Global Online Clothing Rental Market Size, Share, Growth Analysis By Product Type (Ethnic Wear, Western Wear, Formal Wear, Party Wear), By Consumer Demographics (Men, Women, Children), By Duration (Short-term Rental, Long-term Rental), By Business Model, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136222

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Product Type Analysis

- Consumer Demographics Analysis

- Duration Analysis

- Business Model Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

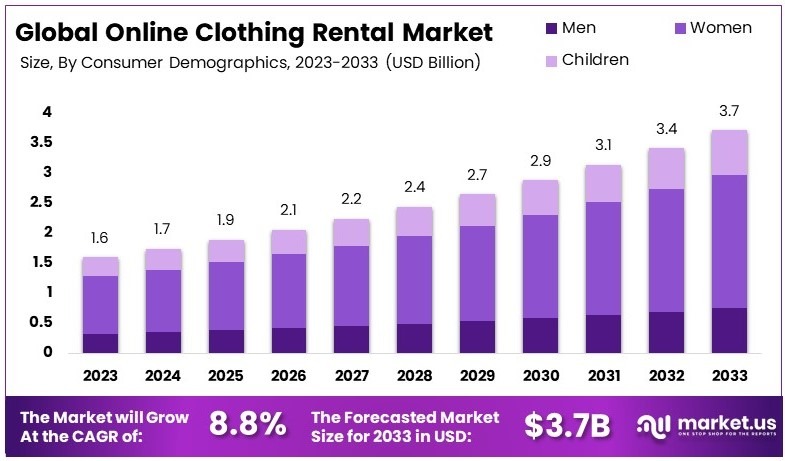

The Global Online Clothing Rental Market size is expected to be worth around USD 3.7 Billion by 2033, from USD 1.6 Billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2024 to 2033.

Online clothing rental is a service that allows customers to rent garments and accessories through digital platforms. Instead of purchasing, users can select items for temporary use, often for special occasions or everyday wear, promoting a more sustainable and cost-effective approach to fashion consumption.

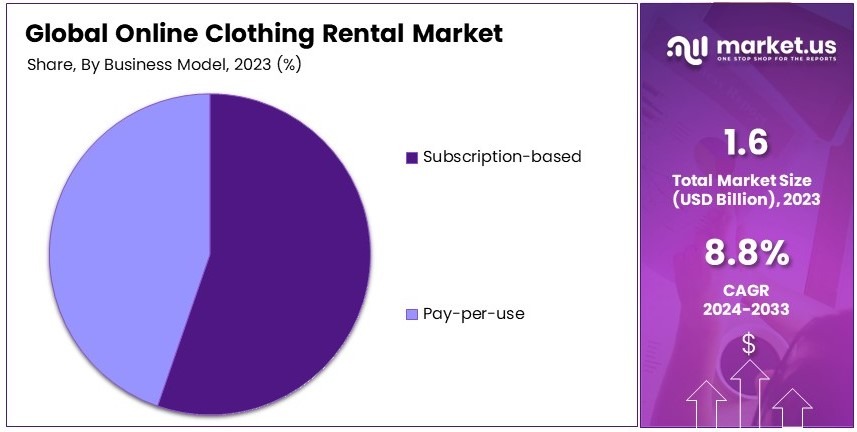

The Online Clothing Rental Market consists of businesses and platforms that facilitate the renting of clothing and accessories via the internet. This market includes subscription-based services, pay-per-use models, and various rental options catering to different consumer needs, aiming to provide convenient and flexible fashion solutions.

The online clothing rental market is expanding as it caters to budget-conscious consumers and supports a sustainable lifestyle. Services like Rent the Runway offer designer outfits starting at $33 per piece, making high-end fashion accessible and affordable. This segment’s growth is driven by the increasing preference for cost-effective solutions in fashion consumption, according to industry sources.

Furthermore, the adoption of online clothing rentals is rising, with companies like Nuuly reaching 250,800 subscribers, showcasing robust market interest. The trend is especially popular among millennials and Gen Z consumers who value sustainability.

This shift is reinforced by statistics showing that 16% to 18% of Americans prefer shopping at thrift stores, a choice driven by both affordability and environmental awareness, according to NARTS: The Association of Resale Professionals.

Additionally, the impact of clothing rental services on waste management and reduction is notable. For example, Circos’s rental service saves customers 242 liters of water and 6 kilograms of CO2 emissions per month. Moreover, the “Thriftmas” trend highlights a cultural shift towards sustainable gifting, with 72% of Gen Z shoppers open to receiving thrifted gifts, reflecting broader consumer behavior trends in sustainable practices.

Overall, the online clothing rental market offers significant opportunities for growth, characterized by a strong demand for sustainable and affordable fashion choices. As more consumers embrace rental and thrift shopping, this sector is poised to make substantial contributions to environmental sustainability and consumer savings, paving the way for a more responsible fashion industry.

