Global Radiology as a Service (RaaS) Market By Service (Tele-radiology Reading Platform Services, Remote Scanning Services, Consulting Services, Staffing Services, Patient Booking & Scheduling, Patient Arrival And Registration, Documentation, Billing services, and other IT services), By Technology (Computed Radiology and Direct Digital Radiology), By Application (Cardiovascular Imaging, Chest Imaging, Dental Imaging, Orthopedic Imaging and Others), By End-use (Hospitals, Diagnostic Imaging Centers, Radiology Clinics, Physician Offices, Nursing Homes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151658

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

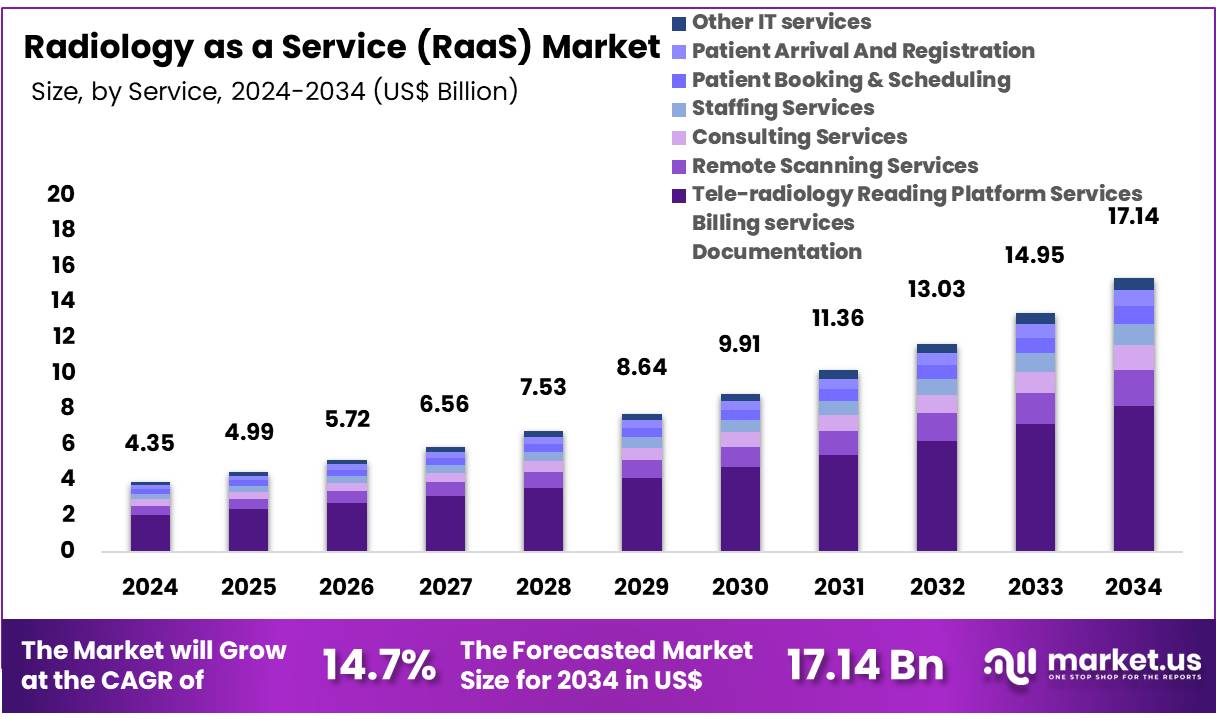

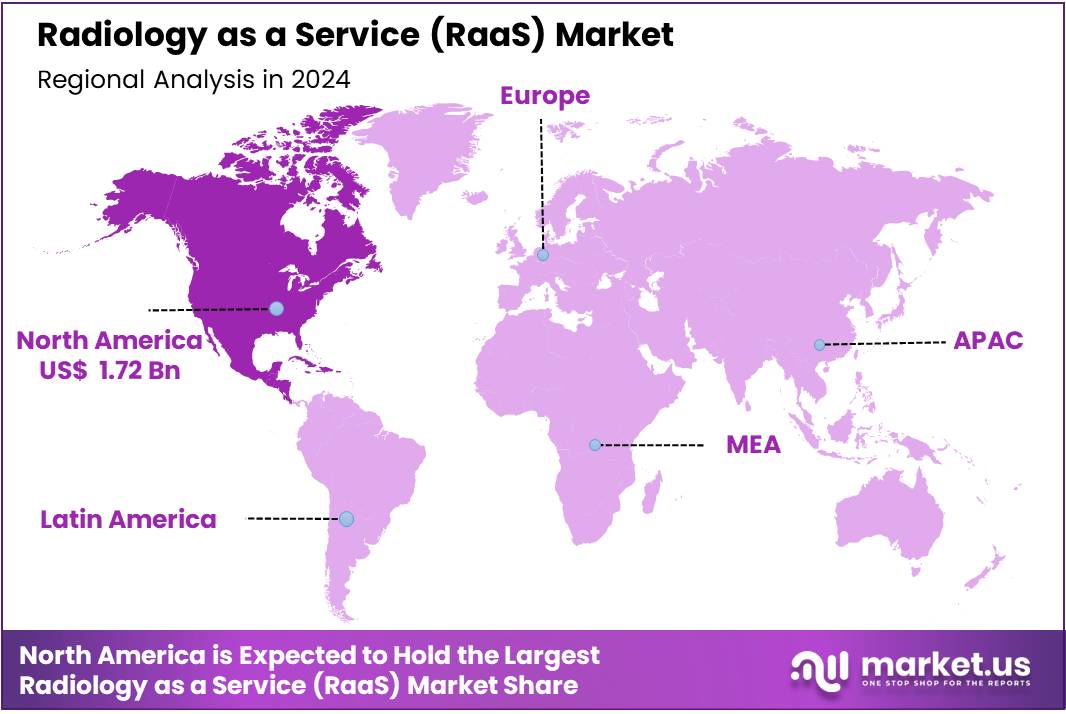

Global Radiology as a Service (RaaS) Market size is expected to be worth around US$ 17.14 Billion by 2034 from US$ 4.35 Billion in 2024, growing at a CAGR of 14.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 1.72 Billion.

In the evolving landscape of healthcare, particularly under Value-Based Care (VBC) models, healthcare providers are increasingly looking at imaging vendors as partners to transform their imaging departments. With rising financial constraints, many hospitals are struggling to afford the necessary imaging equipment to achieve desired clinical outcomes.

These institutions face challenges such as limited capital, a complex procurement process, and a lack of in-house expertise to manage advanced imaging technology. Furthermore, with a growing focus on delivering high-quality clinical services, the ability to invest in and maintain imaging technology becomes even more difficult.

