Global P2P Rental Apps Market Size, Share, Statistics Analysis Report By Rental Type (Property Rental, Vehicle Rental, Tools & Machinery, Others), By Platform (Mobile Apps, Web-based Platform), By End-Use (Individual Consumers, Businesses & Organizations), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 136825

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

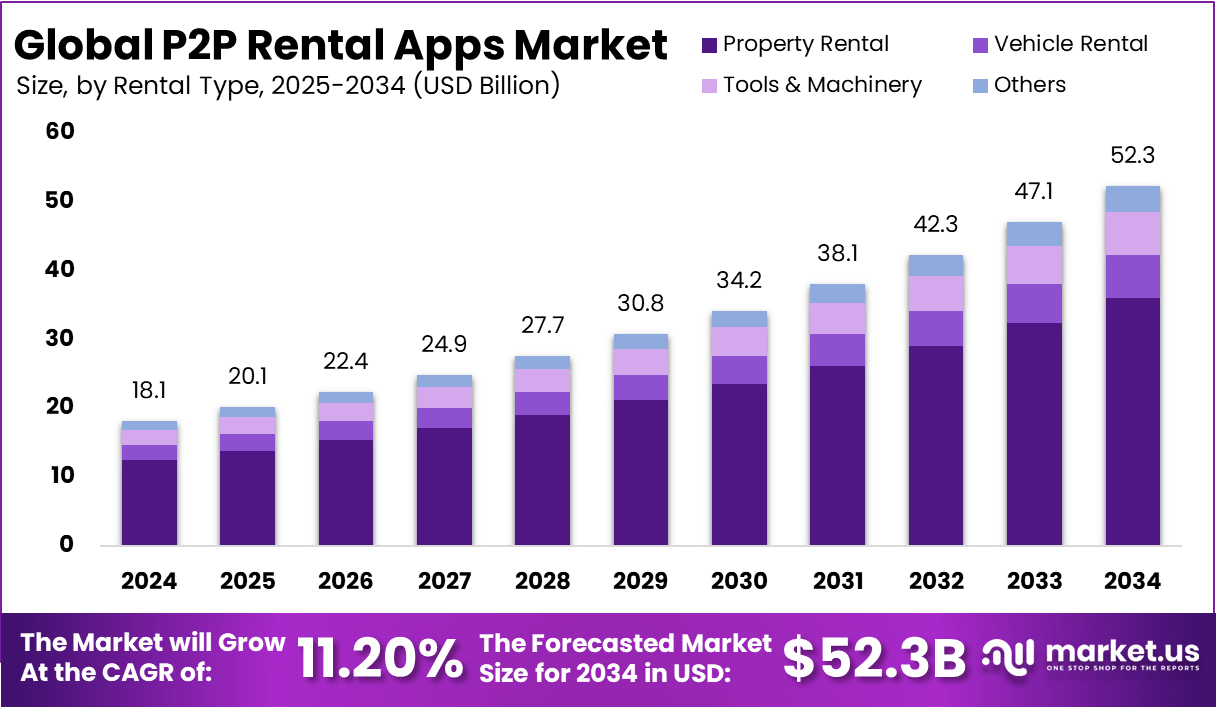

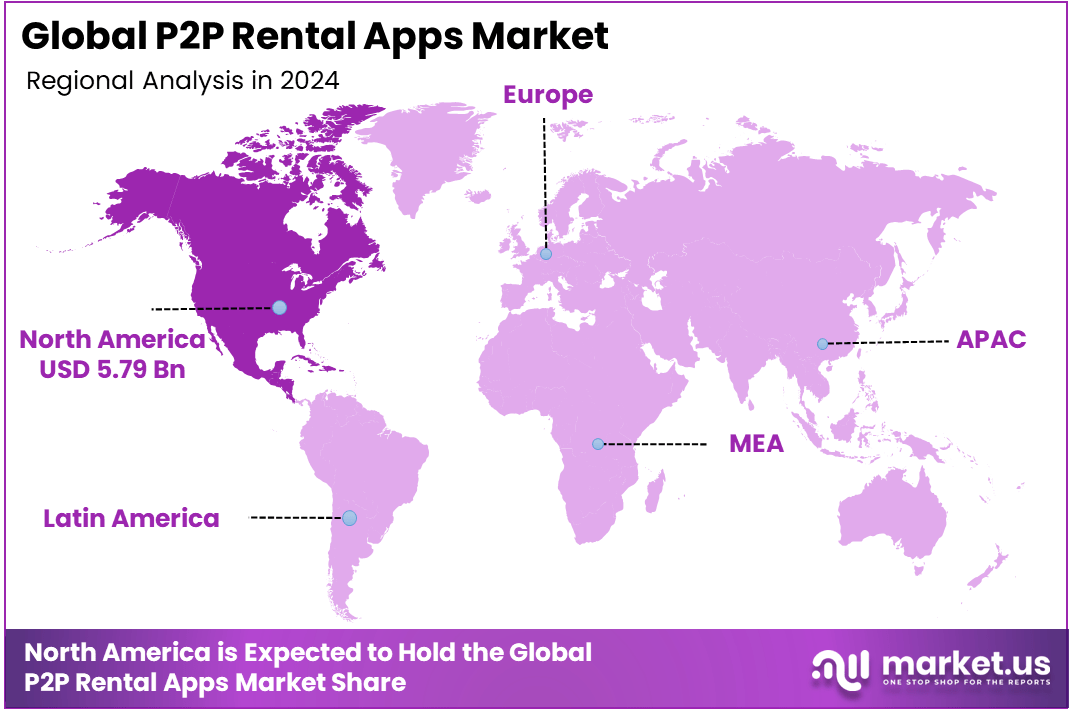

The Global P2P Rental Apps Market size is expected to be worth around USD 84.7 Billion By 2034, from USD 18.1 Billion in 2024, growing at a CAGR of 11.20% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32% share, holding USD 5.79 Billion in revenue. Further, In North America, The United States Dominates the market size by USD 4.01 Billion holding a strong and steady position.

Peer-to-peer (P2P) rental apps allow individuals to rent goods or services directly from each other, without the involvement of traditional rental companies. These apps act as intermediaries, connecting people who have underutilized assets with those needing those items for short-term use. Commonly rented items include vehicles (e.g., cars, bikes), vacation homes, tools, electronics, and even clothing.

By leveraging the power of mobile technology, these platforms provide users with easy access to a wide range of rental options at competitive prices. P2P rental apps have become an integral part of the sharing economy, promoting resource optimization, reducing waste, and fostering a culture of sharing. Popular examples of such apps include Airbnb (for lodging), Turo (for car rentals), and Rent the Runway (for fashion).

The P2P rental apps market is expanding rapidly as the sharing economy continues to thrive, fueled by increasing consumer demand for flexible, cost-effective, and sustainable alternatives to ownership. With the rise of smartphone usage and digital platforms, people are more inclined to rent products and services instead of purchasing them outright.

As a result, P2P rental apps are attracting a large user base across diverse sectors, including travel, transportation, and lifestyle. The market is projected to see significant growth in the coming years, with businesses capitalizing on this shift to provide solutions for everyday needs and high-ticket items. By 2033, the global P2P rental market is expected to reach several billion dollars, driven by increasing adoption and a growing number of rental categories.

Several factors are driving the growth of the P2P rental apps market. First and foremost, changing consumer behavior plays a significant role. Today’s consumers are increasingly seeking convenience, flexibility, and affordability, which renting provides as opposed to ownership. This is especially true for expensive, infrequently used items.

The rising environmental awareness among consumers also contributes to the market’s growth, as renting promotes the efficient use of resources and reduces waste. Technological advancements such as the development of mobile apps, secure payment gateways, and GPS tracking systems are also facilitating the market’s expansion. These technologies enhance user experience, streamline transactions, and improve security, which helps foster trust between users.

