done manually. 5G is expected to revolutionize industries, enabling ultra-low latency, high-speed internet, and massive device connectivity.

However, it also brings significant challenges for network management, including the need for seamless interoperability between 4G and 5G systems, increased capacity, and more dynamic network optimization. To address these challenges, automation technologies such as RAN Intelligent Controllers (RICs) are gaining traction, particularly those that incorporate AI and machine learning for self-optimization.

Restraining Factors

High Implementation Costs for RAN Automation Solutions

One of the key restraints in the RAN Automation market is the high cost of implementation. The deployment of RAN automation solutions, especially for large-scale network operations, requires significant financial investment in infrastructure, technology, and skilled labor.

While RAN automation can deliver long-term cost savings and efficiency, the initial outlay for hardware and software solutions is often substantial. For telecom service providers, particularly smaller operators or those in emerging markets, the cost of adopting RAN automation can be a significant barrier to entry.

This is especially true for advanced solutions that include AI, machine learning, and RAN Intelligent Controllers (RICs), which require a high degree of customization and expertise for integration into existing systems. These costs are not just limited to hardware and software but also include ongoing operational and maintenance expenses associated with the new systems.

Growth Opportunities

Expansion of AI and Machine Learning in RAN Automation

A key opportunity for the RAN Automation market lies in the integration of AI and machine learning (ML) technologies into automation solutions. AI and ML are already being utilized to optimize network performance, enhance troubleshooting, and enable predictive maintenance. As these technologies continue to evolve, their integration into RAN automation systems will become even more sophisticated, offering telecom providers the ability to optimize their networks autonomously and in real-time.

AI-driven RAN solutions can autonomously analyze vast amounts of network data and provide insights into network health, and performance issues, and even predict future network behavior. This can lead to proactive problem-solving, such as identifying network congestion or potential faults before they impact service quality. The ability to automate these processes significantly reduces the reliance on manual intervention, improves service uptime, and lowers operational costs.

Challenging Factors

Managing Network Complexity and Integration of New Technologies

A significant challenge for the RAN Automation market is managing the increasing complexity of modern telecom networks, especially as operators move towards 5G. The integration of new technologies, such as AI, machine learning, and RAN Intelligent Controllers (RICs), into existing RAN architectures can be difficult and resource-intensive.

Many telecom providers operate large, heterogeneous networks that have been built over decades and include legacy systems. Integrating automation technologies with these older systems without causing disruptions or performance issues can be a complex and costly process.

Moreover, with the rollout of 5G and the ongoing operation of 4G networks, telecom operators are dealing with multi-generation networks, each with its unique requirements and challenges. Automation solutions must be adaptable to work across these different network types, without compromising performance or interoperability. This challenge is compounded by the fact that automation solutions must not only be flexible but also scalable to handle growing network traffic and increasing user demand.

Growth Factors

The increasing adoption of 5G technology is one of the major growth drivers for the RAN Automation market. As telecom companies scale up their 5G networks, they require automated solutions to efficiently manage complex operations such as radio resource management, fault detection, and network optimization.

This demand for automation is being fueled by the need to improve operational efficiency and reduce costs. As networks become more distributed, automation plays a crucial role in ensuring smooth and seamless connectivity across multiple locations, especially in rural and remote areas.

Emerging Trends

A major trend influencing the RAN automation market is the integration of AI/ML technologies. AI-driven automation tools are increasingly used for dynamic network management, predictive maintenance, and enhanced traffic management. This enables more effective and efficient use of resources, allowing telecom companies to handle a higher volume of data traffic while maintaining optimal network performance.

Additionally, the shift towards hybrid and multi-cloud environments is another growing trend. As telecom service providers continue to adopt cloud-based solutions for flexibility and scalability, the RAN Automation market is benefitting from these advancements. Automation platforms that can seamlessly integrate with cloud environments are gaining significant traction, especially in regions such as North America and Europe.

Business Benefits

The primary business benefit of adopting RAN automation solutions is the significant reduction in operational costs. By automating routine network management tasks, telecom providers can optimize their workforce and reduce human errors, which in turn lowers operational expenses. Furthermore, these automation systems can also enhance customer satisfaction by ensuring uninterrupted connectivity and faster troubleshooting.

Another key benefit is the improved scalability of telecom networks. As demand for data continues to rise, automation solutions help in scaling network management to meet the increased load without compromising on service quality. This leads to enhanced customer experience, a competitive advantage in the market, and better long-term profitability.

Key Players Analysis

Nokia has been actively enhancing its portfolio in the RAN Automation space through strategic acquisitions and new product launches. In recent years, Nokia has introduced its “AirScale RAN” solution, designed to provide highly scalable and automated 5G network solutions. The company’s focus on cloud-native technologies and AI-driven automation tools has helped telecom operators reduce operational costs while optimizing their network operations.

Ericsson continues to be a major player in RAN Automation, particularly due to its innovations in 5G network automation. Ericsson’s launch of the Ericsson Cloud RAN solution in recent years is a significant step in providing telecom operators with an efficient, cloud-based RAN automation system. The company also emphasizes the integration of AI and machine learning to automate network operations and optimize performance.

Huawei has long been a leader in the global RAN market, and its expansion into RAN Automation has solidified its position in this growing sector. The company’s 5G Autonomous Network strategy is a key focus, with automation and AI being at the forefront of its solution offerings. Huawei’s automation products are designed to address both the complexity and scalability of 5G networks, providing operators with tools to simplify network management and optimize resource allocation.

RAN Automation Market Companies

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Samsung Electronics

- ZTE Corporation

- VMware, Inc.

- Mavenir

- Rakuten Symphony

- Intel Corporation

- NEC Corporation

- Juniper Networks

- Cisco Systems, Inc.

- Others

Recent Developments

- In 2024: Nokia announced the successful deployment of its next-generation RAN Intelligent Controller (RIC) in collaboration with several major telecom operators.

- In 2024: Ericsson launched a new suite of AI-powered automation solutions, including the Ericsson Cloud RAN platform, which enhances 5G network performance and speeds up the deployment of RAN technologies.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Bn Forecast Revenue (2034) USD 13.8 Bn CAGR (2025-2034) 14.70% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component ((Solutions (RAN Intelligent Controllers (RICs)[Non-Real-Time RIC (Non-RT RIC), Near-Real-Time RIC (Near-RT RIC)]), (Software [AI/ML-Based Automation Tools, Network Optimization Tools, Traffic Management Solutions]), (Services (Professional Services [Implementation & Integration Services, Consulting & Training Services, Support & Maintenance]), Managed Services)), By Automation Level (Level 1: Manual Configuration & Monitoring, Level 2: Semi-Automation, Level 3: Full Automation), By Deployment Model (On-Premises, Cloud-Based), By Network Type (4G/LTE, 5G, Others), By End-User (Telecommunication Service Providers [Mobile Network Operators (MNOs), Internet Service Providers (ISPs)]), (Enterprises [Manufacturing, Retail, Healthcare, IT & Telecom, Media & Entertainment, Others (Energy & Utilities, etc.)]) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Nokia Corporation, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Samsung Electronics, ZTE Corporation, VMware, Inc., Mavenir, Rakuten Symphony, Intel Corporation, NEC Corporation, Juniper Networks, Cisco Systems, Inc., Others Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Samsung Electronics

- ZTE Corporation

- VMware, Inc.

- Mavenir

- Rakuten Symphony

- Intel Corporation

- NEC Corporation

- Juniper Networks

- Cisco Systems, Inc.

- Others