To address these challenges, many healthcare administrators are considering ‘as-a-service’ models for imaging. Under this model, healthcare providers are not required to make large upfront investments in imaging equipment. Instead, they can partner with imaging vendors, who will supply the necessary equipment along with support services.

Payments are structured on a pay-per-use or periodic basis, significantly reducing the burden on hospital budgets. This approach minimizes capital expenditures and allows healthcare providers to prioritize clinical care without compromising on the quality and availability of imaging services. It is an attractive proposition, especially for cash-strapped hospitals, enabling them to access the latest imaging technology while maintaining financial flexibility.

The Radiology as a Service (RaaS) market is experiencing significant growth driven by advancements in medical imaging technologies and the increasing demand for remote healthcare services. RaaS leverages cloud-based platforms and teleradiology to provide healthcare facilities with access to diagnostic imaging without the need for heavy investments in equipment or in-house radiology expertise. This service model is particularly beneficial in regions with a shortage of radiologists, as it allows healthcare providers to access expert interpretations remotely.

The rising prevalence of chronic diseases, including cancer, further accelerates the demand for efficient imaging solutions. Additionally, the integration of Artificial Intelligence (AI) is improving diagnostic accuracy and workflow efficiency, creating new opportunities for the market. Despite challenges like the high cost of diagnostic equipment and data security concerns, the RaaS market is expected to expand as healthcare providers increasingly adopt digital, cost-effective solutions to enhance patient care and operational efficiency.