The demand for P2P rental apps is growing across several key sectors. In the travel industry, consumers prefer renting short-term accommodations via platforms like Airbnb rather than staying in traditional hotels, as it offers better flexibility, personalized experiences, and cost savings. Similarly, in the transportation sector, car-sharing services like Turo and Zipcar are gaining popularity, as people are choosing to rent cars for specific occasions instead of committing to long-term ownership.

The increasing popularity of shared economy models in sectors such as home appliances, fashion, and sports equipment is also contributing to the rising demand for P2P rental apps. These services cater to a broad demographic, from millennials and Gen Z consumers seeking affordable alternatives to older generations valuing convenience and accessibility.

The P2P rental apps market presents numerous growth opportunities across various sectors. One of the biggest opportunities lies in the further expansion of rental categories. Beyond traditional rentals like cars, homes, and vacation gear, there is potential to extend into areas such as tools, electronics, and even pets. For instance, app-based tool rental services could cater to DIY enthusiasts and construction workers.

Additionally, the market could tap into the emerging trend of luxury and high-end rentals, where consumers are willing to rent premium items such as luxury cars, designer apparel, and expensive electronics for short-term use. Furthermore, expanding services into underserved regions, especially in emerging markets like Asia-Pacific and Latin America, represents a significant opportunity for growth.

Technological innovation plays a key role in shaping the future of the P2P rental apps market. The continued development of mobile app technologies, including intuitive interfaces and AI-powered recommendation engines, is enhancing user experiences by making it easier for renters to find and book items. Additionally, machine learning algorithms can assist with predicting demand patterns, optimizing rental pricing, and reducing fraud.

Blockchain technology also promises to improve transparency, security, and trust in rental transactions by providing immutable records of agreements. The integration of IoT (Internet of Things) with P2P rental services could also revolutionize asset tracking and maintenance, offering users real-time data on rented products’ status and condition. These advancements make P2P rentals more efficient, accessible, and secure, driving both consumer adoption and market growth.

In the fashion rental sector, platforms such as Rent the Runway and HURR Collective have reported remarkable user engagement. For instance, Rent the Runway has seen a 40% increase in active subscribers over the past year, while HURR Collective has experienced a 300% year-over-year growth in the number of items rented.

Additionally, a survey conducted in 2023 revealed that 66% of millennials are open to renting clothing for special occasions rather than purchasing new items, indicating a cultural shift towards shared consumption. In the realm of fashion rental, platforms like Pickle have reported impressive metrics, with a 300% year-over-year increase in monthly active users and a 519% rise in wedding-related rentals from 2023 to 2024.

The P2P car-sharing market is also thriving, with platforms like Turo and Getaround reporting significant increases in user activity. Turo reported over 14 million users in 2023, with an average of 1.5 million rentals per month. Getaround has seen a 50% increase in rentals since 2022, highlighting the growing acceptance of car sharing as a viable alternative to traditional car ownership.

In terms of geographical distribution, North America remains the largest market for P2P rental apps, accounting for approximately 45% of the total market share in 2023. However, Asia-Pacific is expected to witness the highest growth rate, projected to reach a market value of USD 2.5 billion by 2030 due to increasing urbanization and a rising middle class.

Key Takeaways

- Market Growth: The global P2P rental apps market is projected to grow from USD 18.1 billion in 2024 to USD 84.7 billion by 2034, reflecting a robust CAGR of 11.20% during the forecast period.

- Dominant Rental Type: The property rental segment holds a significant share of the market, accounting for 68.8% in 2024. This growth is largely driven by the rising popularity of short-term lodging and vacation rentals through platforms like Airbnb.