Key Takeaways

- The Online Clothing Rental Market was valued at USD 1.6 Billion in 2023 and is expected to reach USD 3.7 Billion by 2033, with a CAGR of 8.8%.

- In 2023, Formal Wear dominates the Product Type segment with 43.6%, driven by high demand for occasional use attire.

- In 2023, Women account for 57.2% of the Consumer Demographics segment, reflecting their greater adoption of rental services.

- In 2023, Short-term Rental is the preferred Duration, emphasizing flexibility and affordability in renting clothing.

- In 2023, Subscription-based models lead the Business Model segment, offering cost-effective and consistent access to fashion.

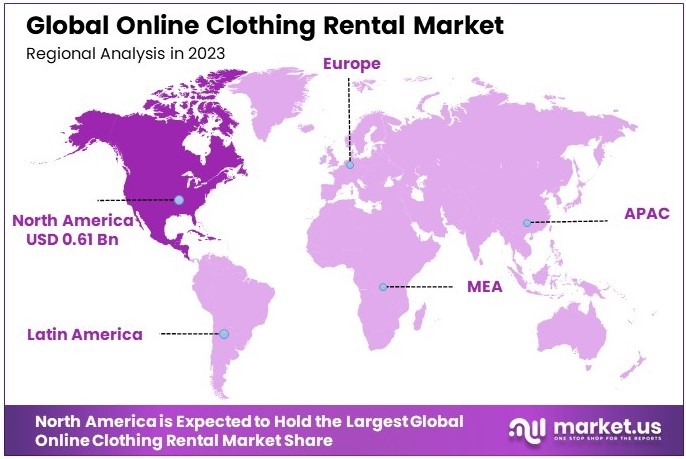

- In 2023, North America holds a 38.4% share with a market value of USD 0.61 Billion, driven by early adoption and high disposable incomes.

Business Environment Analysis

The online clothing rental market is nearing a saturation point in some segments, yet it continues to grow in niche areas. Mango’s investment in La Más Mona as of March 2023, which includes launching a rental pilot on their website, exemplifies exploration of new growth opportunities within an increasingly crowded market.

The target demographic for online clothing rental is diversifying. Arket’s expansion of its childrenswear rental service in January 2024, through a partnership with Bundlee, targets environmentally-conscious parents looking for cost-effective, sustainable clothing options for rapidly growing children.

Product differentiation in the online clothing rental market is evolving to meet specific consumer needs. The “Any Wear, Anywhere” service trial by Sumitomo Corporation, started in July 2023, distinguishes itself by catering to overseas travelers, offering convenience and reducing the need to carry heavy luggage.

Value chain analysis reveals that partnerships are crucial. Mango’s collaboration with La Más Mona integrates the startup’s niche in party clothing rentals into Mango’s broader retail platform, enhancing both reach and service diversity within the rental space.

Adjacent markets, including sustainable fashion and travel services, increasingly overlap with online clothing rentals. Sumitomo’s service trial reflects this trend, merging travel convenience with fashion rental, thus broadening the appeal and functionality of clothing rental services.

Product Type Analysis

Formal Wear dominates with 43.6% due to its high demand for business and special events.

The online clothing rental market is segmented by product type, where Formal Wear takes the lead with a 43.6% share. This segment’s dominance is fueled by the demand for business attire and clothing for special occasions like weddings and galas, which are typically high-cost items that consumers prefer to rent rather than purchase.

Ethnic Wear is crucial for cultural events and festivals, providing a sustainable option for those seeking traditional attire without the commitment of a purchase.

Western Wear remains popular among consumers looking for casual or contemporary styles, offering versatility and a broad appeal for everyday wear.

Party Wear caters to the niche market of special event clothing, where trendy and seasonal styles are preferred for one-time use over long-term wardrobe inclusion.

Consumer Demographics Analysis

Women lead with 57.2% due to their higher propensity to engage in rental for fashion diversity and sustainability.

In consumer demographics, women represent the largest segment in the online clothing rental market at 57.2%. Women’s higher engagement is driven by a desire for fashion diversity and the appeal of accessing a broad range of styles without permanent ownership, aligning with sustainability goals.

Men participate significantly, showing increasing interest in renting for both formal and casual occasions as awareness and acceptance of the rental model grow.

Children’s clothing rentals are growing, driven by the practicality of renting clothes that children will quickly outgrow, offering parents cost-effective, high-quality, and diverse clothing options.

Duration Analysis

Short-term Rental leads due to consumer preference for one-time event usage.

Duration is a key factor in the online clothing rental market, with Short-term Rental leading the segment. This preference is based on consumers’ needs for one-time use items for events, which do not justify the cost of purchase.