Key Takeaways

- In 2024, the market for Radiology as a Service (RaaS) generated a revenue of US$ 4.35 billion, with a CAGR of 14.7%, and is expected to reach US$ 17.14 billion by the year 2034.

- The Service segment is divided into tele-radiology Reading Platform Services, Remote Scanning Services, Consulting Services, Staffing Services, Patient Booking & Scheduling, Patient Arrival And Registration, Documentation, Billing services, and other IT services with Tele-radiology Reading Platform Services taking the lead in 2023 with a market share of 47.8%.

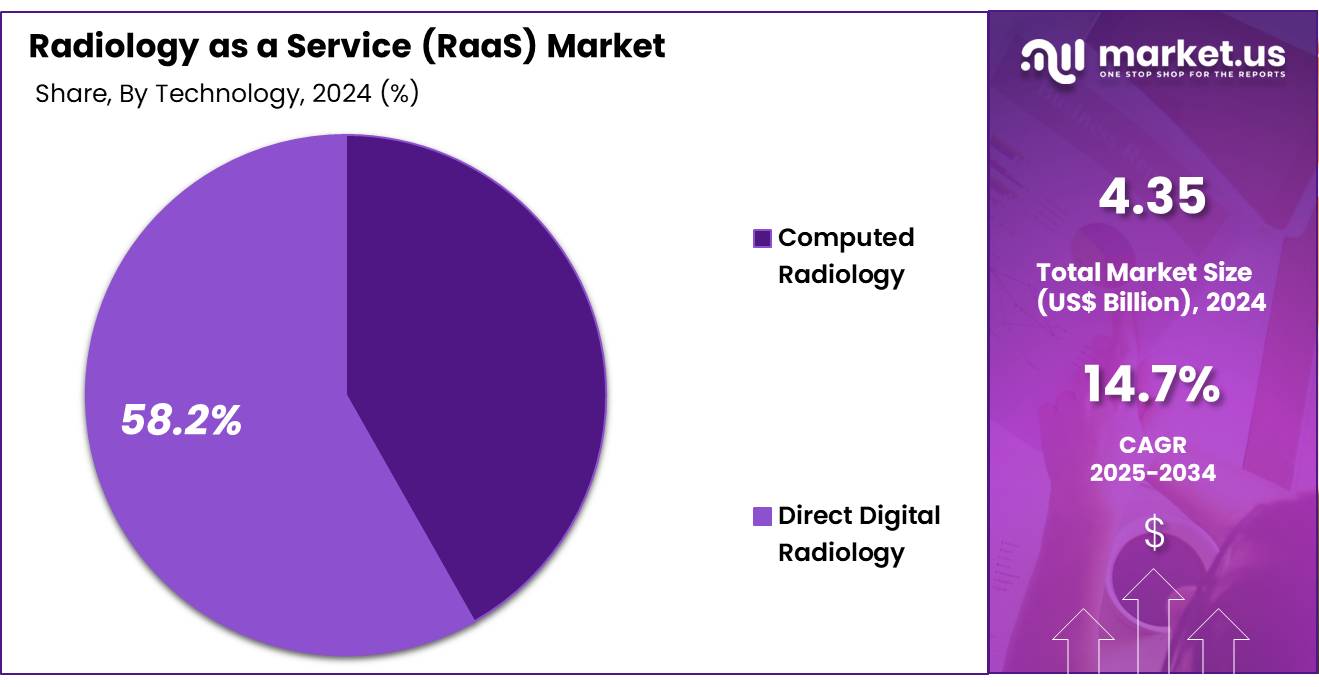

- By Technology, the market is bifurcated into omputed Radiology and Direct Digital Radiology, with Direct Digital Radiology leading the market with 58.2% of market share.