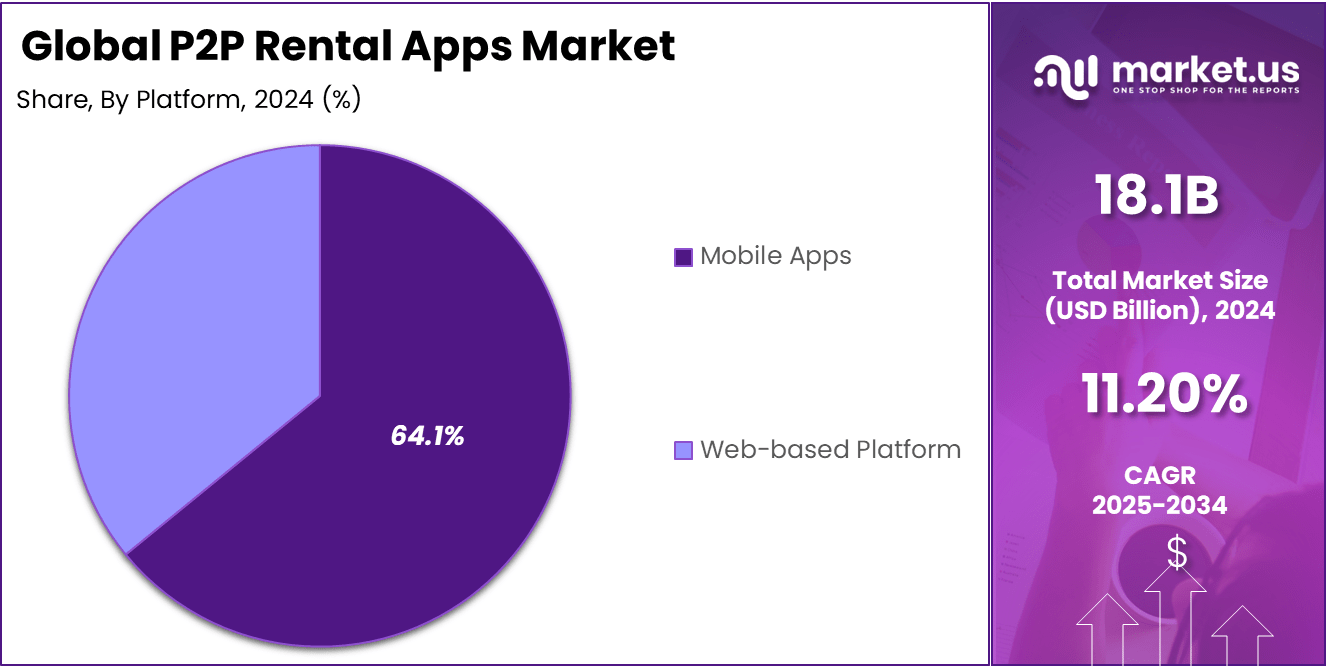

- Platform Preference: Mobile apps remain the leading platform for P2P rentals, with 64.1% of the market share. The ease of access and growing smartphone penetration have made mobile apps the most popular way to engage in peer-to-peer rentals.

- Consumer Demographics: Individual consumers make up the largest portion of the market, representing 76.2% of total demand. The appeal of peer-to-peer rentals, driven by affordability and flexibility, is particularly strong among personal users looking for short-term, cost-effective solutions.

- Regional Insights: North America is the leading region in the P2P rental apps market, with a share of 32%. The US alone generated USD 4.01 billion in revenue in 2024, driven by a well-established sharing economy and high consumer adoption rates.

US Market Size For P2P Rental Apps

In 2024, North America held a dominant market position, capturing more than a 32% share, with revenue of USD 5.79 billion. This region leads the global P2P rental apps market due to several key factors, including its highly developed technological infrastructure, high disposable income, and a strong shift towards the gig economy.

The increasing acceptance of sharing economy models, such as short-term property rentals and peer-to-peer vehicle sharing, has driven the demand for P2P rental platforms like Airbnb, Turo, and other localized services. North America’s dominance is further supported by widespread smartphone usage, facilitating the ease of access to rental platforms.

The U.S. is the primary contributor to North America’s market share, with a significant portion of revenue coming from urban areas where demand for rental properties and vehicles is high. According to recent data, the U.S. market alone generated USD 4.01 billion in 2024.

The growing trend of millennials and Gen Z opting for flexible and affordable rental solutions over traditional ownership models also contributes to the strong market growth in this region. Additionally, the regulatory environment in North America is relatively more conducive to the growth of the sharing economy, making it easier for P2P rental apps to expand and operate.