Long-term Rental serves those looking for seasonal clothing options or extended travel needs, allowing users to maintain a varied wardrobe in an economically efficient manner.

Business Model Analysis

Subscription-based models dominate as they provide continuous value and convenience.

Business models within the online clothing rental market are primarily dominated by Subscription box-based models. This model’s success is due to its ability to offer customers ongoing access to a wide range of clothing for a fixed monthly rate, appealing to those who value variety, constant renewal of choices, and cost management.

Pay-per-use models cater to customers who prefer less frequent, event-specific rental needs, providing flexibility and a lower commitment level, ideal for infrequent but specific rental occasions.

Key Market Segments

By Product Type

- Ethnic Wear

- Western Wear

- Formal Wear

- Party Wear

By Consumer Demographics

- Men

- Women

- Children

By Duration

- Short-term Rental

- Long-term Rental

By Business Model

- Subscription-based

- Pay-per-use

Driving Factors

Cost-Effective Fashion and Sustainability Drive Market Growth

The growing demand for cost-effective fashion is a major driving factor for the online clothing rental market. Consumers, especially millennials and Gen Z, seek affordable options to access high-quality clothing. Rental platforms like Rent the Runway cater to this demand by offering access to premium brands without the high purchase cost.

The focus on sustainable consumption is another key driver. Renting clothes reduces the environmental impact of fast fashion, making it an appealing choice for eco-conscious consumers. Platforms such as Hurr Collective highlight sustainability as a core part of their value proposition.

The popularity of occasion-based rentals also fuels growth. Customers prefer renting outfits for special events like weddings or parties rather than purchasing items they might only wear once. This trend has been successfully adopted by companies like GlamCorner.

Finally, the expansion of digital platforms and user-friendly apps supports market growth. Companies are leveraging technology to improve customer experiences, making it easier to browse, select, and rent items.

Restraining Factors

Hygiene and Operational Challenges Restrain Market Growth

Concerns about hygiene and maintenance present a significant challenge for the online clothing rental market. Consumers often hesitate to rent due to doubts about the cleanliness and condition of rented garments. Platforms must invest in robust cleaning processes, which can increase operational costs.

Limited awareness in emerging markets also restrains growth. Many potential consumers are unfamiliar with the concept of clothing rental, particularly in regions where traditional shopping habits dominate. Educating these markets requires significant effort and investment.

High logistics and operational costs further impact the market. Managing returns, ensuring timely delivery, and maintaining inventory quality add substantial overhead expenses. These costs can make it difficult for platforms to scale profitably.

Inventory turnover challenges also limit growth. Ensuring that clothing remains in good condition across multiple rentals requires efficient inventory management systems. Failure to meet these standards can result in customer dissatisfaction.

Growth Opportunities

Untapped Markets and Tech Integration Provide Opportunities

Expansion into untapped regional markets offers immense opportunities for the online clothing rental market. Emerging economies in Asia and Africa, with growing middle-class populations, provide a new customer base for rental platforms. Companies like Flyrobe are already targeting these regions with tailored offerings.

The integration of AI and big data is another promising area. AI-driven personalization can help platforms understand customer preferences and recommend suitable options. Platforms like Le Tote are utilizing these technologies to improve customer experiences and drive engagement.

Partnerships with high-end and luxury brands further enhance opportunities. Collaborations with designers and premium labels attract customers who aspire to wear luxury apparel without committing to ownership. Rent the Runway’s partnerships with high-fashion brands are an example of this strategy.

Peer-to-peer rental platforms are also gaining traction. These platforms, such as ByRotation, enable individuals to rent their wardrobes to others. This model broadens the market and promotes a sense of community while offering cost-effective options.

Emerging Trends

Social Media and Virtual Fitting Are Latest Trending Factors

The rise of subscription-based rental services is a key trend in the online clothing rental market. Platforms like Nuuly offer monthly subscription plans, allowing customers to rent multiple items for a flat fee. This model promotes repeat engagement and customer loyalty.

Social media marketing is another major trend. Platforms like Instagram and TikTok play a crucial role in driving awareness and showcasing rental options. Influencers often promote rental services, making them more appealing to younger audiences.

Experiential fashion consumption is gaining popularity. Consumers are shifting from owning to experiencing fashion, driven by the flexibility and variety offered by rentals. This trend is evident in the growth of event-specific rental services.

The adoption of AR/VR technology enhances the customer experience. Virtual fitting solutions, such as those offered by Zeekit, allow users to try on outfits digitally before renting. This innovation builds confidence in online rentals and reduces return rates.

Regional Analysis

North America Dominates with 38.4% Market Share

North America leads the Online Clothing Rental Market with a 38.4% share, amounting to USD 0.61 billion. This dominance is driven by high consumer affinity for fashion diversity without the commitment of full ownership, combined with a robust e-commerce infrastructure.