- Furthermore, concerning the Application segment, the market is segregated into Cardiovascular Imaging, Chest Imaging, Dental Imaging, Orthopedic Imaging and Others. The Cardiovascular Imaging stands out as the dominant segment, holding the largest revenue share of 32.5% in the Radiology as a Service (RaaS) market.

- By End-use, the market is bifurcated into Hospitals, Diagnostic Imaging Centers, Radiology Clinics, Physician Offices, Nursing Homes, and Others with Hospitals dominating the market with a market share of 54.3%.

- North America led the market by securing a market share of 39.6% in 2023.

Service Analysis

Tele-radiology Reading Platform Services is the dominant segment with 47.8% makret share in the Radiology as a Service (RaaS) market, driven by the growing need for remote diagnostics and the increasing shortage of radiologists worldwide. This segment involves providing radiological image interpretation and diagnostic reports remotely, offering healthcare providers access to expert radiologists without the need for in-house specialists.

Teleradiology services have gained widespread adoption due to their ability to address the challenges of high workload and long turnaround times in radiology departments. This service model allows for quicker and more efficient diagnoses, ensuring that critical cases receive timely attention, especially in underserved areas or smaller healthcare facilities where radiology expertise may be lacking.

In September 2024, Experity, the national leader in on-demand healthcare solutions, has announced a new enhancement to its teleradiology overread services, integrating artificial intelligence (AI) to assist radiologists in interpreting x-ray images. This AI technology provides a more comprehensive view of imaging services for fracture detection by identifying subtle abnormalities that may not be reflected in a patient’s medical records or might have been overlooked.

Technology Analysis

Direct Digital Radiology (DDR) is the dominant segment with a 58.2% market share in the Radiology as a Service (RaaS) market, driven by its superior image quality, immediate availability, and cost-effective solutions compared to traditional computed radiology (CR). DDR utilizes digital detectors to capture radiographic images directly, eliminating the need for film or intermediate image processing.

The immediate digitization of images allows for faster diagnosis, streamlined workflows, and enhanced patient care. This technology supports seamless integration with other digital systems, such as Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHR), improving overall healthcare management.

The adoption of DDR is growing rapidly, particularly in hospitals and diagnostic imaging centers, as it offers clear advantages over conventional imaging techniques. The ability to instantly view and share digital images enhances collaboration among healthcare providers, which is particularly beneficial in emergency and remote care settings. DDR also reduces the reliance on physical storage, cutting costs and improving sustainability by minimizing the need for chemicals and film.

Application Analysis

Cardiovascular Imaging is the dominant segment with a 32.5% market share in the Radiology as a Service (RaaS) market, driven by the increasing prevalence of cardiovascular diseases (CVDs) globally. As one of the leading causes of morbidity and mortality worldwide, cardiovascular diseases require accurate and timely imaging for diagnosis, treatment planning, and monitoring.

Techniques such as CT angiography, echocardiography, MRI, and ultrasound play a critical role in assessing heart function, detecting blockages, and identifying abnormalities in the cardiovascular system. The rising incidence of CVDs, coupled with the aging global population, is significantly driving the demand for cardiovascular imaging services.

Additionally, advancements in imaging technologies, such as non-invasive imaging modalities and AI integration, have improved diagnostic accuracy, making these services highly sought after. The ability to capture detailed images of blood vessels and heart structures allows healthcare providers to make more informed decisions, improving patient outcomes and reducing the need for invasive procedures.

End-use Analysis

Hospitals represent the dominant end-use segment in the Radiology as a Service (RaaS) market with 54.3% market share, driven by their large-scale operations and the critical need for advanced imaging services. Hospitals are central to healthcare delivery and often serve as the primary setting for a wide range of diagnostic and therapeutic procedures, including those requiring radiology. The demand for RaaS in hospitals is driven by their need for high-volume, accurate imaging services across multiple departments, such as emergency care, oncology, cardiology, and neurology.