As North America continues to embrace digital transformation, the region is expected to maintain its leadership throughout the forecast period. Factors like the increasing popularity of mobile applications for everyday transactions and the rise of sustainable, cost-effective solutions are expected to fuel further growth. Moreover, the influx of investments and partnerships in P2P rental platforms is accelerating the development of more innovative features, improving user experiences, and expanding the overall market landscape.

Given these favorable conditions, North America is poised to retain a significant share of the P2P rental apps market, with sustained demand driven by evolving consumer behavior, technological advancements, and the continued success of major industry players.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

By Rental Type

In 2024, the Property Rental segment held a dominant market position, capturing more than a 68.8% share. This segment leads the P2P rental apps market due to the widespread adoption of short-term property rental platforms, such as Airbnb, Vrbo, and Booking.com.

With an increasing number of travelers preferring to stay in private homes instead of traditional hotels, the demand for property rentals has surged. Property rentals offer flexibility, cost-effectiveness, and unique experiences, making them the preferred option for both vacationers and business travelers alike.

The growing trend of remote working and digital nomadism has further contributed to the dominance of the property rental segment. Individuals now seek temporary accommodations across different cities or countries, fueling the need for short-term rentals. This shift in consumer behavior, combined with the ease of booking through mobile apps, has accelerated the growth of property rental services.

Additionally, the increased interest in urban exploration and localized experiences has led to higher demand for properties in various geographical locations. In urban centers and tourist hotspots, property owners are increasingly capitalizing on the sharing economy model, listing their homes or apartments for short-term rentals. This trend is expected to continue growing, with both homeowners and renters benefiting from a streamlined rental process facilitated by user-friendly mobile apps.

By Platform

In 2024, the Mobile Apps segment held a dominant market position, capturing more than a 64.1% share. This segment leads the P2P rental apps market due to the growing reliance on smartphones for everyday activities, including renting property, vehicles, tools, and other assets.

The convenience of using mobile apps on the go has made them the preferred platform for users. With smartphones being ubiquitous and app stores offering a wide variety of rental platforms, it’s easier than ever for consumers to browse listings, make bookings, and manage transactions directly from their mobile devices.

The ease of use, accessibility, and user-friendly interface of mobile apps contribute to their increasing popularity. Many rental apps have incorporated seamless payment gateways, instant booking confirmations, and in-app communication features, making the entire rental process more efficient and secure. Additionally, push notifications and location-based services further enhance the user experience by alerting users about nearby rental opportunities, discounts, or important updates.

Mobile apps also benefit from continuous updates and improvements, allowing for constant enhancement of user interfaces, security features, and payment processes. With the increasing trend of consumers opting for mobile-first solutions, the demand for mobile apps in the P2P rental market is expected to keep growing. The segment’s dominance is also supported by the ability of these apps to integrate with other platforms and offer a wide range of services, including reviews, ratings, and personalized recommendations.

By End-Use

In 2024, the Individual Consumers segment held a dominant market position, capturing more than a 76.2% share. This segment is the leading driver of growth in the P2P rental apps market due to the increasing adoption of the sharing economy by everyday users.

Individual consumers are increasingly using P2P rental platforms to access items or properties for short-term needs, such as vacation homes, cars, or tools, without the burden of long-term ownership. The flexibility, affordability, and variety of rental options available make these platforms particularly attractive to consumers seeking convenience and cost-effective solutions.

One of the key factors contributing to the dominance of the individual consumer segment is the growing trend of urbanization and transient lifestyles. With more people moving to cities for work or travel, the need for temporary accommodations or shared transportation has surged. P2P rental apps cater to these needs, allowing individuals to rent what they need, when they need it, without the long-term commitment typically associated with ownership.

Furthermore, these platforms offer an easier way for consumers to access items that might otherwise be expensive or inconvenient to purchase outright. Additionally, the rise of digital natives—tech-savvy individuals who are comfortable with mobile apps and online platforms—has also fueled the growth of the individual consumer segment.