Key factors contributing to this success include advanced logistics, widespread internet penetration, and a culture that embraces the sharing economy. Consumers in this region are particularly receptive to the convenience and sustainability aspects of renting clothing.

Looking forward, the market in North America is poised for continued growth. Trends suggest an increasing number of consumers will turn to rental services as a way to reduce closet clutter and environmental impact, potentially increasing the region’s market share.

Regional Mentions:

- Europe: Europe is a strong performer in the Online Clothing Rental Market, emphasizing luxury and designer wear rentals. The market is driven by sustainability-conscious consumers and well-established fashion industries.

- Asia Pacific: Rapidly growing due to increasing fashion consciousness and digital savviness among consumers, especially in urban areas, Asia Pacific is expanding its online rental services.

- Middle East & Africa: This region is gradually exploring the online rental market, focusing on luxury garments and traditional wear, catering to local tastes and international tourists.

- Latin America: Latin America’s market is developing, with increasing internet usage and changing consumer attitudes towards clothing rental as a feasible fashion option.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Online Clothing Rental Market, Rent the Runway, Le Tote, Nuuly (by URBN), and HURR are leading the charge, each offering unique propositions that cater to varied consumer needs and preferences. Rent the Runway has established itself as a pioneer in the market, providing a wide range of high-end designer apparel and accessories for rent.

Their comprehensive subscription model, including Rent the Runway Unlimited, allows customers to access an ever-rotating wardrobe, meeting the demands of a fashion-conscious audience seeking variety and sustainability.

Le Tote follows a similar subscription-based model, where customers receive personalized wardrobe boxes based on their style preferences, which they can wear and return at their convenience. This model offers flexibility and continuous wardrobe refreshment without the commitment of purchase.

Nuuly, a venture by URBN (the parent company of Urban Outfitters, Anthropologie, and Free People), capitalizes on the millennial market with trendy and chic clothing options. Their strong brand affiliations and a focus on stylish yet sustainable fashion resonate well with younger consumers looking to minimize their fashion footprint.

HURR brings a unique angle to the market by focusing on the peer-to-peer exchange of high-fashion pieces, enabling users to rent out their own items while renting others’ luxury garments and accessories. This platform not only facilitates fashion recycling but also builds a community of fashion enthusiasts who advocate for sustainable fashion practices.

These top players in the online clothing rental market are redefining fashion consumption with their innovative business models, appealing to eco-conscious consumers and those seeking to stay trendy without the environmental guilt or financial burden of traditional shopping habits. Each company’s distinct approach to tackling the challenges of sustainable fashion highlights the dynamic nature of this burgeoning industry.

Major Companies in the Market

- Rent the Runway

- Le Tote

- Nuuly (by URBN)

- HURR

- Vigga

- GlamCorner

- Style Lend

- Armarium

- My Wardrobe HQ

- Lending Luxury

- Rent the Runway Unlimited

- Girl Meets Dress

- YCloset

Recent Developments

- Wild West Social House: In August 2023, Wild West Social House, co-founded by Max Feldmann and Kyle Julian Skye, launched a luxury fashion club in Los Angeles, combining clothing rental with a social space. The facility houses over 4,500 luxury garments, with plans to expand to 10,000.

- Altuzarra: In October 2023, luxury fashion brand Altuzarra entered the clothing rental market in collaboration with P180 and powered by Caastle. Customers can rent garments through The Ensemble platform for 14-day periods, with the option to purchase.

- Nuuly: In July 2023, Nuuly, a clothing rental service owned by Urban Outfitters, reported an operating income of $5.3 million, marking its second profitable quarter since its 2019 launch. The company attributes its success to investments in advanced logistics and automation, managing over 2 million garments to streamline order fulfillment.

Report Scope

Report Features Description Market Value (2023) USD 1.6 Billion Forecast Revenue (2033) USD 3.7 Billion CAGR (2024-2033) 8.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ethnic Wear, Western Wear, Formal Wear, Party Wear), By Consumer Demographics (Men, Women, Children), By Duration (Short-term Rental, Long-term Rental), By Business Model (Subscription-based, Pay-per-use) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rent the Runway, Le Tote, Nuuly (by URBN), HURR, Vigga, GlamCorner, Style Lend, Armarium, My Wardrobe HQ, Lending Luxury, Rent the Runway Unlimited, Girl Meets Dress, YCloset Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Online Clothing Rental MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Online Clothing Rental MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Rent the Runway

- Le Tote

- Nuuly (by URBN)

- HURR

- Vigga

- GlamCorner

- Style Lend

- Armarium

- My Wardrobe HQ

- Lending Luxury

- Rent the Runway Unlimited

- Girl Meets Dress

- YCloset