The integration of tele-radiology and cloud-based imaging solutions within hospitals helps streamline operations, improve diagnostic accuracy, and reduce the need for expensive, in-house radiologists. With hospitals facing a constant influx of patients, particularly in emergency departments, the ability to quickly access radiology services remotely enhances patient care by providing faster diagnosis and treatment. Additionally, AI-driven imaging solutions integrated into RaaS platforms can assist in automating and enhancing image analysis, which helps radiologists focus on complex cases.

Key Market Segments

By Service

- Tele-radiology Reading Platform Services

- Remote Scanning Services

- Consulting Services

- Staffing Services

- Patient Booking & Scheduling

- Patient Arrival And Registration

- Documentation

- Billing services

- Other IT services

By Technology

- Computed Radiology

- Direct Digital Radiology

By Application

- Cardiovascular Imaging

- Chest Imaging

- Dental Imaging

- Orthopedic Imaging

- Others

By End-use

- Hospitals

- Diagnostic Imaging Centers

- Radiology Clinics

- Physician Offices

- Nursing Homes

- Others

Drivers

Surge in Global Cancer Cases

The increasing prevalence of cancer globally is a significant driver for the growth of the Radiology as a Service (RaaS) market. Cancer is one of the leading causes of death worldwide, and early detection is crucial for improving patient outcomes. Radiology plays a central role in diagnosing various types of cancer, from breast cancer detected through mammography to lung cancer identified using CT scans and MRIs.

As the number of cancer cases continues to rise, healthcare systems are increasingly relying on advanced imaging technologies to enhance diagnostic accuracy and treatment planning. The World Health Organization projects that the global number of new cancer cases will increase to 29.9 million by 2040, with 15.3 million cancer-related deaths. This surge is driving the demand for radiology services, especially teleradiology and cloud-based imaging services, which offer remote access to radiological expertise.

The growing demand for timely and precise diagnosis will push healthcare providers to adopt Radiology as a Service, enabling quicker, more accurate assessments while also addressing challenges such as radiologist shortages. Consequently, the RaaS market is poised for significant growth as healthcare systems strive to meet the increasing demand for cancer diagnosis and care.

Restraints

High Cost of Diagnostic Imaging Equipment

Despite the increasing demand for Radiology as a Service (RaaS), a significant restraint in the market is the high cost of diagnostic imaging equipment. Advanced imaging technologies like MRI, CT scanners, and PET scans require substantial capital investment. Healthcare providers, particularly small and medium-sized facilities, may struggle to afford these expensive machines, hindering their ability to offer high-quality diagnostic services.

The financial burden extends to maintenance costs, software updates, and staff training, making it difficult for healthcare institutions, especially in developing countries, to stay competitive in terms of technology. Furthermore, these costs also impact the affordability of RaaS, limiting access to high-tech radiology services.

For healthcare providers to adopt RaaS, they must have the infrastructure and financial capacity to integrate cloud-based imaging and AI technologies effectively. The high cost of medical imaging equipment can deter smaller clinics and hospitals from adopting RaaS, creating a barrier to the widespread adoption of these technologies. To overcome this challenge, there is a growing push for cost-effective, scalable imaging solutions that allow healthcare providers to leverage advanced technologies without the financial strain.

Opportunities

Integration of AI and Blockchain Technologies

The integration of Artificial Intelligence (AI) and blockchain technologies presents a tremendous opportunity for the Radiology as a Service (RaaS) market. AI technologies, such as machine learning algorithms, can significantly enhance diagnostic accuracy by automating the interpretation of radiological images. AI systems can detect abnormalities, such as tumors or fractures, more efficiently and accurately than traditional methods, reducing human error and improving patient outcomes.

AI-driven solutions are already being implemented in various imaging modalities like mammography, CT scans, and MRIs. Additionally, blockchain technology offers a secure and transparent method of managing and sharing medical imaging data. With blockchain, patient data can be encrypted and securely stored, enabling healthcare providers to share sensitive imaging data across platforms while ensuring privacy and compliance with healthcare regulations. This integration streamlines workflows, reduces administrative overhead, and enhances the efficiency of radiology practices.