These users are driving the demand for innovative, on-demand rental services across a wide range of categories, including property, vehicles, and everyday goods. Their preference for using mobile platforms for daily transactions continues to expand the market, positioning individual consumers as the dominant force in the P2P rental apps market.

Key Market Segments

By Rental Type

- Property Rental

- Vehicle Rental

- Tools & Machinery

- Others

By Platform

- Mobile Apps

- Web-based Platform

By End-Use

- Individual Consumers

- Businesses & Organizations

Driving Factors

Growing Popularity of the Sharing Economy

The increasing acceptance and adoption of the sharing economy is a significant driver of the P2P rental apps market. People are increasingly looking for ways to reduce costs and avoid ownership burdens, especially for assets they use infrequently. This shift towards a “use rather than own” mindset is prevalent in sectors like property rental, vehicle rental, and tool sharing.

Peer-to-peer rental apps facilitate this by offering a platform for individuals to rent items or properties from each other, avoiding the complexities and expenses of ownership. This trend has been particularly prominent among millennials and Gen Z, who prefer experiences over possessions and are more likely to embrace sharing economy models.

Furthermore, the growing urbanization and the rise in transient populations, particularly in cities, have fueled demand for short-term rentals. With individuals constantly on the move for work, education, or travel, P2P rental platforms provide the convenience of renting goods and services without the need for long-term commitments.

The rise of remote working and digital nomad lifestyles has also accelerated the use of P2P rental services, as people often require temporary housing or transportation. A significant portion of the market growth is driven by the increasing demand for vacation rentals and car-sharing services.

Restraining Factors

Regulatory Challenges and Legal Uncertainties

Despite the significant growth of the P2P rental apps market, regulatory challenges continue to pose a restraint to its expansion. Governments around the world have yet to establish clear and unified regulations surrounding P2P rental platforms.

In particular, the rental of properties, vehicles, and even tools often faces complex and inconsistent legal frameworks, which vary from region to region. For example, short-term rental regulations for properties (such as those for Airbnb) can differ greatly across cities and countries, with some governments imposing restrictions on the duration of stays, occupancy limits, or the types of properties that can be rented out.

Another challenge arises with the growing scrutiny over safety and insurance policies. Many users are concerned about the safety of the items they rent, and platforms face difficulties in providing sufficient liability coverage.

This has led to a lack of trust, particularly when it comes to high-value goods or properties. Even with insurance options offered by platforms, legal complications regarding liability in case of accidents or damages can often lead to hesitation among potential users.

Growth Opportunities

Expansion into Emerging Markets

One of the key opportunities for the P2P rental apps market is the expansion into emerging markets. As developing countries continue to see rapid urbanization and technological advancements, the demand for rental services is growing.

Rising disposable incomes, combined with a young and tech-savvy population, make markets in Asia Pacific, Latin America, and Africa ripe for P2P rental app adoption. With these regions experiencing urban population growth and an increasing middle-class demographic, there is a burgeoning demand for cost-effective rental solutions in sectors such as housing, vehicles, and consumer goods.

In addition, many emerging markets face challenges such as a lack of access to capital, which makes the concept of renting rather than owning more appealing. For instance, in countries where car ownership may not be affordable for a large portion of the population, car-sharing and ride-hailing services can provide a viable alternative. Similarly, with rising housing costs in cities like Mumbai, Sao Paulo, and Nairobi, the rental market is poised for significant growth.

Challenging Factors

Trust and Security Concerns

One of the biggest challenges in the P2P rental apps market is building and maintaining trust between renters and owners. Since these platforms operate by facilitating transactions between individuals, the risk of fraud or disputes is higher compared to traditional rental models.

For example, renters may not always trust the condition or quality of an item, and property owners might fear damage or theft. Ensuring trust is paramount for P2P rental platforms to scale and establish themselves as reliable services.

To address this issue, platforms have been incorporating review systems and user ratings, but this is not always enough to ease concerns. While reviews can provide some insight into previous experiences, they do not fully eliminate the risk for both parties. Additionally, disagreements over refunds, deposits, or damages can create negative experiences, further eroding trust in the platform.