The combination of AI and blockchain also facilitates faster, more accurate diagnoses, making it a promising solution for healthcare facilities facing challenges such as radiologist shortages and data management issues. As these technologies continue to evolve, they present new opportunities to revolutionize the RaaS market and improve the quality of care.

In November 2024, Tassat Group, Inc., a leading provider of private permissioned blockchain-based real-time settlement solutions, has announced a strategic partnership with Veuu, an innovative AI-driven healthcare fintech company. This collaboration aims to address the inefficiencies and lack of transparency in the healthcare claims and payment process.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors such as global economic growth, healthcare spending, and inflation play a crucial role in the market. In developed economies, increasing healthcare budgets and the push toward digital healthcare transformation drive the adoption of RaaS. Economic stability encourages investment in advanced technologies, fostering the demand for cloud-based radiology services, AI-driven diagnostic tools, and teleradiology solutions.

Conversely, during economic downturns or recessions, healthcare systems may experience budget cuts, which could slow the adoption of new technologies and limit spending on non-essential services. Inflationary pressures can also raise the costs of diagnostic equipment and healthcare services, potentially limiting access to advanced imaging services, particularly in developing economies.

Geopolitical factors, including trade policies, regulations, and global conflicts, also affect the RaaS market. For instance, stricter regulations on data privacy and security, such as the GDPR in Europe or HIPAA in the U.S., can influence the way radiology services are delivered, especially in the context of data sharing and cloud-based solutions.

Additionally, political instability or conflicts in certain regions can disrupt the supply chains for imaging equipment and technology, delaying the rollout of radiology services in affected areas. However, in regions with stable political environments, the push for telemedicine and remote healthcare solutions has increased demand for RaaS, as it enables more accessible and efficient diagnostic services in underserved areas.

Latest Trends

Technological Advancements in Imaging Services

One of the key trends driving the growth of the Radiology as a Service (RaaS) market is the rapid advancement of technology in the field of medical imaging. Over the past decade, significant improvements have been made in imaging technologies, including the introduction of AI-powered diagnostics, cloud-based imaging platforms, and mobile radiology solutions. AI-based algorithms are being increasingly employed to aid radiologists in interpreting complex images more accurately and quickly.

These technologies can highlight anomalies in images that may be missed by human eyes, thereby improving diagnostic precision and reducing errors. Cloud-based imaging solutions are gaining popularity due to their ability to store, retrieve, and share large imaging datasets across different healthcare providers and geographic locations, enhancing collaboration and providing quicker access to expert opinions.

Furthermore, mobile radiology services are becoming more prevalent, offering on-demand imaging solutions for patients in remote areas or those with limited access to healthcare facilities. This technological shift not only makes radiology services more efficient and accessible but also aligns with the broader trends in healthcare toward digitalization and telemedicine.

Regional Analysis

North America is leading the Radiology as a Service (RaaS) Market

The Radiology as a Service (RaaS) market in North America is largest with 39.6% market share as the region is experiencing significant growth, driven by advancements in imaging technologies, a shortage of radiologists, and increasing demand for remote healthcare services. Key drivers include the shortage of radiologists, with the U.S. projected to face a shortage of 17,100 to 41,900 radiologists by 2030, intensifying the need for remote radiology services.

Technological advancements such as AI and cloud-based imaging solutions are enhancing diagnostic accuracy and efficiency. Government initiatives and reimbursement policies are encouraging the adoption of telehealth and remote diagnostic services. Challenges include ensuring data security and compliance with regulations like HIPAA, as well as the high initial infrastructure costs for healthcare providers. Despite these challenges, with a robust healthcare infrastructure and increasing adoption of digital health solutions, North America is poised to maintain its leadership in the RaaS market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Radiology as a Service (RaaS) market includes Siemens Healthineers, GE HealthCare, Philips Healthcare, Medica Group PLC, RadNet, Inc., Virtual Radiologic (vRad), Everlight Radiology, Teleradiology Solutions, RamSoft Inc., Telemedicine Clinic, DeepTek Inc., CodaMetrix, DeepHealth, Inc., Enlitic Inc., Coreline Soft, and Other Prominent Players.

Siemens Healthineers offers advanced diagnostic imaging solutions, including AI-powered radiology tools and cloud-based platforms, contributing significantly to the RaaS market. Their technologies, such as teleradiology and cloud storage, enhance diagnostic accuracy, streamline workflows, and provide remote access to radiology services for healthcare providers globally. GE HealthCare provides comprehensive radiology solutions, focusing on advanced imaging systems like MRI, CT, and ultrasound.

Through RaaS offerings, GE integrates cloud-based image management and AI-driven diagnostics to improve efficiency, reduce costs, and enable remote access, supporting healthcare institutions worldwide in delivering quality patient care. Philips Healthcare offers a broad range of imaging solutions with a focus on integrated, cloud-based services. Their RaaS offerings include teleradiology and AI-powered image interpretation, enabling faster diagnoses and improved clinical outcomes.

Top Key Players

- Siemens Healthineers

- GE HealthCare

- Philips Healthcare

- Medica Group PLC

- RadNet, Inc.

- Virtual Radiologic (vRad)

- Everlight Radiology

- Teleradiology Solutions

- RamSoft Inc.

- Telemedicine Clinic

- DeepTek Inc.

- CodaMetrix

- DeepHealth, Inc.

- Enlitic Inc.

- Coreline Soft

- Other Prominent Players

Recent Developments

- In February 2025, Sectra, an international medical imaging IT and cybersecurity company partnered with Siemens Healthineers AG to enhance radiologists’ diagnostic capabilities and improve patient care through seamless integration. The collaboration aims to enable radiologists to access and post-process Siemens Healthineers’ NAEOTOM Alpha class photon-counting CT (PCCT) images within Sectra’s diagnostic application for radiology.

- In October 2024, IKS Health, a provider of healthcare enablement solutions, has announced a partnership with Radiology Partners (RP), a leading radiology practice in the U.S., through its owned and affiliated practices. By utilizing IKS Health’s innovative Gen AI-powered Care Enablement Platform, the collaboration aims to help RP streamline processes and improve access to essential imaging services.

- In June 2024, Royal Philips, a global leader in health technology, announced that existing IntelliSpace Radiology customers in North America will have the option to transition to the cloud on Amazon Web Services (AWS). Set to be available in late 2024, IntelliSpace Radiology as a managed service in the cloud will offer clinicians remote access for reliable and secure diagnostic readings. Additionally, it will provide the option to integrate AI capabilities directly into clinical workflows, aiming to enhance productivity.

Report Scope

Report Features Description Market Value (2024) US$ 4.35 Billion Forecast Revenue (2034) US$ 17.14 Billion CAGR (2025-2034) 14.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (Tele-radiology Reading Platform Services, Remote Scanning Services, Consulting Services, Staffing Services, Patient Booking & Scheduling, Patient Arrival And Registration, Documentation, Billing services, and other IT services), By Technology (Computed Radiology and Direct Digital Radiology), By Application (Cardiovascular Imaging, Chest Imaging, Dental Imaging, Orthopedic Imaging and Others), By End-use (Hospitals, Diagnostic Imaging Centers, Radiology Clinics, Physician Offices, Nursing Homes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers, GE HealthCare, Philips Healthcare, Medica Group PLC, RadNet, Inc., Virtual Radiologic (vRad), Everlight Radiology, Teleradiology Solutions, RamSoft Inc., Telemedicine Clinic, DeepTek Inc., CodaMetrix, DeepHealth, Inc., Enlitic Inc., Coreline Soft, and Other Prominent Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Radiology as a Service (RaaS) MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Radiology as a Service (RaaS) MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers

- GE HealthCare

- Philips Healthcare

- Medica Group PLC

- RadNet, Inc.

- Virtual Radiologic (vRad)

- Everlight Radiology

- Teleradiology Solutions

- RamSoft Inc.

- Telemedicine Clinic

- DeepTek Inc.

- CodaMetrix

- DeepHealth, Inc.

- Enlitic Inc.

- Coreline Soft

- Other Prominent Players