The platform’s ability to offer secure payment systems, insurance, and dispute-resolution mechanisms is critical. However, not all platforms have the resources to provide these services at scale.

Growth Factors

The P2P rental apps market has witnessed significant growth, primarily driven by the increasing acceptance of the sharing economy. Consumers are becoming more inclined to rent assets like property, vehicles, and equipment instead of purchasing them outright. This trend is especially noticeable among younger generations who prioritize experiences and flexibility over ownership.

Additionally, the rise of urbanization, coupled with the increasing transient population in cities, has led to a surge in demand for short-term rentals. Mobile technology advancements have also made renting easier and more accessible, encouraging a broader range of users to participate in the sharing economy.

Emerging Trends

The P2P rental app market is witnessing several emerging trends that are shaping its future. One of the key trends is the increased use of mobile platforms. As smartphones become ubiquitous, consumers prefer using apps to book rentals due to their convenience and flexibility.

Moreover, the integration of AI and machine learning for personalized recommendations, better pricing models, and enhanced customer experience is gaining traction. Another emerging trend is the expansion of rental categories beyond traditional property and vehicle rentals to include tools, machinery, and even personal items like electronics and fashion.

Business Benefits

P2P rental apps offer several business benefits, especially to entrepreneurs and small businesses. For individuals and small-scale rental businesses, these apps provide a cost-effective way to reach a larger customer base. By leveraging existing assets, users can generate additional income without significant upfront investment.

Additionally, for consumers, the flexibility of short-term rentals meets their needs without the long-term financial commitments typically associated with ownership. This model also reduces waste, which appeals to environmentally conscious consumers.

Key Players Analysis

Airbnb, a leading player in the P2P rental app market, has been consistently expanding its footprint through strategic acquisitions and innovative product launches. In 2023, Airbnb acquired HotelTonight, an app that specializes in last-minute hotel bookings, to expand its range of offerings and attract a wider customer base. This acquisition allowed Airbnb to broaden its business model, blending traditional hospitality services with its core short-term rental operations.

Booking.com has made significant strides in the P2P rental app market by leveraging its established presence in the global travel industry. In recent years, Booking.com has introduced a variety of improvements to its platform, including a personalized recommendation engine and enhanced search filters, making it easier for users to find properties that fit their needs. The company also acquired FareHarbor in 2022, a booking platform for activities, tours, and experiences.

Getaround, a pioneer in the car-sharing segment of the P2P rental app market, has focused on product innovation and strategic partnerships to accelerate its growth. In 2023, Getaround merged with Drivy, a European car-sharing company, which significantly expanded its presence in the European market. The merger positioned Getaround as one of the largest car-sharing platforms globally, offering customers a more extensive selection of vehicles across different regions.

P2P Rental Apps Market Companies

- Airbnb

- Booking.com

- Getaround

- Outdoorsy

- RVshare

- Vrbo

- ShareGrid

- Zillow Rentals

- Fat Llama

- Turo

- Other Key Players

Recent Developments

- In 2024: a significant development in the P2P rental apps market is the growing adoption of electric vehicles (EVs) within car-sharing platforms like Getaround and Turo.

- In 2024: platforms such as Airbnb and Booking.com have begun introducing subscription-based rental models, providing users with access to a variety of rental options for a fixed monthly fee.

Report Scope

Report Features Description Market Value (2024) USD 18.1 Bn Forecast Revenue (2034) USD 84.7 Bn CAGR (2025-2034) 11.20% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Rental Type (Property Rental, Vehicle Rental, Tools & Machinery, Others), By Platform (Mobile Apps, Web-based Platform), By End-Use (Individual Consumers, Businesses & Organizations) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Airbnb, Booking.com, Getaround, Outdoorsy, RVshare, Vrbo, ShareGrid, Zillow Rentals, Fat Llama, Turo, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Airbnb

- Booking.com

- Getaround

- Outdoorsy

- RVshare

- Vrbo

- ShareGrid

- Zillow Rentals

- Fat Llama

- Turo

- Other Key Players